Market Overview:

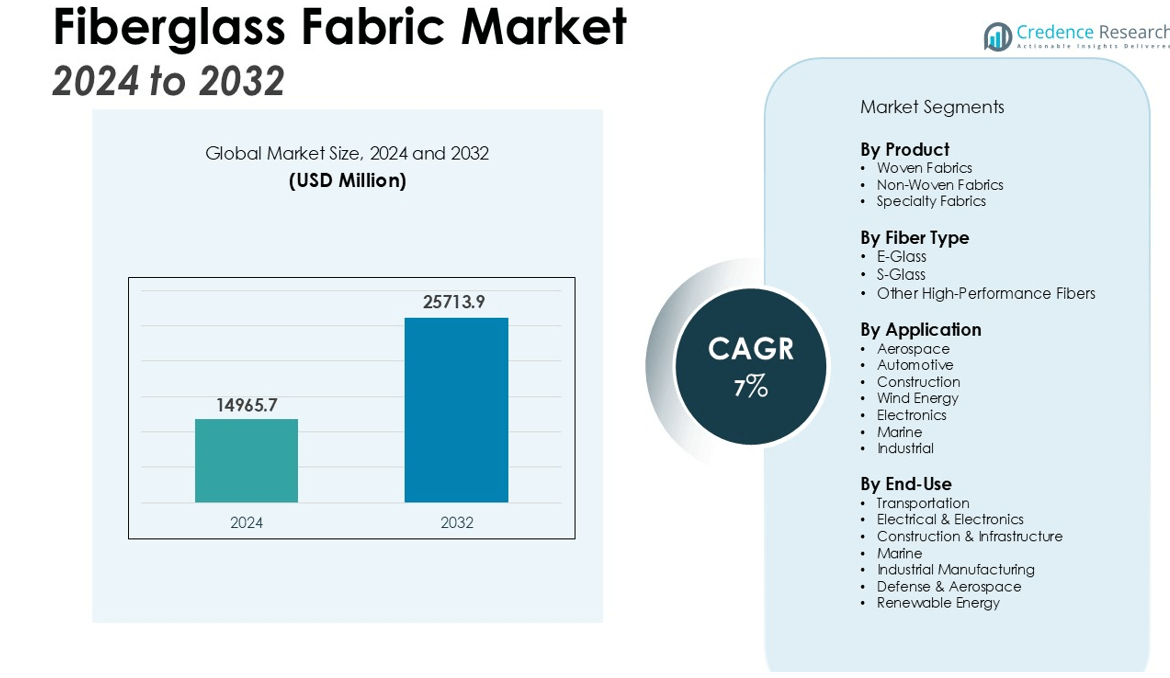

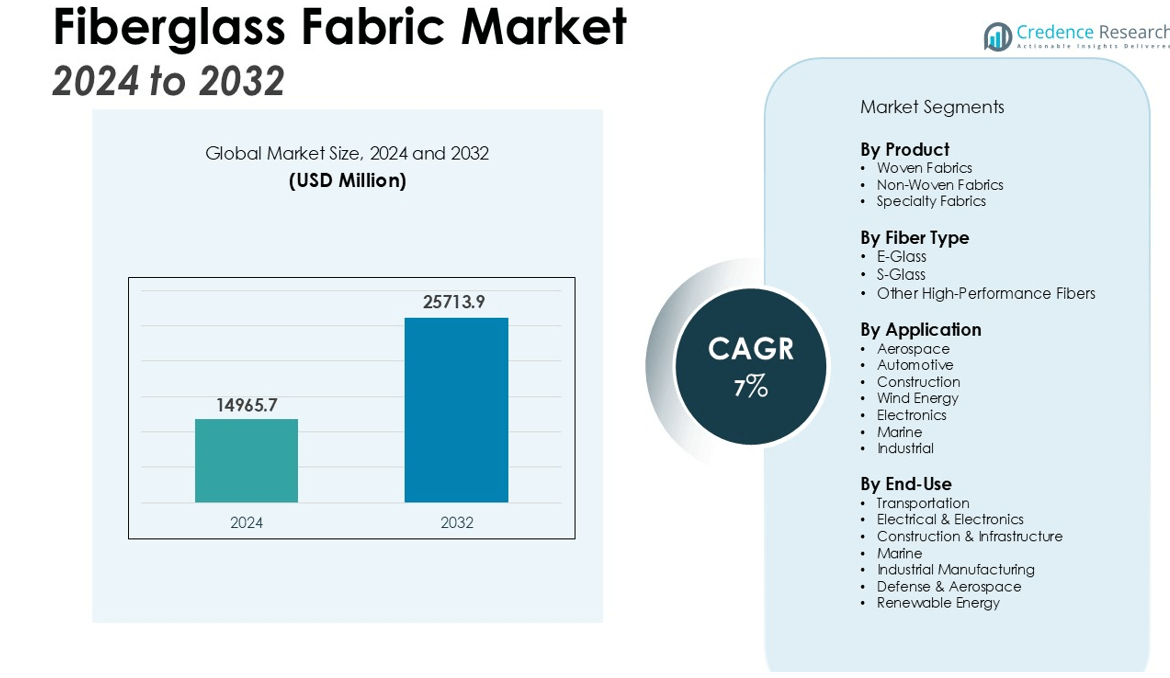

The Fiberglass Fabric Market size was valued at USD 14965.7 million in 2024 and is anticipated to reach USD 25713.9 million by 2032, at a CAGR of 7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiberglass Fabric Market Size 2024 |

USD 14965.7 million |

| Fiberglass Fabric Market, CAGR |

7% |

| Fiberglass Fabric Market Size 2032 |

USD 25713.9 million |

Key drivers shaping market growth include the rising demand for lightweight and high-performance materials to improve fuel efficiency and reduce emissions in the transportation sector. The expanding use of fiberglass fabrics in wind energy applications for blade manufacturing is further propelling market demand. Additionally, the surge in infrastructure projects and the need for durable, fire-resistant, and cost-effective reinforcement materials in construction are boosting adoption rates globally. The increasing integration of fiberglass fabrics in electronics for insulation and circuit board reinforcement is also contributing to sustained market expansion.

Regionally, Asia-Pacific dominates the Fiberglass Fabric Market due to rapid industrialization, strong manufacturing capabilities, and growing investments in renewable energy and infrastructure. North America follows, driven by aerospace and defense applications, while Europe maintains steady demand supported by automotive innovation and stringent environmental regulations promoting lightweight composite materials.

Market Insights:

- The Fiberglass Fabric Market was valued at USD 14,965.7 million and is expected to reach USD 25,713.9 million, growing at a CAGR of 7%, supported by expanding demand in transportation, construction, and renewable energy sectors.

- Rising adoption of lightweight and high-strength materials is driving market expansion, with automotive, aerospace, and marine industries prioritizing performance, fuel efficiency, and emission reduction.

- Wind energy applications, particularly in turbine blade manufacturing, are a major growth contributor due to the material’s fatigue resistance, dimensional stability, and strength under extreme conditions.

