Market Overview

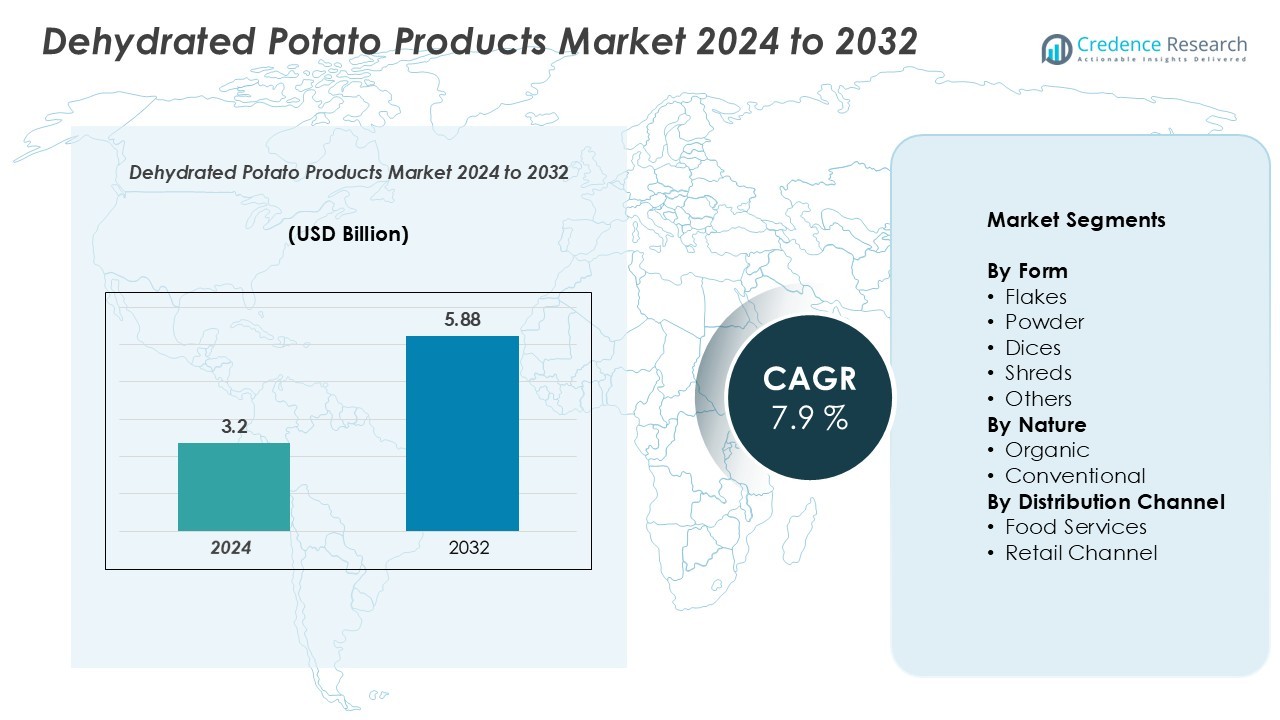

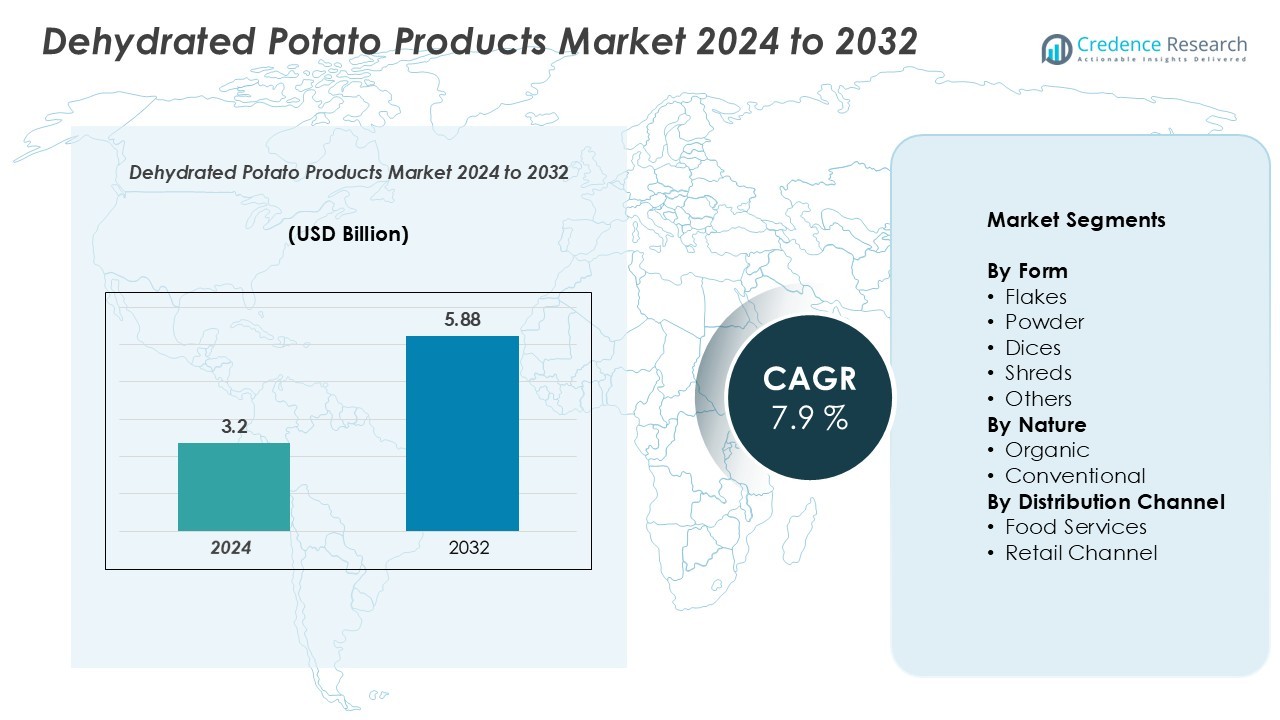

The dehydrated potato products market size was valued at USD 3.2 billion in 2024 and is anticipated to reach USD 5.88 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dehydrated Potato Products Market Size 2024 |

USD 3.2 Billion |

| Dehydrated Potato Products Market, CAGR |

7.9% |

| Dehydrated Potato Products Market Size 2032 |

USD 5.88 Billion |

The dehydrated potato products market is led by prominent players including McCain Foods Limited, Lamb Weston Holdings, J.R. Simplot Company, The Kraft Heinz Company, Idahoan Foods LLC, Agristo NV, Farm Frites International B.V., Aviko B.V., AGRANA Beteiligungs-AG, Burts Potato Chips Ltd., Intersnack Group GmbH & Co. KG, and J.R. Short Milling Company. North America emerges as the largest regional market, accounting for approximately 35% of the global share, driven by strong demand in foodservice and retail channels. Europe follows with a 28% share, supported by high adoption of convenience and organic products. Asia-Pacific, holding around 22%, is witnessing rapid growth due to urbanization and rising processed food consumption. These leading companies leverage technological advancements, diverse product portfolios, and robust distribution networks to maintain competitive advantage and expand their presence across high-demand regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dehydrated potato products market was valued at USD 3.2 billion in 2024 and is projected to reach USD 5.88 billion by 2032, growing at a CAGR of 7.9% during the forecast period.

