Market overview

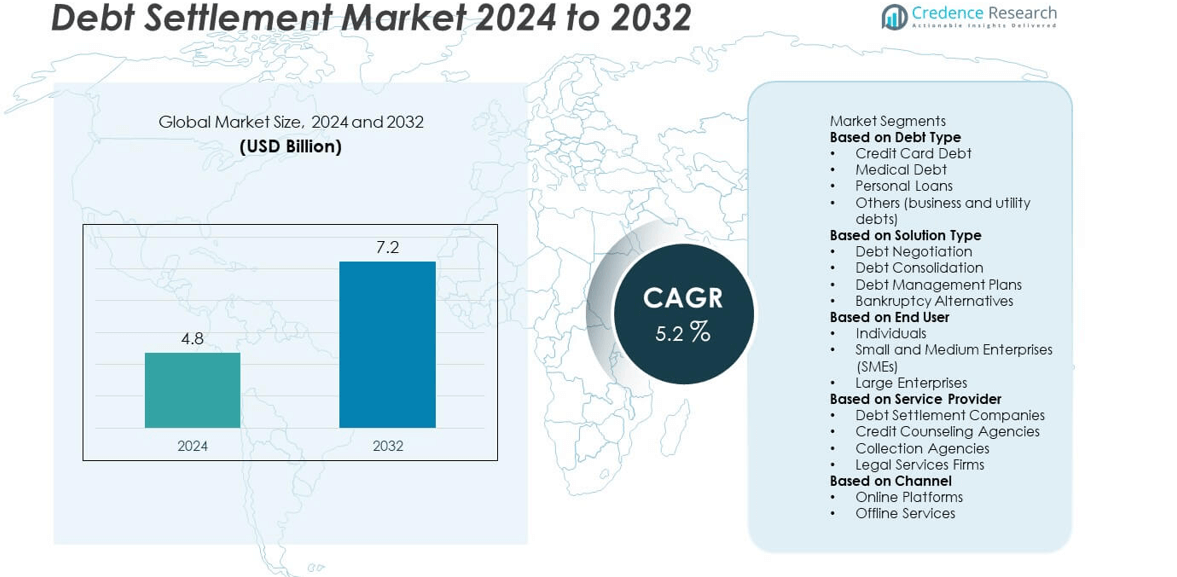

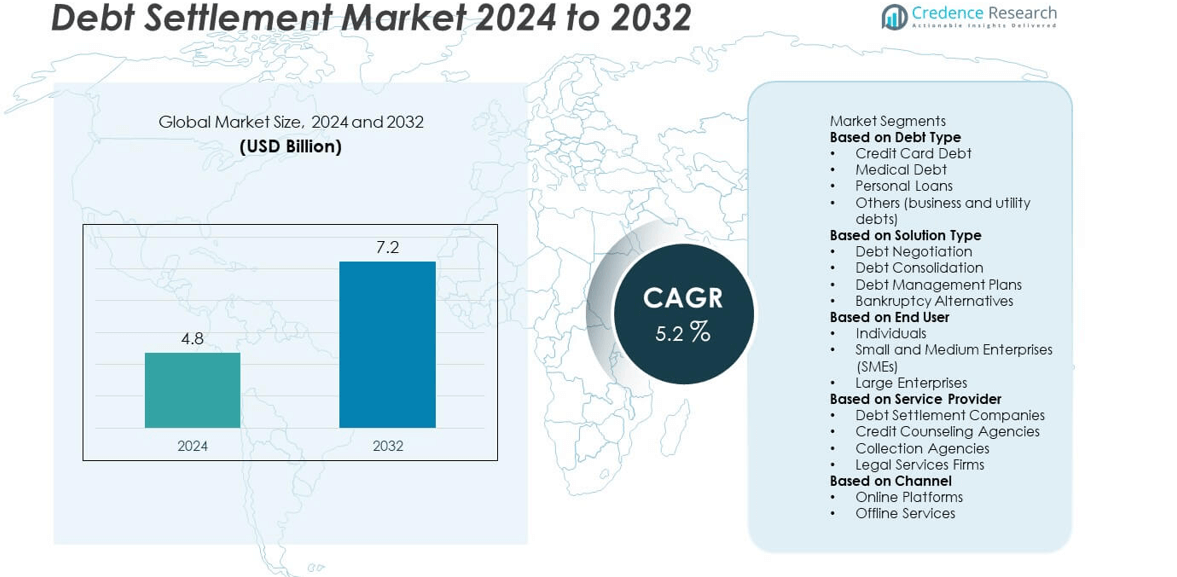

The Debt Settlement market was valued at USD 4.8 billion in 2024 and is projected to reach USD 7.2 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Debt Settlement Market Size 2024 |

