Market Overview

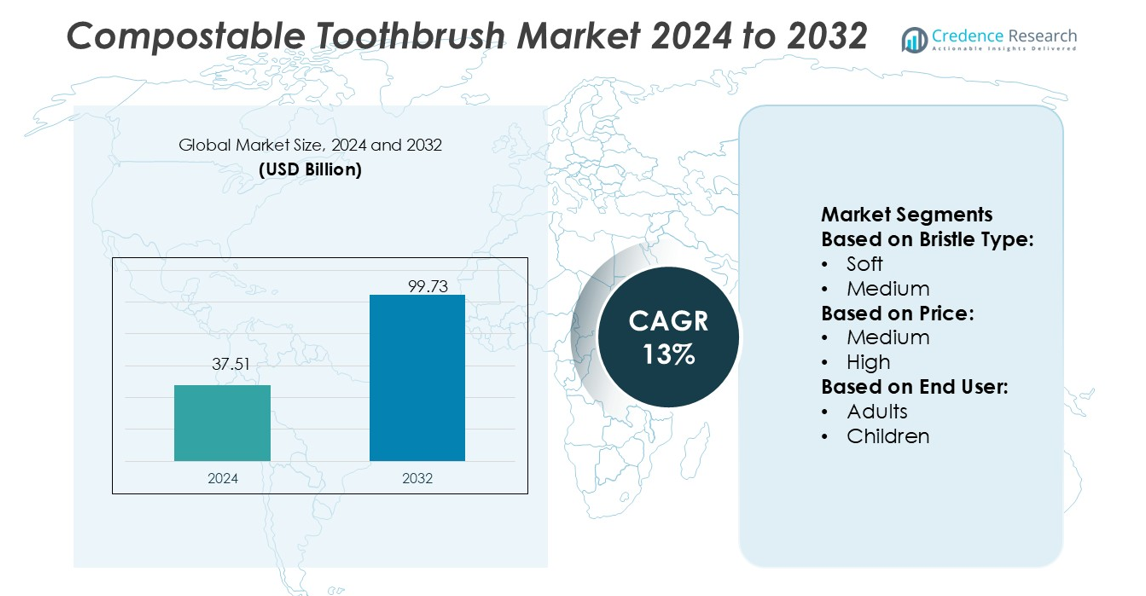

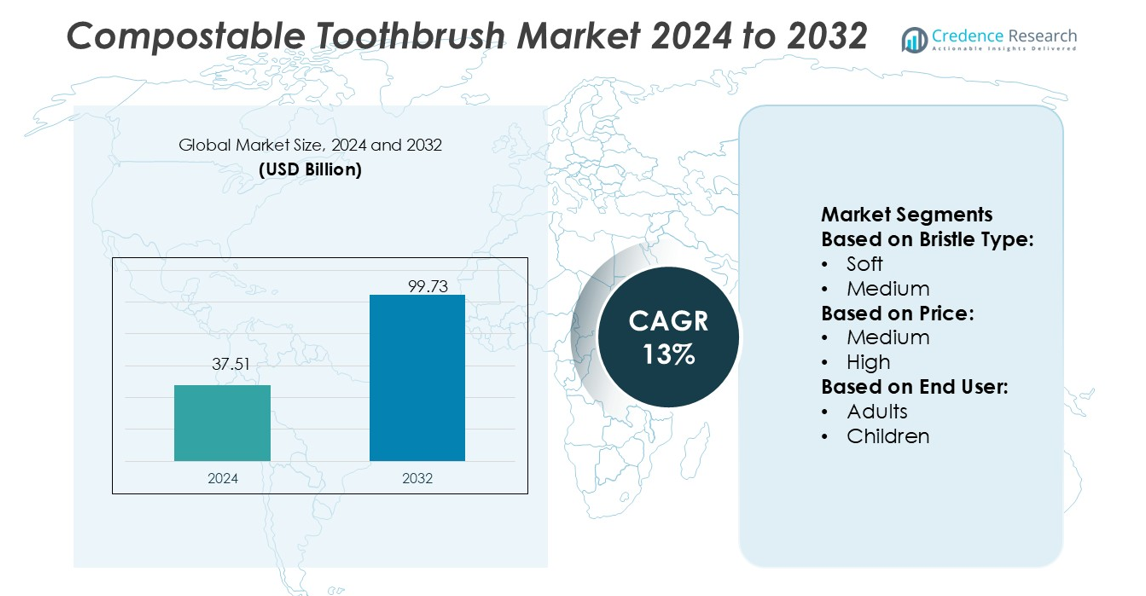

Compostable Toothbrush Market size was valued USD 37.51 billion in 2024 and is anticipated to reach USD 99.73 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Toothbrush Market Size 2024 |

