Market Overview

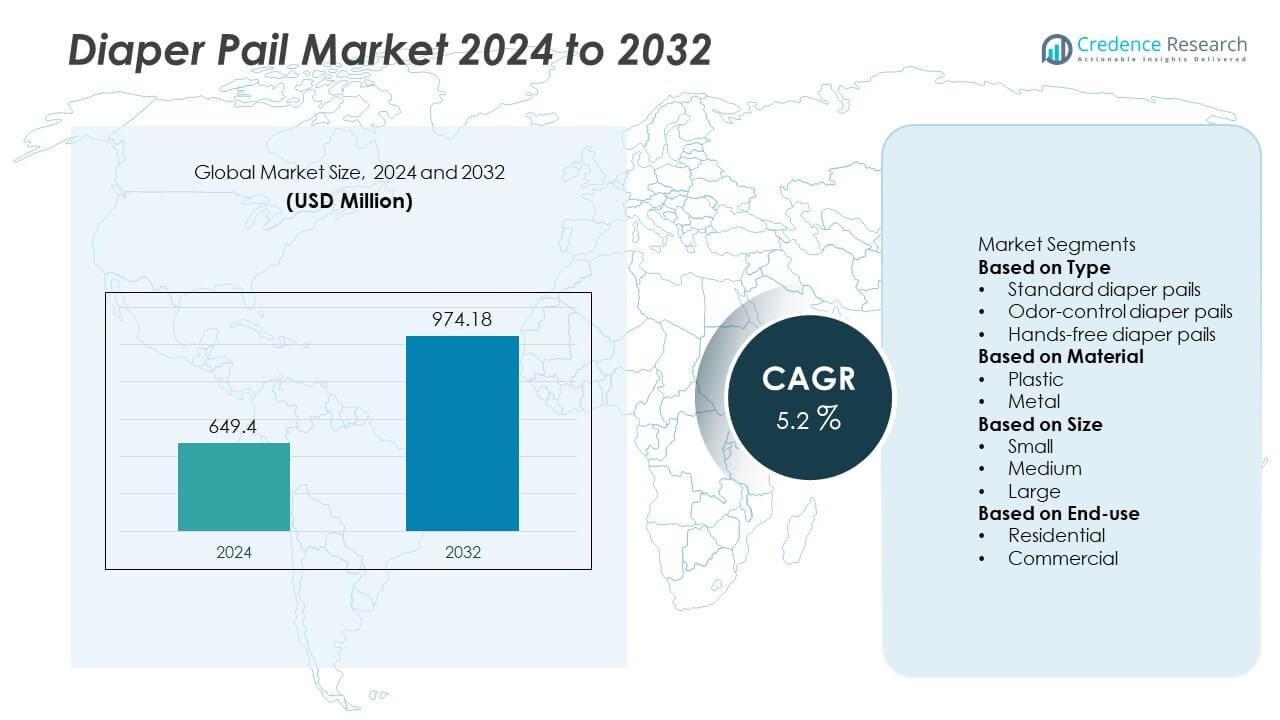

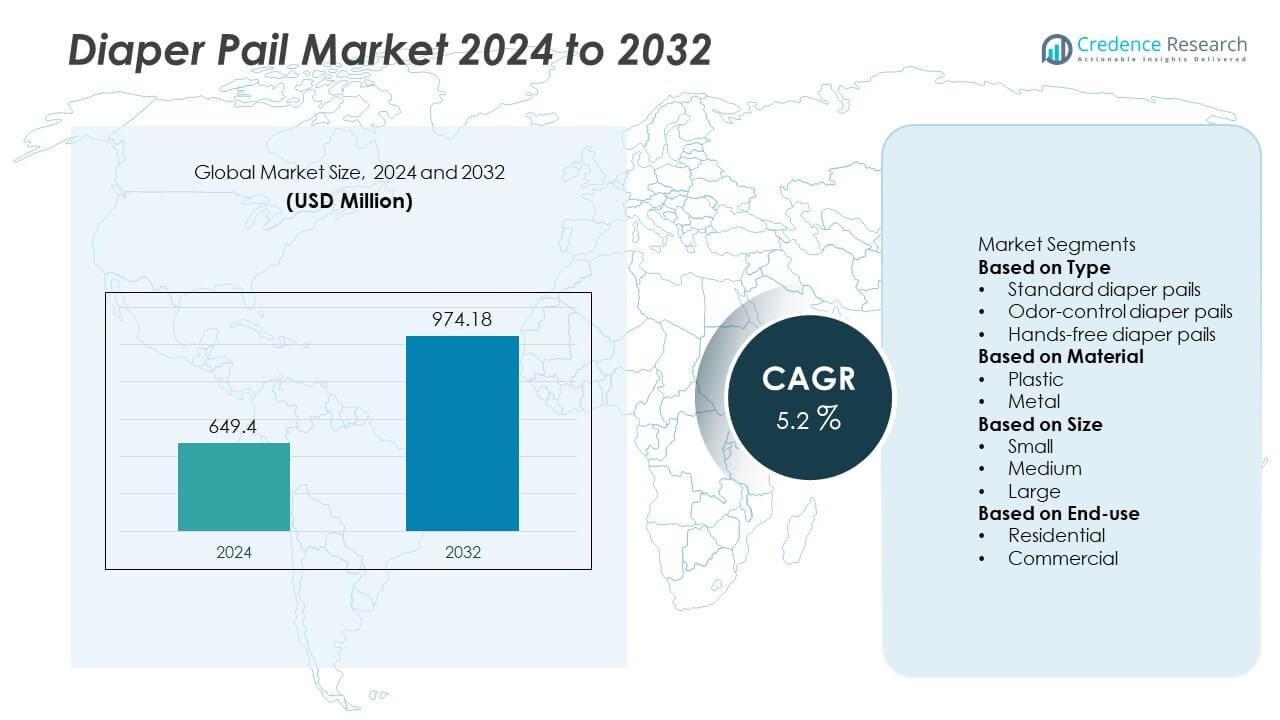

The Diaper Pail Market was valued at USD 649.4 million in 2024. It is expected to grow steadily and reach USD 974.18 million by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diaper Pail Market Size 2024 |

USD 649.4 Million |

| Diaper Pail Market, CAGR |

5.2% |

| Diaper Pail Market Size 2032 |

USD 974.18 Million |

The Diaper Pail market features top players including Bubula, Koala Kare, Chicco, Angelcare, Munchkin, IKEA, Dekor, Brica, Diaper Genie, and Pampers, all focusing on odor-control, durable materials, and child-safe designs to meet hygiene needs in homes and childcare facilities. North America leads the market with a 38% share, driven by high nursery hygiene awareness and strong e-commerce adoption. Europe follows with a 27% share, supported by demand for recyclable and odor-locking diaper disposal systems. Asia Pacific holds a 24% share and continues to expand rapidly due to rising birth rates and increasing urban household adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Diaper Pail market reached USD 649.4 million in 2024 and is projected to reach USD 974.18 million by 2032, expanding at a CAGR of 5.2%, driven by rising focus on nursery hygiene and odor-controlled diaper disposal.

- Growing infant populations and increased hygiene awareness support adoption, with odor-control diaper pails holding a 52% share, driven by advanced sealing systems and carbon filter technology.

- Key market trends include subscription-based refill liner sales, eco-friendly materials, and hands-free disposal systems, which strengthen premium product positioning and improve user convenience for households and daycare centers.

- Competition intensifies as major players enhance odor-blocking features, antimicrobial surfaces, and leak-proof designs, while price sensitivity and ongoing liner replacement costs restrain adoption in cost-focused consumer segments.

- Regionally, North America leads with a 38% share, followed by Europe at 27% and Asia Pacific at 24%, while Latin America holds 6% and Middle East & Africa accounts for 5%, supported by expanding e-commerce and childcare infrastructure.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

The odor-control diaper pails segment leads the market with a 52% share, driven by strong consumer preference for advanced odor-locking features. Parents choose these pails to maintain hygiene, especially in compact living spaces and multi-child households. Sealed lids, carbon filters, and antimicrobial materials improve user confidence. Hands-free diaper pails gain momentum due to touchless designs that reduce contamination risks in daycare centers. Standard diaper pails remain cost-effective options, yet odor-control systems dominate because they address a key purchasing priority: long-lasting and reliable smell containment for daily diaper disposal.

- For instance, Angelcare introduced a multi-layered, 7-layer odor-seal film that traps even the strongest odors and bacteria, and Dekor offers a highly durable, hands-free foot-pedal system, both of which help extend operational durability and hygiene in high-use nurseries and childcare facilities

By Material:

The plastic diaper pails segment holds a dominant 71% share, supported by lightweight construction, easy cleaning, and lower production costs. Plastic designs appeal to budget-conscious families and large daycare chains using multiple disposal units. Improved durability and compatibility with refill liners further enhance adoption. Metal diaper pails attract premium buyers due to sleek aesthetics and enhanced odor resistance, yet higher prices limit wide deployment. Plastic pails remain the preferred choice among retailers and online platforms because they offer broader style options and better portability without compromising hygiene performance.

- For instance, Bubula developed a pail structure using steel and aluminum, which does not absorb odors like plastic, while Munchkin implemented a patented self-sealing system and uses Arm & Hammer baking soda for enhanced odor control during frequent diaper disposal.

By Size:

The medium-sized diaper pails segment accounts for a 57% share, as households prefer a balance between storage capacity and floor space use. Medium models support efficient disposal without frequent emptying, making them suitable for newborn and toddler stages. Large diaper pails expand in daycare and multi-child homes managing higher disposal volumes. Small diaper pails serve travel and secondary nursery needs. The medium category remains dominant because it fits standard nursery layouts, extends liner replacement intervals, and supports strong demand across both offline and e-commerce sales channels.

Key Growth Drivers

Rising Birth Rates and Infant Hygiene Awareness

Higher birth rates and increased focus on infant hygiene drive strong demand for diaper pails. Parents seek reliable waste solutions that prevent odor and reduce contamination. Urban families living in smaller spaces adopt sealed pails to simplify daily disposal. Daycare centers expand usage to maintain clean, safe environments for children. Growing awareness of bacteria control in nurseries also boosts adoption. As disposable diaper consumption rises, diaper pails gain importance as a necessary home and childcare hygiene product.

- For instance, Diaper Genie developed its odor-barrier multi-layer film refill system, with a single continuous-film refill holding up to 270 newborn-sized diapers, and its newer models integrate built-in antimicrobial protection in the pail itself.

Expansion of E-commerce and Subscription Liners

E-commerce platforms strengthen product visibility and help families compare features before purchase. Fast delivery and bundle pricing increase refill liner sales. Subscription-based liner programs encourage repeat buying and support long-term brand loyalty. Online reviews influence parents to invest in odor-control and hands-free systems. Digital parenting communities recommend top-performing pails, boosting market penetration. As online baby care spending increases, manufacturers expand direct-to-consumer channels, improving product access in developed and emerging regions.

- For instance, the Pampers Club mobile app supports consistent consumer replenishment by allowing users to redeem points from product purchases for coupons and discounts on diapers and wipes.

Product Innovation and Improved Odor-Blocking Technology

Advances in sealing systems, carbon filters, and antimicrobial surfaces enhance user experience. Hands-free pedal or sensor-based lids reduce contact and improve hygiene. Multi-layer refill bags extend odor protection and reduce liner changes. Premium models integrate child locks and leak-proof construction, making them safer for households. Innovative packaging and eco-focused liner materials attract sustainability-minded parents. These features differentiate brands and support higher pricing, driving overall market growth.

Key Trends & Opportunities

Growing Shift Toward Eco-Friendly and Recyclable Components

Parents prefer diaper pails compatible with biodegradable bags and low-waste liners. Brands introduce refill systems that reduce plastic usage and disposal frequency. Recyclable and durable materials appeal to environmentally conscious buyers. Marketing focused on sustainability supports premium price positioning. Partnerships with diaper and compostable bag brands create new retail opportunities. This trend encourages product redesign and advances circular packaging adoption.

- For instance, Dekor’s current Eko refill liners are made from 70% GRS-certified post-consumer recycled plastic, providing a more sustainable alternative to standard plastic bags.

Rising Adoption in Daycare and Healthcare Facilities

Daycare centers and maternity wards increase diaper pail use to maintain strict sanitation. Larger capacity and strong odor-blocking performance support safe, efficient waste handling. Bulk purchasing and commercial-grade models provide strong sales potential for manufacturers. Training and hygiene policies reinforce usage in shared childcare environments. Emerging markets invest in childcare infrastructure, expanding institutional demand. This opportunity supports long-term growth beyond home nurseries.

- For instance, Koala Kare commercial baby changing stations feature surfaces with built-in Microban® antimicrobial product protection to inhibit the growth of stain and odor-causing bacteria.

Smart Features and Connected Monitoring

Some brands explore smart features that alert users when liners are full. Connected apps track refill inventory and recommend ordering schedules. Touchless sensors improve hygiene and encourage premium adoption. These innovations enhance convenience and support future product differentiation.

Key Challenges

Price Sensitivity and Competition from Low-Cost Alternatives

Many households still rely on standard trash bins, limiting diaper pail adoption. Budget constraints affect purchasing in emerging markets and multi-child families. Lower-cost generic products weaken premium brand growth. Manufacturers must balance pricing and innovation to remain competitive. This challenge pressures margins and impacts long-term expansion.

Dependence on Refill Liners and Replacement Costs

Ongoing liner purchases increase overall cost for families. Some users switch to DIY or generic bags to reduce expenses, affecting brand revenue. Price sensitivity slows subscription program adoption. Companies must offer flexible bundle pricing and value-based packaging to address cost concerns.