- Rising demand for convenience and ready-to-cook foods is driving market growth, supported by urbanization, busy lifestyles, and increased adoption in retail and foodservice channels.

- Key trends include growing preference for organic and clean-label products, product innovation with flavored and value-added variants, and expansion of e-commerce and modern retail distribution.

- The market is highly competitive, with leading players such as McCain Foods Limited, Lamb Weston Holdings, J.R. Simplot Company, The Kraft Heinz Company, and Idahoan Foods LLC leveraging technological advancements, strong distribution networks, and product diversification. Market restraints include raw material price volatility and stringent regulatory compliance requirements.

- Regionally, North America dominates with a 35% share, followed by Europe at 28%, Asia-Pacific at 22%, Latin America at 10%, and Middle East & Africa at 5%, while flakes remain the dominant form segment.

Market Segmentation Analysis:

By Form

Flakes dominate the dehydrated potato products market by form, accounting for a significant market share of 40%. Their popularity stems from versatility in culinary applications, ease of rehydration, and long shelf life, making them a preferred choice for both food manufacturers and households. Powdered products follow closely, favored for convenience in sauces and soups, while dices and shreds cater mainly to processed and ready-to-eat food sectors. Innovation in texture, packaging, and ready-to-use formats continues to drive adoption across all sub-segments, with flakes maintaining the lead due to cost-effectiveness and widespread usage.

