Market Overview:

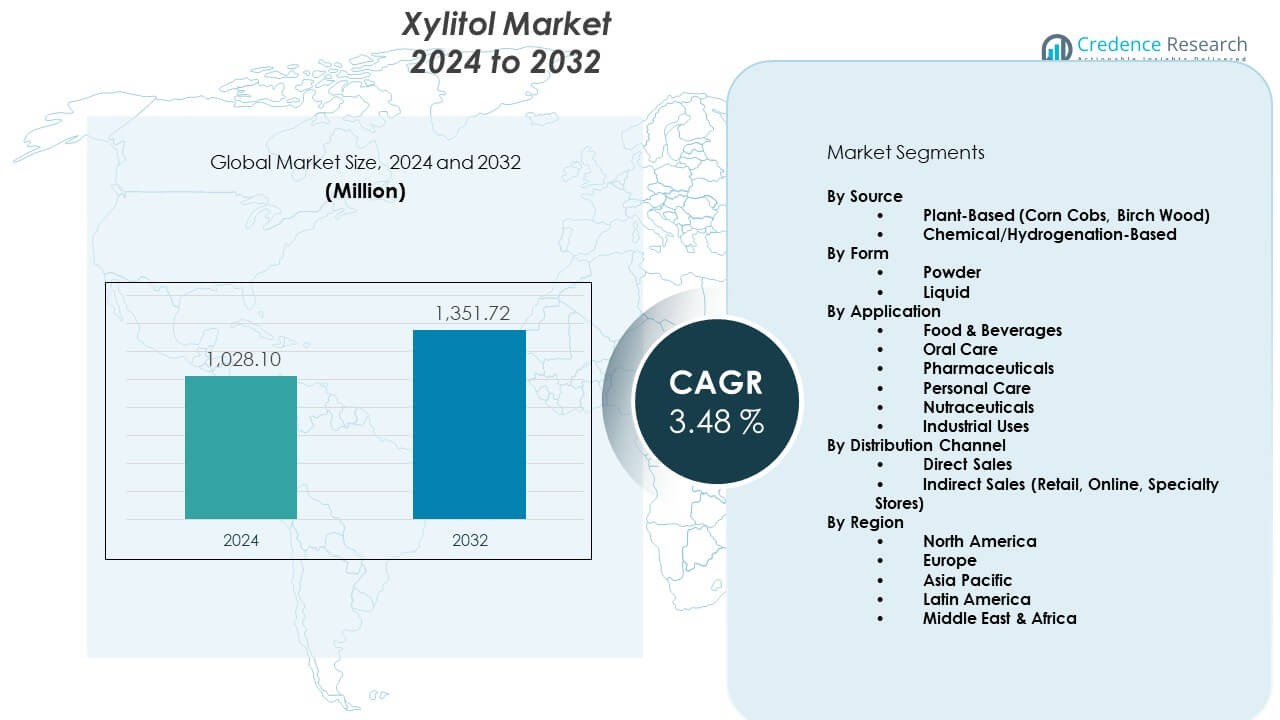

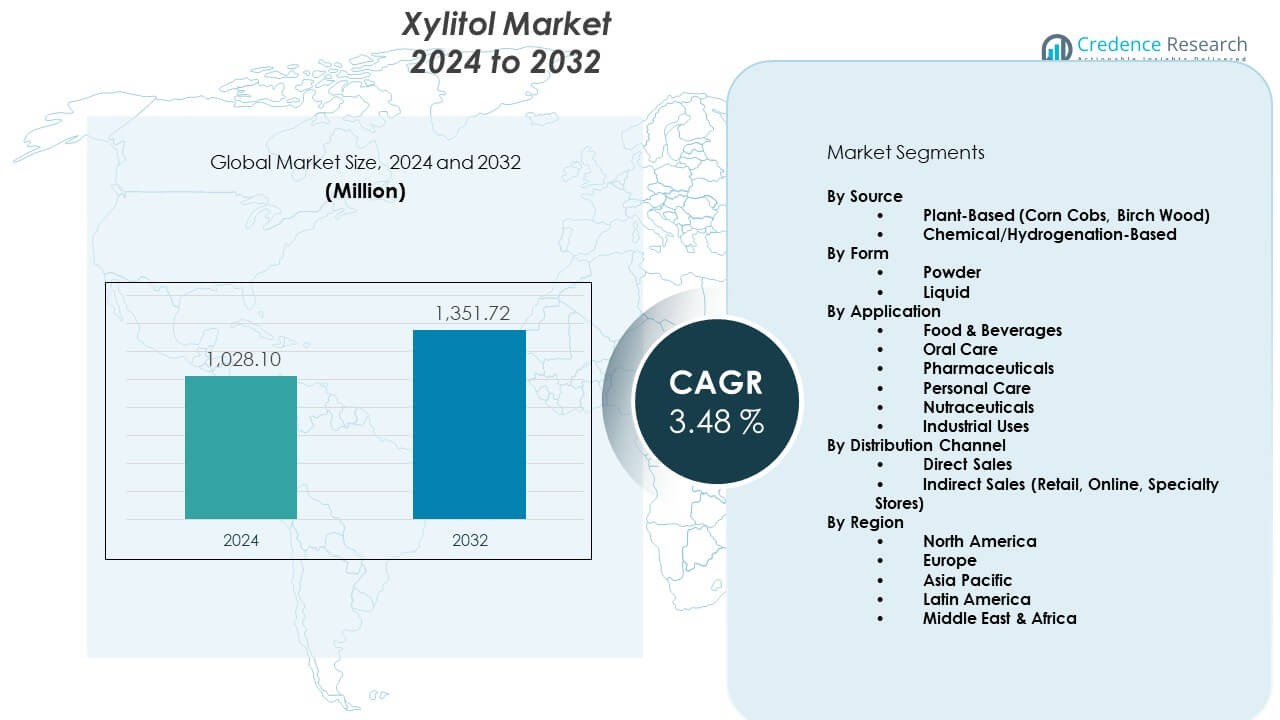

The Xylitol Market is projected to grow from USD 1028.1 million in 2024 to an estimated 1351.72 million by 2032, with a CAGR of 3.48% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Xylitol Market Size 2024 |

USD 1028.1 Million |

| Xylitol Market, CAGR |

3.48% |

| Xylitol Market Size 2032 |

USD 1351.72 Million |

Growth strengthens as consumers shift toward healthier sweetener choices supported by rising lifestyle awareness. Food producers adopt xylitol to reduce sugar without changing taste quality. Oral care brands use xylitol in toothpaste and gums to support dental health messaging. Pharmaceutical firms apply it in formulations for better patient adherence. Bakers leverage its heat-stable profile for consistent product texture. Plant-based trends also support its adoption in new product lines. Wider retail reach helps brands increase visibility. Industry focus on clean ingredients helps long-term expansion.

Europe leads due to strong sugar-reduction policies and steady demand across confectionery and oral care brands. North America follows with a mature functional food ecosystem and higher interest in natural sweeteners. Asia Pacific emerges as the fastest-expanding region supported by broader health awareness and rising processed food production. China and India show stronger adoption through new product launches. Latin America gains traction as brands target urban consumers. The Middle East & Africa shows gradual growth supported by rising retail presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Xylitol market is valued at USD 1028.1 million in 2024 and is projected to reach USD 1351.72 million by 2032, growing at a 3.48% CAGR, driven by demand for sugar-reduction and cleaner sweetener alternatives.

- North America (32%), Europe (28%), and Asia Pacific (30%) dominate due to strong oral care demand, established clean-label adoption, and rising reduced-sugar consumption across food applications.

- Asia Pacific, holding 30% share, is the fastest-growing region supported by expanding food processing activity, higher health awareness, and rapid retail penetration.

- Food & Beverages capture the largest segment share at 42%, supported by wide use in confectionery, bakery, and sugar-free product lines.

- Oral Care accounts for 31% share, driven by strong clinical acceptance and rising demand for cavity-prevention formulations.

Market Drivers:

Rising Demand for Low-Calorie Sweeteners Across Food and Beverage Categories

The Xylitol market grows due to strong demand for low-calorie sweeteners in daily diets. Food brands use xylitol to cut sugar without hurting taste quality. Oral care companies support adoption due to well-known dental health benefits. Retailers highlight sugar-free labels that appeal to health-focused shoppers. Regulatory bodies promote reduced sugar consumption to support public wellness. Bakeries use xylitol to keep product texture stable under heat. Manufacturers promote clean-label positioning to expand visibility. It gains steady momentum as brands push healthier formulations.