Regional Analysis

North America

North America holds a 38% share of the Diaper Pail market, driven by strong consumer focus on nursery hygiene and higher purchasing power among new parents. The United States leads adoption due to growing demand for odor-control and hands-free diaper pail systems. Large daycare facilities and pediatric healthcare centers also contribute to commercial usage. E-commerce platforms support strong product visibility and subscription liner sales. Canada shows increasing interest in eco-friendly and child-safe disposal solutions, reinforcing growth. Continuous product innovation and premium launches strengthen market expansion across the region.

Europe

Europe accounts for a 27% share of the Diaper Pail market, supported by rising infant health awareness and higher hygiene standards in nurseries. Countries such as Germany, France, and the United Kingdom drive significant adoption, especially for odor-control and recyclable diaper pails. Government maternity support programs and modern nursery infrastructure enhance product demand. European consumers show strong interest in sustainable diaper disposal solutions, boosting sales of biodegradable liners and durable materials. Daycare centers and home users drive consistent growth, supported by widespread online availability and brand differentiation.

Asia Pacific

Asia Pacific holds a 24% share and remains the fastest-growing region in the Diaper Pail market, fueled by rising birth rates and expanding urban households. China and Japan lead demand, with parents prioritizing odor management and sanitation in compact living spaces. India and South Korea show increasing adoption as income levels rise and childcare awareness improves. Local and international brands expand operations through online marketplaces, making products more accessible. Growth in daycare facilities and maternity hospitals further accelerates product penetration across the region.

Latin America

Latin America represents a 6% share of the Diaper Pail market, supported by growing childcare spending and improving retail distribution networks. Brazil and Mexico drive most regional demand, with parents seeking more hygienic diaper disposal options. Urbanization and lifestyle changes promote adoption of odor-control systems in smaller living spaces. Daycare centers and private pediatric clinics contribute to institutional usage. Limited consumer budgets pose a challenge, yet opportunities rise as brands expand lower-cost and refill-friendly products across the region.

Middle East and Africa

The Middle East and Africa hold a 5% share of the market, driven by increasing investments in maternity care and infant hygiene solutions. The United Arab Emirates and Saudi Arabia lead demand due to higher disposable income and preference for premium baby products. South Africa experiences growing adoption in urban households and daycare centers, strengthening product visibility. Affordability constraints and limited brand presence slow growth in low-income areas, yet expanding e-commerce and rising awareness of nursery sanitation create long-term opportunities.

Market Segmentations:

By Type

- Standard diaper pails

- Odor-control diaper pails

- Hands-free diaper pails

By Material

By Size

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Diaper Pail market includes key players such as Bubula, Koala Kare, Chicco, Angelcare, Munchkin, IKEA, Dekor, Brica, Diaper Genie, and Pampers. Companies compete by enhancing odor-locking technology, improving liner compatibility, and introducing hands-free or touchless disposal systems. Leading brands focus on leak-proof construction, antimicrobial surfaces, and child-safe lid designs to strengthen consumer trust. Subscription-based refill liner programs support recurring revenue and long-term customer retention, while eco-friendly and recyclable materials help attract sustainability-focused parents. E-commerce channels and influencer-driven parenting communities play a critical role in shaping purchase decisions. Price-sensitive buyers in emerging markets drive demand for cost-efficient models, encouraging value-focused product lines. Strategic partnerships with daycare centers and maternity hospitals expand institutional usage. Continuous product innovation, design differentiation, and customer support services remain central to gaining a competitive advantage and expanding global market presence.

Key Player Analysis

- Bubula

- Koala Kare

- Chicco

- Angelcare

- Munchkin

- IKEA

- Dekor

- Brica

- Diaper Genie

- Pampers

Recent Developments

- In April 2024, Angelcare announced the Compost Genie bin, expanding its odor-control technology into kitchen waste disposal, leveraging its diaper-pail expertise.

- In November 2023, Diaper Genie launched its Platinum model, a stainless-steel, hands-free diaper disposal solution featuring a foot pedal and a 47-newborn-diaper capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Size, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Diaper pails will see wider adoption as parents prioritize odor-free and hygienic nurseries.

- Hands-free and touchless systems will gain traction due to improved convenience and germ control.

- Eco-friendly and biodegradable liner options will expand as sustainability becomes a stronger purchase driver.

- Subscription-based refill liner programs will strengthen brand loyalty and recurring revenue models.

- Product designs will focus on space-saving, lightweight, and portable features for modern homes.

- Growth in daycare centers and pediatric facilities will increase demand for large-capacity diaper pails.

- Smart odor-monitoring and fill-level indicators may emerge to enhance user experience.

- E-commerce platforms will continue to drive sales, supported by influencer and parenting community endorsements.

- Manufacturers will invest in antimicrobial materials and leak-proof construction to improve product safety.

- Adoption will rise in emerging economies as urbanization and childcare spending accelerate.

Market Segmentation Analysis:

Market Segmentation Analysis: