Market Overview

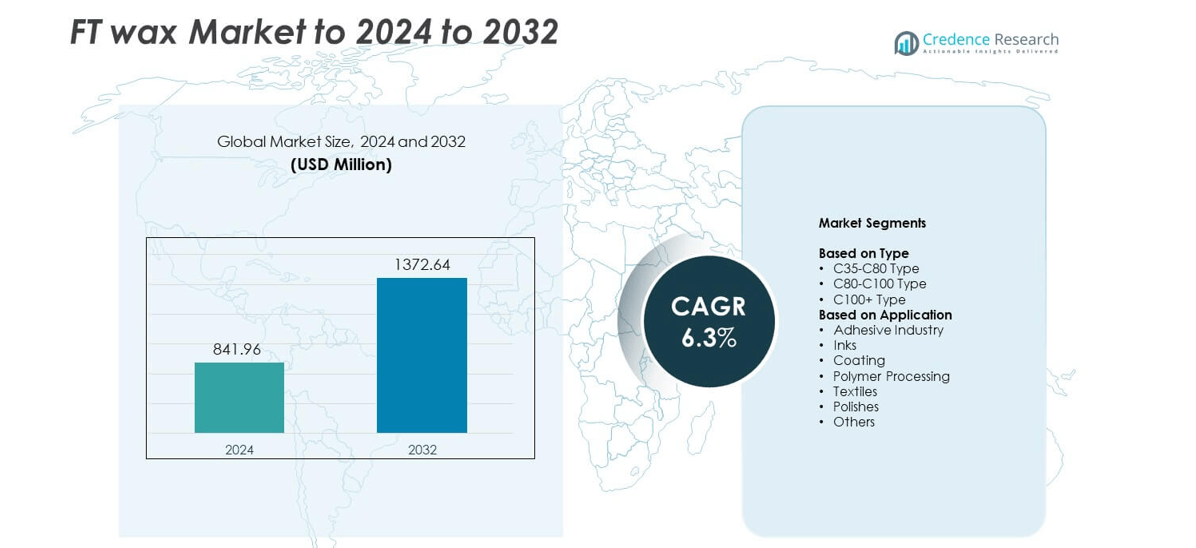

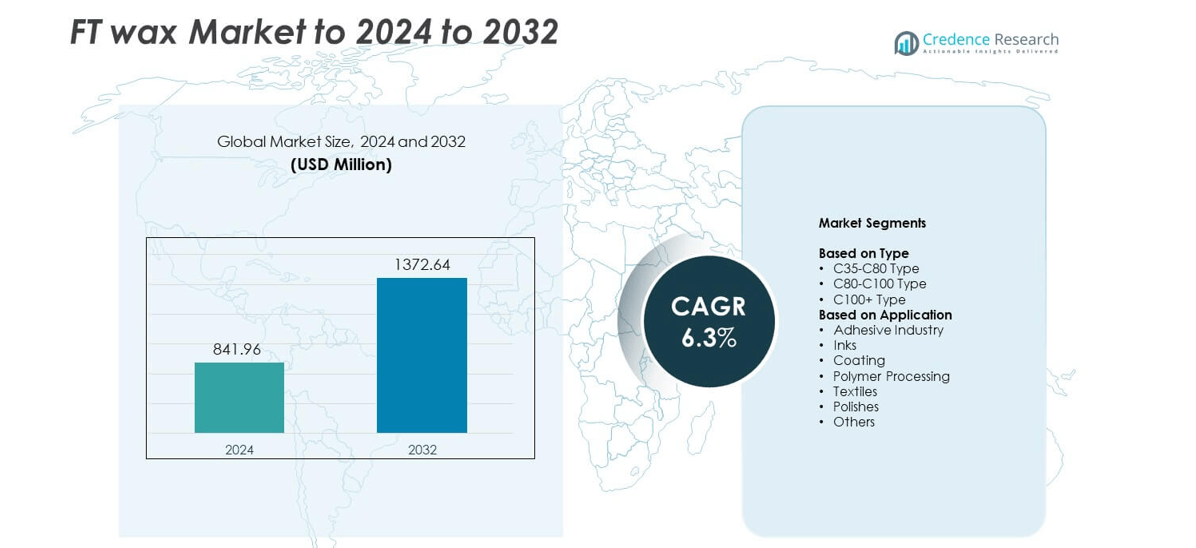

FT wax Market size was valued at USD 841.96 Million in 2024 and is anticipated to reach USD 1372.64 Million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| FT Wax Market Size 2024 |

USD 841.96 Million |

| FT Wax Market, CAGR |

6.3% |

| FT Wax Market Size 2032 |

USD 1372.64 Million |

The FT wax market is shaped by leading companies such as ExxonMobil Corporation, Sinopec Limited, Sasol Limited, Kuwait Petroleum Corporation, Nippon Seiro Co., Ltd., Petrobras, The International Group, Inc., Royal Dutch Shell Plc, China National Petroleum Corporation, and Hexion Inc. These producers compete through high-purity grades, advanced GTL technology, and strong distribution networks. North America leads the market with about 34% share, supported by strong demand in adhesives, coatings, and polymers. Europe follows with nearly 29%, driven by sustainability-focused industries, while Asia Pacific holds around 28% due to rapid manufacturing growth. Latin America and the Middle East & Africa account for roughly 6% and 3% respectively.

Market Insights

- The FT wax market reached USD 841.96 Million in 2024 and is projected to hit USD 1372.64 Million by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by rising demand from adhesives, coatings, and polymer processing, with the adhesive segment holding the largest share at about 34%.

- Key trends include increased use of high-purity synthetic waxes, demand for specialty grades, and a strong shift toward low-emission industrial materials across printing inks and advanced coatings.

- Competition is shaped by major producers investing in GTL technology, capacity upgrades, and improved refining processes to deliver consistent, high-performance wax grades for premium applications.

- North America leads the global market with about 34% share, followed by Europe at nearly 29% and Asia Pacific at around 28%, while Latin America and the Middle East & Africa account for roughly 6% and 3% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The C35–C80 type leads the FT wax market with about 52% share in 2024. This range dominates because converters use these grades in adhesives, inks, and coatings. The segment grows as manufacturers adopt clean-burning waxes for stable performance. Demand rises due to strong melting behavior and controlled viscosity. The C80–C100 range expands in packaging and polymer blends. The C100+ category gains traction in specialty coatings that need high hardness. Growth continues as end users shift toward high-purity synthetic waxes.

- For instance, Sasol’s Fischer-Tropsch hydrogenated hard wax grade Sasolwax C80 lists a typical congealing point range of 80–85 °C (ASTM D938, typical value 83 °C) and a drop melting point of 93 °C max.

By Application

The adhesive industry holds the dominant application share at nearly 34% in 2024. Adhesive producers prefer FT wax because the product enhances bond strength and reduces viscosity. The segment grows as packaging, woodworking, and hygiene products expand. Inks adopt FT wax for rub resistance and smooth dispersion. Coatings use these waxes for scratch resistance and durability. Polymer processing benefits from improved melt flow. Textiles and polishes show steady growth as manufacturers replace petroleum waxes with cleaner synthetic grades.

- For instance, Evonik’s VESTOWAX C 60 oxidised Fischer-Tropsch wax shows a drop point of 100–105 °C and viscosity below 20 mPa·s at 120 °C, and is promoted for hot-melt adhesives and coating formulations that need controlled melt behaviour.

Key Growth Drivers

Rising Demand from Adhesives and Coatings

Growing use of FT wax in hot-melt adhesives and industrial coatings drives strong market expansion. Adhesive producers rely on FT wax to improve bond strength, control viscosity, and deliver cleaner performance. Coating formulators also adopt FT wax for scratch resistance and improved surface hardness. Packaging, woodworking, and construction sectors increase consumption as they shift toward high-purity synthetic waxes. Expanding end-use manufacturing output further strengthens long-term demand.

- For instance, a co-hydrocracking study using a blend of heavy vacuum gas oil (HVGO) with Fischer-Tropsch wax was operated at reaction temperatures of 390, 400, and 410 °C under 8 MPa (80 bar) over a commercial Ni-W and Mo/zeolite Y + AlO catalyst

Shift Toward Cleaner and High-Purity Materials

Industries prefer FT wax because it offers low sulfur levels, consistent melting behavior, and stable chemical properties. This shift grows as companies move away from petroleum-derived waxes due to quality variations and regulatory pressures. FT wax supports stricter emission norms and sustainability goals in adhesives, inks, and coatings. Producers benefit from reliable formulation control, which boosts adoption across premium products. Demand rises as high-purity materials become central to modern manufacturing.

