Market Overview:

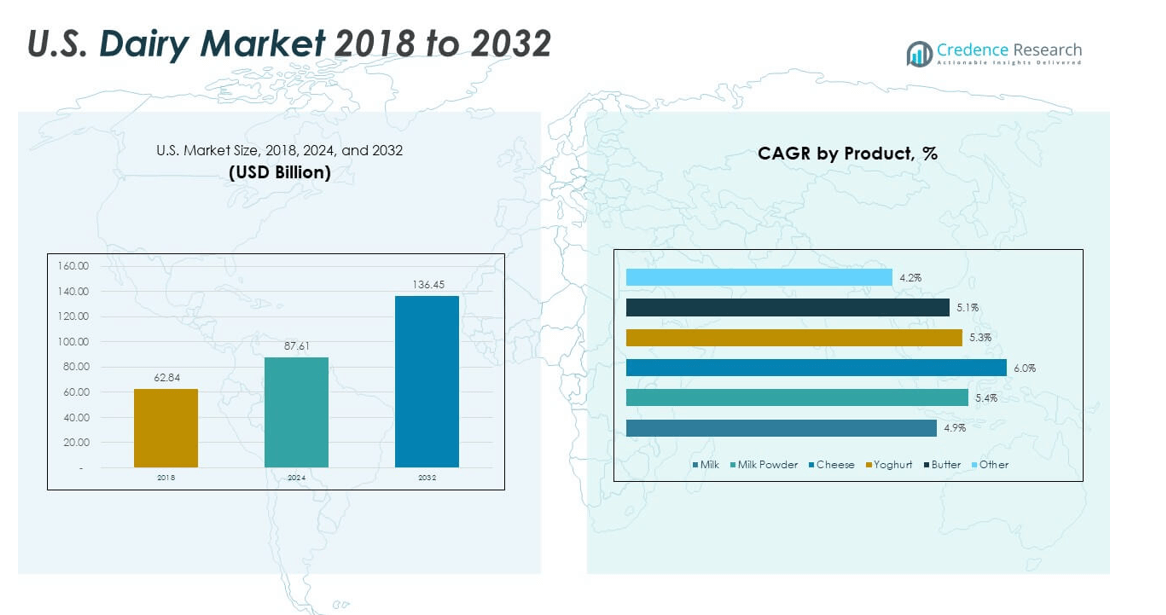

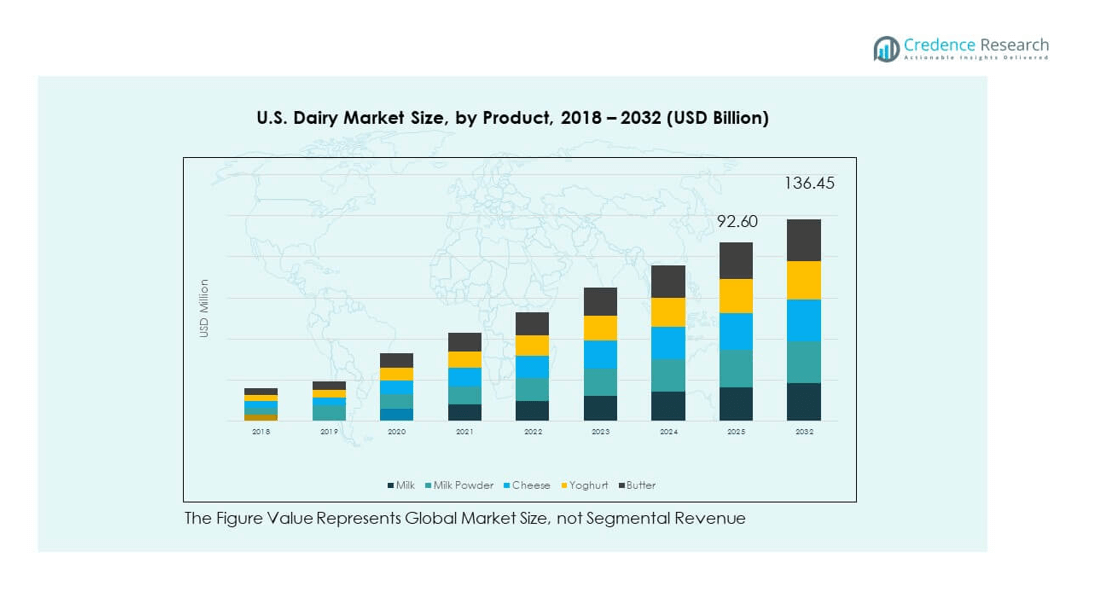

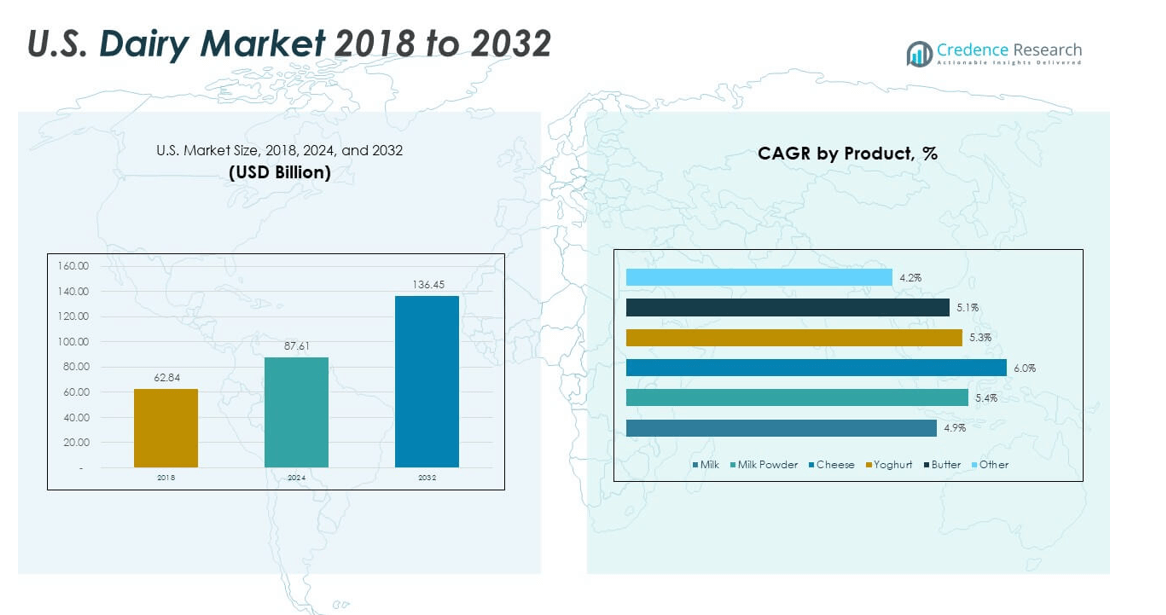

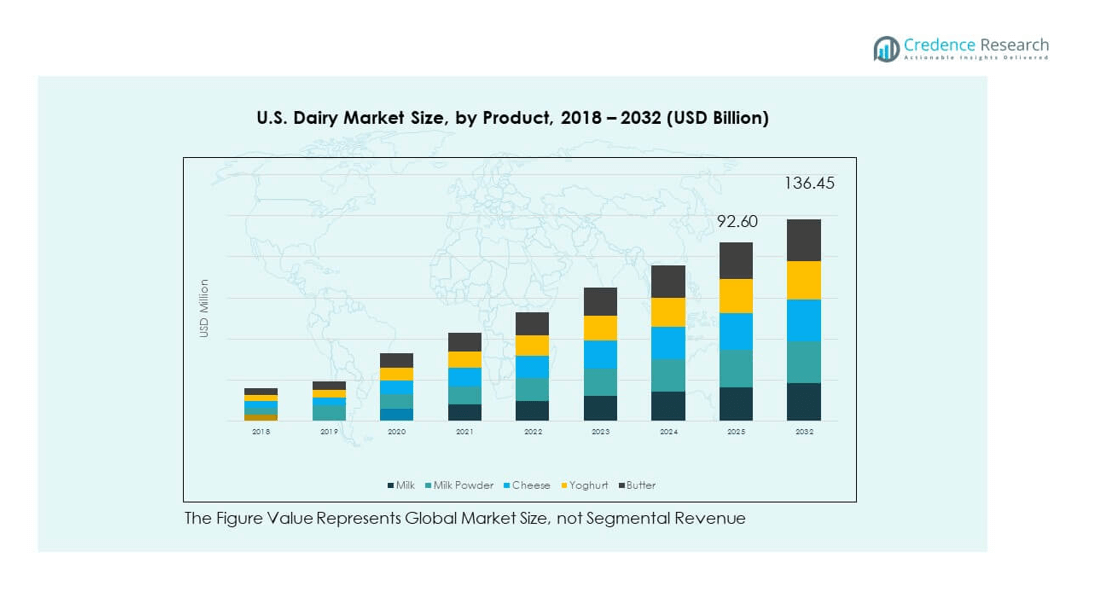

The U.S. Dairy Market size was valued at USD 62.84 billion in 2018 to USD 87.61 billion in 2024 and is anticipated to reach USD 136.45 billion by 2032, at a CAGR of 5.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Dairy Market Size 2024 |

USD 87.61 billion |

| U.S. Dairy Market, CAGR |

5.69% |

| U.S. Dairy Market Size 2032 |

USD 136.45 billio |

Market growth is primarily driven by rising consumer demand for value-added dairy products, including lactose-free, organic, and fortified milk alternatives. The increasing focus on health and nutrition has encouraged dairy manufacturers to expand their product lines to include high-protein yogurt, probiotic drinks, and functional cheese varieties. Additionally, innovations in processing technology, improved cold chain logistics, and sustainability-driven production practices have strengthened the market, while e-commerce platforms and retail expansion continue to boost accessibility and sales nationwide.

Regionally, the U.S. dairy market demonstrates significant variations in consumption and production patterns. The Midwest remains a leading hub due to its vast dairy farming infrastructure, while states in the Northeast show strong demand for specialty cheese and premium dairy. Western regions, particularly California, continue to dominate in fluid milk and dairy alternatives production, driven by large-scale operations. Meanwhile, southern states are emerging as growth markets, fueled by rising population, urbanization, and evolving dietary preferences that are driving demand for diverse dairy categories.

Market Insights:

- The U.S. Dairy Market was valued at USD 87.61 billion in 2024 and is anticipated to reach USD 136.45 billion by 2032, expanding at a CAGR of 5.69% during the forecast period.

- Rising consumer preference for functional, fortified, and organic dairy products continues to drive growth, supported by innovations in yogurt, specialty cheese, and lactose-free categories.

- Strong demand from the foodservice sector, particularly quick-service restaurants and coffee chains, boosts sales of milk, butter, and cream-based products nationwide.

- Technological advancements in processing, packaging, and cold chain logistics strengthen supply chain efficiency and extend product shelf life across multiple segments.

- The U.S. Dairy Market faces restraints from plant-based alternatives gaining popularity among younger consumers, gradually reducing traditional milk consumption.

- The Midwest region leads with nearly 40% share due to its established dairy farming infrastructure, while the West contributes around 30% with California as a key producer.

- The Northeast and South collectively account for the remaining 30% share, driven by rising demand for specialty cheese, organic dairy, and expanding retail networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Shift Toward Nutritional Dairy Products

The U.S. Dairy Market benefits from strong demand for products offering higher nutritional value, such as protein-rich milk, probiotic yogurt, and fortified cheese. Consumers focus on wellness and immunity has created consistent momentum for dairy companies to diversify product portfolios. It reflects the influence of dietary preferences that emphasize natural proteins and gut health solutions. Increasing awareness of lactose-free and organic dairy has created new revenue streams, especially in urban regions. Retail chains, online platforms, and specialty stores amplify access to these premium dairy choices. Innovation in flavors, packaging, and portion sizes continues to attract health-conscious customers. The expansion of functional dairy beverages caters to younger demographics pursuing convenience. A robust mix of innovation and health focus underpins this driver of long-term growth.

- For instance, Dairy Farmers of America introduced DairyPure Milk50, a breakthrough product that contains 75% less sugar than regular fat-free milk while delivering 50 calories and 9 grams of protein per serving, aligning with consumer demand for healthier dairy options.

Strong Role of Foodservice Industry in Shaping Demand

Restaurants, cafes, and quick-service outlets exert a significant influence on the U.S. Dairy Market. It benefits from the heavy utilization of cheese, butter, and cream in fast food and casual dining menus. Growing popularity of coffee chains boosts sales of specialty milk and creamers. Rising consumer preference for ready-to-eat and on-the-go dairy snacks strengthens demand across diverse formats. Foodservice operators drive consistent innovation by partnering with manufacturers to create new dairy-based offerings. Premium artisanal cheese segments thrive due to consumer willingness to pay for quality dining experiences. Frozen desserts and ice creams maintain strong pull among younger consumers, extending demand cycles. The foodservice sector supports higher production volumes and stabilizes consumption across regions.

- For example, Stewart’s Shops received gold honors for best fluid milk, best chocolate milk, and best flavored milk at the 2024 New York State Dairy Products Competition, underscoring its technical excellence and consistent product quality in high-volume foodservice channels.

Technological Advancements and Supply Chain Modernization

The U.S. Dairy Market achieves efficiency gains through advanced processing, automation, and packaging solutions. It leverages cold chain logistics that maintain product freshness across long distances. The integration of robotics in production plants ensures consistency and higher output. Digital tools and predictive analytics provide stronger control over inventory and demand planning. Sustainability efforts encourage the use of energy-efficient equipment and resource optimization. Modernized transportation and storage infrastructure support rapid product distribution nationwide. Technological breakthroughs in ultra-filtration and fermentation open new product lines such as lactose-free and plant-blended dairy. Investments in research and development strengthen product safety and broaden appeal across multiple categories.

Influence of Consumer Lifestyle and Demographic Shifts

The U.S. Dairy Market responds to demographic and lifestyle transformations across the nation. It reflects higher demand from younger populations seeking protein-rich, convenient dairy products. Urban professionals adopt functional and fortified dairy to align with fast-paced routines. Aging populations prefer dairy for bone health, calcium intake, and balanced nutrition. Shifting cultural preferences also expand demand for specialty cheese, flavored milk, and gourmet butter. Increased disposable income allows greater adoption of premium dairy categories. Demand patterns highlight growing preference for ethically sourced and environmentally responsible dairy. A blend of demographic change and lifestyle evolution provides strong growth momentum.

Market Trends:

Expansion of Plant-Blended Dairy and Hybrid Offerings

The U.S. Dairy Market observes a rapid rise in plant-dairy hybrid products that balance taste, nutrition, and sustainability. It reflects manufacturers’ efforts to capture consumers who demand dairy but prefer reduced animal-based consumption. Blended options, such as oat-milk yogurt with dairy proteins, appeal to health-driven buyers. Growing experimentation with hybrid cheese varieties strengthens acceptance among diverse consumer groups. Retailers expand shelf space for these offerings, highlighting their commercial significance. Global influence of flexitarian diets inspires American producers to innovate. Marketing campaigns emphasize clean labeling, transparency, and environmental impact. The hybrid dairy trend positions companies competitively in evolving markets.

- For example, Live Real Farms, a brand under Dairy Farmers of America, launched Dairy Plus Milk Blends, a 50/50 mix of lactose-free cow’s milk and either almond or oat milk. Each serving contains around 5 grams of protein and 6–8 grams of sugar, significantly lower than regular milk, which typically has about 10 grams of protein and 13 grams of sugar per serving.