- Construction sector demand is increasing due to the product’s fire resistance, corrosion protection, and reinforcement capabilities, enabling its use in concrete strengthening, roofing, and insulation.

- Electronics and industrial sectors are boosting consumption, with applications in insulation, printed circuit boards, heat-resistant components, filtration, and sealing solutions.

- Asia-Pacific leads with 46% share, driven by manufacturing capacity, infrastructure growth, and renewable energy investments, followed by North America at 28% and Europe at 20%.

- Market challenges include high production costs, raw material price volatility, technical limitations, and environmental concerns, prompting manufacturers to invest in innovation and process optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Lightweight and High-Strength Materials

The Fiberglass Fabric Market is experiencing strong demand due to the need for materials that combine high strength with low weight. Industries such as automotive, aerospace, and marine are increasingly adopting fiberglass fabrics to improve fuel efficiency and enhance structural performance. It offers an optimal balance of durability, flexibility, and cost-effectiveness, making it suitable for both performance-critical and commercial applications. This demand is further reinforced by the shift toward energy-efficient and sustainable production in manufacturing sectors.

- For instance, Raven Aerostar’s payload recovery parachute holds the record for the heaviest payload recovered from a stratospheric balloon flight, successfully managing a weight of 8,000 pounds.

Expansion of Renewable Energy Applications

Wind energy is a significant driver for the Fiberglass Fabric Market, with turbine blade manufacturing requiring high-performance reinforcement materials. It provides the necessary strength, fatigue resistance, and dimensional stability to withstand extreme operating conditions. The global shift toward clean energy and government incentives for renewable power projects are encouraging large-scale adoption. Manufacturers are focusing on advanced weaving techniques to optimize performance for wind applications, supporting market growth.

Increasing Use in Infrastructure and Construction Projects

The construction sector is boosting demand for fiberglass fabrics due to their fire resistance, corrosion protection, and reinforcement properties. It is widely used in concrete strengthening, roofing, and insulation applications where long-term performance is essential. Ongoing urban development projects and the need for cost-effective yet durable materials are driving market penetration. The product’s compatibility with modern architectural designs adds further value to infrastructure applications.

- For instance, to meet the extensive demand from infrastructure and other sectors, leading manufacturer China Jushi Co., Ltd. operates with a production capacity of 2 million tons of fiberglass.

Growing Adoption in Electronics and Industrial Applications

The electronics industry is expanding its use of fiberglass fabrics for insulation, printed circuit board reinforcement, and heat-resistant components. It delivers consistent performance in high-temperature environments, ensuring product reliability in critical systems. Industrial applications, including filtration, sealing, and protective coverings, are also increasing demand. The versatility of fiberglass fabrics allows manufacturers to cater to diverse industry requirements while maintaining high performance standards.

Market Trends:

Technological Advancements in Fabric Manufacturing and Product Innovation

The Fiberglass Fabric Market is benefiting from advancements in weaving technology, resin compatibility, and surface treatment processes. Manufacturers are developing high-performance fabrics with improved tensile strength, heat resistance, and flexibility to meet diverse industrial demands. It is increasingly being tailored for application-specific requirements, such as aerospace-grade composites or corrosion-resistant marine products. The integration of hybrid materials, combining fiberglass with carbon or aramid fibers, is enhancing mechanical properties while maintaining cost efficiency. Automation in production lines is improving consistency, reducing defects, and enabling faster delivery schedules. These innovations are helping the market address stringent performance standards across automotive, wind energy, and defense sectors.

- For instance, Saint-Gobain has developed Tygon® XLCOMP 60 IB tubing, a product for resin transfer in composites manufacturing that is engineered to withstand high temperatures up to 200°C.

Sustainability Focus and Expanding End-Use Applications

Environmental regulations and the shift toward eco-friendly materials are influencing the adoption of fiberglass fabrics across industries. It is gaining traction in renewable energy infrastructure, green building projects, and recyclable composite manufacturing. The construction sector is integrating fiberglass fabrics into sustainable architecture for improved insulation and energy efficiency. In electronics, the material is finding increased use in high-frequency circuit boards and thermal management solutions. Growing investment in marine and offshore applications is creating opportunities for enhanced water-resistant and lightweight fabrics. The expansion of its application scope across both traditional and emerging industries is reinforcing long-term market potential.

- For instance, Isodan Engineering’s mobile recycling plant, now operational at Greater Renewable of Iowa, can process up to 20,000 pounds of end-of-life fiberglass wind blades per shift.

Market Challenges Analysis:

High Production Costs and Raw Material Price Volatility

The Fiberglass Fabric Market faces challenges from fluctuating prices of raw materials such as silica sand and specialty resins. It requires energy-intensive manufacturing processes, which increase production costs, particularly in regions with high energy tariffs. Currency fluctuations and supply chain disruptions further impact pricing stability. Manufacturers must balance cost control with maintaining product quality and performance standards. Competitive pressure from alternative materials, including carbon fiber and advanced polymers, intensifies cost-related challenges. This dynamic compels industry players to focus on process optimization and sourcing strategies.

Technical Limitations and Environmental Concerns

Certain technical limitations, such as reduced impact resistance compared to other composites, restrict its use in specific high-stress applications. It can also face degradation under prolonged UV exposure without proper protective coatings. Environmental concerns over non-biodegradability and disposal issues are prompting stricter regulations, influencing production and waste management practices. Meeting evolving safety and environmental standards requires investment in research and product innovation. Handling challenges, including dust generation during processing, create additional workplace safety requirements. These factors collectively influence market adoption rates and operational costs for manufacturers.

Market Opportunities:

Rising Demand in Renewable Energy and Sustainable Construction

The Fiberglass Fabric Market has significant growth opportunities in the renewable energy sector, particularly in wind turbine blade manufacturing. It offers the strength, fatigue resistance, and lightweight properties essential for improving energy efficiency and extending operational life. The global shift toward clean energy and investments in wind power infrastructure are expected to drive large-scale demand. Sustainable construction practices are also creating prospects, with fiberglass fabrics being used for insulation, roofing, and reinforcement in eco-friendly building designs. Government initiatives promoting green infrastructure further support market expansion. Manufacturers can leverage these trends to diversify applications and strengthen their market presence.

Advancements in High-Performance and Hybrid Composites

Technological advancements in composite engineering are opening new opportunities for fiberglass fabric applications in aerospace, marine, and automotive sectors. It can be combined with carbon or aramid fibers to enhance tensile strength, thermal stability, and impact resistance while keeping costs competitive. The rising need for lightweight, durable materials in electric vehicles and high-speed transport systems is expected to stimulate demand. Emerging applications in electronics, such as heat management solutions and high-frequency circuit boards, also present potential growth areas. The ability to tailor product properties to meet specific industry requirements positions fiberglass fabrics as a versatile solution in evolving markets.

Market Segmentation Analysis:

By Product

The Fiberglass Fabric Market includes products such as woven, non-woven, and specialty fabrics designed for diverse industrial uses. Woven fabrics dominate due to their high tensile strength, dimensional stability, and suitability for aerospace, automotive, and marine applications. Non-woven variants are gaining traction in filtration, insulation, and protective coverings where flexibility and cost efficiency are priorities. Specialty fabrics, treated for enhanced chemical or heat resistance, are increasingly adopted in critical environments. The variety in product offerings enables manufacturers to meet specific performance and durability requirements.

- For instance, the Tetraglas® Needled Blanket from Darco Southern, Inc., which is made from non-woven E-type fiberglass fibers, is designed for a continuous service temperature of 1000°F in industrial and aerospace applications.

By Fiber Type

This market is segmented into E-glass, S-glass, and other high-performance fibers. E-glass holds the largest share due to its balance of mechanical strength, thermal resistance, and cost-effectiveness, making it suitable for construction, electronics, and general industrial use. S-glass offers superior strength and modulus, making it essential in defense, aerospace, and advanced engineering applications. Other specialty fibers cater to niche markets where extreme performance characteristics are required. The choice of fiber type significantly influences application scope and product pricing.

- For instance, JPS Composite Materials manufactures high-performance S-glass fabrics used in the aerospace industry for components like cargo liners, which provide a tensile strength of 4,600 MPa for critical structural integrity.

By Application

Applications span aerospace, automotive, construction, wind energy, electronics, marine, and industrial sectors. Aerospace and automotive segments rely on fiberglass fabrics for lightweight, high-strength composites that improve efficiency and safety. Construction uses include reinforcement, roofing, and insulation materials that ensure durability and fire resistance. Wind energy remains a fast-growing application due to the need for robust, fatigue-resistant materials in turbine blades. The broad application base underscores the versatility and sustained growth potential of this market.

Segmentations:

By Product

- Woven Fabrics

- Non-Woven Fabrics

- Specialty Fabrics

By Fiber Type

- E-Glass

- S-Glass

- Other High-Performance Fibers

By Application

- Aerospace

- Automotive

- Construction

- Wind Energy

- Electronics

- Marine

- Industrial

By End-Use

- Transportation

- Electrical & Electronics

- Construction & Infrastructure

- Marine

- Industrial Manufacturing

- Defense & Aerospace

- Renewable Energy

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific Leading with Strong Manufacturing and Infrastructure Growth

Asia-Pacific accounted for 46% of the Fiberglass Fabric Market, making it the largest regional contributor. The region’s dominance is supported by rapid industrialization, extensive manufacturing capabilities, and large-scale infrastructure development. It benefits from high demand in sectors such as wind energy, construction, and automotive, particularly in China, India, and Japan. Government investments in renewable energy and urban development projects are creating strong consumption patterns. The region’s competitive production costs and access to raw materials further strengthen its position. Continuous technological upgrades in local manufacturing facilities are improving product quality and expanding export potential.

North America Driven by Aerospace, Defense, and Renewable Energy

North America held 28% of the Fiberglass Fabric Market, supported by strong demand in aerospace, defense, and renewable energy applications. It is widely used in advanced composites for aircraft, defense vehicles, and renewable energy infrastructure. The region benefits from high R&D investments, stringent quality standards, and a mature composite manufacturing ecosystem. The expansion of offshore wind farms and adoption of lightweight materials in transportation are reinforcing market growth. Strong regulatory frameworks promoting energy efficiency and environmental compliance are also boosting product adoption across industries.

