Market Overview

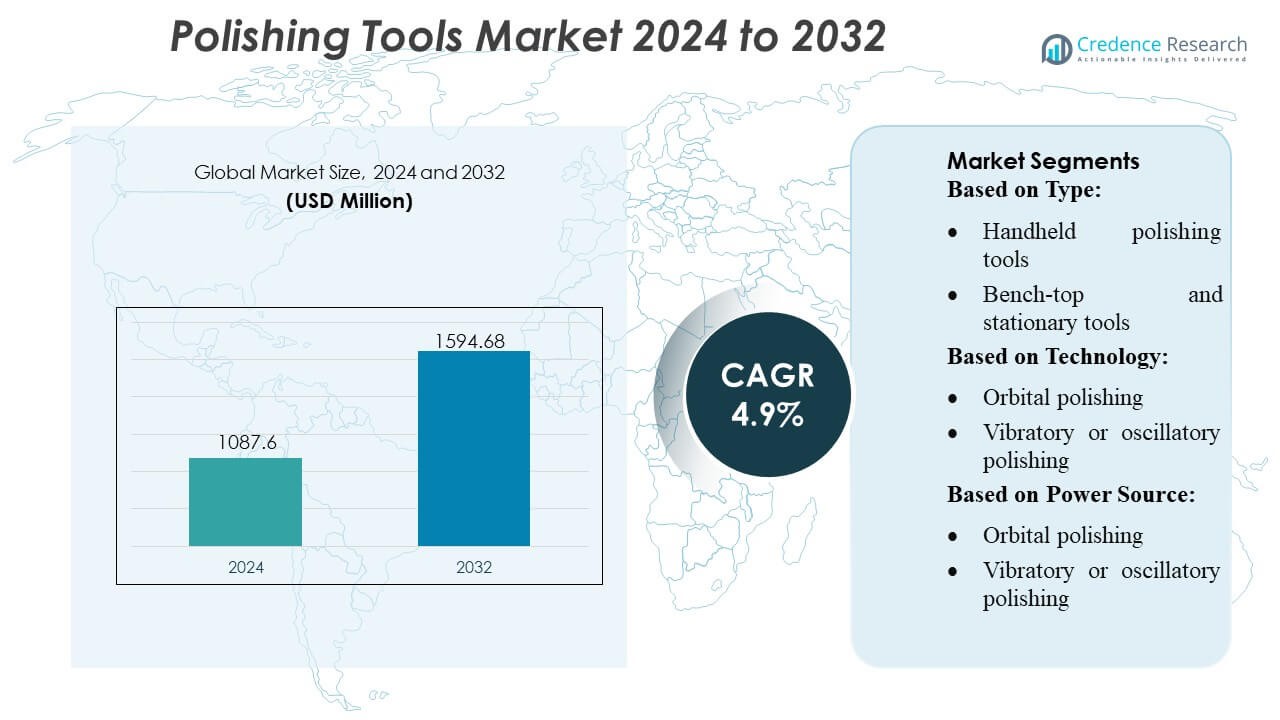

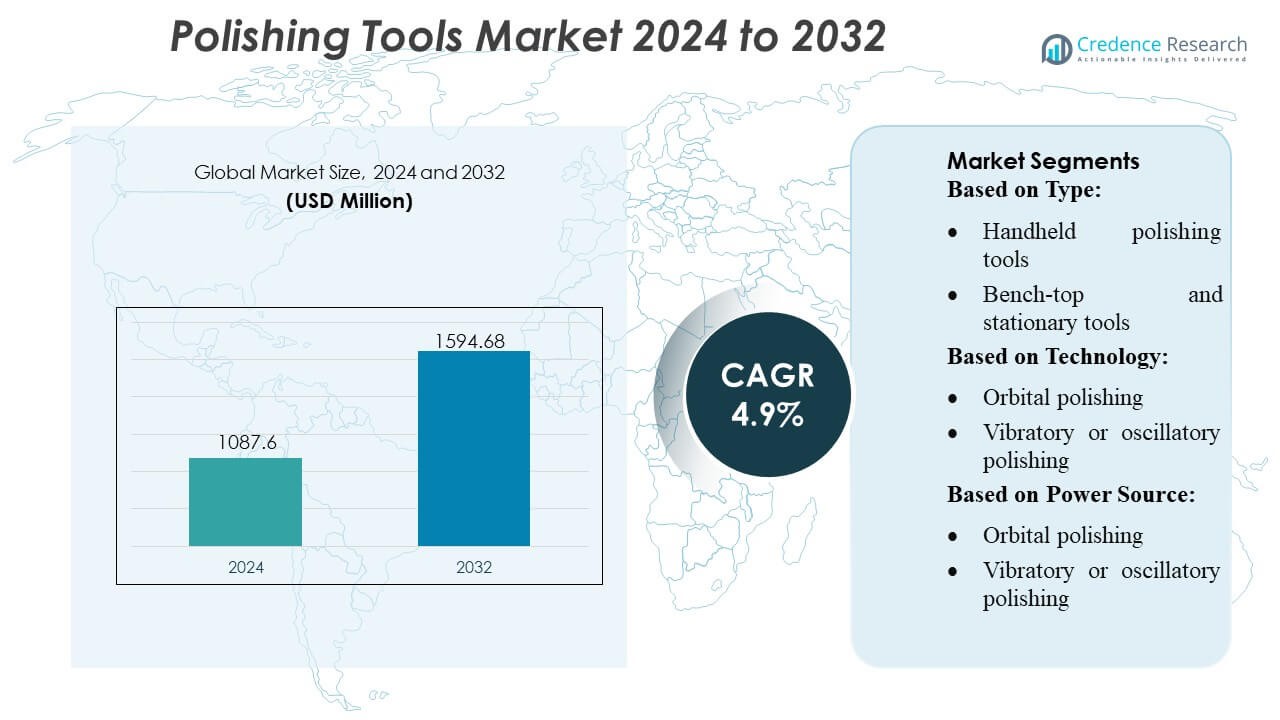

Polishing Tools Market size was valued USD 1087.6 million in 2024 and is anticipated to reach USD 1594.68 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polishing Tools Market Size 2024 |

USD 1087.6 Million |

| Polishers Market, CAGR |

4.9% |

| Polishers Market Size 2032 |

USD 1594.68 Million |

The Polishing Tools Market is shaped by a mix of global manufacturers and specialized surface-finishing technology providers that compete through advancements in precision engineering, automation, and ergonomic tool design. Leading companies focus on expanding portfolios of electric, pneumatic, and smart-enabled polishing systems tailored for automotive, aerospace, semiconductor, and metalworking applications. Innovation in high-performance abrasives, vibration-reduction mechanisms, and multi-axis polishing platforms continues to strengthen competitive positioning across industrial sectors. North America remains the leading region with an exact 38% market share, supported by strong manufacturing infrastructure, high adoption of advanced finishing tools, and a well-developed aftermarket ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polishing Tools Market reached USD 1087.6 million in 2024 and is projected to grow to USD 1594.68 million by 2032 at a 9% CAGR, reflecting steady demand from industrial, commercial, and aftermarket users.

- Rising adoption of precision finishing tools in automotive, aerospace, semiconductor, and metalworking industries drives market growth, supported by advances in smart-enabled systems, brushless motors, and high-performance abrasives.

- Key trends include the expansion of electric and pneumatic tool portfolios, increasing use of vibration-reduction technologies, and growing preference for ergonomic, low-fatigue designs across professional applications.

- Market restraints stem from high replacement costs of consumables and the need for skilled operators to achieve uniform surface quality, challenging adoption in cost-sensitive sectors.

- North America leads with 38% regional share, while electric tools dominate by power source and handheld tools hold the largest segment share, strengthened by widespread use in detailing, fabrication, and construction maintenance activities.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Handheld polishing tools dominate the market with an estimated 44% share, driven by their portability, precision, and wide applicability across automotive detailing, construction, metal fabrication, and maintenance operations. Their ergonomic designs and compatibility with interchangeable pads support high adoption in both professional and DIY environments. Bench-top and stationary tools maintain steady demand in workshops requiring consistent surface finishing, while polishing pads and abrasives expand with rising consumable replacement cycles. Other components such as polishing plates and heads gain traction in specialized industrial finishing systems.

- For instance, DISCO Corporation upgraded its precision-finishing portfolio with the DFG8540 grinder, which achieves ultra-fine surface specifications and supports advanced wafer thinning processes, demonstrating the level of material removal that influences industrial polishing standards.

By Technology

Orbital polishing leads the segment with an approximate 48% market share, supported by its ability to deliver swirl-free finishes, reduced heat generation, and uniform surface correction across metals, composites, and coated substrates. Its user-friendly operation and low surface damage risk strengthen adoption in automotive, marine, and electronics finishing processes. Vibratory or oscillatory polishing grows with demand for bulk part finishing in manufacturing and metalworking. Other technologies, including specialty rotational and centrifugal systems, serve niche high-precision applications such as aerospace components and tool-and-die polishing.

- For instance, JOEN LIH MACHINERY CO., LTD’s JL-3060ATD CNC surface grinder features a high-precision spindle, a high level of repeatability, and a fully automated multi-axis control system capable of maintaining very tight parallelism tolerances.

By Power Source

Electric polishing tools dominate with an estimated 52% share, driven by advancements in brushless motors, variable-speed control, improved torque delivery, and compatibility with smart monitoring features. Their widespread availability and suitability for both professional and consumer applications reinforce their leadership. Pneumatic tools hold strong demand in industrial environments requiring continuous operation and high power-to-weight performance, particularly in automotive refinishing and fabrication units. Other power sources, including gas-powered and hydraulic tools, serve heavy-duty maintenance, outdoor operations, and high-load industrial tasks where durability and mobility are critical.

Key Growth Drivers

1. Rising Demand for High-Precision Surface Finishing

Demand for precise surface finishing across automotive, aerospace, metal fabrication, and electronics industries drives strong adoption of advanced polishing tools. Manufacturers require consistent surface accuracy to meet tightening tolerances and improve component performance. Growth in premium automotive detailing and the rising need for reconditioning metal and composite parts further support tool utilization. High-precision polishing also aligns with quality assurance standards in semiconductor production, die manufacturing, and surgical instrument finishing, strengthening market momentum across industrial and commercial applications.

- For instance, Body Glove does offer a men’s “Phoenix” hooded fullsuit in a 5.5/4.5 mm thickness. It is designed for very cold water conditions (around 46-53°F or 8-12°C) to maintain core warmth.

2. Expansion of Construction, Renovation, and Infrastructure Activities

Increasing global investments in residential, commercial, and infrastructure development significantly boost the need for polishing tools used in concrete finishing, flooring, stone restoration, and on-site surface preparation. Renovation and remodeling projects create steady demand for handheld and electric tools that support efficient polishing of tiles, granite, wood, and metal fixtures. Urbanization and interior design trends reinforce usage of surface enhancement tools that deliver aesthetic improvements and long-lasting finishes. This construction-led momentum elevates tool consumption across contractors, facility managers, and maintenance service providers.

- For instance, Hobie manufactures the “Apex 4R” SUP in a 12’6″ length. The 12’6″ x 25.75″ version has a verified hull volume of 227.2 liters. The average weight for this model is confirmed as 23 lbs / 10.43 kg.

3. Technological Advancements in Power Systems and Ergonomics

Continuous improvement in brushless motors, variable-speed mechanisms, abrasive materials, and vibration-reduction systems enhances tool performance and user comfort. Smart-enabled polishing tools with digital controls, thermal protection, and torque monitoring increase precision and operational safety. Lightweight housings, high-efficiency batteries, and optimized grip designs reduce fatigue and accelerate adoption among professionals and DIY users. These innovations deliver stronger durability, reduced operational downtime, and improved finish consistency across surfaces, positioning advanced polishing systems as preferred solutions in fast-paced industrial environments.

Key Trends & Opportunities

1. Growing Shift Toward Smart and Connected Polishing Tools

The integration of IoT-enabled sensors, digital speed controls, and performance analytics presents a strong opportunity for manufacturers to differentiate offerings. Connected devices allow monitoring of tool load, pad condition, vibration levels, and runtime, enabling predictive maintenance and consistent quality. Professional detailing centers and production facilities adopt smart polishing platforms to optimize workflows and reduce operational errors. This transition toward digitalization opens new revenue streams, particularly in premium tool categories and subscription-based service platforms for industrial users.

- For instance, Mares manufactures the “Pro Therm 8/7” men’s wetsuit, which uses a differentiated thickness of neoprene. The suit features 8 mm neoprene applied in thermally critical core areas for maximum warmth and 7 mm panels in areas that require more elasticity and freedom of movement.

