Market Overview

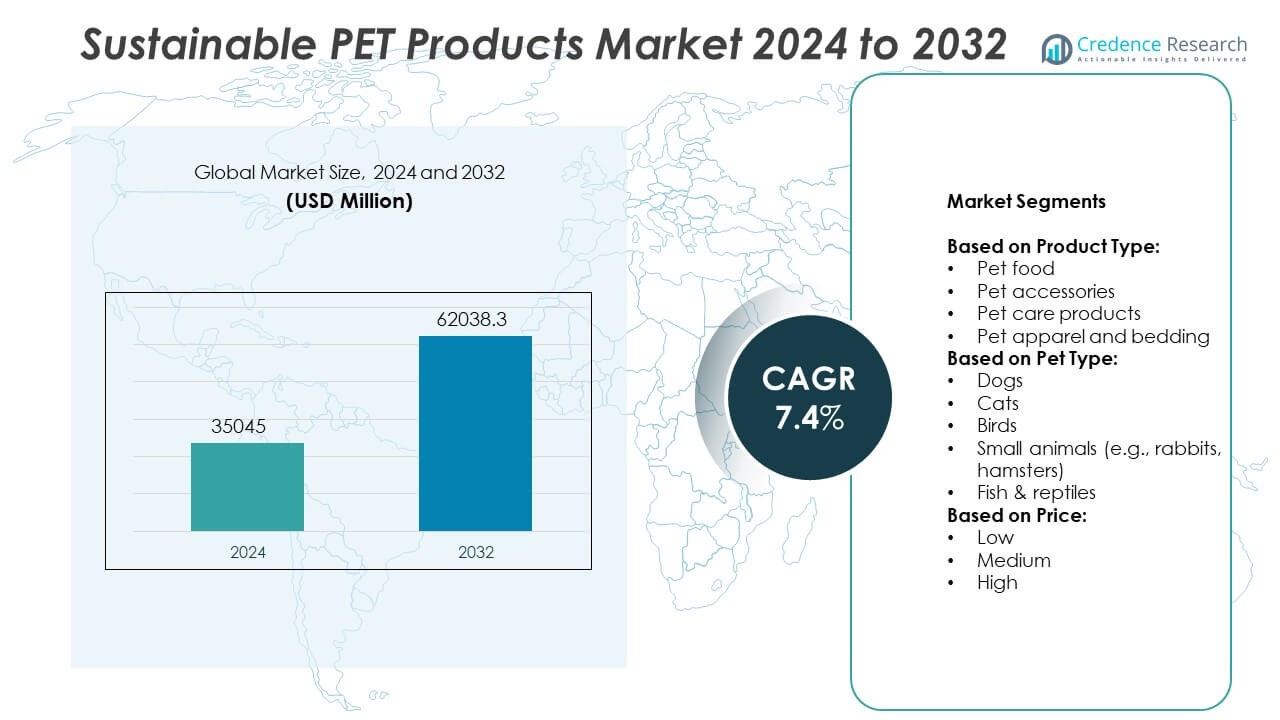

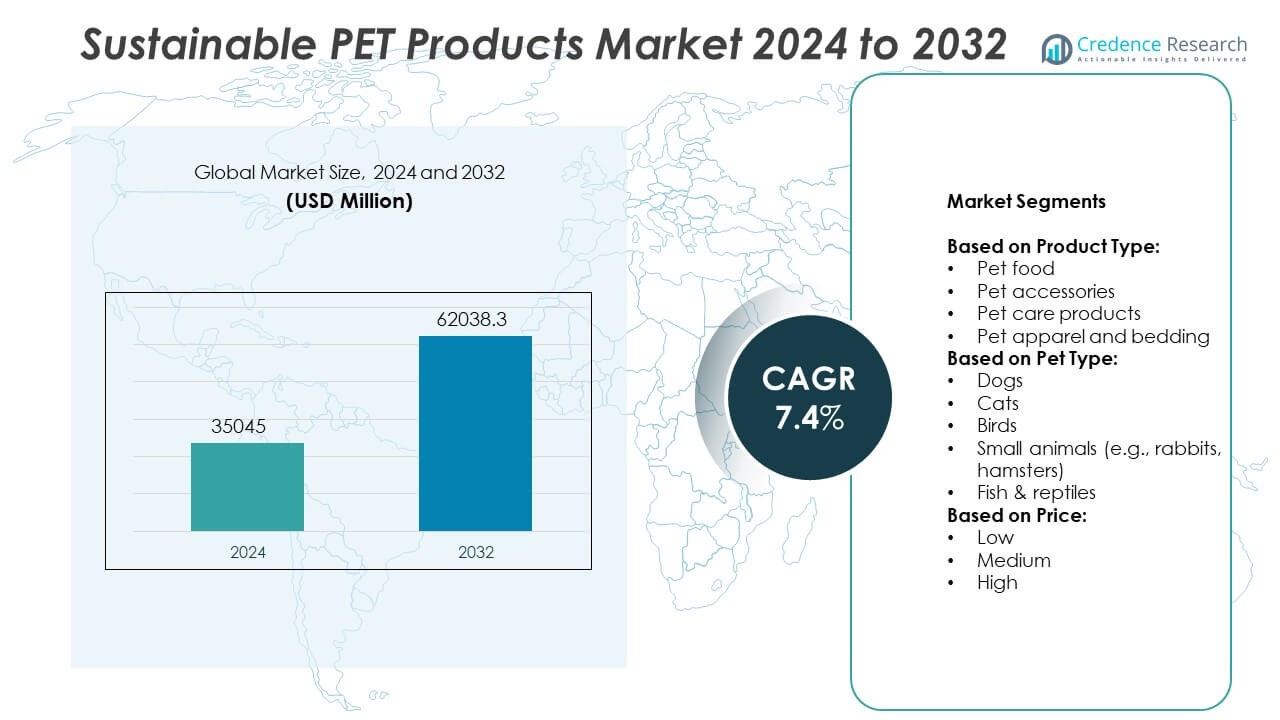

The Sustainable PET Products Market size was valued at USD 35,045 million in 2024 and is anticipated to reach USD 62,038.3 million by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sustainable PET Products Market Size 2024 |

USD 35,045 Million |

| Sustainable PET Products Market, CAGR |

7.4% |

| Sustainable PET Products Market Size 2032 |

USD 62,038.3 Million |

The Sustainable PET Products market is driven by rising consumer demand for eco-friendly pet goods, regulatory mandates on plastic reduction, and corporate sustainability commitments. Companies are replacing conventional materials with recycled or biobased PET to meet environmental goals and improve brand image. Technological advancements in recycling and material innovation support product quality and scalability. Key trends include the growing adoption of high recycled content packaging, expansion of biobased PET.

North America and Europe lead the Sustainable PET Products market due to strong consumer awareness, advanced recycling infrastructure, and supportive regulatory frameworks. Asia Pacific is emerging as a high-growth region driven by increasing pet adoption, urbanization, and rising environmental consciousness. Latin America and the Middle East & Africa are gradually adopting sustainable practices, supported by expanding retail networks and premium product imports. Key players in the market include West Paw, Spectrum Brands, and Colgate-Palmolive, all of which are investing in sustainable materials, product innovation, and eco-friendly packaging to strengthen their market presence and meet evolving consumer expectations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sustainable PET Products market was valued at USD 35,045 million in 2024 and is expected to reach USD 62,038.3 million by 2032, growing at a CAGR of 7.4% during the forecast period.

- Rising demand for eco-friendly and recyclable pet products is driving market growth, with consumers preferring sustainable options in food, accessories, and care products.

- Trends include increased adoption of recycled content packaging, expansion of biobased PET, and brand partnerships with recyclers to enhance supply chain sustainability.

- North America and Europe lead the market due to strong environmental regulations and high consumer awareness, while Asia Pacific shows rapid growth driven by urbanization and pet ownership.

- Competitive players like West Paw, Spectrum Brands, and Colgate-Palmolive are focusing on material innovation, product development, and sustainable packaging to strengthen market share.

- Key restraints include limited access to high-quality recycled PET, high production costs, and technical challenges in maintaining product performance using recycled materials.

- Manufacturers are expanding into emerging markets and investing in closed-loop recycling systems to meet evolving regulatory requirements and consumer expectations.

