Market Overview

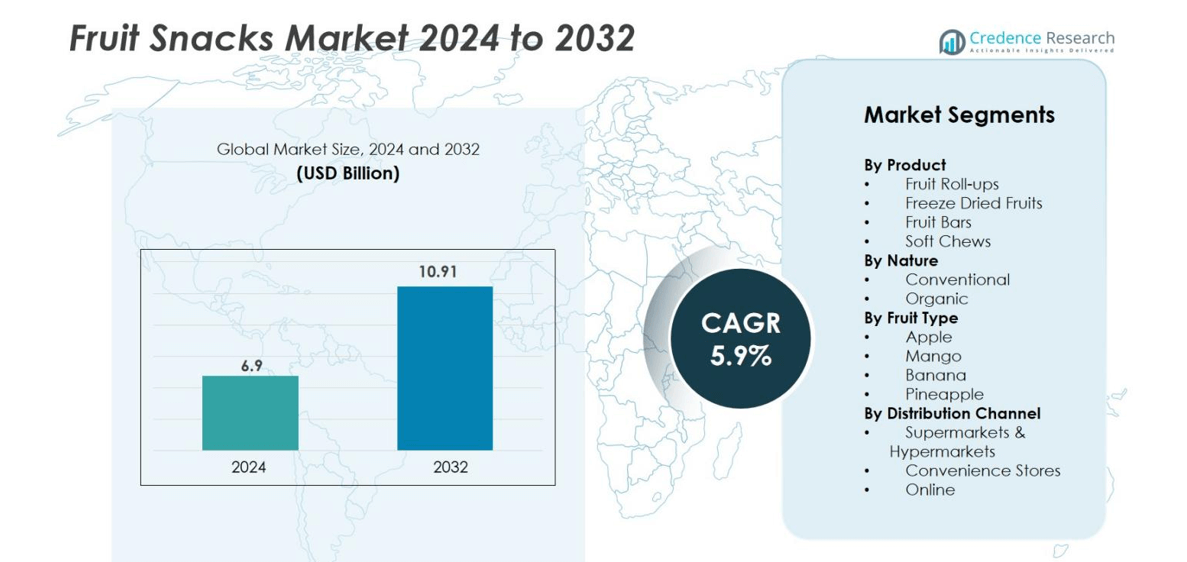

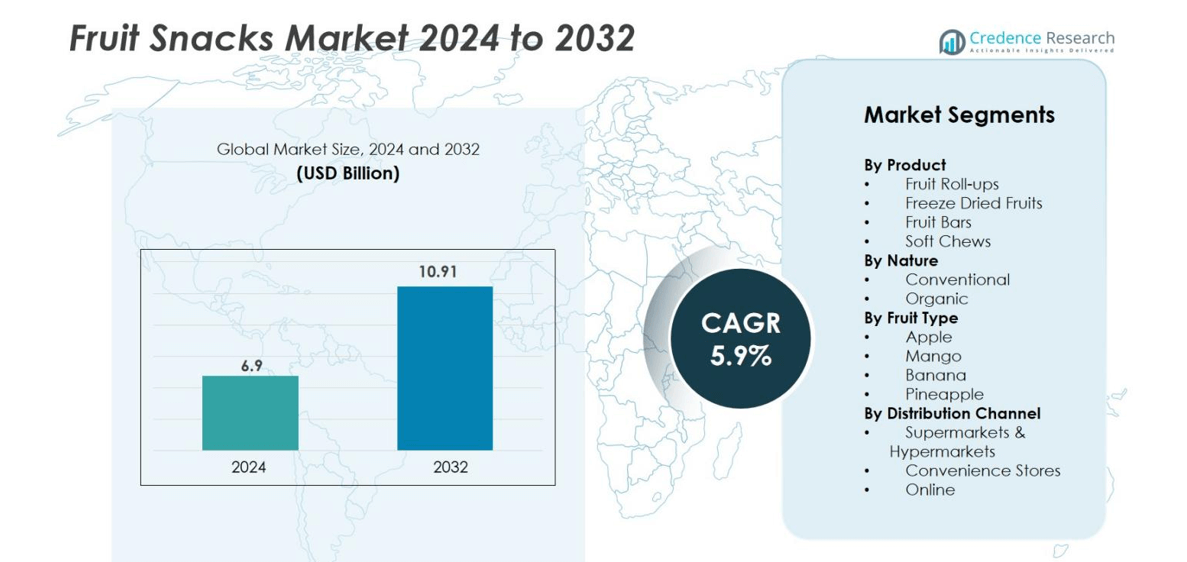

Fruit Snacks market size was valued at USD 6.9 Billion in 2024 and is anticipated to reach USD 10.91 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fruit Snacks Market Size 2024 |

USD 6.9 Billion |

| Fruit Snacks Market, CAGR |

5.9% |

| Fruit Snacks Market Size 2032 |

USD 10.91 Billion |

Leading companies in the fruit snacks market include General Mills Inc., Kellogg Company, Mount Franklin Foods, Welch’s, SunOpta Inc., Sunkist Growers Inc., Keurig Dr Pepper Inc., Seneca Foods Corporation, Crispy Green Inc., and Chaucer Foods Ltd. These brands compete through clean-label ingredients, natural fruit flavors, and innovative packaging formats such as bars, roll-ups, and freeze-dried bites. Many companies expand organic and sugar-free product lines to attract health-focused buyers. Retail distribution, online sales, and private-label partnerships support wider penetration across supermarkets and specialty stores. North America remains the leading region with 38% market share, driven by strong demand for convenient and healthy packaged snacks among families and young consumers.

Market Insights

- The fruit snacks market reached USD 6.9 Billion in 2024 and will hit USD 10.91 Billion by 2032 at a 5.9% CAGR.

- Growing health awareness and demand for natural, fiber-rich snacks drive sales, with fruit roll-ups holding 34% share in the product segment.

- Clean-label, vegan, and organic launches continue to shape trends as brands introduce low-sugar, freeze-dried, and vitamin-fortified options to attract premium buyers.

- Competition remains strong, with global brands and private labels expanding distribution through supermarkets and e-commerce while investing in better packaging and flavor innovation.

