Market Overview:

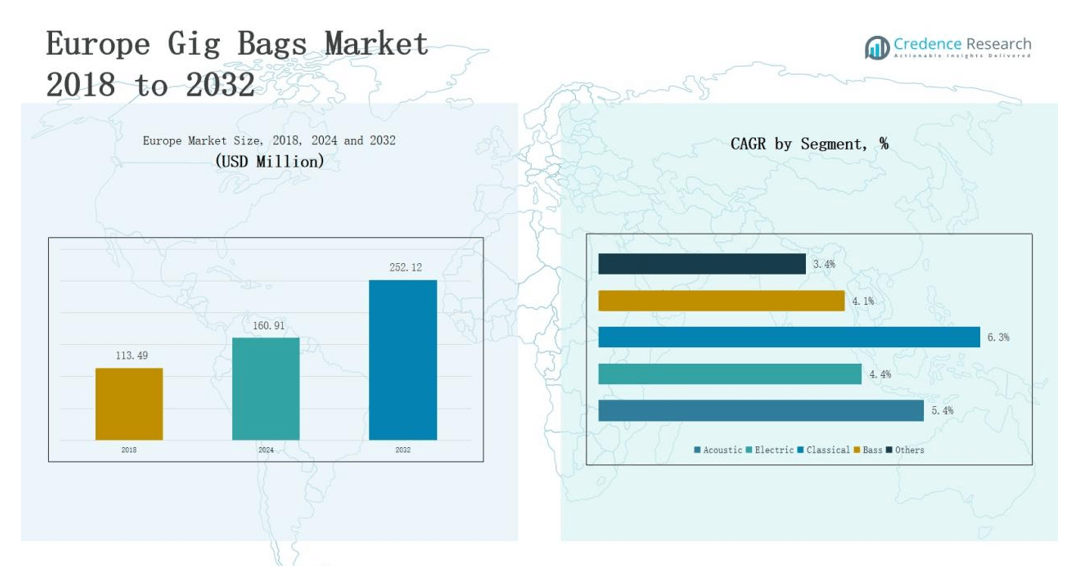

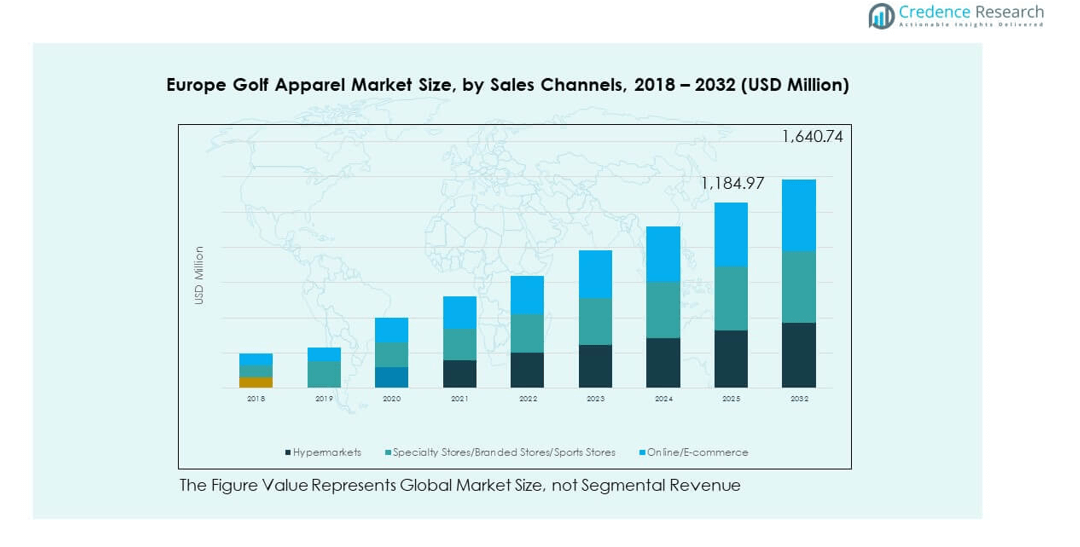

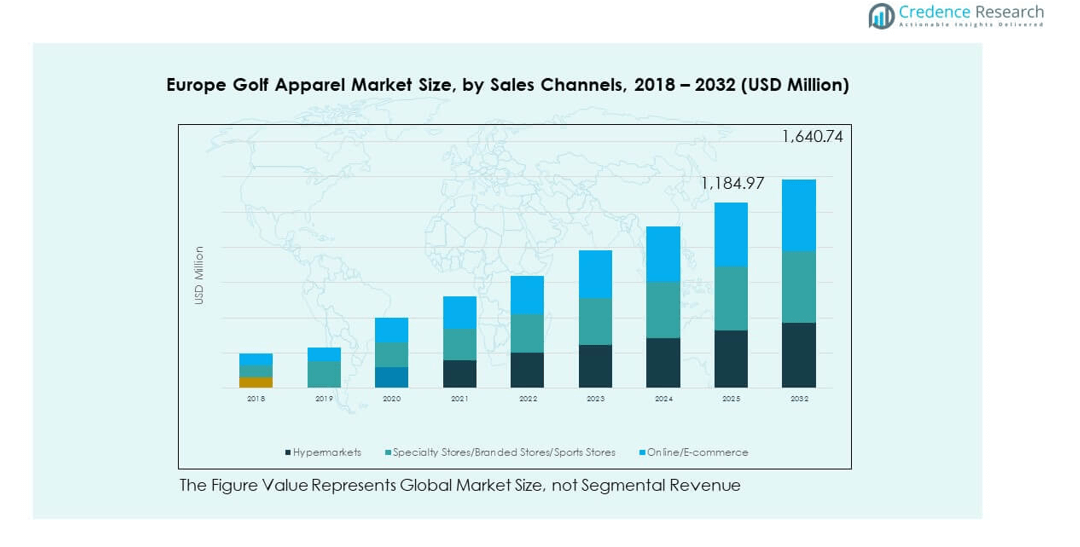

The Europe Golf Apparel Market size was valued at USD 905.63 million in 2018 to USD 1,136.48 million in 2024 and is anticipated to reach USD 1,640.74 million by 2032, at a CAGR of 4.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Golf Apparel Market Size 2024 |

USD 1,136.48 million |

| Europe Golf Apparel Market, CAGR |

4.68% |

| Europe Golf Apparel Market Size 2032 |

USD 1,640.74 million |

Market growth is primarily driven by the rising popularity of golf as both a professional sport and a leisure activity, supported by increased participation rates across different age groups. The expansion of golf tourism, coupled with the organization of prestigious tournaments, is boosting demand for high-quality apparel. Innovation in performance fabrics, offering breathability, UV protection, and moisture-wicking properties, is further enhancing product appeal. Additionally, the influence of fashion trends and celebrity endorsements is attracting a broader customer base.

Geographically, Western Europe leads the market, with countries such as the United Kingdom, Germany, and France being major contributors due to a strong golfing culture and established infrastructure. Southern European nations, including Spain and Italy, are emerging growth areas, benefiting from favorable climates that support year-round golfing. Eastern Europe is witnessing gradual expansion as rising disposable incomes and growing sports interest encourage participation. The combined effect of mature markets and emerging regions is creating a balanced growth trajectory for the sector.

Market Insights:

- The Europe Golf Apparel Market was valued at USD 1,136.48 million in 2024 and is projected to reach USD 1,640.74 million by 2032, growing at a CAGR of 4.68%.

- The Golf Apparel Market size was valued at USD 3,367.9 million in 2018 to USD 4,189.0 million in 2024 and is anticipated to reach USD 5,977.2 million by 2032, at a CAGR of 4.61% during the forecast period.

- Rising participation in golf across professional, amateur, and leisure segments is driving steady demand for performance-oriented apparel.

- Technological advancements in fabrics, including moisture-wicking, UV protection, and climate adaptability, are enhancing product appeal and adoption.

- High pricing of premium apparel is limiting accessibility for budget-conscious consumers, especially in emerging golf regions.

- Western Europe leads the market share, with the UK, Germany, and France dominating due to strong golfing culture and infrastructure.

