Market Overview:

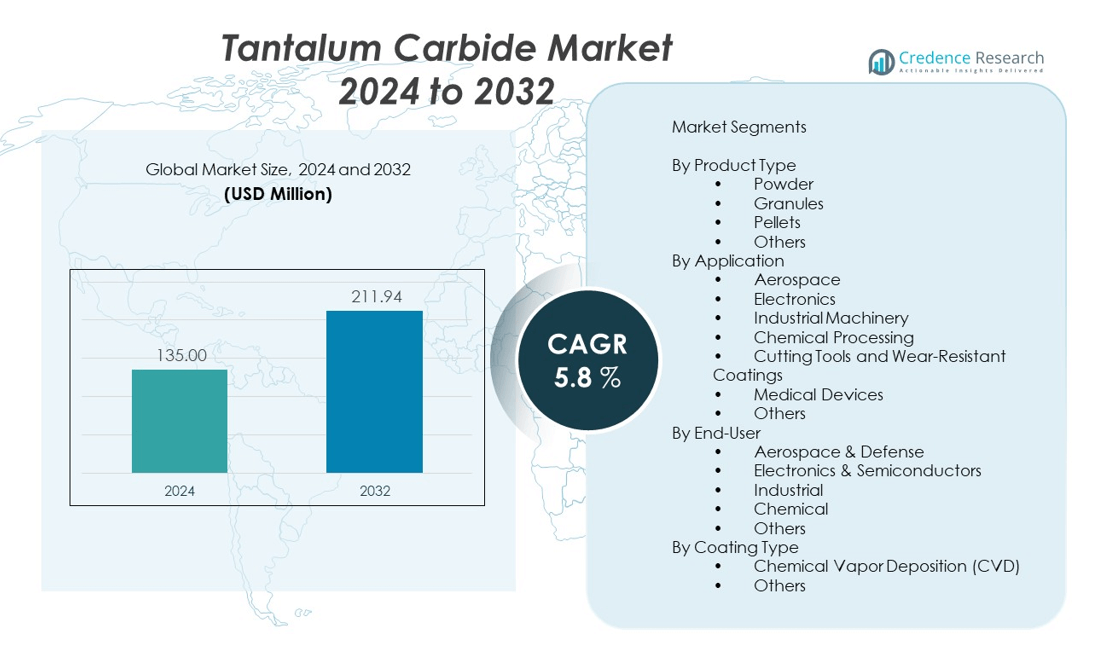

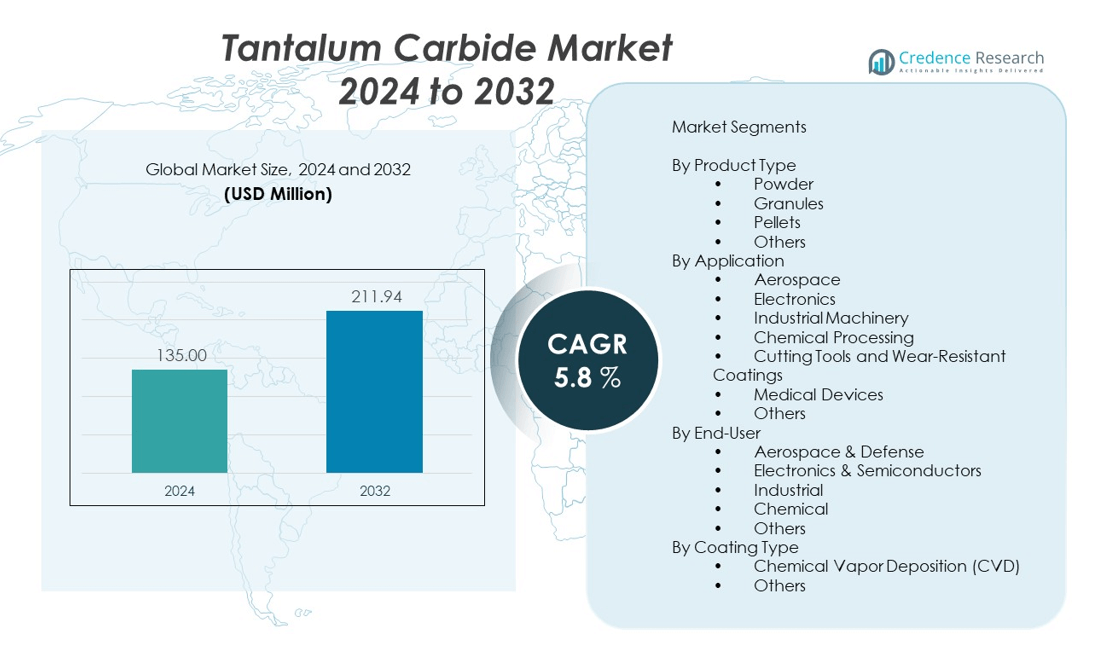

The Tantalum carbide market is projected to grow from USD 135 million in 2024 to an estimated USD 211.94 million by 2032, at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tantalum Carbide Market Size 2024 |

