Market Overviews

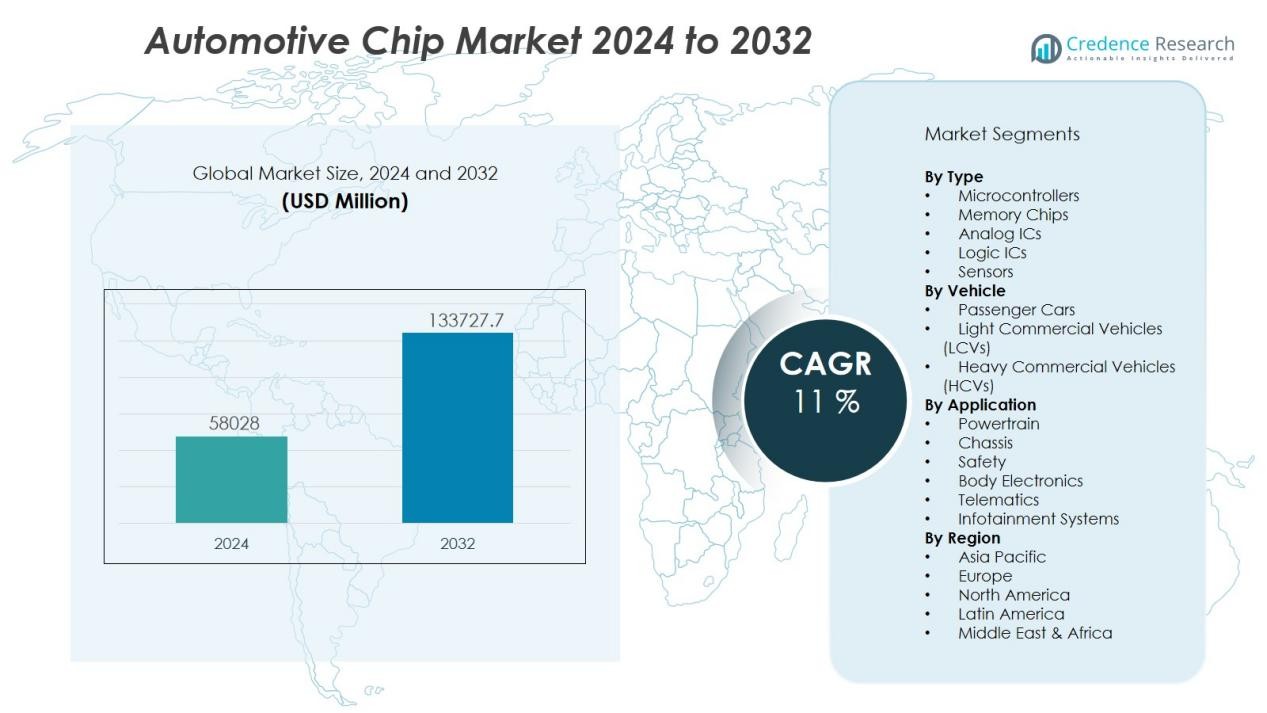

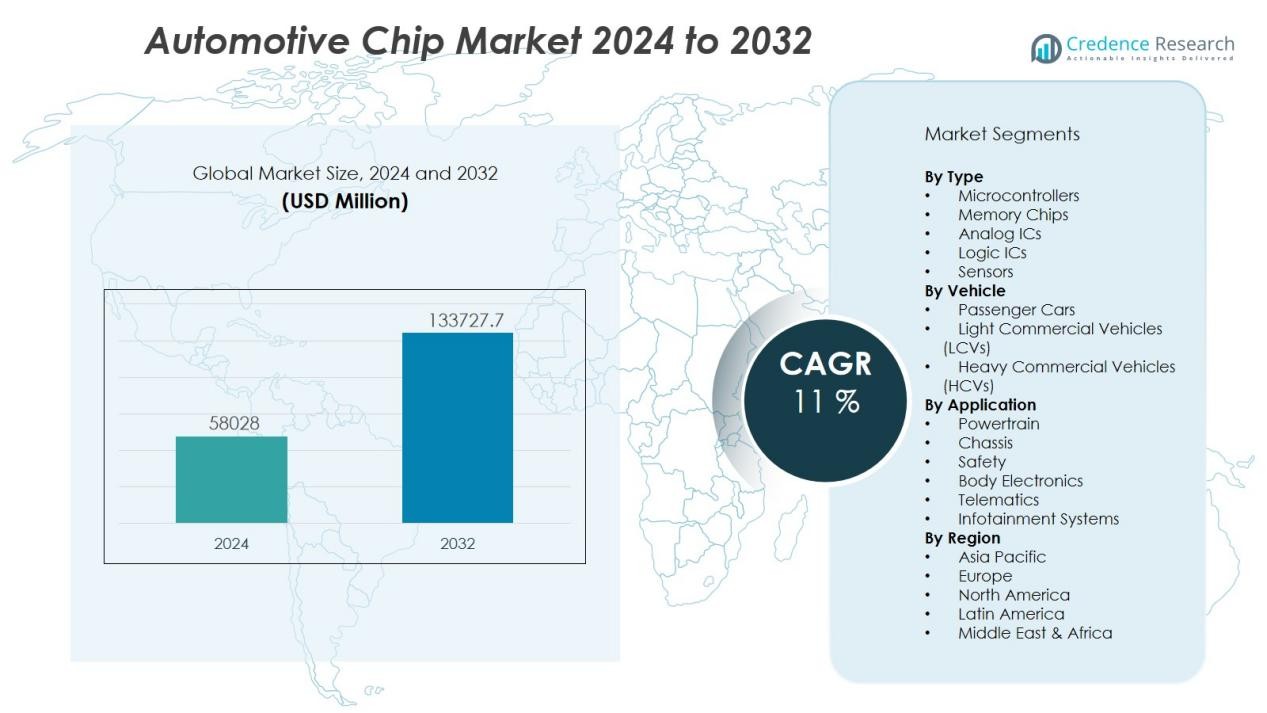

The automotive chip market size was valued at USD 58028 million in 2024 and is anticipated to reach USD 133727.7 million by 2032, at a CAGR of 11 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Chip Market Size 2024 |

USD 58028 Million |

| Automotive Chip Market, CAGR |

11 % |

| Automotive Chip Market Size 2032 |

USD 133727.7 Million |

Market growth is driven by the rising demand for intelligent mobility solutions, stringent government regulations on vehicle safety, and the shift toward energy-efficient transportation. The proliferation of ADAS (Advanced Driver Assistance Systems), vehicle-to-everything (V2X) communication, and connected car technologies is boosting the need for high-performance automotive chips. Furthermore, advancements in semiconductor manufacturing, including smaller process nodes and higher integration capabilities, are enabling more powerful and efficient solutions for both traditional and emerging automotive applications.

Regionally, Asia-Pacific dominates the automotive chip market due to its strong automotive manufacturing base in countries such as China, Japan, and South Korea, coupled with rapid EV adoption. North America holds a significant share, supported by technological leadership and R&D investments in autonomous and connected vehicle systems. Europe remains a key market driven by premium car manufacturers, stringent emission standards, and robust safety regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The automotive chip market was valued at USD 58,028 million in 2024 and is projected to reach USD 133,727.7 million by 2032, driven by rapid technological integration in vehicles.

