Market Overview:

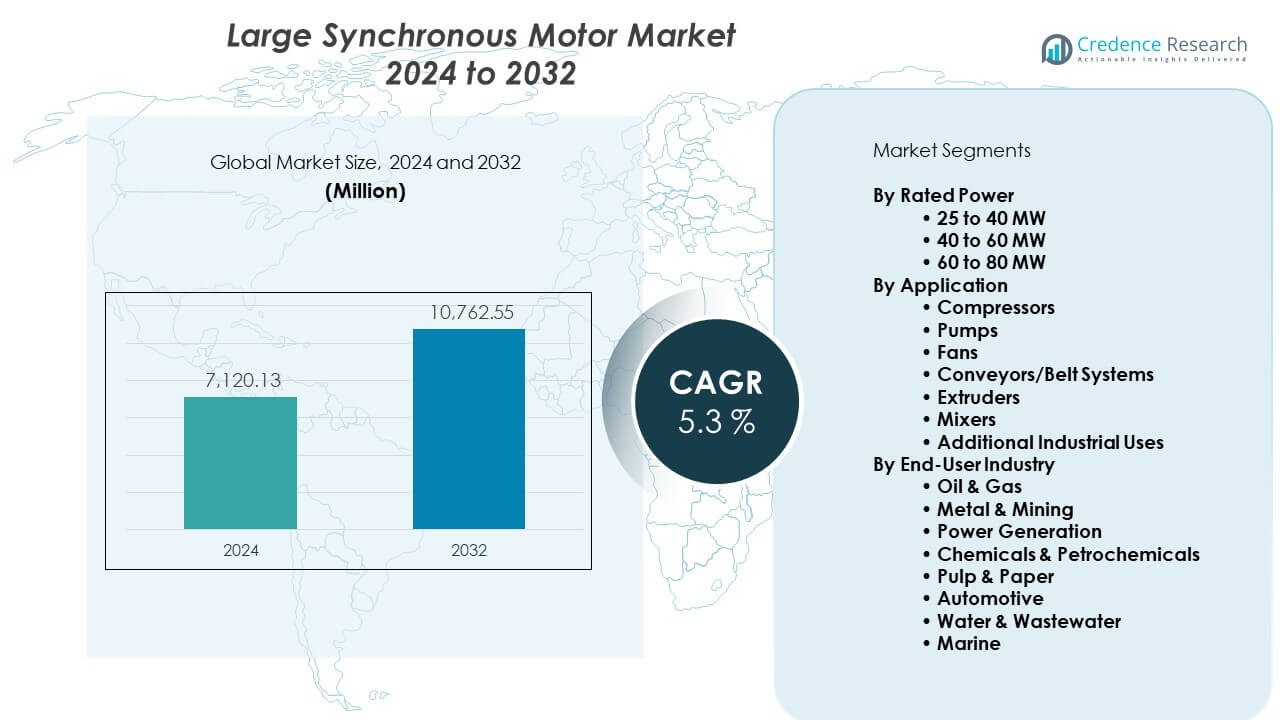

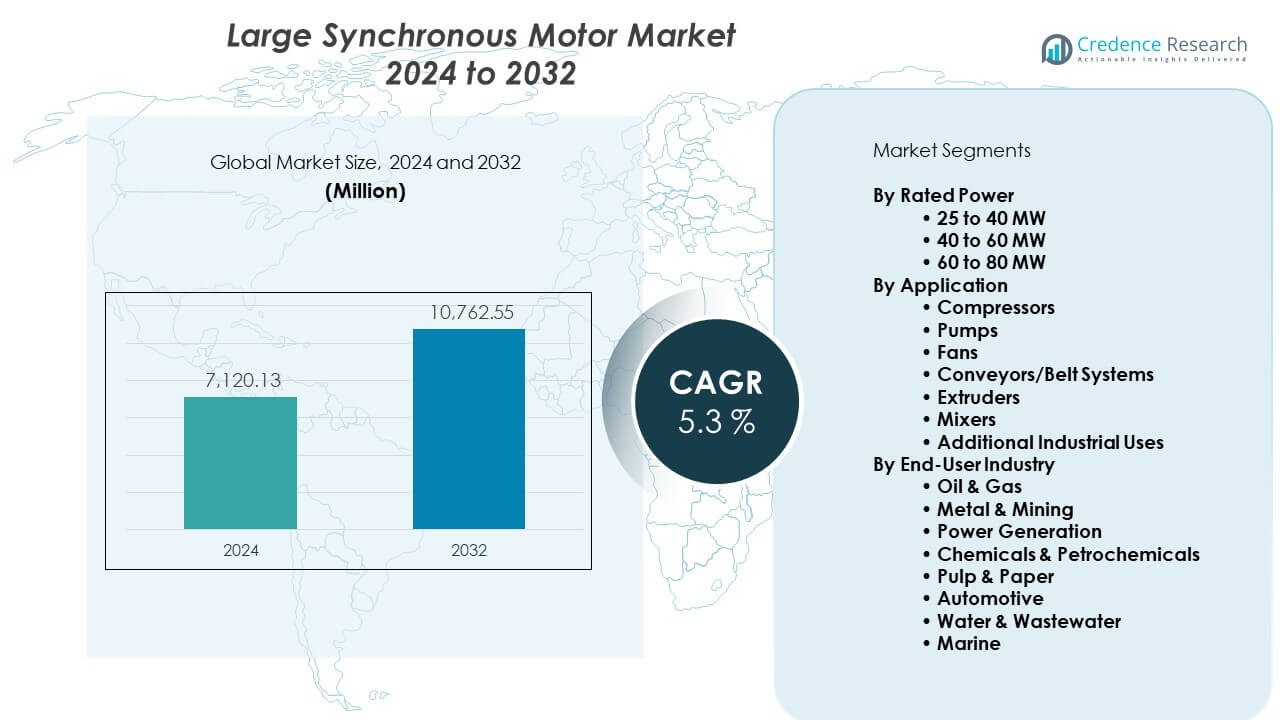

The large synchronous motor market is projected to grow from USD 7,120.13 million in 2024 to USD 10,762.55 million by 2032, registering a CAGR of 5.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Large Synchronous Motor Market Size 2024 |

USD 7,120.13 Million |

| Large Synchronous Motor Market, CAGR |

5.3% |

| Large Synchronous Motor Market Size 2032 |

USD 10,762.55 Million |

Rising industrial modernization drives steady demand for high-efficiency synchronous motors. Heavy industries adopt these systems to reduce power losses and improve operational stability. Companies invest in reliable torque solutions for compressors, mills, and high-power pumps. Grid operators value synchronous motors for power factor correction and enhanced system stability. Improved motor designs support lower maintenance cycles and longer service life. Automation growth increases installation in large manufacturing sites. Energy-intensive sectors shift toward motors that meet efficiency standards. Wider digital control integration boosts adoption across modern facilities.

North America leads due to strong industrial bases in metals, mining, and power applications. Europe follows with high adoption supported by strict efficiency rules and advanced automation use. Asia Pacific emerges as the fastest-growing region due to rapid industrial expansion and rising infrastructure activity. China, India, and Southeast Asian countries invest in heavy manufacturing and energy projects that use high-capacity synchronous motors. Latin America expands steadily through mining and processing sectors. The Middle East & Africa show potential as new industrial zones develop across key economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The large synchronous motor market stands at USD 7,120.13 million in 2024 and is projected to reach USD 10,762.55 million by 2032, reflecting a 5.3% CAGR driven by rising demand in heavy industries.

