Market Overview

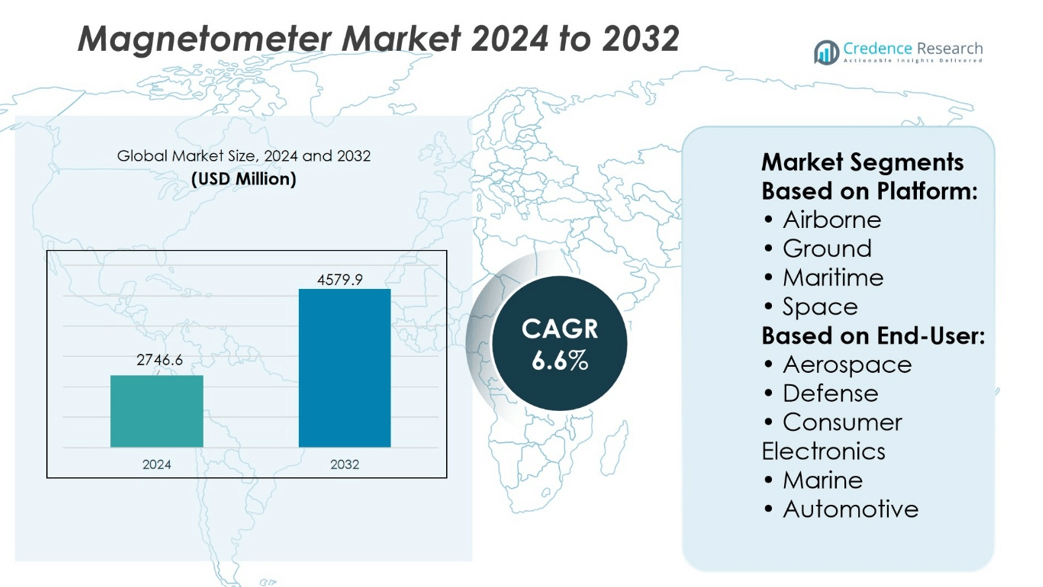

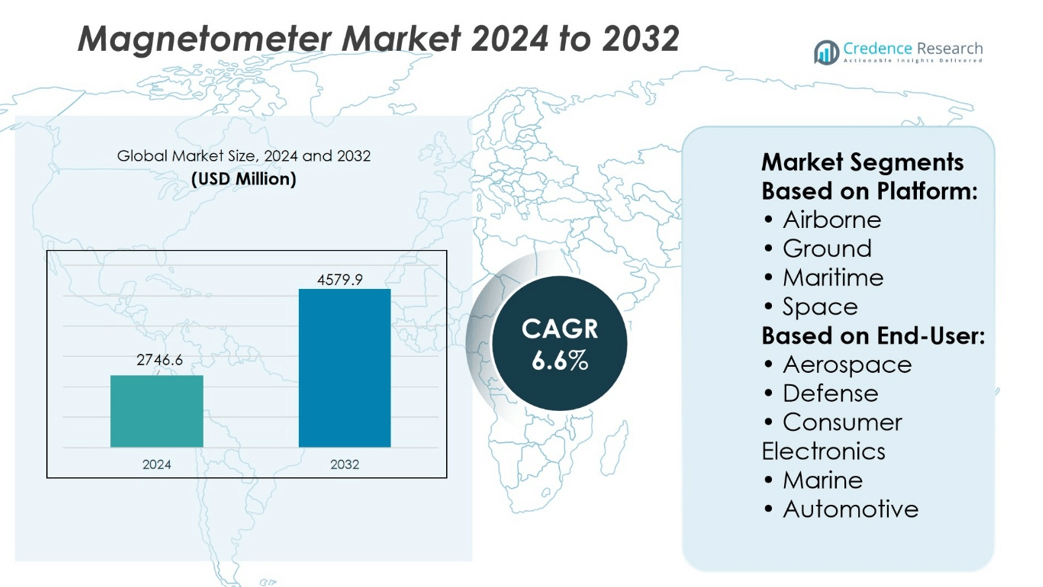

Magnetometer Market size was valued at USD 2746.6 million in 2024 and is anticipated to reach USD 4579.9 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnetometer Market Size 2024 |

USD 2746.6 million |

| Magnetometer Market, CAGR |

6.61% |

| Magnetometer Market Size 2032 |

USD 4579.9 million |

The Magnetometer Market grows with rising demand from defense, aerospace, geophysical exploration, and industrial automation sectors. It benefits from expanding applications in autonomous vehicles, drones, and marine navigation, where high-precision magnetic sensing is essential. Advancements in miniaturization, materials science, and integration with digital data systems enhance performance and broaden adoption. Increasing investments in space exploration and smart infrastructure further boost market potential. Trends include the development of lightweight, energy-efficient models and multi-sensor integration for complex operational environments, enabling manufacturers to meet evolving industry needs while supporting both commercial and scientific applications across global markets.