- North America leads the market with 38% share, supported by high spending on packaged foods and wide retail availability, while Asia-Pacific grows fastest due to rising urban consumption and school snack programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Fruit roll-ups lead the product segment with 34% market share in 2024 due to high demand among children and young adults. These snacks offer longer shelf life, varied flavors, and convenient on-the-go packaging. Soft chews and fruit bars follow due to clean-label ingredients and rising interest in low-sugar snacks. Freeze-dried fruits gain attention from health-focused buyers seeking natural taste and nutrients without additives. Brand innovation in portion sizes and tropical flavors also boosts adoption. The shift toward healthier packaged snacks keeps fruit roll-ups dominant across supermarkets and online retail channels.

- For instance, companies like Fertin produce soft chew products that accommodate high loads of natural active ingredients without compromising taste, appealing to health-conscious buyers.

By Nature

The conventional category commands 71% market share, supported by mass availability and lower pricing. Conventional fruit snacks dominate retail shelves, making them widely accessible for families and schools. Organic fruit snacks are growing faster due to rising clean-label awareness, vegan preferences, and pesticide-free claims. Higher costs restrict wider penetration, but expanding organic farming and certification programs attract urban consumers. Manufacturers also promote non-GMO, gluten-free, and preservative-free options, pushing premium organic lines in e-commerce and specialty stores.

- For instance, By Nature’s Simply Nature Organic Mixed Berry Fruit Snacks are USDA Organic, Non-GMO, and free from over 125 artificial ingredients and preservatives, catering to the growing demand for clean-label products in urban markets.

By Fruit Type

Apple-based fruit snacks hold 29% market share owing to broad consumer acceptance, mild taste, and year-round supply. Apple concentrates and purees are cost-effective ingredients for roll-ups, bars, and pouches, helping brands control price points. Mango and banana-based snacks grow as tropical flavors gain popularity among children and adults. Pineapple flavors attract buyers seeking tangy and vitamin-rich options. Companies launch mixed-fruit variants, natural sweeteners, and vitamin-fortified blends to meet nutritional expectations. Strong product diversity ensures steady growth in this segment.

Key Growth Drivers

Rising Shift Toward Healthy Packaged Snacking

Consumers are reducing intake of high-sugar confectionery and fried snacks, creating strong demand for healthier alternatives like fruit snacks. Parents choose fruit-based snacks because they offer natural sweetness, fiber, and added vitamins. Brands respond with clean-label formulas, no artificial colors, and low-sugar variants that appeal to kids and adults. Supermarkets, convenience stores, and online platforms also expand shelf space for fruit snacks, helping customers find multiple flavors and formats. In schools and offices, fruit bars and pouches replace candies and pastries due to easier portion control. Marketing campaigns highlight real fruit content, gluten-free composition, and vegan suitability, driving purchase decisions among health-focused buyers.

- For instance, Calbee America launched “Harvest Snaps Kids Freeze-Dried Fruit Snacks,” made from whole fruit ingredients like grapes and apples, free from artificial colors, flavors, added sugar, and preservatives, and certified gluten-free and non-GMO, catering to parents seeking clean-label snacks for children.

Innovation in Flavors, Formulations, and Packaging

Product development plays a major role in market expansion, with brands launching tropical, exotic, and mixed-fruit flavors. Freeze-dried fruits, fruit gummies, and fruit bars cater to different age groups and dietary needs. Companies introduce vitamin-fortified, high-fiber, keto-friendly, and sugar-free fruit snacks to attract premium buyers. Portion-controlled packs and resealable pouches support on-the-go snacking for travel, school, and work. Packaging also uses biodegradable films and recyclable materials to satisfy sustainability goals. E-commerce channels help brands test new flavors through subscription boxes and direct-to-customer campaigns. Seasonal and limited-edition flavors create excitement and repeat purchases. Private labels add low-priced options in supermarkets, increasing household adoption.

- For instance, Freeter Foods offers freeze-dried fruit snacks like Alphonso mango and strawberry crisps, which are 100% natural with no added sugar or preservatives, providing a crunchy, nutrient-rich alternative for all age groups.

Growth of Online Retail and Direct-to-Consumer Sales

E-commerce is turning into a major sales channel as consumers prefer home delivery and subscription plans for snacks. Online platforms list a wide range of fruit bars, roll-ups, bites, and freeze-dried fruits, letting buyers compare flavors and nutrition details. Digital advertising helps smaller brands reach younger audiences without heavy retail investment. Influencers and parenting groups promote fruit snacks as safe, natural treats for children, increasing online demand. Flash deals, combo packs, and monthly deliveries support bulk purchasing. During festivals and events, online retailers push gift boxes and promotional hampers, boosting seasonal revenue.

Key Trends & Opportunities

Rising Demand for Organic, Vegan, and Clean-Label Products

A major trend shaping the market is the rising demand for organic and vegan fruit snacks. Health-conscious buyers avoid synthetic additives, gelatin, and artificial sweeteners. As a result, brands use real fruit pulp, plant pectin, and natural colors. Clean-label certification, non-GMO claims, gluten-free formulas, and allergen-free production give manufacturers a strong marketing edge. Organic snacks also gain traction in premium supermarkets, online specialty stores, and export markets. Companies launch products with chia seeds, flax, probiotics, and wholegrain bases to improve nutritional value. This trend encourages partnerships with organic farms and sustainable suppliers

- For instance, Cibo Vita launched Probiotic FruiChias in early 2025, a snack made from real fruit purée and chia seeds, offering 2 billion probiotics per serving along with being non-GMO, gluten-free, and free of added sugar, enhancing both nutritional and clean-label appeal.