- Southern Europe benefits from year-round golfing conditions and strong golf tourism, especially in Spain and Italy.

- Eastern Europe shows high growth potential, supported by infrastructure investments, rising disposable incomes, and increasing youth participation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Participation in Golf and Expanding Consumer Base Across Europe

The Europe Golf Apparel Market benefits from the increasing number of golf players across both professional and amateur segments. Golf clubs and associations are actively promoting the sport, attracting younger demographics and female players. It is witnessing rising interest among corporate clients, who use golf as a networking and leisure activity. Tourism linked to golf is driving apparel sales in regions with prominent courses. Seasonal golfing events and international tournaments stimulate higher spending on branded apparel. Consumers are seeking performance-oriented clothing that complements active play. This trend supports steady market expansion and brand diversification. Growth is also reinforced by public initiatives to make golf more accessible. The steady rise in memberships across European clubs is further sustaining apparel demand.

Technological Advancements in Performance-Oriented Fabrics

Innovation in textile technology is influencing the Europe Golf Apparel Market significantly. Brands are introducing apparel with moisture-wicking, UV protection, and quick-dry capabilities. It ensures comfort and functionality for players under diverse weather conditions. Apparel with stretchable materials enhances mobility without compromising style. Lightweight fabrics support prolonged outdoor play while reducing fatigue. Increasing awareness about technical benefits is influencing purchasing decisions. Collaborations between sportswear companies and fabric technology providers are accelerating innovation. Such advancements are positioning premium apparel as essential equipment for golfers. The competitive push to introduce new materials is shortening innovation cycles. Expanding R&D investments are expected to create more specialized and weather-adaptive apparel.

- For example, Nike’s Aerogami fabric technology, introduced in June 2023, uses moisture-reactive ventilation panels that open when sweat builds and close as the body cools. This adaptive system enhances breathability, comfort, and performance during extended activity.

Strong Influence of Fashion and Lifestyle Trends in Golf Apparel

The Europe Golf Apparel Market is evolving with the blending of fashion and performance. Apparel now incorporates modern cuts, vibrant colors, and stylish designs. It appeals to younger consumers and those who value fashion both on and off the course. Celebrity endorsements and collaborations with fashion designers are amplifying brand visibility. Limited-edition collections are driving exclusivity and demand among enthusiasts. Consumers are increasingly willing to invest in high-quality apparel that reflects personal style. Golf clubs and resorts are adopting dress codes that encourage refined yet comfortable clothing. This shift is reshaping purchasing patterns in the region. The alignment of golf apparel with lifestyle fashion trends is strengthening its year-round sales potential. Designers are now integrating cross-season styling to appeal to both dedicated players and casual wearers.

- For instance, Adidas’s 2024 launch of the women’s-only golf collection in collaboration with JAY3LLE led by fashion visionary Johan Lindeberg pushed design boundaries by offering contemporary, fashion-driven silhouettes.

Expansion of Distribution Channels and Online Retail Penetration

The Europe Golf Apparel Market is gaining from robust retail infrastructure and e-commerce adoption. Specialty sports stores and branded outlets are expanding in major cities. It benefits from partnerships with golf clubs and pro shops that directly influence purchase decisions. Online platforms are offering wide product selections and exclusive collections. Direct-to-consumer strategies are helping brands improve margins and customer engagement. Seasonal promotions and loyalty programs encourage repeat purchases. Cross-border e-commerce is enabling access to premium international brands. These developments strengthen market reach across varied consumer segments. Investments in omnichannel retail strategies are also improving the shopping experience. Digital integration with personalized product recommendations is further boosting conversion rates.

Market Trends

Integration of Sustainability and Eco-Friendly Materials in Golf Apparel

The Europe Golf Apparel Market is experiencing a shift toward sustainable production. Brands are using organic cotton, recycled polyester, and biodegradable fibers. It aligns with growing consumer demand for eco-conscious fashion. Certifications and transparency in sourcing are influencing purchase preferences. Environmentally responsible packaging complements the shift to green operations. Luxury golf brands are adapting sustainability without compromising performance. Eco-focused product lines are appealing to younger, socially aware golfers. This movement is fostering long-term brand loyalty in the market. Governments promoting sustainable manufacturing practices are accelerating the adoption rate. Retailers are creating dedicated eco-product sections to attract environmentally conscious buyers.

Rise of Personalization and Custom-Fit Golf Apparel

Customization is emerging as a key trend in the Europe Golf Apparel Market. Players are seeking tailored fits, monogramming, and personalized color schemes. It enhances brand connection and perceived exclusivity. Digital tools enable consumers to preview designs before purchase. Golf clubs and corporate events are commissioning branded apparel for members and participants. Customization services are expanding through online portals and physical stores. Demand for unique designs supports premium pricing strategies. This personalization trend is redefining competitive differentiation among brands. Growth in 3D body scanning technology is improving accuracy in custom fits. Limited-run personalized editions are becoming status symbols within golfing circles.

- For example, Titleist, through its parent Acushnet, enhanced customization capabilities by operating a new 500,000 sq ft distribution and embroidery center in Lakeville, MA, increasing throughput and reducing lead times for custom-embroidered FootJoy apparel and personalized Titleist gear.

Influence of Smart and Connected Wearable Integration in Apparel

The Europe Golf Apparel Market is witnessing interest in smart clothing innovations. Apparel is being integrated with sensors to track posture, swing, and performance. It enables players to receive real-time feedback through connected devices. Brands are collaborating with tech companies to develop golf-specific wearables. Smart apparel is positioned as a value-added investment for serious players. This technology appeals to data-driven golfers seeking performance enhancement. Market adoption is gradual but gaining traction among competitive players. Such innovation expands the functional scope of golf apparel. Integration with mobile applications is enhancing user engagement. The convergence of apparel and data analytics is redefining training methodologies in the sport.

- For instance, Under Armour has led advancements in smart wearable integration by embedding high-fidelity sensors in the midsole of its UA HOVR™ shoes, which connect via Bluetooth to deliver stride analysis, cadence, and real-time gait coaching through the MapMyRun™ app.

Blurring of Boundaries Between Golf Wear and Casual Fashion

Golf apparel is increasingly designed for versatility beyond the course. The Europe Golf Apparel Market is responding with hybrid styles suitable for both sports and casual wear. It reflects the growing preference for multipurpose wardrobes. Brands are blending traditional golf aesthetics with streetwear influences. This crossover is attracting non-golfers who appreciate the style. Retailers are marketing collections as lifestyle apparel, expanding customer bases. Seasonal lines are being designed to adapt to both athletic and leisure settings. This trend is broadening market appeal and boosting year-round sales. Collaborations with mainstream fashion labels are amplifying this crossover trend. Collections inspired by everyday wear are helping brands capture wider lifestyle markets.

Market Challenges Analysis

High Pricing of Premium Golf Apparel Limiting Mass Adoption

The Europe Golf Apparel Market faces challenges from the high cost of premium products. Leading brands price their apparel at levels that deter budget-conscious consumers. It restricts wider adoption in emerging golf regions. Economic fluctuations influence discretionary spending on non-essential apparel. Players in lower-income segments often opt for lower-cost, generic alternatives. The price gap between branded and non-branded options is significant. Limited discounting in high-end segments further constrains sales growth. Brands must balance premium positioning with accessibility to capture broader market share. Competitive entry from mid-tier brands is exerting pricing pressure on established players. The challenge remains in preserving exclusivity while expanding reach.

Seasonal Demand Fluctuations Impacting Sales Stability

The Europe Golf Apparel Market experiences seasonal variations due to climate conditions. Demand peaks in spring and summer when golfing activity is at its highest. It slows during colder months, creating sales volatility for retailers. Inventory management becomes challenging, especially for seasonal collections. Promotional activities during off-seasons are necessary but reduce profitability. Some regions with mild climates maintain steadier demand, but others experience sharp drops. Weather unpredictability further complicates sales forecasting. Such fluctuations necessitate strategic planning to stabilize revenues. Introducing all-weather and indoor golf apparel is helping brands reduce seasonal dependency. Strong pre-order and reservation models are improving demand predictability.