Europe Maintaining Steady Demand Through Innovation and Sustainability Goals

Europe represented 20% of the Fiberglass Fabric Market, driven by its automotive innovation, renewable energy initiatives, and strict environmental regulations. It sees consistent demand from the marine, construction, and industrial sectors, with manufacturers emphasizing sustainable and recyclable composite solutions. Countries such as Germany, France, and the UK are leading in integrating fiberglass fabrics into high-performance applications. The region’s focus on reducing carbon emissions and improving material efficiency aligns with the growing adoption of lightweight composites. Collaborative research projects and cross-industry partnerships are driving further advancements in production and application diversity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tah Tong Textile

- BGF Industries

- Owens Corning

- Amatex Corporation

- Saint-Gobain Performance Plastics

- Gurit

- Jushi Group

- Chomarat Textile Industries

- Auburn Manufacturing

- Saertex GmbH

- Hexcel Corporation

- Asahi Kasei Corporation

- Nitto Boseki

Competitive Analysis:

The Fiberglass Fabric Market is highly competitive, with global and regional players focusing on product innovation, quality enhancement, and cost efficiency to strengthen market positioning. It is characterized by strategic mergers, acquisitions, and partnerships aimed at expanding production capacity and diversifying product portfolios. Leading companies invest heavily in research and development to develop high-performance fabrics tailored for aerospace, automotive, wind energy, and construction applications. Competitive advantage often depends on technological expertise, supply chain integration, and the ability to meet stringent industry standards. Key players also emphasize sustainable manufacturing practices to align with regulatory requirements and growing customer preference for eco-friendly materials. The market’s competitive dynamics are influenced by regional manufacturing strengths, with Asia-Pacific housing major production hubs and North America and Europe leading in advanced composite applications. This environment drives continuous improvement and innovation across product types and application segments.

Recent Developments:

- In July 2025, Owens Corning announced leadership transitions, appointing Nico Del Monaco as President of the Roofing division and Jose Canovas as President of the Insulation division.

- In July 2025, Asahi Kasei Corporation and Toyota Tsusho Corporation established a strategic partnership to supply Hipore™ lithium-ion battery (LIB) separators for the automotive industry in North America.

- In July 2025, Hexcel Corporation announced a leadership transition in its Aerospace and Industrial Business and declared a quarterly dividend.

Market Concentration & Characteristics:

The Fiberglass Fabric Market demonstrates moderate to high concentration, with a mix of established global manufacturers and specialized regional players. It is defined by strong competition in product quality, technological innovation, and application diversity. Leading companies maintain a competitive edge through advanced production capabilities, extensive distribution networks, and long-term partnerships with end-use industries. The market features high entry barriers due to capital-intensive manufacturing processes, stringent quality standards, and the need for specialized technical expertise. Product differentiation is driven by performance characteristics such as tensile strength, heat resistance, and chemical durability. Demand patterns are influenced by sector-specific requirements in aerospace, automotive, construction, wind energy, and electronics, creating opportunities for tailored product development.

Report Coverage:

The research report offers an in-depth analysis based on Product, Fiber Type, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand from aerospace and automotive industries will drive adoption of lightweight, high-strength composite materials.

- Expansion of wind energy projects globally will sustain the need for durable, fatigue-resistant fiberglass fabrics in turbine blade manufacturing.

- Rising investments in sustainable construction will boost applications in insulation, roofing, and structural reinforcement.

- Advancements in hybrid composites combining fiberglass with carbon or aramid fibers will create new performance capabilities.

- Growth in electric vehicle production will increase the use of fiberglass fabrics for lightweight structural components and battery enclosures.

- Technological innovations in weaving and resin systems will improve material performance and expand application potential.

- Expansion of the electronics sector will drive demand for fiberglass fabrics in circuit board reinforcement and heat-resistant insulation.

- Marine and offshore industries will increasingly adopt corrosion-resistant fiberglass fabrics for structural and protective uses.

- Regional manufacturing capacity expansion, particularly in Asia-Pacific, will strengthen supply capabilities and export potential.

- Greater emphasis on recyclable and eco-friendly composite materials will encourage sustainable production practices in the market.