USD 135 million |

| Tantalum Carbide Market, CAGR |

5.8% |

| Tantalum Carbide Market Size 2032 |

USD 211.94 million |

The market expansion is driven by rising demand for high-performance materials in extreme operating environments. Industries such as aerospace and defense increasingly use tantalum carbide for its ability to withstand high temperatures and mechanical stress. In electronics, its conductive properties support applications in semiconductors and thin-film resistors. Growing investment in R&D for advanced ceramics and superalloys also stimulates demand, as manufacturers seek materials that enhance product durability, efficiency, and performance.

Geographically, North America and Europe lead the tantalum carbide market due to their strong aerospace, defense, and electronics industries, along with advanced manufacturing capabilities. The United States, Germany, and France are key contributors, driven by high R&D investment and technological innovation. Asia-Pacific is emerging as a high-growth region, with China, Japan, and South Korea rapidly expanding their electronics and industrial manufacturing sectors. The region benefits from increasing infrastructure development, a growing automotive industry, and government initiatives to boost high-tech materials production.

Market Insights:

- The tantalum carbide market was valued at USD 135 million in 2024 and is projected to reach USD 211.94 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- Demand is driven by its exceptional hardness, high melting point, and thermal conductivity, making it essential for aerospace, electronics, and industrial tool applications.

- Growing adoption in semiconductor manufacturing and wear-resistant coatings strengthens its position in high-performance engineering sectors.

- High production costs and complex manufacturing processes limit widespread adoption, particularly in cost-sensitive industries.

- Raw material supply risks and geopolitical factors affecting tantalum sourcing pose significant market restraints.

- North America leads with 37% market share due to strong aerospace, defense, and electronics industries, followed by Europe at 29% and Asia-Pacific at 24%.

- Emerging economies in Asia-Pacific are witnessing rapid growth driven by expanding manufacturing capabilities and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from Aerospace and Defense for Extreme Condition Applications:

The aerospace and defense sectors are major consumers of high-performance materials capable of enduring extreme conditions, and the tantalum carbide market benefits significantly from this requirement. Its high melting point and exceptional hardness make it ideal for use in thermal protection systems, jet engine components, and defense armor. It supports reliable operation under severe thermal and mechanical stress, making it valuable in missile systems and space vehicles. Advancements in hypersonic technology have further increased the demand for materials with superior heat resistance. The push for lighter, stronger, and more durable components continues to drive adoption. Government investments in space exploration and defense modernization projects reinforce this trend. The rising use of superalloys containing tantalum carbide in turbine blades adds to its industrial importance. Global competition in aerospace innovation ensures sustained consumption of this material.

- For instance, companies like Advanced Refractory Metals (ARM) produce tantalum hafnium carbide (Ta4HfC5), which withstands temperatures exceeding 4000°C and maintains structural integrity in hypersonic and space vehicle parts, fortifying spacecraft safety in harsh environments.

Rising Demand for Wear-Resistant and Cutting Tool Applications:

Industrial machining and manufacturing processes require tools that maintain sharpness and durability under high friction, and the tantalum carbide market gains strong traction in this area. It is a critical component in cutting tool inserts, milling cutters, and drill bits due to its extreme hardness and abrasion resistance. The material extends tool life, reduces downtime, and enhances productivity in metalworking operations. Sectors such as automotive, mining, and heavy machinery rely on these tools for precision and efficiency. Manufacturers integrate tantalum carbide coatings to improve surface durability and reduce wear. Growth in infrastructure development and large-scale manufacturing across emerging economies fuels demand. The shift toward advanced manufacturing technologies, including CNC machining, further supports its adoption. These factors together strengthen its role in the industrial tools market.

- For instance, Sandvik Coromant utilizes tantalum carbide coatings on drills and milling cutters, resulting in tools lasting up to 30% longer when machining hard materials, which enhances manufacturing efficiency.

