Market Overview

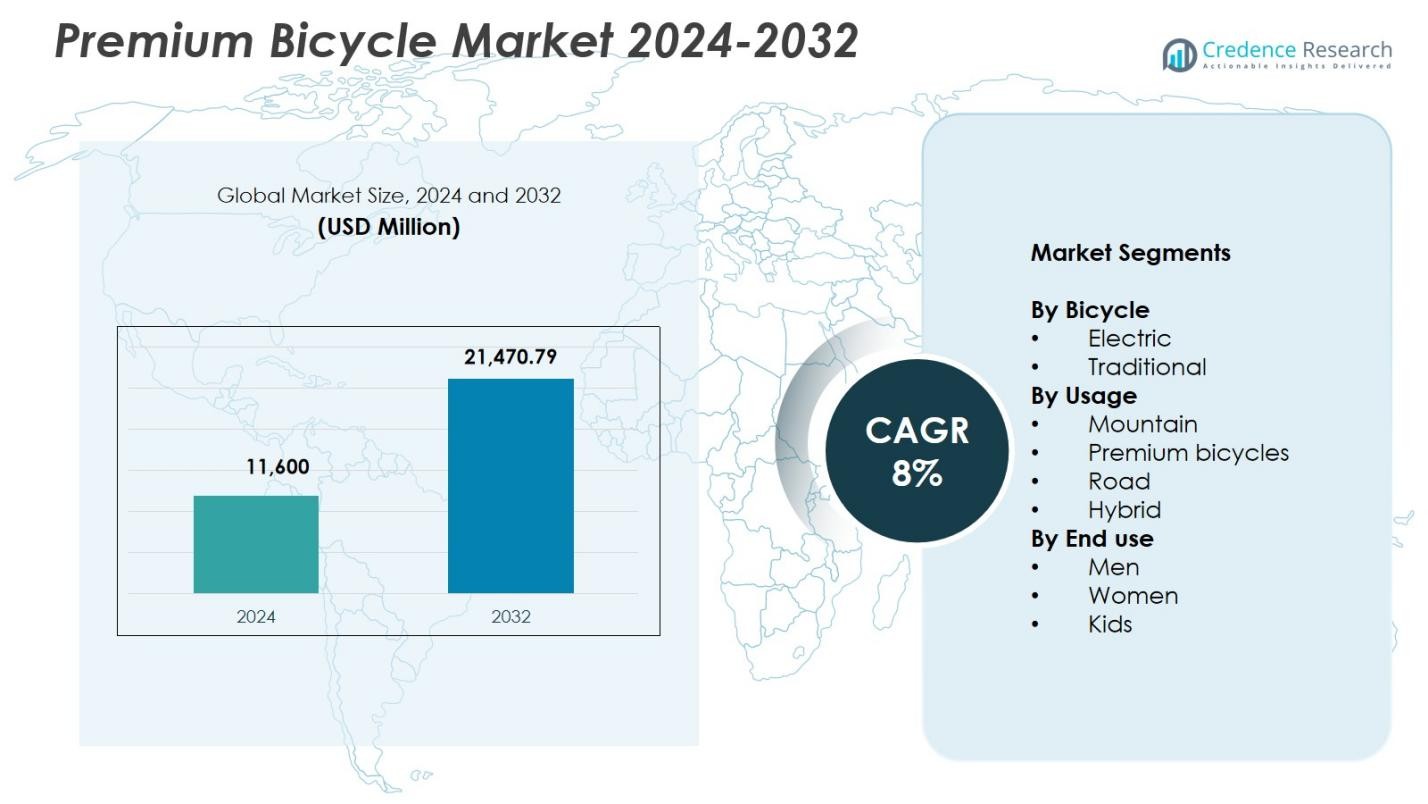

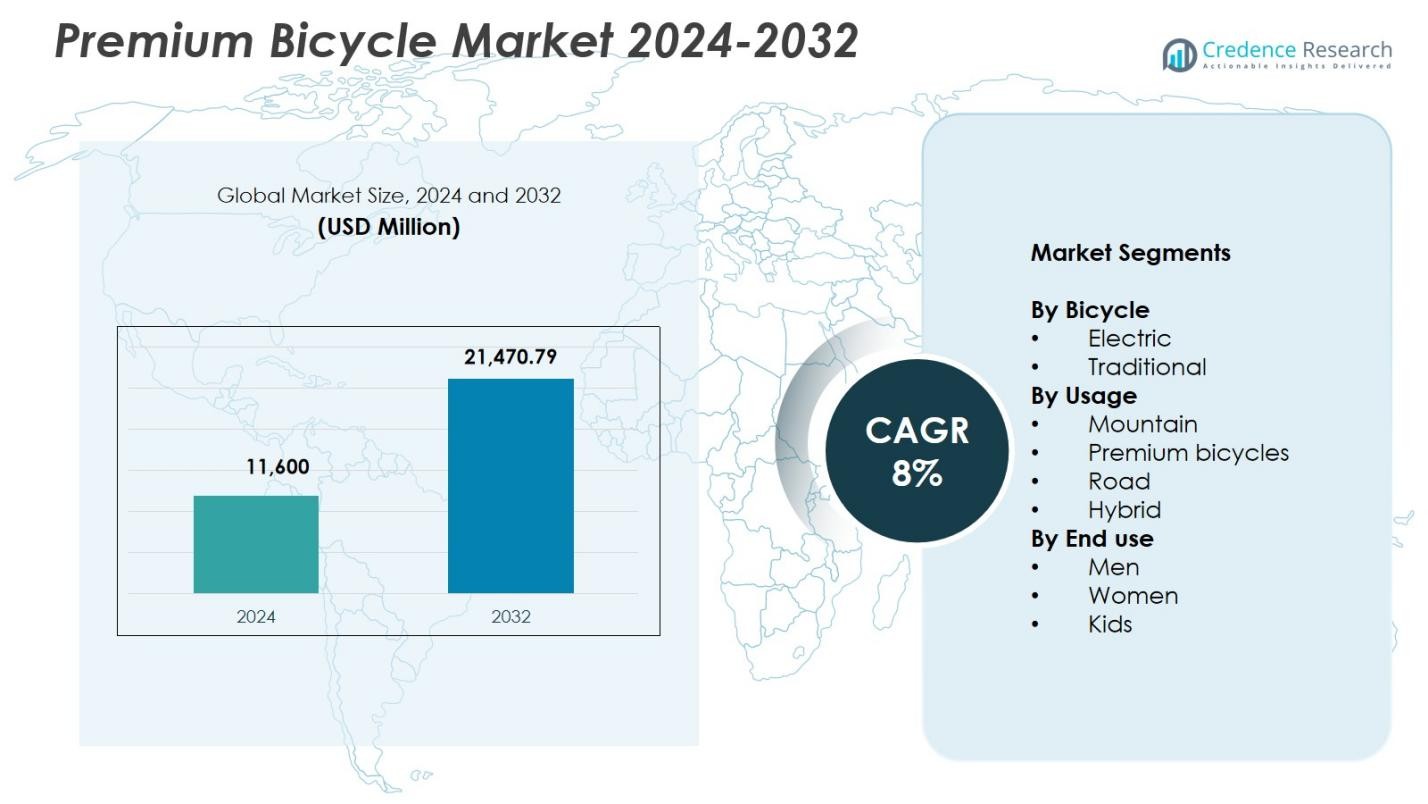

Premium Bicycle Market size was valued at USD 11,600 Million in 2024 and is anticipated to reach USD 21,470.79 Million by 2032, at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Bicycle Market Size 2024 |

USD 11,600 Million |

| Premium Bicycle Market, CAGR |

8% |

| Premium Bicycle Market Size 2032 |

USD 21,470.79 Million |

Premium Bicycle Market features leading players such as Cervélo Cycles, Giant Manufacturing Co. Ltd., Specialized Bicycle Components, Pon Holdings BV, Cannondale, Accell Group N.V., BMC Switzerland, Merida Industry Co. Ltd., Trek Bicycle Corporation, and Canyon Bicycles, all driving innovation through advanced frame engineering, electronic shifting, and smart-connected technologies. These companies focus on enhancing performance, durability, and rider customization to strengthen global presence across professional and recreational segments. North America led the market with a 34.7% share in 2024, followed by Europe at 29.4%, supported by strong cycling culture, expanding mobility initiatives, and rising adoption of premium electric and high-performance bicycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premium Bicycle Market reached USD 11,600 Million in 2024 and is projected to hit USD 21,470.79 Million by 2032 at a CAGR of 8%.

- Market growth is driven by rising demand for high-performance bicycles, increasing urban mobility adoption, and expanding interest in fitness, endurance racing, and long-distance cycling.

- Key trends include rapid adoption of premium electric bicycles with a 6% share and strong uptake of road bicycles holding 37.2% as consumers prioritize aerodynamic efficiency and advanced components.