USD 4.8 billion |

| Debt Settlement Market, CAGR |

5.2% |

| Debt Settlement Market Size 2032 |

USD 7.2 billion |

The debt settlement market is led by key players such as Freedom Debt Relief, National Debt Relief, CuraDebt Systems, Pacific Debt Inc., New Era Debt Solutions, Accredited Debt Relief, ClearOne Advantage, Guardian Debt Relief, Debt Negotiators, and Century Support Services. These companies emphasize customer-centric programs, digital platforms, and transparent negotiation processes to enhance credit rehabilitation outcomes. North America dominated the market with a 41% share in 2024, driven by high consumer debt levels and a strong regulatory environment. Europe followed with 28% share, supported by growing financial awareness, while Asia Pacific accounted for 22%, emerging as the fastest-growing region due to increasing adoption of digital debt management services and expanding middle-class consumer base.

Market Insights

- The debt settlement market was valued at USD 4.8 billion in 2024 and is projected to reach USD 7.2 billion by 2032, growing at a CAGR of 5.2%.

- Rising consumer debt, increasing financial stress, and growing demand for structured repayment programs are driving market expansion globally.

- The market is witnessing trends such as the adoption of AI-based negotiation tools, online settlement platforms, and personalized financial advisory services.

- Key players including Freedom Debt Relief, National Debt Relief, and Accredited Debt Relief focus on digital integration, transparency, and customer-centric approaches to strengthen competitiveness.

- North America led with 41% share in 2024, followed by Europe with 28% and Asia Pacific with 22%, while the credit card debt segment dominated with 46% share; however, high service fees and inconsistent regulatory frameworks continue to limit faster market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Debt Type

The credit card debt segment dominated the debt settlement market in 2024 with a 46% share, driven by rising consumer borrowing and high-interest revolving credit balances. Increasing dependency on credit cards for daily expenses and online purchases has led to mounting unsecured debt levels. Financial institutions and settlement firms are offering tailored repayment programs to help individuals reduce outstanding balances. Growing awareness of credit rehabilitation and the need for structured repayment plans further support segment growth. The demand for professional negotiation services continues to rise, especially among middle-income consumers facing financial strain.

- For instance, Freedom Debt Relief assisted over 1 million clients in resolving over $20 billion in unsecured debt through structured negotiation programs.

By Solution Type

The debt negotiation segment held the largest market share of 39% in 2024, supported by growing preference for direct negotiation between debtors and creditors to lower principal amounts. Consumers choose negotiation-based programs to avoid bankruptcy and maintain partial credit stability. This approach provides faster resolution and more flexibility than traditional repayment options. Advancements in digital platforms now allow automated communication and settlement tracking, enhancing transparency. The convenience and success rate of negotiated settlements make this solution type the preferred choice among financially distressed individuals and small enterprises.

- For instance, National Debt Relief helps clients settle debts for a reduced amount, which is often a multi-year process. The company recently invested in and formed a strategic partnership with Relief, an AI-enabled debt resolution app, to accelerate its digital services.

By End User

The individuals segment led the debt settlement market in 2024 with a 57% share, driven by rising household debt and financial instability among middle-income populations. Increasing medical expenses, job losses, and high-interest personal loans are key contributors to consumer debt accumulation. Individuals are turning to settlement programs for structured repayment options and relief from mounting penalties. Growing awareness about credit repair and the benefits of managed debt reduction programs has encouraged higher participation. The widespread availability of online financial advisory platforms also supports the strong adoption of debt settlement services among individuals worldwide.

Key Growth Drivers

Rising Consumer Debt Levels

The growing burden of consumer debt, particularly from credit cards, personal loans, and medical expenses, is driving the debt settlement market. Economic uncertainty and inflation have increased reliance on credit-based spending, resulting in higher default risks. Debt settlement programs provide structured solutions that help consumers negotiate manageable repayment terms. As financial distress becomes more widespread, individuals increasingly turn to professional settlement firms to avoid bankruptcy and regain financial stability, fueling steady growth in the global debt settlement market.

- For instance, Pacific Debt Inc. has settled over $500 million in consumer debt since 2002 by negotiating with creditors on behalf of clients. The company offers a client-centric approach and free consultations for individuals with unsecured debts.