Expansion into School Catering, Fitness, and Travel Retail

Fruit snacks are gaining approval in school nutrition programs as healthier substitutes for chocolates and chips. Travel stores in airports and rail stations also place fruit bars and dried fruit pouches at checkout counters, taking advantage of impulse buying behavior. Fitness centers, diet clinics, and sports clubs stock high-fiber fruit snacks as energy boosters. Tourism and hospitality sectors add freeze-dried fruits and fruit bites to breakfast and minibar menus. Airlines and hotels choose fruit snacks due to longer shelf life and easy storage. Companies create single-serve packs that meet school and airline safety requirements. As more institutions adopt healthy snacking policies, manufacturers gain access to large-volume contracts and recurring demand.

- For instance, Whitworths launched resealable dried fruit pouches in WHSmith travel retail locations at UK train stations and airports, specifically positioned at checkout displays to encourage healthy impulse buys among travelers

Key Challenges

High Sugar Levels and Label Concerns

Many fruit snacks contain added sugar or concentrated sweeteners, leading to criticism from nutrition groups and parents. Despite “fruit-based” positioning, some products resemble candy due to low fiber and high fructose content. Governments tighten rules on sugar labeling, child-targeted advertising, and artificial flavors, forcing companies to reformulate recipes. Brands must invest in low-sugar technology, natural sweeteners, and fruit-only ingredients to maintain consumer trust. Clean labels require transparency about preservatives, allergens, and nutritional benefits. Companies that fail to address sugar concerns risk losing shelf space in health stores, school canteens, and premium retail chains.

Price Sensitivity and Raw Material Dependency

Raw fruits such as mango, pineapple, and berries face seasonal availability, weather risks, and fluctuating farm prices. Dried fruits and purees require processing, storage, and transport, which raise production costs. As a result, fruit snacks often cost more than regular candies or chips, limiting adoption in price-sensitive regions. Import restrictions, export duties, and supply chain disruptions also affect ingredient supply. Small brands struggle to maintain stable pricing, especially when competing with large multinational companies. To handle this challenge, manufacturers need better contracts with farmers, improved cold-chain systems, and automation in drying and packaging.

Regional Analysis

North America

North America leads the global fruit snacks market with 38% market share in 2024 due to strong consumer preference for healthy packaged foods and wide product availability in retail chains. Major brands offer organic, vegan, and low-sugar variants that appeal to families and fitness-conscious buyers. Schools, airlines, and office cafeterias add fruit bars and pouches, increasing bulk consumption. The United States drives demand through strong marketing and rapid online grocery adoption. Private labels in supermarkets expand affordable options, while premium fruit snacks gain traction in urban markets. Innovations in flavors and recyclable packaging support continued regional growth.

Europe

Europe holds 27% market share, driven by growing adoption of clean-label, gluten-free, and organic snacks. Strict food safety standards increase consumer trust in packaged fruit snacks. Germany, the U.K., and France lead sales through supermarkets, discount retailers, and online delivery services. Manufacturers highlight natural fruit pulp, probiotic blends, and reduced-sugar recipes to meet nutritional expectations. Demand rises among young adults seeking healthy convenience snacks. Seasonal fruit shortages drive interest in freeze-dried options with long shelf life. Sustainability goals also encourage recyclable packaging and ethically sourced fruit concentrates across the region.

Asia-Pacific

Asia-Pacific accounts for 23% market share and shows the fastest growth as urban families shift from traditional sweets to convenient fruit-based products. China, Japan, Australia, and India drive demand through supermarkets, e-commerce platforms, and school distribution programs. Rising disposable income supports premium fruit bars and freeze-dried fruit snacks. Tropical flavors such as mango, lychee, and pineapple attract young consumers. Local and international brands invest in attractive packaging and smaller portion sizes to appeal to children. Government focus on child nutrition and health awareness supports steady expansion across the region.

Latin America

Latin America captures 7% market share, supported by rising consumption of packaged snacks in Brazil, Mexico, and Argentina. Fruit-rich agriculture helps manufacturers access raw materials for purees, concentrates, and freeze-dried pieces. Urban consumers prefer soft chews and fruit bars as affordable alternatives to chocolates. Major retailers expand private-label products with tropical flavors like guava and pineapple. Economic volatility limits premium product penetration, but online grocery platforms help niche brands reach younger buyers. Growing tourism and hospitality sectors also add fruit snacks to travel retail and minibar assortments.

Middle East & Africa

Middle East & Africa hold 5% market share, driven by increasing health awareness and demand for natural snack foods. Countries such as the UAE, Saudi Arabia, and South Africa show rising adoption in supermarkets, hypermarkets, and airport retail stores. Imported fruit snacks dominate due to limited local production, raising product prices. Families and schools favor portion-packed snacks for convenience and hygiene. Manufacturers promote sugar-free and halal-certified varieties to attract a wider consumer base. Expansion of modern retail and e-commerce services helps well-known brands strengthen distribution across the region.

Market Segmentations

By Product

- Fruit Roll-ups

- Freeze Dried Fruits

- Fruit Bars

- Soft Chews

By Nature

By Fruit Type

- Apple

- Mango

- Banana

- Pineapple

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fruit snacks market features strong competition among global brands and regional producers focusing on flavor innovation, nutritional improvements, and broader distribution. Key players such as Kellogg Company, General Mills Inc., Welch’s, and Keurig Dr Pepper Inc. expand their portfolios with low-sugar, organic, vegan, and allergen-free variants to meet changing consumer preferences. Companies like SunOpta Inc. and Mount Franklin Foods focus on natural ingredient sourcing and clean labeling, while Sunkist Growers Inc. and Chaucer Foods Ltd introduce premium fruit-based snacks using advanced dehydration and freeze-drying methods to retain nutrients. Crispy Green Inc. leads in freeze-dried fruit offerings, and Seneca Foods Corporation enhances its supply chain through sustainable sourcing partnerships with fruit growers. Marketing strategies emphasize kid-friendly packaging, seasonal flavors, and promotional bundles across supermarkets and e-commerce. The growing presence of private-label brands and collaborations with schools, airlines, and hospitality providers further intensify competition, driving continuous innovation in ingredients, packaging, and branding.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kellogg Company

- Mount Franklin Foods

- SunOpta Inc.

- Sunkist Growers Inc.

- Chaucer Foods Ltd

- Welch’s

- Crispy Green Inc.

- General Mills Inc.

- Keurig Dr Pepper Inc.

- Seneca Foods Corporation

Recent Developments

- In February 2023, Fetch, a leading U.S. rewards app and top consumer engagement platform, partnered with PIM Brands, Inc., the producer of Welch’s Fruit Snacks, to strengthen promotional reach and digital engagement.

- In 2022, the Kellogg Company expanded its Nutri-Grain brand with three new flavor mashups, including two fruit-and-veggie breakfast bars and bites, each containing 8 grams of whole grains and soft-baked textures for healthier snacking.

- In April 2022, Sunkist Growers, in collaboration with Naturipe Farms and T&G Global’s Envy Apples, launched the “Fruitastic” campaign to promote the Strawberry Shortcake flavor, focusing on cross-brand marketing and fruit-based indulgence.

Report Coverage

The research report offers an in-depth analysis based on Product, Nature, Fruit Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for healthy packaged snacks will continue to rise among children and adults.

- Brands will launch more organic, vegan, and allergen-free fruit snacks.

- Freeze-dried and dehydrated fruit formats will gain popularity for longer shelf life.

- Portion-controlled packs will expand due to school and travel consumption.

- Online retail and subscription models will boost direct-to-consumer sales.

- Manufacturers will invest in clean-label ingredients with no artificial colors or preservatives.

- Companies will explore new tropical and mixed-fruit flavors to attract young buyers.

- Sustainable and recyclable packaging will become a key focus for major brands.

- Partnerships with schools, airlines, and gyms will support bulk purchases.

- Emerging markets in Asia-Pacific and Latin America will drive future volume growth.