Market Overview:

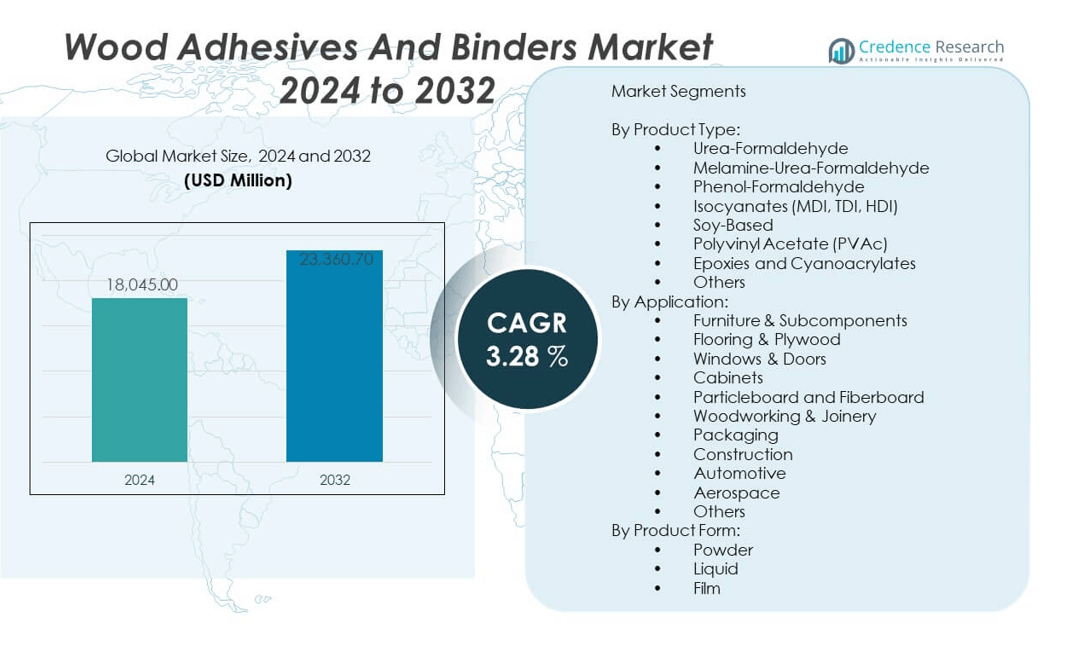

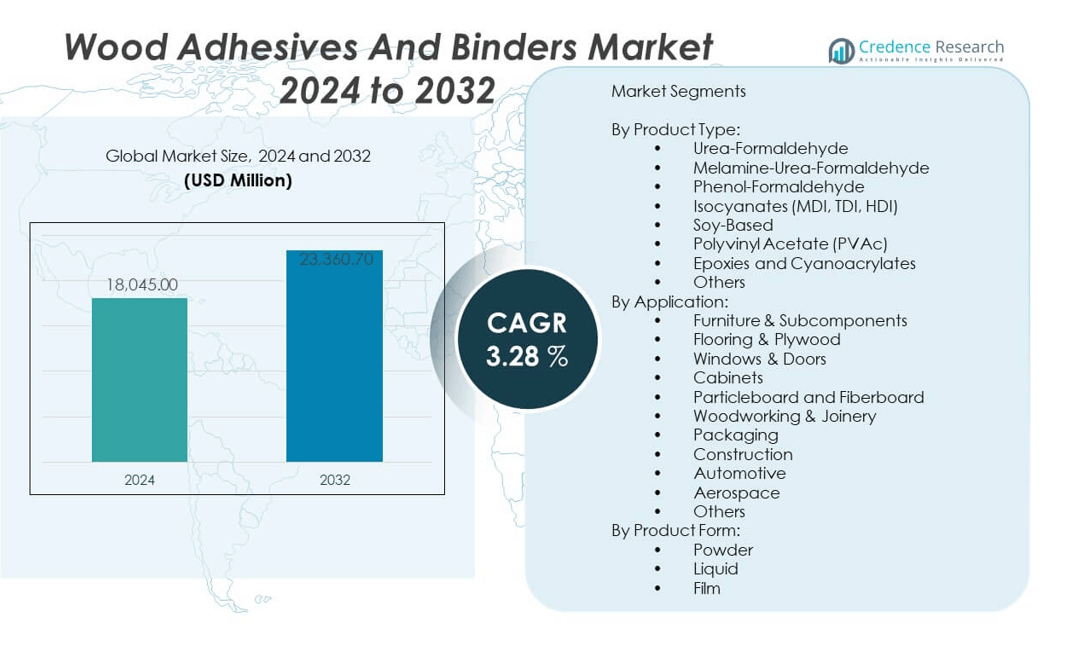

The Wood adhesives and binders’ market is projected to grow from USD 18,045 million in 2024 to an estimated USD 23,360.7 million by 2032, with a compound annual growth rate (CAGR) of 3.28% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wood Adhesives and Binders Market Size 2024 |

USD 18,045 million |

| Wood Adhesives and Binders Market, CAGR |

3.28% |

| Wood Adhesives and Binders Market Size 2032 |

USD 23,360.7 million |

The market benefits from the expansion of the furniture, construction, and woodworking industries, which increasingly demand reliable, eco-friendly bonding solutions. Growing consumer preference for engineered wood products, such as plywood and particleboard, has accelerated the use of adhesives that offer durability, moisture resistance, and sustainability. Advancements in bio-based and formaldehyde-free formulations have enhanced product acceptance amid tightening environmental regulations and rising awareness around indoor air quality.

Asia-Pacific leads the global wood adhesives and binders’ market due to rapid urbanization, increased construction activity, and a strong manufacturing base for furniture and wood products. North America and Europe follow, supported by mature wood processing sectors and strict environmental standards driving innovation in low-emission adhesives. Emerging regions such as Latin America and the Middle East are witnessing rising demand, fueled by infrastructure growth, modernization of building materials, and increasing adoption of engineered wood.

Market Insights:

- The wood adhesives and binders’ market is projected to grow from USD 18,045 million in 2024 to USD 23,360.7 million by 2032, registering a CAGR of 3.28% during the forecast period.

- Growth is driven by rising demand from furniture, construction, and engineered wood sectors seeking durable and efficient bonding solutions.

- Increasing regulatory pressure on formaldehyde emissions and VOC content challenges manufacturers to reformulate adhesives for compliance.