2. Rising Consumption of Eco-Friendly Abrasives and Pads

Growing environmental concerns encourage adoption of biodegradable abrasives, low-emission pads, and sustainable polishing consumables. Industries seek alternatives that minimize chemical usage and reduce waste generated during finishing processes. Manufacturers respond by integrating plant-based fibers, water-efficient polishing compounds, and long-life abrasives that lower replacement frequency. Demand for sustainable surface finishing solutions expands in sectors such as marine, electronics, automotive refinishing, and construction, creating an opportunity for brands to capture eco-conscious buyers and meet evolving regulatory expectations.

- For instance, Airhead Mach 3 tube is confirmed as 107 inches in length by 75 inches in width. The item weight is consistently listed as 33.9 pounds. The recommended maximum weight capacity for this 3-person tube is 510 pounds.

3. Increasing Penetration of E-Commerce and DIY User Base

E-commerce platforms significantly enhance the distribution of polishing tools, enabling faster product comparisons, broad assortments, and competitive pricing. The rise of home improvement culture and DIY surface restoration boosts demand for user-friendly handheld polishers and consumables. Online tutorials and influencer-led demonstrations accelerate awareness of premium polishing techniques, encouraging hobbyists and small workshops to invest in professional-grade tools. This digital sales momentum creates opportunities for manufacturers to expand direct-to-consumer channels and strengthen visibility in emerging markets.

Key Challenges

1. High Maintenance and Replacement Costs of Consumables

Frequent replacement of polishing pads, abrasives, and backing plates increases operational costs for workshops, detailing centers, and industrial facilities. High-quality consumables used in metalworking, aerospace, and precision finishing require strict handling and continuous replenishment, raising total cost of ownership. Inadequate storage or heat buildup during operation can reduce consumable lifespan, further inflating expenses. These recurrent costs discourage adoption among cost-sensitive users and challenge manufacturers to improve durability while maintaining performance standards.

2. Skilled Labor Requirements and Performance Variability

Polishing efficiency depends heavily on operator skill, particularly in applications requiring uniform finishes, controlled pressure, and precise tool handling. Lack of trained technicians increases the risk of surface damage, inconsistent results, and higher rework rates. Industries such as automotive refinishing and aerospace part finishing face productivity losses when inexperienced operators struggle to manage tool speed, pad selection, and abrasive compatibility. This skill dependency limits scalability and pushes manufacturers to develop more intuitive, automated, and training-friendly polishing solutions.

Regional Analysis

North America

North America holds 38% of the global market, supported by strong industrial infrastructure, high automotive aftermarket activity, and significant adoption of precision surface finishing tools across aerospace, electronics, and metal fabrication sectors. The region benefits from early adoption of electric and smart-enabled polishing systems, driven by professional detailing centers and technologically advanced manufacturing units. Growth in residential remodeling and commercial renovation projects reinforces demand for handheld and bench-top tools. The presence of major tool manufacturers and strong distribution networks further strengthens the market’s leadership position in the region.

Europe

Europe accounts for 27% of the global market, fueled by its mature automotive manufacturing base, advanced engineering industries, and strict surface quality standards across aerospace and industrial production. Demand rises due to increased adoption of eco-friendly abrasives and high-precision polishing tools in metalworking and fabrication units. Renovation activities in residential and commercial spaces enhance tool consumption, while regulatory emphasis on safety and ergonomic designs drives adoption of next-generation equipment. Strong manufacturing capabilities in Germany, Italy, and the UK support continuous product innovation and reinforce the region’s competitive position.

Asia-Pacific

Asia-Pacific holds 29% of the market, driven by rapid industrialization, expanding automotive production, and strong growth in construction and infrastructure projects. China, India, Japan, and South Korea lead demand for electric and pneumatic polishing tools across fabrication units, manufacturing plants, and home improvement markets. Increasing investment in electronics and semiconductor manufacturing boosts usage of high-precision polishing systems. The region also benefits from low-cost manufacturing capabilities and rising DIY culture in urban households. Growing distribution networks and e-commerce penetration further accelerate market expansion across Asia-Pacific.

Latin America

Latin America represents 4% of the global market, supported by increasing construction activity, rising automotive aftermarket demand, and an expanding network of small-scale fabrication workshops. Countries such as Brazil, Mexico, and Argentina adopt handheld and electric polishing tools for renovations, metal finishing, and industrial maintenance operations. Limited availability of advanced systems constrains higher penetration, yet growing e-commerce access helps consumers and businesses source a wider range of tools. As urbanization accelerates and manufacturing expands gradually, the region shows steady potential for long-term market growth.

