Market Overview

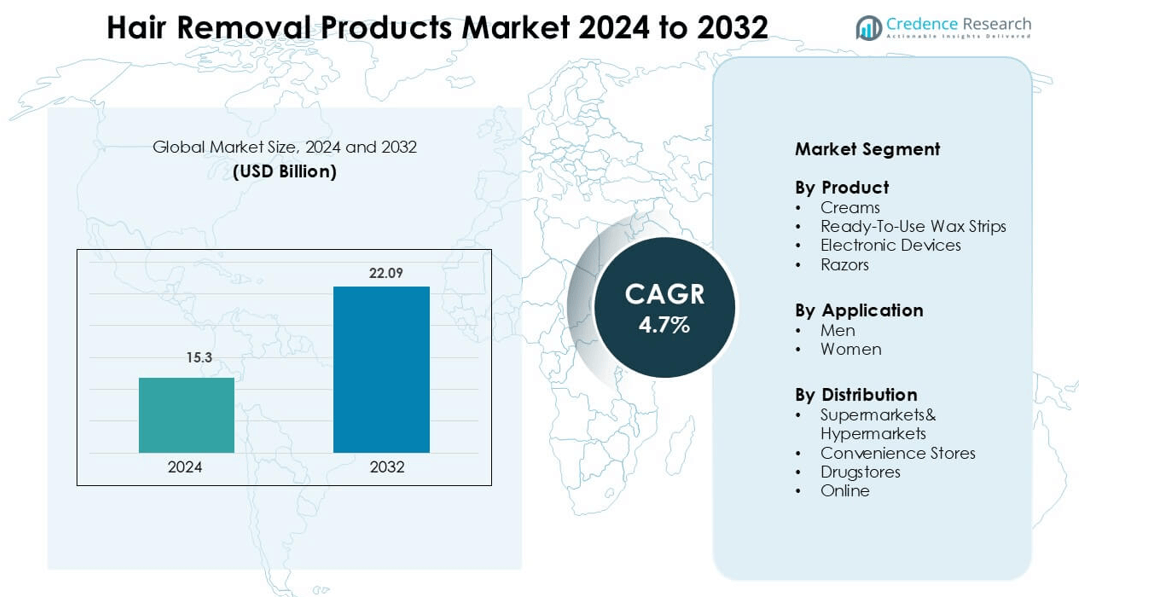

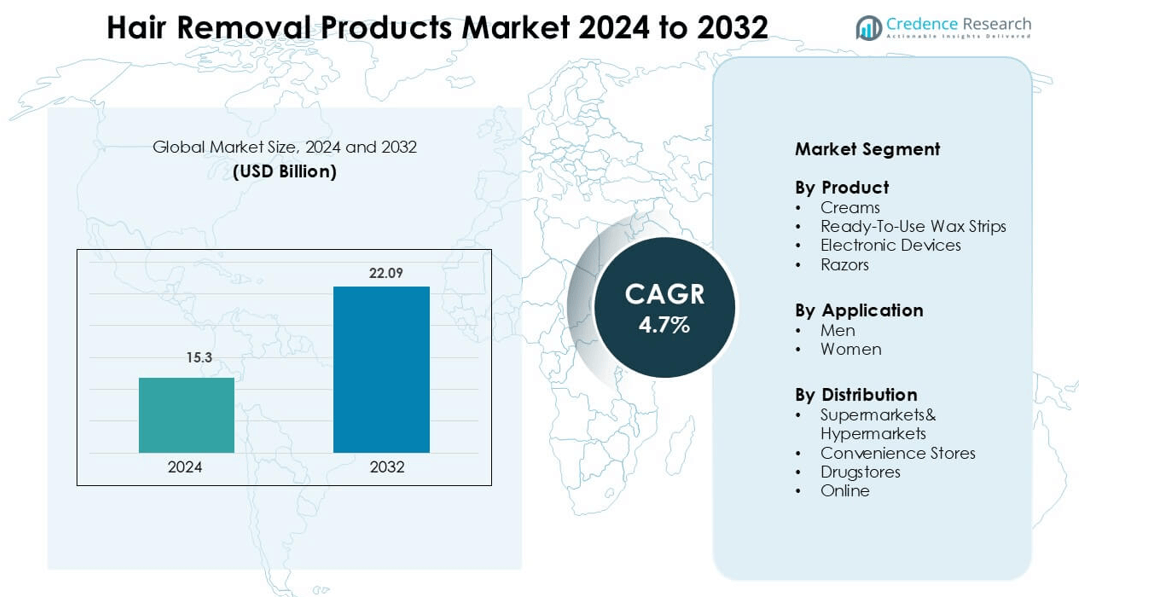

Hair Removal Products Market was valued at USD 15.3 billion in 2024 and is anticipated to reach USD 22.09 billion by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Removal Products Market Size 2024 |

USD 15.3 billion |

| Hair Removal Products Market, CAGR |

4.7% |

| Hair Removal Products Market Size 2032 |

USD 22.09 billion |

The Hair Removal Products Market includes major players such as Procter & Gamble, Philips Personal Care B.V., Reckitt Benckiser Group PLC, Church & Dwight Co., Inc., Emjoi Inc., Sally Hansen, SI&D (Aust) Pty Ltd, Helios Lifestyle Private Limited, Vijohnkart.com, and Revitol. These companies compete through sensitive-skin creams, ready-to-use wax strips, advanced razors, and rechargeable grooming devices. Many brands highlight natural ingredients, dermatologist-tested formulations, and reusable tools to increase customer loyalty. North America leads the global market with 36% share, driven by strong retail presence, high grooming awareness, and rapid adoption of premium and at-home hair removal solutions.

Market Insights

- The Hair Removal Products Market is valued at USD 15.3 billion in 2024 and is set to reach USD 22.09 billion by 2032, growing at a 4.7 % CAGR during the forecast period.

- Rising preference for at-home grooming solutions drives demand for creams, ready-to-use wax strips, razors, and compact electronic devices that offer fast and affordable results.

- Product innovation remains strong, with brands launching sensitive-skin formulas, natural ingredients, moisturizing wax blends, and rechargeable devices that ensure smoother and longer-lasting outcomes.

- The market is competitive, with global and regional players focusing on packaging, price differentiation, dermatologically tested options, and online promotions, while substitutes like salon waxing and laser treatments pose a restraint.

- North America leads with 36% market share due to strong retail presence and high grooming spending, while creams hold the dominant product segment share, supported by easy use, low cost, and growing adoption among both women and an expanding male customer base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Creams, ready-to-use wax strips, electronic devices, and razors form the key categories. Creams hold the largest share due to easy use, quick results, and low cost. Demand rises in urban areas where consumers prefer painless options and chemical formulations that suit sensitive skin. Advertising and frequent product launches support wider reach. Ready-to-use strips grow as users want longer-lasting outcomes at home. Electronic devices also gain attention because of reusable features, yet high price limits mass use. Razors remain common among budget users, but shifting interest toward smoother, irritation-free results keeps creams in the leading position.

- For instance, Veet, marketed by Reckitt Benckiser Group PLC, sells ready-to-use wax strips tested for precision hair pull-out lengths of 1.5 mm or lower, allowing cleaner results on short hair according to brand guidelines.

By Application

Women dominate the market as they account for the highest consumption of hair removal creams, wax strips, and razors across regular grooming routines. Frequent use, preference for smoother skin, and rising beauty awareness support their leading share. Social media influence and personal care trends further boost product uptake. Men show steady growth due to expanding grooming habits and rising sales of electronic trimmers and razors. Brands introduce sensitive-skin creams and faster hair removal options tailored for male users. However, women continue to lead because of broader product acceptance and higher repeat purchases.

- For instance, Emjoi markets the Emjoi eRase e60 epilator with 60 tweezer heads documented to remove hair as short as 0.3 mm, a feature widely promoted for women seeking smoother results.

By Distribution Channel

Supermarkets and hypermarkets lead the segment as consumers prefer in-store buying, instant product access, and availability of multiple brands in one place. Promotions, trial packs, and visibility on shelves drive higher sales for creams and wax strips. Drugstores also attract users seeking dermatology-backed labels and expert recommendations. Convenience stores offer quick restocking for razors and small packs. Online channels grow fastest as buyers look for privacy, discounts, subscription packs, and wider brand availability. Despite this growth, supermarkets and hypermarkets dominate due to strong retail presence and trusted product selection.

Key Growth Drivers

Growing Preference for At-Home Grooming Solutions

The Hair Removal Products Market benefits from strong demand for convenient, at-home grooming solutions. Busy lifestyles and higher self-care awareness push consumers to choose creams, ready-to-use wax strips, razors, and small electronic tools instead of salon visits. These products save time, reduce long-term grooming cost, and provide privacy to users who prefer personal care at home. Manufacturers promote smooth-skin outcomes, painless formulas, and fast application to increase adoption. Subscription kits, combo packs, and dermatologically tested variants also improve repeat purchases. The rise of e-commerce and doorstep delivery strengthens access to both premium and budget products, encouraging wider consumption across age groups and income levels.

- For instance, In May 2017, Gillette launched “Gillette on Demand,” an on-demand razor and blade replenishment service in the U.S.

Strong Pace of Product Innovation and Skin-Safe Formulations

Product innovation acts as a key growth driver because users prioritize safety and comfort while removing hair. Companies invest in gentle chemicals, sensitive-skin creams, and peel-off wax strips that reduce redness or irritation. Electronic devices now include precision tips, rechargeable units, and multi-use attachments, making them suitable for various body areas. Brands also produce paraben-free and dermatology-certified options to gain trust. Clear packaging, ingredient transparency, and skin-type targeting further improve acceptance. This focus on new technology and safe ingredients expands the consumer base and shifts users away from traditional shaving toward more effective alternatives that promise smoother and longer-lasting results.

- For instance, Veet Pure line depilatory creams are listed as free from parabens, dyes, and mineral oils, with formulas tested for sensitive skin on company product labels.

Rising Grooming Demand Among Men

Men form a growing customer group in the Hair Removal Products Market as personal care routines become more common. Beard shaping, body grooming, and hygiene-focused shaving influence demand for razors, trimmers, hair removal creams, and waxing strips. Sports culture, gym-focused lifestyles, and media influence also increase use across younger consumers. Brands market quick-acting, non-irritating formulas with stronger fragrances to suit male users. Barbers and salons encourage retail purchases of grooming products for home use. As acceptance grows in urban areas, companies launch gender-specific marketing campaigns and dedicated product lines, supporting a steady rise in male grooming adoption.

Key Trends and Opportunities

Shift Toward Skin-Friendly and Organic Ingredients

A major trend in the Hair Removal Products Market is the transition to organic, natural, and sensitive-skin formulations. Consumers want safer ingredients, especially those who experience rash, redness, or ingrown hair from harsh chemical options. Brands introduce aloe vera, chamomile, shea butter, and toxin-free formulas to target concerned users. Wax strips and creams now focus on moisturizing effects and post-care results. Clean-label marketing and dermatologist approvals help build trust. This trend opens opportunities for premium pricing and loyal customer groups that value wellness-linked personal care.

- For instance, Sally Hansen Hair Remover Wax Strip Kit lists vitamin E and after-use Azulene Oil or finishing wipes extract in moisturizing agents on its packaging.

Rapid Adoption of Online Retail and Subscription Services

Online platforms create strong opportunities, as users compare reviews, explore niche brands, and buy products discreetly. Digital discounts, seasonal deals, and doorstep delivery increase purchasing frequency. Subscription services allow regular restocking of razors, strips, and creams, supporting long-term customer retention. Social media influencers, grooming tutorials, and product trials further raise awareness. As digital payment and logistics improve, small brands scale faster and reach markets where retail distribution is limited.

- For instance, Gillette’s shave subscription service in the United States surpassed 100,000 active members according to Procter & Gamble disclosures, providing scheduled blade replenishment.

Key Challenges

High Risk of Skin Sensitivity and Product Reactions

The market faces challenges due to potential side effects linked with certain creams, wax strips, and electronic tools. Skin irritation, allergy, burns, and redness discourage repeat use among sensitive users. Negative experiences lead some consumers back to shaving or professional salon treatments. Companies must test products rigorously, offer hypoallergenic formulas, and provide clear usage guidelines to reduce safety concerns. Regulatory approvals and dermatologist certifications become essential to building trust. Despite efforts, the perception of risk remains a key barrier in attracting new users.

Presence of Strong Substitutes and Salon-Based Services

At-home hair removal products compete directly with salon waxing, laser treatments, and professional grooming services that promise longer-lasting results. Growing interest in laser hair reduction shifts some consumers away from frequent purchase of creams and strips. Professional services also appeal to users who want expert handling and are willing to pay more. To compete, brands must highlight convenience, affordability, and improved results from advanced formulas and devices. While demand remains strong, long-term growth relies on continuous innovation to retain users against improving salon technologies.

Regional Analysis

North America

North America holds the largest share of the Hair Removal Products Market, accounting for nearly 36% of total revenue. Consumers prefer creams, razors, and ready-to-use wax strips for fast at-home grooming. Premium brands promote sensitive-skin formulas, refillable razors, and subscription packs that increase repeat purchases. Strong retail networks across supermarkets, drugstores, and online channels improve product availability. Beauty influencers and rising male grooming trends support steady demand. High awareness of skincare and quick adoption of new products keep North America in the leading position.

Europe

Europe represents roughly 28% of the market share, driven by strong demand for high-quality and skin-safe products. Users prefer wax strips and creams that offer longer-lasting and irritation-free results. Strict cosmetic regulations encourage safer, certified formulations, increasing trust in branded products. Sustainable packaging, organic ingredients, and dermatologist-approved labels attract premium buyers. Well-developed supermarket chains and fast-growing e-commerce channels support product reach. Growing acceptance of male grooming further drives adoption, helping Europe maintain a strong market position.

Asia-Pacific

Asia-Pacific holds nearly 24% of the global share and shows the fastest growth rate among regions. Rising urban populations, improved income levels, and social media influence encourage frequent grooming habits. Affordable razors and depilatory creams lead sales, while electronic devices gain interest in urban areas. India, China, Japan, and South Korea contribute the largest volumes due to high young consumer populations. Online marketplaces offer discounts, brand variety, and doorstep delivery, which increase product penetration. As awareness rises, Asia-Pacific continues to capture a growing share each year.

Latin America

Latin America accounts for about 7% of the market share. Brazil and Mexico drive demand, supported by strong grooming culture and frequent use of wax strips and razors. Budget-friendly products dominate, while premium creams appeal to customers seeking smoother and irritation-free results. Salons influence brand choices, and many consumers buy products recommended by professionals. Growth in online shopping improves access to international brands. Despite price sensitivity, stable beauty spending and rising urban populations support consistent market demand.

Middle East & Africa

The Middle East & Africa region holds close to 5% of the market share. Rising beauty consciousness among women and higher availability of branded products drive demand. Climate conditions push consumers to prefer skin-friendly creams and soothing wax formulas. Urban shoppers often purchase through supermarkets and pharmacies, while online platforms attract younger users. Grooming interest among men also increases razor and trimmer usage. Although premium adoption remains limited due to price constraints, gradual retail expansion supports steady growth potential.

Market Segmentations:

By Product

- Creams

- Ready-To-Use Wax Strips

- Electronic Devices

- Razors

By Application

By Distribution

- Supermarkets& Hypermarkets

- Convenience Stores

- Drugstores

- Online

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hair Removal Products Market features a mix of multinational corporations, regional manufacturers, and fast-growing direct-to-consumer brands. Companies invest in product innovation, dermatologist-tested ingredients, and sensitive-skin formulations to strengthen customer trust. Creams and wax strips remain highly competitive, with brands focusing on pain-free application, moisturizing elements, and long-lasting smoothness. Razor manufacturers push reusable handles, eco-friendly blades, and subscription models that increase repeat sales. Electronic hair removal devices gain ground through rechargeable units and multi-area attachments. Marketing on social media, endorsements, and influencer campaigns raise visibility among younger buyers. E-commerce platforms allow smaller brands to expand quickly with trial packs and value bundles. Major players also compete on packaging, fragrance, natural ingredients, and after-care benefits. As men adopt grooming routines, companies launch dedicated product lines with faster action and strong fragrances. Continuous innovation, pricing competition, and digital marketing define the current industry rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Procter & Gamble

- SI&D (Aust) Pty Ltd

- Philips Personal Care B.V.

- Sally Hansen

- Helios Lifestyle Private Limited.

- Church & Dwight Co., Inc.

- com

- Emjoi, Inc.

- Reckitt Benckiser Group PLC

- Revitol

Recent Developments

- In October 2025, Philips Personal Care B.V. launched OneBlade Intimate in India, a unisex device for sensitive areas. Philips positions it for Gen Z, citing high intimate-grooming adoption. Early testing showed strong intent to switch.

- In March 2025, Procter & Gamble (Gillette Venus): Rolled out upgrades across the Venus lineup and partnered with the WTA. The push highlights shave, trim, and style options for diverse needs. Campaign features pro tennis athletes.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for at-home hair removal products will increase as users seek privacy and convenience.

- Sensitive-skin and chemical-free formulations will gain higher customer acceptance.

- Electronic grooming devices will see rising adoption due to reusable and long-lasting performance.

- Subscription razor and wax refill models will improve brand loyalty and repeat purchases.

- Male grooming products will expand as more men adopt regular body and facial hair care.

- Online sales will grow faster than retail stores because of discounts, reviews, and wider product choices.

- Organic and eco-friendly packaging will attract buyers focused on sustainability.

- Brands will focus on multi-benefit creams and wax strips that reduce irritation and offer smoother results.

- Regional brands will compete strongly with global players through price-friendly products.

- Innovation in post-care products such as soothing gels and anti-ingrown solutions will strengthen overall sales