Market Overview:

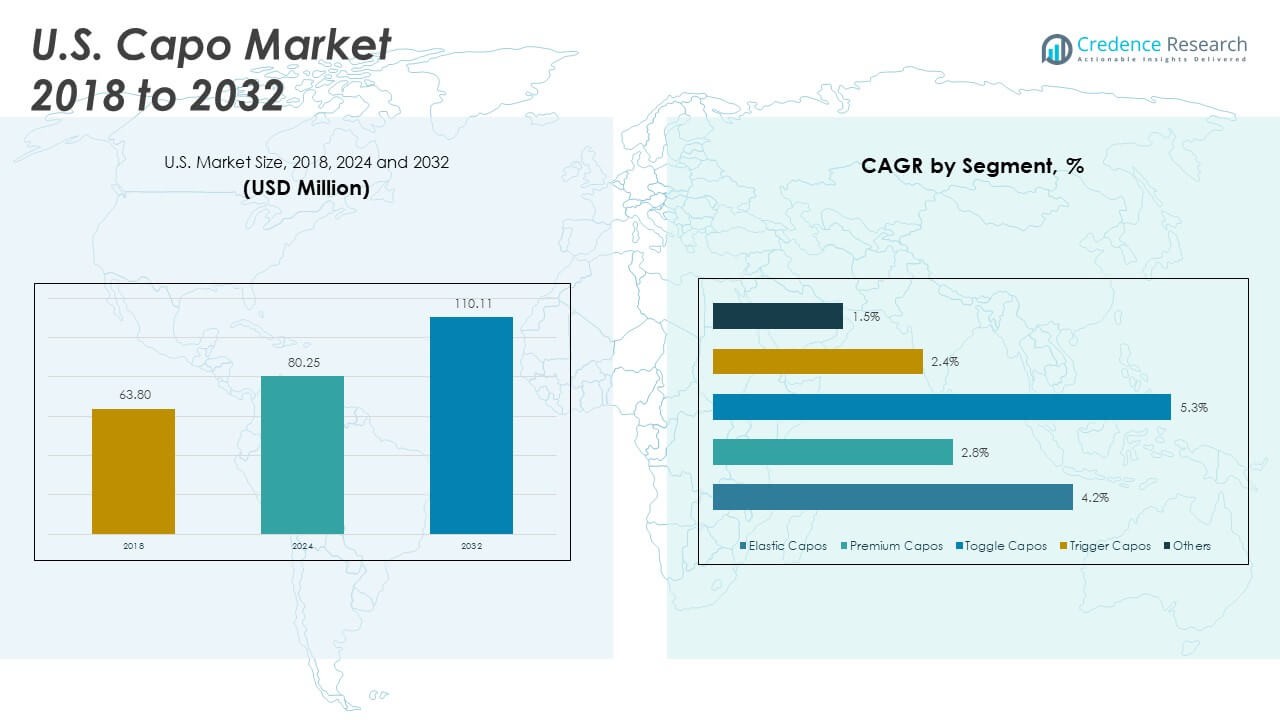

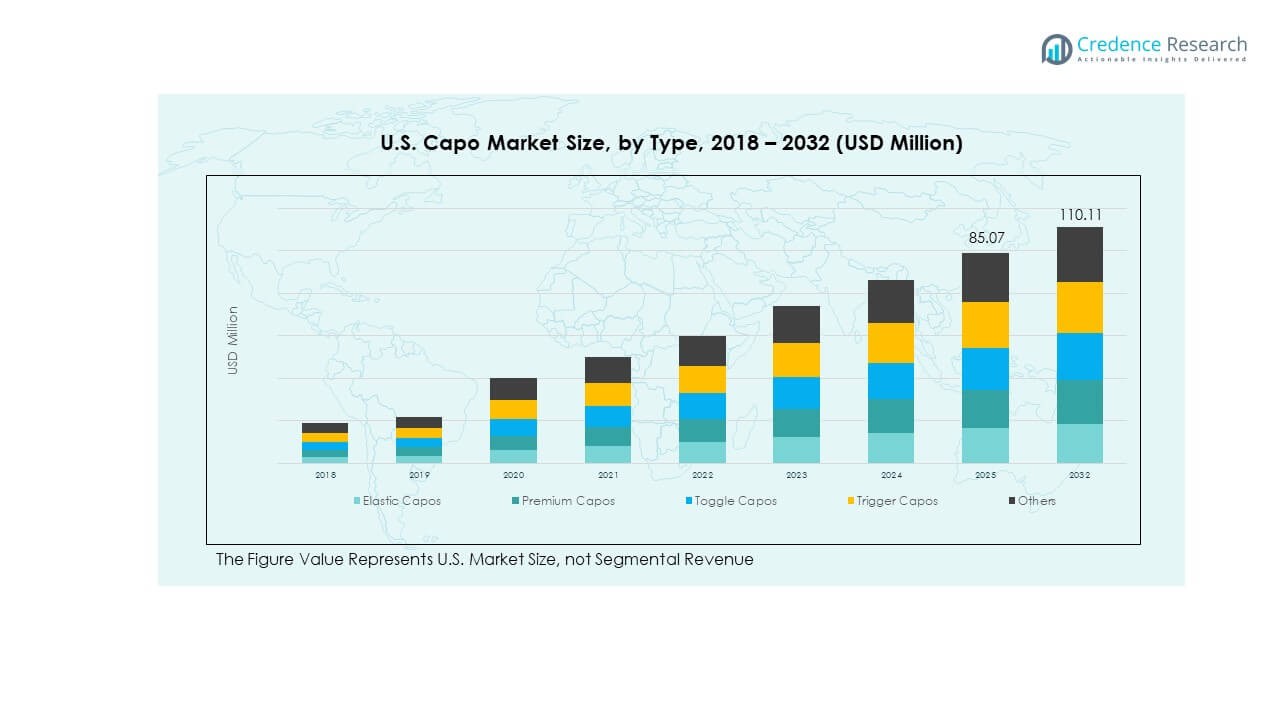

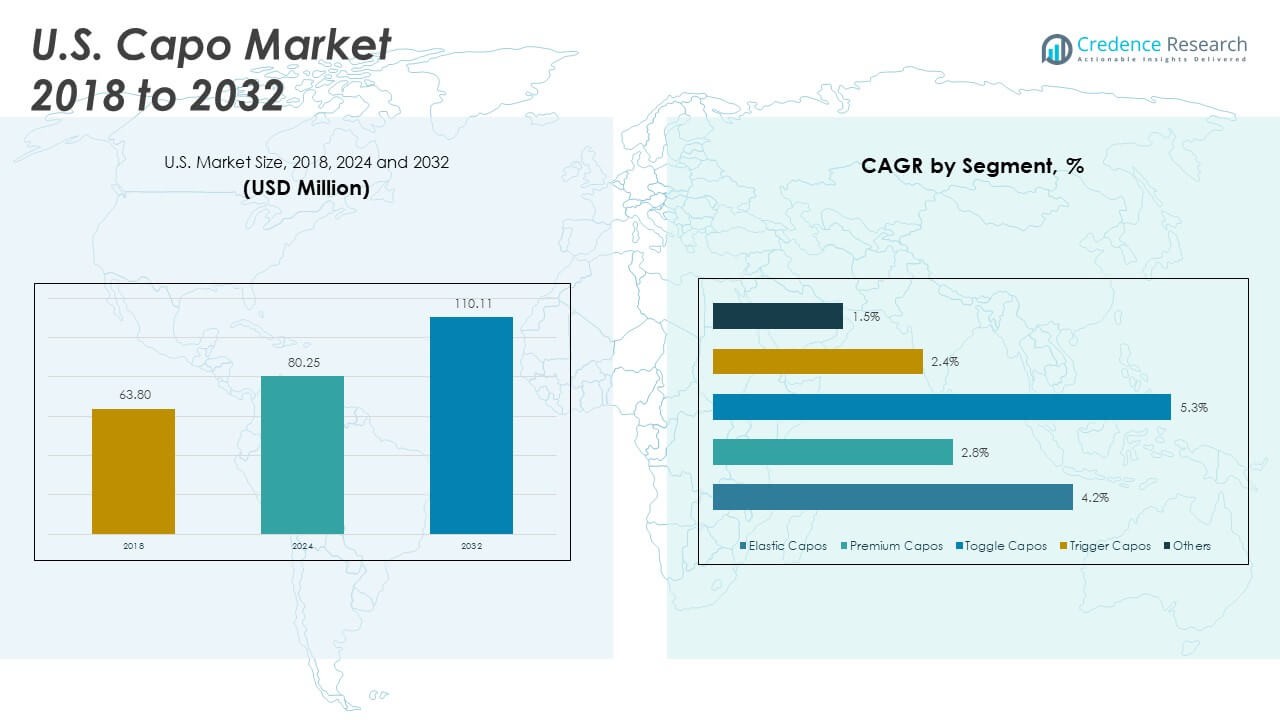