Market Opportunities

Expansion in Untapped and Emerging European Golf Regions

The Europe Golf Apparel Market holds opportunities in emerging golf destinations. Countries in Eastern and Southern Europe are investing in golf infrastructure. It creates demand for apparel among new players and tourists. Partnerships with local golf clubs can enhance brand visibility. Regional tournaments and promotional events encourage apparel adoption. Market entry strategies tailored to local preferences can boost acceptance. These regions present growth potential beyond the saturated Western European market. Growing airline connectivity to golf resorts is further stimulating sports tourism. Strategic brand ambassadors from emerging markets can accelerate apparel adoption.

Leveraging Technological Innovation for Product Differentiation

The Europe Golf Apparel Market can expand through advanced product technologies. Incorporating climate-adaptive fabrics and wearable tech can attract tech-savvy golfers. It supports brand positioning as an innovator in the segment. Collaborations with research institutions can accelerate product development. Offering exclusive online product launches builds customer engagement. Investment in design and functional enhancement can secure competitive advantage. This approach can appeal to both professional and recreational players seeking performance benefits. Growth in AI-based product recommendation systems is enriching the online shopping experience. Integration of virtual try-on tools is enhancing customer confidence and reducing return rates.

Market Segmentation Analysis:

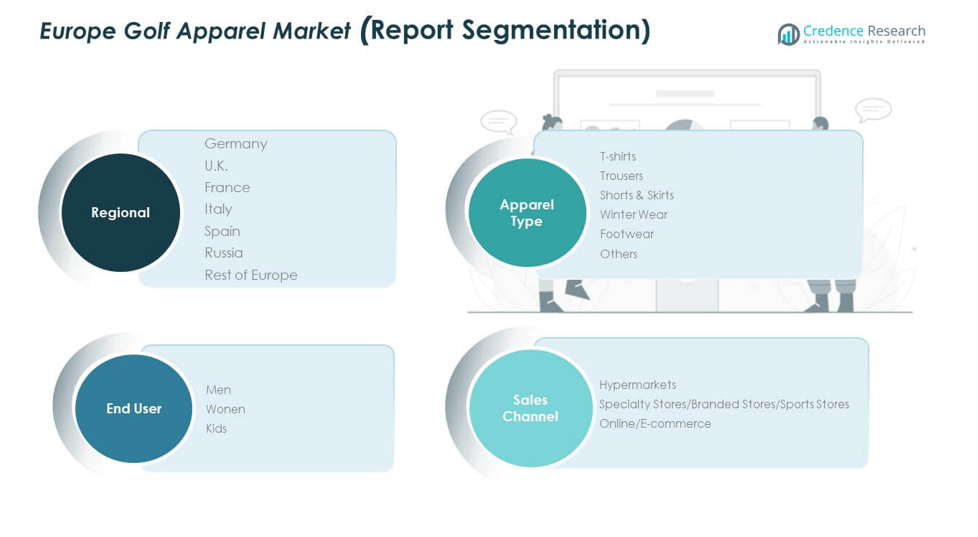

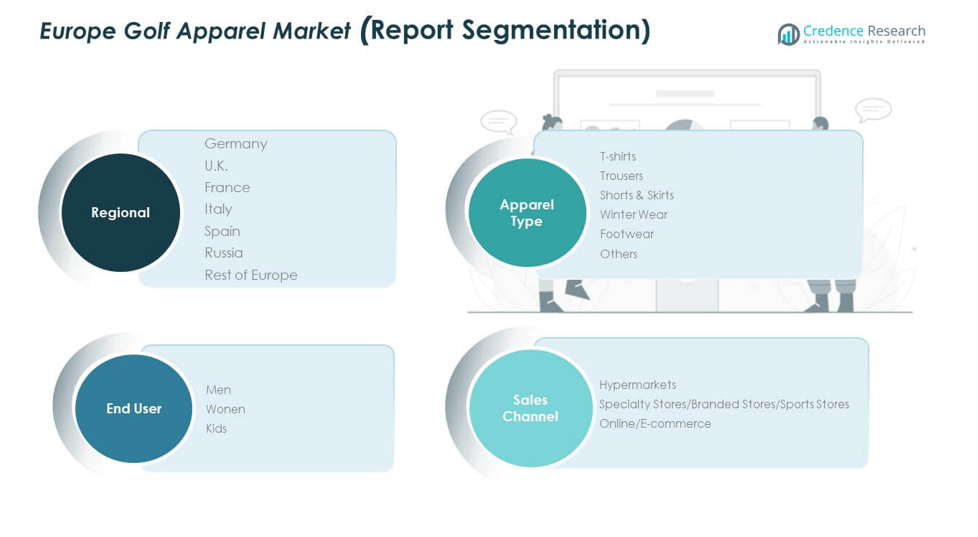

The Europe Golf Apparel Market is segmented

By apparel type into T-shirts, trousers, shorts & skirts, winter wear, footwear, and others. T-shirts hold a substantial share due to their versatility and year-round usage, supported by performance fabrics and fashion-forward designs. Trousers remain essential for both casual and tournament play, while shorts & skirts gain traction in warmer climates. Winter wear contributes to sales in regions with extended cold seasons, offering weather-resistant and thermal options. Footwear is a critical performance-driven category, with demand for spiked and spikeless designs. The “others” category, including accessories, adds incremental value to the market.

By end user, the market is divided into men, women, and kids. Men account for the largest share due to higher participation rates and a broader product range tailored to professional and leisure play. Women’s apparel is expanding with brands introducing fashionable, performance-focused designs. The kids’ segment is growing, supported by junior golf programs and rising interest among younger players.

- For instance, in 2024, Chervò, the premium Italian golf apparel brand, introduced its Spring/Summer collection featuring women’s golf wear in bold ocean-inspired colors and modern cuts. The range incorporates SunBlock®, Dry-Matic®, and Wind-Lock® fabrics, offering UV protection, breathability, and thermal regulation for optimal on-course performance.

By sales channel, the market comprises hypermarkets, specialty stores/branded stores/sports stores, and online/e-commerce. Specialty and branded sports stores dominate due to product expertise and personalized fitting services. Hypermarkets capture value through competitive pricing and accessibility. Online and e-commerce channels are expanding rapidly, driven by convenience, product variety, and exclusive digital collections. It is leveraging omnichannel strategies to integrate physical retail with digital experiences, strengthening customer engagement across all segments.

- For example, Clubhouse Golf, a leading UK golf retailer, operates both an extensive online store and physical retail locations staffed by PGA professionals. The company offers in-store custom fittings alongside a wide selection of golf apparel and equipment, positioning itself as a destination for personalized service and product expertise.

Segmentation:

By Apparel Type

- T-shirts

- Trousers

- Shorts & Skirts

- Winter Wear

- Footwear

- Others

By End User

By Sales Channel

- Hypermarkets

- Specialty Stores / Branded Stores / Sports Stores

- Online / E-commerce

By Country (Europe)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe holds the largest share of the Europe Golf Apparel Market, accounting for 52% of total revenue in 2024. The United Kingdom, Germany, and France lead this region, supported by a strong golfing culture, established infrastructure, and a dense concentration of premium golf courses. High participation rates among professionals and amateurs, along with frequent hosting of international tournaments, sustain consistent demand. Brands benefit from well-developed retail networks and high consumer spending power. It is also characterized by a preference for premium, performance-driven apparel. Golf tourism in destinations such as Scotland further boosts sales during peak seasons. Seasonal product launches and high-profile endorsements strengthen brand visibility in this region.

Southern Europe represents 28% of the market, with Spain and Italy as leading contributors. Warm climates and year-round golfing opportunities in coastal and resort areas support steady demand for lightweight and breathable apparel. Golf tourism plays a pivotal role, with international visitors driving sales of branded merchandise. It benefits from high tourist footfall in luxury golf resorts, where apparel purchases are integrated into leisure spending. Local consumer preferences lean toward stylish and versatile designs suitable for both the course and casual wear. Seasonal influxes of players during winter months from Northern Europe help maintain sales stability. Partnerships between golf resorts and apparel brands have expanded retail opportunities.