USD 37.51 billion |

| Compostable Toothbrush Market, CAGR |

13% |

| Compostable Toothbrush Market Size 2032 |

USD 99.73 billion |

The Compostable Toothbrush Market is driven by key players such as Brush with Bamboo, Georganics Company, Ecosphere, Bambrush, Humble Group, Bare Necessities, Colgate-Palmolive Company, Environmental Toothbrush, Bam&Boo, and BlueRock Living. These companies emphasize sustainable production, using bamboo, cornstarch, and bio-based materials to replace plastic toothbrushes. They focus on innovation, eco-friendly packaging, and expanding distribution through retail and online platforms. North America leads the global market with a 34% share, supported by high consumer awareness, strict plastic regulations, and growing demand for biodegradable personal care products. The region’s advanced manufacturing capabilities and strong sustainability initiatives position it as a major hub for eco-conscious oral care solutions.

Market Insights

- The Compostable Toothbrush Market was valued at USD 37.51 billion in 2024 and is projected to reach USD 99.73 billion by 2032, growing at a CAGR of 13%.

- Rising consumer preference for eco-friendly and plastic-free oral care products drives strong market growth across global regions.

- The market shows a clear trend toward sustainable materials such as bamboo and cornstarch, supported by innovation in bio-based bristles and recyclable packaging.

- Competition intensifies as both established brands and startups invest in expanding retail and e-commerce networks while ensuring product certifications.

- North America leads with a 34% regional share, while the soft bristle segment holds the dominant position due to comfort and dentist recommendations, reflecting strong consumer alignment with sustainability and usability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Bristle Type

Soft bristles hold the dominant share of 57% in the Compostable Toothbrush Market. Their popularity stems from their gentle cleaning action, making them suitable for sensitive gums and enamel protection. Manufacturers use biodegradable nylon-4 and plant-based polymers to enhance flexibility and eco-friendliness. Medium and hard bristles cater to niche users seeking stronger cleaning performance but face lower adoption due to gum abrasion risks. Increasing dental health awareness and dentist recommendations for soft bristles continue to strengthen their dominance across both retail and e-commerce channels.

- For instance, Ecosphere produces 100 % biodegradable bamboo toothbrushes with PLA bristles. Their product line spans baby, kids, and adult sizes, with ultra-soft and soft bristle options.

By Price

The medium-price segment accounts for 46% of the market share, representing the largest consumer group. This category balances affordability with quality, offering sustainable materials and ergonomic designs. Brands focus on compostable handles made from bamboo and cornstarch to maintain cost-effectiveness while ensuring durability. Low-priced options attract entry-level consumers but often compromise longevity, while premium variants target eco-conscious buyers seeking superior aesthetics. The rising middle-income population and growing retail penetration of mid-tier sustainable products fuel this segment’s leadership.

- For instance, DS Smith replaced over 1.2 billion pieces of plastic across customer packaging systems — hitting their plastic removal target 16 months ahead of schedule.

By End User

Adults dominate the Compostable Toothbrush Market with a 71% market share. The adult segment benefits from higher environmental awareness and spending capacity. Manufacturers design compostable toothbrushes with minimalist aesthetics and ergonomic handles to appeal to this demographic. Children’s toothbrushes, though smaller in share, are expanding rapidly through colorful designs and safe, plant-based materials. The adult preference for replacing plastic products with biodegradable alternatives, coupled with wide product availability in supermarkets and online stores, continues to drive this segment’s market dominance.

Key Growth Drivers

Rising Consumer Shift Toward Sustainability

Growing environmental awareness is driving consumers to adopt compostable toothbrushes. Brands emphasize biodegradable materials like bamboo and cornstarch to replace plastic handles. Companies such as Brush with Bamboo report eliminating millions of plastic toothbrushes from landfills through sustainable alternatives. Increased eco-consciousness, combined with supportive regulations on plastic waste reduction, strengthens market growth. The global movement toward circular economy practices further fuels product demand, encouraging large retailers to expand their eco-friendly oral care product lines.

- For instance, Rengo aims to reduce average corrugated board grammage by 0.5 g/m² per year and raise the share of environmentally friendly plastic products to a target accounting for 20% of net sales.

Government Regulations and Plastic Ban Policies

Many countries have imposed bans on single-use plastics, pushing consumers toward biodegradable oral care solutions. Compostable toothbrush makers benefit from such legislative support. For instance, the European Union’s Single-Use Plastics Directive has encouraged manufacturers to switch to natural materials. Brands now highlight compliance certifications like USDA BioPreferred and FSC for credibility. This regulatory shift, coupled with growing institutional procurement of sustainable hygiene products, positions compostable toothbrushes as a preferred choice in environmentally responsible markets.

- For instance, Stora Enso expanded its formed fiber production at the Hylte site, raising its output from 50 million units annually to 115 million units after upgrades.

Expanding Retail and E-commerce Availability

The rise of e-commerce platforms has increased product accessibility for sustainable toothbrush brands. Companies leverage digital marketplaces like Amazon and Etsy to reach eco-conscious consumers globally. Subscription models for oral hygiene kits also enhance repeat purchases. Major retailers have begun dedicating shelf space to green personal care products, increasing visibility and awareness. The integration of storytelling and transparent sourcing on digital platforms helps strengthen consumer trust, further boosting market adoption and brand loyalty.

Key Trends & Opportunities

Innovation in Biodegradable Material Technology

Manufacturers are developing advanced biopolymers that improve product durability and compostability. Research in materials such as PLA (polylactic acid) and PHA (polyhydroxyalkanoates) is expanding design flexibility while maintaining biodegradability. For example, The Humble Co. introduced hybrid handles combining bamboo with bio-based resins for enhanced comfort and strength. Continuous material innovation creates opportunities to broaden product lines beyond toothbrushes to related oral hygiene tools, catering to both premium and mass-market consumers.

- For instance, BASF expanded its certified compostable biopolymer lineup by launching ecoflex® F Blend C1200 BMB, a biomass-balanced PBAT grade that yields a 60 % lower Product Carbon Footprint versus the standard ecoflex® counterpart, while retaining identical mechanical and processing properties.

Growing Influence of Eco-conscious Branding

Brands are focusing on transparency, minimal packaging, and ethical messaging to attract millennials and Gen Z. Certification labels like “Zero Waste” and “Vegan” enhance credibility and promote responsible consumerism. Companies such as Terra & Co. integrate storytelling about sourcing and sustainability in their marketing. Collaborations with dental care professionals also strengthen product legitimacy. This trend presents opportunities for differentiation and long-term consumer loyalty in a competitive oral care landscape.

- For instance, Mondi recently increased capacity of its Functional Barrier paper achieves oxygen transmission rate (OTR) below 0.5 cm³/m²·day and water vapor transmission rate (WVTR) below 0.5 g/m²·day.

Partnerships with Dental Professionals and NGOs

Manufacturers are forming alliances with dentists and sustainability-focused NGOs to promote eco-friendly oral hygiene education. Programs offering compostable toothbrushes in schools or communities enhance brand visibility and social impact. Organizations like Colgate’s Bright Smiles initiative increasingly include sustainable alternatives in outreach programs. Such collaborations help expand adoption in both developed and developing markets, positioning compostable toothbrushes as practical, ethical choices supported by credible institutions.

Key Challenges

High Production Costs and Price Sensitivity

Compostable toothbrushes often cost more than conventional plastic versions due to higher raw material and manufacturing expenses. Bamboo processing and biopolymer sourcing increase production complexity. Small-scale manufacturers face scalability challenges that limit price competitiveness. In cost-sensitive markets, this price gap reduces adoption rates, particularly among middle-income consumers. Reducing production costs through localized sourcing and automation remains a key challenge for industry players aiming for mass-market penetration.

Limited Consumer Awareness and Misconceptions

Many consumers remain unaware of compostable toothbrush benefits or proper disposal methods. Misconceptions about product durability and hygiene discourage adoption. Some buyers mistakenly believe biodegradable materials compromise brushing performance. Lack of clear composting infrastructure also hinders waste management benefits. To overcome this, manufacturers and governments must invest in education campaigns and transparent labeling to ensure consumers understand both the environmental value and effectiveness of compostable oral care products.

Regional Analysis

North America

North America dominates the Compostable Toothbrush Market with a 34% share. The region’s growth is driven by high awareness of plastic pollution and strong sustainability initiatives. Major brands and startups are investing in eco-friendly oral care solutions supported by government bans on single-use plastics. The U.S. leads due to high disposable income and increased adoption of compostable materials like bamboo and cornstarch. Companies such as Humble Co. and Bite are expanding their biodegradable product lines. Retail expansion and online distribution further strengthen North America’s leadership in sustainable toothbrush adoption.

Europe

Europe holds a 29% share in the Compostable Toothbrush Market, supported by stringent environmental regulations and eco-conscious consumers. Countries like Germany, France, and the U.K. promote compostable products through recycling mandates and circular economy programs. Rising demand for vegan, cruelty-free products boosts market adoption. European brands such as Truthbrush and Hydrophil lead innovation with FSC-certified bamboo and bio-based bristles. The strong retail presence of sustainable oral care products across supermarkets and e-commerce platforms enhances regional penetration and brand visibility.

Asia-Pacific

Asia-Pacific accounts for a 27% market share and shows the fastest growth in the Compostable Toothbrush Market. Expanding urban populations and growing middle-class awareness about eco-friendly products fuel regional demand. China, India, and Japan are major contributors due to bamboo availability and large oral care markets. Local manufacturers like Bamboo Brush Society and Terrabrush are promoting affordable, biodegradable toothbrushes. Government initiatives supporting sustainable product manufacturing and export are accelerating regional competitiveness and supply chain strength.

Latin America

Latin America holds a 6% share in the Compostable Toothbrush Market. Brazil and Mexico lead adoption due to rising environmental consciousness and expanding personal care industries. Consumers increasingly prefer eco-friendly and cost-effective alternatives to plastic brushes. Local startups and sustainable retail outlets are promoting biodegradable toothbrush brands. Growth is supported by government initiatives to reduce plastic waste and corporate CSR commitments. Product availability through e-commerce platforms and health stores strengthens regional accessibility and consumer engagement.

Middle East & Africa

The Middle East & Africa region captures a 4% share in the Compostable Toothbrush Market. Growth remains gradual due to limited awareness but improving with sustainability campaigns and import availability. The UAE and South Africa are leading markets, emphasizing eco-friendly oral care through premium retail chains. Global brands are expanding distribution partnerships to capture niche urban markets. Increasing environmental regulations and educational initiatives are expected to drive gradual adoption of compostable toothbrushes across key cities in the region.

Market Segmentations:

By Bristle Type:

By Price:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Compostable Toothbrush Market features leading players including Brush with Bamboo, Georganics Company, Ecosphere, Bambrush, Humble Group, Bare Necessities, Colgate-Palmolive Company, Environmental Toothbrush, Bam&Boo, and BlueRock Living. The competitive landscape of the Compostable Toothbrush Market is characterized by continuous innovation, sustainability-driven strategies, and strong brand differentiation. Manufacturers focus on developing biodegradable toothbrushes made from bamboo, cornstarch, and bio-based polymers to align with global plastic reduction goals. Many brands are investing in advanced materials and eco-friendly packaging to enhance durability and consumer appeal. The market also witnesses rising collaborations with oral care specialists and retailers to expand visibility and product reach. Companies emphasize certifications such as FSC and vegan approvals to strengthen brand credibility. E-commerce and subscription models are becoming key growth channels, offering convenience and customization. Continuous R&D investments and growing awareness of sustainable living contribute to an increasingly competitive and innovation-focused market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Futamura and GK Sondermaschinenbau collaborate on a compostable packaging laminate for liquid sachets, using NatureFlex technology and cellulose film for barrier and biofilm seals.

- In March 2025, Green Lab, a leading eco-packaging manufacturer in Southeast Asia, entered the U.S. market, offering FSC-certified, 100% recycled paper bags and eco-friendly food packaging.

- In September 2024, Pakka Ltd., a major compostable packaging company, launched a new range of compostable flexible packaging solutions aimed at the Fast-Moving Consumer Goods (FMCG) industry. This initiative represents a significant step in addressing environmental concerns related to packaging waste, particularly in India.

- In April 2024, The Humble Co. expanded its range of sustainable oral care products by releasing new toothbrush heads compatible with Oral-B handles, as well as offering replaceable heads for its own plant-based toothbrushes

Report Coverage

The research report offers an in-depth analysis based on Bristle Type, Price, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly oral care products will continue rising with stronger environmental awareness.

- Manufacturers will increase R&D spending to enhance durability and biodegradability of materials.

- Bamboo and cornstarch-based toothbrushes will dominate future product innovations.

- E-commerce platforms will play a major role in global product distribution.

- Partnerships with dental professionals will boost brand credibility and adoption.

- Governments will implement stricter plastic regulations supporting compostable alternatives.

- Subscription-based models will attract consumers seeking sustainable convenience.

- Customization in toothbrush design and packaging will improve user engagement.

- Emerging economies will experience higher adoption driven by affordable pricing.

- Continuous innovation in plant-based bristles and packaging will shape market competitiveness.