Market Overview

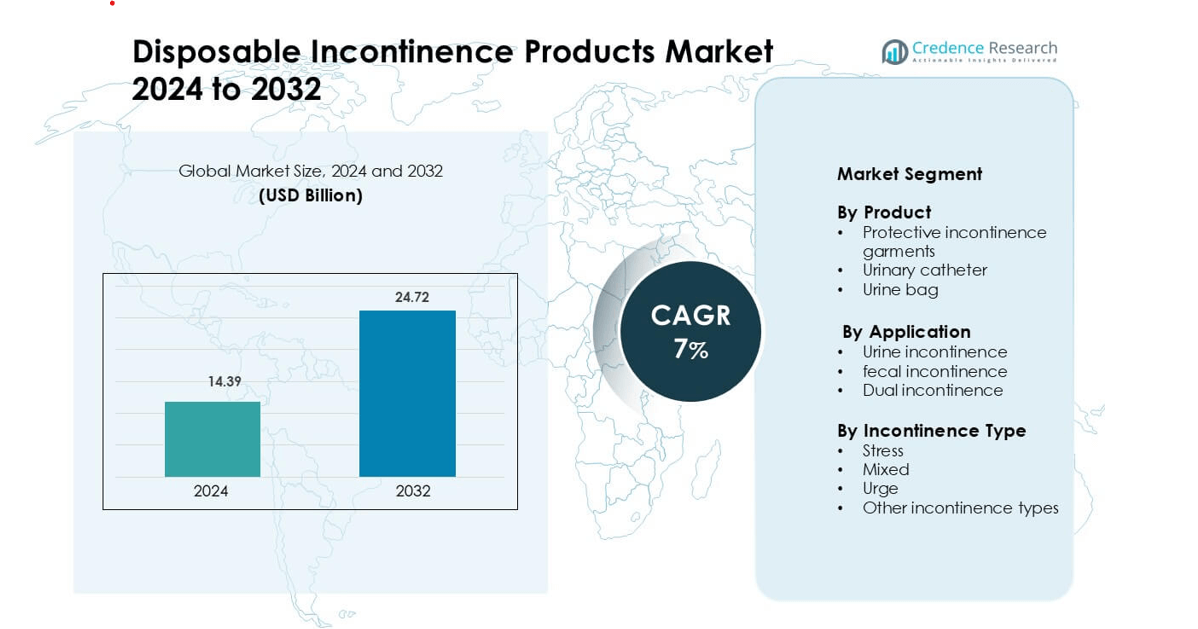

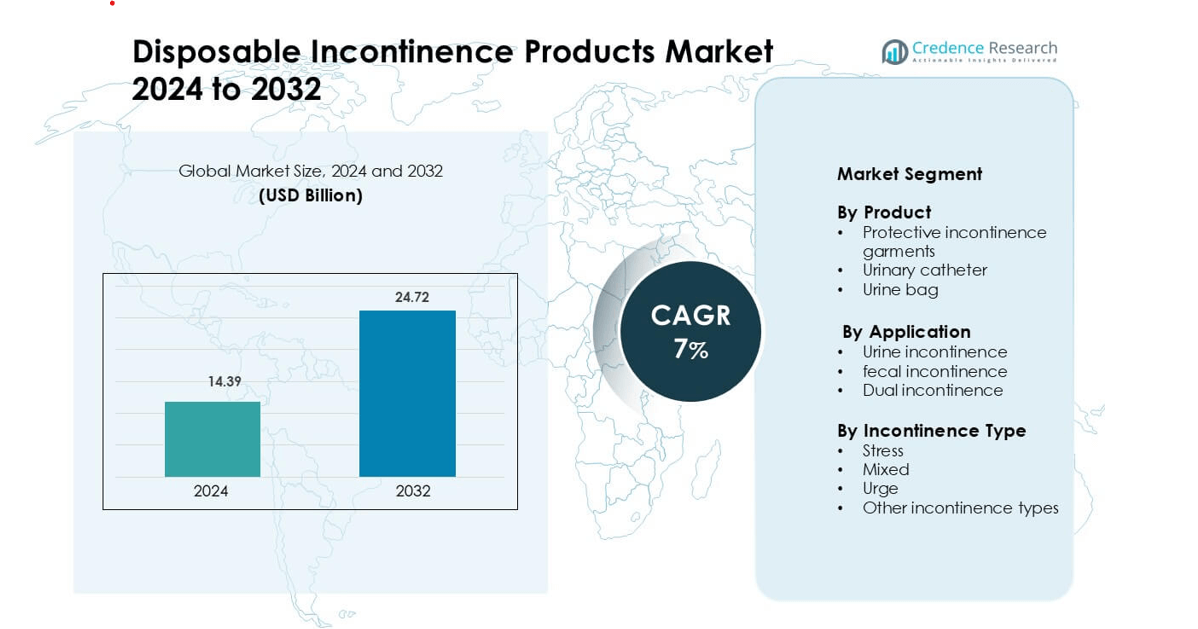

Disposable Incontinence Products Market was valued at USD 14.39 billion in 2024 and is anticipated to reach USD 24.72 billion by 2032, growing at a CAGR of 7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Incontinence Products Market Size 2024 |

USD 14.39 billion |

| Disposable Incontinence Products Market, CAGR |

7% |

| Disposable Incontinence Products Market Size 2032 |

USD 24.72 billion |

Major participants in the Disposable Incontinence Products Market include FUBURG, BD, Hollister, Attends, B Braun, Cardinal Health, ABENA, Essity, Coloplast, and ConvaTec. These companies focus on high-absorbency cores, breathable fabrics, odor-control layers, and skin-friendly materials to support long wear and reduce irritation. Product portfolios span adult diapers, pads, liners, and pull-up underwear used in hospitals, nursing homes, and home-care settings. North America leads the market with 37% share, driven by a large aging population, strong insurance reimbursement, and wide availability of premium incontinence solutions through retail, pharmacies, and e-commerce channels.

Market Insights

- The Disposable Incontinence Products Market reached USD 14.39 billion in 2024 and is projected to grow at a 7% CAGR during the forecast period.

- Demand increases as hospitals and home-care providers use high-absorbency diapers and pads for aging patients and post-surgery care; adult diapers remain the largest segment with 46% share due to strong adoption in elderly care.

- Trends include breathable fabrics, odor-neutralizing technology, gender-specific designs, and biodegradable product lines to improve comfort and sustainability.

- Competition grows as FUBURG, Essity, Hollister, B Braun, CardinalHealth, Coloplast, and ConvaTec expand product portfolios and partner with pharmacies and online retailers for wider distribution.

- North America leads the market with 37% share, supported by advanced healthcare infrastructure and strong insurance coverage, while Europe and Asia Pacific show rapid growth due to rising geriatric populations and expanding home-care usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Protective incontinence garments hold the dominant position with 46% share, driven by strong adoption in elder care, post-surgery recovery, and home-care settings. These products offer high absorption, odor control, and skin-safe materials, making them suitable for long wear. Hospitals and long-term care facilities use pull-ups, adult diapers, and pads to reduce bedding changes and improve hygiene. Urinary catheters and urine bags follow, supporting patients with mobility issues or surgical recovery needs. As aging populations rise, demand for discreet, comfortable garments continues to drive the product segment forward.

- For instance, Essity’s TENA ProSkin line integrates ConfioAir breathable technology and super-absorbent polymers, proven through clinical studies to reduce skin irritation and maintain normal skin pH.

By Application

Urine incontinence leads this segment with 67% share, supported by a large patient base tied to aging, childbirth complications, chronic diseases, and mobility limitations. Hospitals and caregivers rely on disposable diapers, pads, and liners to prevent leakage and maintain hygiene. Fecal incontinence products are used in long-term care and severe gastrointestinal disorders, while dual incontinence solutions support bedridden and post-stroke patients. Growing awareness, improved product design, and better comfort features strengthen the dominance of urine incontinence applications.

- For instance, Essity’s TENA Slip Maxi offers documented absorption capacity exceeding 2,000 milliliters, verified through ISO standard absorbency tests, ensuring leakage protection for extended wear.

By Incontinence Type

Stress incontinence dominates with 41% share, driven by high prevalence among elderly women, post-menopausal patients, and individuals with weakened pelvic muscles. Protective garments and pads remain the preferred choice due to their comfort, discreet fit, and effective absorption. Urge incontinence follows, supported by demand from patients with neurological or bladder control issues. Mixed incontinence solutions serve users with combined symptoms, while other types remain niche. Rising awareness, improved product materials, and the shift toward home-based care support continued growth in stress incontinence products.

Key Growth Drivers

Rising Geriatric Population and Home-Care Adoption

The global rise in elderly populations drives sustained demand for disposable incontinence products. Age-related bladder weakness, dementia, reduced mobility, and post-surgery recovery make adult diapers, pads, and pull-ups essential in long-term care. Families increasingly prefer home-care over institutional treatment, boosting sales through pharmacies and online channels. Products with breathable layers, odor control, and skin-friendly materials reduce rashes and improve comfort during extended wear. Hospitals and nursing homes rely on protective garments to improve hygiene, reduce linen changes, and protect patients with limited mobility. As life expectancy increases and chronic diseases rise, adoption continues to accelerate across both developed and emerging markets.

- For instance, Cardinal Health serves more than 100,000 locations and provides medical products to over 75% of hospitals in the United States.

Expansion of Healthcare Infrastructure and Post-Surgical Use

Improved hospital capacity and investments in nursing homes, rehabilitation centers, and assisted living facilities strengthen market growth. Patients recovering from prostate surgery, childbirth complications, or urological disorders rely on disposable incontinence pads and garments. Healthcare providers choose high-absorbency, leak-proof solutions to maintain hygiene and prevent skin infections. Catheters and urine bags support bedridden patients and critical care units. Insurance reimbursement in developed countries further boosts adoption. Growth in outpatient surgeries and minimal-invasive procedures extends demand, as many patients require temporary incontinence support during recovery.

- For instance, more than 100 million urinary catheters, including Foley catheters, are sold or used globally each year. This is a well-established statistic in medical literature.

Product Innovation and Comfort-Focused Design

Manufacturers compete through innovations that improve comfort, discretion, and skin protection. Super-absorbent polymers, odor-lock barriers, and moisture-wicking surfaces reduce irritation and leakage. Gender-specific designs, body-fit shaping, and ultra-thin products help users maintain confidence during daily activities. Biodegradable and reduced-plastic variants respond to sustainability expectations. Subscription models and discreet delivery services make purchasing easier for home-care users. As awareness increases and stigma declines, premium incontinence products gain market share among active adults seeking comfortable, long-wear solutions.

Key Trends & Opportunities

Sustainable and Eco-Friendly Product Development

Environmental concerns push manufacturers to reduce plastic content and improve biodegradability. Companies invest in recyclable packaging, organic top sheets, and reusable components while maintaining absorbency and strength. Healthcare facilities show growing interest in eco-certified supplies for hygiene compliance. This trend also boosts demand for premium products among users looking for skin-safe, chemical-free alternatives. Brands offering greener solutions gain a competitive advantage and stronger consumer loyalty.

- For instance, ABENA’s Abri-Flex and Abri-San Premium products are produced using FSC-certified pulp and carry the Nordic Swan Ecolabel, with documented reductions in energy and water consumption during manufacturing.

Growth of E-Commerce, Subscription Services, and Discreet Delivery

Digital platforms make purchasing easier for users who prefer privacy and home delivery. Subscription models ensure regular restocking of pads, liners, and diapers without pharmacy visits. Online reviews and comparison tools help customers find products with better fit, odor control, and absorbency. As mobile shopping expands in emerging markets, companies partner with e-commerce and medical supply platforms to serve a wider customer base.

- For instance, Coloplast is a global company that develops medical devices and services for intimate healthcare needs (ostomy, continence, etc.). Its products currently help over 2 million people around the world in total.

Key Challenges

Skin Irritation, Disposal Issues, and Environmental Concerns

Although products are more advanced, long-term use can cause rashes, dermatitis, or discomfort if not designed with breathable and skin-safe materials. High usage also creates large volumes of non-biodegradable waste, raising environmental concerns for households and healthcare facilities. Regulations on waste management may increase costs for producers and buyers. These challenges push manufacturers to balance performance with sustainability and dermatological safety.

Stigma, Limited Awareness, and Price Sensitivity in Developing Regions

Social stigma prevents many patients from seeking incontinence support, especially in emerging markets. Limited awareness, low reimbursement, and high product cost restrict adoption. Hospitals often prioritize basic hygiene supplies over premium solutions. Manufacturers must invest in education, affordable product ranges, and clinical endorsements to expand adoption. Overcoming these barriers is essential to unlock long-term growth in underpenetrated regions.

Regional Analysis

North America

North America holds 37% share, supported by advanced healthcare infrastructure, strong insurance reimbursement, and high awareness of incontinence management. The U.S. leads due to large geriatric populations, wide retail availability, and strong home-care adoption. Hospitals and nursing homes demand high-absorbency diapers, pads, and pull-ups to maintain hygiene and reduce linen changes. Manufacturers focus on breathable fabrics, odor-control layers, and dermatologically tested products for long wear. E-commerce and subscription services further strengthen adoption among home users. Growing chronic diseases and post-surgical recovery cases continue to push steady demand across the region.

Europe

Europe accounts for 31% share, led by Germany, the U.K., and France, where elderly care programs and well-established reimbursement policies support product usage. Nursing homes and assisted-living centers rely on high-absorbency solutions for long-term patients. Sustainability expectations drive demand for biodegradable pads and reduced-plastic packaging. Strong presence of hygiene product manufacturers enables wide product availability. Awareness campaigns and government support improve early diagnosis and treatment of incontinence. Rising preference for discreet, comfortable products encourages growth in premium disposable segments.

Asia Pacific

Asia Pacific holds 23% share and remains the fastest-growing region due to large aging populations, expanding healthcare access, and rising home-care spending. Japan leads adoption with strong demand for adult diapers and pull-ups, while China and India show rapid growth as awareness improves. Local and global brands expand retail and online distribution to reach urban and rural users. Hospitals adopt disposable incontinence products to reduce infection risk and maintain hygiene. Increasing chronic illnesses and mobility-related disorders further support market momentum.

Latin America

Latin America captures 6% share, driven by expanding healthcare systems in Brazil, Mexico, and Argentina. Rising cases of diabetes, obesity, and post-surgical recovery create higher demand for adult diapers and pads. Pharmacy chains and online platforms help improve product availability. Cost sensitivity remains a barrier to premium options, but awareness campaigns gradually improve acceptance. Growth in private hospitals and elderly-care services is expected to support long-term adoption.

Middle East & Africa

Middle East & Africa hold 3% share, supported by increasing use in hospitals, maternal care, and chronic disease treatment. GCC nations show higher adoption due to better healthcare spending and import of premium incontinence products. Africa remains a developing market where limited awareness and affordability challenges restrict usage. However, urbanization, rising life expectancy, and expansion of retail pharmacies are improving market accessibility. Over time, improved healthcare infrastructure and home-care services will drive gradual growth across the region.

Market Segmentations:

By Product

- Protective incontinence garments

- Urinary catheter

- Urine bag

By Application

- Urine incontinence

- Fecal incontinence

- Dual incontinence

By Incontinence Type

- Stress

- Mixed

- Urge

- Other incontinence types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Disposable Incontinence Products Market includes global healthcare brands and specialized hygiene manufacturers focused on high-absorbency, skin-safe, and discreet products. Companies such as FUBURG, BD, Hollister, Attends, B Braun, CardinalHealth, ABENA, Essity, Coloplast, and ConvaTec compete through innovation in fluid-locking polymers, breathable materials, and odor-control technology. Product lines span adult diapers, pads, liners, and protective underwear designed for hospitals, long-term care centers, and home-care users. Firms invest in ergonomic designs, dermatologically tested surfaces, and gender-specific fits to increase comfort and leakage protection. Sustainability also reshapes competition, as manufacturers introduce biodegradable fabrics and reduced-plastic packaging. Growing partnerships with pharmacies, online retailers, and healthcare providers support wider product access and subscription-based purchasing models. As aging populations rise and home-care adoption expands, companies with strong distribution networks and clinically validated products gain a competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FUBURG

- BD

- Hollister

- Attends

- B Braun

- CardinalHealth

- ABENA

- essity

- Coloplast

- ConvaTec

Recent Developments

- In 2024, Hollister Named a new CEO overseeing portfolios including Continence Care. Signals leadership focus across continence product lines.

- In March 2024, BD: DME MACs revised PureWick coding and billing guidance. Crosswalked the system from HCPCS K1006 to E2001 effective Jan 1, 2024.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Incontinence Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as aging populations and home-care services expand worldwide.

- Product innovation will focus on thinner, breathable, and skin-friendly designs for long wear.

- Sustainable and biodegradable incontinence products will gain stronger market preference.

- E-commerce and subscription models will drive recurring sales and discreet purchasing.

- Hospitals and nursing homes will continue shifting from reusable to disposable hygiene solutions.

- Growth in minimally invasive surgeries will increase short-term incontinence product usage.

- Premium products with odor control, fast absorption, and leak barriers will gain market share.

- Manufacturers will invest in gender-specific and body-contoured designs for better comfort.

- Awareness campaigns will reduce stigma and encourage more users to seek medical support.

- Asia Pacific will remain the fastest-growing region with rising healthcare access and elderly care.