- Major players such as Cervélo Cycles, Giant Manufacturing, Specialized, Pon Holdings, and Trek focus on smart connectivity, carbon-fiber innovation, and DTC sales models, while restraints include high component costs and supply chain disruptions.

- Regionally, North America led with 7%, followed by Europe at 29.4% and Asia-Pacific at 23.8%, supported by cycling infrastructure growth, e-bike incentives, and expanding recreational cycling communities.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Bicycle Type

The electric bicycle segment dominated the Premium Bicycle Market with a 58.6% share in 2024, driven by rising urban commutes, integrated lithium-ion battery systems, and government incentives promoting e-mobility. Consumers increasingly prefer electric models for their extended range, assisted pedaling, and reduced physical strain. Traditional premium bicycles captured 41.4%, supported by demand from fitness enthusiasts and professional cyclists seeking lightweight frames and high-performance drivetrains. The strong shift toward sustainable transportation and advanced motor-assisted technologies continues to strengthen the electric segment’s leadership.

- For instance, Cannondale’s Turbo Vado 4.0 and similar high-end commuter e-bikes offer integrated lithium-ion battery systems and pedal-assist motors that support daily city travel and longer-distance rides, providing extended range and smoother acceleration for urban professionals.

By Usage

Road bicycles held the largest share at 37.2% in 2024, supported by growing interest in endurance riding, competitive racing, and high-precision carbon frame engineering that enhances speed and performance. Mountain bicycles accounted for 28.5%, driven by expanding trail infrastructure and rising adventure sports participation. Hybrid bicycles captured 21.7% as users favored versatile models suitable for both commuting and recreational riding. Premium specialty bicycles secured 12.6%, reflecting the niche demand for custom-built, performance-tuned models. The dominance of road bicycles continues as cyclists prioritize aerodynamic efficiency and long-distance comfort.

- For instance, Specialized’s trail bikes like the Stumpjumper integrate FSR rear suspension and Brain technology, which automatically adjusts damping for optimal control on rough terrain.

By End Use

Men accounted for the dominant 49.8% share in 2024, supported by higher participation in competitive cycling, premium sports activities, and greater spending on advanced components like carbon frames and smart-connectivity systems. Women represented 32.6%, driven by increasing adoption of fitness-oriented cycling and the availability of ergonomically designed premium models. Kids held an 17.6% share, with growth fueled by rising awareness of early fitness habits and demand for lightweight, safety-enhanced bicycles. The men’s segment maintains leadership as manufacturers target performance-driven features and broader model variety.

Key Growth Drivers

Rising Demand for High-Performance and Technologically Advanced Bicycles

The Premium Bicycle Market experiences strong growth as consumers increasingly seek high-performance bicycles equipped with advanced drivetrains, carbon-fiber frames, electronic gear shifting, and integrated smart connectivity. Growing participation in endurance racing, long-distance cycling, and recreational sports amplifies demand for bicycles offering precision control and reduced weight. Manufacturers continue to invest in research and development to enhance aerodynamics, durability, and riding efficiency. This shift toward performance-centric biking encourages higher spending on premium models, strengthening market expansion across professional and enthusiast consumer groups.

- For instance, Pinarello’s Dogma F incorporates M40X carbon fiber for superior tensile strength and lateral stiffness, paired with a Shimano Dura-Ace Di2 electronic groupset and an optimized Onda fork with 47mm rake for enhanced descent handling.

Expansion of Urban Mobility and Eco-Friendly Transportation Adoption

Urban commuters are driving substantial premium bicycle adoption as cities emphasize sustainable mobility, cycling infrastructure development, and congestion reduction. Premium electric bicycles, in particular, gain momentum due to their assisted pedaling capabilities, extended range, and alignment with low-emission transportation goals. Government incentives, tax benefits, and cycling-friendly policies across North America, Europe, and Asia-Pacific reinforce uptake. Growing awareness of environmental protection and the health benefits of active commuting accelerates replacement of conventional vehicles, positioning premium bicycles as a preferred alternative for urban travel.

- For instance, Aventon launched the Soltera.2, a lightweight Class II commuter e-bike at 46 pounds with a torque sensor for natural pedaling, integrated turn signals, and up to 46 miles of range.

Increasing Health, Fitness, and Lifestyle-Oriented Consumer Spending

Increasing global focus on fitness, preventive healthcare, and active lifestyles significantly boosts premium bicycle demand. Consumers are investing in high-quality bicycles to support endurance training, outdoor recreation, and weight-management activities. Post-pandemic lifestyle shifts have strengthened interest in cycling as a safe, accessible, and engaging form of exercise. Premium brands benefit from rising disposable incomes and willingness to spend on equipment that enhances performance and comfort. This trend is supported by the rapid expansion of cycling clubs, community events, and wellness-driven recreational activities worldwide.

Key Trends & Opportunities

Advancements in Smart, Connected, and Electrified Bicycle Technologies

A major emerging trend in the Premium Bicycle Market is the rapid integration of smart features, including GPS tracking, real-time ride analytics, wireless gear shifting, and app-based performance monitoring. Electric premium bicycles with torque sensors and advanced battery systems create new product differentiation opportunities. Manufacturers integrating IoT-enabled diagnostics, anti-theft technology, and predictive maintenance gain strong competitive advantage. This convergence of digital innovation and high-end engineering opens opportunities for subscription-based services, personalized training insights, and connected mobility ecosystems.

- For instance, SRAM provides the Red eTap AXS groupset with 2×12-speed wireless electronic shifting via shift-brake levers, enabling customizable reach and precise gear changes without cables.

Growth of Customization and Direct-to-Consumer Premium Bicycle Models

Premium bicycle brands increasingly adopt direct-to-consumer (DTC) models, enabling tailored purchasing experiences, competitive pricing, and access to fully customized builds. Consumers are choosing bicycles designed with personalized geometry, specialized components, and unique color schemes to match individual performance needs. This trend supports higher brand loyalty and margin expansion as companies streamline supply chains and build deeper customer engagement. Custom-fit premium bicycles, supported by virtual fitting tools and online configurators, create strong opportunities for market differentiation and attract high-value cycling enthusiasts.

- For instance, Canyon’s MyCanyon platform on the Aeroad CFR model offers curated custom paint from collections like Sparkle Stealth or artist collaborations with Felipe Pantone, plus options for stem length adjustments up to 20 mm longer than stock and personalized name stickers.

Key Challenges

High Cost of Premium Components and Limited Affordability for Mass Consumers

Premium bicycles rely heavily on carbon composites, advanced alloy materials, and precision-engineered components, significantly increasing overall product cost. High prices limit accessibility among casual cyclists and price-sensitive consumers, slowing market penetration in developing regions. Additionally, the cost burden extends to electric premium bicycles due to expensive batteries and electronic systems. Manufacturers face continuous pressure to balance innovation with affordability while managing raw material volatility. This challenge restricts large-scale adoption and requires strategic pricing, localized production, and product segmentation to broaden customer reach.

Supply Chain Disruptions and Component Shortages Impacting Production

The Premium Bicycle Market faces ongoing challenges from global supply chain disruptions, particularly shortages of braking systems, drivetrains, and electronic components. High dependency on specialized suppliers increases production bottlenecks and extends delivery times for premium models. Logistics constraints, fluctuating freight costs, and geopolitical tensions further impact inventory planning. These disruptions hinder manufacturers’ ability to meet rising demand and maintain consistent product availability. Strengthening supplier networks, diversifying sourcing regions, and investing in in-house component capabilities are essential to mitigate long-term risks.

Regional Analysis

North America

North America held a 34.7% share of the Premium Bicycle Market in 2024, driven by strong participation in competitive cycling, rapid adoption of premium e-bikes, and expanding recreational cycling culture. The United States leads the region as consumers invest in high-performance bicycles featuring advanced drivetrains and carbon-frame engineering. Growth in cycling infrastructure, rising fitness awareness, and increasing commuter preference for eco-friendly mobility reinforce demand. Canada contributes to market expansion through supportive government incentives and a growing community of endurance cyclists. The region’s strong retail presence and direct-to-consumer sales models further strengthen uptake.

Europe

Europe accounted for a 29.4% share in 2024, supported by a well-established cycling culture, strict emission regulations, and widespread adoption of electric premium bicycles across urban centers. Countries such as Germany, the Netherlands, and Denmark drive significant demand due to extensive cycling networks and strong consumer preference for sustainable transportation. Premium mountain and road bicycles also gain traction due to active participation in outdoor sports and professional racing events. Government incentives for e-mobility, combined with rising tourism-related cycling activities, reinforce Europe’s strong position as a leading market for premium bicycle innovations.

Asia-Pacific

Asia-Pacific captured a 23.8% share in 2024, propelled by strengthening urban mobility trends, expanding cycling communities, and rising disposable incomes in China, Japan, and Southeast Asia. Demand for premium electric bicycles continues to accelerate due to increasing congestion in metropolitan areas and awareness of sustainable commuting. Growth in recreational cycling and professional racing events across the region supports higher adoption of high-end road and mountain bicycles. Manufacturers benefit from large-scale production capabilities in China and Taiwan, enabling competitive pricing and technological advancements that elevate Asia-Pacific as a fast-growing premium bicycle hub.

Latin America

Latin America held a 6.2% share in 2024, influenced by rising health awareness, expanding urban cycling infrastructure, and growing adoption of premium bicycles in Brazil, Mexico, and Colombia. Economic improvements and lifestyle shifts encourage consumers to invest in high-quality fitness and recreational products. Premium mountain bicycles gain traction due to diverse terrain and increasing adventure sports participation. Although price sensitivity remains a challenge, the region’s growing middle-class population and government-backed mobility initiatives support steady market development. Local distributors and specialty bicycle retailers continue to broaden access to premium bicycle brands.

Middle East & Africa

The Middle East & Africa region accounted for a 5.9% share in 2024, supported by rising interest in outdoor sports, expanding cycling clubs, and infrastructure investments in countries such as the UAE, Saudi Arabia, and South Africa. Premium road and mountain bicycles record strong demand due to growing participation in endurance events and desert racing formats. E-bike adoption is increasing in urban centers as cities promote sustainable transportation solutions. Although premium bicycle penetration remains lower than other regions, rising tourism activities, sports investments, and high-income expatriate populations contribute to sustained growth potential.

Market Segmentations:

By Bicycle

By Usage

- Mountain

- Premium bicycles

- Road

- Hybrid

By End use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premium Bicycle Market features leading players such as Cervélo Cycles, Giant Manufacturing Co. Ltd., Specialized Bicycle Components, Pon Holdings BV, Cannondale, Accell Group N.V., BMC Switzerland, Merida Industry Co. Ltd., Trek Bicycle Corporation, and Canyon Bicycles. These companies compete through continuous innovation in drivetrain technology, carbon-fiber engineering, electronic shifting systems, and integrated smart connectivity. Manufacturers emphasize performance enhancement, lightweight frame construction, and customization options to meet diverse rider preferences across professional, recreational, and urban mobility segments. Strategic investments in electric premium bicycles strengthen their portfolio differentiation as demand for assisted mobility accelerates. Direct-to-consumer sales models, online configurators, and immersive retail experiences improve customer engagement and brand loyalty. Key players are also expanding geographically through dealer networks, specialty stores, and partnerships with cycling events to enhance global visibility. The market remains innovation-driven, with companies prioritizing R&D, advanced aerodynamics, and sustainability-focused materials to maintain competitive positioning.

Key Player Analysis

- Cervélo Cycles

- Giant Manufacturing Co. Ltd.

- Specialized Bicycle Components

- Pon Holdings BV

- Cannondale

- Accell Group N.V.

- BMC Switzerland

- Merida Industry Co. Ltd.

- Trek Bicycle Corporation

- Canyon Bicycles

Recent Developments

- In September 2025, Trek Bicycle Corporation launched its first-ever electric gravel bike the Checkpoint+ SL expanding its premium e-gravel lineup.

- In March 2024, Canyon Bicycles announced a long-term 10-year commitment agreement with rider Mathieu van der Poel, reinforcing its pro-cycling alliance and brand alignment.

- In October 2022, Trek Bicycle Corporation launched its new e-bike line “Domane+” to expand its premium electric bicycle offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Bicycle, Usage, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium bicycles will witness rising adoption as consumers increasingly prioritize high-performance mobility, fitness, and recreational cycling.

- Electric premium bicycles will continue to expand rapidly as battery efficiency, torque sensors, and lightweight motor systems improve.

- Smart connectivity features such as GPS tracking, performance analytics, and wireless shifting will become standard in premium models.

- Custom-built and direct-to-consumer bicycle models will grow as riders seek personalized geometry and component configurations.

- Carbon-fiber and advanced alloy frame technologies will evolve to offer greater durability, aerodynamics, and weight reduction.

- Urban mobility initiatives and cycling infrastructure expansion will strengthen demand across major global cities.

- Health and wellness trends will drive consistent interest in high-end road, hybrid, and mountain bicycles.

- Supply chain localization and in-house component manufacturing will gain importance to reduce production delays.

- Sustainability-focused materials and eco-designed components will become central to premium bicycle development.

- Competitive differentiation will increasingly depend on digital integration, after-sales services, and enhanced customer experiences.

Market Segmentation Analysis:

Market Segmentation Analysis: