Market Overview:

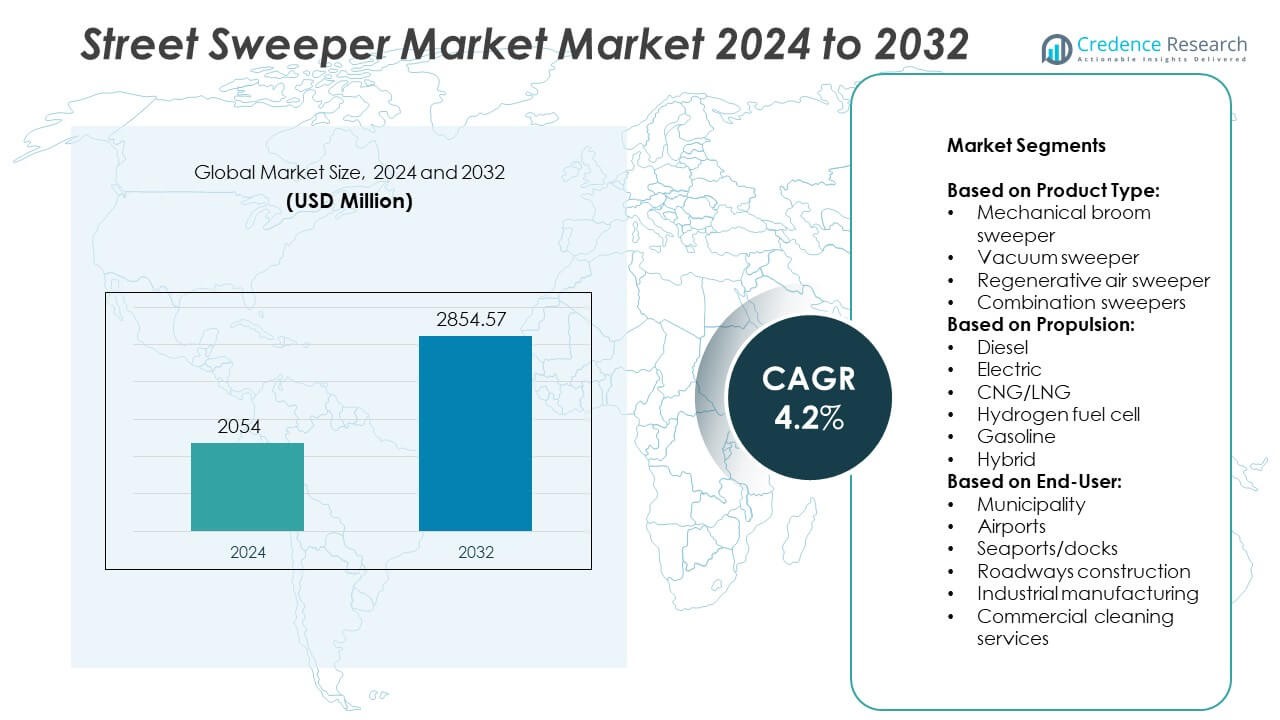

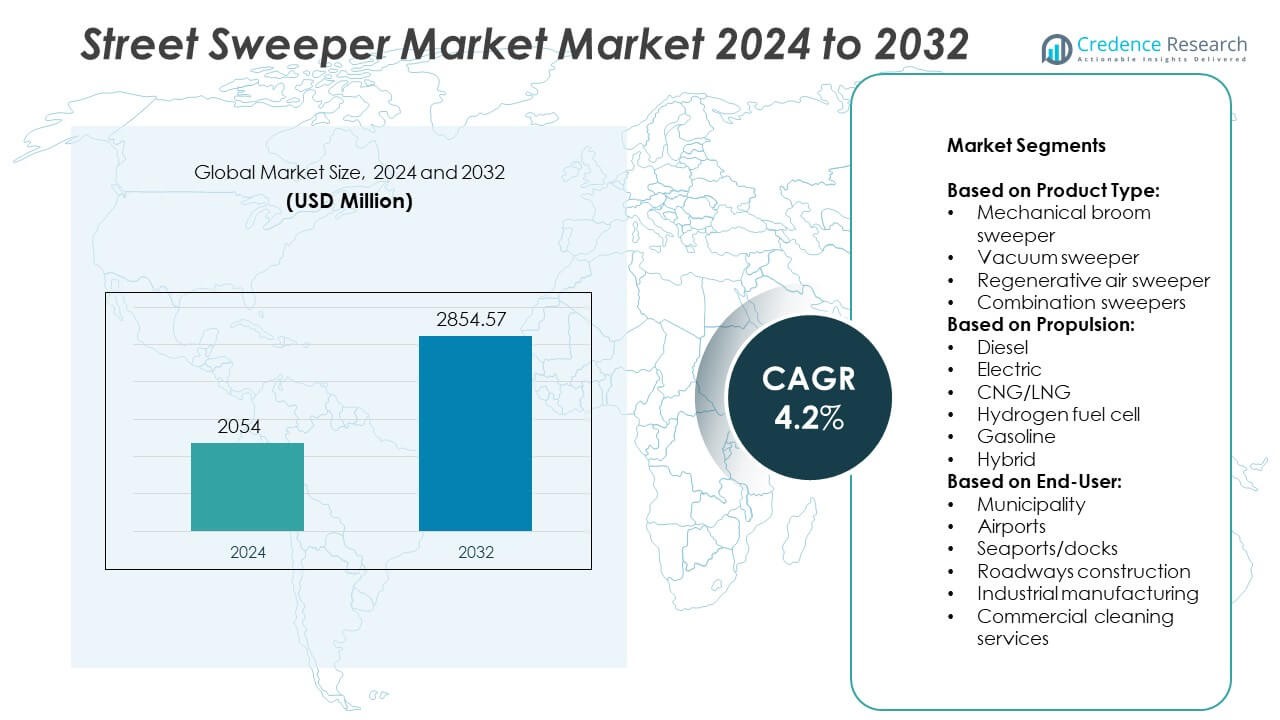

Street Sweeper Market size was valued at USD 2054 million in 2024 and is anticipated to reach USD 2854.57 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Street Sweeper Market Size 2024 |

USD 2054 Million |

| Street Sweeper Market, CAGR |

4.2% |

| Street Sweeper Market Size 2032 |

USD 2854.57 Million |

The Street Sweeper Market is driven by increasing urbanization, stricter environmental regulations, and rising demand for efficient municipal cleaning solutions. Governments are investing in smart city infrastructure, encouraging the adoption of advanced, low-emission sweepers. The market also benefits from growing awareness of air quality and the need for automated road maintenance and the rising popularity of compact, multi-functional sweepers. Rental and leasing services are gaining traction among cost-conscious buyers, expanding market reach across both public and private sectors.

The Street Sweeper Market shows strong demand across North America, Europe, and Asia Pacific due to expanding urban infrastructure and growing focus on environmental cleanliness. North America leads in the adoption of advanced and hybrid sweepers, supported by regulatory standards and municipal investments. Europe emphasizes low-emission and electric models, aligning with its environmental goals. Asia Pacific, which is driving equipment demand. which focuses on innovative, environmentally friendly technologies. Aebi Schmidt also plays a significant role with its specialized solutions for urban and airport cleaning applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Street Sweeper Market was valued at USD 2054 million in 2024 and is projected to reach USD 2854.57 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Increasing urbanization and expanding smart city projects are fueling demand for automated street cleaning solutions in municipalities and commercial areas.