- Rising adoption of ADAS and semi-autonomous driving features increases demand for high-performance chips capable of real-time data processing and sensor fusion.

- Electrification of the automotive industry fuels the need for advanced power management, battery monitoring, and drivetrain control semiconductors.

- Growth in connected vehicle technologies, including 5G, V2X communication, and high-resolution infotainment systems, boosts semiconductor innovation.

- Global supply chain disruptions and semiconductor shortages continue to challenge production timelines and inventory stability.

- Asia-Pacific leads with a 49% market share due to its strong manufacturing base, high EV adoption, and significant investment in chip fabrication.

- North America and Europe remain key markets, supported by advanced R&D capabilities, stringent safety regulations, and strong adoption of connected and electrified vehicle technologies.

Market Drivers:

Rising Demand for Advanced Driver Assistance Systems (ADAS) and Autonomous Features:

The automotive chip market benefits from the growing integration of ADAS and semi-autonomous functionalities across vehicle segments. Consumers and regulators are prioritizing enhanced safety, pushing manufacturers to adopt high-performance chips for real-time data processing and sensor fusion. It enables functions such as lane-keeping assist, adaptive cruise control, and collision avoidance. Increased affordability of these systems in mass-market vehicles accelerates adoption. The push toward higher levels of autonomy continues to expand semiconductor content per vehicle.