Market Drivers

Rising Consumer Demand for Eco-Friendly Packaging Across Industries

The growing awareness of environmental issues among consumers is encouraging companies to adopt sustainable alternatives. Demand for eco-friendly packaging solutions in food and beverage, cosmetics, and personal care sectors continues to rise. Companies are actively replacing conventional plastics with sustainable PET products to meet both regulatory and consumer expectations. The Sustainable PET Products market benefits directly from this shift, especially as end users seek recyclable and low-carbon footprint materials. Brands are enhancing their product appeal by highlighting sustainability credentials on packaging. It strengthens customer loyalty and supports premium pricing strategies in competitive markets.

- For instance, DEJA TM is available across 100% rPET IVL recycled flake, pellet, fiber and filament. These products are derived by recycling 140 kilo tonne of plastic bottles yearly and transforming them into extra-ordinary, innovative, product ingredients.

Supportive Government Policies and Regulatory Mandates Worldwide

Governments across major economies are enforcing stricter environmental regulations that promote recyclable and reusable materials. Policies banning single-use plastics and incentivizing recycled content in packaging are creating strong tailwinds. It aligns with industry initiatives focused on meeting circular economy goals and achieving net-zero emissions. The Sustainable PET Products market is expanding due to increased investment in compliance and innovation. Companies face pressure to align their operations with sustainability targets or risk penalties and reputational damage. Regulations are also driving investments in collection and recycling infrastructure, supporting end-to-end adoption.

- For instance, DMT from methanolysis ranks significantly better than fossil-based DMT on 13 out of the 14 environmental impact indicators studied.

Technological Advancements in Recycling and Material Processing

Improved recycling technologies and enhanced material recovery systems are enabling the production of high-quality recycled PET. New processes allow better separation, purification, and repolymerization of post-consumer waste into durable, food-grade materials. It boosts confidence among manufacturers to increase the recycled content in their products without compromising performance. The Sustainable PET Products market benefits from these innovations, which lower production costs and improve scalability. Advances in chemical recycling, especially, help overcome the limitations of traditional mechanical recycling. It creates a more robust supply chain for sustainable raw materials.

Corporate Sustainability Goals Driving Material Substitution

Large corporations are adopting ambitious sustainability targets that include reducing virgin plastic use and increasing recycled content in packaging. These goals are driving strategic shifts in procurement and supply chain management. Companies are committing to sustainable PET products to align with ESG frameworks and stakeholder expectations. It also helps strengthen brand equity and investor confidence in environmentally responsible operations. The Sustainable PET Products market gains traction from these commitments, which translate into long-term demand stability. Corporate partnerships with recyclers and material innovators are further reinforcing the market landscape.

Market Trends

Shift Toward High Recycled Content Packaging Across Consumer Goods

Consumer goods companies are increasingly integrating recycled PET into their packaging to meet sustainability commitments. This trend reflects both regulatory pressure and a desire to improve brand image through eco-conscious practices. High recycled content is becoming a key differentiator in competitive markets, especially within food, beverage, and personal care sectors. The Sustainable PET Products market is evolving to meet this need, with suppliers developing advanced formulations that maintain clarity and durability. It also supports the move away from virgin plastics without sacrificing product quality. Industry players are investing in infrastructure to secure reliable sources of recycled PET.

- For instance, Alpla Group produces recycled PET(coca cola) bottles containing up to 100% rPET with clarity and mechanical properties equivalent to virgin PET, using advanced solid-state polycondensation technology.

Growth in Demand for Closed-Loop Recycling Systems

Brands and manufacturers are prioritizing closed-loop systems to improve material recovery and reduce plastic leakage into the environment. This model encourages the collection, recycling, and reuse of PET products within a controlled cycle. The Sustainable PET Products market supports these systems by providing materials that maintain quality through multiple life cycles. It aligns with corporate and policy-driven efforts to reduce overall environmental impact. Collection partnerships and digital tracking tools are being deployed to enhance transparency and traceability. These efforts also strengthen consumer trust in recycling programs.

- For instance, Indorama Ventures leading global manufacturer of Polyethylene Terephthalate (PET) with more than 20 PET production plants across five continents. Our PET business is part of our core polyester value chain.

