Market Overview

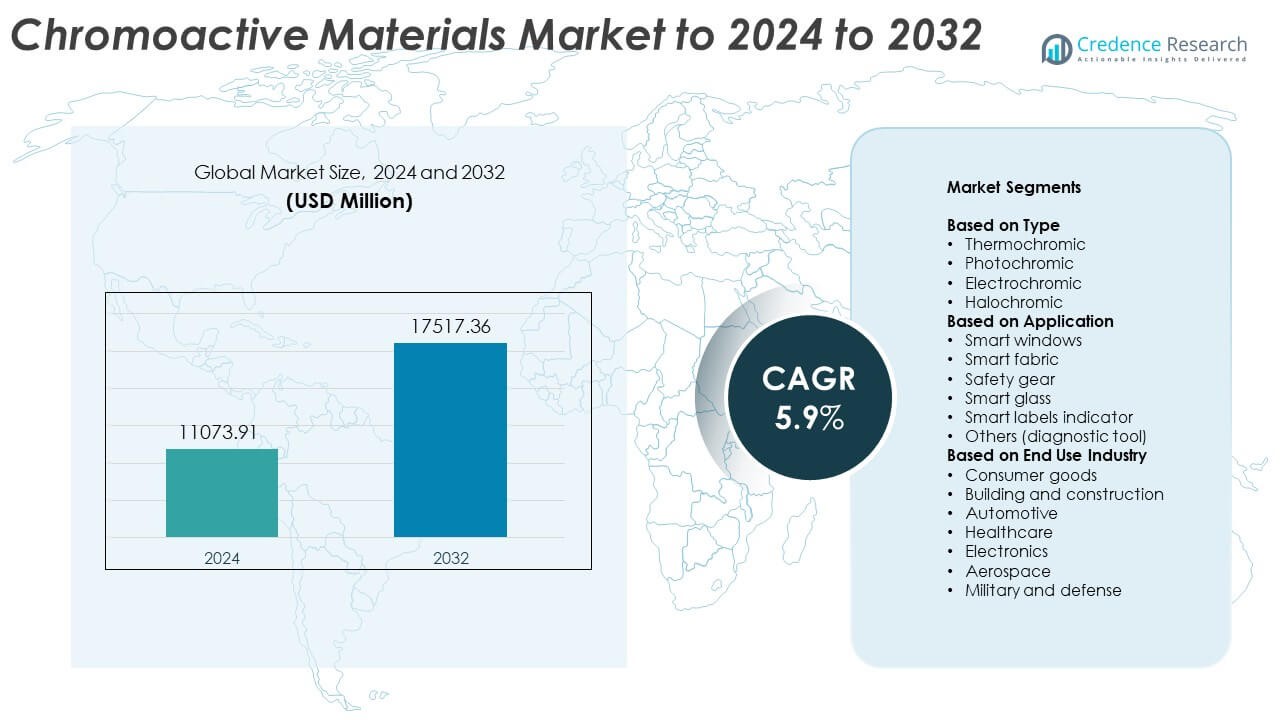

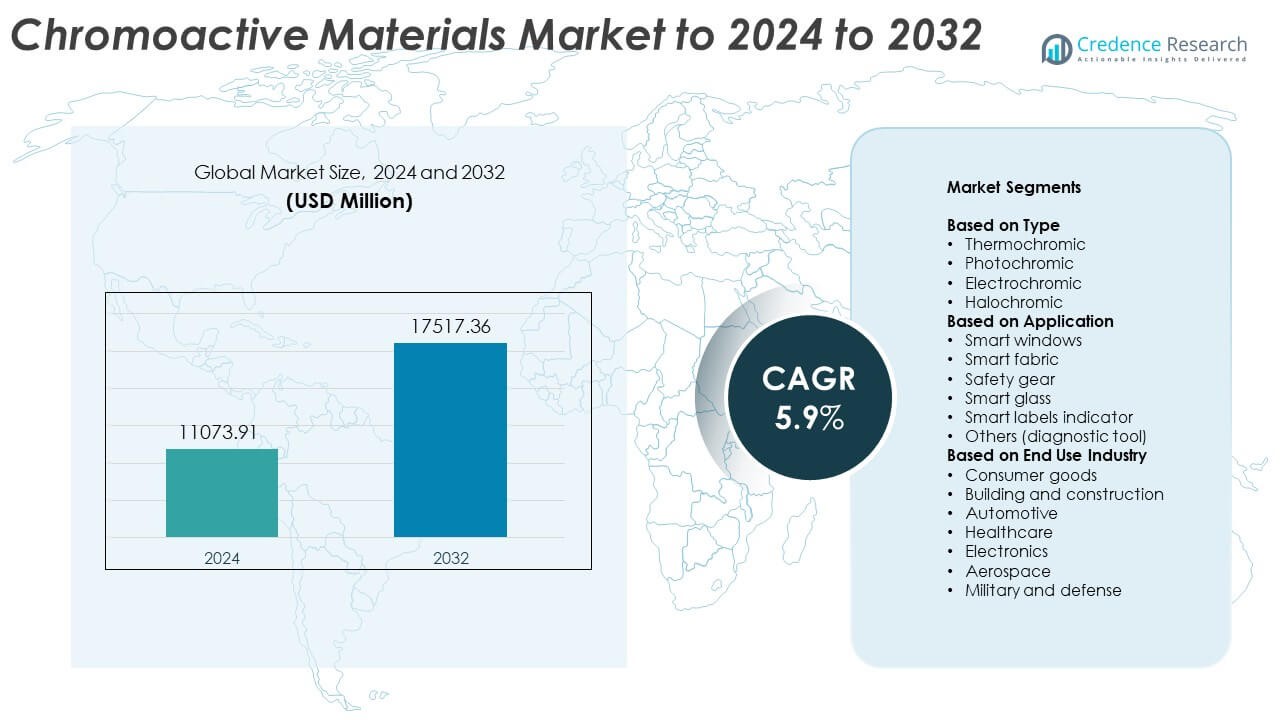

Chromoactive Materials Market size was valued at USD 11073.91 Million in 2024 and is anticipated to reach USD 17517.36 Million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromoactive Materials Market Size 2024 |

USD 11073.91 Million |

| Chromoactive Materials Market, CAGR |

5.9% |

| Chromoactive Materials Market Size 2032 |

USD 17517.36 Million |

The chromoactive materials market is led by major players including BASF SE, ChromoGenics AB, LUMO Bodytech, Merck Group, Kaneka Corporation, Vantablack Ltd., 3M Company, Fusheng Group Co. Ltd., E.I. du Pont de Nemours and Company, and Luminescence Technology Corporation. These companies compete through innovation in thermochromic, photochromic, and electrochromic technologies, focusing on energy efficiency, smart design, and advanced coatings. North America leads the global market with a 34% share, followed by Europe at 28% and Asia Pacific at 25%. Market leadership is reinforced by strong R&D capabilities, growing industrial collaborations, and the integration of chromoactive solutions into high-value applications across construction, automotive, and consumer sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chromoactive materials market was valued at USD 11073.91 million in 2024 and is projected to reach USD 17517.36 million by 2032, growing at a CAGR of 5.9%.

- Rising demand for smart and energy-efficient materials across construction, automotive, and consumer goods sectors drives overall market expansion.

- Advancements in nanotechnology and material science are improving product durability, stability, and responsiveness, enhancing performance in smart windows, fabrics, and coatings.

- The market features strong competition, with leading manufacturers focusing on eco-friendly formulations and strategic partnerships to expand global reach.

- North America leads the market with 34% share, followed by Europe with 28% and Asia Pacific with 25%, while thermochromic materials dominate by type with 39% share due to broad applications in smart coatings and packaging.

Market Segmentation Analysis:

By Type