- Bio-based adhesives derived from soy, starch, and lignin are gaining traction due to sustainability goals and shifting consumer preferences.

- The market faces cost fluctuations due to volatility in petrochemical-based raw materials such as MDI, TDI, and formaldehyde.

- Asia-Pacific dominates the market, supported by rapid urbanization, infrastructure development, and strong manufacturing bases in China and India.

- North America and Europe show stable growth, backed by stringent environmental regulations, green building codes, and innovation in eco-friendly adhesives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from the Furniture and Construction Sectors Fuels Adhesive Use:

The demand for engineered wood products in furniture and construction continues to expand, driving consistent consumption of adhesives and binders. Consumers prefer ready-to-assemble furniture and modular interiors, which rely heavily on adhesive-based assembly. Wood panel manufacturers use high-performance binders to increase product stability and moisture resistance. The construction industry adopts these materials in flooring, paneling, and framework due to ease of application and cost-effectiveness. Interior fit-out contractors prioritize adhesives that cure quickly and bond strongly. The rise of multi-family housing and commercial complexes creates large-volume adhesive requirements. Sustainable building certification programs push for low-VOC adhesive usage, supporting compliant product development. The Wood adhesives and binders market gains traction through alignment with evolving material preferences in both structural and decorative applications.

- For instance, 3M Company has developed a low-VOC adhesive that reduces curing time by 20% while maintaining a bond strength exceeding 5.5 MPa, specifically designed for modular furniture applications. The Wood adhesives and binders market gains traction through alignment with evolving material preferences in both structural and decorative applications.