- For instance, Cargill produces a wide range of polyols, including xylitol and sorbitol, and is a key supplier to global food and beverage brands. While the company is a major global player, specific, verifiable production tonnage across its entire polyol portfolio is not publicly detailed in market reports, which instead indicate large global market volumes (e.g., more than one million tons for sorbitol globally around the mid-2000s).

Expanding Use in Oral Care Products Driven by Global Dental Awareness Growth

The Xylitol market strengthens through rising interest in functional oral care products. Gum makers use xylitol to support enamel protection messaging. Toothpaste brands highlight cavity-prevention features backed by clinical support. Pharmacies offer broader sugar-free product sets for different age groups. Dental associations promote xylitol to improve preventive care routines. Manufacturers launch new variants to meet taste expectations. Youth groups adopt sugar-free gums more actively. It benefits from stronger awareness campaigns across regions.

- For instance, Mars Wrigley’s EXTRA brand offers sugar-free gum in numerous global markets, and the company’s sugar-free gum products can contain xylitol, which promotes dental health. While the specific ingredients like xylitol can vary by region and product line, sugar-free gum dominates the general market, with one report indicating it accounts for an estimated 85% of the U.S. gum market compared to regular sugared products.

Growing Inclusion in Pharmaceutical Formulations for Better Patient Compliance

The Xylitol market rises due to stronger use in pharmaceutical blends that require gentle sweeteners. Drug makers use xylitol in syrups and chewables to support patient comfort. Hospitals choose products that enable smoother dosage acceptance. Research teams explore xylitol for broader respiratory and digestive formulations. Brands focus on natural-origin claims to reach sensitive patient groups. Retail channels push easy-to-use formats for children and older adults. Production teams refine blends to support high stability. It expands as pharmaceutical companies widen product portfolios.

Increasing Production Capacity and Innovation Efforts Among Global Brands

The Xylitol market gains traction as producers invest in advanced production systems. Manufacturers upgrade extraction lines to improve long-term output. Companies diversify raw material sources to manage supply risks. Research teams explore new applications in snacks and wellness goods. Packaging upgrades help firms improve shelf presence. Cross-border partnerships expand access to new consumer bases. Cleaner production models support sustainability goals. It moves toward broader industrial integration supported by new product launches.

Market Trends:

Rising Shift Toward Plant-Derived and Clean-Label Ingredient Profiles

The Xylitol market aligns with growing interest in plant-derived ingredients across consumer groups. Brands use natural sourcing claims to strengthen trust. Retail stores dedicate more space to clean-label products. Food developers design recipes that remove synthetic components. Product teams highlight transparent labeling on packaging. Rising vegan and plant-based diets support broader usage. Wellness trends push firms toward minimal-additive formulas. It benefits from cleaner ingredient expectations in multiple sectors.

- For instance, Roquette processes over 2 million tons of plant-based raw materials each year across its global facilities, supporting its leadership in natural ingredient supply.

Growing Development of Sugar-Free Confectionery and Functional Snack Ranges

The Xylitol market expands as confectionery makers launch sugar-free items for wider audiences. Gum and mint brands introduce new flavor formats to attract younger buyers. Retailers push functional snacks through targeted displays. Food technologists refine blends that maintain texture under transport. Sugar-reduction initiatives guide new recipe development. Snack companies promote low-sugar claims to differentiate premium lines. Brands test new product forms to improve taste delivery. It gains support from rising interest in healthier snacking.

- For instance, Perfetti Van Melle produces sugar-free Mentos and Alpenliebe variants in over 150 countries, with sugar-free lines forming a rapidly expanding share of its confectionery portfolio.

Wider Penetration Into Nutraceutical and Wellness-Driven Product Segments

The Xylitol market benefits from rising use in nutraceuticals shaped by health-focused lifestyles. Supplement makers use xylitol to create better-tasting chewable products. Wellness brands promote low-sugar formulations across product families. Distribution networks highlight natural sweeteners to meet consumer demand. Research units test xylitol in digestive-friendly blends. Companies refine delivery formats for faster user acceptance. Packaging shifts target fitness-aware demographics. It grows with the expansion of wellness-driven product portfolios.