The thermochromic segment dominates the chromoactive materials market with around 39% share in 2024. Its leadership is driven by the rising use in temperature-sensitive coatings, textiles, and packaging solutions. Thermochromic materials change color in response to heat, making them ideal for smart labels, security printing, and energy-efficient products. Increasing adoption in consumer goods and industrial applications enhances their demand. Meanwhile, photochromic and electrochromic variants are gaining traction in eyewear, automotive glass, and smart windows, supported by technological advancements in light-responsive and voltage-controlled materials.

- For instance, Chromatic Technologies Inc. enabled Coors Light’s thermochromic cans on lines running 2,000 cans per minute, first launched in 2007.

By Application

Smart windows lead the market, accounting for approximately 36% share in 2024. Their dominance stems from widespread adoption in commercial buildings, vehicles, and energy-efficient infrastructure. These windows regulate light transmission and heat absorption, improving energy conservation and comfort. Growing demand for sustainable construction materials and government initiatives promoting green buildings are key drivers. Smart glass and safety gear segments also show strong growth due to applications in adaptive visibility control, protective equipment, and smart architecture integrating automated environmental regulation.

- For instance, Saint-Gobain’s SageGlass supplied 200,000 sq ft of electrochromic glazing for Rio Business Park in Bengaluru, cited as the world’s largest smart-glass installation.

By End Use Industry

The building and construction sector holds the largest share of about 33% in 2024. This dominance is fueled by the increasing integration of chromoactive materials in smart windows, façade systems, and interior applications to enhance energy efficiency and aesthetics. The sector benefits from the global push toward green and sustainable buildings. The automotive and consumer goods industries also contribute significantly, leveraging these materials for adaptive lighting, temperature indicators, and design enhancement. Additionally, healthcare and aerospace sectors are exploring advanced chromoactive coatings for safety and diagnostic innovations.

Key Growth Drivers

Rising Demand for Smart and Energy-Efficient Solutions

Growing adoption of smart windows, responsive textiles, and temperature-sensitive coatings is driving the chromoactive materials market. These materials improve energy efficiency, reduce maintenance, and enhance user comfort by dynamically adjusting to environmental conditions. Increasing investments in sustainable infrastructure and smart cities are expanding application scope. The demand for materials that adapt to heat, light, or electric stimuli supports widespread use across construction, automotive, and consumer goods industries, establishing this as a major growth catalyst.

- For instance, Gentex shipped 29.9 million interior and 17.8 million exterior auto-dimming (electrochromic) mirrors in 2024, showing large-scale adoption in vehicles.

Advancements in Material Science and Nanotechnology

Ongoing research in nanostructured pigments and polymer composites has improved color-changing stability, reversibility, and response speed. These advancements enable manufacturers to produce high-performance chromoactive materials suitable for extreme temperature and UV exposure environments. Integration with nanotechnology also enhances optical clarity and energy responsiveness in products such as smart glass and sensors. Continuous innovation in formulation and durability broadens adoption in electronics, defense, and aerospace applications, fueling consistent market expansion.

- For instance, E Ink’s Prism 3 shows ultra-low power needs around 0.04 W/m² per minute update, and BMW’s i Vision Dee uses 240 E-Ink segments supporting 32 colors.

Growing Adoption in Consumer and Healthcare Applications

Rising demand for intelligent packaging, wearables, and diagnostic tools is boosting market growth. Chromoactive materials are increasingly used in consumer goods and healthcare for indicators that change color with environmental or biological changes. Their ability to enhance safety and usability in daily products supports large-scale commercialization. Expanding healthcare innovation and consumer preference for interactive and functional materials are expected to strengthen this adoption trend across global markets.

Key Trends & Opportunities

Integration of Chromoactive Technology in Wearables and IoT Devices

The convergence of chromoactive materials with Internet of Things (IoT) technology is unlocking new product categories. Smart fabrics, sensors, and display coatings now integrate responsive color-change functions for monitoring and feedback. Wearable applications use these materials to provide temperature, UV, or health indicators in real time. The expanding wearable technology ecosystem and user demand for interactive features present strong opportunities for manufacturers to innovate adaptive and connected chromoactive products.

- For instance, EssilorLuxottica reported 2 million Ray-Ban Meta smartglasses sold since launch, materially lifting quarterly growth in 2025.

Sustainability and Eco-Friendly Product Development

Manufacturers are focusing on developing non-toxic, recyclable, and solvent-free chromoactive formulations to meet sustainability goals. The global shift toward low-emission and energy-efficient materials drives investments in green chemistry and bio-based production. Eco-friendly chromoactive coatings are finding applications in architectural glass, packaging, and textiles. This trend aligns with regulatory pressure to reduce environmental impact while improving product performance, creating significant opportunities for long-term growth and differentiation.

- For instance, Gauzy’s SPD smart glass blocks up to 99% of visible light and is deployed in Mercedes models under “Magic Sky Control.

Key Challenges

High Production Costs and Limited Scalability

Despite growing demand, large-scale production of chromoactive materials remains cost-intensive. The synthesis process requires precise temperature and environmental control, increasing operational expenses. Limited economies of scale and high raw material costs restrict adoption among small and medium manufacturers. Improving cost efficiency through process optimization and material standardization is essential to enhance market accessibility and ensure broader commercial viability.

Durability and Performance Limitations

Chromoactive materials often face degradation issues when exposed to continuous UV light, heat, or humidity. This reduces color stability and lifespan in outdoor and industrial applications. Maintaining long-term responsiveness without compromising performance remains a key technical challenge. Advancements in encapsulation, surface coating, and formulation are being explored to overcome these limitations and extend product reliability across diverse use cases.

Regional Analysis

North America

North America dominates the chromoactive materials market with around 34% share in 2024. The region’s growth is driven by strong demand for smart glass, responsive textiles, and energy-efficient coatings across construction and automotive sectors. High adoption of advanced materials in the United States and Canada supports innovation in sustainable infrastructure. Increasing investments in smart building projects and stringent energy regulations further accelerate product usage. Presence of key manufacturers and extensive research in nanomaterials strengthen North America’s position as the leading hub for chromoactive material development and commercialization.

Europe

Europe accounts for about 28% share of the chromoactive materials market in 2024. The market benefits from robust growth in eco-friendly coatings, smart windows, and smart textiles driven by the region’s strong sustainability goals. Countries such as Germany, France, and the United Kingdom are at the forefront of integrating chromoactive technologies into automotive and architectural applications. The European Union’s policies promoting green building and low-emission materials further enhance demand. Continuous innovation in photochromic and electrochromic technologies fosters expansion in the region’s construction and consumer product industries.

Asia Pacific

Asia Pacific holds approximately 25% share of the global chromoactive materials market in 2024. Rapid urbanization, expanding construction projects, and a growing consumer electronics industry drive market growth in China, Japan, South Korea, and India. The region is witnessing strong demand for smart windows, wearable devices, and intelligent packaging. Increasing investment in advanced manufacturing and government initiatives promoting smart infrastructure boost material adoption. Lower production costs and a rising number of local manufacturers enhance Asia Pacific’s competitiveness in chromoactive material production and technology innovation.

Latin America

Latin America captures around 7% share of the chromoactive materials market in 2024. Market expansion is supported by growing adoption of energy-efficient building materials and smart automotive components in Brazil, Mexico, and Argentina. The construction sector’s focus on modern architectural designs and sustainability fuels product demand. Limited local production capabilities currently constrain market penetration, but increasing imports and collaborations with global suppliers are bridging the gap. Investments in smart city initiatives and renewable energy infrastructure are expected to provide new growth avenues across the region.

Middle East and Africa

The Middle East and Africa region account for roughly 6% share in 2024. Market growth is supported by rising investments in luxury infrastructure, automotive innovation, and energy-efficient technologies. The Gulf countries, particularly the UAE and Saudi Arabia, are adopting smart glass and adaptive coatings in large-scale construction and commercial projects. Increasing awareness of climate-responsive materials enhances regional adoption. However, high production costs and dependency on imports remain barriers. Gradual industrial diversification and government focus on sustainable development are likely to drive steady growth in the coming years.

Market Segmentations:

By Type

- Thermochromic

- Photochromic

- Electrochromic

- Halochromic

By Application

- Smart windows

- Smart fabric

- Safety gear

- Smart glass

- Smart labels indicator

- Others (diagnostic tool)

By End Use Industry

- Consumer goods

- Building and construction

- Automotive

- Healthcare

- Electronics

- Aerospace

- Military and defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chromoactive materials market features major players such as BASF SE, ChromoGenics AB, LUMO Bodytech, Merck Group, Kaneka Corporation, Vantablack Ltd., 3M Company, Fusheng Group Co. Ltd., E.I. du Pont de Nemours and Company, and Luminescence Technology Corporation. The market is characterized by continuous innovation, strong research initiatives, and expanding product portfolios across multiple application domains. Companies are focusing on developing advanced thermochromic, photochromic, and electrochromic materials with enhanced durability and responsiveness. Strategic collaborations with automotive, construction, and consumer goods industries are helping manufacturers strengthen global distribution networks. Increasing emphasis on eco-friendly and energy-efficient materials supports differentiation and competitive advantage. Moreover, growing investment in nanotechnology-based formulations and scalable production technologies is enabling firms to reduce costs and expand adoption in emerging markets. The competitive environment is expected to remain dynamic, driven by technological evolution and rising demand for adaptive smart materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, DuPont showcased next-generation solutions for advanced circuit materials at the Taiwan Printed Circuit Association (TPCA) Show, emphasizing fine line applications, advanced packaging, signal integrity, and thermal management tailored for AI and high-performance computing needs.

- In 2023, Merck launched its ChemisTwin digital reference materials platform, a digital laboratory tool that supports chemical analysis and quality control in labs that may work with chromoactive materials.

- In 2023, ChromoGenics announced it would deliver its ConverLight dynamic glass to an office building in Sweden (later revealed to be the new headquarters for the Swedish National Board of Housing, Building and Planning, Boverket)., and started the producyion and delivery in 2024.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and adaptive materials will rise with expanding smart infrastructure projects.

- Thermochromic and electrochromic technologies will see wider use in construction and automotive sectors.

- Integration of chromoactive coatings in consumer electronics will enhance energy efficiency and design appeal.

- Growth in wearable technology will accelerate adoption of color-changing textiles and sensors.

- Advancements in nanotechnology will improve durability, response speed, and stability of chromoactive materials.

- The market will benefit from regulatory support promoting sustainable and eco-friendly material innovation.

- Partnerships between material science firms and electronics manufacturers will drive new product developments.

- Asia Pacific will emerge as the fastest-growing production and consumption hub for chromoactive materials.

- Increased R&D investment will lead to cost reductions and better scalability in mass production.

- Expanding applications in healthcare diagnostics and aerospace coatings will open new growth avenues.