Increasing Awareness of Debt Management Solutions

Rising financial literacy and improved access to information are boosting demand for debt settlement services. Consumers are becoming more aware of their options for negotiating with creditors and reducing debt obligations without legal proceedings. Educational campaigns and digital financial advisory platforms have made debt resolution strategies more transparent and accessible. This growing awareness encourages responsible financial behavior and drives the adoption of settlement programs that support long-term credit recovery and financial rehabilitation.

- For instance, Accredited Debt Relief, a financial services company operating as a DBA of Beyond Finance, LLC, has served clients with financial solutions since 2011. These services may include interactive debt analysis tools and repayment simulations that help users track settlement progress and navigate financial recovery pathways.

Growth of Digital and Automated Settlement Platforms

Technological advancements are reshaping the debt settlement industry, making services more efficient and accessible. Online platforms equipped with AI-driven negotiation tools and automated payment systems streamline communication between debtors and creditors. These platforms offer real-time status tracking and personalized settlement plans, improving user experience and trust. The shift toward digital debt resolution reduces manual errors, shortens settlement timelines, and lowers operational costs for service providers. This digital transformation continues to expand the reach of debt settlement services to a wider global customer base.

Key Trends and Opportunities

Expansion of Online and Mobile Debt Resolution Services

The increasing penetration of internet and smartphone use is fueling demand for online debt settlement platforms. Mobile applications now allow users to monitor balances, negotiate settlements, and receive financial counseling in real time. The convenience of digital access encourages younger, tech-savvy consumers to manage debt proactively. Financial institutions are partnering with fintech firms to provide secure, automated settlement solutions. This trend opens new opportunities for scalability, particularly in emerging markets where digital adoption is accelerating.

- For instance, ClearOne Advantage is a debt settlement company that uses AWS services to streamline its operations and helps clients with unsecured debts such as credit cards and personal loans. The company has been recognized as a “Top Workplace” by The Baltimore Sun and a “Best Place to Work” finalist by The Baltimore Business Journal.

Integration of AI and Predictive Analytics

Artificial intelligence is transforming debt settlement by improving credit assessment and negotiation outcomes. Predictive analytics enables service providers to forecast repayment potential, assess debtor risk, and design customized settlement offers. AI-powered chatbots enhance customer communication and reduce response time. These innovations increase settlement success rates and operational efficiency. As financial institutions adopt AI-driven risk modeling, data analytics will continue to play a key role in modernizing the debt settlement process and strengthening creditor-debtor relationships.

- For instance, companies such as Attunely, CollectWise, and TrueAccord have developed AI-based platforms that analyze large datasets of debtor information and interaction records to optimize debt settlement strategies. These platforms use predictive modeling to automate collections, personalize communication, and increase recovery rates through data-backed negotiation scoring.

Key Challenges

Regulatory and Compliance Constraints

Debt settlement companies face complex and varying regulations across regions, impacting operational flexibility. Strict consumer protection laws and licensing requirements often limit fee structures and negotiation practices. Non-compliance can lead to penalties and loss of trust among consumers. Maintaining transparency and adhering to ethical standards is essential for long-term credibility. As governments tighten financial regulations, companies must invest in compliance frameworks and legal expertise to operate effectively while ensuring fair and secure settlement procedures.

High Risk of Consumer Fraud and Mismanagement

The growing demand for debt settlement has led to an increase in fraudulent operators promising unrealistic outcomes. Unscrupulous firms exploit financially distressed consumers, leading to financial loss and reputational damage for the industry. Lack of awareness and proper verification mechanisms aggravate this challenge. To mitigate risks, regulatory bodies and industry leaders are emphasizing certification programs and strict oversight. Building trust through transparent pricing, verified service providers, and consumer education remains crucial to sustaining confidence in legitimate debt settlement services.

Regional Analysis

North America

North America held a 41% share of the debt settlement market in 2024, driven by high consumer borrowing levels and strong demand for structured financial recovery programs. The United States dominates due to rising credit card and personal loan debts, along with increased awareness of debt relief options. Supportive regulations and the presence of established settlement companies further boost market expansion. Canada also contributes steadily, supported by government initiatives promoting responsible lending and financial literacy. The region’s mature financial ecosystem and digital adoption strengthen the growth of technology-driven debt settlement services.

Europe

Europe accounted for 28% share of the debt settlement market in 2024, supported by growing financial stress among consumers and tightening economic conditions. The United Kingdom, Germany, and France lead the region, driven by high household debt levels and demand for transparent repayment frameworks. Regulatory reforms promoting fair debt collection and consumer protection are encouraging greater adoption of settlement services. Expanding fintech collaborations and digital advisory platforms are helping individuals manage debt more efficiently. Rising living costs and inflationary pressures continue to drive European consumers toward professional debt relief solutions.