Expanding Use in Electronics and Semiconductor Manufacturing:

The electronics industry increasingly incorporates materials that offer high electrical conductivity and thermal stability, supporting the growth of the tantalum carbide market. It is used in thin-film resistors, capacitors, and microelectronic devices where performance and reliability are critical. Its ability to withstand high temperatures without degradation makes it suitable for semiconductor fabrication processes. Rising global demand for consumer electronics, IoT devices, and high-performance computing systems drives consumption. Manufacturers seek materials that ensure long-term stability in microchips and circuitry. The shift toward miniaturization in electronics amplifies the need for stable and durable conductive materials. Continuous investments in semiconductor manufacturing infrastructure in Asia-Pacific and North America increase usage. The integration of tantalum carbide in advanced display technologies is also gaining momentum.

Increasing Research and Development in Advanced Ceramics and Coatings:

Ongoing R&D in high-performance ceramics and protective coatings boosts the prospects of the tantalum carbide market. It is valued for its role in enhancing the hardness, corrosion resistance, and thermal performance of ceramic composites. Advanced coatings containing tantalum carbide are applied to machine parts, molds, and aerospace components to improve service life. Research institutions and manufacturers focus on developing new sintering techniques to improve density and performance. The push for additive manufacturing solutions, including 3D printing of high-performance ceramics, expands application possibilities. Collaborative efforts between material scientists and industrial manufacturers lead to innovative product solutions. Governments and private companies are funding projects to improve manufacturing efficiency of this material. These advancements widen the scope of its applications across sectors.

Market Trends:

Integration of Tantalum Carbide in Additive Manufacturing Processes:

The increasing adoption of additive manufacturing technologies is shaping new applications in the tantalum carbide market. Its compatibility with powder-based manufacturing methods enables the production of complex, high-performance components. This trend supports customization and rapid prototyping in aerospace, defense, and medical industries. The material’s wear resistance and heat stability make it suitable for 3D-printed molds, tools, and engine parts. Powder metallurgy advancements have improved its processing efficiency. Manufacturers are investing in specialized equipment to handle refractory metal carbides in additive production. The ability to produce lightweight yet strong parts aligns with industry goals for material efficiency. The trend strengthens its role in modern manufacturing ecosystems.

- For instance, powder-based 3D printing methods now leverage tantalum carbide’s wear resistance and thermal stability to create durable molds and engine components, enabling lightweight but strong parts crucial for aerospace and defense customizations.

Growing Interest in High-Temperature Energy Systems and Applications:

Energy industries are adopting materials that can sustain performance under intense thermal loads, creating opportunities for the tantalum carbide market. Its thermal stability and corrosion resistance suit applications in nuclear reactors, high-efficiency solar thermal systems, and advanced fuel cells. The drive for higher efficiency in power generation encourages the use of refractory carbides in critical components. Global energy transition projects increase interest in durable materials for renewable energy equipment. Research is exploring its potential in hydrogen production systems requiring extreme operational resilience. Integration into next-generation turbines is under consideration. This focus on high-temperature energy solutions enhances its market relevance.

- For instance, tantalum carbide’s integration in next-generation turbine components and hydrogen production systems withstands harsh operational environments, assisting in maintaining efficiency under intense thermal loads.

Emergence of Hybrid and Composite Materials with Enhanced Properties:

Material scientists are developing composites that combine tantalum carbide with other advanced materials to enhance performance characteristics. These hybrid materials aim to deliver improved fracture toughness, thermal shock resistance, and cost efficiency. Industries seeking multi-functional properties are adopting these composites in high-demand environments. Such developments are particularly relevant for aerospace and industrial cutting applications. Collaborative research between universities and manufacturing companies accelerates these innovations. The ability to tailor properties for specific use cases broadens the adoption potential. This trend underscores the role of material engineering in expanding market opportunities.

Sustainability Focus in Material Sourcing and Recycling:

Sustainability concerns are influencing production practices in the tantalum carbide market. Stakeholders are emphasizing ethical sourcing of tantalum to avoid supply chain issues linked to conflict minerals. Recycling initiatives aim to reclaim tantalum and carbide materials from end-of-life products, reducing dependence on virgin raw materials. Improved recycling technologies are making the recovery process more efficient and cost-effective. Industry certification programs encourage compliance with environmental and ethical standards. This focus on responsible production supports corporate sustainability commitments. Customers increasingly prefer suppliers with transparent and compliant sourcing practices. These shifts promote market stability and long-term viability.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Requirements:

The tantalum carbide market faces significant challenges due to the high costs associated with its production. Extracting tantalum, synthesizing carbide, and achieving high purity require advanced equipment and specialized expertise. Manufacturing processes such as sintering and hot pressing are energy-intensive and expensive. These factors raise the overall cost of end products, limiting adoption in cost-sensitive industries. Limited availability of raw tantalum compounds further contributes to price volatility. Smaller manufacturers may struggle to compete with established players due to capital constraints. The complexity of processing also slows scalability in emerging markets. This cost barrier impacts widespread application potential.