Expansion of Engineered Wood Manufacturing Drives Adhesive Consumption:

Engineered wood products like plywood, oriented strand board (OSB), and medium-density fiberboard (MDF) have become essential materials in modern construction and furniture. Their production depends on high-quality binders to maintain strength and dimensional stability. It supports uniform dispersion of stress across bonded surfaces, making it ideal for load-bearing structures. Manufacturers select adhesives based on curing speed, water resistance, and compatibility with automated lines. Growth in prefabricated housing expands the use of adhesive-bound components in walls and panels. Countries promoting low-carbon construction practices turn to engineered wood as a green alternative to steel and concrete. This transition creates consistent adhesive demand across value chains. The Wood adhesives and binders segment aligns closely with trends in offsite and modular construction practices, which prioritize clean and efficient bonding techniques.

Rising Environmental Concerns and Regulations Shape Product Formulation:

Regulatory pressure to reduce formaldehyde emissions and volatile organic compounds (VOCs) has led manufacturers to innovate eco-friendly adhesive solutions. Product formulators develop water-based and soy-based alternatives to meet indoor air quality standards. Builders and furniture makers prefer compliant adhesives to satisfy certifications like LEED and BREEAM. Companies must ensure that their formulations balance sustainability with mechanical performance and cost efficiency. End-users in healthcare, education, and hospitality settings seek adhesives with minimal chemical emissions. Regional regulations in the EU and North America significantly influence formulation strategies across global supply chains. The demand for green chemistry and bio-based polymers accelerates. The Wood adhesives and binders market responds by investing in cleaner, safer options that meet current and future legislative expectations.

Automation and Process Efficiency Accelerate Adoption of High-Performance Adhesives:

Industries are moving toward automated wood processing, which requires adhesives that support fast curing, high shear strength, and minimal downtime. Plants need formulations that bond quickly without compromising bond integrity under pressure and heat. Automated systems demand consistent viscosity and pot life for smooth application through rollers, sprayers, or extruders. It increases yield and reduces waste, aligning with lean manufacturing goals. Adhesives must also accommodate substrate variation without impacting bond quality. Process reliability improves when adhesives work well under fluctuating temperature or humidity. High-speed production lines in Asia and Europe adopt such systems to meet mass demand. The Wood adhesives and binders sector gains relevance by delivering solutions that maximize throughput and maintain consistent product quality.

Market Trends:

Shift Toward Bio-Based and Renewable Adhesives Gains Market Momentum:

Sustainability concerns have spurred interest in bio-based adhesives derived from natural polymers like starch, lignin, and soy protein. Manufacturers explore these options to reduce carbon footprint and dependence on petrochemical feedstocks. Product developers prioritize non-toxic, biodegradable binders that offer sufficient mechanical performance for structural and interior applications. Demand grows in markets where green labeling and environmental product declarations influence buyer decisions. Packaging, furniture, and plywood industries adopt such solutions to meet consumer expectations. It promotes circular economy principles across the value chain. Technological partnerships between chemical firms and wood panel manufacturers facilitate scalable deployment. The Wood adhesives and binders market reflects this trend with growing investments in sustainable raw material innovation.

- For instance, BASF SE recently launched a soy-protein-based binder offering a tensile shear strength of 4 MPa in plywood applications while achieving a 30% reduction in carbon footprint compared to conventional resins. The Wood adhesives and binders market reflects this trend with growing investments in sustainable raw material innovation.

Customized Formulations Support Diverse Application Requirements:

Different end-use industries demand adhesives tailored for specific load-bearing, moisture, and environmental conditions. Furniture makers require flexible adhesives for laminates, while flooring installers prioritize high shear strength and water resistance. Plywood and MDF manufacturers need formulations that meet interior, semi-exterior, or exterior use standards. It drives suppliers to expand their product lines with hybrid, reactive, and structural adhesives. Smart formulation enables compatibility with multiple substrate types, including bamboo, composite wood, and recycled materials. Customization improves product lifecycle performance and reduces field failures. Application-specific adhesives improve customer retention and product differentiation. The Wood adhesives and binders sector evolves by integrating precise performance attributes into their portfolio offerings.