- For instance, Bosch has developed and commercially introduced a radar sensor with RF CMOS technology at 22-nanometer transistor size, integrating high-frequency and digital circuits on a single chip, enabling efficient ADAS functions.

Electrification of the Automotive Industry and Growth of Electric Vehicles (EVs):

The transition to electric mobility significantly boosts the demand for automotive chips. It requires advanced power management, battery monitoring, and thermal control solutions to ensure efficiency and safety in EVs. Semiconductor components play a crucial role in electric drivetrain control and charging infrastructure compatibility. The automotive chip market experiences heightened demand from leading EV manufacturers and emerging players. Expanding charging networks and supportive policies further strengthen this trend.

- For instance, NXP’s BMx7318 series 18-channel Li-ion battery cell controller ICs have shipped over 1 million units to Chevrolet Bolt EV battery packs as of July 2025.

Proliferation of Connected Vehicle Technologies and In-Vehicle Infotainment:

Connectivity has become a central feature in modern vehicles, driving the need for robust processing capabilities. It supports infotainment systems, navigation, real-time traffic updates, and over-the-air software upgrades. The automotive chip market sees growth from integrating 5G, V2X communication, and high-resolution displays into vehicles. Strong consumer expectations for seamless digital experiences influence automakers to invest in advanced semiconductor solutions. This convergence of automotive and consumer electronics accelerates innovation in chip design.

Regulatory Pressure for Safety, Emissions, and Energy Efficiency:

Governments worldwide are imposing stricter regulations on vehicle safety and environmental performance. It drives automakers to incorporate semiconductor-based solutions for compliance and competitive advantage. The automotive chip market benefits from demand for sensors, microcontrollers, and processors that enable low-emission powertrains and predictive maintenance. Enhanced monitoring of vehicle systems helps meet regulatory standards while improving reliability. This alignment between policy objectives and technological advancement sustains long-term market growth.

Market Trends:

Integration of Artificial Intelligence (AI) and Machine Learning in Automotive Semiconductors:

The automotive chip market is witnessing rapid adoption of AI and machine learning capabilities to enhance vehicle intelligence and automation. It enables real-time decision-making in autonomous driving, predictive maintenance, and advanced safety systems. AI-powered chips are supporting complex data processing from multiple sensors, cameras, and LiDAR units, improving accuracy and responsiveness. Automakers are investing in AI-driven semiconductor platforms to differentiate products and meet evolving consumer expectations. The trend extends to optimizing energy consumption and improving battery management in EVs. Semiconductor companies are collaborating with automotive OEMs to develop custom AI accelerators tailored for specific applications, driving innovation in chip architectures.

- For instance, Tesla’s AI6 chip, built on a 3nm process featuring eight tensor cores and 5 exaflops of mixed-precision performance, powers Full Self-Driving (FSD) systems and Optimus robots, showcasing a significant leap in vertical integration and AI coherence across applications with a cost efficiency of $80 per unit.

Shift Toward System-on-Chip (SoC) Designs and Advanced Packaging Technologies:

Vehicle electronics are becoming more compact, efficient, and multifunctional, driving the shift toward SoC-based solutions in the automotive chip market. It consolidates multiple functions—such as infotainment, safety, and connectivity—onto a single chip, reducing space, weight, and cost. Advanced packaging methods, including 3D stacking and chiplet architectures, are improving performance and thermal efficiency. These innovations address the growing demand for high-performance computing in vehicles without compromising reliability. The adoption of SoCs aligns with the push for modular and scalable electronic control units (ECUs), enabling faster design cycles and easier software updates. This integration trend supports the move toward centralized vehicle computing, which simplifies architecture and enhances overall vehicle performance.

- For instance, NXP’s S32G3 SoC integrates four Arm Cortex-A53 cores running at up to 1.5 GHz alongside dual real-time Cortex-M7 cores, all in a single package with 10 Gbps Time-Sensitive Networking (TSN) support for in-vehicle Ethernet.