Supply Chain Vulnerabilities and Raw Material Availability Risks:

Global supply chains for tantalum are highly sensitive to geopolitical, regulatory, and environmental factors. The tantalum carbide market depends on stable access to tantalum ores, which are concentrated in a few regions, creating supply risks. Political instability or trade restrictions in mining countries can disrupt availability. Stringent environmental regulations may restrict mining operations, impacting supply continuity. Competition from other industries, such as electronics and superalloy manufacturing, can exacerbate shortages. Transportation disruptions and fluctuating demand patterns further complicate procurement strategies. These vulnerabilities make long-term planning and pricing stability difficult for market participants.

Market Opportunities:

Rising Applications in Advanced Energy and Space Exploration Programs:

The expansion of advanced energy systems and space exploration initiatives offers strong opportunities for the tantalum carbide market. Its exceptional thermal resistance and mechanical strength make it valuable in components for high-efficiency turbines, rocket nozzles, and deep-space probes. Governments and private companies are investing heavily in space technologies requiring materials that withstand extreme conditions. The growing adoption of nuclear and renewable energy technologies presents additional demand. Manufacturers can align R&D to address these specialized needs, positioning themselves for premium market segments.

Expanding Potential in Medical and Biomedical Applications:

Emerging research highlights the potential of tantalum carbide in medical and dental applications due to its biocompatibility and wear resistance. Orthopedic implants, surgical tools, and dental prosthetics can benefit from its durability and stability. The increasing global demand for advanced medical devices drives exploration of new material solutions. Additive manufacturing enables customized medical components using this material, offering a pathway to innovative healthcare solutions.

Market Segmentation Analysis:

By Product Type

The tantalum carbide market is segmented into powder, granules, pellets, and others. Powder leads the segment due to its suitability for high-performance aerospace, electronics, and tooling applications where fine particle uniformity ensures superior performance. Granules and pellets cater to applications requiring specific density, flow characteristics, and controlled processing, particularly in industrial manufacturing. Other forms address custom specifications for specialized end uses.

- For instance, Granules and pellets supply needs for controlled density and flow in specific industrial manufacturing processes, while specialized forms meet custom requirements for niche applications.

By Application

Applications include aerospace, electronics, industrial machinery, chemical processing, cutting tools and wear-resistant coatings, medical devices, and others. Aerospace holds a dominant position, driven by the need for materials with exceptional heat resistance and mechanical strength. Electronics is a significant segment, supported by growing semiconductor and microelectronic production. Cutting tools and coatings see robust demand from industries seeking enhanced wear resistance and operational efficiency.

- For instance, Cutting tools and wear-resistant coatings benefit industries aiming to improve operational longevity and efficiency through enhanced surface durability.

By End-User

End-users are classified into aerospace & defense, electronics & semiconductors, industrial, chemical, and others. Aerospace & defense remains the largest contributor due to advanced engineering and defense technology requirements. Electronics & semiconductors benefit from global expansion in consumer electronics and high-performance computing. Industrial and chemical sectors use tantalum carbide for its hardness, corrosion resistance, and durability in harsh operating environments.

By Coating Type

Coating types include chemical vapor deposition (CVD) and others such as electrodeposition, sol-gel coating, and hybrid methods. CVD dominates due to its ability to produce dense, high-purity, and strongly adherent coatings ideal for extreme conditions. Other methods serve cost-sensitive or application-specific requirements, enabling broader adoption across diverse industries.

Segmentation:

By Product Type

- Powder

- Granules

- Pellets

- Others

By Application

- Aerospace

- Electronics

- Industrial Machinery

- Chemical Processing

- Cutting Tools and Wear-Resistant Coatings

- Medical Devices

- Others

By End-User

- Aerospace & Defense

- Electronics & Semiconductors

- Industrial

- Chemical

- Others

By Coating Type

- Chemical Vapor Deposition (CVD)

- Others

Regional Analysis:

North America

North America holds the largest share of the tantalum carbide market, accounting for approximately 37% of global revenue. Strong demand from aerospace, defense, and electronics sectors drives regional growth. The United States leads the market with advanced manufacturing capabilities, significant R&D investments, and the presence of key aerospace and semiconductor companies. Defense modernization programs and expansion in high-performance electronics further support adoption. Canada contributes through industrial applications and specialized manufacturing segments. The region benefits from a robust supply chain and strict quality standards, ensuring consistent demand for high-purity materials. Growth is reinforced by technological innovation and a focus on advanced coatings and additive manufacturing.

Europe

Europe accounts for about 29% of the global market, supported by its established aerospace, automotive, and industrial machinery sectors. Germany, France, and the United Kingdom are major contributors, driven by high-value manufacturing and precision engineering. The tantalum carbide market in Europe benefits from investments in energy-efficient and durable materials, particularly in cutting tools and wear-resistant coatings. The region’s stringent environmental regulations encourage adoption of advanced materials with long service life and lower maintenance requirements. The European aerospace industry plays a key role, with demand for components capable of withstanding extreme temperatures. Growth in semiconductor manufacturing and medical device production also adds to market strength.

Asia-Pacific

Asia-Pacific represents approximately 24% of the global market and is the fastest-growing region. China, Japan, and South Korea lead demand due to their strong electronics, semiconductor, and industrial manufacturing bases. The tantalum carbide market in this region benefits from large-scale production capacities, cost advantages, and rising infrastructure development. Expanding aerospace and defense programs in China and India create additional opportunities. The region is also a major hub for raw material processing, which supports local manufacturing. Increasing adoption of advanced manufacturing technologies, such as CNC machining and additive manufacturing, further boosts market growth. The competitive landscape is strengthened by the presence of both domestic producers and global suppliers targeting high-growth sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABSCO

- Edgetech Industries

- C. Starck Tungsten / H.C. Starck GmbH

- Hunan Fushel Technology

- Ningxia Orient Tantalum Industry Co., Ltd.

- Yanling Jincheng Tantalum & Niobium

- Reade Advanced Materials

- Stanford Advanced Materials

- Treibacher Industrie AG

- Materion Corporation

- Kennametal Inc.

- Japan New Metals Co., Ltd.

- American Elements

- Zhuzhou Cemented Carbide Group Co., Ltd.

- Plansee SE

- Global Advanced Metals Pty Ltd

Competitive Analysis:

The tantalum carbide market is characterized by the presence of global and regional players competing through product quality, technological expertise, and industry-specific customization. Key companies focus on advanced manufacturing processes, including chemical vapor deposition and powder metallurgy, to achieve high-purity, high-performance materials. Strategic partnerships with aerospace, electronics, and industrial manufacturers strengthen market positions. Innovation in coating technologies and additive manufacturing applications enhances competitive advantage. Companies also invest in sustainable sourcing and recycling initiatives to address raw material supply concerns. The market remains moderately consolidated, with a few leading players holding significant share while smaller companies target niche applications. Continuous R&D and capacity expansions are central to maintaining competitiveness.

Recent Developments:

- In May 2024, Mitsubishi Materials Corporation announced the acquisition of H.C. Starck Holding GmbH from Masan High-Tech Materials. H.C. Starck is known for producing high-quality powders including tungsten, tungsten carbide, and tantalum carbide. The acquisition is aimed at expanding Mitsubishi’s tungsten and refractory metals business globally, leveraging H.C. Starck’s strong presence in Europe, North America, and China, as well as its leading recycling capabilities for tungsten and related materials. The transaction closure was expected by the end of March 2025, positioning Mitsubishi Materials to enhance R&D and recycling technologies in refractory metals including tantalum carbide.

- In early 2025, Kennametal Inc. launched a new series of tantalum carbide composite-coated cutting tools. These tools, aimed at automotive and mining industries, demonstrated extended operational life and wear resistance under rigorous high-friction conditions, providing improved manufacturing productivity and precision.

Market Concentration & Characteristics:

The tantalum carbide market is moderately concentrated, with leading players such as H.C. Starck GmbH, Kennametal Inc., Plansee SE, Materion Corporation, and Global Advanced Metals holding substantial market shares. It is defined by high entry barriers due to complex production processes, specialized equipment requirements, and raw material sourcing challenges. Technological expertise, quality certifications, and strategic partnerships are critical competitive factors. Demand is driven by specialized industries, making long-term supplier relationships essential for sustained growth. Companies differentiate through application-specific solutions, advanced coatings, and precision-engineered materials.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-user, and coating type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for high-performance materials in aerospace and defense will sustain market growth.

- Increased adoption in semiconductor manufacturing will enhance long-term prospects.

- Expansion of additive manufacturing will create new product design opportunities.

- Development of hybrid composites will improve performance capabilities.

- Investment in sustainable sourcing will address supply chain vulnerabilities.

- Growth in medical device applications will open emerging revenue streams.

- Asia-Pacific will continue to lead in production capacity expansion.

- Technological advancements in coating methods will enhance durability and efficiency.

- Strategic collaborations between manufacturers and end-users will boost innovation.

- Continued R&D will enable cost reduction and broaden application scope.