Market Overview:

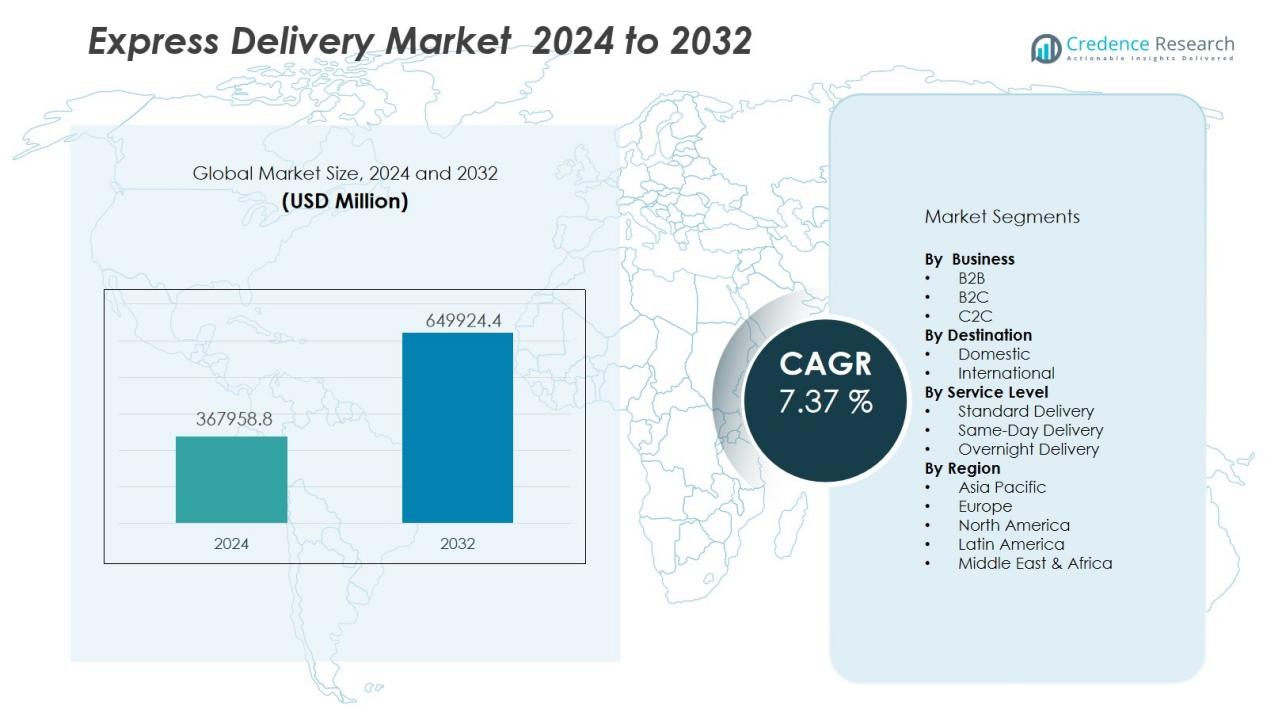

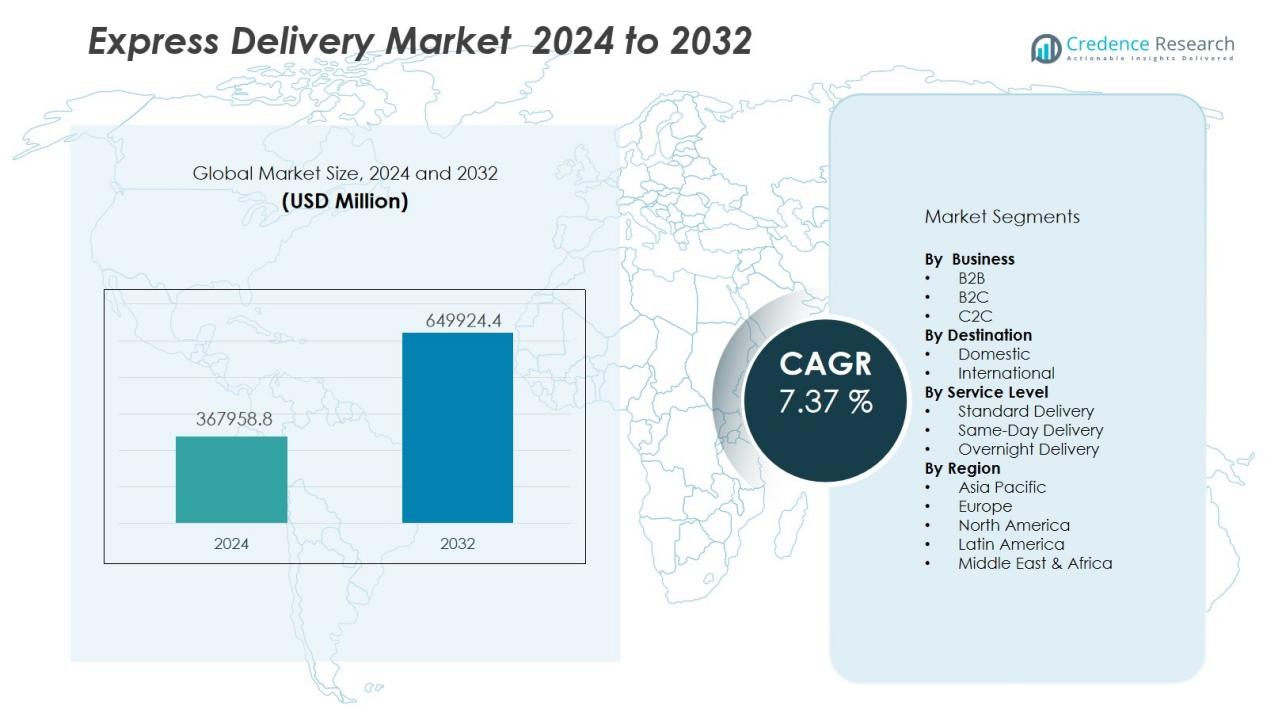

The express delivery market size was valued at USD 367958.8 million in 2024 and is anticipated to reach USD 649924.4 million by 2032, at a CAGR of 7.37 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Express Delivery Market Size 2024 |

USD 367958.8 Million |

| Express Delivery Market, CAGR |

7.37 % |

| Express Delivery Market Size 2032 |

USD 649924.4 Million |

Rising global e-commerce penetration remains a primary driver, with consumers and businesses increasingly expecting same-day or next-day delivery options. Technological innovations, including AI-powered route optimization, autonomous delivery vehicles, and drone-based last-mile delivery, are enhancing operational capabilities. Additionally, subscription-based retail models, cross-border trade, and growing demand from high-value sectors such as pharmaceuticals and electronics contribute significantly to market momentum. Sustainability initiatives, such as electric delivery fleets and eco-friendly packaging, are also shaping competitive strategies.

Regionally, Asia-Pacific dominates the express delivery market, driven by high e-commerce adoption in China, India, and Southeast Asia, coupled with substantial investments in logistics infrastructure. North America follows, supported by mature courier networks and robust demand from retail, healthcare, and industrial sectors. Europe maintains steady growth, benefiting from cross-border trade within the EU and the adoption of green logistics solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The express delivery market was valued at USD 367,958.8 million in 2024 and is projected to reach USD 649,924.4 million by 2032, reflecting a CAGR of 7.37% from 2024 to 2032.

- Rapid e-commerce expansion continues to drive shipment volumes, with consumers demanding faster delivery options and seamless coordination between retailers and logistics providers.

- Technological advancements such as AI-based route optimization, real-time tracking, and drone-enabled last-mile delivery are improving efficiency and service reliability.

- High-value sectors including healthcare, electronics, and luxury goods are fueling demand for premium, secure, and time-sensitive delivery solutions.

- Sustainability is shaping competitive strategies, with companies investing in electric fleets, renewable-powered facilities, and eco-friendly packaging solutions.

- Asia-Pacific leads with 41% market share, supported by strong e-commerce growth, infrastructure investments, and cross-border trade expansion.

- North America holds 28% market share, driven by mature networks, technological adoption, and strong demand from retail, healthcare, and B2B sectors, while Europe secures 22% through green logistics and cross-border trade within the EU.

Market Drivers:

- Commerce Expansion Driving Shipment Volumes:

The rapid growth of global e-commerce is a key driver for the express delivery market, significantly increasing shipment volumes across domestic and cross-border channels. Consumers expect faster delivery options, often within the same day or next day, pushing logistics providers to enhance speed and efficiency. It benefits from the integration of advanced order management systems, enabling seamless coordination between retailers and delivery networks. The trend is especially strong in sectors such as fashion, electronics, and personal care, where timely delivery directly influences purchase decisions.

- For instance, UPS’s ORION route-optimization system has reduced delivery routes by approximately 100 million miles per year, directly boosting parcel throughput and next-day service reliability.

Technological Advancements Enhancing Operational Efficiency:

The deployment of AI-driven route optimization, real-time tracking systems, and automated sorting facilities has transformed service capabilities. It allows operators to reduce delivery times, optimize vehicle utilization, and minimize operational costs. Drone-based delivery pilots and autonomous delivery vehicles are expanding the possibilities for efficient last-mile solutions. These innovations strengthen the competitive positioning of major logistics companies by providing customers with greater reliability and transparency.

- For instance, Wing’s drone delivery service in Logan, Australia, surpassed 100,000 customer deliveries by its second anniversary, with drones completing one delivery every 30 seconds during peak periods.

Growing Demand from High-Value and Time-Sensitive Sectors:

Healthcare, electronics, and luxury goods industries require secure, fast, and precise delivery services, driving consistent demand for premium express delivery solutions. The market benefits from the need to transport perishable goods, medical supplies, and critical spare parts with minimal delays. It prompts service providers to invest in temperature-controlled logistics and advanced security measures. This specialization supports higher margins and fosters customer loyalty in niche, high-value segments.

Sustainability Initiatives Shaping Service Offerings:

Rising environmental awareness is influencing logistics companies to adopt greener operations. It includes investments in electric delivery fleets, renewable energy-powered warehouses, and eco-friendly packaging solutions. These efforts align with regulatory requirements and growing customer preference for sustainable practices. Incorporating sustainability into operations enhances brand reputation while supporting long-term operational efficiency and compliance.

Market Trends:

Adoption of Advanced Logistics Technologies for Speed and Transparency:

The express delivery market is witnessing accelerated adoption of advanced logistics technologies to meet the rising demand for speed and transparency. Service providers are deploying AI-based predictive analytics, IoT-enabled tracking systems, and automated sorting centers to streamline operations. It enhances real-time visibility for customers while enabling companies to proactively address delivery disruptions. Drone delivery trials and autonomous vehicle deployments are becoming more frequent, particularly in urban and remote areas. Integration of blockchain solutions is improving shipment authentication and reducing fraud risks. Companies are also focusing on data-driven route optimization to minimize fuel consumption and reduce delivery times. These innovations are strengthening service reliability and customer trust.

- For instance, FedEx Express completed its first scheduled last-mile drone delivery in Ireland via Future Mobility Campus Ireland, successfully performing test flights with deliveries accomplished in under 13minutes per run.

Growth of Sustainable and Flexible Delivery Models:

Sustainability is emerging as a prominent trend, with logistics providers investing in electric vehicles, alternative fuel fleets, and energy-efficient warehousing. It aligns with regulatory mandates and growing customer preference for eco-conscious solutions. Flexible delivery models, including on-demand and same-day services, are gaining traction among both businesses and consumers. The market is also seeing an increase in pick-up and drop-off (PUDO) networks and smart parcel lockers to improve convenience and reduce last-mile congestion. Cross-border e-commerce growth is encouraging companies to expand international express services with competitive pricing and faster transit times. Partnerships between logistics firms, retailers, and technology providers are enabling the creation of hybrid delivery ecosystems. These developments are positioning service providers to cater to evolving market expectations while maintaining operational efficiency.

- For instance, Amazon has deployed over 20,000 Rivian electric delivery vans in the US and achieved delivery of 1 billion parcels via electric vehicles.

Market Challenges Analysis:

Rising Operational Costs and Infrastructure Constraints:

The express delivery market faces growing pressure from rising fuel prices, labor shortages, and increased maintenance expenses. It challenges providers to balance service speed with cost efficiency, particularly in last-mile delivery operations. Infrastructure limitations in congested urban centers and underdeveloped rural areas further hinder service optimization. Seasonal demand spikes strain resources, often requiring temporary capacity expansions that increase operational complexity. Meeting delivery commitments under these conditions demands substantial investment in technology and network expansion. Providers must also manage fluctuating global trade dynamics, which can disrupt supply chains and delivery schedules.

Regulatory Compliance and Environmental Pressures:

Tightening environmental regulations and international trade policies present another layer of challenge for industry participants. The express delivery market must adapt to stricter emission standards, customs procedures, and cross-border compliance requirements. It increases the need for specialized documentation, advanced shipment tracking, and compliant packaging solutions. Delays caused by regulatory inspections can impact service reliability and customer satisfaction. Balancing fast delivery with eco-friendly practices demands careful planning and investment in sustainable technologies. Providers also face the challenge of harmonizing operations across multiple jurisdictions with differing legal and environmental frameworks.

Market Opportunities:

Expansion of Cross-Border E-Commerce and Emerging Markets:

The express delivery market holds strong growth potential through the expansion of cross-border e-commerce and rising demand in emerging economies. It benefits from increasing internet penetration, growing middle-class purchasing power, and the global reach of online marketplaces. Service providers can capture new revenue streams by offering competitive international shipping rates, faster customs clearance, and localized delivery solutions. Emerging regions in Asia, Africa, and Latin America present untapped opportunities for network expansion and strategic partnerships. Investments in regional hubs and optimized trade routes can improve transit times and service coverage. Adapting offerings to cater to local preferences will further strengthen market presence.

Integration of Technology-Driven and Sustainable Solutions:

Rising customer expectations for real-time visibility and eco-friendly services create significant opportunities for innovation. The express delivery market can leverage AI-powered demand forecasting, autonomous delivery vehicles, and drone-based logistics to improve efficiency. It can also enhance competitiveness through electric fleets, renewable-powered facilities, and biodegradable packaging solutions. Collaborations with technology startups can accelerate the deployment of advanced last-mile solutions. Growth in B2B segments, including healthcare and high-value goods, offers scope for premium, specialized delivery services. Providers that align speed, sustainability, and technology will gain a competitive edge in the evolving logistics landscape.

Market Segmentation Analysis:

By Business:

The express delivery market is segmented into B2B, B2C, and C2C services, with B2C holding the largest share due to the surge in e-commerce transactions. It benefits from increasing consumer preference for fast and reliable delivery of online purchases. B2B demand remains strong in manufacturing, healthcare, and automotive sectors, where timely supply chain movement is critical. The C2C segment is gaining traction with the growth of peer-to-peer marketplaces and social commerce.

- For instance, during Cyber Monday 2024, FedEx picked up nearly 24million packages in the U.S.—almost 70% higher than its average daily volume—demonstrating strong B2C demand and operational capacity.

By Destination:

Domestic deliveries dominate the market, driven by high demand for same-day and next-day services within national boundaries. It benefits from established distribution networks and improved last-mile delivery infrastructure. International deliveries are expanding steadily, supported by cross-border e-commerce growth and improved customs clearance processes. Service providers are enhancing their global networks to reduce transit times and optimize cost efficiency.

- For instance,UPS, whose ORION AI-driven route optimization system has removed millions of unnecessary miles from delivery routes annually, directly accelerating delivery speeds and cutting down on fuel costs while managing over 17.4million parcels per U.S. weekday in 2025.

By Service Level:

Standard, same-day, and overnight delivery services define this segment, with same-day delivery witnessing the fastest growth. It reflects rising consumer expectations for immediate fulfillment, particularly in urban centers. Standard delivery remains relevant for cost-sensitive shipments, while overnight services cater to high-value and time-critical consignments. Providers are integrating automation, AI-driven logistics, and advanced tracking systems to improve service precision across all levels.

Segmentations:

By Business:

By Destination:

By Service Level:

- Standard Delivery

- Same-Day Delivery

- Overnight Delivery

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific accounts for 41% market share in the global express delivery market, driven by rapid e-commerce adoption and significant logistics investments. China, India, and Southeast Asia dominate regional volumes due to large populations and increasing online retail penetration. It benefits from government-led infrastructure projects, digital payment adoption, and efficient distribution networks. Service providers are expanding last-mile capabilities and integrating advanced tracking technologies to meet customer expectations. Cross-border trade within Asia-Pacific is also fueling demand for faster and more cost-effective delivery solutions. The growth of domestic courier startups and international partnerships further strengthens the competitive environment.

North America :

North America holds 28% market share, supported by a well-established courier infrastructure and high consumer demand for express and same-day deliveries. The United States drives most of the regional revenue, aided by a strong retail sector and technological innovation in logistics. It benefits from high adoption of AI-powered routing, automated sorting, and electric delivery vehicles. Healthcare, electronics, and B2B segments contribute significantly to premium service demand. Companies are focusing on sustainability initiatives, expanding green fleets, and reducing carbon emissions. The presence of major global logistics providers ensures competitive pricing and extensive coverage.

Europe :

Europe represents 22% market share, supported by strong cross-border trade within the EU and regulatory emphasis on sustainable logistics. The region benefits from a dense transportation network and high adoption of eco-friendly delivery methods. It sees steady demand from retail, manufacturing, and high-value goods sectors. Service providers are investing in electric vans, parcel lockers, and efficient urban distribution centers. The integration of digital platforms is improving operational transparency and customer engagement. Strategic alliances between postal operators and private logistics firms are enhancing service quality and market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aramex International LLC

- DHL International GmbH

- C.H. Robinson Worldwide Inc.

- OnTrac

- Schenker AG

- FedEx Corporation

- Geodis

- SF Express (Group) Co. Ltd.

- Yamato Holdings Co. Ltd

- United Parcel Service Inc.

Competitive Analysis:

The express delivery market is defined by strong competition among global and regional logistics providers that compete on service speed, reliability, and network reach. Leading players such as Aramex International LLC, DHL International GmbH, C.H. Robinson Worldwide Inc., OnTrac, and Schenker AG maintain a dominant presence through expansive infrastructure, advanced tracking technologies, and diversified service portfolios. It also includes FedEx Corporation and Geodis, which leverage strategic partnerships, innovation in last-mile delivery, and investments in automation to strengthen market share. Companies are focusing on integrating AI-driven route optimization, sustainable delivery fleets, and real-time visibility to enhance customer experience. Competitive differentiation is further shaped by the ability to cater to high-value and time-sensitive sectors, including healthcare, electronics, and e-commerce. Regional players are intensifying competition by offering localized expertise, cost-effective solutions, and flexible delivery models tailored to specific market needs.

Recent Developments:

- In May 2025, Aramex International LLC announced an expanded partnership with Sprinklr to improve customer experience management across more than 65 countries, leveraging AI-powered solutions for seamless, real-time interactions.

- In January 2025, C.H. Robinson Worldwide Inc. launched an innovative payment solution in collaboration with Triumph Financial, aiming to empower carriers by enabling rapid access to payments.

- In July 2024, OnTrac expanded its delivery coverage to Chicago and major Midwest markets, increasing reach to 17 million additional consumer.

Market Concentration & Characteristics:

The express delivery market exhibits moderate to high concentration, with a few global players such as DHL, FedEx, UPS, and SF Express holding significant influence through extensive networks and advanced technology integration. It is characterized by intense competition, driven by service speed, reliability, and pricing strategies. Regional and niche players compete by offering specialized solutions, localized expertise, and flexible delivery models. The market is shaped by high barriers to entry, including capital-intensive infrastructure, regulatory compliance, and technological investment requirements. Strong demand from e-commerce, healthcare, and cross-border trade segments continues to fuel service innovation and diversification.

Report Coverage:

The research report offers an in-depth analysis based on Business, Destination, Service Level and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The express delivery market will witness sustained growth driven by expanding global e-commerce and increasing consumer preference for faster delivery options.

- Service providers will invest heavily in AI, automation, and IoT solutions to improve operational efficiency and shipment visibility.

- Drone delivery and autonomous vehicles will transition from pilot projects to commercial-scale deployments in select urban and remote regions.

- Cross-border e-commerce growth will lead to the development of faster, cost-effective customs clearance and international shipping solutions.

- Sustainability will remain a core focus, with companies adopting electric fleets, renewable-powered facilities, and biodegradable packaging.

- Last-mile delivery innovations, including parcel lockers and crowd-sourced delivery networks, will become more common to reduce congestion and costs.

- Healthcare, electronics, and luxury goods sectors will drive demand for premium, secure, and temperature-controlled express delivery services.

- Strategic partnerships between logistics providers, retailers, and technology companies will strengthen integrated service offerings.

- Regional players will expand into underserved markets, intensifying competition with established global operators.

- Data-driven analytics will play a crucial role in demand forecasting, route optimization, and enhancing overall service reliability.