Market Overview:

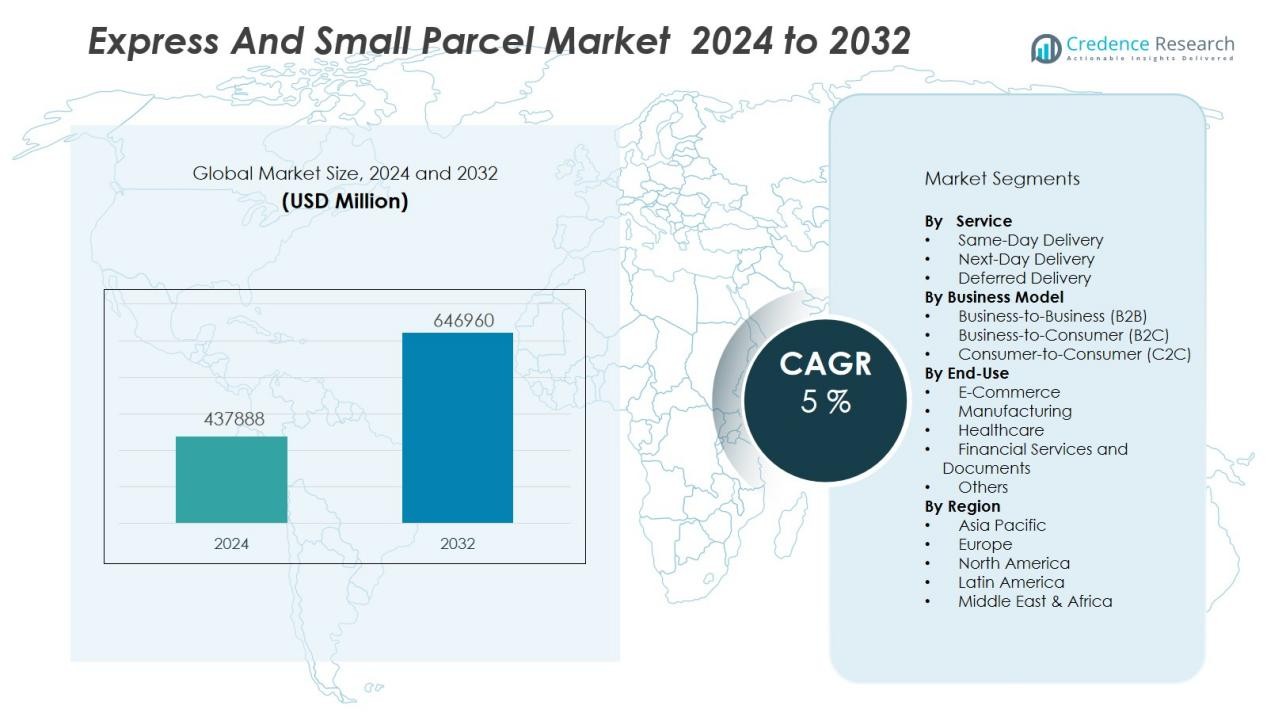

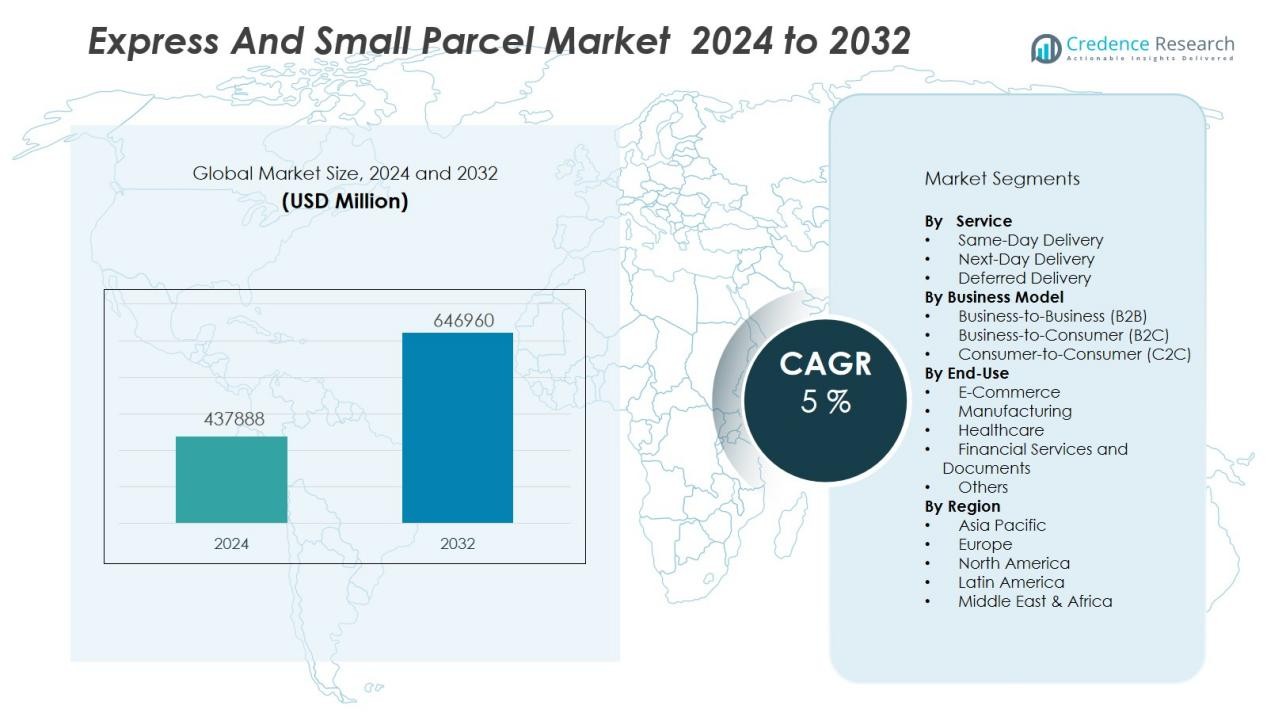

The express and small parcel market size was valued at USD 437888 million in 2024 and is anticipated to reach USD 646960 million by 2032, at a CAGR of 5 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Express And Small Parcel Market Size 2024 |

USD 437888 Million |

| Express And Small Parcel Market, CAGR |

5 % |

| Express And Small Parcel Market Size 2032 |

USD 646960 Million |

Market growth is driven by evolving consumer expectations for faster and more reliable delivery services, prompting logistics providers to invest in advanced tracking systems, automation, and last-mile delivery optimization. Technological innovations such as AI-based route planning, drone delivery trials, and the integration of autonomous delivery vehicles are enhancing operational efficiency. Additionally, the proliferation of subscription-based retail models, coupled with the expansion of same-day and next-day delivery offerings, is boosting demand across key industry verticals.

Regionally, Asia-Pacific dominates the express and small parcel market, fueled by high e-commerce adoption in China, India, and Southeast Asia, alongside significant logistics infrastructure investments. North America follows, supported by mature courier networks and strong demand from retail and healthcare sectors. Europe maintains steady growth, driven by cross-border trade within the EU and rising adoption of sustainable delivery solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The express and small parcel market was valued at USD 437,888 million in 2024 and is projected to reach USD 646,960 million by 2032, growing at a CAGR of 5% from 2024 to 2032.

- E-commerce expansion remains the strongest growth driver, increasing demand for fast, reliable, and flexible delivery services across domestic and cross-border shipments.

- Rising consumer expectations for same-day and next-day delivery are pushing logistics providers to enhance automation, AI-driven route optimization, and last-mile efficiency.

- Technological advancements such as drone deliveries, autonomous vehicles, smart lockers, and predictive analytics are improving operational accuracy and cost efficiency.

- Asia-Pacific leads with 42.6% market share, driven by high e-commerce adoption, large-scale logistics infrastructure investments, and strong cross-border trade.

- North America holds 28.4% market share, supported by mature courier networks, sustainable delivery initiatives, and advanced tracking solutions.

- Europe accounts for 21.7% market share, with growth supported by cross-border trade within the EU, sustainable delivery practices, and automated distribution hubs.

Market Drivers:

- Commerce Expansion Driving Shipment Volumes:

The rapid growth of global e-commerce is the primary catalyst for the express and small parcel market. Rising online retail sales are increasing the demand for fast, reliable, and flexible delivery services. It is pushing logistics providers to scale capacity, enhance tracking capabilities, and improve delivery speed to meet consumer expectations. Cross-border e-commerce is further amplifying shipment volumes, creating new opportunities for both international and domestic parcel networks.

- For instance, DHL eCommerce Solutions installed Dorabot’s DoraSorter robots in 2022, each sorting over 1,000 small parcels per hour.

Rising Consumer Demand for Faster Delivery:

Changing customer preferences toward same-day or next-day delivery are accelerating market competition. The express and small parcel market is responding with investments in automation, AI-driven route optimization, and enhanced last-mile delivery systems. Retailers are partnering with logistics companies to expand service coverage and reduce delivery lead times. This trend is strengthening service differentiation and brand loyalty in highly competitive retail environments.

Technological Advancements Enhancing Operational Efficiency:

Automation, robotics, and real-time tracking technologies are transforming parcel handling and delivery processes. It is enabling logistics providers to optimize routes, reduce fuel costs, and improve delivery accuracy. Innovations such as drone deliveries, autonomous vehicles, and smart lockers are gradually shifting operational models toward greater efficiency. Technology integration is also allowing better demand forecasting and capacity planning for peak seasons.

Infrastructure Development and Network Expansion:

Significant investments in logistics infrastructure are improving delivery capabilities in emerging and developed markets. The express and small parcel market benefits from upgraded distribution centers, expanded warehouse networks, and improved transportation corridors. Urban logistics hubs and regional fulfillment centers are reducing transit times and enhancing service coverage. Infrastructure modernization is also facilitating the integration of sustainable delivery practices to meet environmental regulations and corporate sustainability goals.

- For instance, DHL Supply Chain expanded its footprint in 2025 by acquiring IDS Fulfillment, adding over 1.3million square feet of multi-customer warehouse and distribution space strategically across the U.S..

Market Trends:

Integration of Technology and Automation in Delivery Operations:

Technology adoption is reshaping the express and small parcel market, with automation, AI, and data analytics driving efficiency gains. It is enabling logistics providers to streamline sorting processes, optimize delivery routes, and enhance real-time shipment visibility. Smart lockers, autonomous delivery vehicles, and drone trials are gaining traction to address last-mile delivery challenges. Predictive analytics is improving capacity planning, reducing delivery errors, and enhancing customer satisfaction. The deployment of advanced warehouse robotics is accelerating order processing and improving scalability during peak demand periods. Blockchain solutions are also emerging for secure and transparent cross-border transactions, supporting the expansion of global parcel networks.

- For instance, Plus One Robotics’ vision-guided systems perform over 500million picks annually for logistics warehouses, significantly speeding up e-commerce order fulfillment.

Sustainability and Green Logistics as Competitive Differentiators:

Environmental responsibility is becoming a key trend, with the express and small parcel market increasingly adopting sustainable delivery models. It is prompting companies to invest in electric delivery fleets, carbon-neutral shipping programs, and eco-friendly packaging solutions. Urban consolidation centers and alternative fuel vehicles are reducing emissions in densely populated areas. Retailers and logistics providers are integrating green delivery options to attract environmentally conscious customers. Regulatory pressures in regions such as Europe are accelerating the adoption of low-emission logistics practices. Partnerships between governments and industry players are fostering the development of cleaner transport infrastructure, reinforcing the shift toward greener delivery networks.

- For instance, Deutsche Post DHL Group announced that by the end of 2025 it will have deployed approximately 35 000 electric delivery vans in its Post & Parcel Germany business unit.

Market Challenges Analysis:

Rising Operational Costs and Competitive Pricing Pressure:

The express and small parcel market faces mounting cost pressures driven by fuel price volatility, labor shortages, and infrastructure expenses. It is challenging for service providers to maintain profitability while meeting consumer expectations for low-cost or free delivery. Intense competition from both global carriers and regional players forces companies to adopt aggressive pricing strategies, further compressing margins. Seasonal demand spikes, such as during holiday periods, require significant temporary workforce and capacity expansion, adding to operational strain. Fluctuating international trade policies and customs regulations also create cost unpredictability in cross-border shipments.

Last-Mile Delivery Complexity and Infrastructure Constraints:

Last-mile delivery remains a critical challenge, particularly in congested urban areas and remote rural locations. The express and small parcel market must address traffic delays, restricted delivery time windows, and varying address accessibility. It is investing in alternative delivery models such as parcel lockers and pickup points to improve efficiency. Inadequate infrastructure in developing markets limits service speed and reliability. Environmental regulations are increasing compliance costs, especially in regions enforcing low-emission zones. Balancing speed, cost efficiency, and sustainability in last-mile operations remains a difficult operational and strategic hurdle for industry players.

Market Opportunities:

Expansion of Cross-Border E-Commerce and Trade Facilitation:

The express and small parcel market can capitalize on the rapid rise of cross-border e-commerce, driven by growing consumer access to global online marketplaces. It is encouraging logistics providers to develop faster customs clearance processes and integrated tracking systems. Emerging trade agreements and simplified international shipping regulations are opening new growth corridors. Demand for premium cross-border delivery services, including guaranteed timeframes and end-to-end visibility, is increasing. Small and medium-sized enterprises are leveraging global parcel networks to reach new customer bases, further expanding shipment volumes.

Adoption of Smart Logistics and Alternative Delivery Models:

Technological advancements offer strong opportunities to optimize delivery networks and enhance customer experience. The express and small parcel market can benefit from AI-powered demand forecasting, automated sorting facilities, and autonomous last-mile delivery solutions. It is enabling logistics providers to reduce costs, increase delivery accuracy, and scale operations efficiently. Expanding parcel locker networks, crowd-sourced delivery models, and flexible pickup options are improving accessibility in urban and rural areas. Sustainability-focused solutions, such as electric fleets and carbon-neutral delivery programs, can also serve as competitive differentiators, appealing to environmentally conscious consumers.

Market Segmentation Analysis:

By Service:

The express and small parcel market is segmented into same-day, next-day, and deferred delivery services. Same-day services are gaining strong traction in urban centers where speed is a critical differentiator. Next-day delivery remains a dominant segment due to its balance of speed and cost efficiency. Deferred delivery caters to price-sensitive shipments, particularly in non-urgent e-commerce and B2B consignments. It is seeing steady demand from businesses optimizing logistics costs while maintaining service reliability.

- For instance, FedEx achieved a roughly 10% reduction in pickup and delivery costs in markets where its Network 2.0 initiative has been fully rolled out, increasing stop density and operational efficiency for next-day services.

By Business Model:

The market operates through business-to-business (B2B), business-to-consumer (B2C), and consumer-to-consumer (C2C) models. B2C holds the largest share, fueled by the surge in e-commerce transactions and demand for doorstep delivery. B2B services remain vital for industrial supply chains, spare parts distribution, and wholesale trade. C2C is expanding with the rise of peer-to-peer marketplaces and social commerce platforms. It is encouraging providers to introduce flexible pickup and drop-off solutions.

- For instance, B2B services remain vital for industrial supply chains, spare parts distribution, and wholesale trade; for instance, DHL Supply Chain has rolled out 5 000 Locus Robotics autonomous mobile robots across 35 warehouses, supporting over 500 million robot-assisted picks and doubling picker productivity in targeted facilities.

By End-Use:

Key end-use segments include e-commerce, manufacturing, healthcare, and others such as financial services and documents. E-commerce dominates due to high shipment frequency and diverse delivery requirements. Manufacturing relies on time-critical deliveries for production continuity and supply chain efficiency. Healthcare demand is rising for secure, temperature-controlled, and urgent medical shipments. It is driving investments in specialized handling, tracking, and compliance-focused delivery solutions.

Segmentations:

By Service:

- Same-Day Delivery

- Next-Day Delivery

- Deferred Delivery

By Business Model:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Consumer-to-Consumer (C2C)

By End-Use:

- E-Commerce

- Manufacturing

- Healthcare

- Financial Services and Documents

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific accounts for 42.6% market share in the express and small parcel market, driven by rapid digital adoption and high-volume e-commerce transactions. China, India, and Southeast Asia are the primary growth hubs, supported by government investments in logistics infrastructure and expanding fulfillment networks. It is benefiting from large-scale online retail events, which generate significant shipment surges. The region’s logistics providers are investing in automation, AI-driven delivery systems, and cross-border parcel solutions. Cross-border trade within Asia-Pacific is strengthening, with regional agreements reducing delivery lead times. Growing adoption of alternative delivery models, such as parcel lockers and local collection points, is improving last-mile efficiency.

North America :

North America holds 28.4% market share, supported by a mature courier ecosystem and strong demand from retail, healthcare, and manufacturing sectors. The United States remains the largest contributor, with Canada showing steady growth through e-commerce expansion. It is focusing on enhancing last-mile delivery speed, integrating same-day and next-day services, and expanding pickup options. Logistics providers are investing in electric vehicle fleets and warehouse automation to improve sustainability and efficiency. The region also benefits from advanced tracking technologies, offering customers real-time visibility. Cross-border shipments between the U.S., Canada, and Mexico continue to grow under favorable trade frameworks.

Europe :

Europe accounts for 21.7% market share, supported by the European Union’s integrated logistics policies and strong regional trade flows. Key markets such as Germany, the UK, and France lead parcel volumes, fueled by thriving e-commerce sectors. It is focusing on sustainability through electric fleets, cargo bikes, and low-emission delivery zones. Cross-border deliveries within the EU are benefiting from simplified customs processes, improving transit times. Investments in automated sorting hubs and regional distribution centers are boosting operational capacity. Growing consumer demand for flexible delivery options is driving adoption of out-of-home delivery points and green logistics solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- FedEx

- Amazon Logistics

- Deutsche Post DHL Group

- Aramex

- United Parcel Service Inc. (UPS)

- One World Express Inc. Ltd.

- Qantas Airways Limited

- SF Express (Group) Co. Ltd.

- Royal Mail Group Limited

- TNT Express

- Blue D

- Yamato Transport Co., Ltd.

Competitive Analysis:

The express and small parcel market is highly competitive, with global integrators and regional specialists competing through service speed, network coverage, and technology integration. Leading players such as FedEx, Amazon Logistics, Deutsche Post DHL Group, Aramex, United Parcel Service Inc. (UPS), One World Express Inc. Ltd., Qantas Airways Limited, and SF Express (Group) Co. Ltd. maintain strong market positions through expansive logistics infrastructure and advanced delivery solutions. It is characterized by continuous investment in automation, AI-driven routing, and last-mile optimization to meet growing e-commerce demand. Companies are focusing on sustainability by deploying electric fleets and reducing emissions in urban delivery zones. Strategic partnerships with retailers and cross-border trade facilitation are strengthening service offerings. The market also sees rising competition from emerging logistics startups leveraging flexible delivery models and digital platforms, intensifying the push for innovation and cost efficiency among established operators.

Recent Developments:

- In February 2025, FedEx acquired RouteSmart Technologies, integrating advanced route optimization technology across its delivery network.

- In April 2025, Deutsche Post DHL Group launched Xcelerate, a premium fast-track airport-to-airport cargo service with a mandatory SAF (Sustainable Aviation Fuel) surcharge for sustainability.

- In April 2023, Deutsche Post DHL Group debuted GoGreen Dashboard, an integrated emissions reporting tool enabling customers to track carbon emissions across all DHL business units.

Market Concentration & Characteristics:

The express and small parcel market is moderately concentrated, with a mix of global integrators, regional carriers, and niche service providers competing for market share. It is characterized by high service intensity, time-sensitive delivery requirements, and continuous investment in technology to enhance speed, reliability, and tracking accuracy. Leading players differentiate through extensive logistics networks, advanced automation, and flexible delivery solutions catering to both B2B and B2C segments. Competition is driven by price, delivery speed, and service customization, pushing companies to expand infrastructure and adopt sustainable practices. The market also exhibits strong barriers to entry due to high capital requirements, regulatory compliance, and established brand loyalty among customers.

Report Coverage:

The research report offers an in-depth analysis based on Service, Business Model, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- E-commerce growth will continue to drive parcel volumes, supported by increasing online retail penetration in emerging and developed markets.

- Cross-border delivery services will expand, fueled by rising global trade and simplified customs processes.

- Logistics providers will invest in automation, robotics, and AI to optimize sorting, routing, and last-mile delivery operations.

- Sustainable delivery models, including electric fleets and carbon-neutral shipping programs, will gain prominence under tightening environmental regulations.

- Same-day and next-day delivery services will see higher adoption as consumer expectations for speed intensify.

- Parcel locker networks and out-of-home delivery points will expand, improving convenience and reducing last-mile inefficiencies.

- Advanced data analytics will enhance demand forecasting, capacity planning, and operational decision-making.

- Strategic partnerships between retailers and logistics companies will strengthen service reach and efficiency.

- Infrastructure investments in warehouses, distribution centers, and transport corridors will support faster and more reliable deliveries.

- New business models, such as crowd-sourced delivery and subscription-based shipping plans, will diversify service offerings and capture evolving customer preferences.