Improved Manufacturing Efficiency Through Sustainable and Automated Processes

The Xylitol market progresses with steady upgrades in sustainable production practices. Manufacturers adopt energy-saving systems to cut operational waste. Automation improves product consistency during peak demand cycles. Companies invest in clean-processing models to reach eco-certification targets. Supply partners adopt greener sourcing frameworks. Research teams test new extraction technologies to improve yield. Global buyers value brands with strong environmental claims. It benefits from supply chain modernization.

Market Challenges Analysis:

High Production Costs, Raw Material Pressure, and Supply Chain Constraints

The Xylitol market faces pressure from high production costs linked to complex extraction steps. Manufacturers depend on limited feedstock sources that raise input volatility. Supply chain gaps affect consistent availability across regions. Smaller producers struggle with capital requirements for efficient processing. Brands face difficulty balancing cost and clean-label expectations. Regulatory shifts create uncertainty around ingredient approval cycles. Import-dependent countries manage longer lead times. It navigates these hurdles while maintaining product quality.

Intense Competition From Artificial and Natural Sweetener Alternatives

The Xylitol market encounters strong competition from stevia, erythritol, and other sugar substitutes. Brands compare sweetness levels to match consumer taste profiles. Food companies choose alternatives with lower cost structures. Retailers promote multi-sweetener options that diversify buyer choice. Marketing teams must highlight unique dental protection benefits. Product developers work to reduce aftertaste differences. Competitive pricing strategies influence product placement. It must maintain clear positioning to defend long-term market share.

Market Opportunities:

Growing Demand for Sugar-Free and Functional Food Innovations Across Regions

The Xylitol market gains new opportunities from rising global demand for sugar-free foods. Brands create functional confectionery lines that meet health expectations. Food companies explore new formats suited for premium segments. Regulatory backing for sugar reduction supports product expansion. Wellness consumers look for natural sweeteners in daily diets. Retailers promote sugar-free categories through targeted campaigns. Innovations in flavor delivery support product differentiation. It captures growth in evolving health-conscious markets.

Expansion Potential in Pharmaceuticals, Nutraceuticals, and Clean-Label Product Lines

The Xylitol market sees strong opportunity in expanding pharmaceutical and nutraceutical applications. Drug makers use xylitol to enhance formulation comfort for sensitive users. Supplement brands explore new chewable forms with better taste. Clean-label trends open space for natural sweeteners in emerging product groups. Manufacturers invest in scalable production for higher volumes. Retail growth in health stores improves category exposure. Research into new therapeutic uses widens long-term possibilities. It stands positioned for broader multi-industry adoption.

Market Segmentation Analysis:

By Source

The Xylitol market divides sourcing into plant-based inputs such as corn cobs and birch wood, along with chemical or hydrogenation-based processes. Plant-derived sources lead due to strong acceptance in clean-label food products. Chemical routes support high-volume supply for industrial users. Manufacturers balance both methods to manage cost and output stability. Brands favor plant-origin claims to strengthen natural positioning. Industrial buyers choose chemical routes for predictable consistency. It benefits from diversified sourcing in mature and emerging regions.

- For instance, Shandong Futaste operates one of Asia’s largest corn-based xylitol production systems, and the company plans to achieve an annual production capacity of 600,000 tons for all sugar alcohol products when its industrial park is fully completed. The company uses corn and corncobs as raw materials for the deep processing operations that produce a range of products including xylose, xylitol, and L-arabinose.

By Form

Powder holds a strong share due to wide use across food, oral care, and pharmaceutical applications. It supports efficient blending in bulk formulations. Liquid form grows in niche uses where solubility and smoother dispersion matter. Producers refine both formats to improve functional performance. Powder maintains broader reach due to easy transport and storage. Liquid supports product developers targeting specialized solutions. It gains flexibility as companies expand product variations.

- For instance, Ingredion supplies polyol powders and liquid sweetener systems to more than 120 countries through 44 manufacturing sites, enabling flexible formulation options for global clients.

By Application

Food and beverages lead due to extensive sugar-reduction efforts across baked goods and confectionery. Oral care maintains strong adoption due to established dental benefits. Pharmaceuticals incorporate xylitol to improve taste and patient comfort. Personal care brands use it for moisture retention in select items. Nutraceuticals integrate xylitol in chewables and wellness-focused blends. Industrial users apply it for targeted chemical processes. It achieves deeper penetration through expanding application diversity.

By Distribution Channel

Direct sales support bulk buyers across food, pharma, and industrial sectors. Indirect sales through retail, online, and specialty stores help brands reach consumers seeking sugar-free products. Online platforms expand visibility of clean-label items. Retail networks highlight functional sweeteners across new aisles. Specialty stores drive health-focused adoption. It grows stronger with multi-channel availability.

Segmentation:

By Source

- Plant-Based (Corn Cobs, Birch Wood)

- Chemical/Hydrogenation-Based

By Form

By Application

- Food & Beverages

- Oral Care

- Pharmaceuticals

- Personal Care

- Nutraceuticals

- Industrial Uses

By Distribution Channel

- Direct Sales

- Indirect Sales (Retail, Online, Specialty Stores)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Xylitol market holds strong presence in North America, which accounts for an estimated 32% share supported by high adoption in oral care, pharmaceuticals, and sugar-free confectionery. The region benefits from strong consumer focus on reduced-sugar diets. Manufacturers supply diverse grades to meet strict regulatory and quality expectations. Retail channels promote clean-label sweeteners through expanded health-focused assortments. Innovation in functional food products strengthens category depth. It gains support from mature processing infrastructure and consistent customer awareness across the U.S. and Canada.

Europe

Europe secures roughly 28% share due to strong dental health awareness and steady use of xylitol in confectionery and personal care ranges. Regional brands highlight natural and plant-derived ingredients, which aligns with evolving food standards. The region maintains high engagement in sugar-reduction programs supported by public health agencies. Retailers stock extensive sugar-free formats across mainstream and premium categories. Local producers invest in sustainable sourcing models to meet environmental targets. It benefits from strong consumer familiarity across Western and Nordic countries.

Asia Pacific

Asia Pacific holds an estimated 30% share and stands as the fastest-expanding regional cluster driven by rising health awareness and broader food processing activity. Demand increases in China, India, Japan, and South Korea as brands promote sugar-free and dental-health-focused products. Local manufacturers scale capacity to serve food, nutraceutical, and pharmaceutical users. Retail networks expand clean-label assortments in urban markets. Growing middle-class consumption supports deeper category penetration. It captures long-term momentum due to rising lifestyle shifts and broader industry investment.

Key Player Analysis:

- Cargill

- DuPont (Danisco)

- Roquette Frères

- Ingredion Incorporated

- Mitsubishi Chemical Corporation

- ZuChem Inc.

- Novagreen Inc.

- Thompson Biotech

- Zhejiang Huakang Pharmaceutical

- Shandong Futaste Co., Ltd.

Competitive Analysis:

The Xylitol market features strong competition between global ingredient suppliers and regional producers that focus on cost efficiency and cleaner sourcing. Leading companies invest in improved extraction technologies to enhance yield and maintain consistency. Firms target food, oral care, and pharmaceutical clients through wide product portfolios. Strategic expansion in plant-based production helps brands strengthen premium positioning. Partnerships with food manufacturers support deeper penetration in confectionery and bakery items. Pricing pressure drives companies to optimize operational models. It maintains steady competitive activity as producers scale capacity across major regions.

Recent Developments:

- In March 2024, Roquette Frères completed a transformative acquisition by signing an agreement to take over IFF Pharma Solutions. The transaction, finalized on May 1, 2025, is set to diversify Roquette’s excipient technologies, particularly in pharmaceutical applications including xylitol-based drug delivery systems. This acquisition marks a major step toward broadening Roquette’s pharma product range and global R&D footprint.

- International Flavors & Fragrances Inc. (IFF) continues to play an active role in the xylitol market with significant M&A activity shaping its ingredient portfolio. The most notable industry-relevant news is the completion of the merger of International Flavors & Fragrances Inc.’s (IFF) Nutrition & Biosciences business with DuPont’s Nutrition & Health division.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Source and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global demand for sugar-free foods will support higher xylitol adoption.

- Expansion in oral care products will drive long-term category stability.

- Pharmaceutical applications will widen due to improved taste and formulation benefits.

- Plant-based extraction methods will gain preference across major markets.

- Sustainability pressure will push producers to refine energy-efficient processes.

- Online retailing will increase consumer access to sugar-free and clean-label goods.

- Product innovation in confectionery and bakery items will boost usage frequency.

- Partnerships between food brands and ingredient suppliers will shape new launches.

- Regional players will expand capacity to meet rising domestic demand.

- It will benefit from stronger health awareness across developed and emerging regions.