Market Overview

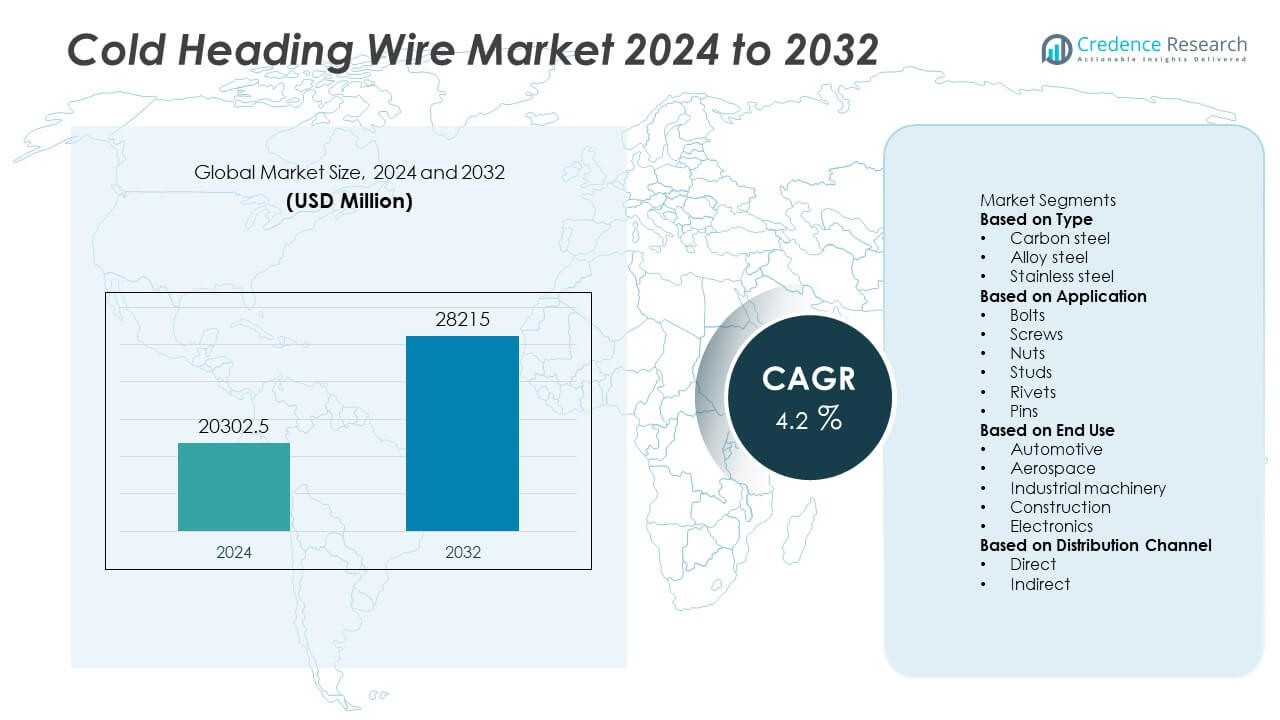

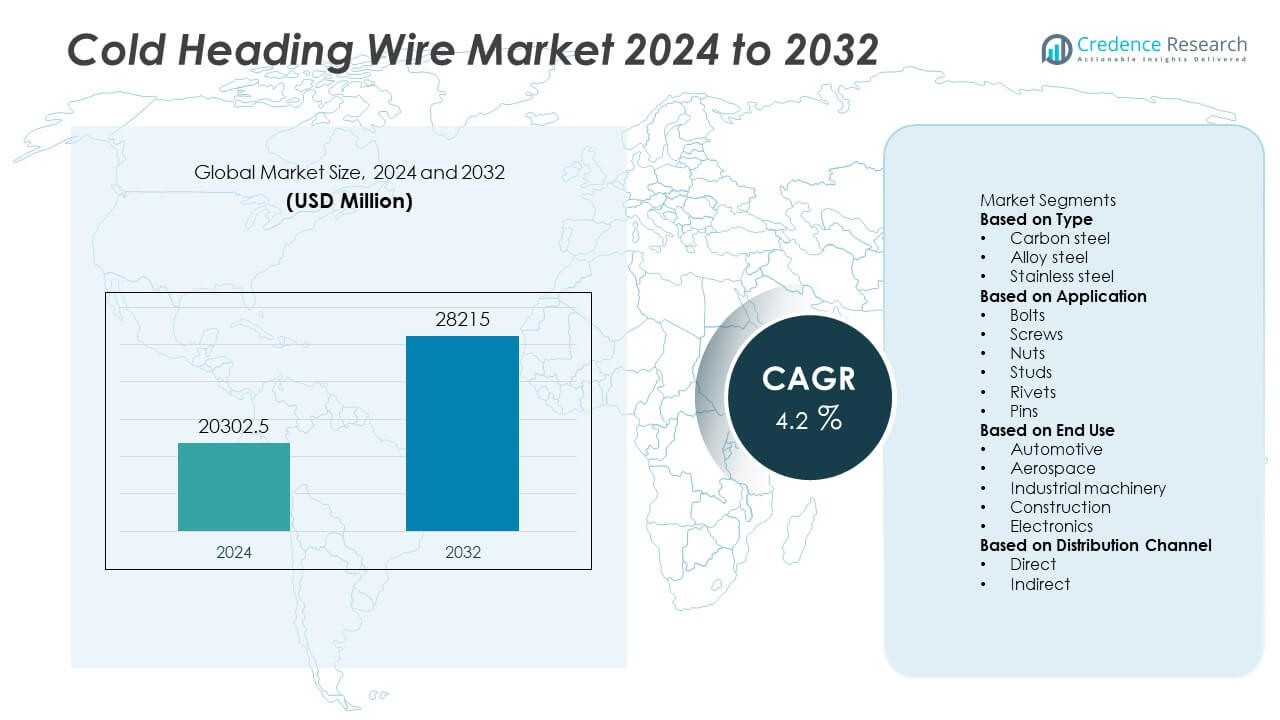

The Cold Heading Wire Market was valued at USD 20,302.5 million in 2024 and is projected to reach USD 28,215 million by 2032, growing at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Heading Wire Market Size 2024 |

USD 20,302.5 Million |

| Cold Heading Wire Market, CAGR |

4.2% |

| Cold Heading Wire Market Size 2032 |

USD 28,215 Million |

The Cold Heading Wire Market grows due to increasing demand for high-strength, lightweight fasteners in automotive and aerospace industries, driven by the need for improved fuel efficiency and durability. It benefits from advancements in wire alloys and manufacturing technologies that enhance performance and reduce production costs. Rising environmental regulations encourage the adoption of eco-friendly materials and processes.

The Cold Heading Wire Market demonstrates strong regional growth driven by industrial hubs across North America, Europe, and Asia Pacific. North America benefits from advanced automotive and aerospace sectors, while Europe’s focus on precision engineering and stringent regulations supports demand for high-quality wire products. Asia Pacific experiences rapid industrialization and infrastructure development, particularly in China, India, and Japan, expanding market opportunities. Key players leading the Cold Heading Wire Market include ArcelorMittal, Nippon Steel Corporation, Baosteel Group Corporation, and Nucor Corporation. These companies invest heavily in research and development to enhance wire quality and diversify product offerings. Their global manufacturing capabilities and strategic partnerships enable them to meet the evolving needs of automotive, construction, and industrial customers worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cold Heading Wire Market was valued at USD 20,302.5 million in 2024 and is projected to grow steadily at a CAGR of 4.2% during the forecast period.

- Rising demand for high-strength and lightweight fasteners in automotive and aerospace sectors drives the market, with industries prioritizing fuel efficiency and durability.

- Technological advancements in wire alloys and manufacturing processes improve product performance, reduce production costs, and expand applications in heavy machinery and construction.

- Increasing adoption of automation and precision manufacturing enhances product consistency and reduces lead times, supporting growth in emerging industrial hubs.

- High initial investment costs and the complexity of processing advanced alloy wires limit market penetration among smaller manufacturers and in developing regions.

- North America, Europe, and Asia Pacific lead market growth due to strong industrial bases, with Asia Pacific witnessing rapid expansion driven by infrastructure development and rising automotive production.

- Key market players such as ArcelorMittal, Nippon Steel Corporation, Baosteel Group Corporation, and Nucor Corporation compete through product innovation, strategic partnerships, and global manufacturing capabilities.

