Market Overview

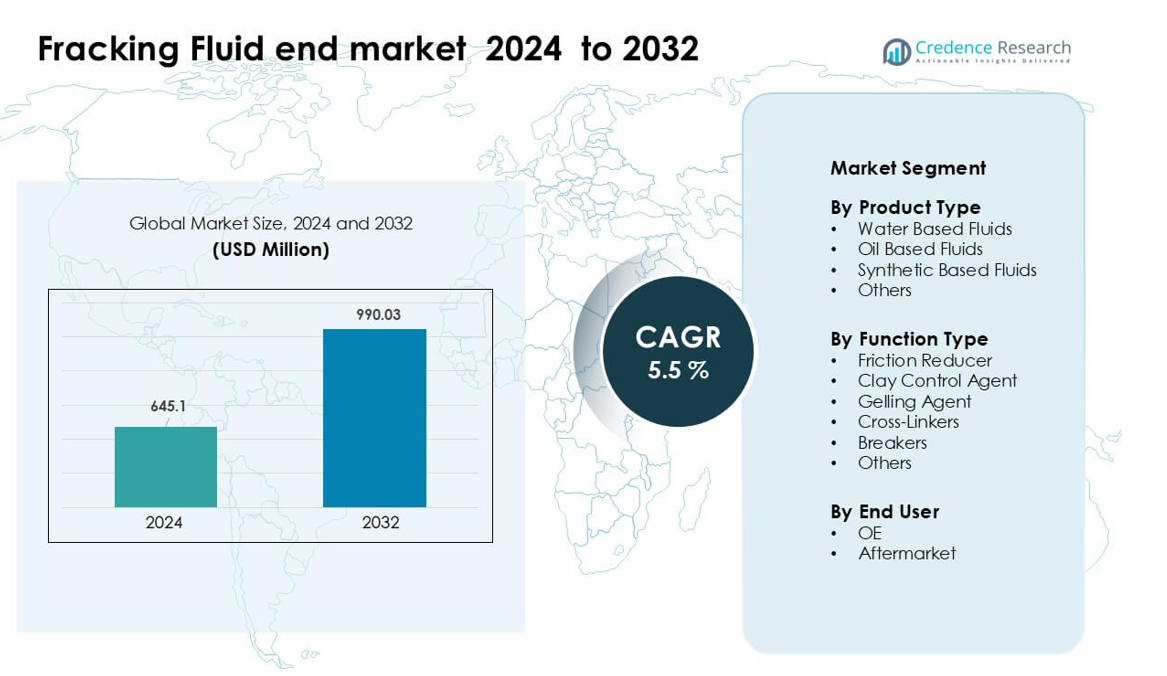

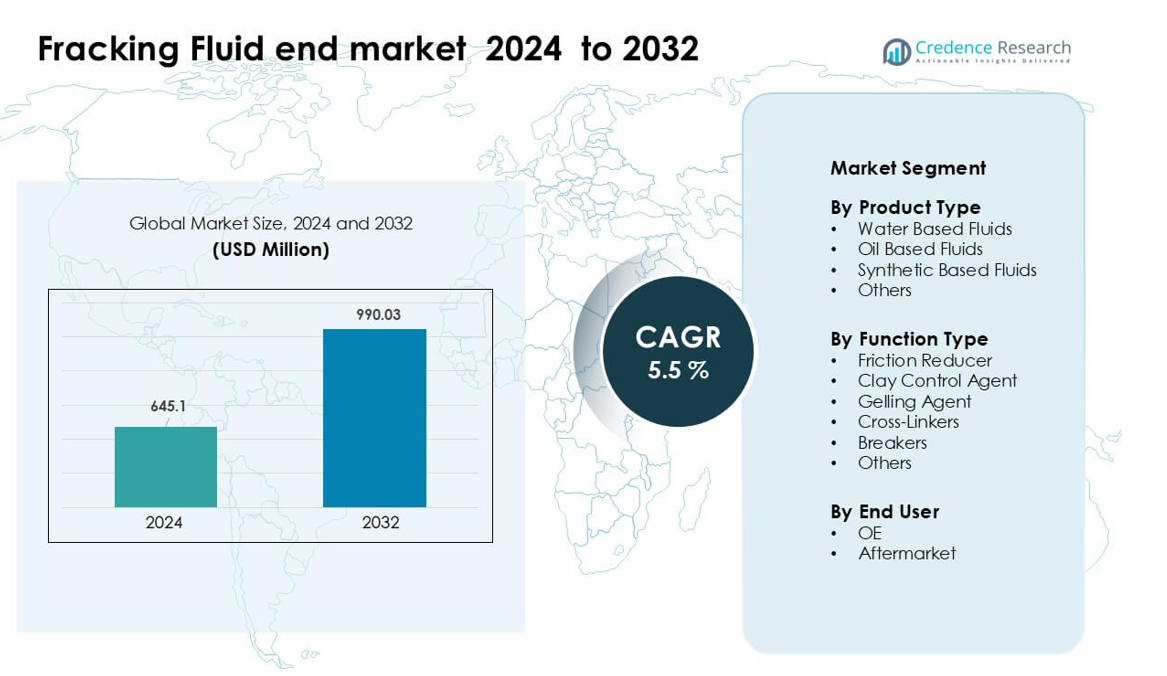

Fracking Fluid end market was valued at USD 645.1 million in 2024 and is anticipated to reach USD 990.03 million by 2032, growing at a CAGR of 5.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fracking Fluid Market Size 2024 |

USD 645.1 million |

| Fracking Fluid Market, CAGR |

5.5% |

| Fracking Fluid Market Size 2032 |

USD 990.03 million |

The fracking fluid end-market is shaped by leading companies such as Weatherford International, Solvay, Chevron Phillips Chemical, BJ Services, Trican Well Service, Halliburton, DuPont, Schlumberger, Ashland Global Holdings, and Baker Hughes. These players compete through advanced additive technologies, basin-specific formulations, and integrated stimulation services that support high-intensity shale operations. Many firms focus on performance enhancers such as friction reducers, cross-linkers, and environmentally compliant fluid systems to meet rising regulatory and operational demands. North America remained the leading region in 2024 with about 54% share, supported by strong drilling activity, robust service infrastructure, and continuous horizontal well development.

Market Insights

- The fracking fluid end-market was valued at USD 645.1million in 2024 market value and is projected to reach its USD 990.03 million 2032 value at a steady CAGR of 5.5 % during forecast period.

- Strong drilling activity and rising use of water-based fluids, which held about 63% share in 2024, drive demand as operators complete longer horizontal wells that require high-volume stimulation.

- Trends include wider adoption of digital fluid optimization, recycled-water-compatible additives, and low-toxicity chemistries aligned with stricter environmental norms across major shale basins.

- Competition remains intense among Weatherford, Schlumberger, Halliburton, Baker Hughes, Solvay, and others offering friction reducers, cross-linkers, and high-performance fluid systems tailored for complex reservoirs.

- North America led the market in 2024 with about 54% share, followed by Asia-Pacific at nearly 23%, while friction reducers dominated the function segment with an estimated 48% share, reinforcing strong regional and segment-level concentration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Water based fluids held the dominant share in 2024 with about 63% of the fracking fluid end-market. Operators preferred these fluids because they offer lower cost, broad shale compatibility, and easier handling during large-volume hydraulic fracturing programs. Water based formulas also support high-pressure pumping and reduce environmental risks compared with oil-based blends. Demand rose further as energy companies adopted improved water-recycling systems, which cut sourcing costs and supported regulatory compliance in major shale regions. Oil based and synthetic based fluids grew in deep-well and high-temperature zones, but water-based fluids stayed ahead due to wide field use.

- For instance, Chevron, in its Permian Basin operations, announced that over 99% of its frack‑water demand in 2021 was met using brackish groundwater and recycled produced water, with 45% of the water used being recycled water.

By Function Type

Friction reducers dominated the segment in 2024 with nearly 48% share. Shale developers relied on these additives to lower pipe friction, increase pumping rates, and maximize fracture length during horizontal drilling. Friction reducers gained stronger adoption as operators shifted to longer laterals exceeding 10,000 feet, which require higher fluid velocity and stable flow performance. Gelling agents, clay control agents, and cross-linkers showed steady uptake in complex formations, yet friction reducers remained the most used function category because they directly enhance operational efficiency and cut overall completion time.

- For instance, Halliburton’s FightR EC‑17 friction reducer was used in a field trial in the Eagle Ford, where it reduced friction‑reducer volumes by 5–10% compared to the incumbent product, cut treating pressures by 15%, and enabled over 1,500 stimulation stages, helping the operator save US$ 125,000.

By End User

The aftermarket segment led the fracking fluid end-market in 2024 with around 57% share. Frequent fluid replacement, continuous well stimulation needs, and rising refracturing activities increased aftermarket demand across active shale basins. Service companies purchased large volumes of ready-formulated fluids to support rapid deployment schedules and manage variable well conditions. OE demand stayed relevant for new drilling equipment and chemical system installations, but the aftermarket segment dominated because most purchases occur during routine field operations, high-intensity pumping cycles, and repeated maintenance across existing wells.

Key Growth Drivers

Rising Unconventional Oil and Gas Production

Unconventional resource development continues to expand as shale basins mature and drilling intensity increases. Energy operators rely heavily on high-performance fracking fluids to maximize hydrocarbon recovery, enhance fracture propagation, and support longer horizontal wells. Growth accelerated as major producers raised completion counts in basins such as the Permian, Marcellus, and Montney, where high-volume stimulation requires advanced fluid systems. The shift toward multi-well pads and high-density fracture stages also increased fluid demand per well. Regulatory pressure to improve water efficiency encouraged wider adoption of optimized water-based blends, supporting recurrent consumption. These combined factors strengthened fluid usage and positioned unconventional drilling as a primary market growth engine.

- For instance, new Permian wells combined in July 2024 generated a total of 433,000 barrels per day (b/d) in their first full month.

Advancements in Fluid Chemistry and Additives

Ongoing improvements in additive formulations, cross-linking systems, and friction-reducing polymers boosted fracking efficiency and expanded use in complex reservoirs. Companies introduced enhanced gelling agents, biodegradable surfactants, and high-temperature-resistant additives that supported deeper wells and tighter formations. These innovations reduced pumping energy, improved proppant transport, and minimized formation damage. Operators increasingly sought fluid chemistries that offered predictable rheology, improved viscosity retention, and compatibility with recycled water. Technology suppliers invested in R&D to develop customizable blends for varying shale characteristics, enabling higher well productivity. The performance gains delivered by new chemistries continued to stimulate fluid demand across major shale regions.

- For instance, Baker Hughes’ Spectra Frac G system uses a borate‑crosslinked guar polymer that maintains high apparent viscosity up to 149 °C (300°F), and its crosslink times can be tuned from 15 seconds to 3 minutes, thereby reducing hydraulic horsepower requirements.

Increased Adoption of Water Recycling and Low-Impact Fluids

Water management became a strategic priority for energy companies, driving large-scale adoption of recycled water, low-toxicity additives, and sustainable fluid designs. Rising regulatory scrutiny on water withdrawals and disposal encouraged operators to integrate treatment technologies that allow repeated water reuse in stimulation programs. This shift supported greater consumption of water-based fluids compatible with recycled streams. Environment-focused drilling campaigns also increased the use of green friction reducers and non-hazardous biocides, expanding market volume. The broader industry push toward reduced environmental footprint strengthened demand for sustainable fracking fluids and positioned eco-optimized blends as a long-term driver of market expansion.

Key Trends & Opportunities

Shift Toward High-Performance Digital and Real-Time Fluid Optimization

Digital monitoring tools gained prominence as operators adopted real-time fluid analysis systems to enhance performance and reduce chemical wastage. Smart sensors, downhole pressure mapping, and AI-based mixing controls enabled precise fluid adjustments during stimulation. This trend created opportunities for chemical companies to offer integrated digital-fluid packages that improve well efficiency and reduce completion costs. Real-time optimization also supported the use of variable-viscosity fluids tailored to dynamic reservoir responses, unlocking new avenues for performance-based fluid contracts. The convergence of digital tools and fluid engineering emerged as a major opportunity for specialized fluid technology providers.

- For instance, Schlumberger’s Well Watcher Stim monitoring service captures downhole pressure pulses in near real‑time in wells as deep as 6,100 m MD (about 20,000 ft), allowing operators to detect events such as fluid entry or stage isolation during fracturing and immediately adjust treatment designs.

Growing Demand for Environment-Friendly and Low-Toxicity Additives

The market saw rising interest in bio-derived surfactants, biodegradable polymers, and non-hazardous cross-linkers as operators addressed stricter environmental norms. Demand strengthened in regions enforcing groundwater protection, chemical disclosure, and emission control policies. Companies responded by developing greener friction reducers, natural clay stabilizers, and ultra-low toxicity breakers. These products opened new opportunities in sensitive drilling zones and enhanced industry acceptance of sustainable stimulant systems. The shift toward green fluid portfolios also offered competitive differentiation for chemical manufacturers targeting long-term service contracts with ESG-focused operators.

- For instance, Solvay has developed a next‑generation green friction reducer using a dispersion polyacrylamide copolymer (i.e., no oil phase), which shows rapid hydration and friction‑reduction performance even in synthetic brine with 200,000 mg/L total dissolved solids (TDS), and remains effective at loadings as low as 1 gallon per thousand (gpt).

Expansion of High-Temperature and Deep-Well Fluid Solutions

Deeper unconventional wells and hotter reservoir environments increased demand for thermally stable fluid systems. Chemical manufacturers introduced next-generation cross-linkers, high-temperature gelling agents, and advanced surfactants that maintain performance under extreme downhole conditions. These innovations created opportunities in deep Permian zones, Gulf Coast shales, and international tight reservoirs. As operators pushed for greater lateral lengths and higher pumping pressures, high-end deep-well fluids became essential. This trend opened a premium segment within the market focused on performance fluids engineered for extreme conditions.

Key Challenges

Regulatory Restrictions on Water Use and Chemical Disclosure

Stricter environmental policies on water sourcing, chemical usage, and wastewater disposal posed significant challenges for fluid suppliers and operators. Regions with water scarcity imposed sourcing caps, limiting large-volume hydraulic fracturing activities. Mandatory chemical disclosure programs required detailed reporting of fluid ingredients, increasing compliance costs for manufacturers. Disposal regulations raised costs for managing flowback and produced water, further complicating operations. These factors forced companies to redesign formulations, adopt advanced treatment systems, and adjust supply chain processes to meet legal expectations, creating cost and operational burdens across the market.

Volatility in Crude Prices Influencing Drilling Activity

Fluctuations in crude oil prices continued to disrupt drilling schedules, completion budgets, and stimulation volumes across shale regions. When prices fall, operators scale back drilling plans, delay completion cycles, and reduce fluid consumption, directly weakening market demand. Chemical suppliers face unpredictable order volumes, inventory challenges, and lower capacity utilization during downturns. This cyclic behavior limits stable long-term planning and makes revenue forecasting difficult for fluid manufacturers. Price volatility also affects investment decisions in R&D and infrastructure, slowing innovation momentum within the fracking fluid supply chain.

Regional Analysis

North America

North America dominated the fracking fluid end-market in 2024 with about 54% share due to its large unconventional reserves and high drilling intensity across the Permian, Marcellus, Eagle Ford, and Bakken basins. Operators increased well completions and adopted high-volume stimulation designs that required large quantities of water-based and friction-reducing fluids. Strong service infrastructure, advanced chemical technologies, and rising refracturing campaigns further supported market strength. Regulatory focus on water management encouraged broader use of recycled-water fluid systems, sustaining overall consumption. The presence of major service companies and continuous horizontal drilling activity kept North America the leading region.

Europe

Europe held nearly 11% share in 2024, influenced by limited shale development but steady stimulation activity in regions such as the North Sea and parts of Eastern Europe. The region adopted fracking fluids mainly for tight-gas and mature-field enhancement rather than large-scale shale drilling. Strict environmental policies increased demand for low-toxicity additives and controlled fluid systems. Operators relied on advanced chemistries for high-pressure offshore wells, supporting moderate fluid consumption. Regulatory uncertainty slowed broader expansion, yet targeted redevelopment programs and rising interest in energy security kept Europe’s fracking fluid usage stable.

Asia-Pacific

Asia-Pacific accounted for roughly 23% share in 2024, driven by active shale and tight-gas development in China, Australia, and India. China’s aggressive drilling programs and extended horizontal wells boosted the demand for high-viscosity and friction-reducing fluids. Australia focused on coal-seam gas stimulation, which relied heavily on water-based blends. Growing energy demand, government-backed unconventional exploration, and investments in drilling technology strengthened market expansion. Fluid manufacturers gained opportunities as operators pursued deeper wells and high-temperature formations, increasing adoption of advanced additives. Asia-Pacific emerged as the fastest-growing regional market due to rising unconventional production.

Latin America

Latin America held close to 8% share in 2024, supported mainly by activity in Argentina’s Vaca Muerta shale and Brazil’s tight reservoirs. Argentina expanded long-lateral drilling and high-stage fracturing, increasing its dependence on gelling agents, cross-linkers, and friction reducers. Limited infrastructure and supply chain constraints slowed broader adoption, yet government incentives encouraged ongoing development. Fluid demand grew as operators optimized stimulation designs and improved proppant transport requirements. Although political and economic volatility affected consistency, the region continued to maintain a stable contribution to the global fracking fluid market.

Middle East & Africa

The Middle East & Africa region represented around 4% share in 2024, with fracking fluids used mainly for tight-gas and unconventional reservoirs in Saudi Arabia, UAE, Algeria, and Oman. Operators focused on developing high-temperature and deep-reservoir fluid systems tailored for harsh geological conditions. National oil companies invested in enhanced stimulation programs to reduce gas imports and boost domestic output. Adoption remained selective due to reservoir complexity and high operational costs, but rising gas demand and diversification toward unconventional resources supported gradual fluid consumption. MEA maintained a niche yet growing position in the global market.

Market Segmentations:

By Product Type

- Water Based Fluids

- Oil Based Fluids

- Synthetic Based Fluids

- Others

By Function Type

- Friction Reducer

- Clay Control Agent

- Gelling Agent

- Cross-Linkers

- Breakers

- Others

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fracking fluid end-market features major service companies and specialized chemical manufacturers that shape product innovation and field adoption. Weatherford International, Solvay, Chevron Phillips Chemical, BJ Services, Trican Well Service, Halliburton, DuPont, Schlumberger, Ashland Global Holdings, and Baker Hughes lead the space through broad product portfolios, advanced additive technologies, and integrated stimulation services. These players invest in high-performance friction reducers, biodegradable surfactants, cross-linkers, and recycled-water-compatible systems to support complex shale developments. Many companies focus on digital fluid monitoring, real-time mixing optimization, and basin-specific formulations to improve well productivity. Strategic partnerships with operators, expansion of manufacturing hubs near key basins, and continuous R&D spending strengthen competitive positioning. Environmental compliance and the shift toward low-toxicity additives also drive firms to accelerate green-chemistry development, intensifying competition across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Weatherford International Plc.

- Solvay SA

- Chevron Phillips Chemical Co. LLC

- BJ Services LLC

- Trican Well Service Ltd.

- Halliburton Co.

- DuPont de Nemours Inc.

- Schlumberger Ltd.

- Ashland Global Holdings, Inc.

- Baker Hughes Co.

Recent Developments

- In November 2025, Chevron Phillips Chemical (via its Drilling Specialties offering) launched NanoSlide™, a next-generation drilling-fluid lubricant/multiphase lubricant formulated to reduce friction and wear in drilling and completion fluid systems

- In May 2025, Halliburton hosted its Frac Technology Showcase (May 5-8) and debuted the ZEUS IQ™ intelligent fracturing platform, the first closed-loop fracturing solution combining automation and real-time subsurface feedback.

- In March 2025, BJ Energy Solutions (formerly BJ Services) took delivery of its fifth set of TITAN™ natural-gas-fueled direct-drive fracturing units from Jereh, raising its total hydraulic horsepower offering to ~400,000 across major North American basins.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Function Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as operators expand horizontal drilling and multi-stage fracturing programs.

- Water-based and recycled-water-compatible fluids will gain stronger adoption across shale basins.

- Digital fluid monitoring and real-time optimization tools will become standard in stimulation operations.

- Green chemistries and low-toxicity additives will see wider use due to stricter environmental rules.

- High-temperature and deep-well fluid systems will grow as drilling moves into complex reservoirs.

- Service companies will invest more in basin-specific formulations to boost well productivity.

- Partnerships between chemical suppliers and drilling contractors will increase to streamline supply chains.

- Refracturing activity will expand, driving repeat demand for friction reducers and gelling agents.

- Automation in mixing, pumping, and fluid quality control will improve operational efficiency.

- Global market presence will grow as Asia-Pacific and Latin America accelerate unconventional resource development.