Premiumization of Cheese and Specialty Dairy Products

The U.S. Dairy Market shows growing momentum in specialty cheese, artisanal butter, and high-quality yogurt. It benefits from consumer willingness to invest in premium food experiences at home and through foodservice outlets. Specialty cheese varieties such as goat, blue, and organic aged products gain wide acceptance. Innovative flavors and international influences expand product diversity. Consumers associate premium dairy with authenticity, superior taste, and craftsmanship. Food bloggers and digital channels amplify awareness and visibility of these niche categories. Retailers create dedicated sections for artisanal and organic products, further shaping demand. Premiumization creates differentiation and strengthens brand loyalty across dairy brands.

Digital Retail Transformation and E-Commerce Expansion

The U.S. Dairy Market experiences a major shift toward online channels for dairy purchase and distribution. It adapts to consumer convenience expectations by enabling subscription-based deliveries of milk, yogurt, and cheese. Online platforms promote specialty dairy products directly to consumers, reducing reliance on traditional intermediaries. Digital analytics help companies predict demand more accurately and improve customer targeting. E-commerce enhances the availability of niche products, especially in metropolitan areas. Home delivery partnerships ensure speed and product freshness. Social media marketing amplifies exposure for emerging dairy brands and personalized options. The digital ecosystem transforms accessibility and purchasing habits across the dairy sector.

- For instance, Organic Valley expanded its online store and home delivery service to strengthen direct-to-consumer engagement, offering customizable subscription options for milk, yogurt, and cheese products while supporting convenience-focused buyers seeking farm-to-door access.

Rising Influence of Sustainability and Ethical Sourcing Practices

The U.S. Dairy Market embraces sustainability initiatives across production, packaging, and sourcing. It responds to consumer demand for traceability, eco-friendly practices, and animal welfare commitments. Packaging innovations prioritize recyclable, biodegradable, and lightweight materials. Farmers adopt renewable energy and resource-efficient farming techniques to align with sustainability expectations. Ethical sourcing certifications strengthen consumer trust in premium dairy categories. Brands highlight local sourcing and community partnerships to reinforce authenticity. Sustainability-linked investments shape long-term business strategy and stakeholder engagement. The sustainability-driven trend redefines industry benchmarks and consumer-brand relationships.

Market Challenges Analysis:

Increasing Pressure from Alternative Products and Shifting Preferences

The U.S. Dairy Market faces competitive challenges from plant-based alternatives and changing dietary patterns. It experiences demand erosion in certain segments due to rising acceptance of almond, oat, and soy-based substitutes. Marketing campaigns from plant-based brands emphasize health, environmental impact, and ethical values. Younger demographics exhibit stronger preference for dairy alternatives, affecting traditional milk consumption. Product innovation in substitutes continues to erode market share in beverages. Dairy producers must adapt through diversification and improved consumer engagement. The challenge reflects deep shifts in consumer perception and value alignment. It requires ongoing efforts to balance tradition with innovation.

Volatility in Production Costs and Regulatory Complexities

The U.S. Dairy Market navigates volatility in raw material costs, labor availability, and energy prices. It confronts challenges in balancing supply chain stability with rising operational expenses. Weather patterns influence feed availability and milk production levels. Regulatory frameworks impose strict compliance requirements for safety, quality, and environmental standards. Farmers and processors face capital pressures from sustainability-driven infrastructure upgrades. Trade disputes and tariff policies create uncertainty in global export performance. Maintaining competitiveness requires efficiency improvements and policy adaptation. The challenge remains central to industry sustainability and profitability.

Market Opportunities:

Expansion into Functional Dairy and Value-Added Categories

The U.S. Dairy Market holds significant opportunity in functional products enriched with probiotics, vitamins, and high protein. It aligns with consumers demanding dairy that supports immunity, digestion, and energy balance. Yogurt drinks, fortified milk, and functional cheese dominate innovation pipelines. It creates strong visibility for dairy brands across fitness-focused and health-conscious consumers. Expanding research accelerates product diversification. Functional categories attract premium pricing and customer loyalty. The opportunity strengthens the long-term value proposition of dairy in modern diets.

Strong Global Export Potential and Niche Market Development

The U.S. Dairy Market can expand further through global exports and niche categories. It benefits from rising international demand for cheese, butter, and premium dairy powders. Trade agreements and strategic partnerships increase access to high-growth markets in Asia, Middle East, and Latin America. Specialty segments such as artisanal cheese and organic butter create strong positioning opportunities. It enables U.S. producers to capture revenue from differentiated premium goods. Emerging global middle-class populations prefer Western-style dairy, amplifying market potential. The opportunity highlights competitive advantage through quality, scale, and product diversity.

Market Segmentation Analysis:

By product, The U.S. Dairy Market demonstrates strong diversity across product categories, with milk maintaining the largest share due to its widespread household consumption and versatile application in foodservice and processing. Milk powder continues to expand in demand, supported by its longer shelf life and use in confectionery and bakery products. Cheese remains one of the most lucrative segments, driven by rising consumption of specialty and premium varieties across retail and foodservice channels. Yoghurt shows robust growth momentum, supported by consumer preference for probiotic and high-protein options. Butter consumption is rising steadily with increased use in bakery, packaged foods, and gourmet cooking. Other dairy products, including cream, ghee, and functional dairy beverages, form a niche yet expanding category fueled by innovation and evolving consumer preferences.

- For instance, Lactalis USA processes more than 800 million pounds of raw milk annually at its Walton and Buffalo, New York facilities, supporting production for Galbani cheeses like ricotta, mozzarella, and provolone, as well as Breakstone’s sour cream and cottage cheese.

By animal segment, the U.S. Dairy Market is primarily dominated by cow-based production, which accounts for the majority of milk supply across domestic and industrial use. Buffalo-based dairy, though smaller in scale, is gaining attention for its higher fat content and suitability for specialty cheese production. Goat milk and its derivatives are experiencing steady adoption due to their digestibility and appeal among health-conscious consumers. Camel milk remains a niche segment, driven by rising interest in alternative nutritional profiles and unique functional benefits. Sheep milk contributes to the market through artisanal cheese and specialty dairy products, carving a distinct space in premium categories. Together, these animal segments provide a diverse foundation for growth and consumer choice.

- For instance, Desert Farms, a California-based distributor, began offering pasteurized camel milk online and through retailers like Whole Foods in California, responding to growing interest among lactose‑intolerant and health‑focused consumers.

Segmentation:

By Product Segment

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other Dairy Products

By Animal Segment

- Cow

- Buffalo

- Goat

- Camel

- Sheep

Regional Analysis:

The U.S. Dairy Market is dominated by the Midwest, which accounts for nearly 40% of total market share. It benefits from large-scale dairy farming, advanced processing facilities, and strong supply chain networks that ensure consistent output. Wisconsin and Minnesota lead with cheese and milk production, supporting both domestic consumption and exports. The region has also witnessed investments in technology that enhance efficiency and sustainability. It holds a competitive edge due to its established dairy infrastructure and skilled farming workforce. The Midwest continues to act as the backbone of the industry, shaping both volume and value growth.

The West contributes around 30% share of the U.S. Dairy Market, with California standing as the largest milk-producing state. It benefits from large herd sizes, advanced processing plants, and diversified product output ranging from milk to specialty cheese. The region has developed strong export capabilities, particularly in dairy powders and value-added products. It faces water scarcity challenges, yet innovation in sustainable farming practices supports resilience. The West also plays a leading role in the production of dairy alternatives, creating a dual advantage in conventional and hybrid markets. It remains a hub for both scale and product diversification.

The Northeast and South collectively account for the remaining 30% of the U.S. Dairy Market, with the Northeast holding about 18% share and the South contributing close to 12%. The Northeast excels in specialty cheese, butter, and organic dairy, with states like New York and Pennsylvania driving demand. The South reflects growing consumption supported by rising population, urbanization, and expanding retail distribution. It shows potential for higher dairy penetration in convenience and value-added categories. Both regions benefit from strong foodservice sectors, which amplify demand across diverse product segments. It ensures balanced growth despite structural differences in farming scale and consumption patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Danone S.A.

- Lactalis Group

- Ausnutria Dairy Corporation Ltd.

- Emmi Group

- Dairy Farmers of America

- Holle Baby Food AG

- Land O’Lakes Inc.