- The market is witnessing a clear shift toward electric and hybrid street sweepers due to rising environmental concerns and stricter emission regulations.

- Integration of smart technologies such as GPS tracking, IoT-based diagnostics, and fleet monitoring systems is improving operational efficiency and driving product innovation.

- Leading players such as Bucher Municipal, Elgin Sweeper, FAUN, and Aebi Schmidt are focusing on expanding their product portfolios and global presence through partnerships and service networks.

- High initial investment and ongoing maintenance costs pose challenges for adoption, particularly in smaller municipalities and developing regions with limited budgets.

- North America and Europe remain key markets due to infrastructure maturity and environmental policies, while Asia Pacific shows rapid growth driven by urban development in countries like China and India.

Market Drivers

Urban Expansion and Municipal Infrastructure Development Support Market Growth

Rapid urbanization and growing populations in cities are placing immense pressure on municipal infrastructure. Governments and city administrations are investing in efficient cleaning systems to maintain hygiene and manage waste effectively. The Street Sweeper Market benefits from this trend as demand rises for mechanized cleaning solutions in urban environments. These machines help reduce manual labor and ensure quicker, more consistent results across large areas. City planners are incorporating street sweepers into smart city initiatives to enhance operational efficiency. It drives consistent demand for advanced and eco-friendly sweeping technologies.

- For instance, Boschung’s Urban-Sweeper S2.0, a fully electric sweeper, is now operating in more than 120 municipalities across Switzerland, Germany, and France, each unit offering a range of 10 hours per charge and reducing noise levels to under 60 dB(A) during operation.

Government Regulations on Cleanliness and Pollution Control Encourage Adoption

Strict environmental regulations aimed at dust and debris control are influencing municipalities and private contractors to upgrade their cleaning equipment. Street sweepers reduce particulate matter and improve air quality, aligning with public health goals. The Street Sweeper Market sees increased procurement due to policies that mandate regular road cleaning and pollution mitigation. Authorities prioritize sustainable technologies that support emission reduction and compliance with green standards. It prompts market players to innovate in fuel efficiency and electric vehicle integration. Government funding and public tenders further boost product penetration across cities and towns.

- For instance, Dulevo International’s D.zero² Hydro, a compact electric street washer and sweeper hybrid, has been deployed in over 70 cities across Europe and Asia, with a cleaning width of 1,900 mm and a turning radius of just 2,200 mm, making it effective in congested urban corridors.

Technological Advancements in Cleaning Equipment Enhance Operational Efficiency

The integration of automation, GPS tracking, and smart diagnostics is transforming the performance of street sweeping machines. These features enable real-time monitoring, reduce downtime, and improve route optimization. The Street Sweeper Market gains traction from end-users seeking cost-effective and intelligent equipment solutions. Manufacturers are focusing on quiet operation and compact designs to suit diverse urban layouts. It helps streamline maintenance and improve worker productivity. Advanced models also cater to both dry and wet cleaning functions, expanding their utility in various settings.

Increased Outsourcing of Municipal Services Spurs Demand from Private Operators

Public-private partnerships in urban service management are expanding across several regions. Cities are outsourcing street cleaning tasks to private contractors for better service quality and operational flexibility. The Street Sweeper Market benefits from rising equipment purchases and rentals by private fleet operators. These firms demand high-performance machines that ensure minimal downtime and lower total ownership cost. It creates a competitive environment encouraging product upgrades and aftermarket services. Industry players respond with innovative leasing models and service contracts to meet evolving customer needs.

Market Trends

Rising Preference for Electric and Hybrid Street Sweepers Reflects Sustainability Goals

Urban centers are focusing on low-emission and noise-free operations, which is driving interest in electric and hybrid street sweepers. These models help cities reduce their carbon footprint while lowering fuel costs. The Street Sweeper Market is witnessing a shift from conventional diesel-powered machines to battery-operated and hybrid units. Governments and municipalities are aligning procurement plans with environmental sustainability targets. It encourages manufacturers to invest in cleaner technologies and improve battery efficiency. These machines also appeal to regions with strict emission norms and urban noise regulations.

- For instance, Tenax International’s Electra 2.0 NEO, a fully electric street sweeper, operates with a 48V battery and delivers up to 10 hours of continuous sweeping. The company has deployed over 350 units in cities including Milan, Paris, and Dubai as part of clean transportation programs.

Integration of Smart Technologies Improves Cleaning Precision and Fleet Management

Digital tools such as GPS, IoT, and real-time diagnostics are reshaping how street sweepers are managed and operated. Fleet managers can track performance, schedule maintenance, and optimize routes using connected systems. The Street Sweeper Market is evolving toward intelligent equipment that enhances transparency and accountability in municipal services. It supports cost savings through predictive maintenance and improved resource utilization. This trend is gaining momentum among both public agencies and private contractors. Vendors are adding smart features to differentiate their products in a competitive landscape.

- For instance, with the acquisition of TIP Canada, TEN will be North America’s second largest full-service trailer lessors with a combined fleet of over 83,000 trailers with locations across most major logistics hubs.