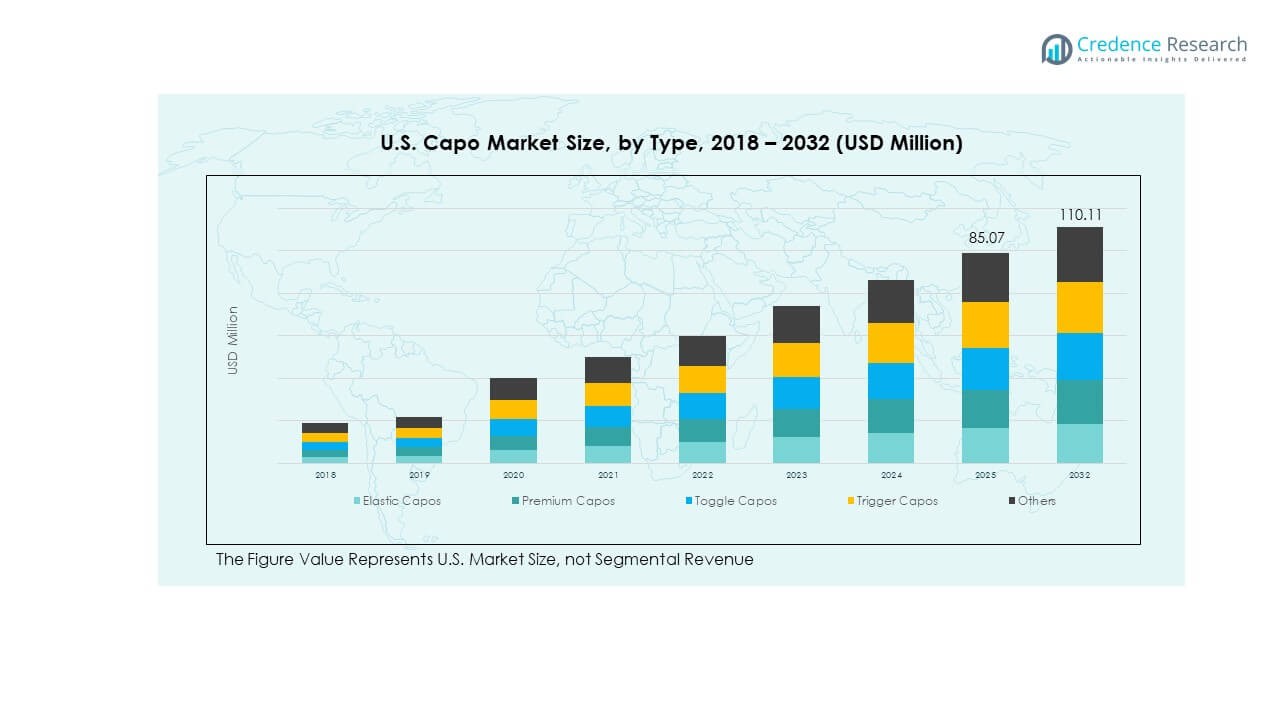

The U.S. Capo Market size was valued at USD 63.80 million in 2018 to USD 80.25 million in 2024 and is anticipated to reach USD 110.11 million by 2032, at a CAGR of 4.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Capo Market Size 2024 |