The Magnetometer Market shows strong presence across North America, Europe, and Asia Pacific, with North America leading due to advanced aerospace and defense sectors, Europe supported by industrial and research applications, and Asia Pacific emerging as the fastest-growing region driven by electronics and infrastructure projects. Key players include Marine Magnetics, GEM Systems, AGICO Technology, FOERSTER, Scintrex, Overhauser Geomagnetic Instruments, Bartington Instruments, Oxford Instruments, Geometrics, and Lake Shore Cryotronics, all focusing on innovation, precision, and global expansion to maintain competitive advantage.

Market Insights

- The Magnetometer Market was valued at USD 2746.6 million in 2024 and is projected to reach USD 4579.9 million by 2032, at a CAGR of 6.6%.

- Rising demand from defense, aerospace, geophysical exploration, and industrial automation sectors is driving market growth.

- Expanding applications in autonomous vehicles, drones, marine navigation, and space exploration are creating new opportunities.

- Competition is defined by innovation, product precision, customization capabilities, and global expansion strategies of leading players.

- High production costs and complex manufacturing processes can limit adoption in price-sensitive markets.

- North America leads due to advanced aerospace and defense sectors, Europe benefits from strong industrial and research applications, and Asia Pacific is the fastest-growing region.

- Key players focus on developing lightweight, energy-efficient, and multi-sensor integrated models to address diverse operational needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Aerospace, Defense, and Marine Sectors

The Magnetometer Market experiences strong growth from its critical role in aerospace, defense, and marine navigation. It supports precise heading reference and detection of magnetic anomalies, which are essential for military and research operations. Defense agencies rely on it for submarine detection, unexploded ordnance location, and secure navigation in GPS-denied environments. The aerospace sector adopts it for satellite attitude control and spacecraft orientation. Marine applications leverage it for mapping seafloor structures and resource exploration. The integration of magnetometers into these sectors ensures high operational accuracy in challenging conditions.

- For instance, NASA and NOAA awarded a contract worth 26.1 million dollars to Southwest Research Institute for the development of two magnetometer instruments.

Advancement in Consumer Electronics Integration

The Magnetometer Market benefits from rapid integration into smartphones, tablets, and wearable devices. It enables orientation detection, augmented reality features, and enhanced navigation without relying solely on GPS. Manufacturers embed it into devices to improve mapping accuracy and gaming experiences. Consumer electronics companies invest in miniaturization and low-power designs to extend battery life. Demand increases as devices require seamless indoor and outdoor location services. The widespread use of it in personal devices expands the overall market adoption.

- For instance, Samsung incorporated magnetometer sensors into 60.5 million of its smartphones in a single quarter.

Rising Adoption in Industrial and Geological Applications

The Magnetometer Market gains momentum in industrial automation, mineral exploration, and geophysical surveys. It allows detection of ferrous materials in manufacturing processes, improving safety and quality control. Geological exploration firms employ it for locating mineral deposits and assessing fault lines. Archaeological teams use it to detect buried artifacts without excavation. It provides non-invasive and cost-effective surveying methods, which attract both commercial and academic interest. Growing infrastructure development projects further drive its deployment in field surveys.

Technological Innovation and Sensor Performance Enhancement

The Magnetometer Market advances through developments in sensitivity, stability, and miniaturization. Manufacturers design high-resolution sensors that operate reliably in extreme temperatures and magnetic environments. Integration with IoT platforms enables remote monitoring and data analytics in real time. Multi-axis designs enhance accuracy in motion tracking and navigation systems. Automotive manufacturers incorporate it into advanced driver assistance systems for improved positioning. Continuous R&D investment leads to compact, power-efficient solutions that open new application areas across industries.

Market Trends

Increased Integration with Autonomous Vehicle Navigation Systems

The Magnetometer Market witnesses a growing trend of integration into autonomous vehicle platforms for enhanced navigation accuracy. It assists in providing precise directional data even in areas where GPS signals weaken or face obstruction. Automotive manufacturers implement it to support lane-level positioning and improve safety features. The combination of magnetometer data with other sensors strengthens overall reliability. Advances in calibration techniques reduce magnetic interference in urban environments. The role of it in vehicle guidance systems continues to expand with the rise of autonomous mobility.

- For instance, Bosch reported the deployment of 500 million magnetic sensors including magnetometers for steering angle and position sensing applications across its vehicle platforms.

Expansion of Miniaturized and Low-Power Designs

The Magnetometer Market progresses toward compact and energy-efficient models to meet the demands of portable and embedded systems. It enables incorporation into smaller consumer electronics without compromising accuracy. Wearable devices, smartphones, and drones benefit from these advances in size and power consumption. Manufacturers focus on designs that maintain high sensitivity while reducing operational load. Improved manufacturing processes contribute to consistent sensor performance across varied environments. This trend supports broader adoption in applications requiring space and power efficiency.

- For instance, Honeywell reported shipping 55 million low-power, Hall‑effect based magnetometer units embedded in compact electronic devices worldwide.

Growing Role in Space Exploration and Satellite Applications

The Magnetometer Market shows increased demand from space agencies and satellite manufacturers for high-precision magnetic field measurements. It supports spacecraft navigation, space weather monitoring, and planetary research missions. Multi-axis designs enhance the ability to detect subtle magnetic variations in space. Satellite payloads integrate it to gather critical scientific data for mission objectives. Sensor reliability in harsh space environments remains a priority for development. This trend reflects the rising number of government and commercial space projects globally.

Adoption in Smart Infrastructure and Industrial IoT Systems

The Magnetometer Market gains traction through its adoption in smart city infrastructure and industrial IoT frameworks. It contributes to monitoring structural health, detecting metallic objects, and optimizing traffic systems. Industrial facilities use it for automated inspection and predictive maintenance. Integration with IoT networks allows real-time data collection and analytics for decision-making. Enhanced communication protocols improve interoperability with other smart devices. The expanding role of it in connected infrastructure aligns with the shift toward data-driven urban management.

Market Challenges Analysis

Susceptibility to Magnetic Interference and Environmental Factors

The Magnetometer Market faces operational challenges due to susceptibility to magnetic interference from surrounding electronic devices and infrastructure. It can experience performance degradation in environments with strong electromagnetic fields or metallic structures. Urban settings, industrial plants, and transportation hubs often present conditions that affect accuracy. Sensor drift over time further complicates long-term reliability in critical applications. Manufacturers must invest in advanced shielding, calibration, and compensation techniques to minimize these effects. Maintaining consistent performance across varying environmental conditions remains a primary technical hurdle.

High Development Costs and Integration Complexities

The Magnetometer Market encounters constraints linked to high research, development, and integration costs. It often requires sophisticated design modifications to meet application-specific performance demands, driving up production expenses. Incorporating it into multi-sensor systems for navigation or industrial use involves complex calibration and software integration. Smaller manufacturers struggle to compete due to limited budgets for R&D and advanced manufacturing facilities. Long certification processes in aerospace, defense, and automotive sectors extend time-to-market. These cost and integration challenges limit broader adoption in price-sensitive segments.

Market Opportunities

Emerging Applications in Renewable Energy and Environmental Monitoring

The Magnetometer Market has strong growth potential through its use in renewable energy and environmental monitoring initiatives. It supports offshore wind farm construction by aiding in subsea cable routing and detecting buried metallic objects. Environmental agencies deploy it for monitoring geomagnetic activity and assessing natural resource deposits. The ability of it to provide precise magnetic readings enables accurate mapping in remote or underwater locations. Expanding renewable energy infrastructure creates consistent demand for advanced sensing technologies. Its role in sustainable development projects aligns with global efforts to transition toward cleaner energy systems.

Advancements in Wearable Technology and Healthcare Diagnostics

The Magnetometer Market offers opportunities in healthcare and wearable technology sectors through innovative sensor applications. It enables non-invasive diagnostic tools to detect metallic fragments in the human body or track surgical instruments during procedures. Wearable devices integrate it to enhance motion tracking and improve rehabilitation monitoring. The miniaturization of high-sensitivity magnetometers opens possibilities for continuous patient monitoring without bulky equipment. Consumer health devices also benefit from its ability to support precise orientation and location tracking. These advancements broaden its utility across both medical and lifestyle applications.

Market Segmentation Analysis:

By Platform

The Magnetometer Market is segmented into airborne, ground, maritime, and space platforms, each addressing specific operational environments. Airborne platforms integrate it into aircraft, drones, and satellites to support navigation, geophysical surveys, and defense missions. Ground-based platforms utilize it for mineral exploration, infrastructure monitoring, and archaeological surveys, benefiting from stable deployment conditions. Maritime platforms employ it for submarine detection, undersea mapping, and navigation in GPS-limited waters, offering critical capabilities for naval and commercial operations. Space platforms use it to measure planetary magnetic fields, monitor space weather, and support satellite attitude control. Demand across all platforms grows with technological improvements that enhance sensitivity and resilience in extreme environments.

- For instance, SPH Engineering outfitted drone-based magnetometer systems—such as the SENSYS MagDrone series—with over 15 million individual magnetic sensor.

By End User

The Magnetometer Market serves diverse end users, including aerospace and defense, consumer electronics, marine/naval, and automotive sectors. Aerospace and defense organizations rely on it for secure navigation, magnetic anomaly detection, and reconnaissance applications, often in mission-critical scenarios. Consumer electronics manufacturers embed it into smartphones, wearables, and tablets to improve orientation, location accuracy, and augmented reality functions. Marine and naval applications use it for seabed mapping, ship navigation, and detection of submerged objects in strategic and commercial contexts. Automotive applications adopt it for advanced driver assistance systems, electric vehicle navigation, and autonomous driving solutions, where precision and stability are vital. The broad applicability across these sectors reinforces its role as a critical sensing technology in both commercial and defense markets.

- For instance, quantum sensor manufacturers supply over 140 million magnetometer-capable quantum sensor units across aerospace and defense platforms globally.

Segments:

Based on Platform:

- Airborne

- Ground

- Maritime

- Space

Based on End-User:

- Aerospace

- Defense

- Consumer Electronics

- Marine

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the magnetometer market in 2024, at about 38.7%, and crossed 40% in 2025. The region’s leadership is due to high demand from aerospace, defense, healthcare, and research sectors. Magnetometers are widely used in drones, autonomous vehicles, navigation systems, and precision measurement equipment. The presence of leading manufacturers and research institutions ensures consistent innovation in magnetometer technologies. Government-funded projects in space exploration, environmental monitoring, and defense surveillance also boost adoption. The United States accounts for most of the regional share, followed by Canada, where strong industrial applications are growing.

Europe

Europe accounted for over 30% of the global magnetometer market in 2025. This share is supported by a well-developed industrial base, advanced manufacturing capabilities, and the presence of strong automotive, electronics, and healthcare industries. European countries have been early adopters of advanced sensing technologies in industrial automation, scientific research, and space programs. Magnetometers are also in demand for applications such as mineral exploration, underwater navigation, and security systems. Germany, France, and the United Kingdom are key contributors, while Nordic countries also have increasing adoption in research and defense. The region’s strong R&D networks help maintain a competitive edge.

Asia-Pacific

Asia Pacific held about 23% of the market in 2025 and is the fastest-growing region globally. Rising demand is driven by rapid growth in consumer electronics, especially smartphones, wearable devices, and IoT equipment. Countries such as China, India, Japan, and South Korea are investing heavily in defense, aerospace, and industrial infrastructure. The region also benefits from cost-effective manufacturing capabilities, enabling large-scale production of magnetometer components. In addition, magnetometers are being deployed in geological surveys, navigation systems, and smart city projects. The strong presence of electronics manufacturing hubs in China and Japan further accelerates regional growth.

Latin America

Latin America accounted for around 5% of the global magnetometer market in 2025. Although its share is smaller compared to North America, Europe, and Asia Pacific, the region shows steady growth potential. Mining is the largest contributor to demand, as magnetometers are widely used in mineral exploration and geophysical surveys to detect underground deposits. Countries like Brazil and Chile dominate usage due to their rich mineral resources and advanced exploration activities. In addition, industrial automation is gaining traction in sectors such as manufacturing, oil & gas, and renewable energy. Magnetometers are also finding applications in infrastructure monitoring and environmental studies, especially in earthquake-prone areas like Chile and Peru.