Middle East & Africa

The Middle East & Africa region holds 2% market share, driven by construction megaprojects, industrial expansion, and increased maintenance activities in commercial and hospitality sectors. Demand rises for durable polishing tools used in stone restoration, concrete finishing, and metalworks across the Gulf region. South Africa and the UAE show growing adoption of electric and pneumatic tools, supported by infrastructure modernization. Despite relatively slow technology adoption in some countries, ongoing investments in industrial manufacturing and facility upgrades gradually strengthen the market outlook across MEA.

Market Segmentations:

By Type:

- Handheld polishing tools

- Bench-top and stationary tools

By Technology:

- Orbital polishing

- Vibratory or oscillatory polishing

By Power Source:

- Orbital polishing

- Vibratory or oscillatory polishing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polishing Tools Market features a competitive landscape shaped by global manufacturers such as DISCO Corporation, JOEN LIH MACHINERY CO., LTD, Applied Materials, Inc., Lapmaster Wolters, Fujikoshi Machinery Corp., Qingdao Gaoce Technology Co., Ltd, SHIN NIPPON KOKI CO., LTD., Engis Corporation, TOKYO SEIMITSU CO., LTD, and ATM Qness GmbH. The Polishing Tools Market reflects a highly competitive environment driven by continuous innovation in precision finishing technologies, automation, and advanced material solutions. Manufacturers focus on enhancing tool durability, speed control accuracy, and vibration-reduction capabilities to meet the stringent requirements of automotive, aerospace, semiconductor, and metal fabrication industries. Competition intensifies as companies integrate smart-enabled features, optimize brushless motor performance, and develop eco-friendly abrasive systems that deliver consistent results with lower consumable usage. Global players expand distribution networks, invest in R&D centers, and strengthen OEM collaborations to improve product accessibility and technical support. Rising demand for high-precision surfaces, improved workflow efficiency, and ergonomic tool designs further accelerates innovation, shaping a market where technological advancement and performance differentiation remain central to competitive success.

Key Player Analysis

Recent Developments

- In February 2025, The Mirka AIRP 300 is a game-changer because it provides users with a high-performance rotary polisher that integrates effortlessly. This new rotary polisher provides an alternative to traditional oscillating polishers and is suitable for use across a range of industries, including automotive, aerospace, woodworking, and electronics manufacturing.

- In September 2024, JEOL Ltd. announced the launch of the new Cross Section Polisher IB-19540CP/Cooling Cross Section Polisher (IB-19550CCP), a key tool for preparing pristine sample surfaces for electron microscopy, particularly useful for fragile items like batteries, polymers, and biologicals, offering high-speed, cooling, and automated processing for electronics, ceramics, metals, and life science.

- In September 2024, Milwaukee Tool announced its next-generation deep cut band saws that deliver better user-cutting performance. The new band saws cut 4-inch black iron pipes 20% faster than old ones.

- In November 2023, Dynabrade partnered with Renny Doyle, to launch a geared dual-action polisher that cuts like a rotary and finishes. The developed tool is lightweight and features precision balanced design and single action lock trigger.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience steady demand as industries prioritize high-precision finishing for automotive, aerospace, and electronics components.

- Manufacturers will continue integrating brushless motors, smart controls, and automation features to improve efficiency and consistency.

- Adoption of eco-friendly abrasives and long-life polishing pads will rise as sustainability expectations strengthen across global markets.

- E-commerce and direct-to-consumer channels will expand, increasing product accessibility for professionals and DIY users.

- Industrial expansion in Asia-Pacific will reinforce the region’s position as a key growth engine for polishing tool adoption.

- Demand for ergonomic, low-vibration, and user-safe designs will influence product development strategies.

- Growth in semiconductor and optics manufacturing will drive investments in ultra-precision polishing technologies.

- Construction and renovation activities will continue supporting the use of handheld and bench-top polishing tools.

- Predictive maintenance and IoT-enabled monitoring features will gain traction in advanced polishing systems.

- Global competition will intensify as companies enhance R&D capabilities and diversify product portfolios to meet evolving surface finishing needs.

Market Segmentation Analysis:

Market Segmentation Analysis: