Market Overview:

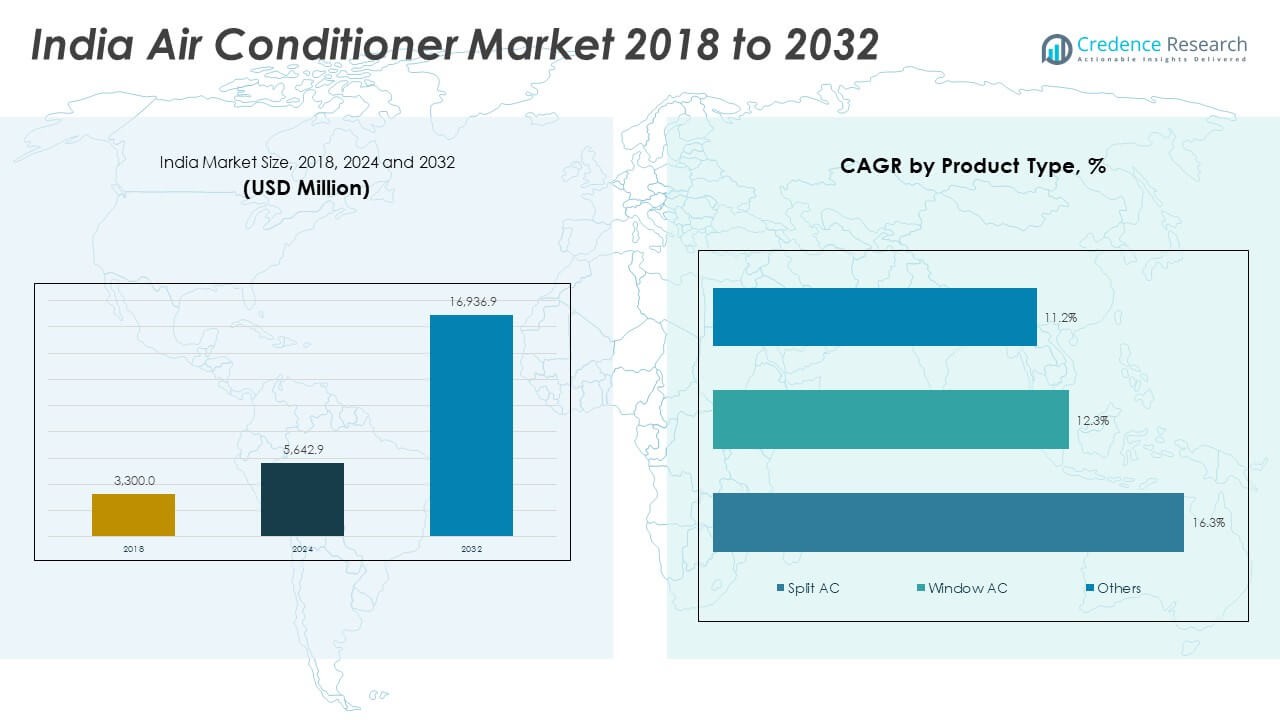

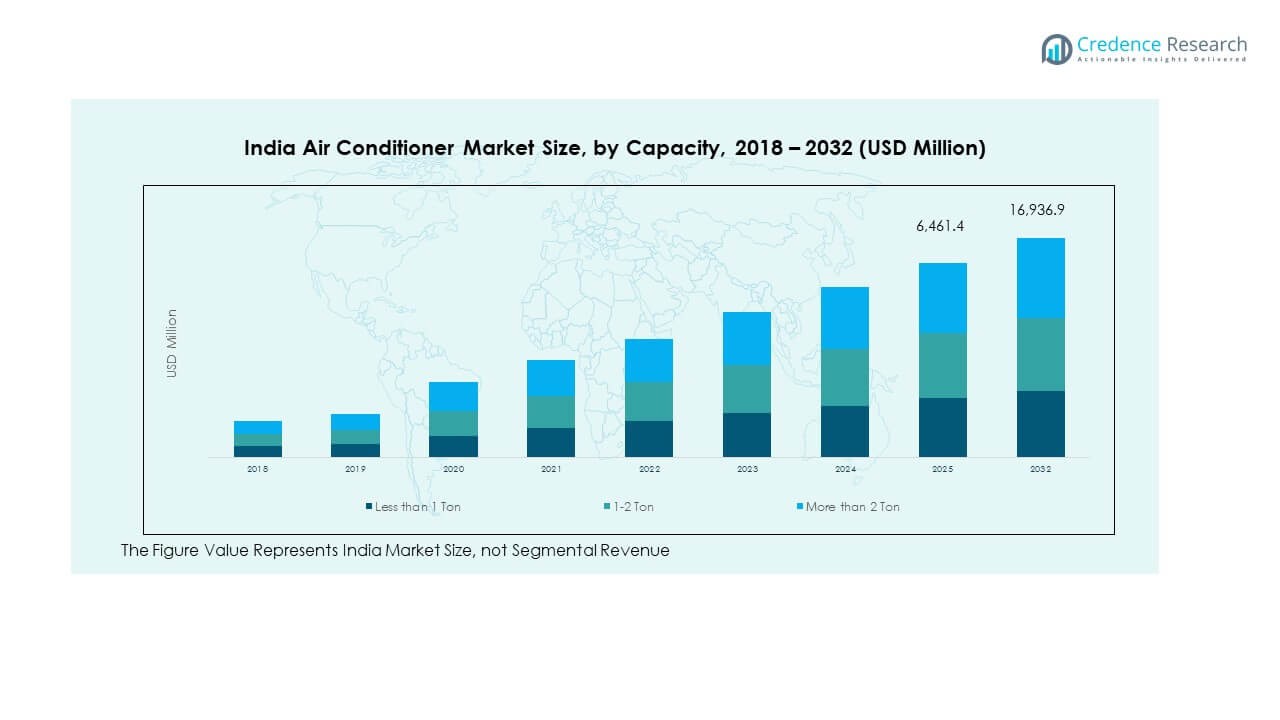

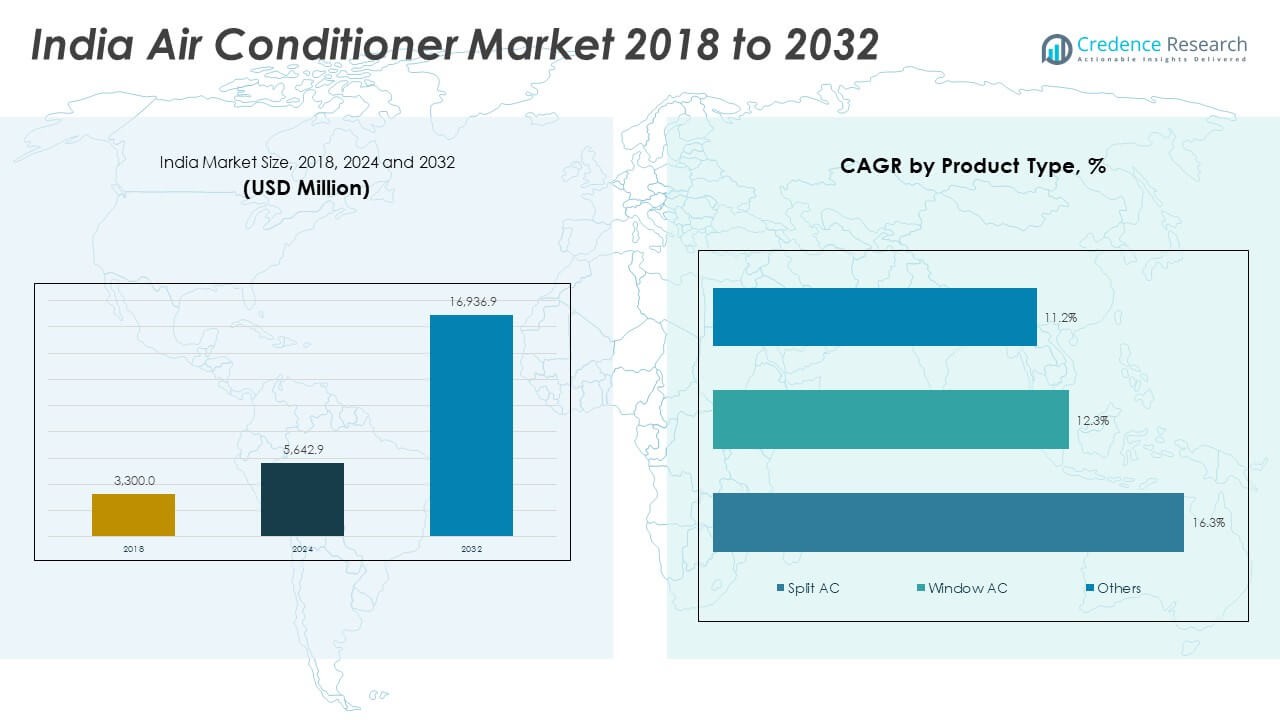

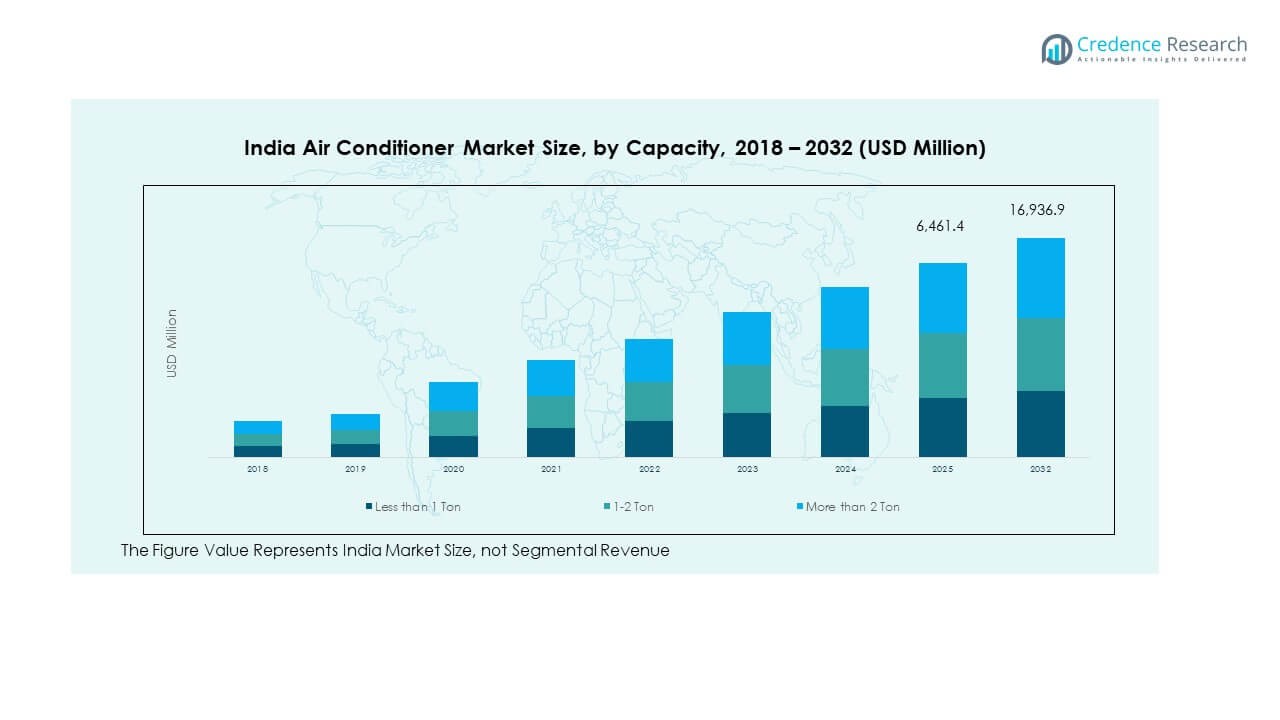

The India Air Conditioner Market size was valued at USD 3,300.0 million in 2018 to USD 5,642.9 million in 2024 and is anticipated to reach USD 16,936.9 million by 2032, at a CAGR of 14.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Air Conditioner Market Size 2024 |

USD 5,642.9 Million |

| India Air Conditioner Market, CAGR |

14.8% |

| India Air Conditioner Market Size 2032 |

USD 16,936.9 Million |

The market growth is driven by rising disposable incomes, rapid urbanization, and increasing awareness of energy-efficient appliances. Expanding middle-class households and the adoption of inverter technology have boosted residential demand, while commercial infrastructure projects further fuel sales. Additionally, rising temperatures and prolonged summers in many regions have increased the reliance on cooling systems, encouraging manufacturers to innovate with eco-friendly refrigerants and advanced air purification features to attract environmentally conscious consumers.

Regionally, metropolitan areas such as Delhi, Mumbai, Bengaluru, and Chennai dominate the India Air Conditioner Market due to higher purchasing power, dense urban populations, and extensive commercial infrastructure. Emerging growth is evident in Tier 2 and Tier 3 cities, where rising urbanization, improved electricity access, and expanding retail networks are making air conditioners more accessible. Coastal and hot-climate regions also exhibit strong adoption rates, driven by climatic necessity, while the growing real estate sector across multiple states supports market penetration in both residential and commercial segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Air Conditioner Market was valued at USD 5,642.9 million in 2024 and is expected to reach USD 16,936.9 million by 2032, growing at a CAGR of 14.8%.

- Rising disposable incomes and expanding middle-class households are boosting residential and commercial demand.

- Rapid urbanization and infrastructure development in metro and smart cities are creating strong growth opportunities.

- High energy consumption and rising electricity costs remain key restraints for widespread adoption.

- Seasonal demand peaks in summer drive strong sales cycles but create production and inventory management challenges.

- North India leads with 38% market share, followed by South India at 27% and West India at 22%.

- Expanding retail networks and e-commerce penetration are accelerating adoption in Tier 2 and Tier 3 cities.

Market Drivers:

Rising Disposable Incomes and Expanding Middle-Class Consumer Base

The India Air Conditioner Market benefits from a growing middle-class population with higher purchasing power, driving demand for residential cooling solutions. Increased affordability of appliances due to competitive pricing has accelerated adoption in urban and semi-urban areas. Seasonal heatwaves and extended summers amplify the need for reliable air conditioning. Lifestyle upgrades and a focus on comfort contribute to higher penetration rates. Expanding organized retail and e-commerce platforms improve product accessibility. Brand promotions and financing schemes attract first-time buyers. Government-led rural electrification projects enable new market entry. Manufacturers respond with varied product ranges catering to different income segments.

- For instance, Voltas achieved sales of over 2 million air conditioner units in FY2023-24, becoming the first brand in India to cross this milestone, with a 35% year-on-year volume growth driven by expanded access and consumer demand.

Rapid Urbanization and Infrastructure Development

Rapid urban expansion fuels demand for air conditioning across residential, commercial, and industrial segments. The India Air Conditioner Market gains momentum from large-scale real estate projects, IT parks, malls, and hospitality ventures. Urban dwellers prioritize modern living standards, making AC units a necessity rather than a luxury. High-density housing increases reliance on efficient cooling systems. Commercial demand rises with corporate expansions and coworking spaces. Builders integrate AC-ready designs to enhance property appeal. Infrastructure upgrades improve electricity stability, supporting wider adoption. The growth of metro cities and upcoming smart cities expands the market footprint.

- For instance, Daikin India’s Neemrana manufacturing complex in Rajasthan had reached an installed capacity of 1.5 million room AC units per year by 2023, supporting rising demand from urban infrastructure and real estate projects, and positioning it among the country’s largest dedicated AC production facilities.

Technological Advancements and Energy-Efficient Models

Manufacturers leverage technology to produce energy-efficient and eco-friendly models meeting consumer expectations. The India Air Conditioner Market is influenced by innovations such as inverter compressors, AI-based temperature control, and IoT-enabled monitoring. Consumers prefer appliances that reduce electricity bills without compromising performance. Government energy rating programs encourage purchases of higher-efficiency models. Awareness of eco-friendly refrigerants drives sustainable product development. Smart ACs with app-based controls gain traction among tech-savvy buyers. Customizable climate settings improve user comfort. These advancements enhance market competitiveness while addressing environmental concerns.

Expanding Commercial and Industrial Applications

Beyond residential use, the commercial and industrial sectors create strong demand for air conditioning systems. The India Air Conditioner Market serves hotels, hospitals, retail chains, and manufacturing units requiring precise climate control. Growth in sectors like pharmaceuticals and food processing increases adoption of specialized cooling solutions. Commercial leasing models include AC maintenance in rental agreements, boosting installations. Tourism growth drives hotel room upgrades with modern AC units. Healthcare facilities prioritize temperature regulation for patient comfort and medical equipment safety. Event venues and auditoriums depend on large-capacity units. Industrial automation processes require stable climate conditions, reinforcing demand.

Market Trends

Increasing Adoption of Smart and Connected Air Conditioning Systems

Consumers shift toward smart air conditioning units that offer remote control and energy monitoring through mobile applications. The India Air Conditioner Market experiences higher demand for products with voice assistant compatibility and AI-based climate adjustment. Wi-Fi-enabled models allow seamless integration into smart home ecosystems. Real-time usage tracking supports energy-saving habits. Customization options appeal to younger demographics seeking convenience. Brands invest in partnerships with smart device ecosystems to enhance product value. Service providers offer predictive maintenance alerts to minimize downtime. The growing influence of home automation fuels this trend.

Growing Popularity of Portable and Compact Cooling Solutions

Space-saving air conditioning options witness rising adoption in rental accommodations and small apartments. The India Air Conditioner Market benefits from portable and window AC units that require minimal installation. Urban consumers appreciate flexibility and lower upfront costs. Seasonal users find portable models more cost-effective. Lightweight designs and multi-mode operations increase convenience. Marketing emphasizes easy relocation and minimal maintenance. Compact solutions cater to small business owners seeking affordable cooling. Rising real estate costs further encourage the shift toward portable systems.

Shift Toward Premium Segment with Advanced Features

Premium AC models with superior design, noise reduction, and high-end air filtration gain traction. The India Air Conditioner Market sees affluent consumers favoring products offering luxury experiences alongside performance. Air purification technology attracts health-conscious buyers in polluted urban environments. Low-noise operation appeals to home office users. Multi-stage cooling ensures optimal comfort in extreme weather. Manufacturers differentiate through sleek designs and premium finishes. Brand loyalty strengthens when products combine aesthetics with durability. This trend aligns with the rising demand for aspirational lifestyle products.

- For instance, LG’s Smart Inverter air purifiers operate at noise levels as low as 23dB while offering multi-stage filtration and stylish designs.

Seasonal Demand Optimization Through Flexible Financing and Offers

Manufacturers and retailers focus on maximizing seasonal sales through attractive financing and promotional offers. The India Air Conditioner Market adapts with zero-interest EMIs, extended warranties, and buy-back programs. Retailers align marketing with peak summer months to drive volumes. E-commerce flash sales create urgency among buyers. Extended service contracts build long-term customer relationships. Brands collaborate with financial institutions to expand credit access. Such strategies help balance production and inventory cycles. Seasonal campaigns strengthen brand visibility and customer engagement.

- For instance, Mitsubishi ACs can be purchased in India using the Bajaj Finserv EMI Network Card, enabling consumers to buy units via No Cost EMIs. Extended warranty programs provide coverage up to ₹1.5 lakh for an additional 12 months, ensuring longer-term customer protection.

Market Challenges Analysis

High Energy Consumption and Operational Costs

The India Air Conditioner Market faces challenges due to high energy usage, which increases electricity bills for consumers. Rising tariffs discourage frequent use, especially among cost-sensitive households. Many regions still experience power supply fluctuations, limiting adoption. Energy-intensive cooling also impacts environmental sustainability targets. Consumers seek alternatives like ceiling fans or evaporative coolers in areas with high utility costs. Manufacturers face pressure to balance performance with efficiency. Rural adoption remains slower due to electricity infrastructure constraints. Addressing these concerns requires continued innovation in low-power consumption technologies.

Intense Price Competition and Market Fragmentation

Multiple domestic and international brands create a competitive environment that compresses profit margins. The India Air Conditioner Market witnesses aggressive pricing strategies that benefit consumers but challenge manufacturers. New entrants increase market fragmentation, making brand differentiation critical. Counterfeit products in unorganized markets affect brand reputation and revenue. Import-dependent brands face currency fluctuation risks impacting pricing. Distribution challenges in remote regions slow expansion. Maintaining quality while keeping prices competitive remains a constant struggle. Strong after-sales service networks become essential for brand loyalty.

Market Opportunities

Expanding Penetration in Tier 2 and Tier 3 Cities

Untapped potential exists in emerging urban centers where rising incomes and infrastructure improvements support AC adoption. The India Air Conditioner Market can capture growth through targeted marketing, localized distribution, and product customization. Compact, energy-efficient models meet the needs of smaller homes. Financing options help overcome upfront cost barriers. Localized service centers strengthen brand trust. Seasonal promotions aligned with regional festivals can increase sales. These cities present long-term growth potential with evolving consumer preferences.

Growth of Green and Sustainable Cooling Solutions

Sustainability-focused consumers create opportunities for eco-friendly product lines using natural refrigerants and energy-saving technologies. The India Air Conditioner Market benefits from aligning with environmental regulations and green building standards. Manufacturers can introduce solar-powered AC units for off-grid use. Marketing focused on environmental responsibility resonates with younger buyers. Collaborations with builders for green-certified projects enhance brand value. Investments in R&D for low-carbon cooling systems open new segments. Expanding awareness of climate impact accelerates adoption of sustainable models.

Market Segmentation Analysis:

The India Air Conditioner Market is segmented

By product type into split AC, window AC, and others. Split ACs hold the dominant share due to higher energy efficiency, quieter operation, and better aesthetics, making them the preferred choice in urban households and premium commercial spaces. Window ACs remain relevant in budget-sensitive segments and smaller rooms, offering ease of installation and lower upfront costs. The “others” category includes portable and cassette ACs, serving niche requirements in flexible cooling and specialized environments.

- For instance, ENERGY STAR-certified ductless split systems from Mitsubishi and Daikin feature advanced inverter technology for improved efficiency, with indoor noise levels as low as 19 dB(A). Such quiet operation makes them ideal for homes, libraries, and hospitals.

By capacity, the market is classified into less than 1 ton, 1–2 ton, and more than 2 ton units. The 1–2 ton category leads in demand, catering to standard residential spaces and small offices. Less than 1 ton ACs target compact rooms and single-occupancy settings, particularly in smaller urban homes. Units above 2 ton find strong adoption in large commercial facilities, industrial spaces, and premium residences requiring high-capacity cooling solutions.

- For example, cooling a 4,000sqft retail outlet or restaurant may require an 11–12-ton system, ensuring effective climate control for both customers and equipment

By application, the market spans residential, commercial, and industrial sectors. Residential use accounts for the largest share, driven by urban lifestyle shifts and rising disposable incomes. Commercial demand stems from offices, retail outlets, and hospitality, where climate control supports comfort and operational efficiency. Industrial applications focus on temperature-sensitive processes and workforce comfort.

By distribution channel, offline retail, including specialty stores, remains the primary sales avenue due to product demonstrations and after-sales service. Online platforms are growing rapidly, supported by competitive pricing, wide assortments, and doorstep delivery, appealing to digitally engaged consumers seeking convenience.

Segmentation:

By Product Type

- Split AC

- Window AC

- Others

By Capacity

- Less than 1 Ton

- 1-2 Ton

- More than 2 Ton

By Application

- Residential

- Commercial

- Industrial

By Distribution Channel

- Offline (Retailers, Specialty Stores)

- Online (E-commerce Platforms)

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North India holds the largest share of the India Air Conditioner Market at 38%, driven by extreme summer temperatures, high population density, and rapid urbanization. Metropolitan cities such as Delhi, Chandigarh, and Lucknow show strong adoption across both residential and commercial segments. Demand is supported by large-scale infrastructure projects, organized retail expansion, and rising disposable incomes. The hospitality and corporate sectors in the region continue to invest in modern cooling systems, further boosting sales. Government housing schemes and smart city initiatives improve electricity access, enabling higher penetration in semi-urban areas. Seasonal peaks during summer create substantial sales surges for retailers and e-commerce platforms.

South India accounts for 27% of the market, supported by a warm climate throughout most of the year and a strong presence of IT hubs in Bengaluru, Hyderabad, and Chennai. The region benefits from higher demand for inverter ACs and energy-efficient models among environmentally conscious consumers. Coastal cities experience consistent air conditioner usage due to high humidity, pushing sales of advanced filtration and dehumidification features. Rising urban migration and real estate development contribute to growing adoption in residential complexes. Commercial spaces such as tech parks, shopping malls, and hotels generate steady demand for large-capacity units. Strong manufacturer presence and competitive pricing strategies keep the region highly dynamic.

West India captures 22% of the market, driven by economic centers like Mumbai, Pune, and Ahmedabad, where high purchasing power fuels premium AC sales. The region sees robust growth in the commercial segment, particularly in retail, hospitality, and office spaces. Residential adoption is expanding with increasing high-rise apartment projects and gated communities. Hot and dry climates in areas such as Rajasthan amplify seasonal sales, especially during summer. East India holds a 13% share, with growing adoption in states like West Bengal, Odisha, and Assam, supported by improved infrastructure and urban development. Expanding retail networks and e-commerce penetration are making air conditioners more accessible in this emerging market, creating long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Voltas

- LG Electronics

- Daikin Industries

- Blue Star

- Hitachi Air Conditioning

- Samsung Electronics

- Panasonic

- Carrier

- Godrej Appliances

- Whirlpool

- Mitsubishi Electric

- General

- IFB Industries

- Electrolux

- Videocon

Competitive Analysis:

The India Air Conditioner Market is highly competitive, with a mix of domestic leaders and global brands vying for market share. Voltas, LG Electronics, Daikin Industries, Blue Star, and Hitachi Air Conditioning lead through extensive distribution networks, product innovation, and strong brand recognition. Samsung, Panasonic, Carrier, and Godrej Appliances strengthen competition with diverse product portfolios and competitive pricing. It remains influenced by aggressive marketing, financing schemes, and seasonal promotions. Players focus on energy-efficient models, smart features, and eco-friendly refrigerants to align with consumer preferences and regulatory standards. Partnerships with real estate developers and expansion into Tier 2 and Tier 3 cities enhance market penetration. After-sales service quality continues to be a critical differentiator among competitors.

Recent Developments:

- In August 2025, Robert Bosch GmbH made headlines in the Indian air conditioner market by acquiring a 74.2% controlling stake in Johnson Controls-Hitachi Air Conditioning India Ltd (JCHAI). This strategic move not only grants Bosch operational control and board-level influence over a leading Indian AC manufacturer but also marks Bosch’s strongest push yet into the Indian home appliance market.

- In February 2025, Haier Appliances India launched its exclusive colourful Kinouchi Air Conditioner series. This premium range is designed to transform modern home cooling experiences by marrying avant-garde aesthetics with high-end performance. With this launch, Haier is setting a new benchmark for the Indian market, targeting consumers seeking both superior technology and innovative design for their living spaces.

- In April 2024, Voltas launched its new HVAC and SmartAir AC lineup at ACREX 2024. The updated portfolio includes Inverter Scroll Chillers with eco-friendly refrigerants, upgraded fixed-speed Cassette ACs, water-cooled Ducted and Packaged ACs, and the IoT-connected Voltas SmartAir AC series.

Market Concentration & Characteristics:

The India Air Conditioner Market exhibits moderate-to-high concentration, with the top five players accounting for a significant share of total sales. It is characterized by rapid technological upgrades, strong brand loyalty, and seasonal sales spikes. Competition intensifies during peak summer months, with aggressive discounting and promotional offers. The market demonstrates steady demand growth driven by urbanization, lifestyle upgrades, and rising disposable incomes. Distribution strength, brand equity, and product efficiency remain key competitive parameters shaping market dynamics. Innovation in energy-efficient models and expansion into underserved regions are expected to further redefine the competitive landscape. Strategic collaborations with e-commerce platforms are also strengthening market reach and customer engagement.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Capacity, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising urbanization will increase residential and commercial adoption, creating consistent demand across metropolitan and emerging cities.

- Energy-efficient and inverter-based models will gain wider traction as consumers prioritize reduced electricity consumption and environmental compliance.

- Expansion into Tier 2 and Tier 3 cities will present new growth avenues through localized marketing and tailored product offerings.

- Smart and connected air conditioners with AI-enabled climate control will see stronger acceptance among tech-savvy consumers.

- The premium segment will expand as affluent buyers seek advanced air purification, noise reduction, and multi-stage cooling features.

- Industrial and commercial sectors will continue driving demand for large-capacity units to support operational efficiency and temperature-sensitive processes.

- Growth in e-commerce channels will enhance accessibility and diversify purchasing options for urban and semi-urban buyers.

- Partnerships with real estate developers will facilitate pre-installed AC systems in residential and commercial projects.

- Green cooling technologies and eco-friendly refrigerants will align with sustainability initiatives and regulatory standards.

- Continuous product innovation and competitive pricing strategies will intensify brand competition while increasing market penetration.