Market Drivers

Rising Demand from Automotive and Industrial Fastening Applications Driving Market Growth

The Cold Heading Wire Market experiences significant growth due to increasing demand in automotive and industrial fastening applications. Manufacturers rely on cold heading wire for producing high-strength fasteners that meet stringent safety and durability standards. It supports the manufacturing of components like bolts, screws, and rivets used in vehicle assembly and machinery. The ability to produce complex shapes with consistent quality at high speed enhances production efficiency. Automotive sector expansion, particularly in emerging economies, further boosts wire consumption. Industrial equipment manufacturing also drives demand due to the need for reliable fastening solutions in heavy machinery and construction.

- For instance, Nippon Steel Corporation reported producing over 250,000 metric tons of high-strength cold heading wire specifically for automotive fasteners in 2023, supporting major OEMs globally. Automotive sector expansion, particularly in emerging economies, further boosts wire consumption. Industrial equipment manufacturing also drives demand due to the need for reliable fastening solutions in heavy machinery and construction.

Advancements in Wire Material Composition Enhancing Performance and Application Range

Technological advancements in wire composition contribute to the Cold Heading Wire Market’s growth by improving material properties. Innovations include high-carbon steel and alloy steel wires that offer superior tensile strength, ductility, and corrosion resistance. These improvements enable the wire to withstand extreme mechanical stresses and environmental conditions. Manufacturers benefit from reduced material waste and enhanced product longevity. The expanded range of wire grades allows application across diverse industries such as electronics, aerospace, and healthcare. It facilitates precision manufacturing and extends component service life.

- For instance, ArcelorMittal developed a cold heading wire grade with tensile strength reaching approximately 1,400 MPa, tailored for aerospace and automotive applications requiring high durability and precision. This material advancement reduces waste during manufacturing and extends product service life. The broader variety of wire grades enables application across electronics, aerospace, and medical device manufacturing, facilitating precision engineering and longer-lasting components.

Stringent Quality and Performance Standards Elevating Market Demand

The market growth is influenced by strict quality and performance standards imposed by automotive, aerospace, and industrial sectors. Cold heading wire must comply with regulations regarding mechanical properties, dimensional accuracy, and surface finish. It ensures reliable performance in critical applications where failure can lead to significant safety risks and operational downtime. Industry standards encourage the adoption of advanced testing and inspection techniques, driving manufacturers to improve wire consistency and traceability. This focus on quality supports long-term customer trust and expands market opportunities.

Expansion of Manufacturing Facilities and Global Supply Chain Strengthening Market Penetration

Growth in manufacturing infrastructure and global supply chain integration positively impact the Cold Heading Wire Market. Increasing investments in production facilities enhance manufacturing capacity and meet rising demand worldwide. Efficient logistics and distribution networks improve product availability and reduce lead times for end-users. Emerging economies witness rapid industrialization, supporting localized production and consumption. Companies adopt strategic partnerships and acquisitions to broaden their geographic presence. This expansion facilitates access to new markets and strengthens competitive positioning.

Market Trends

Increasing Adoption of High-Strength and Specialty Alloy Wires to Meet Industry Demands

The Cold Heading Wire Market shows a clear trend toward the use of high-strength and specialty alloy wires. Manufacturers prioritize wires with enhanced mechanical properties to cater to automotive, aerospace, and industrial sectors requiring durable and lightweight fasteners. It allows the production of components that meet stringent performance and safety standards while reducing overall weight. Advances in metallurgy and alloy development drive this shift, enabling cold heading wire to perform reliably under harsh conditions. The market witnesses growing demand for corrosion-resistant and fatigue-resistant wires, broadening application scope. This trend supports the creation of high-performance fasteners designed for longevity and efficiency.

- For instance, Baosteel Group Corporation produces alloy steel wires with tensile strengths reaching up to 1,500 MPa, widely used in automotive and aerospace fasteners to improve fatigue resistance and reduce component weight.

Integration of Sustainable Manufacturing Practices in Cold Heading Wire Production

Sustainability emerges as a key trend influencing the Cold Heading Wire Market. Producers focus on minimizing energy consumption and waste throughout the manufacturing process. It encourages the adoption of eco-friendly raw materials and recycling initiatives to reduce environmental impact. Compliance with global environmental regulations promotes cleaner production techniques and resource efficiency. Companies invest in technologies that lower carbon footprints and improve operational sustainability. This trend aligns with broader industrial goals of responsible manufacturing, enhancing the market’s appeal among environmentally conscious customers.