- Asia Pacific holds 38% share, North America follows with 33%, and Europe accounts for 29%, supported by strong industrial bases and higher adoption of high-capacity motor systems.

- Asia Pacific remains the fastest-growing region with 38% share, supported by rapid industrialization, expansion of metals and mining, and rising investment in power projects.

- Compressors dominate application share due to strong use across oil, gas, and process industries, supported by high torque and continuous-duty needs.

- Oil and gas lead end-user share, strengthened by heavy deployment of synchronous motors in large compressors, pumps, and processing units across global operations.

Market Drivers:

Rising Adoption of High-Efficiency Motor Systems Across Heavy Industries

The Large synchronous motor market gains strength from a steady shift toward high-efficiency drive systems across critical industries. Heavy plants upgrade legacy motors to reduce energy loss and improve torque stability. Power generation sites deploy synchronous designs to support better grid control. Mining and metals operators prefer stable torque for crushers and mills. Petrochemical units rely on precise speed control for large compressors. Strong uptime requirements push industries toward motors with longer service life. Digital monitoring systems support better fault detection in high-load environments. Industrial operators expand capacity with motors that deliver reliable output under harsh duty cycles.

- For instance, ABB achieved a world-record efficiency of 99.13% with its synchronous motor designed for a steel plant in India, surpassing the previous record of 99.05% set in 2017. This TIE-optimized motor enables the customer to save approximately 61 GWh of energy and $5.9 million in electricity costs over a 25-year lifespan while avoiding 45,000 tons of CO₂ emissions.

Growing Focus on Power Factor Correction and Grid Stability Needs

Power utilities prefer synchronous motors to support power factor correction at scale. Strong grid loads push organizations toward designs that offer reactive power support. Many plants replace induction motors to meet stability needs for large equipment. The Large synchronous motor market benefits from rising demand for controlled speed in rotating units. Hydropower plants use synchronous drives for stable turbine alignment. Compressor stations deploy these motors for steady start-up cycles. Grid operators value lower thermal stress on equipment. Industrial users adopt synchronous machines to cut operational imbalance across high-load networks.

- For instance, GE Vernova’s synchronous condensers are modular, air-cooled, and rated for any range up to 300 Mvar+ per machine, providing both steady state and dynamic support to the power system efficiently. These machines can provide more than two times their rating for up to 10 seconds during emergencies or short-term contingencies.

Higher Investment in Automation and Process Optimization Across Industries

Industrial automation drives steady investment in advanced motor systems. Automated plants prefer synchronous motors for steady output during continuous runs. Robotics lines depend on designs that deliver accurate speed under peak tension. The Large synchronous motor market benefits from stronger interest in connected monitoring. Automated mixing, milling, and conveyor systems rely on high-stability torque. Maintenance teams use diagnostic software to track motor health. Modern plants deploy synchronous motors in expansion zones to meet uptime goals. Production hubs integrate these motors to reduce deviations across long duty cycles.

Rising Demand for Large Compressors, Pumps, and Industrial Fans

Heavy industrial sites invest in high-capacity motors for large compressor banks. Petrochemical clusters use synchronous motors to stabilize output across multi-stage pumps. Water utilities adopt these motors for reservoir pumping cycles. The Large synchronous motor market gains traction through rising use in air-handling units. Steelmakers rely on steady torque during smelting support processes. Cement plants deploy these motors for kiln fans and grinding mills. System integrators choose synchronous drives to reduce vibration risk. Industrial clusters expand capacity with motors that support long operational hours.

Market Trends:

Expansion of Smart Motor Monitoring and Predictive Intelligence Platforms

Digital monitoring expands across major industrial hubs. Plants deploy sensors that track vibration and thermal drift. Predictive tools alert operators about early-stage faults. The Large synchronous motor market sees strong adoption of IoT-integrated drives. Data dashboards help maintenance teams reduce downtime. AI systems read torque variation data to predict wear. Plants adopt remote inspection tools for faster repair cycles. Cloud-linked maintenance plans improve service reliability across large sites.

- For instance, IIoT-based sensor nodes for industrial motors utilize 3-axial MEMS accelerometers to acquire vibration data on radial and axial axes, enabling real-time monitoring and early fault detection that minimizes unscheduled downtime and leads to cost savings. AI systems read torque variation data to predict wear.

Stronger Shift Toward High-Voltage and Ultra-High-Capacity Motor Designs

Industrial users prefer high-voltage synchronous motors for large-scale operations. Strong output needs push manufacturers toward higher capacity ranges. Advanced insulation materials support safer thermal cycles. The Large synchronous motor market grows with new extra-high-voltage designs. Heavy mining units deploy large drives for crushers and conveyors. LNG plants use high-capacity motors for refrigeration and pumping. New designs reduce footprint across space-limited sites. High-capacity drives support better load control under extreme duty.

- For instance, ABB synchronous motors feature class F insulated stator windings that undergo vacuum pressure impregnation (VPI) with mica-based tape and specially formulated epoxy resin, producing a sealed and homogenous insulation system with good performance in dielectric strength and heat transfer.

Rising Integration of Synchronous Motors in Renewable Power Projects

Renewable power plants deploy synchronous motors for turbine-driven systems. Hydropower stations rely on accurate rotor alignment. Solar farms integrate large drives for auxiliary tasks. The Large synchronous motor market grows with cleaner energy adoption. Wind component suppliers use synchronous drives in manufacturing lines. Renewable project expansions increase demand for stable rotating equipment. Industrial plants adopt green energy policies and choose efficient motors. New project pipelines support stronger synchronization needs.

Shift Toward Low-Maintenance, Long-Life Motor Designs for Harsh Environments

Industries prefer motors that perform well under dust, heat, and vibration. New coating technologies help protect internal assemblies. Insulated bearings improve run time across heavy loads. The Large synchronous motor market grows with designs that need fewer service intervals. Plants replace old units to reduce downtime risk. Harsh-environment sites expand capacity with rugged motors. Sealed housings reduce contamination in extreme plants. Operators favor motors that extend replacement cycles.

Market Challenges Analysis:

High Installation Costs and Complex Engineering Requirements for Large Motors

The Large synchronous motor market faces challenges due to high installation expenses across heavy industries. Large drives need engineered foundations and advanced alignment procedures. Many plants delay upgrades due to budget limits. System integration requires skilled teams that many regions lack. Motors with high ratings need reinforced electrical infrastructure. Long commissioning times increase project delays. Engineering complexity slows adoption in mid-sized factories. Industries need strong planning to manage installation risks.

Maintenance Complexity, Skilled Labor Shortage, and Voltage Stability Issues

Large synchronous motors need precise maintenance work across long duty cycles. Many regions lack trained staff for rotor balancing and excitation checks. Plants face downtime when skilled teams are unavailable. The Large synchronous motor market experiences delays when spare parts arrive late. Voltage dips cause operational instability across older grids. Heavy plants require strong power systems for stable performance. Maintenance teams struggle with aging support infrastructure. Operational risks increase when monitoring tools are not updated.

Market Opportunities:

Rising Industrial Modernization and Expansion of High-Efficiency Motor Programs

New projects across metals, mining, and energy unlock strong potential. Industries replace legacy induction drives with high-efficiency synchronous systems. The Large synchronous motor market gains opportunity from smart monitoring adoption. Plants expand output and need motors that support longer cycles. Large compressor and pump installations create demand for advanced drives. Energy policies support efficient equipment use across heavy sectors. Manufacturers push new designs for better torque stability. Industrial upgrades create room for rapid growth.

Growth of Renewable Energy and Grid Stabilization Projects Across Regions

Renewable expansion creates fresh demand for synchronous motors in hydropower and auxiliary units. Grid developers install systems that use motors for power factor correction. The Large synchronous motor market benefits from government-backed energy reforms. Utilities deploy synchronous drives in expansion zones for stability needs. Industrial hubs adopt cleaner energy and sync their systems with large drives. Strong investment pipelines create long-term growth. New manufacturing zones support wider adoption across critical sectors.

Market Segmentation Analysis:

By Rated Power

The Large synchronous motor market expands across three core power bands that support heavy-duty operations. The 25 to 40 MW class sees strong use in medium-load industrial systems where stable torque is essential. The 40 to 60 MW segment records higher deployment in large compressors and regulated pump networks. The 60 to 80 MW range supports high-intensity environments that need strong torque and precise control. Industries pick power bands based on torque demand, operational stability, and energy goals. Each range serves plants that require long operational cycles. It strengthens usage where load variation stays high. Adoption grows in facilities targeting long-term performance reliability.

- For instance, TMEIC’s 48.4 MW 6-pole synchronous motor achieved 99.0% efficiency and was first shipped to a major industrial gas manufacturer in July 2024. The 60 to 80 MW range supports high-intensity environments that need strong torque and precise control.

By Application

Compressors lead due to strong demand from oil, gas, and process industries. Pumps follow through wide use in water transfer, refining units, and cooling systems. Fans support cement, metal, and power plants that rely on steady airflow. Conveyors and belt systems use synchronous designs for controlled movement during heavy transport. Extruders and mixers depend on accurate speed control for material consistency. Other industrial uses extend adoption across integrated production lines. Each application favors torque stability and low energy loss. It supports continuous-duty environments that operate under intense conditions.

- For instance, ABB’s IE5 SynRM motors reduce energy losses by up to 40% compared to IE3 motors, with a single 90 kW motor saving 79,800 Euros and reducing CO₂ emissions by 95,760 kg over 20 years, often delivering payback in as little as 5 months. Fans support cement, metal, and power plants that rely on steady airflow.

By End-User Industry

Oil and gas lead due to large compressor and pump requirements across upstream and midstream assets. Metal and mining sectors rely on synchronous drives for crushers and grinding mills. Power generation plants adopt these motors for turbine support and auxiliary systems. Chemicals and petrochemicals deploy synchronous motors for high-load processing units. Pulp and paper plants integrate them into heavy mechanical lines. Automotive, water and wastewater, and marine sectors use these motors for reliability in long-hour operations. Each industry values strong durability and controlled torque delivery.

Segmentation:

By Rated Power

- 25 to 40 MW

- 40 to 60 MW

- 60 to 80 MW

By Application

- Compressors

- Pumps

- Fans

- Conveyors/Belt Systems

- Extruders

- Mixers

- Additional Industrial Uses

By End-User Industry

- Oil & Gas

- Metal & Mining

- Power Generation

- Chemicals & Petrochemicals

- Pulp & Paper

- Automotive

- Water & Wastewater

- Marine

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The large synchronous motor market holds a strong position in North America with an estimated 33% share driven by heavy industrial activity across oil, gas, metals, and power sectors. The region benefits from advanced automation practices that support stable adoption of high-capacity motors. U.S. plants prefer synchronous drives for grid stability and power factor correction needs. Canada strengthens demand through mining and hydro-based applications. Strong investment in modernization projects supports replacement of older motor fleets. It continues to grow due to higher interest in efficient and long-life motor systems. Regional manufacturers invest in digital monitoring platforms that enhance operational reliability.