Expansion of Biobased PET to Reduce Carbon Footprint

Companies are exploring biobased PET made from renewable feedstocks to reduce dependence on fossil fuels. This trend is gaining traction among sustainability-focused brands seeking to lower greenhouse gas emissions. The Sustainable PET Products market is incorporating these materials to complement recycled content offerings. It allows manufacturers to diversify their sustainable product lines while maintaining familiar material performance. Supply chains are adapting to include agricultural waste and other bio-based inputs for PET production. This shift supports both climate targets and material innovation.

Increased Collaboration Between Brands and Recycling Innovators

Brands are forming strategic partnerships with recycling technology firms to secure high-quality sustainable PET. These collaborations aim to scale up chemical recycling methods that can process mixed or contaminated plastic waste. The Sustainable PET Products market benefits from such partnerships, which ensure consistency in supply and performance. It also encourages innovation in packaging design to improve recyclability at end of life. By working together, stakeholders are creating more efficient, circular value chains. This trend continues to shape long-term market dynamics and investment priorities.

Market Challenges Analysis

Limited Availability and High Cost of Recycled PET Material

The supply of high-quality recycled PET remains inconsistent across regions, creating sourcing challenges for manufacturers. Limited collection infrastructure and low recycling rates in many countries restrict access to suitable feedstock. It raises production costs and delays adoption for companies aiming to meet sustainability targets. The Sustainable PET Products market faces volatility due to fluctuations in raw material pricing and availability. Companies must invest in advanced sorting and cleaning technologies to ensure quality, which increases operational expenses. These barriers hinder scalability, especially for small and mid-sized enterprises.

Technical Limitations and Quality Concerns in Recycled Applications

Recycled PET often suffers from degraded mechanical properties compared to virgin materials, limiting its use in certain applications. Variability in feedstock quality leads to inconsistencies in product performance, particularly in food-grade and high-clarity packaging. It challenges manufacturers to maintain compliance with safety and regulatory standards. The Sustainable PET Products market must overcome these technical hurdles through innovation in additives, processing methods, and quality control systems. End users may hesitate to fully transition due to concerns about appearance, durability, or product safety. Building confidence in recycled PET requires greater transparency and certification across the value chain.

Market Opportunities

Expansion into Emerging Markets with Growing Environmental Awareness

Emerging economies are witnessing a surge in environmental consciousness driven by urbanization, media influence, and policy shifts. Consumers in these regions are becoming more selective, favoring sustainable packaging and responsible brands. Governments are implementing stricter waste management policies, creating demand for recyclable and eco-friendly materials. The Sustainable PET Products market can capitalize on this momentum by offering cost-effective and scalable solutions tailored to local needs. It also benefits from the growing retail and e-commerce sectors, which rely heavily on packaging materials. Companies that establish early presence in these markets gain long-term competitive advantage and brand loyalty.

Innovation in Product Development and Material Engineering

Advancements in material science offer significant opportunities to enhance the performance and range of sustainable PET applications. Manufacturers are exploring bio-based additives, lightweight structures, and improved barrier properties to expand into new industries. The Sustainable PET Products market stands to benefit from these innovations by tapping into sectors such as pharmaceuticals, electronics, and specialty packaging. It also opens doors for premium offerings that combine sustainability with high functionality. Tailored product development can meet specific customer requirements while supporting brand differentiation. Investments in R&D and cross-sector collaboration will accelerate this opportunity landscape.

Market Segmentation Analysis:

By Product Type:

The market is segmented into pet food, pet accessories, pet care products, and pet apparel and bedding. Pet food holds a dominant share due to rising consumer preference for sustainably packaged and ethically sourced food products. Manufacturers are introducing eco-friendly packaging and using natural ingredients to meet demand. Pet accessories such as toys and collars made from recycled materials are gaining popularity, especially among environmentally conscious pet owners. Pet care products, including shampoos and grooming items, are increasingly using biodegradable formulations. Pet apparel and bedding made from organic and recycled textiles are also witnessing steady growth.

- For instance, Purina packaging is already made with materials that can be recycled over 90%, and aim to reach 95% Aluminum, which can be endlessly recycled, makes up a large part of the brand’s product packaging and is accepted in single-stream recycling.

By Pet Type:

The market covers dogs, cats, birds, small animals such as rabbits and hamsters, and fish & reptiles. Dogs account for the largest share, supported by a broad range of sustainable products including food, grooming items, and wearable accessories. Cat owners are also showing strong interest in eco-friendly litter and toys. The Sustainable PET Products market continues to expand in the birds and small animals segments, where natural bedding materials and biodegradable accessories are gaining traction. Fish and reptile products are emerging as niche categories, with limited but growing demand for sustainable feeding and habitat solutions. It reflects increased awareness of environmental impact across all pet categories.

- For Instance, Colgate-Palmolive announced it will acquire Prime100, a leading fresh pet food brand in Australia, to expand its Hill’s Pet Nutrition portfolio. The acquisition strengthens Colgate’s presence in the growing fresh pet food market with Prime100’s veterinarian-endorsed products.

By Price:

The market is divided into low, medium, and high segments. Medium-priced products lead the market due to their balance between affordability and sustainability. Consumers are willing to pay a premium for products that deliver value and meet environmental standards. High-end products cater to a niche but growing segment focused on luxury and eco-consciousness. The low-price segment faces challenges in incorporating sustainable materials without compromising margins. It still holds potential in price-sensitive markets where adoption is at an early stage.

Segments:

Based on Product Type:

- Pet food

- Pet accessories

- Pet care products

- Pet apparel and bedding

Based on Pet Type:

- Dogs

- Cats

- Birds

- Small animals (e.g., rabbits, hamsters)

- Fish & reptiles

Based on Price:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for the largest share of the Sustainable PET Products market, holding approximately 35% of the global revenue in 2024. The region benefits from strong consumer awareness, well-developed recycling infrastructure, and active participation from major pet brands. The United States drives most of the demand due to its large pet ownership base and consumer preference for eco-conscious products. Regulatory frameworks, including bans on single-use plastics and incentives for recycled content, further support market expansion. Leading manufacturers in the region are investing in circular packaging solutions, sustainable sourcing, and closed-loop systems. Canada is also showing notable growth, with increased availability of green pet product options in retail and online channels.

Europe

Europe follows closely, with a market share of around 30%, supported by stringent environmental regulations and high consumer engagement in sustainability. Countries like Germany, France, the UK, and the Netherlands are leading adopters of sustainable pet products. The European Union’s directives on packaging waste, circular economy strategies, and carbon neutrality are accelerating the shift toward recycled and biodegradable materials. Pet owners in this region often prioritize sustainability over price, which boosts demand across high-end segments. The Sustainable PET Products market in Europe benefits from strong retailer cooperation, government funding for recycling technologies, and a highly informed consumer base. Many European companies are also early adopters of biobased materials and refillable packaging formats.

The Asia Pacific region

The Asia Pacific region captured approximately 22% of the market share in 2024 and is expected to witness the highest growth rate over the forecast period. Rapid urbanization, rising disposable income, and increasing pet adoption in countries such as China, India, Japan, and South Korea are fueling market growth. Although sustainability awareness is relatively lower than in Western markets, it is gaining momentum through education campaigns and government policies. The Sustainable PET Products market in this region is expanding as local brands begin offering eco-friendly alternatives in response to shifting consumer expectations. Manufacturers are gradually incorporating recycled content in packaging and focusing on localized supply chains to improve efficiency and reduce carbon emissions. Initiatives to improve plastic waste management and recycling capacity are further strengthening long-term growth potential.

Latin America

Latin America holds a smaller but emerging share, accounting for nearly 7% of the global market. Brazil, Mexico, and Argentina lead regional demand, driven by increasing pet care expenditure and rising awareness of environmental concerns. Growth remains limited by underdeveloped recycling systems and relatively low availability of sustainable alternatives. Still, international brands expanding into the region are introducing product lines that emphasize eco-friendly packaging and ingredients. It creates opportunities for local producers to align with global trends and expand sustainable offerings. Regional governments are also beginning to promote environmental standards that may accelerate future adoption.