- For instance, Grover Food, based in Bareilly, Uttar Pradesh, operates a state-of-the-art processing plant equipped with European-standard machinery.

By Nature

Conventional dehydrated potato products hold the dominant position in the market, capturing 75% of the total share. Their widespread cultivation, availability, and lower price points compared to organic variants drive higher adoption, especially among large-scale food processors and retail buyers. Organic products are gaining traction due to rising consumer awareness of health and sustainability, supported by certifications and eco-friendly sourcing. The segment growth is fueled by increasing demand for clean-label and natural ingredients, yet conventional remains the primary contributor due to its affordability, scalability, and established supply chain.

- For instance, Roquette, a global leader in plant-based ingredients, operates more than 40 production sites worldwide.

By Distribution Channel

The retail channel leads the market with a dominant share of 60%, driven by the growing trend of at-home cooking and ready-to-eat convenience products. Supermarkets, hypermarkets, and online platforms provide broad accessibility and promotional opportunities, enhancing product visibility and consumer adoption. Food services, including restaurants and institutional catering, represent a smaller but steadily growing segment, propelled by menu diversification and operational efficiency requirements. Retail continues to shape market dynamics, leveraging consumer preference for packaged and easy-to-use dehydrated potato solutions.

Key Growth Drivers

Rising Demand for Convenience and Ready-to-Cook Foods

The increasing consumer preference for convenience and ready-to-cook meals is a primary growth driver for the dehydrated potato products market. Busy lifestyles and urbanization have shifted demand toward products that reduce preparation time without compromising taste or quality. Dehydrated potatoes such as flakes, dices, and shreds offer easy rehydration and versatile applications in snacks, soups, and processed foods, catering to both households and commercial kitchens. The expansion of retail networks, e-commerce platforms, and frozen food offerings further supports this demand. Additionally, the ability to store dehydrated products for extended periods with minimal spoilage enhances their appeal. Food manufacturers and quick-service restaurants leverage these products to improve operational efficiency, meet consumer convenience expectations, and maintain consistent quality, driving sustained growth across regions.

- For instance, McCain Foods, a leader in frozen and dehydrated potato products, sources high-quality potatoes and utilizes efficient drying techniques to supply versatile flakes and dices used widely in quick-service restaurants to enhance operational efficiency.

Expansion of Processed Food and Foodservice Industries

The rapid growth of the processed food and foodservice sectors is significantly boosting the demand for dehydrated potato products. Restaurants, hotels, catering services, and institutional kitchens increasingly rely on dehydrated potatoes for menu diversification and operational efficiency. These products reduce labor and storage costs while offering standardized taste and texture, crucial for large-scale food preparation. In parallel, the processed food industry—encompassing snacks, instant mashed potatoes, and ready-to-eat meals—leverages dehydrated potatoes for consistent quality, long shelf life, and scalability. Regional expansions of quick-service restaurants and multinational food chains are creating steady procurement pipelines. As urbanization accelerates and disposable incomes rise, the synergy between processed food manufacturing and foodservice operations continues to strengthen market demand.

- For instance, Roquette, a global leader in plant-based ingredients, operates multiple production sites worldwide. These facilities produce a range of starches and derivatives, including those derived from potatoes, catering to various industries such as food, pharmaceuticals, and nutrition.

Advancements in Processing Technology and Packaging

Technological innovations in dehydration and packaging methods are key drivers of market growth. Vacuum drying, freeze-drying, and advanced drum-drying techniques enhance product quality, texture, and nutrient retention, making dehydrated potatoes more appealing to both manufacturers and consumers. Improved packaging solutions, such as moisture-resistant, air-tight pouches, extend shelf life and simplify storage and transport. These technological advancements reduce wastage, maintain product integrity, and support global distribution, enabling market players to cater to distant markets efficiently. Moreover, automation and process optimization have increased production efficiency, lowered costs, and allowed manufacturers to meet rising demand with consistent quality, thereby reinforcing market expansion.

