Market Overview

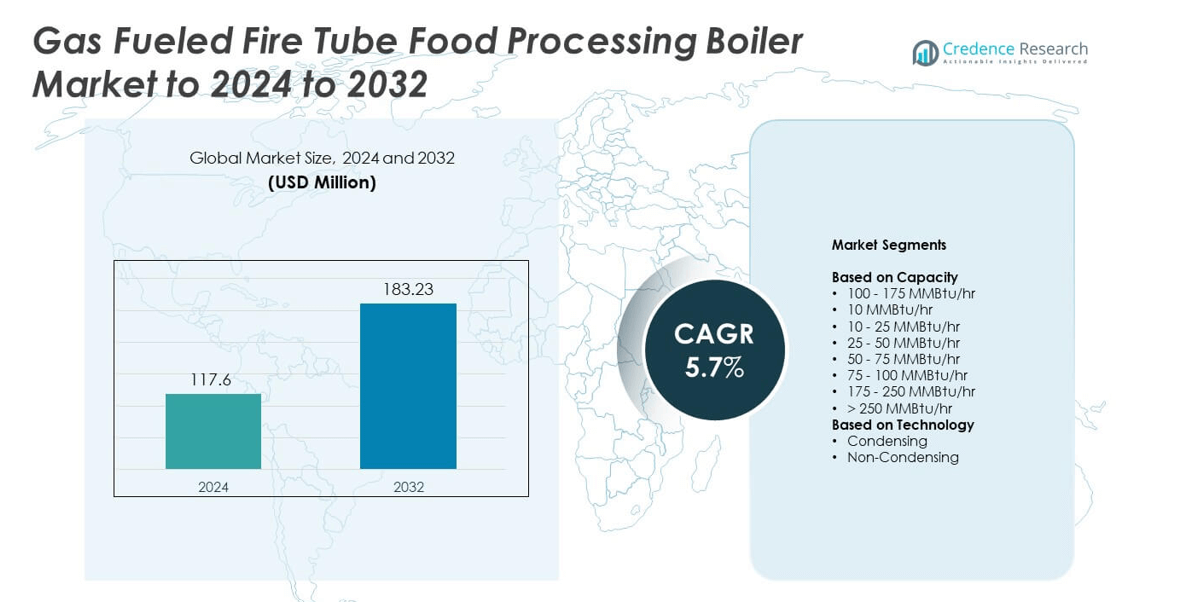

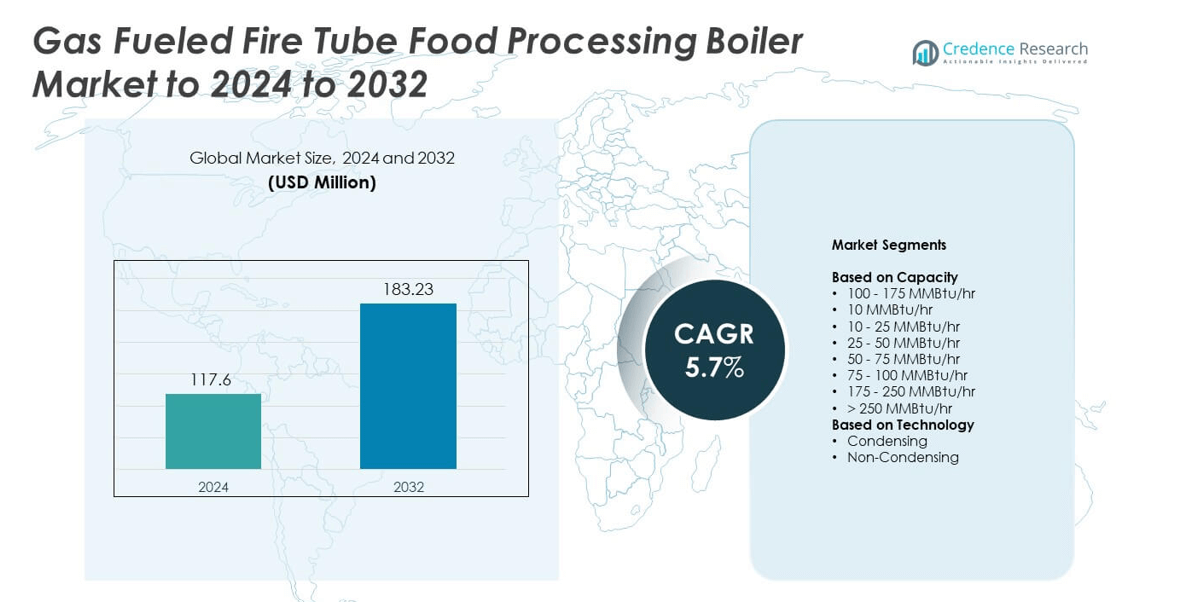

Gas Fueled Fire Tube Food Processing Boiler Market size was valued at USD 117.6 million in 2024 and is anticipated to reach USD 183.23 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fueled Fire Tube Food Processing Boiler Market Size 2024 |