Europe

Europe captures nearly 29% share backed by strict efficiency rules and higher use of advanced automation systems. Germany, France, and the U.K. lead due to strong industrial frameworks across metals, chemicals, and power generation. European plants favor motors that deliver stable torque under variable-load conditions. Rising sustainability goals push industries toward high-efficiency synchronous designs. It records strong adoption in water, wastewater, and marine operations across coastal nations. Eastern Europe expands demand through new industrial corridors. Regional policy support enhances long-term investment in premium motor technologies.

Asia Pacific

Asia Pacific accounts for the largest share at 38%, driven by rapid industrial growth and higher investment across heavy manufacturing. China leads deployment in mining, steel, and energy projects that require high-capacity synchronous motors. India and Southeast Asia show strong momentum through expanding process industries and new infrastructure programs. Japan and South Korea support adoption through advanced plant automation and robust marine applications. It strengthens regional growth through rising power sector upgrades and wider industrial electrification. New manufacturing zones drive long-hour operational requirements that favor synchronous designs. The region maintains the fastest growth trajectory supported by strong capital spending.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Large synchronous motor market features strong competition driven by global manufacturers that supply high-capacity motors for heavy industries. Leading companies differentiate through advanced torque control systems, higher efficiency grades, and long-life designs that support continuous-duty operations. Product portfolios expand through digital monitoring platforms that improve fault detection. Firms invest in custom motor engineering to meet sector-specific demands across oil, gas, metals, and power generation. It benefits from strategic alliances that enhance technology upgrades and regional coverage. After-sales service networks strengthen customer retention. The market remains competitive due to wider adoption of automation and long-cycle industrial processes.

Recent Developments:

- In September 2025, ABB expanded its portfolio of IE5-efficiency synchronous reluctance (SynRM) motors by adding three smaller frame sizes (90, 100, 112), covering ratings from 0.75–450 kW. These motors can cut energy losses by up to 40% compared to IE3 motors, resulting in payback periods as short as five months. Over a 20-year period, a 90 kW SynRM motor could save €79,800 ($94,000) in energy costs and reduce CO₂ emissions by 95,760 kg. The new motors, with their extended power options and operating speeds of up to 3,600 rpm, are suitable for pump, fan, and compressor applications.

- In May 2025, ABB set a new world record for energy efficiency in large synchronous motors with its breakthrough TIE (Topclass IE) design initiative. This achievement is especially striking considering that the average efficiency for this class of synchronous motor typically lies between 98.2% and 98.5%. ABB’s TIE initiative tackles an overlooked gap in energy efficiency regulations for large-scale motors above 3 MW. While these machines represent only a small proportion of the global motor fleet, they are responsible for converting roughly 25% of all energy used in motion applications.

- In February 2025, TMEIC Corporation developed and started shipping a 6-pole large synchronous motor (Output: 48.4 MW), achieving a world-class efficiency of 99.0%. By enhancing the efficiency of large motors, which serve as the primary power sources in factories and plants, the motor contributes to energy savings, CO₂ emission reductions, and lower operating and maintenance costs. The first unit was shipped to a major industrial gas manufacturer in July 2024 and has been operating stably ever since. Using TMEIC’s proprietary 3D model for highly accurate analysis, efficiency was improved by 0.4 percentage points from the previous 98.6% through measures such as material and shape changes to reduce losses.

Report Coverage:

The research report offers an in-depth analysis based on Rated Power, Application, and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising industrial automation will boost adoption of precision-controlled synchronous drives.

• Power generation upgrades will increase demand for high-capacity motor systems.

• Mining expansion will push installation of large compressors supported by synchronous motors.

• Petrochemical growth will sustain demand for torque-stable and long-life motor designs.

• Digital monitoring will advance predictive maintenance across major facilities.

• Grid operators will integrate synchronous systems to strengthen stability programs.

• New manufacturing corridors will raise long-hour operational loads.

• Renewable energy integration will improve demand for auxiliary synchronous drives.

• Marine and water infrastructure upgrades will expand motor deployment.

• Strong modernization cycles will support replacement of aging industrial motor fleets.