Middle East and Africa

The Middle East and Africa together accounted for roughly 3% of the global magnetometer market in 2025, with the Middle East contributing about 2% and Africa around 1%. In the Middle East, demand is driven primarily by oil & gas exploration, where magnetometers are used for underground mapping, drilling target identification, and pipeline monitoring, with Saudi Arabia, United Arab Emirates, and Qatar leading adoption. The region is also investing in aerospace and satellite programs that require high-precision magnetic sensing. In Africa, mining dominates usage, particularly in South Africa, Namibia, Botswana, and Ghana, where magnetometers assist in geological mapping and mineral exploration. While both regions have relatively small market sizes compared to North America, Europe, and Asia Pacific, their high-value, specialized applications, combined with increasing government investments and international partnerships, are expected to support steady growth in adoption over the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marine Magnetics

- GEM Systems

- AGICO Technology

- FOERSTER

- Scintrex

- Overhauser Geomagnetic Instruments

- Bartington Instruments

- Oxford Instruments

- Geometrics

- Lake Shore Cryotronics

Competitive Analysis

The magnetometer market features include Marine Magnetics, GEM Systems, AGICO Technology, FOERSTER, Scintrex, Overhauser Geomagnetic Instruments, Bartington Instruments, Oxford Instruments, Geometrics, and Lake Shore Cryotronics. The magnetometer market is characterized by intense competition, with companies focusing on innovation, precision, and application-specific solutions to secure market share. Manufacturers prioritize developing high-sensitivity instruments with improved noise reduction, durability, and adaptability for diverse environments, ranging from deep-sea exploration to space missions. Advancements in miniaturization and integration with digital systems are enabling broader adoption in defense, aerospace, mining, and industrial automation. Firms actively pursue partnerships with research institutions, defense agencies, and technology providers to enhance product performance and expand into emerging markets. Geographic expansion strategies target fast-growing regions such as Asia Pacific and Latin America, where demand is rising for both commercial and scientific applications. Price competitiveness, coupled with robust after-sales service and customization capabilities, remains critical in differentiating offerings. Continuous investment in research and development ensures the creation of next-generation magnetometers that meet evolving industry standards and specialized user requirements, sustaining competitive strength in a rapidly advancing technological landscape.

Recent Developments

- In January 2025, Marine Magnetics introduced advancements in their Synapse Horizontal Gradiometer, a high-sensitivity marine towfish magnetometer designed for precise marine magnetic surveys.

- In December 2024, MDA Space selected Honeywell to provide a satellite Attitude Control System and Magnetometers Unit components, including Reaction Wheel Assemblies and 3-axis Space Rate Sensors, for the MDA AURORA product line supporting Telesat’s LEO satellite constellation.

- In June 2023, Xaba and Lockheed Martin collaborated to assess automating vital manufacturing tasks with the integration of Xaba’s xCognition AI model into Lockheed Martin’s industrial robots.

- In February 2023, Lake Shore Cryotronics and Oxford Instruments established a partnership. This collaboration combines their expertise in measurement and control solutions to develop an automated and readily deployable electrical transport measurement solution for Oxford Instruments’ Teslatron system.

Market Concentration & Characteristics

The Magnetometer Market shows a moderately concentrated structure, with a mix of global leaders and specialized regional players competing on technology, precision, and application diversity. It benefits from steady demand across defense, aerospace, geophysical exploration, and industrial automation, driven by the need for accurate magnetic field measurement. The market is defined by high entry barriers due to advanced technology requirements, significant R&D investment, and specialized manufacturing capabilities. It is characterized by continuous innovation, with companies focusing on enhancing sensitivity, reducing noise, and improving portability to meet evolving operational needs. Competitive differentiation relies on product performance, customization, and integration with advanced data acquisition systems. Geographic expansion into high-growth regions such as Asia Pacific is a key strategic focus, supported by partnerships with research institutions and government agencies. The market demonstrates strong technological orientation, with manufacturers leveraging advancements in materials science, electronics, and miniaturization to create versatile and reliable instruments that address both commercial and scientific applications.

Report Coverage

The research report offers an in-depth analysis based on Platform, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of magnetometers in defense and aerospace applications.

- Demand will grow in geophysical exploration for mining and oil & gas projects.

- Integration with autonomous vehicles and drones will create new opportunities.

- Miniaturization will support increased use in consumer electronics and wearable devices.

- Advancements in materials will enhance sensitivity and reduce device weight.

- Marine and underwater navigation applications will gain more importance.

- Space exploration projects will drive specialized magnetometer development.

- Industrial automation will generate consistent demand for high-precision sensors.

- Emerging economies will adopt magnetometers for infrastructure and research projects.

- Collaboration between manufacturers and research institutions will accelerate product innovation.