- Hewitt’s Dairy

- Woolwich Dairy Inc.

- Saputo Inc.

- Courtyard Farms

- Other Key Players

Competitive Analysis:

The U.S. Dairy Market is highly competitive, with multinational corporations and cooperatives shaping industry dynamics through scale, innovation, and product diversity. Key players such as Nestlé, Danone, Lactalis, Arla Foods, and Dairy Farmers of America focus on expanding value-added categories like probiotic yogurt, specialty cheese, and lactose-free milk. It leverages technology-driven efficiency, sustainable farming practices, and strong retail distribution to strengthen market positioning. Companies pursue acquisitions, mergers, and strategic alliances to secure a wider consumer base and expand exports. Rising investment in premium and functional dairy products enhances product differentiation and customer loyalty. The competitive landscape reflects both consolidation and innovation, highlighting the balance between traditional producers and emerging niche players.

Recent Developments:

- In June 2025, Lactalis USA, the U.S. arm of the world’s largest dairy company, completed the acquisition of General Mills’ U.S. yogurt business, which includes major brands like Yoplait, Go-Gurt, Oui, Mountain High, and :ratio. The transaction encompasses two manufacturing facilities, around 1,000 employees, and is expected to generate approximately $1.2billion in annual sales, consolidating Lactalis’s leadership in the U.S. yogurt segment.

- In May 2025, Clover Sonoma introduced its Pasture Raised Organic Greek Nonfat Plain Yogurt, marking a return to its Greek yogurt line-up and highlighting a renewed focus on organic and pasture-raised dairy innovation for health-conscious consumers.

- In August 2024, Fonterra Cooperative Group entered a strategic partnership with Superbrewed Food to develop new biomass protein solutions for dairy products in the U.S. market. By integrating Superbrewed’s fermentation technology with Fonterra’s dairy processing expertise, the collaboration aims to add value to dairy by converting lactose permeate into sustainable, nutrient-rich proteins that support gut health.

- In Feb 2024, Nestlé launched Orgain Better Whey, its first precision fermentation-derived, animal-free, and lactose-free whey protein powder in the U.S. market. This product, developed in partnership with Orgain, delivers 21g of protein per serving and marks a significant step in Nestlé’s strategy to offer dairy options with reduced environmental footprints.

Market Concentration & Characteristics:

The U.S. Dairy Market demonstrates moderate to high concentration, with a few large cooperatives and global corporations holding significant revenue share. It remains fragmented in niche categories such as artisanal cheese, organic dairy, and goat milk, where smaller players compete actively. Market characteristics include strong dependence on large-scale cow-based production, diversified product portfolios, and growing integration of sustainability-driven practices. It reflects both scale efficiency and consumer-driven specialization, balancing traditional mass-market products with emerging premium categories.

Report Coverage:

The research report offers an in-depth analysis based on Product and Animal. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Dairy Market is expected to witness stronger demand for functional and fortified dairy, driven by consumer focus on health, immunity, and nutrition.

- Sustainability will shape industry practices, with greater adoption of renewable energy, eco-friendly packaging, and responsible sourcing initiatives.

- Digital retail channels will expand, creating opportunities for direct-to-consumer models, subscription services, and personalized dairy offerings.

- Innovation in hybrid dairy and plant-blended products will accelerate, addressing evolving dietary preferences among flexitarian consumers.

- Premiumization in cheese, butter, and yogurt categories will strengthen, supported by rising consumer willingness to pay for quality and artisanal products.

- Export potential will grow as producers capture demand in emerging international markets, particularly in Asia, the Middle East, and Latin America.

- Foodservice partnerships will continue to drive growth, especially in quick-service restaurants and specialty coffee chains relying on dairy products.

- Advances in processing technology will improve efficiency, extend shelf life, and enable development of innovative product lines.

- Regional diversification will enhance supply resilience, with growing contributions from the South and Northeast to balance traditional Midwest and West dominance.

- Investments in research and product innovation will define competitiveness, with companies focusing on high-value categories and consumer-centric solutions.