Eastern Europe accounts for 20% of the Europe Golf Apparel Market, and it is emerging as a high-growth area due to increasing sports participation and rising disposable incomes. Countries such as Poland, the Czech Republic, and Russia are investing in golf infrastructure to attract both domestic and international players. Retail penetration remains lower compared to Western and Southern Europe, creating untapped potential for global and regional brands. It is experiencing increased interest from younger demographics encouraged by golf academies and local tournaments. Online retail adoption is helping bridge product availability gaps in less developed markets. Strategic entry by mid-tier brands is making apparel more accessible, supporting long-term market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amer Sports

- Roger Cleveland Golf Company Inc

- Golfsmith International Holdings Inc

- Dixon Golf Inc.

- Perry Ellis

- Fila

- Ralph Lauren

- Oxford Golf

- Sunice

- EP NY

- Other Key Players

Competitive Analysis:

The Europe Golf Apparel Market features a competitive landscape dominated by global brands such as Amer Sports, Ralph Lauren, Fila, Perry Ellis, and Dixon Golf Inc., alongside regional players with niche offerings. Leading companies compete on product innovation, brand reputation, and distribution reach. It benefits from partnerships with golf clubs, sponsorship of tournaments, and endorsements from professional players to strengthen brand equity. Product portfolios emphasize performance fabrics, modern designs, and seasonal collections. E-commerce growth has intensified competition, with brands launching exclusive online ranges and personalized services. Mergers, acquisitions, and collaborations are expanding market presence and accelerating innovation pipelines. Expansion into emerging European markets is creating new opportunities for brand positioning. Continuous investment in marketing campaigns is further strengthening consumer engagement and loyalty.

Recent Developments:

- In January 2025, Authentic Brands Group formed a licensing partnership with Sports Casuals International (SCI) to expand the Reebok golf category. SCI will design, manufacture, and distribute adult performance golf apparel under the Reebok brand, reinforcing Reebok’s presence in the Europe Golf Apparel Market.

- In July 2025, Dixon Golf Inc. inaugurated a new 10,000-square-foot eco-friendly headquarters in Chandler, Arizona, aligning with the company’s commitment to sustainability. Led by CEO William Carey, the headquarters features energy-efficient systems and minimal-waste practices, supporting the brand’s continued push for environmentally conscious golf products.

Market Concentration & Characteristics:

The Europe Golf Apparel Market is moderately concentrated, with a few multinational brands commanding a significant share while regional players target specific segments. It is characterized by high brand loyalty, premium pricing strategies, and a strong emphasis on product differentiation through technology and design. Seasonal demand patterns influence inventory cycles, while omnichannel distribution strategies are becoming essential for maintaining competitiveness. Increasing sustainability adoption is shaping brand positioning and product development. Expanding digital marketing strategies are helping both global and regional players capture new consumer segments effectively. Strategic collaborations with golf associations are enhancing visibility in key markets. Growing investments in localized product designs are supporting deeper market penetration across diverse European regions.

Report Coverage:

The research report offers an in-depth analysis based on Apparel Type, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Golf Apparel Market is expected to witness steady expansion driven by increased participation in both professional and recreational golf.

- Product innovation in performance fabrics and climate-adaptive materials will strengthen consumer preference for premium apparel.

- Evolving fashion trends will encourage brands to introduce versatile designs suitable for both on-course and casual wear.

- Growth in golf tourism across established and emerging destinations will boost apparel demand throughout the year.

- Online retail penetration will expand further, supported by personalized shopping experiences and advanced digital engagement tools.

- Sustainable manufacturing practices and eco-friendly materials will gain importance as consumer awareness rises.

- Collaborations with golf clubs, tournaments, and sports associations will enhance brand visibility and customer loyalty.

- Entry of new regional players will increase competition, prompting global brands to strengthen their positioning.

- Adoption of smart and connected apparel technology will appeal to tech-savvy golfers seeking performance enhancement.

- Expanding presence in underserved Eastern and Southern European markets will create new growth opportunities for established and emerging brands.