Market Overview

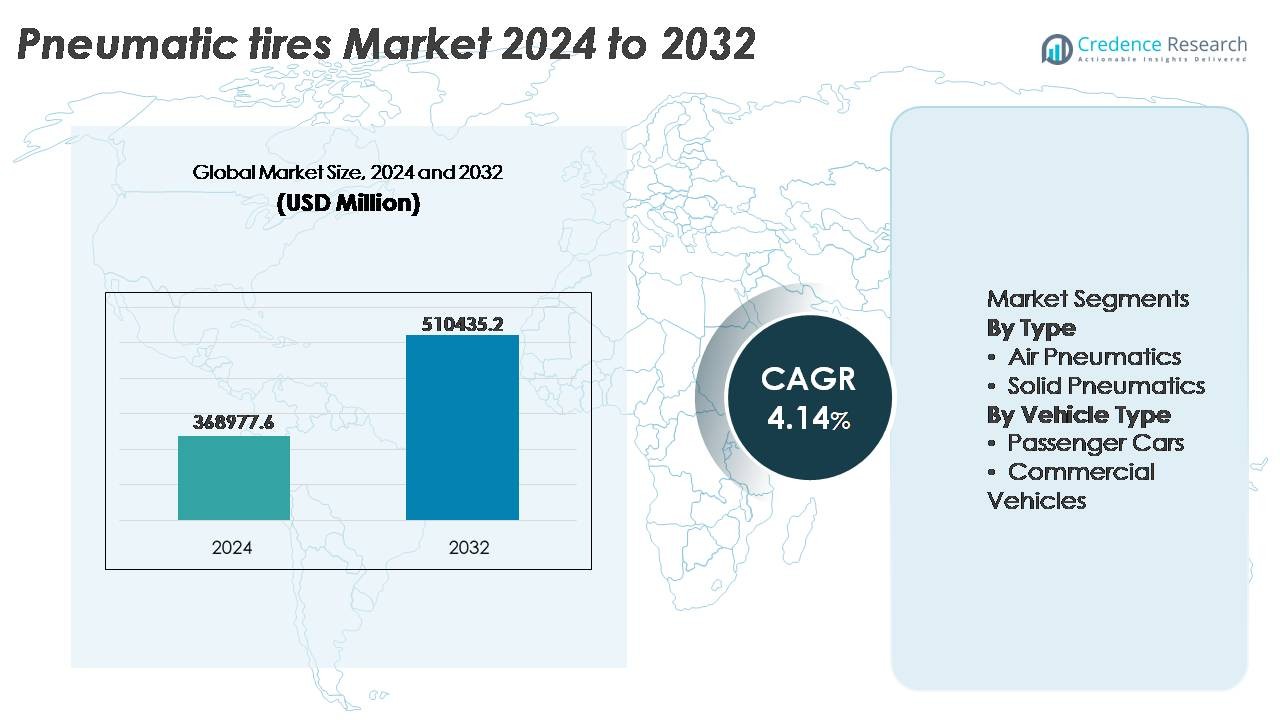

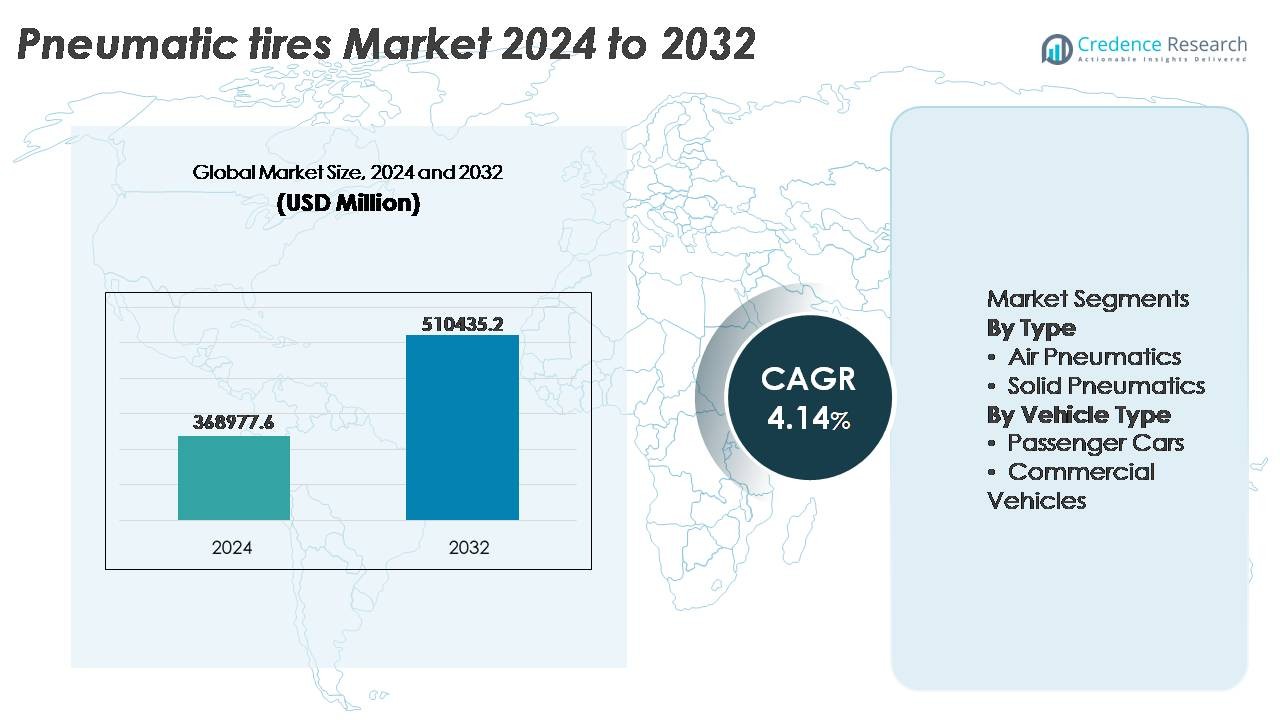

The global pneumatic tires market was valued at USD 368,977.6 million in 2024 and is projected to reach USD 510,435.2 million by 2032, reflecting a CAGR of 4.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pneumatic Tires Market Size 2024 |

USD 368,977.6 Million |

| Pneumatic Tires Market, CAGR |

4.14% |

| Pneumatic Tires Market Size 2032 |

USD 510,435.2 Million |

The pneumatic tires market is dominated by globally established manufacturers such as Bridgestone Corporation, MICHELIN, Continental AG, The Goodyear Tire & Rubber Company, Hankook Tire & Technology, THE YOKOHAMA RUBBER CO., LTD., and KUMHO TIRE CO., INC., each competing through product innovation, OEM partnerships, and extensive distribution networks. These companies focus on premium tire technologies, sustainable material formulations, and performance enhancements to strengthen aftermarket and commercial fleet penetration. Asia Pacific remains the leading region, accounting for approximately 41% of the market share, driven by large-scale automotive production, growing mobility demand, and expanding logistics infrastructure supporting recurring tire replacement cycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global pneumatic tires market was valued at USD 368,977.6 million in 2024 and is projected to reach USD 510,435.2 million by 2032, advancing at a CAGR of 4.14% during the forecast period.

- Growth is fueled by rising automotive production, increasing replacement cycles, and expanding commercial fleets supporting logistics, e-commerce, and construction activities on a global scale.

- Market trends include adoption of sustainable compounds, smart tire technologies, and fuel-efficient tread designs that reduce rolling resistance and support electric and hybrid vehicle platforms.

- Competitive dynamics are shaped by global leaders prioritizing R&D, distribution expansion, and strategic OEM partnerships, while mid-tier manufacturers compete on cost efficiency and regional supply capabilities.

- Asia Pacific leads with 41% share, followed by North America at 27% and Europe at 24%; by type, air pneumatic tires hold the dominant segment share, driven by superior traction, shock absorption, and adaptability across passenger and commercial applications.

Market Segmentation Analysis:

By Type

Air pneumatic tires represent the dominant sub-segment, accounting for the majority share of the market, driven by their superior shock absorption, enhanced traction, and improved fuel efficiency, which make them the preferred choice for passenger cars, commercial fleets, and off-road applications. Their ability to adjust internal pressure for terrain and load variability supports extensive use in logistics and agriculture. Solid pneumatic tires, while smaller in share, continue to gain adoption in industrial and warehouse environments due to puncture resistance, minimal maintenance, and longer operational lifespan in material-handling equipment.

- For instance, Michelin’s Selfseal air-pneumatic technology injects a natural rubber-based sealant layer capable of instantly sealing tread penetrations of up to 6 mm in diameter, reducing roadside failures and maintenance interruptions for fleet operators.

By Vehicle Type

Passenger cars comprise the leading market sub-segment, holding a substantial share, supported by expanding automobile ownership, rapid urbanization, and ongoing demand for replacement tires linked to mileage consumption. Advancements in radial construction, low-rolling resistance compounds, and noise-reduction tread designs further strengthen adoption in compact and mid-size vehicles. Commercial vehicles are experiencing notable growth as fleet operators prioritize durability, retreading capabilities, and load-handling performance. Increasing freight movement, last-mile delivery expansion, and construction equipment modernization continue to drive demand in light, medium, and heavy commercial segments.

- For instance, Continental’s UltraContact passenger tire utilizes a tread compound engineered to deliver a tested tread depth of 7.7 mm and demonstrated reduced abrasion of approximately 0.8 grams per 1,000 kilometers during standardized wear evaluations, supporting extended usage intervals.

Key Growth Drivers

Expansion of Global Automotive Production and Aftermarket Tire Replacement

The continuous rise in automotive production, particularly in developing economies, remains a primary driver for pneumatic tire demand. Increasing household incomes, urban migration, and the shift toward personal mobility contribute to the growing passenger vehicle base. Simultaneously, the tire replacement market is accelerating as vehicle ownership increases and fleet utilization intensifies, driving cyclical tire wear. Modern logistics operations and e-commerce growth generate higher mileage accumulation, particularly in delivery and freight segments, resulting in more frequent tire servicing and replacement intervals. Aging vehicles also remain a major aftermarket catalyst, as extended vehicle lifespans require multiple tire replacement cycles. Regulatory emphasis on road safety and minimum tread standards reinforces scheduled maintenance practices and mandates quality tire usage. Collectively, expanding automotive production and recurring replacement demand ensure sustained volume growth, forming the backbone of the pneumatic tire market.

- “For instance, commercial fleet testing for regional delivery trucks often reports an average tire lifecycle of approximately 100,000 to 140,000 kilometers(about 62,000 to 87,000 miles) before replacement under controlled operating conditions, illustrating the frequency of wear-driven aftermarket purchases.”

Advancements in Tire Construction, Material Science, and Air-Retention Technologies

Recent innovations in tread patterns, polymer compounds, and radial construction significantly enhance the performance and lifecycle of pneumatic tires. Low-rolling-resistance formulations improve fuel economy and reduce carbon emissions, supporting global environmental compliance. Reinforced sidewalls, synthetic rubber-enhanced durability, and optimized bead designs contribute to improved load-bearing capacities and reduced heat generation during high-speed operations. Advancements in air-retention systems, including butyl-rich inner liners and self-sealing coatings, minimize leakages and reduce maintenance requirements for fleets and consumers. Smart tire sensors with pressure and temperature monitoring enable predictive maintenance, lowering downtime and operational risk. For construction, agriculture, and off-road applications, technology-led innovations in tread depth, block design, and mud-shedding features improve traction and safety. These engineering improvements position pneumatic tires as high-performance, cost-efficient components in evolving automotive platforms.

- For instance, Bridgestone’s ENLITEN® technology platform reduces tire mass by approximately 10%and delivers rolling-resistance values with an average reduction of 20% compared to a standard premium summer touring tire, supporting measurable efficiency gains and extended tread life.

Growth of Logistics, Mining, Agriculture, and Infrastructure Projects

Large-scale industrial operations and infrastructure expansion significantly contribute to pneumatic tire deployment across commercial sectors. Increasing freight movement driven by manufacturing growth and retail distribution strengthens demand for medium and heavy-duty vehicle tires. In mining and quarrying, the need for specialized tires capable of withstanding abrasive terrains and high-load conditions drives adoption of reinforced off-the-road (OTR) pneumatic tires. Agriculture modernization, mechanization of farms, and expanded tractor usage propel need for high-traction, low-soil-compaction tires. Infrastructure spending stimulates construction equipment fleets, including loaders, dump trucks, and cranes, requiring continuous tire maintenance and replacement. Fleet operators prioritize cost efficiency and operational uptime, making pneumatic tires essential for diverse end-use industries reliant on mobility, productivity, and heavy loading operations. As industrialization continues across emerging economies, multi-sector adoption remains a long-term growth catalyst.

Key Trends & Opportunities

Sustainable Tires, Recyclable Materials, and Low-Emission Mobility

The shift toward sustainability presents significant opportunity for pneumatic tire manufacturers. Brands are developing eco-focused tires using bio-based and recycled rubber compounds, minimizing reliance on petroleum derivatives. Low-emission vehicles and stringent carbon targets promote the adoption of fuel-saving tire designs that optimize rolling resistance. Circular economy practices such as retreaded tires, energy-efficient manufacturing, and cradle-to-cradle recycling align with regulatory frameworks and consumer expectations. Electric vehicles (EVs) require specialized low-noise, high-torque tires with enhanced sidewall strength, creating a new technology segment. These advancements enable manufacturers to differentiate through performance, lifecycle cost, and environmental benefit.

- For instance, In October 2022, Michelin unveiled road-approved passenger car tires that contain 45% sustainable materials including natural rubber, recycled steel, and recovered carbon black and a bus tire with 58% sustainable materials.

Digital Integration, Smart Tires, and Predictive Maintenance Platforms

Digital transformation is emerging as a strategic opportunity, with smart tires equipped with embedded sensors enabling real-time monitoring of pressure, temperature, and tread health. These systems enhance vehicle safety, energy efficiency, and fleet management, particularly in logistics operations where downtime directly impacts profitability. Integration with telematics platforms allows predictive maintenance, reduces blowout risks, and improves tire utilization. Manufacturers are exploring subscription-based monitoring services and data-driven value-added models, transforming tires into a digitally managed asset. This trend strengthens customer retention and opens long-term service revenue streams.

- For instance, Goodyear’s SightLine intelligent tire technology processes more than 15 billion data points annually from connected commercial fleets, using predictive algorithms to identify air-loss events up to 90% of the time before they occur.

Key Challenges

Volatile Raw Material Prices and Supply Chain Disruptions

The pneumatic tire sector relies heavily on natural rubber, synthetic rubber, carbon black, and petroleum derivatives, making the industry vulnerable to supply fluctuations and pricing instability. Geopolitical events, currency movements, export restrictions, and weather patterns affecting rubber plantations disrupt procurement planning. Energy and transportation cost increases amplify manufacturing expenses, impacting margins for both OEM and aftermarket segments. Global supply chain complexities highlighted by recent pandemic-related interruptions emphasize the need for reshoring, localization, and flexible sourcing strategies. Managing input volatility remains a persistent operational challenge for tire producers.

Environmental Impact, Waste Management, and Regulatory Pressure

The environmental footprint associated with tire manufacturing, disposal, and microplastic shedding presents long-term regulatory challenges. End-of-life tires pose disposal concerns due to their durability and volume, requiring efficient recycling or energy recovery systems. Emission standards during production and usage further increase compliance costs. Manufacturers must adopt sustainable design, emission control technologies, and recycling partnerships to meet government expectations and consumer scrutiny. Stricter regulations on material composition, landfill usage, and extended producer responsibility initiatives push companies to accelerate innovation. Balancing performance, cost, and sustainability ambitions remains a complex barrier for industry stakeholders.

Regional Analysis

North America

North America holds approximately 27% of the global pneumatic tires market share, driven by strong replacement demand, a mature automotive landscape, and high vehicle ownership per capita. The United States remains the dominant contributor due to its extensive highway freight network, resulting in significant commercial tire consumption. Advancements in tire durability, retreading, and air-pressure management systems support fleet performance optimization. The rapid expansion of electric vehicles also fuels demand for specialized pneumatic tires designed for reduced noise, enhanced traction, and instant torque handling. Regulatory focus on tire labeling, road safety, and emission reduction further shapes innovation and adoption.

Europe

Europe accounts for around 24% of the global market share, anchored by stringent safety standards, premium automotive manufacturing, and rapid transition toward environmentally compliant mobility. Germany, France, and Italy represent key consumption clusters supported by strong OEM production and export capabilities. Demand for high-quality radial tires and winter-specific pneumatic tires remains strong in Nordic and Central European climates. The region is at the forefront of sustainable tire development, recycling mandates, and low rolling-resistance solutions supporting fuel efficiency. Electrification initiatives and shared mobility platforms drive innovation in long-life, energy-efficient pneumatic tire design and intelligent wear-monitoring features.

Asia Pacific

Asia Pacific dominates the pneumatic tires market with approximately 41% share, underpinned by large-scale automotive production, rising disposable incomes, and expanding logistics and construction sectors. China, India, Japan, and South Korea contribute significantly through strong OEM and aftermarket demand. The region’s rapidly growing two-wheeler and passenger car population fuels continuous replacement cycles. Industrialization and urban infrastructure projects accelerate heavy-duty tire consumption for commercial fleets. Increasing e-commerce delivery operations generate high tire mileage turnover, supporting aftermarket growth. Government investment in road networks and mobility electrification further positions Asia Pacific as the central growth engine for pneumatic tires globally.

Latin America

Latin America captures nearly 5% of the market share, influenced by fluctuating economic conditions but supported by steady vehicle parc growth and modernization of freight operations. Brazil and Mexico lead consumption due to expanding manufacturing bases and active cross-border trade. Increased adoption of agricultural machinery and commercial transport vehicles drives pneumatic tire demand in rural and semi-urban zones. Replacement cycles remain a significant revenue stream as aging fleets dominate regional mobility. However, import dependency and currency fluctuations impact pricing structures. Gradual regulatory improvements and infrastructure development support long-term demand stability across the region.

Middle East & Africa

The Middle East & Africa region holds around 3% of the global market, with growth concentrated in the GCC, South Africa, and Turkey. Rising investments in construction, mining, and oilfield mobility support heavy-duty pneumatic tire requirements. Expanding tourism and rental vehicle activity contribute to passenger tire sales. Demand for durable, heat-resistant pneumatic tires is notable due to extreme climate conditions. Infrastructure megaprojects and logistics corridor development fuel commercial tire adoption. However, economic diversification challenges and import reliance affect pace of growth. Continued infrastructure expansion and fleet modernization represent the primary forward market drivers.

Market Segmentations:

By Type

- Air Pneumatics

- Solid Pneumatics

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the pneumatic tires market is characterized by a mix of global tire manufacturers, regional producers, and technology-focused disruptors competing through innovation, brand equity, and distribution scale. Leading companies emphasize advancements in tread engineering, low-rolling-resistance materials, and smart tire technologies to enhance performance, safety, and lifecycle efficiency. Extensive dealer networks and strong OEM partnerships strengthen market penetration, while aftermarket positioning remains critical due to recurring replacement demand. Sustainability initiatives, including recycled rubber usage, carbon emission reduction, eco-friendly compounds, and retreading programs, shape competitive differentiation. Manufacturers are increasingly investing in automation, data-driven manufacturing, and digital monitoring platforms to meet evolving mobility requirements. Competitive intensity is further accelerated by growing demand for electric vehicle-compatible tires, prompting investments in noise reduction, torque durability, and thermal management. Cost competitiveness, raw material volatility, and regulatory compliance remain key strategic challenges. As market dynamics evolve, leadership hinges on innovation pipeline, operational agility, and total cost-of-ownership value proposition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KUMHO TIRE CO., INC.

- MICHELIN

- Hankook Tire & Technology

- THE YOKOHAMA RUBBER CO., LTD.

- Continental AG

- The Goodyear Tire & Rubber Company

- Bridgestone Corporation

Recent Developments

- In June 2025, the company was voted “Germany’s Quality Winner 2025” in the car-tire category, based on feedback from nearly 45,000 customer ratings, reflecting strong consumer confidence in product quality and consistency.

- In 2025, Yokohama posted record-high results over nine months, with sales rising and business profit increasing over 20% reflecting strong demand in aftermarket premium and performance tire segments.

- In March 2024, Goodyear Tire & Rubber Company introduced the RL-5K, their newest offering in the radial Off-The-Road (OTR) tire category designed specifically for large wheel loaders. These heavy-duty pneumatic tires boast an enhanced load-carrying capacity, making them ideal for applications demanding maximum performance and durability.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will accelerate development of sustainable, recyclable, and bio-based tire materials to meet tightening environmental regulations.

- Smart and connected pneumatic tires with embedded sensors will gain adoption for predictive maintenance and enhanced fleet monitoring.

- Demand for EV-optimized tires will rise, requiring low-noise, high-torque, and heat-resistant designs.

- Retreading and circular economy models will expand as fleet operators prioritize cost efficiency and reduced carbon footprint.

- Advanced tread compounds and structural improvements will extend tire lifespan and performance in diverse terrains.

- Automation and AI-driven quality control will redefine production efficiency and defect reduction.

- Growth in e-commerce will increase tire replacement frequency for last-mile delivery fleets.

- Off-the-road and industrial segments will benefit from infrastructure, mining, and agricultural equipment expansion.

- Air pressure self-regulation systems will improve safety, traction, and fuel efficiency.

- Regional manufacturing localization will increase to mitigate supply chain risks and import dependency.