Key Trends & Opportunities

Growing Preference for Organic and Clean-Label Products

A significant trend shaping the dehydrated potato products market is the increasing consumer preference for organic and clean-label products. Health-conscious consumers are seeking products free from artificial additives, preservatives, and GMOs. Organic dehydrated potatoes, supported by certifications such as USDA Organic and EU Organic, are witnessing rising adoption, particularly in developed markets. This shift presents opportunities for manufacturers to differentiate products, command premium pricing, and establish brand loyalty. Additionally, transparent labeling and sustainable sourcing practices appeal to environmentally aware consumers. The combination of health awareness, regulatory support, and demand for traceable supply chains is encouraging companies to expand their organic offerings, creating a lucrative growth avenue.

- For instance, AGRANA, a global leader in plant-based ingredients, operates multiple production sites worldwide. These facilities produce a range of starches and derivatives, including those derived from potatoes, catering to various industries such as food, pharmaceuticals, and nutrition.

Expansion of E-commerce and Retail Distribution Channels

The growing penetration of e-commerce platforms and modern retail channels offers substantial opportunities for the dehydrated potato products market. Online grocery shopping allows consumers to access a wider variety of dehydrated potato products, including niche and premium options, without geographic constraints. Retail chains, hypermarkets, and supermarkets provide visibility, promotions, and bulk purchase options that enhance consumer adoption. The digital shift also enables companies to implement targeted marketing strategies, subscription models, and home delivery services, increasing product reach and convenience. This trend supports both brand awareness and sales growth, particularly in regions where traditional retail access is limited, positioning the market for broader penetration and higher revenues.

- For instance, McCain Foods, a global leader in potato processing, offers a wide range of dehydrated and frozen potato products through major online grocery platforms like BigBasket, where items such as McCain Smiles and Aloo Tikki are available for direct consumer purchase.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in potato prices and agricultural inputs remain a critical challenge for the dehydrated potato products market. Seasonal variations, crop yield inconsistencies, and changing weather patterns can increase production costs, impacting profitability for manufacturers. Price volatility also affects supply chain stability and may lead to increased product costs for end consumers, potentially reducing demand. Additionally, reliance on specific potato varieties for optimal dehydration quality exposes producers to supply disruptions. Companies must adopt risk mitigation strategies such as contract farming, strategic sourcing, and inventory management to stabilize costs, yet these measures may not fully offset market unpredictability.

Stringent Regulatory Compliance and Quality Standards

Compliance with food safety regulations, quality standards, and certification requirements poses challenges for market players. Dehydrated potato products must meet standards related to microbial safety, pesticide residues, moisture content, and labeling. Variations in regulatory frameworks across regions require companies to adapt production processes, testing protocols, and documentation, increasing operational complexity and cost. Non-compliance can lead to recalls, penalties, and reputational damage. Ensuring consistent quality while scaling production remains a significant hurdle, particularly for smaller manufacturers and those expanding into international markets with stricter standards.

Regional Analysis

North America

North America leads the dehydrated potato products market with a share of approximately 35%, driven by high demand from the processed food and foodservice sectors. The United States dominates due to well-established supply chains, technological advancements in dehydration, and strong consumer preference for convenience foods. Canada also contributes through rising adoption in quick-service restaurants and retail channels. Increasing urbanization, disposable income, and the popularity of ready-to-cook meals support steady growth. Manufacturers benefit from advanced infrastructure, efficient distribution networks, and the presence of key global players, consolidating North America’s position as a mature and profitable market region.

Europe

Europe holds around 28% of the market, with Germany, France, and the UK emerging as key contributors. Strong demand from retail channels, including supermarkets and hypermarkets, drives the adoption of dehydrated potato products. Organic and clean-label variants are gaining traction due to heightened health awareness, particularly among European consumers. The foodservice industry, including restaurants and institutional kitchens, further stimulates growth. Technological innovations, coupled with stringent quality and safety standards, ensure consistent product quality. European players are investing in product diversification, flavored options, and sustainable sourcing to strengthen their market position and capture the rising demand across the region.

Asia-Pacific

Asia-Pacific is witnessing rapid growth with a market share of approximately 22%, led by countries like China, India, and Japan. Expanding urban populations, increasing disposable incomes, and growing acceptance of Western-style convenience foods drive demand. The region’s foodservice sector, including quick-service restaurants and catering, heavily relies on dehydrated potato products for menu consistency and operational efficiency. Rapid expansion of modern retail chains and e-commerce platforms further facilitates product penetration. Additionally, technological collaborations and local production investments enhance product availability. Rising awareness of health-oriented and fortified products presents opportunities for premium and organic dehydrated potato variants.

Latin America

Latin America accounts for nearly 10% of the market, with Brazil and Mexico serving as key contributors. Increasing urbanization, expansion of the retail sector, and rising demand from quick-service restaurants drive market growth. Dehydrated potato products offer logistical advantages in regions with less developed cold-chain infrastructure, supporting adoption in both foodservice and processed food industries. The region presents opportunities for flavor innovation and ready-to-cook convenience products. However, challenges such as raw material price volatility and regulatory compliance may limit rapid expansion. Strategic partnerships and local manufacturing investments are enabling companies to strengthen their presence and tap into growing consumer demand.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the market, driven by rising foodservice demand, retail expansion, and growing urban populations in countries like Saudi Arabia, UAE, and South Africa. Dehydrated potato products are increasingly used in restaurants, hotels, and institutional catering due to their long shelf life and ease of preparation. Imported products dominate the market, though local production is gradually emerging. The region also witnesses rising consumer interest in convenience foods and ready-to-cook meals. Market growth is supported by investments in modern retail formats, infrastructural improvements, and collaborations between regional distributors and global manufacturers.

Market Segmentations:

By Form

- Flakes

- Powder

- Dices

- Shreds

- Others

By Nature

By Distribution Channel

- Food Services

- Retail Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dehydrated potato products market is highly competitive, with several global and regional players striving to enhance market share through innovation, strategic partnerships, and expansion initiatives. Leading companies such as McCain Foods Limited, Lamb Weston Holdings, and J.R. Simplot Company dominate the market through extensive product portfolios, advanced processing technologies, and strong distribution networks across retail and foodservice channels. Companies focus on product differentiation by offering value-added, organic, and flavored variants to cater to evolving consumer preferences. Strategic mergers, acquisitions, and collaborations enable market entrants to expand geographically and strengthen supply chains. Additionally, investments in automation, quality control, and sustainable sourcing practices enhance operational efficiency and brand reputation. The competitive landscape is further intensified by regional players like Agristo NV, Aviko B.V., and Idahoan Foods LLC, who leverage local market knowledge, cost advantages, and customer relationships to challenge global incumbents.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- McCain Foods Limited

- Lamb Weston Holdings, Inc.

- R. Simplot Company

- The Kraft Heinz Company

- Idahoan Foods, LLC

- Aviko B.V.

- Farm Frites International B.V.

- Agristo NV

- AGRANA Beteiligungs-AG

- Intersnack Group GmbH & Co. KG

- Burts Potato Chips Ltd.

- R. Short Milling Company

Recent Developments

- In January 2023, Aviko, a Dutch potato processor, launched Potato Cheezz, a novel plant-based product that tastes and looks like cheese which is salt-free, fat-free, and lactose-free while also being an environmentally friendly, animal-friendly, and safe innovation. With this, the company intended to expand its product portfolio and boost its business position.

- In January 2023, Emsland Group, an internationally operating company, plans to expand potato flake production in Emlichheim to increase the production capacity of dehydrated potatoes.

- In October 2022, dairy giant Amul launched frozen potato products such as French fries and burger patty in the Indian market. This event was set to help the company expand its business in the fast-food industry and extend customer reach

Report Coverage

The research report offers an in-depth analysis based on Form, Nature, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for convenience and ready-to-cook foods is expected to grow steadily across households and foodservice sectors.

- Adoption of organic and clean-label dehydrated potato products will increase due to rising health consciousness.

- Product innovation, including flavored and value-added variants, will drive consumer interest and market differentiation.

- Expansion of e-commerce and modern retail channels will enhance product accessibility and regional penetration.

- Technological advancements in dehydration and packaging will improve shelf life, quality, and operational efficiency.

- Processed food and quick-service restaurant growth will continue to support consistent demand for dehydrated potato products.

- Emerging markets in Asia-Pacific and Latin America will witness rapid adoption due to urbanization and rising disposable incomes.

- Sustainability and eco-friendly sourcing will influence product development and brand positioning.

- Strategic partnerships, mergers, and acquisitions will strengthen market presence and supply chain efficiency.

- Flakes and powdered forms will maintain dominance, while niche formats will gain traction in specialized applications.