- For instance, Tjhsxy International Trade Co., Ltd specifies its HSFT Fischer-Tropsch wax with a melting point of 74.5 °C, viscosity of 6.9 mm²/s at 100 °C and a drop point of 80 °C for one grade

Expanding Use in Polymer Processing and Plastics

Polymer converters use FT wax to enhance melt flow, improve dispersion, and boost processing speed. The material helps achieve smooth surfaces, reduced friction, and better pigment stability. Rising consumption in masterbatches, films, and rigid plastics supports steady market growth. Increasing plastics demand in packaging and consumer goods increases the need for FT-based processing aids. Manufacturers favor FT wax for its thermal stability and compatibility with high-performance polymers.

Key Trends and Opportunities

Growth of High-Performance and Specialty Grades

Demand rises for FT wax grades tailored to coatings, printing inks, and engineered polymers. Producers invest in advanced refining and controlled crystallization to reach tighter molecular ranges. Specialty waxes gain traction in sectors that require higher hardness, gloss enhancement, or improved thermal stability. Innovation in microcrystalline-like FT structures and ultra-low-impurity grades creates strong opportunities. The market benefits from expanding applications in premium coatings and high-value chemical formulations.

- For instance, Clariant’s Licowax PE 190 powder, used as a lubricant in rigid plastics, has a softening point between 132 and 138 °C and density between 0.95 and 0.97 g/cm³, reflecting a high-melting, tightly defined specialty wax grade

Adoption in Sustainable and Low-Emission Applications

FT wax aligns well with sustainability goals due to its clean combustion and consistent purity. Industries use it to reduce emissions in adhesives, coatings, and processing applications. Adoption grows in packaging and textile care as brands strengthen environmental commitments. Opportunities increase as regulators push for lower volatile and sulfur content in industrial materials. The trend accelerates development of greener product lines supported by synthetic wax technology.

- For instance, the Michelman guidelines for using DigiPrime® for off-line coaters specify that the recommended target coat weight of undiluted DigiPrime on most surfaces is 1–1.5 g/m² wet (gsm wet). Specific target coat weights are 1.0 gsm for films and 1.5 gsm for uncoated papers.

Increasing Use in Digital and Industrial Printing

FT wax enhances rub resistance, surface smoothness, and dispersion stability in printing inks. Digital printing manufacturers prefer its controlled melting profile for uniform print quality. Growth in packaging, labels, and high-speed printing expands opportunities. Producers introduce ink-compatible FT waxes designed for sharper graphics and durable finishes. Rising demand for printed consumer goods strengthens long-term adoption across commercial printing markets.

Key Challenges

High Production Costs and Limited Supply Base

FT wax production depends on gas-to-liquids facilities, which require high capital investment. Limited global capacity restricts supply flexibility and leads to cost fluctuations. Producers face challenges in scaling output due to feedstock availability and long commissioning timelines. These constraints affect pricing and create barriers for small or regional manufacturers. Market growth slows in regions that rely heavily on imports.

Competition from Cheaper Petroleum-Based Waxes

Petroleum waxes remain more affordable and widely available, creating strong competitive pressure. Many mass-market applications choose lower-cost paraffin or microcrystalline waxes despite purity trade-offs. This competition affects adoption in cost-sensitive industries such as basic polishes and commodity coatings. End users weigh performance benefits against price gaps, limiting FT wax penetration. Fluctuating crude oil prices can also shift purchasing behavior in favor of cheaper alternatives.

Regional Analysis

North America

North America holds the largest share of the FT wax market at about 34% in 2024. Demand stays strong due to high consumption in adhesives, coatings, and polymer processing. Growth rises as manufacturers adopt high-purity waxes to meet strict environmental rules. The region benefits from advanced chemical processing facilities and stable supply networks. Expanding packaging and construction activity also supports higher offtake. Rising adoption of premium printing inks strengthens overall demand across the United States and Canada.

Europe

Europe accounts for nearly 29% share of the FT wax market in 2024. Regional industries rely on FT wax for inks, coatings, and engineered polymers that require consistent purity and performance. Strong sustainability policies drive a shift toward low-emission materials, supporting synthetic wax adoption. Packaging, automotive, and industrial manufacturing increase consumption as they integrate high-grade waxes into advanced formulations. Demand also grows in textile care and polishes. Well-developed R&D capabilities help expand specialty applications.

Asia Pacific

Asia Pacific represents about 28% share of the FT wax market in 2024 and grows rapidly due to rising industrial output. Strong expansion in packaging, plastics, adhesives, and printing inks drives higher consumption. China, India, and Southeast Asia increase demand as manufacturing scales up in consumer goods and infrastructure sectors. Local producers adopt FT wax for controlled melting and low-impurity performance. Growth continues as regional industries shift from petroleum waxes to more consistent synthetic alternatives.

Latin America

Latin America holds roughly 6% share of the FT wax market in 2024. Demand grows gradually due to rising use in adhesives, coatings, and polymer processing. Brazil and Mexico lead consumption as packaging, construction, and paints industries expand. Manufacturing companies adopt FT wax to improve product stability and surface properties. Growth remains steady as regional converters move toward higher-quality wax options. Import dependence continues, but improving distribution networks support wider adoption.

Middle East and Africa

The Middle East and Africa account for around 3% share of the FT wax market in 2024. Consumption increases in coatings, printing inks, and industrial adhesives as manufacturing capacity expands. Countries with developing packaging and construction sectors adopt FT wax for its purity and thermal stability. Growth remains moderate due to limited local production and reliance on imports. Rising investment in industrial projects gradually increases the demand base. Adoption improves as companies shift toward low-emission and consistent-quality materials.

Market Segmentations:

By Type

- C35-C80 Type

- C80-C100 Type

- C100+ Type

By Application

- Adhesive Industry

- Inks

- Coating

- Polymer Processing

- Textiles

- Polishes

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The FT wax market features key players such as ExxonMobil Corporation, Sinopec Limited, Sasol Limited, Kuwait Petroleum Corporation, Nippon Seiro Co., Ltd., Petrobras, The International Group, Inc., Royal Dutch Shell Plc, China National Petroleum Corporation, and Hexion Inc. Companies in this space compete through advancements in gas-to-liquids technology, tighter molecular control, and improved refining methods that deliver high-purity synthetic waxes. Producers focus on expanding specialty grades with enhanced hardness, stability, and performance for adhesives, coatings, and polymer processing. Many firms strengthen supply reliability by upgrading production units and optimizing distribution networks across major regions. Investments in low-emission materials and sustainable processing support rising demand from packaging, textiles, and printing sectors. Competitors also align product development with regulatory trends favoring cleaner industrial inputs. Overall, the market remains moderately consolidated, with competition driven by technology depth, product consistency, and long-term supply capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ExxonMobil Corporation

- Sinopec Limited

- Sasol Limited

- Kuwait Petroleum Corporation

- Nippon Seiro Co., Ltd.

- Petrobras

- The International Group, Inc.

- Royal Dutch Shell Plc

- China National Petroleum Corporation (CNPC)

- Hexion Inc.

Recent Developments

- In 2025, ExxonMobil advanced its product solutions technology by starting up a first-of-its-kind facility in Singapore that converts lower-value fuel oil into higher-value lubricant base stocks and fuel

- In 2024, Sasol introduced SASOLWAX LC100, an industrial wax grade with a 35% lower carbon footprint, targeting the adhesive packaging industry.

- In 2023, Hexion received ISCC PLUS certification at its Baytown, Texas, site after introducing bio-based methanol into production, a move communicated through its wax-emulsions sustainability pages.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The FT wax market will grow as industries shift toward high-purity synthetic materials.

- Adhesives and coatings will remain major demand drivers due to performance needs.

- Polymer processors will expand usage to improve melt flow and dispersion quality.

- Printing ink producers will adopt more FT wax for better rub resistance and smooth finish.

- Specialty and high-performance wax grades will gain traction across premium applications.

- Sustainability rules will push industries to replace petroleum waxes with cleaner FT options.

- Packaging, construction, and consumer goods sectors will support steady long-term demand.

- Producers will invest in advanced refining to deliver narrower molecular ranges.

- Regional supply expansion will reduce dependence on a limited set of GTL facilities.

- Competition with low-cost petroleum waxes will influence pricing and adoption trends.