Asia Pacific

Asia Pacific captured 22% share of the debt settlement market in 2024, emerging as the fastest-growing region. The rapid increase in personal and consumer lending, coupled with economic volatility, has heightened the need for debt resolution programs. China, India, and Japan lead adoption, supported by growing fintech penetration and financial inclusion initiatives. Consumers are becoming more aware of structured repayment and credit recovery solutions. Government-backed financial literacy campaigns and expansion of digital payment systems further accelerate market development. The region’s growing middle-class population and urbanization trends continue to create significant opportunities for settlement service providers.

Latin America

Latin America held 6% share of the debt settlement market in 2024, driven by rising personal debt levels and increasing financial instability in emerging economies. Brazil and Mexico are key contributors, supported by the growing number of credit users and fintech-driven debt recovery solutions. Economic fluctuations and currency devaluation have led consumers to seek structured repayment plans. However, limited financial literacy and inconsistent regulations across countries hinder faster adoption. Ongoing partnerships between financial institutions and digital service providers are expected to expand access to affordable and transparent debt settlement services in the region.

Middle East & Africa

The Middle East and Africa accounted for 3% share of the debt settlement market in 2024. The region’s growth is supported by increasing consumer debt and rising financial awareness among individuals and businesses. The United Arab Emirates and Saudi Arabia lead market adoption due to expanding credit markets and improved financial regulation. In Africa, South Africa and Kenya are witnessing gradual growth through mobile-based financial services that support structured debt repayment. Although adoption remains limited, growing digital infrastructure and financial inclusion initiatives are expected to enhance market penetration in the coming years.

Market Segmentations:

By Debt Type

- Credit Card Debt

- Medical Debt

- Personal Loans

- Others (business and utility debts)

By Solution Type

- Debt Negotiation

- Debt Consolidation

- Debt Management Plans

- Bankruptcy Alternatives

By End User

- Individuals

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Service Provider

- Debt Settlement Companies

- Credit Counseling Agencies

- Collection Agencies

- Legal Services Firms

By Channel

- Online Platforms

- Offline Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the debt settlement market is defined by the presence of leading players such as Freedom Debt Relief, National Debt Relief, CuraDebt Systems, Pacific Debt Inc., New Era Debt Solutions, Accredited Debt Relief, ClearOne Advantage, Guardian Debt Relief, Debt Negotiators, and Century Support Services. These companies focus on providing customized debt resolution programs that balance affordability, transparency, and credit recovery. Strategic partnerships with financial institutions, technology integration, and regulatory compliance are key factors shaping their competitiveness. Many firms are adopting digital platforms and AI-driven tools to enhance communication, automate settlement tracking, and improve customer experience. The growing emphasis on consumer trust, ethical practices, and certified financial counseling is also driving differentiation among players. Intense market competition encourages providers to expand service offerings, optimize negotiation success rates, and explore cross-border operations, particularly in emerging economies with rising household debt levels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Freedom Debt Relief

- National Debt Relief

- CuraDebt Systems

- Pacific Debt Inc.

- New Era Debt Solutions

- Accredited Debt Relief

- ClearOne Advantage

- Guardian Debt Relief

- Debt Negotiators

- Century Support Services

Recent Developments

- In July 2025, National Debt Relief topped Forbes Advisor’s Best Debt Relief & Settlement Companies of 2025 list for the third straight year.

- In May 2025, Accredited Debt Relief earned a 2025 Buyer’s Choice Award from ConsumerAffairs for Best Value, Customer Service, and Process.

- In January 2025, Century Support Services was listed by ConsumerAffairs as a top debt settlement company

- In 2025, Pacific Debt Relief reportedly adopted new technology to enhance client-team communication for smoother case management

Report Coverage

The research report offers an in-depth analysis based on Debt Type, Solution Type, End User, Service Provider, Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-based negotiation and analytics tools will enhance settlement efficiency.

- Digital debt management platforms will expand accessibility and improve transparency.

- Demand for personalized and automated repayment solutions will continue to rise.

- Collaboration between fintech companies and financial institutions will increase service reach.

- Regulatory frameworks will strengthen to ensure ethical and transparent settlement practices.

- Financial literacy programs will boost awareness of professional debt relief options.

- Integration of mobile applications will simplify user engagement and payment tracking.

- Growth in unsecured consumer lending will sustain market demand for settlement services.

- Expansion into emerging economies will open new opportunities for service providers.

- Technology-driven solutions will improve negotiation success rates and customer satisfaction.