USD 117.6 million |

| Gas Fueled Fire Tube Food Processing Boiler Market, CAGR |

5.7% |

| Gas Fueled Fire Tube Food Processing Boiler Market Size 2032 |

USD 183.23 million |

The Gas Fueled Fire Tube Food Processing Boiler Market features leading players including Thermodyne Boilers, Cleaver-Brooks Inc., Miura America Co. Ltd., Babcock Wanson SAS, Viessmann Werke GmbH & Co. KG, Bosch Industriekessel GmbH, Thermax Limited, BM GreenTech, Par Techno-Heat Pvt. Ltd., and Babcock & Wilcox Enterprises Inc. These manufacturers compete through high-efficiency designs, low-emission systems, and advanced automation suited for diverse food processing operations. North America leads the market with a 34% share in 2024, driven by strict energy standards and rapid modernization of processing facilities, followed by Europe at 27% and Asia Pacific at 29% as production capacity expands across major food-manufacturing economies.

Market Insights

- The Gas Fueled Fire Tube Food Processing Boiler Market was valued at USD 117.6 million in 2024 and is projected to reach USD 183.23 million by 2032 at a CAGR of 5.7%.

• Rising demand for energy-efficient steam generation in bakery, dairy, beverage, and ready-meal plants drives adoption, with the 25–50 MMBtu/hr segment holding 31% share due to strong operational suitability.

• Condensing boilers gain traction as a key trend because they support low-emission goals and hold 57% share, helped by stricter industrial efficiency regulations.

• The market remains competitive as major players focus on automation, digital monitoring, and heat-recovery systems, while high installation costs and emission-compliance pressure act as restraints.

• North America leads with 34% share, followed by Europe at 27% and Asia Pacific at 29%, supported by expanding processed food production and growing upgrades across medium-scale facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

The 25 to 50 MMBtu/hr capacity range dominates the Gas Fueled Fire Tube Food Processing Boiler Market with about 31% share in 2024. Food plants prefer this range because it supports steady steam generation for baking, blanching, sterilizing, and dehydration lines. Medium-capacity boilers offer strong thermal efficiency, easy integration, and lower fuel waste, which helps processors reduce operating costs. Adoption grows as mid-scale dairy, beverage, and ready-meal facilities expand production lines and replace older low-efficiency systems.

- For instance, Cleaver-Brooks confirms in its CBEX Firetube specifications that the largest available model in the CBEX Elite line delivers up to 2,200 boiler horsepower, with a corresponding maximum continuous steam output of 75,900 pounds per hour, as documented in its official technical brochures.

By Technology

The condensing technology segment leads this market with nearly 57% share in 2024. Condensing units gain traction because they recover latent heat from exhaust gases and deliver higher energy efficiency compared to non-condensing models. Food processors choose these systems to lower fuel costs, meet emission norms, and support sustainability goals. Demand rises further in regions promoting cleaner industrial heating, which drives upgrades from traditional non-condensing fire tube boilers.

- For instance, Bosch Thermotechnology’s official technical data sheets for the UL-S steam boiler line verify that the largest available model produces a maximum continuous steam output of up to 28,000 kilograms per hour (kg/h) at a safety pressure of up to 30 bar.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Systems

Food processors adopt high-efficiency gas-fueled fire tube boilers to reduce fuel consumption and cut operating expenses. Many facilities replace outdated boilers to meet strict emission norms and improve thermal performance. The growing push for greener industrial heating accelerates upgrades across bakeries, beverage plants, and dairy units. This shift supports long-term cost savings and helps companies meet sustainability goals.

- For instance, Miura states in its official performance sheet that the LX-300 model achieves a full steam startup time of 5 minutes and NOx emissions as low as 9 ppm, confirmed in Miura’s published engineering data.