- For instance, H.B. Fuller Company developed a high-performance polyurethane adhesive tailored for bamboo flooring, offering a lap shear strength of over 6 MPa and curing within 15 minutes under standard conditions. The Wood adhesives and binders sector evolves by integrating precise performance attributes into their portfolio offerings.

Digitalization and Smart Manufacturing Influence Product Selection:

Smart factories and Industry 4.0 initiatives influence adhesive procurement decisions by emphasizing process control, data capture, and predictive maintenance. Buyers seek adhesives that perform reliably under automated dispensing and real-time quality assurance conditions. Integration with digital control systems enables feedback loops for temperature, viscosity, and cure monitoring. This reduces rework, energy waste, and material loss. Suppliers develop formulations compatible with such environments, supporting zero-defect manufacturing goals. It enhances visibility across production lines, especially in large-volume MDF and OSB plants. Digitalization also enables traceability in raw material sourcing and sustainability reporting. The Wood adhesives and binders market supports this transformation with products that enable process intelligence and operational efficiency.

Growth of DIY and Modular Furniture Expands Retail-Focused Product Lines:

Consumer preference for DIY and modular furniture solutions influences packaging, formulation, and branding strategies. Adhesive brands develop user-friendly products suitable for home use, including low-odor and fast-curing options. Packaging shifts toward compact cartridges, tubes, and pouches with easy dispensing features. It drives retail channel growth, especially in developed markets where home improvement trends remain strong. Demand for assembly adhesives that bond wood, plastic, and composite panels increases. Online platforms promote bundled kits with adhesives for specific repair or assembly tasks. The Wood adhesives and binders market capitalizes on this by targeting individual consumers and small-scale craftsmen through differentiated, ready-to-use product lines.

Market Challenges Analysis:

Price Volatility of Raw Materials Disrupts Cost Management and Planning:

Wood adhesives and binders rely on petrochemical-based inputs such as phenol, formaldehyde, isocyanates, and polyvinyl acetate. Fluctuations in crude oil prices, trade restrictions, and global supply imbalances frequently impact input costs. Manufacturers face pressure to maintain pricing while absorbing raw material volatility, which affects margins and procurement strategies. Price spikes reduce competitiveness, particularly for small and mid-sized adhesive producers. Substitution with bio-based alternatives remains limited in high-performance applications due to inconsistent supply or high production cost. End-users demand stable pricing to support long-term projects or contracts. Supply chain disruptions caused by geopolitical events or environmental regulations further strain sourcing strategies. The Wood adhesives and binder’s industry must manage volatility while continuing to meet performance and compliance expectations.

Stringent Regulatory Compliance and Environmental Certification Create Entry Barriers:

Meeting emission standards and health safety regulations requires substantial R&D investment in formulation and testing. Adhesive manufacturers must align with global norms such as REACH, EPA standards, and ISO certifications for chemical safety. Testing costs and compliance documentation extend time-to-market and limit the agility of smaller firms. Markets like the EU and North America enforce strict formaldehyde limits, creating challenges for traditional resin systems. In-house reformulation adds technical and operational complexity to legacy plants. Failure to comply may result in product recalls, certification loss, or legal consequences. The Wood adhesives and binders market faces high regulatory scrutiny that limits entry for new players and increases operational burden for existing manufacturers.

Market Opportunities:

Emergence of Green Building Codes Boosts Demand for Low-VOC Adhesives:

Global efforts to promote green construction present a strong opportunity for manufacturers that offer compliant, eco-friendly adhesive solutions. Builders and architects now prioritize adhesives that contribute to indoor air quality certifications and sustainable building ratings. Demand is growing for products that satisfy LEED, WELL, and BREEAM guidelines without sacrificing bond strength or durability. The Wood adhesives and binders’ segment can benefit from increasing mandates around environmentally responsible sourcing and low-emission materials.

Penetration of Adhesive Technologies in Emerging Economies Accelerates Market Reach:

Rapid urbanization and infrastructure development in Asia, Latin America, and Africa create new demand for wood products and adhesive solutions. Governments and developers in these regions seek efficient and cost-effective construction materials to support housing, education, and healthcare projects. Domestic furniture markets are expanding, especially in mid-income segments. The Wood adhesives and binders’ market can capture these opportunities by offering region-specific product lines and investing in local production or partnerships.

Market Segmentation Analysis:

By Product Type

The Wood adhesives and binders market includes a diverse range of formulations based on application performance and cost. Urea-formaldehyde leads in volume due to affordability and broad use in engineered wood panels. Melamine-urea-formaldehyde is favored for added moisture resistance. Phenol-formaldehyde caters to outdoor applications requiring long-term durability. Isocyanates (MDI, TDI, HDI) offer strong structural bonding for high-performance needs. Soy-based adhesives are gaining attention with increasing demand for sustainable, bio-based solutions. Polyvinyl acetate (PVAc) remains popular for interior applications such as furniture and cabinetry. Epoxies and cyanoacrylates serve niche uses in construction, aerospace, and repairs. Others include hybrid or custom formulations for specialized requirements.

By Application

Furniture and subcomponents represent the largest application segment, driven by demand for modular and ready-to-assemble products. Flooring and plywood segments require adhesives that ensure dimensional stability and resistance to stress. Windows, doors, cabinets, and fiberboard-based products utilize adhesives that support lamination and finishing processes. Woodworking and joinery rely on fast-curing options for precision assembly. Construction applications cover structural bonding, paneling, and insulation. Adhesives used in packaging, automotive, and aerospace require specific performance characteristics, including impact resistance, low weight, and thermal stability.

- For instance, Bostik SA (Arkema) introduced a fast-curing adhesive for woodworking applications that achieves handling strength in under 5 minutes, boosting assembly line efficiency by 15%.

By Product Form

Liquid adhesives dominate the market due to ease of use and versatility across manual and automated systems. Powder forms offer longer shelf life and suitability for industrial-scale operations. Film adhesives are used in precise, clean applications with minimal waste.

By End-Use Industry

Construction and furniture are the primary consumers due to consistent demand for bonded wood components. Packaging maintains a stable share, while automotive and aerospace sectors require advanced adhesives for specialized bonding solutions.

Segmentation:

By Product Type:

- Urea-Formaldehyde

- Melamine-Urea-Formaldehyde

- Phenol-Formaldehyde

- Isocyanates (MDI, TDI, HDI)

- Soy-Based

- Polyvinyl Acetate (PVAc)

- Epoxies and Cyanoacrylates

- Others

By Application:

- Furniture & Subcomponents

- Flooring & Plywood

- Windows & Doors

- Cabinets

- Particleboard and Fiberboard

- Woodworking & Joinery

- Packaging

- Construction

- Automotive

- Aerospace

- Others

By Product Form:

By End-Use Industry:

- Construction

- Furniture

- Packaging

- Automotive

- Aerospace

Regional Analysis:

Asia-Pacific Leads with Dominant Manufacturing and Construction Growth

Asia-Pacific holds the largest share in the Wood adhesives and binders’ market, accounting for approximately 41.3% of the global market. Strong manufacturing infrastructure in China, India, Japan, and Southeast Asia drives high consumption across construction, furniture, and engineered wood production. Rapid urbanization and government investments in housing and infrastructure increase demand for bonded wood products. China leads the region in both production and export of wood panels, while India shows rising domestic consumption. Growing furniture exports from Vietnam and Indonesia further strengthen adhesive usage. It benefits from local raw material availability, competitive labor costs, and favorable economic policies supporting manufacturing expansion.

North America Maintains Strong Position with Regulatory and Technological Focus

North America holds an estimated 26.4% share of the global Wood adhesives and binders’ market. The United States leads adhesive consumption in the region due to a mature housing market, growing demand for prefabricated wood structures, and high penetration of modular furniture. Environmental regulations around VOC emissions and formaldehyde content push manufacturers toward low-emission and bio-based adhesives. Major players in the region invest in R&D to meet evolving compliance standards and performance benchmarks. The region also benefits from rising demand for engineered wood in both residential and non-residential construction. Canada supports the market with its strong forestry sector and sustainable timber supply chain.

Europe Focuses on Sustainability and Bio-Based Adhesive Innovation

Europe represents approximately 20.7% of the global market, driven by environmental regulations, green building codes, and strong industrial production. Countries such as Germany, France, and Italy support the market through advanced manufacturing capabilities and high consumption of engineered wood in housing and public infrastructure. The Wood adhesives and binders’ market in Europe aligns closely with demand for low-VOC and formaldehyde-free adhesives, leading to increased development of soy- and starch-based formulations. Manufacturers benefit from regulatory incentives promoting sustainable construction materials. It also shows stable demand in furniture and interior design segments, supported by consumer preferences for eco-certified wood products.

Remaining Market Share (~11.6%) is distributed across Latin America, the Middle East, and Africa, where growth is emerging due to urbanization, infrastructure expansion, and increasing adoption of wood-based products in residential and commercial construction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- 3M Company

- Ashland Inc. / Ashland Global Specialty Chemicals Inc.

- B. Fuller Company

- Henkel AG & Co. KGaA

- BASF SE

- Huntsman Corporation

- Avery Dennison Corporation

- Dow Chemical Company

- Adhesives Research Inc.

- Bostik SA (Arkema)

- Franklin Adhesives and Polymers

Competitive Analysis:

The Wood adhesives and binders market features a mix of global chemical conglomerates and specialized adhesive manufacturers competing on product performance, innovation, and environmental compliance. Key players such as Henkel, H.B. Fuller, BASF, Bostik (Arkema), and 3M maintain strong brand portfolios and global reach, supported by continuous R&D investment. These companies focus on developing low-VOC, bio-based, and high-strength adhesives tailored to construction, furniture, and packaging applications. Competitive intensity is rising due to increasing demand for sustainable solutions and regional players expanding their market presence. Strategic collaborations and product customization help leading firms gain a competitive edge in end-use specific segments.

Recent Developments:

- In 2025, 3M Companyhas focused on enhancing their portfolio with innovative adhesive technologies that emphasize sustainability and high performance in wood bonding applications, aligning with industry trends toward eco-friendly products and regulatory compliance. Specific new product launches focus on low-VOC and bio-based adhesive formulations.

- In 2025, B. Fuller Companylaunched new sustainable adhesive products targeting wood bonding applications that cater to the furniture and construction industries, emphasizing product longevity, chemical resistance, and improved bonding strength to meet evolving customer demands.

- In 2025, Henkel AG & Co. KGaAreinforced its wood adhesive portfolio through partnerships with key manufacturers in the construction and furniture sectors to co-develop advanced adhesive systems that enhance durability and sustainability, responding to market demands toward green building materials.

- In 2025, BASF SEintroduced innovative bio-based binder solutions for wood adhesives, emphasizing low environmental impact and compliance with stringent regulations on formaldehyde emissions, thus supporting the market shift toward safer, greener adhesives.

Market Concentration & Characteristics:

The Wood adhesives and binders market demonstrates moderate to high concentration, with a few multinational firms holding significant shares due to advanced R&D capabilities, wide distribution networks, and diversified portfolios. It is characterized by strong competition in high-volume applications such as furniture and plywood, while niche segments like aerospace and bio-based adhesives attract innovation-driven differentiation. Price sensitivity, regulatory compliance, and performance customization remain defining factors. Market players compete by offering eco-friendly formulations, rapid-curing systems, and technical support to strengthen client relationships across industries.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Product Form, and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for eco-friendly and formaldehyde-free adhesives will continue to rise.

- Bio-based adhesives will gain market share across furniture and packaging sectors.

- Regulatory pressure will drive product innovation in North America and Europe.

- Liquid adhesives will maintain dominance due to versatility and ease of application.

- Asia-Pacific will remain the largest market, led by China, India, and Southeast Asia.

- Strategic partnerships between adhesive manufacturers and wood product firms will increase.

- Automation in panel production will drive demand for fast-curing, high-performance adhesives.

- Investment in R&D will focus on reducing emissions and enhancing bond strength.

- E-commerce and DIY trends will expand demand for consumer-ready adhesive formats.

- Aerospace and automotive sectors will create niche growth opportunities for high-spec adhesives.