The Middle East and Africa

The Middle East and Africa region contributes around 6% of the market and shows slow but steady growth. Pet ownership is increasing gradually, especially in urban areas of the UAE, Saudi Arabia, and South Africa. The market is in its early stages of sustainability integration, limited by infrastructure gaps and price sensitivity. However, rising tourism, global retail chains, and premium product imports are introducing consumers to sustainable options. The Sustainable PET Products market in this region is gaining traction among affluent consumers and younger demographics concerned about climate change. Brand-driven education and strategic partnerships with local distributors will play a key role in unlocking regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kurgo

- Jiminy’s

- West Paw

- Petcurean

- Beco Pets

- Petco

- RC Pet Products

- Spectrum Brands

- Ruffwear

- Pawz

- Hurtta

- Green Pet Shop

- ColgatePalmolive

- Purina

- Freshpet

Competitive Analysis

The leading players in the Sustainable PET Products market include West Paw, Spectrum Brands, Colgate-Palmolive, and Petcurean. These companies are actively strengthening their market presence through product innovation, sustainable sourcing, and investment in environmentally responsible manufacturing. They focus on integrating recycled and biobased PET materials into their product lines while maintaining performance, durability, and safety standards. Companies are also enhancing their packaging practices by adopting recyclable formats and reducing overall plastic usage. Strategic partnerships with recycling firms and material technology providers allow them to improve supply chain efficiency and secure high-quality sustainable inputs. Many of these players are aligning with global ESG goals and sustainability reporting standards to appeal to both environmentally conscious consumers and investors. Their competitive strategies include expanding distribution through both e-commerce and retail channels, launching eco-labeled products, and marketing their environmental commitments. These actions not only differentiate their offerings but also build long-term brand loyalty. The market remains competitive, with innovation, transparency, and responsiveness to consumer preferences serving as key factors for success. By leveraging R&D capabilities and sustainability-focused branding, leading players continue to shape the direction of the Sustainable PET Products market and drive adoption across new and existing customer segments.

Recent Developments

- In August 2025, Hill’s Pet Nutrition, a Colgate-Palmolive division, reported net sales growth, reflecting ongoing business expansion in pet nutrition.

- In February 2025, Colgate-Palmolive announced its acquisition of Prime100, a leading fresh pet food brand in Australia, to expand its Hill’s Pet Nutrition division and strengthen its position in sustainable pet products.

- In July 2024, Purina remained one of the top pet food companies in the market, significantly contributing to Nestlé’s growth in key regions like North America and Europe.

Market Concentration & Characteristics

The Sustainable PET Products market shows moderate to high market concentration, with a few key players holding significant influence due to their established brand presence, advanced supply chains, and strong commitment to sustainability. It is characterized by innovation-driven competition, where companies focus on integrating recycled and biobased PET materials without compromising product quality or safety. The market emphasizes transparency, environmental compliance, and consumer trust, driving brands to invest in traceable sourcing and eco-friendly packaging. Consumer preferences continue to shift toward ethically produced and low-impact products, pushing manufacturers to differentiate through design, material integrity, and verified sustainability claims. Entry barriers include high setup costs, limited access to quality recycled feedstock, and regulatory complexity. It favors companies with robust R&D, strategic supplier partnerships, and the ability to scale sustainable operations globally. The Sustainable PET Products market continues to evolve in line with circular economy principles, demanding agility and innovation from all participants.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pet Type, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for eco-friendly pet products across all categories.

- Consumer awareness of environmental issues will continue to influence purchasing decisions toward sustainable alternatives.

- Brands will increase investments in recycled and biobased PET materials to align with global sustainability goals.

- Technological advancements in recycling and material processing will enhance product quality and supply consistency.

- Regulatory support for plastic reduction and circular economy practices will drive broader market adoption.

- E-commerce growth will expand the reach of sustainable pet products to wider consumer segments.

- Emerging markets will present new growth opportunities as pet ownership and environmental awareness increase.

- Strategic partnerships between manufacturers and recyclers will strengthen the supply chain for sustainable inputs.

- Premiumization trends will support the growth of high-end sustainable products in developed regions.

- Companies will focus on transparent labeling, eco-certifications, and product innovation to build consumer trust and brand loyalty.