Expansion of Processed Food Production Capacity

Rapid growth in packaged foods leads manufacturers to increase steam demand for cooking, drying, and sterilizing. Fire tube boilers remain essential due to stable pressure, easy maintenance, and dependable output. Rising investments in ready-meal, poultry, and beverage production support wider adoption of mid to high-capacity boiler systems. This expansion directly drives higher installation and replacement activity.

- For instance, Fulton’s technical specifications for the FT-N thermal fluid heater line confirm that the electric models within this series offer outputs ranging from 75,000 BTU/hr to 1,719,000 BTU/hr, operating with thermal fluid temperatures up to 650°F (340°C).

Growing Adoption of Automation in Boiler Operations

Modern food plants integrate automated controls, sensors, and safety systems to improve boiler efficiency. Automation reduces manual intervention, boosts temperature accuracy, and minimizes downtime. Food manufacturers prefer smart boilers because they offer predictive maintenance and optimized fuel use. This trend increases the appeal of advanced gas-fired fire tube units over older manual systems.

Key Trends and Opportunities

Shift Toward Low-Emission and Condensing Boiler Technology

Food processors show strong interest in condensing boilers because they recover heat from exhaust gases and lower emissions. Governments promote cleaner heating systems, leading to faster replacement of non-condensing units. This shift opens opportunities for manufacturers offering high-efficiency models with advanced heat exchangers. Rising sustainability targets accelerate this transition.

- For instance, Hurst StackMaster economizer technical literature emphasizes that incorporating this heat recovery system can improve boiler efficiency by approximately 1.5% to 2%.

Increasing Upgrades in Mid-Scale Food Processing Facilities

Medium-sized dairy, bakery, and beverage plants invest heavily in upgrading boiler rooms to boost output and reliability. Many facilities expand capacity, which raises demand for mid-range fire tube boilers. Manufacturers benefit as processors prioritize systems with better thermal efficiency and longer service life. These upgrades create steady opportunities in replacement and retrofit projects.

- For instance, the Superior Boiler official technical brochure for the Mohawk 3-pass firetube boiler line confirms that it is available in sizes from 30 to 1,000 HP

Integration of Smart Monitoring and Remote Diagnostics

Digital monitoring platforms enable real-time tracking of fuel use, steam load, and system health. Food processors adopt remote diagnostic tools to prevent downtime and reduce maintenance costs. Manufacturers offering connected boiler solutions gain a competitive edge. This trend strengthens market prospects for advanced fire tube systems.

Key Challenges

High Initial Installation and Upgrade Costs

Modern fire tube boilers with automation and condensing features require higher upfront investment. Many small and mid-scale processors delay adoption due to capital constraints. Installation of auxiliary components such as control panels and exhaust systems further increases project cost. These financial barriers slow replacement rates in certain regions.

Compliance Pressure from Evolving Emission Regulations

Food processors face increasing pressure to comply with stricter fuel and emission norms. Older non-condensing boilers often fail to meet updated standards, forcing companies to consider expensive retrofits. Regulatory uncertainty and frequent policy changes create planning challenges for manufacturers and end users. This factor limits rapid market expansion in cost-sensitive areas.

Regional Analysis

North America

North America holds about 34% share in the Gas Fueled Fire Tube Food Processing Boiler Market in 2024. Demand remains strong as food processors upgrade steam systems to meet strict efficiency and emission norms. Growth is supported by expanding bakery, dairy, and beverage production, along with rising investments in condensing technology. Many mid-size plants replace aging boilers to cut fuel costs and improve output stability. The United States leads adoption due to advanced food manufacturing infrastructure and strong regulatory enforcement, while Canada shows steady uptake in processed meat and frozen food facilities.

Europe

Europe accounts for nearly 27% share and benefits from strong industrial decarbonization policies that push manufacturers toward high-efficiency condensing boilers. Food processors across Germany, France, Italy, and the Netherlands modernize steam systems to reduce carbon output and comply with tightening emission rules. Growth is supported by expanding bakery, confectionery, dairy, and ready-meal production. Increasing investment in automation and digital boiler monitoring enhances adoption. Energy cost volatility also drives processors to shift from older, high-consumption models to cleaner gas-fired fire tube boilers with improved heat recovery capabilities.