USD 80.25 Million |

| U.S. Capo Market, CAGR |

4.03% |

| U.S. Capo Market Size 2032 |

USD 110.11 Million |

The U.S. Capo Market is primarily driven by the growing number of amateur and professional musicians, rising popularity of stringed instruments, and increased interest in live performances and online content creation. Advancements in capo designs that enhance tuning stability, durability, and ease of use also contribute to market expansion. Companies are developing lightweight, ergonomic, and aesthetically appealing products that cater to both seasoned professionals and hobbyists. Additionally, the availability of capos across various online and offline retail channels has significantly improved market accessibility and consumer purchasing power.

Within the U.S., the market sees strong traction in states with vibrant music cultures such as California, Texas, Tennessee, and New York, where demand is supported by music schools, recording studios, and live performance venues. Emerging growth is observed in suburban and rural regions where online education and at-home learning of instruments are gaining pace. These areas are witnessing increasing capo adoption among beginners and casual musicians, largely due to the accessibility of budget-friendly options and rising digital music influence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Capo Market was valued at USD 80.25 million in 2024 and is projected to reach USD 11 million by 2032, growing at a CAGR of 4.03%.

- The Global Capo Market size was valued at USD 182.87 million in 2018, rising to USD 230.00 million in 2024, and is anticipated to reach USD 315.60 million by 2032, at a CAGR of 3.75 % during the forecast period.

- Trigger capos lead the market due to their user-friendly spring mechanism and widespread use among both professionals and hobbyists.

- Growth in music education programs and online learning platforms is expanding capo adoption across beginner and intermediate user segments.

- Independent artists and gig performers continue to drive demand for durable and performance-ready capo designs.

- Counterfeit products and low product differentiation limit premium brand growth and weaken consumer loyalty in price-sensitive segments.

- The Western region holds the largest market share, supported by vibrant music communities and retail availability in states like California and Oregon.

- Suburban and rural regions are emerging growth zones due to rising access to digital retail and at-home music learning tools.

Market Drivers:

Growth in Musical Education and Learning Platforms Across the U.S. Fuels Capo Adoption

The rise in formal and informal music education is a key factor accelerating capo usage. Institutions and private educators recommend capos for beginners to simplify chord transitions. Online learning platforms have boosted guitar and ukulele popularity, driving demand for basic accessories. It helps beginners focus on learning without worrying about complex finger placement. Growth in music programs at schools and colleges sustains long-term demand. The inclusion of capos in beginner kits has become a common trend. This initiative aligns with rising interest among Gen Z and millennials in acoustic instruments. The U.S. Capo Market benefits from these expanding educational and digital learning networks.

- For instance, Kyser’s Quick-Change Capo is widely popular among beginner and intermediate players for its ease of use and reliability. Kyser capos are known for their strong, lightweight aluminum construction and a spring-loaded design that fits various guitar necks, making them a preferred choice in music education and home playing settings.

Expansion of Independent Artists and Gig Economy in Music Scene Boosts Sales

The increasing number of independent musicians and gig performers contributes to consistent capo sales. Live acoustic sessions, street performances, and small venue gigs promote capo use for versatility and key changes. Capos serve as an affordable solution for musicians aiming to adapt to vocal ranges without altering compositions. It enhances the performance flexibility that solo artists often require. With more artists self-producing and distributing music, accessory purchases like capos remain steady. Independent artists often own multiple capos for varied tuning preferences. Social media platforms amplify visibility for capo-equipped performances. The U.S. Capo Market reflects this growth in independent musical expression.

Retail Expansion and E-commerce Penetration Strengthen Product Accessibility

Wider distribution networks and online retail availability have played a critical role in capo market growth. Capos are now sold across music stores, general e-commerce platforms, and brand websites. It has improved product discoverability and customer access. Discount campaigns, product bundling, and influencer marketing on online platforms further stimulate demand. Music retailers actively promote capos through targeted advertising. Offline stores offer try-before-buy experiences, enhancing buyer confidence. Growing access to international brands in the U.S. increases product variety. The U.S. Capo Market leverages both retail and digital infrastructure for stable product circulation.