Compact and Multi-Functional Designs Cater to Urban Infrastructure Constraints

Narrow streets, heavy traffic, and limited access areas in urban settings require more agile and versatile cleaning machines. Compact sweepers with high maneuverability and modular components are gaining popularity. The Street Sweeper Market is responding to these needs with smaller yet powerful machines suited for dense cityscapes. It enables effective cleaning without obstructing regular traffic flow. Equipment that supports multiple cleaning modes is becoming a preferred choice for local governments. Manufacturers are introducing ergonomic and user-friendly designs to improve operator efficiency.

Rental Services and Equipment Leasing Gain Momentum Among Cost-Conscious Buyers

Rising operational costs and budget constraints are making rental and leasing options more attractive to municipalities and contractors. Flexible financing and short-term ownership models are reducing the entry barrier for advanced equipment. The Street Sweeper Market is seeing steady growth in leasing services that include maintenance and technical support. It allows clients to access the latest technologies without long-term financial commitments. This trend is particularly strong in developing economies where capital expenditure is limited. Providers are expanding their rental fleets to meet the growing demand for short-duration and project-based services.

Market Challenges Analysis

High Initial Investment and Maintenance Costs Limit Adoption in Budget-Constrained Regions

Street sweepers involve significant upfront costs, which can hinder adoption, especially in small municipalities and developing economies. Procurement of advanced models with smart features and electric drivetrains further increases capital expenditure. The Street Sweeper Market faces resistance from buyers unable to justify the cost without visible short-term returns. It creates a challenge for suppliers aiming to penetrate price-sensitive markets. Ongoing maintenance, spare parts availability, and technical service requirements add to the total cost of ownership. Many regions still rely on manual cleaning due to these financial constraints.

Operational Limitations in Diverse Weather and Terrain Conditions Impact Performance

Street sweepers often struggle with efficiency under extreme weather conditions such as heavy rain, snow, or excessive dust. Equipment designed for dry climates may not perform effectively in wet or icy environments. The Street Sweeper Market must address issues related to durability, terrain adaptability, and seasonal usability. It puts pressure on manufacturers to develop region-specific models that can withstand varying environmental conditions. Some machines also face limitations when navigating congested or uneven roadways. These operational challenges can reduce machine lifespan and increase service disruptions.

Market Opportunities

Expansion of Smart City Initiatives Opens New Revenue Channels for Manufacturers

Global smart city projects are prioritizing automation, sustainability, and data-driven infrastructure, creating strong demand for modern street sweeping solutions. These initiatives often include government funding and public-private partnerships, offering a stable foundation for large-scale procurement. The Street Sweeper Market stands to benefit from integration with city-wide digital ecosystems, including real-time monitoring and fleet analytics. It enables manufacturers to position their offerings as essential components of urban efficiency and cleanliness. Smart sweepers equipped with sensors and connectivity features align well with these evolving city standards. Growth potential is particularly strong in Asia and the Middle East, where urban infrastructure development is accelerating.

Emerging Demand from Industrial and Private Commercial Spaces Supports Market Diversification

Factories, airports, warehouses, and large commercial campuses are adopting street sweepers to maintain operational hygiene and comply with safety standards. These non-municipal sectors provide a growing customer base beyond traditional government clients. The Street Sweeper Market has the opportunity to develop tailored solutions for industrial environments with specific debris types and surface conditions. It encourages product differentiation and targeted marketing strategies. Demand from logistics hubs and manufacturing zones is expected to rise due to increased focus on cleanliness and operational efficiency. Service contracts and leasing models further enhance market accessibility for private sector clients.

Market Segmentation Analysis:

By Product Type:

Mechanical broom sweepers hold a significant share due to their simplicity, low cost, and effectiveness in collecting heavy debris. These models are widely used in construction zones and rural areas. Vacuum sweepers are gaining popularity in urban settings for their ability to pick up fine dust and lighter waste, making them suitable for pollution-sensitive zones. Regenerative air sweepers provide efficient dust control by reusing air in a closed-loop system, appealing to municipalities focused on air quality. Combination sweepers, which merge mechanical and vacuum technologies, are growing in demand for their versatility across various surface types. The Street Sweeper Market benefits from this product diversification by meeting specific operational needs across industries.

- For instance, Dulevo International’s D6 road sweeper—widely used in municipal and industrial applications—features a sweeping capacity of about 1,162,080 ft²/hr.

By Propulsion:

Diesel-powered sweepers dominate due to their widespread availability and high torque performance, especially in heavy-duty applications. However, electric sweepers are gaining market share due to rising environmental concerns and government incentives for clean energy vehicles. CNG/LNG-powered models offer reduced emissions and appeal to regions with developed gas infrastructure. Hydrogen fuel cell sweepers are in the early adoption stage but present long-term potential due to zero emissions and fast refueling capabilities. Gasoline variants are less preferred for large-scale operations but still used in small urban projects. Hybrid sweepers combine electric and fuel engines to extend operational range while reducing emissions, offering a balanced solution for fleet operators.

- For instance, regenerative‑air sweepers feature a single-engine system with an 8 yd³ (approx. 6 m³) hopper and a 908 L water tank—deployed across airports and large paved areas in the U.S. due to its efficiency in handling both litter and fine particulate debris.

By End-User:

Municipalities represent the largest segment due to their responsibility for public cleanliness and infrastructure maintenance. Airports and seaports require specialized equipment for large paved surfaces and strict cleanliness standards. Roadway construction projects use sweepers to clear debris and prepare surfaces, ensuring worker and vehicle safety. Industrial manufacturing facilities adopt sweepers to maintain regulatory compliance and workplace safety. Commercial cleaning services demand compact, easy-to-operate machines for malls, campuses, and private properties. The Street Sweeper Market addresses these varied requirements through targeted product offerings across all user categories.

Segments:

Based on Product Type:

- Mechanical broom sweeper

- Vacuum sweeper

- Regenerative air sweeper

- Combination sweepers

Based on Propulsion:

- Diesel

- Electric

- CNG/LNG

- Hydrogen fuel cell

- Gasoline

- Hybrid

Based on End-User:

- Municipality

- Airports

- Seaports/docks

- Roadways construction

- Industrial manufacturing

- Commercial cleaning services

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounted for the largest share of the Street Sweeper Market in 2024, holding approximately 32% of the global market. This dominance is supported by well-established urban infrastructure, strict environmental regulations, and a strong presence of leading manufacturers. The United States leads regional demand, driven by municipal budgets focused on smart city development and public cleanliness. Advanced fleet management solutions and emission-compliant sweepers are widely adopted across cities. Private contractors and public agencies both invest in electric and hybrid models to meet sustainability goals. Government funding and initiatives promoting urban hygiene further fuel market growth. The demand for rental and leasing services is also high, catering to seasonal and project-specific requirements.

Europe

Europe held around 26% of the global Street Sweeper Market in 2024, supported by strict EU emission norms and a strong focus on sustainable urban planning. Countries such as Germany, France, and the UK are at the forefront, adopting electric and hybrid sweepers as part of environmental compliance efforts. Municipalities prefer compact and low-noise machines suitable for narrow streets and residential zones. The market benefits from government-backed clean mobility programs and incentives for electric vehicle procurement. Smart features like route optimization, automation, and energy-efficient systems are well integrated across fleets. Public awareness and emphasis on air quality continue to push municipalities toward more efficient and eco-friendly equipment.

Asia Pacific

Asia Pacific accounted for approximately 22% of the global market share in 2024 and is expected to grow rapidly during the forecast period. China and India lead demand due to massive urbanization, increasing population, and infrastructure development. Government-driven cleanliness initiatives such as “Swachh Bharat Abhiyan” in India and urban development schemes in China support widespread adoption of street sweepers. While cost remains a concern in several emerging economies, demand for durable, low-maintenance, and semi-automated machines is on the rise. Local manufacturers compete on pricing while global players introduce scalable solutions to meet specific operational needs. As cities in Asia expand, the need for mechanized cleaning systems will continue to rise.

Latin America

Latin America represented about 10% of the global Street Sweeper Market in 2024. The region sees growing interest in modernizing municipal services, although budget constraints remain a limiting factor. Brazil and Mexico are the key contributors, investing gradually in cleaner and more efficient street maintenance technologies. Adoption of electric and hybrid models is still in early stages, with diesel-powered machines dominating. Opportunities lie in the expansion of leasing models and entry-level sweepers tailored for regional conditions. The market is expected to expand steadily with urban expansion and policy support.

Middle East & Africa (MEA)

Middle East & Africa (MEA) held roughly 10% of the market share in 2024. Demand is concentrated in urbanized areas such as the UAE, Saudi Arabia, and South Africa. Investment in tourism and smart city projects like NEOM is driving equipment upgrades. While climate and terrain pose operational challenges, municipalities prefer durable and weather-adaptable machines. Growth potential exists through partnerships and technology transfers from global players. The region is gradually adopting automated and eco-conscious solutions aligned with long-term sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Street Sweeper Market is highly competitive with key players including Bucher Municipal, Elgin Sweeper, FAUN, Aebi Schmidt, Boschung, Alamo Group, Dulevo, Hako, Madvac, and Global Environmental Products. These companies focus on product innovation, technological integration, and expanding their geographic presence to strengthen their market position. They offer a diverse range of sweepers tailored to meet the varying needs of municipalities, airports, industrial facilities, and commercial cleaning services.Each player invests in electric and hybrid technologies to align with global emission standards and meet growing demand for eco-friendly equipment. Integration of GPS, IoT, and real-time diagnostics has become a core strategy to enhance machine performance and fleet management capabilities. Companies also emphasize after-sales services, leasing models, and training programs to build long-term customer relationships. Competitive pricing, strong distribution networks, and regional customization further contribute to brand differentiation. The market remains dynamic, with innovation and sustainability driving future competition.

Recent Developments

- In 2025, Alamo Group offered a sequential operating margin improvement OF 410 basis points in their Vegetation Management Division, which includes street sweeper products.

- In March 2025, Nilfisk announced the launch of the CS7500 Combination Sweeper-Scrubber, an advanced solution in industrial cleaning that redefines efficiency, user accessibility and sustainability. Engineered for maximum performance in diverse environments, the CS7500 features an intuitive touchscreen with multilingual support and ergonomic design that makes it easy to operate.

- In January 2025, Boschung announce the launch of the Urban-Sweeper S2.0 MAX, the latest addition to its fully electric vehicle lineup. This introduction marks the third electric-powered machine in Boschung’s portfolio, underscoring the company’s dedication to sustainable and innovative urban maintenance solutions.

- In October 2023, Alamo Group announced that it has acquired 100% of the outstanding equity capital of Royal Truck & Equipment, Inc., a leading manufacturer of truck mounted highway attenuator trucks and other specialty trucks and equipment for the highway infrastructure and traffic control market. Royal Truck’s annual revenue was approximately $40 million in 2022, and the company had trailing twelve-month revenue of approximately $44 million as of the end of August 2023.

- In June 2023, Modine, a leading manufacturing firm, announced that Elgin Sweeper Company will be using the Modine EVantage L-CON Battery Thermal Management System (BTMS) for producing the hybrid variant of Pelican three-wheeled mechanical sweeper.

Market Concentration & Characteristics

The Street Sweeper Market displays a moderately concentrated structure, with a few established players holding significant influence across global regions. It is characterized by strong brand loyalty, high capital requirements, and specialized technical expertise, which create entry barriers for new participants. The market caters to both public and private sectors, offering equipment with varying specifications to meet urban, industrial, and commercial needs. It relies heavily on innovation, with manufacturers integrating electric propulsion, automation, and digital monitoring systems to stay competitive. Product customization, regional compliance, and after-sales support are key differentiators influencing buyer decisions. Demand patterns are cyclical and depend on infrastructure development, government regulations, and seasonal cleaning requirements. It also reflects a growing trend toward service-based models, including rentals and long-term maintenance contracts. Global players dominate in developed regions, while local manufacturers compete in cost-sensitive markets with basic, rugged models. The market continues to evolve through a mix of innovation, environmental compliance, and customer-centric strategies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Propulsion, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased demand for electric and hybrid sweepers driven by stricter emission regulations.

- Smart city initiatives will continue to boost adoption of automated and connected sweeping systems.

- Manufacturers will invest in compact and multi-functional designs suited for dense urban areas.

- Advanced features such as GPS tracking and IoT-based diagnostics will become standard in new models.

- Public-private partnerships will play a larger role in municipal street cleaning services.

- Rental and leasing models will gain popularity among cost-conscious buyers and small municipalities.

- Demand from non-municipal sectors such as airports, industrial zones, and commercial facilities will grow steadily.

- Local and regional players will expand offerings to meet diverse requirements in emerging markets.

- Product innovation focused on noise reduction and operator comfort will influence purchasing decisions.

- Sustainability goals and environmental policies will drive long-term investment in green cleaning technologies.