Asia Pacific

Asia Pacific leads many emerging markets and holds around 29% share in 2024, driven by rapid growth in packaged food, dairy, beverage, and meat processing industries. China, India, Japan, and Southeast Asian countries increase capacity expansion, which elevates steam demand across cooking, drying, and sterilization lines. Rising preference for efficient boilers supports adoption of mid-capacity systems. Manufacturing upgrades in large food clusters accelerate demand for gas-fired fire tube models with improved fuel efficiency. Government initiatives promoting cleaner industrial heating further strengthen growth across developing economies.

Latin America

Latin America holds about 6% share, supported by steady growth in poultry, meat processing, bakery, and beverage sectors. Countries such as Brazil, Mexico, and Argentina invest in expanding food export capacity, which raises demand for reliable steam systems. Mid-capacity boilers gain traction as small and mid-scale processors focus on reducing fuel consumption. Adoption is slower compared to major regions due to higher installation costs but continues to rise as manufacturers replace outdated equipment. The region also shows growing interest in condensing boilers to meet energy efficiency targets.

Middle East and Africa

Middle East and Africa account for nearly 4% share in 2024, driven by rising investment in food processing clusters across Gulf nations, South Africa, and North Africa. Growth comes from increasing production of dairy, bakery, and packaged foods to meet domestic demand. The region sees gradual adoption of gas-fueled fire tube boilers as industrial gas availability improves. However, limited infrastructure and high upfront costs slow wider penetration. Expansion of modern food factories and interest in efficient heating technology support long-term market development.

Market Segmentations:

By Capacity

- 100 – 175 MMBtu/hr

- 10 MMBtu/hr

- 10 – 25 MMBtu/hr

- 25 – 50 MMBtu/hr

- 50 – 75 MMBtu/hr

- 75 – 100 MMBtu/hr

- 175 – 250 MMBtu/hr

- > 250 MMBtu/hr

By Technology

- Condensing

- Non-Condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Fueled Fire Tube Food Processing Boiler Market is shaped by major companies such as Thermodyne Boilers, Cleaver-Brooks Inc., Miura America Co. Ltd., Babcock Wanson SAS, Viessmann Werke GmbH & Co. KG, Bosch Industriekessel GmbH, Thermax Limited, BM GreenTech, Par Techno-Heat Pvt. Ltd., and Babcock & Wilcox Enterprises Inc. Competition centers on fuel efficiency, emission control, and reliable steam output tailored for food processing needs. Manufacturers focus on advanced heat recovery, automation, and condensing technology to strengthen performance. Many players expand regional footprints through distributor networks and aftermarket service programs. Development of compact, easy-to-install fire tube systems supports adoption in mid-scale plants. Companies also invest in digital monitoring, remote diagnostics, and predictive maintenance to improve system uptime. Growing demand for sustainability encourages innovation in low-NOx burners and high-efficiency heat exchangers. The landscape remains dynamic as firms enhance product portfolios to serve diverse processing lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermodyne Boilers

- Cleaver-Brooks Inc.

- Miura America Co. Ltd.

- Babcock Wanson SAS

- Viessmann Werke GmbH & Co. KG

- Bosch Industriekessel GmbH

- Thermax Limited

- BM GreenTech

- Par Techno-Heat Pvt. Ltd.

- Babcock & Wilcox Enterprises Inc.

Recent Developments

- In 2024, Cleaver-Brooks launched a next-generation fire tube boiler control system integrating real-time monitoring and predictive maintenance analytics that help reduce unplanned downtime in food processing operations.

- In 2024, Babcock Wanson launched the LV-Pack, a low-voltage industrial electric boiler with design pressure up to 18 barg, which helps meet energy efficiency standards and greenhouse gas reduction targets in Europe.

- In 2023, Miura Boiler highlighted its high-efficiency, low-NOx gas-fired water-tube boilers as an energy-saving solution for food processing plants, emphasizing their fast start-up times to reduce energy waste and costs compared to traditional fire-tube boiler

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as food processors upgrade to high-efficiency boiler systems.

- Adoption of condensing boilers will rise due to emission and energy-saving needs.

- Mid-capacity fire tube boilers will see steady demand from expanding food plants.

- Digital monitoring and automation will become standard features in new installations.

- Replacement of aging boilers will accelerate across bakery, dairy, and beverage units.

- Sustainability targets will push manufacturers to design cleaner and smarter systems.

- Asia Pacific will remain the fastest-growing region with strong processing expansion.

- Strict regulatory norms in developed regions will boost advanced boiler adoption.

- Hybrid heat recovery solutions will gain traction to reduce fuel consumption.

- Manufacturers will benefit from rising investments in retrofit and modernization projects.