- For instance, ArcelorMittal implemented energy-efficient processes in its wire production facilities, reducing CO₂ emissions by over 30,000 tons annually through optimized furnace operations and waste heat recovery systems. Compliance with global environmental regulations promotes cleaner production techniques and resource efficiency.

Advancement in Automation and Digitalization to Boost Production Efficiency

Automation and digital technologies increasingly integrate into the Cold Heading Wire Market to optimize production workflows. Automated systems improve precision in wire drawing, heat treatment, and surface finishing processes. It reduces human error and enhances product consistency and quality. Real-time monitoring and data analytics help manufacturers anticipate maintenance needs and streamline operations. The adoption of Industry 4.0 practices enables faster response to market demands and customization requirements. This shift drives higher throughput while maintaining stringent quality standards, strengthening competitive advantage.

Expansion of Cold Heading Wire Applications in Emerging Sectors and Regions

The Cold Heading Wire Market benefits from expanding applications beyond traditional industries into emerging sectors such as electronics, healthcare, and renewable energy. These sectors demand specialized fasteners with exacting specifications and superior performance. It fosters innovation in wire grades and coating technologies tailored to unique application needs. Geographic expansion in developing economies contributes to market growth due to increasing industrial activity and infrastructure development. Companies target these regions with localized production and distribution strategies to capture new opportunities. This trend supports broader market diversification and resilience.

Market Challenges Analysis

High Raw Material Costs and Volatility Affecting Production Margins in the Cold Heading Wire Market

The Cold Heading Wire Market faces significant challenges from fluctuating raw material prices, particularly steel and alloy inputs. It increases production costs and pressures profit margins for manufacturers. The dependence on global commodity markets exposes the supply chain to price volatility driven by geopolitical tensions and trade policies. Manufacturers must balance cost management with maintaining product quality and meeting delivery schedules. Limited availability of high-grade raw materials can cause supply disruptions, affecting production timelines. These factors compel companies to explore alternative sourcing strategies and invest in supply chain resilience to mitigate risks and sustain operations.

Technical Limitations and Stringent Quality Requirements Restricting Market Expansion

The Cold Heading Wire Market encounters challenges related to technical constraints and rigorous quality standards demanded by end-use industries. It requires precise control over wire composition, dimensional accuracy, and surface finish to meet performance criteria in automotive, aerospace, and industrial applications. Achieving consistent quality across large production volumes remains difficult, particularly with specialty alloys and advanced materials. This limits the ability of some manufacturers to cater to highly specialized or emerging applications. The need for continuous investment in R&D and sophisticated testing infrastructure increases operational costs. Overcoming these challenges is essential for market participants to maintain competitiveness and expand into new sectors.

Market Opportunities

Growing Demand for Lightweight and High-Strength Materials Creating New Application Opportunities

The Cold Heading Wire Market benefits from increasing demand for lightweight yet high-strength materials in automotive, aerospace, and industrial sectors. It enables manufacturers to produce fasteners and components that improve fuel efficiency and reduce overall weight without compromising durability. This demand drives innovation in wire alloys and surface treatments tailored for enhanced mechanical performance. Emerging technologies in electric vehicles and advanced machinery further expand the need for specialized cold heading wire products. Companies that develop wires with superior strength-to-weight ratios can capture new market segments. This trend opens avenues for expanding product portfolios and entering high-growth industries.

Expansion in Emerging Economies Offering Untapped Market Potential for Cold Heading Wire

Emerging economies present substantial growth opportunities for the Cold Heading Wire Market due to rapid industrialization and infrastructure development. It supports increasing demand from automotive manufacturing, construction, and heavy machinery sectors in these regions. Local production capabilities and favorable government policies encourage investment in cold heading wire manufacturing facilities. Expanding consumer bases and rising urbanization fuel demand for reliable fastening solutions across multiple industries. Strategic market entry and partnerships in these regions allow companies to tap into new customer segments. This geographic expansion contributes to diversifying revenue streams and strengthening global market presence.

Market Segmentation Analysis:

By Type

The market divides into high carbon steel wire, alloy steel wire, and stainless steel wire. High carbon steel wire dominates due to its excellent tensile strength and cost-effectiveness, making it suitable for general fastening and industrial applications. Alloy steel wire offers enhanced mechanical properties, including improved fatigue resistance and hardness, which makes it ideal for heavy-duty automotive and aerospace components. Stainless steel wire holds a growing share because of its corrosion resistance and aesthetic appeal, favored in industries like electronics and healthcare. The choice of wire type directly impacts the performance and durability of cold-headed components, influencing market demand.

- For instance, Nippon Steel Corporation manufactures high carbon steel wire with tensile strengths reaching up to 1,600 MPa, widely used in construction and general fastener production. Alloy steel wire offers enhanced mechanical properties, including improved fatigue resistance and hardness, which makes it ideal for heavy-duty automotive and aerospace components.

By Application

Cold heading wire serves a wide range of applications, primarily in fastener manufacturing, which includes bolts, screws, rivets, and pins. Fasteners require wires with consistent mechanical properties and surface finish to ensure reliability under stress. Beyond fasteners, cold heading wire finds use in the production of springs, washers, and clips, where flexibility and tensile strength are critical. The automotive sector remains the largest consumer, driven by demand for high-strength fasteners that enhance vehicle safety and efficiency. Industrial machinery and construction sectors also rely heavily on these wires to produce durable components that withstand rigorous conditions.

By End Use

The Cold Heading Wire Market serves various end-use industries, including automotive, aerospace, construction, electronics, and healthcare. The automotive industry leads in consumption, driven by the need for lightweight, high-strength fasteners to improve fuel efficiency and safety. Aerospace applications demand precision-grade wires capable of meeting strict regulatory standards and extreme performance requirements. Construction uses cold heading wire for structural components and heavy machinery parts requiring durability and corrosion resistance. Electronics and healthcare sectors increasingly adopt stainless steel and specialty alloy wires to meet demands for miniaturization and biocompatibility. The diversity of end-use industries contributes to the market’s resilience and ongoing expansion.

Segments:

Based on Type

- Carbon steel

- Alloy steel

- Stainless steel

Based on Application

- Bolts

- Screws

- Nuts

- Studs

- Rivets

- Pins

Based on End Use

- Automotive

- Aerospace

- Industrial machinery

- Construction

- Electronics

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 35% of the global market share in 2024. The region benefits from a well-established automotive and aerospace industry where stringent quality standards drive demand for high-performance cold heading wire. The United States leads this market due to its strong manufacturing base and ongoing investments in advanced materials and production technologies. Canada and Mexico also contribute significantly, with growing automotive assembly plants and expanding industrial infrastructure projects. North America’s focus on innovation and sustainability further supports the adoption of specialty cold heading wires designed for lightweight and corrosion-resistant applications, reinforcing its dominant position in the global market.

Europe

Europe holds about 28% of the Cold Heading Wire Market share, driven by robust industrial manufacturing and automotive sectors. Germany, France, and Italy are major contributors within the region, supported by their advanced engineering capabilities and high production volumes. The presence of leading fastener manufacturers and strict environmental regulations incentivizes the use of efficient and eco-friendly wire products. Europe’s emphasis on precision engineering and lightweight materials in aerospace and automotive industries fuels demand for alloy and stainless-steel wires. The region also benefits from well-developed supply chains and R&D infrastructure, enabling manufacturers to innovate and meet evolving market requirements effectively.

Asia Pacific

Asia Pacific accounts for approximately 22% of the global Cold Heading Wire Market, reflecting rapid industrialization and expanding manufacturing capabilities in countries such as China, Japan, India, and South Korea. China dominates the region with its large-scale automotive production and significant infrastructure development projects. India and Southeast Asian countries contribute through rising demand in automotive and construction sectors. The Asia Pacific market benefits from cost-competitive manufacturing and increasing foreign direct investment in industrial plants. Rising urbanization and growing middle-class populations fuel demand for automobiles and consumer goods, which in turn drives the need for reliable fasteners and precision components manufactured from cold heading wire. The region’s dynamic growth and increasing technology adoption present substantial opportunities for market expansion.

Middle East and Africa

The Middle East and Africa hold around 8% of the Cold Heading Wire Market share, with demand largely driven by the oil and gas, construction, and heavy machinery sectors. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa lead regional consumption due to large infrastructure projects and ongoing industrial maintenance activities. The market in this region is developing steadily, supported by investments in energy production and transport infrastructure. The demand for corrosion-resistant and high-strength wires grows in response to the harsh environmental conditions common in these areas. Increasing industrial diversification and efforts to upgrade manufacturing capabilities are expected to enhance market growth in this region.

Latin America

Latin America represents nearly 7% of the Cold Heading Wire Market share, with Brazil and Mexico as the leading markets. The region sees steady growth driven by the automotive, mining, and construction industries. Brazil’s established automotive manufacturing and Mexico’s role as a hub for automotive assembly attract significant demand for cold heading wire products. Mining operations across the region also require durable fasteners and components that meet rigorous performance standards. Despite economic fluctuations posing challenges, increasing industrial investments and infrastructure modernization projects provide growth prospects. Latin America’s expanding industrial base supports gradual increases in cold heading wire consumption and production capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Cold Heading Wire Market features intense competition among leading global players including ArcelorMittal, Nippon Steel Corporation, Baosteel Group Corporation, Nucor Corporation, Gerdau, POSCO, Kobe Steel, SeAH Steel Corporation, Bekaert, and Dongbei Special Steel Group. These companies focus on expanding their product portfolios through continuous innovation in wire alloys and manufacturing technologies to meet the rising demand for high-performance, lightweight fasteners. They invest significantly in research and development to enhance wire strength, corrosion resistance, and dimensional precision, catering to automotive, aerospace, and construction industries. Strategic partnerships and collaborations with end-users and technology providers enable these players to improve supply chain efficiency and accelerate new product introductions. Geographic expansion into emerging markets remains a critical strategy, with companies establishing manufacturing facilities and sales networks in Asia Pacific and Latin America to capitalize on growing industrialization. Additionally, leading players prioritize sustainability by adopting eco-friendly production methods and materials to comply with stringent environmental regulations. Competitive differentiation also arises from offering customized solutions and technical support, which strengthens customer loyalty. The market’s competitive landscape underscores the importance of innovation, operational efficiency, and market responsiveness in maintaining and growing market share.

Recent Developments

- In February 2024, Nippon Steel Corporation’s U.S. joint venture for steel wire production remained active, supporting its global supply network. The company also reported a significant plant expansion in Suzhou, China, during the first half of 2024, incorporating integrated process improvements to enhance production efficiency and product quality.

- In September 2024, ArcelorMittal launched new low carbon emissions steel cold heading wire products, offering a high level of CO2 reduction. These products are part of their XCarb®recycled and renewably produced steel range, which includes options with up to 75% less CO2 emissions compared to standard steel

- In May 2024, market and industry reports highlighted Baosteel Group Corporation’s development and supply of enhanced cold heading wire rods for the automotive sector.

Market Concentration & Characteristics

The Cold Heading Wire Market demonstrates a moderately concentrated structure with several key global players holding significant influence. It is characterized by strong competition among well-established steel manufacturers and specialty wire producers who leverage advanced technologies and extensive distribution networks. These companies focus on product innovation, quality enhancement, and operational efficiency to differentiate themselves in a market driven by demand from automotive, aerospace, and industrial sectors. The market requires substantial capital investment and technical expertise, creating high entry barriers that limit the number of new entrants. It places emphasis on developing high-strength, lightweight, and corrosion-resistant wires to meet evolving industry standards and environmental regulations. The market’s competitive landscape reflects ongoing efforts to expand geographic reach, particularly into emerging economies with growing industrial bases. Strategic partnerships and long-term customer relationships play a crucial role in maintaining market share and driving growth. It also shows a trend toward sustainable manufacturing practices, aligning with global environmental goals. This combination of technological advancement, market demand, and strategic positioning shapes the dynamic nature of the Cold Heading Wire Market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cold Heading Wire Market will continue growing due to increasing demand in automotive and aerospace sectors.

- Manufacturers will focus on developing higher strength and lightweight wire materials.

- Emerging economies will offer significant growth opportunities due to industrial expansion.

- Advances in manufacturing technology will improve wire precision and production efficiency.

- Adoption of eco-friendly and sustainable production processes will rise across the industry.

- Automation and digitalization will enhance quality control and reduce manufacturing lead times.

- Companies will expand their presence in Asia Pacific and Latin America through new facilities and partnerships.

- Demand for corrosion-resistant and specialty alloy wires will increase in construction and energy sectors.

- Collaboration between wire producers and end-users will drive customized solutions and innovation.

- Investment in research and development will remain critical for maintaining competitive advantage.