Product Innovations and Ergonomic Designs Drive Repeat Purchases

Manufacturers focus on creating lightweight, stylish, and easy-to-use capos with enhanced pressure control. Precision engineering helps maintain tuning accuracy, which is critical for professionals. New materials such as aluminum alloys reduce weight while increasing durability. It contributes to product differentiation in a competitive space. Players now seek capos that match their instrument aesthetics and performance needs. Color variants and ergonomic grips add visual and functional appeal. Repeat purchases occur as musicians explore improved or specialized models. The U.S. Capo Market stays dynamic through continuous product innovation and user-focused upgrades.

- For instance, Kyser’s “Quick-Change Ultra-Light” capo is made from aircraft-grade aluminum alloy, making it exceptionally lightweight and easy to use. Weighing significantly less than traditional capos, it features ergonomic curves designed to reduce player fatigue, making it a popular choice among touring musicians. This capo is known for its reliability, durability, and ease of use, providing convenience for musicians on the go.

Market Trends

Customization and Aesthetic Capo Designs Gain Traction Among Younger Consumers

Younger musicians increasingly seek capos that reflect personal style. Brands respond with customized options featuring engravings, color choices, and themed designs. These capos become visual extensions of the instrument and the artist’s persona. It builds consumer loyalty among creative user segments. Limited-edition releases and artist-collaboration models attract niche buyers. Social media unboxing and visual content promote trend-based capo designs. Musicians view capos as both functional tools and fashion accessories. The U.S. Capo Market evolves with this shift toward personalized and artistic presentation.

- For instance, Dunlop Manufacturing partnered with Eric Clapton to create an artist-endorsed capo that features precision-adjusted tension with a patented locking mechanism; the Clapton signature capo reportedly sold over 50,000 units within its first year, attributed to Clapton’s public endorsements and signature design enhancements.

Integration of Smart Capos and Digital Enhancements in Premium Segments

Technological integrations are entering the premium capo category. Brands experiment with digital tuners embedded in capos or quick-locking tension adjustment. These features provide added value for experienced musicians. It reduces tuning error and improves transition time on stage. Professional users demand tools that increase efficiency during live sets or studio sessions. Smart capos appeal to technologically inclined musicians looking for multifunctional devices. Their higher cost is offset by advanced utility and branding appeal. The U.S. Capo Market gradually absorbs these innovations into its upper-tier offerings.

Growth in Subscription-Based Music Equipment Rentals Influences Capo Circulation

Subscription services for musical equipment have gained popularity in urban areas. These platforms include capos in accessory kits provided to subscribers. It introduces new users to various capo types without requiring outright purchases. Musicians can test multiple products before committing to ownership. Rental companies keep capos in regular circulation through curated plans. It ensures that capos remain present in both short-term and casual-use scenarios. The U.S. Capo Market benefits from this alternate distribution model that prioritizes access over ownership.

Integration of Capos into Evolving Guitar Accessory Ecosystems

In the U.S. Capo Market, capos are becoming integral components of complete guitar accessory bundles. Manufacturers frequently include them in beginner kits alongside tuners, picks, and instructional guides to boost product appeal. This bundling approach enhances perceived value and supports learning experiences for new players. It fuels demand for ergonomic, durable, and compatible capo designs. U.S. retailers reinforce this trend by promoting capos as essential tools for tonal flexibility. Companies respond by offering compact, multi-functional products that align with user expectations. This strategy strengthens brand engagement and drives repeat purchases in entry-level and intermediate segments.

- For example, Fender offers lightweight, portable capos designed for easy use and quick capo changes without fret buzz. These capos are often bundled with Fender’s Play subscription platform, providing new players with ergonomic, efficient tools to enhance their learning experience.

Market Challenges Analysis

Low Product Differentiation and Price Sensitivity Impact Brand Loyalty and Profitability

Most capos serve the same basic function, limiting scope for functional differentiation. Competing on aesthetics or minor ergonomic variations often leads to market saturation. Consumers with price sensitivity prioritize affordability over brand value. It reduces brand loyalty in mid-range and budget segments. New entrants replicate existing models, creating downward pressure on pricing. Online marketplaces enable bulk sales of generic alternatives, intensifying competition. It discourages premium manufacturers from investing heavily in innovation. The U.S. Capo Market struggles to establish long-term brand differentiation due to limited technical variation.

Prevalence of Counterfeit Products and Quality Control Issues in Online Channels

E-commerce platforms expose consumers to unverified third-party sellers offering counterfeit capos. These low-cost imitations mimic premium models but lack durability and performance. It creates trust issues for genuine brands operating online. Customer dissatisfaction from counterfeit experiences can negatively affect overall category perception. Manufacturers must invest in anti-counterfeit packaging and brand protection strategies. It raises operational costs and affects margins in digital retail. The U.S. Capo Market faces growing scrutiny regarding authenticity and product quality in online sales environments.

Market Opportunities

Expansion into Beginner Kits, School Programs, and Music Therapy Segments Offers Volume Sales Potential

Capo integration into bundled kits for beginner guitars can create recurring demand. Schools purchasing instruments for music programs present bulk order opportunities. Music therapy organizations increasingly use string instruments to engage patients. It positions capos as essential accessories in therapeutic and developmental applications. Educational institutions prefer durable, user-friendly models for long-term use. Retailers can offer customized bulk solutions for these institutional buyers. The U.S. Capo Market can increase unit sales by targeting these non-traditional yet high-volume buyer groups.

Cross-Promotional Bundling and Subscription Upgrades Can Unlock Higher User Engagement

Pairing capos with tuners, straps, or picks in targeted promotions can increase per-order value. Subscription services offering periodic accessory upgrades appeal to enthusiasts and learners. Users are more likely to try innovative models when bundled with familiar tools. It builds brand exposure and helps consumers explore new capo functionalities. Manufacturers can collaborate with online music courses to feature branded accessories. The U.S. Capo Market can expand buyer engagement through such cross-promotional partnerships and experiential marketing strategies.

Market Segmentation Analysis:

By type, trigger capos dominate the U.S. Capo Market due to their spring-loaded mechanism, allowing quick application and removal during performances. It appeals to professionals and hobbyists seeking efficiency and ease of use. Premium capos follow closely, favored by experienced musicians for their build quality, tuning stability, and ergonomic designs. Elastic capos maintain traction in the entry-level market owing to their affordability and simplicity. Toggle capos cater to niche users who prefer manual adjustability and vintage aesthetics. The others category includes specialized designs made for unique instruments or custom applications.

- For example, the Shubb C7 capo is an example of a premium capo, known for its precise tuning accuracy and durable stainless-steel construction. It’s favored by professional musicians who seek consistent performance and build quality.

By application, folk pop guitar leads the U.S. Capo Market due to high adoption in mainstream and acoustic music genres. These capos support quick chord modulation and vocal adaptability during performances. Flamenco guitar follows, driven by tonal flexibility needs and the style’s traditional capo usage. The others segment includes classical, jazz, and experimental genres, where capos are used less frequently but serve specific tuning or stylistic purposes. It reflects diverse usage across musical disciplines and user preferences.

- For instance, D’Addario’s NS Artist Capo is widely used across multiple genres, offering micrometer tension adjustment that minimizes string buzz and supports a variety of neck profiles, making it a favorite among diverse players.

Segmentation:

By Type:

- Elastic Capos

- Premium Capos

- Toggle Capos

- Trigger Capos

- Others

By Application:

- Flamenco Guitar

- Folk Pop Guitar

- Others

By Region

Regional Analysis:

The Western region leads the U.S. Capo Market, accounting for 32% market share, driven by a strong presence of music hubs such as California, Oregon, and Washington. High concentration of independent artists, frequent live performances, and a thriving acoustic music culture support steady demand. California alone contributes significantly through its active recording studios and music schools. Retailers and e-commerce warehouses in this region ensure fast delivery and availability of diverse capo products. It maintains growth through innovation-focused consumers and broad retail access. The U.S. Capo Market gains consistent revenue from the Western region’s musically inclined population.

The Southern region holds 28% market share, fueled by the popularity of country, bluegrass, and gospel music across states like Tennessee, Texas, and Georgia. Music festivals and cultural events regularly drive capo purchases by performers and amateurs alike. The rise in local guitar brands and accessory makers supports competitive pricing and variety. It also benefits from the growth of music-focused education programs and community performances. Physical music stores remain active, supported by strong cultural attachment to stringed instruments. The U.S. Capo Market sees stable sales volume from this region’s musically diverse demographic.

The Midwest and Northeast collectively contribute 40% market share, with the Midwest accounting for 22% and the Northeast 18%. The Midwest benefits from affordable instrument pricing and growing online music education participation, especially in states like Illinois, Ohio, and Michigan. The Northeast supports capo sales through urban markets such as New York and Boston, where professional musicians and educators represent a significant customer base. It also benefits from strong distribution infrastructure and specialty retail outlets. Despite urban saturation, regional colleges and music academies help sustain demand. The U.S. Capo Market remains balanced in these regions through consistent educational and performance-based consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.S. Capo Market features a mix of established brands and emerging players competing on innovation, durability, and affordability. Key players such as Kyser, Shubb, and Dunlop maintain strong brand loyalty through consistent quality and ergonomic designs. These companies focus on artist endorsements, product customization, and reliable distribution networks to retain market position. New entrants target niche segments with unique aesthetics or smart features. It creates a competitive landscape driven by both function and form. Product variety across price tiers allows brands to cater to beginners and professionals alike. The market reflects moderate consolidation with room for differentiation through design and marketing. Companies continue to invest in R&D to improve capo tension systems and reduce tuning issues. Brand partnerships with music schools and events also strengthen their competitive edge.

Recent Developments:

- In June 2025, Vanguard Food LP, a joint venture formed by Kennedy Lewis Investment Management, Sweat Equities, and Village Farms International, officially closed a transaction that privatized certain fresh produce assets of Village Farms. This venture aims to become a leading branded consumer packaged goods company in the North American produce industry, focusing on healthy lifestyles and sustainable farming.

- In April 2025, Brynwood Partners announced the sale of its portfolio company, Harvest Hill Beverage Company, to Castillo Hermanos, a family-owned company with a long history in the beverage business. This acquisition significantly expands Castillo Hermanos’ U.S. presence and provides a platform for growth in the U.S. beverage market.

- In September 2024, Brynwood Partners acquired Miracapo Pizza Company from CC Industries, marking an expansion in the frozen pizza manufacturing space. Miracapo operates three manufacturing facilities in the Chicagoland area and serves convenience stores and branded retail customers.

Market Concentration & Characteristics:

The U.S. Capo Market shows moderate concentration, with a few dominant players holding substantial share while smaller brands compete in price-sensitive segments. It operates in a low-barrier environment, encouraging new entrants and continuous product innovation. Most companies prioritize lightweight materials, quick-release mechanisms, and tuning stability. Consumer preferences vary by skill level, driving the need for both premium and entry-level options. Market growth depends heavily on retail visibility, online sales, and music education channels. It sustains competition through diverse brand offerings and frequent product refresh cycles. Regional distribution networks play a crucial role in ensuring availability across performance hubs. Seasonal promotions and bundled sales packages further define market dynamics.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for ergonomic and lightweight capo designs will increase as users prioritize comfort during extended use.

- Integration of smart features in premium capos is expected to gain traction among technologically inclined musicians.

- E-commerce platforms will continue to expand market access, especially in suburban and rural regions.

- Artist collaborations and influencer marketing will drive product visibility and shape consumer preferences.

- Growth in music education and therapy programs will open new channels for capo adoption.

- Manufacturers will invest in durable materials and precision mechanisms to enhance tuning stability.

- Entry-level segments will benefit from bundled starter kits and school-based music initiatives.

- Counterfeit prevention and brand authentication efforts will become more critical in online sales.

- Subscription-based music gear services may emerge as a viable distribution model for capos.

- Innovation in aesthetics and personalized capo options will strengthen brand differentiation and customer loyalty.