Market Challenges Analysis:

Supply Chain Disruptions and Semiconductor Shortages:

The automotive chip market continues to face challenges from global semiconductor supply constraints. It experiences production delays due to limited wafer fabrication capacity and disruptions in raw material availability. Geopolitical tensions, natural disasters, and logistical bottlenecks further strain the supply chain. Automakers are forced to prioritize high-margin models or delay new launches, impacting overall market growth. The cyclical nature of semiconductor demand complicates inventory planning for both chipmakers and vehicle manufacturers. Long lead times and dependency on a few foundries heighten the risk of production halts.

Rising Complexity and Cost of Advanced Chip Development:

The shift toward autonomous driving, electrification, and connected vehicles demands high-performance semiconductors with advanced design features. It increases development costs, testing requirements, and time-to-market for new chip architectures. Smaller process nodes and specialized functionalities require substantial R&D investment. The automotive chip market faces the added challenge of meeting stringent automotive-grade safety and reliability standards, which lengthen product qualification cycles. Compliance with multiple regional regulations adds complexity to design and manufacturing processes. These factors create barriers for new entrants and pressure existing players to continuously innovate while maintaining cost competitiveness.

Market Opportunities:

Expansion of Electric and Autonomous Vehicle Segments:

The automotive chip market holds significant growth potential from the accelerating shift toward electric and autonomous vehicles. It benefits from the increasing semiconductor content required for power electronics, battery management systems, and advanced driver assistance features. High-performance chips enable efficient energy conversion, predictive safety measures, and real-time navigation capabilities. Growing government incentives and infrastructure development for EV adoption create a favorable business environment. The rise of Level 3 and above autonomy expands demand for specialized processors, AI accelerators, and sensor fusion technologies. This segment presents long-term opportunities for both established players and innovative startups.

Adoption of Connected Mobility and Over-the-Air (OTA) Upgrades:

The surge in connected vehicle solutions opens new revenue streams for the automotive chip market. It supports in-vehicle infotainment, telematics, predictive maintenance, and fleet management applications. Integration of 5G connectivity, V2X communication, and cloud-based platforms increases the need for high-speed, secure semiconductors. Automakers are focusing on OTA software updates to enhance performance and add new features without physical intervention. This trend drives demand for chips with robust processing power, cybersecurity capabilities, and scalability. The growing ecosystem of connected mobility services creates opportunities for continuous innovation in chip design and functionality.

Market Segmentation Analysis:

By Type:

The automotive chip market includes segments such as microcontrollers, memory chips, analog ICs, logic ICs, and sensors. Microcontrollers hold a significant share due to their role in controlling various electronic systems within vehicles. Memory chips support data storage for infotainment, navigation, and advanced safety features. Analog ICs enable power management and signal processing, while sensors are essential for ADAS, autonomous driving, and environmental monitoring. It continues to see innovation in integrated solutions that combine multiple functions for efficiency and performance gains.

- For instance, NXP Semiconductors offers a 32-bit high-performance microcontroller optimized for radar signal processing that supports up to ASIL D radar applications, combining microcontroller and DSP features to deliver efficient real-time control and safety.

By Vehicle:

This market serves passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Passenger cars represent the largest demand, driven by the integration of infotainment, connectivity, and safety systems across all price segments. LCVs are adopting advanced electronics to improve efficiency, navigation, and driver safety. HCVs require durable, high-performance chips for telematics, fleet management, and load monitoring. It experiences rising demand from electric vehicles across all categories, boosting semiconductor content per unit.

- For instance, Volvo Cars’ next-generation XC90 SPA2 uses the NVIDIA DRIVE Orin SoC delivering 254 TOPS of AI compute performance for Level 2+ autonomous and intelligent cockpit functions in production models.

By Application:

Applications span powertrain, chassis, safety, body electronics, telematics, and infotainment systems. Powertrain applications require chips for engine control, battery management, and energy optimization. Safety systems depend on advanced processors and sensors for collision prevention and stability control. Body electronics include lighting, HVAC, and comfort features, while infotainment and telematics demand high-speed processors for connectivity and entertainment. It benefits from the growing convergence of safety, performance, and user experience in modern vehicles.

Segmentations:

By Type:

- Microcontrollers

- Memory Chips

- Analog ICs

- Logic ICs

- Sensors

By Vehicle:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

By Application:

- Powertrain

- Chassis

- Safety

- Body Electronics

- Telematics

- Infotainment Systems

By Region:

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds a market share of 49% in the automotive chip market, driven by its dominant position in global vehicle and semiconductor manufacturing. China, Japan, and South Korea lead production capacity, supported by established supply chains and rapid technological adoption. It benefits from high EV penetration, strong government incentives, and rising demand for advanced safety systems. Local semiconductor companies collaborate with global players to meet the increasing requirements for high-performance chips. The region’s focus on smart mobility and autonomous driving accelerates innovation in chip design. Continuous investment in fabrication plants strengthens its competitive advantage in both domestic and export markets.

North America :

North America accounts for a market share of 27% in the automotive chip market, supported by its expertise in advanced semiconductor design and integration. The United States leads innovation in autonomous vehicle platforms, AI-driven systems, and EV technologies. It benefits from strong collaborations between automakers, technology firms, and semiconductor manufacturers. The region’s robust regulatory framework for safety and emissions drives adoption of cutting-edge electronics in vehicles. Expansion of EV charging infrastructure and government-backed incentives enhances market demand. Strong venture capital support fuels the growth of startups specializing in automotive-grade semiconductor solutions.

Europe :

Europe holds a market share of 18% in the automotive chip market, driven by its premium car manufacturers and strict regulatory standards. Germany, France, and the United Kingdom lead adoption of advanced driver assistance, connectivity, and electrification technologies. It focuses heavily on meeting sustainability targets, which promotes integration of efficient semiconductor solutions in low-emission vehicles. Collaborations between OEMs and chipmakers aim to optimize performance and compliance. The region’s commitment to autonomous driving research further supports long-term demand. Strong investment in local semiconductor production capacity reduces dependency on external suppliers and strengthens supply chain resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The automotive chip market is highly competitive, with established semiconductor manufacturers leveraging technology leadership and strong industry partnerships to secure market share. Key players include Qualcomm Technologies, Inc., Infineon Technologies AG, Renesas Electronics Corporation, STMicroelectronics, NXP Semiconductors, Texas Instruments Incorporated, and Broadcom. It is driven by continuous innovation in AI integration, advanced packaging, and system-on-chip designs to meet evolving automotive requirements. Companies focus on expanding product portfolios to address applications in ADAS, electrification, connectivity, and infotainment. Strategic collaborations with automakers and Tier 1 suppliers enhance customization and speed to market. Investment in manufacturing capacity, supply chain resilience, and compliance with stringent automotive-grade standards remains a priority. Competitive differentiation is shaped by performance, reliability, scalability, and cost efficiency of semiconductor solutions tailored for diverse vehicle platforms

Market Concentration & Characteristics:

The automotive chip market is moderately concentrated, with a mix of global semiconductor leaders and specialized automotive-focused suppliers holding significant competitive positions. It is characterized by high entry barriers due to complex design requirements, stringent automotive-grade certifications, and substantial R&D investment needs. Leading companies leverage strong partnerships with automakers to deliver customized, high-performance solutions for safety, electrification, and connectivity applications. The market exhibits long product development cycles and rigorous testing to ensure reliability under extreme operating conditions. Technological innovation, such as AI integration, advanced packaging, and system-on-chip architectures, shapes competitive differentiation. Supply chain resilience, vertical integration, and manufacturing capacity expansion remain critical factors influencing market leadership.

Report Coverage:

The research report offers an in-depth analysis based on Type, Vehicle, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing adoption of autonomous and semi-autonomous driving features will drive demand for high-performance AI-enabled automotive chips.

- Expansion of electric vehicle production will boost the need for advanced power management, battery monitoring, and energy efficiency solutions.

- Integration of 5G and V2X communication will enhance connectivity and require chips with faster processing speeds and low-latency performance.

- Growing consumer demand for advanced infotainment systems will spur innovation in multimedia and high-resolution display processing chips.

- Advancements in system-on-chip architectures will enable compact, multifunctional solutions that reduce cost and improve vehicle design flexibility.

- Development of automotive-grade chips with enhanced cybersecurity features will gain priority to safeguard connected vehicle ecosystems.

- Increased localization of semiconductor manufacturing will improve supply chain stability and reduce dependency on limited global foundry capacity.

- Rising demand for over-the-air software updates will encourage the adoption of scalable, upgrade-ready chip platforms.

- Collaboration between automakers and semiconductor companies will accelerate customized chip development tailored to specific vehicle platforms.

- Focus on sustainable and energy-efficient semiconductor production processes will align with global environmental regulations and corporate ESG goals.