Market Overview:

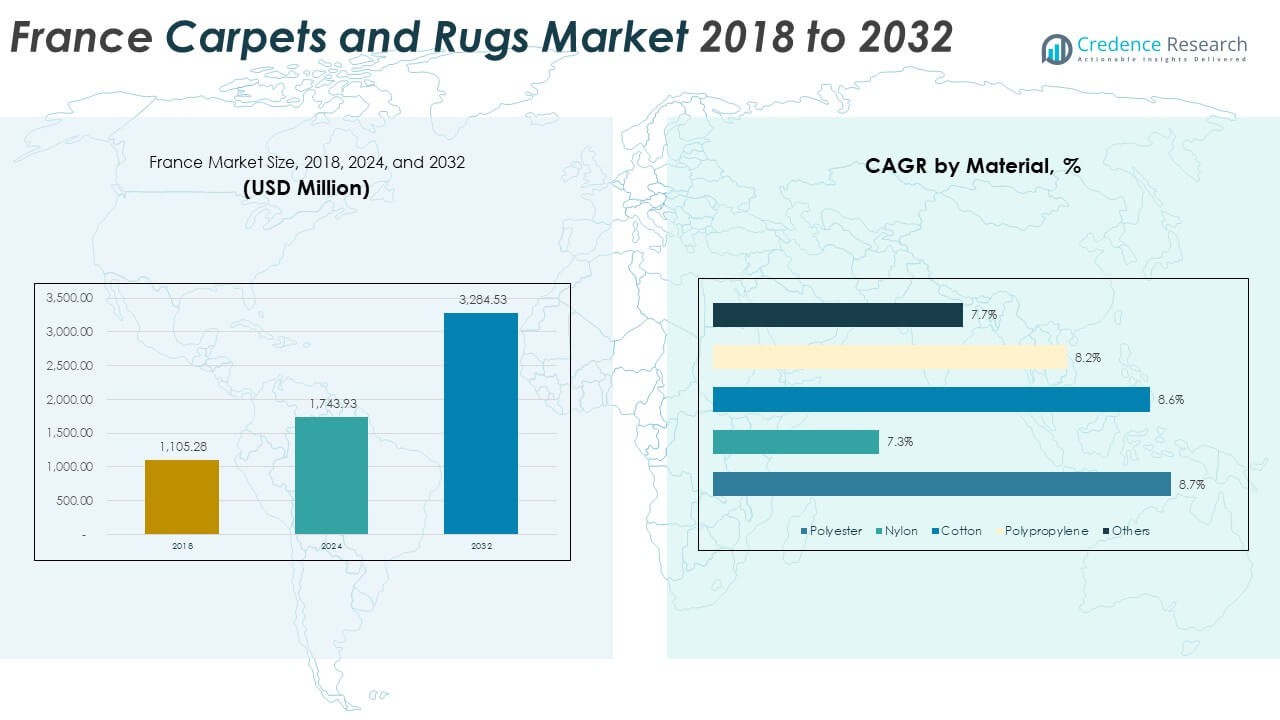

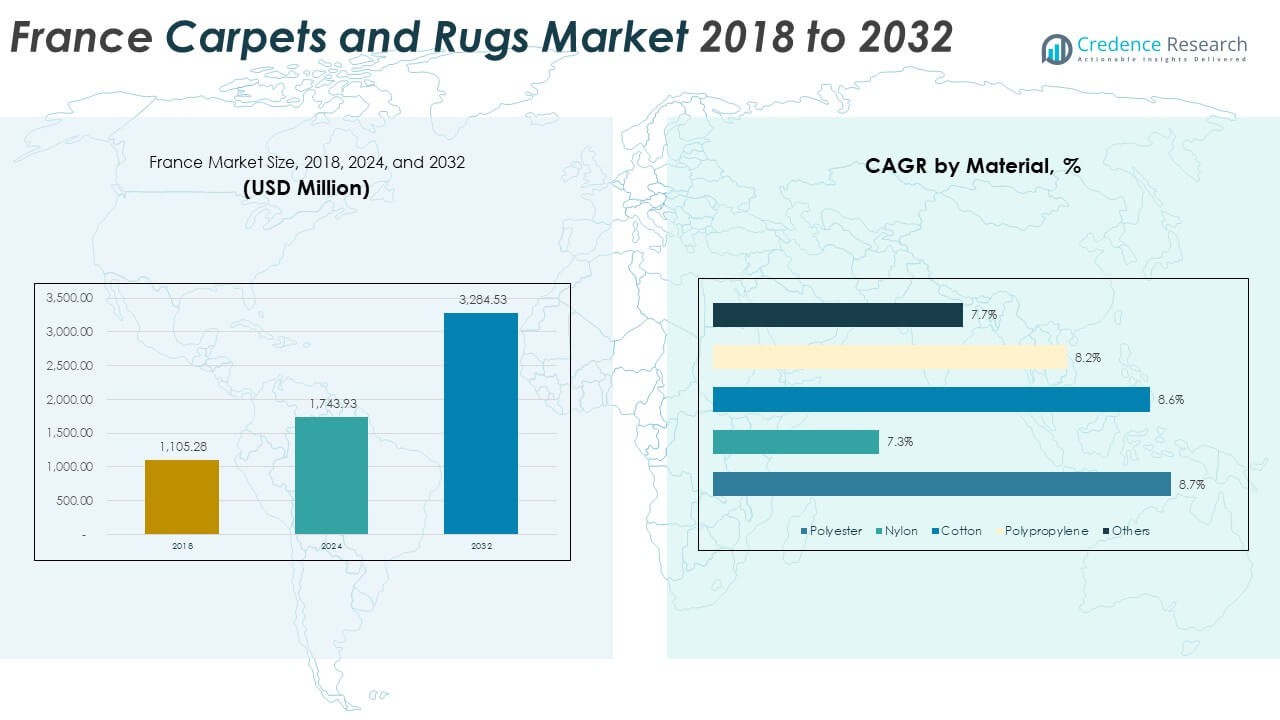

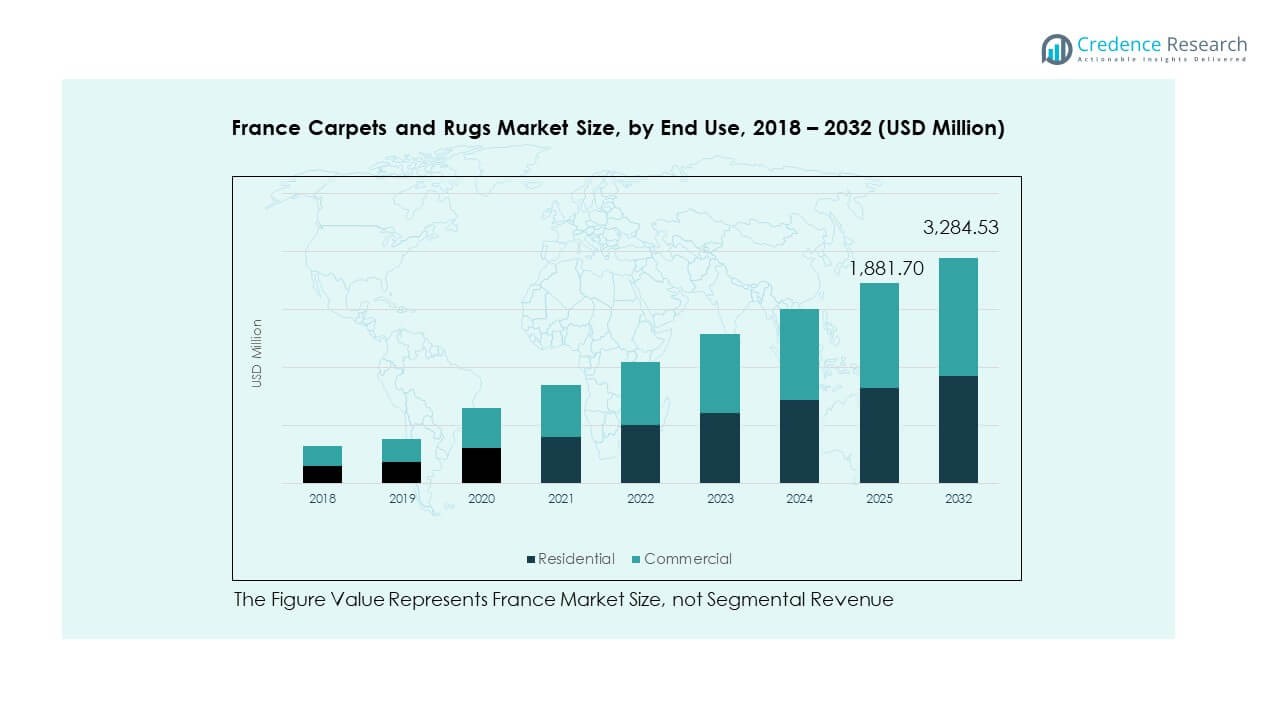

The France Carpets and Rugs Market size was valued at USD 1,105.28 million in 2018 to USD 1,743.93 million in 2024 and is anticipated to reach USD 3,284.53 million by 2032, at a CAGR of 8.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Carpets and Rugs Market Size 2024 |

USD 1,743.93 Million |

| France Carpets and Rugs Market, CAGR |

8.05% |

| France Carpets and Rugs Market Size 2032 |

USD 3,284.53 Million |

The growth of the France Carpets and Rugs Market is primarily driven by the increasing demand for aesthetically pleasing and durable flooring options in residential, commercial, and hospitality sectors. The trend toward eco-friendly and sustainable products has further boosted market demand, as consumers seek products with lower environmental impact. Additionally, technological advancements in carpet manufacturing, such as the introduction of smart textiles, and the growing preference for luxurious and custom-designed rugs continue to propel market expansion.

Geographically, France remains a leading market in Western Europe, supported by strong consumer preferences for high-quality flooring solutions. The demand for carpets and rugs is particularly concentrated in urban areas with a high density of residential, commercial, and retail spaces. Emerging regions in southern France also show an increasing interest in carpets, driven by the growing real estate market and the renovation of old buildings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Carpets and Rugs Market was valued at USD 1,105.28 million in 2018 and is expected to reach USD 3,284.53 million by 2032, growing at a CAGR of 8.05% from 2024 to 2032.

- Île-de-France dominates the market with a market share of around 30–35%, driven by high urbanization, luxury residential demand, and strong commercial infrastructure in Paris. Southern France, including Provence-Alpes-Côte d’Azur, accounts for 20%, boosted by tourism and hospitality sectors.

- The fastest-growing region is the south of France, particularly coastal areas, with a focus on premium carpets due to increasing tourist-driven demand for luxury accommodations.

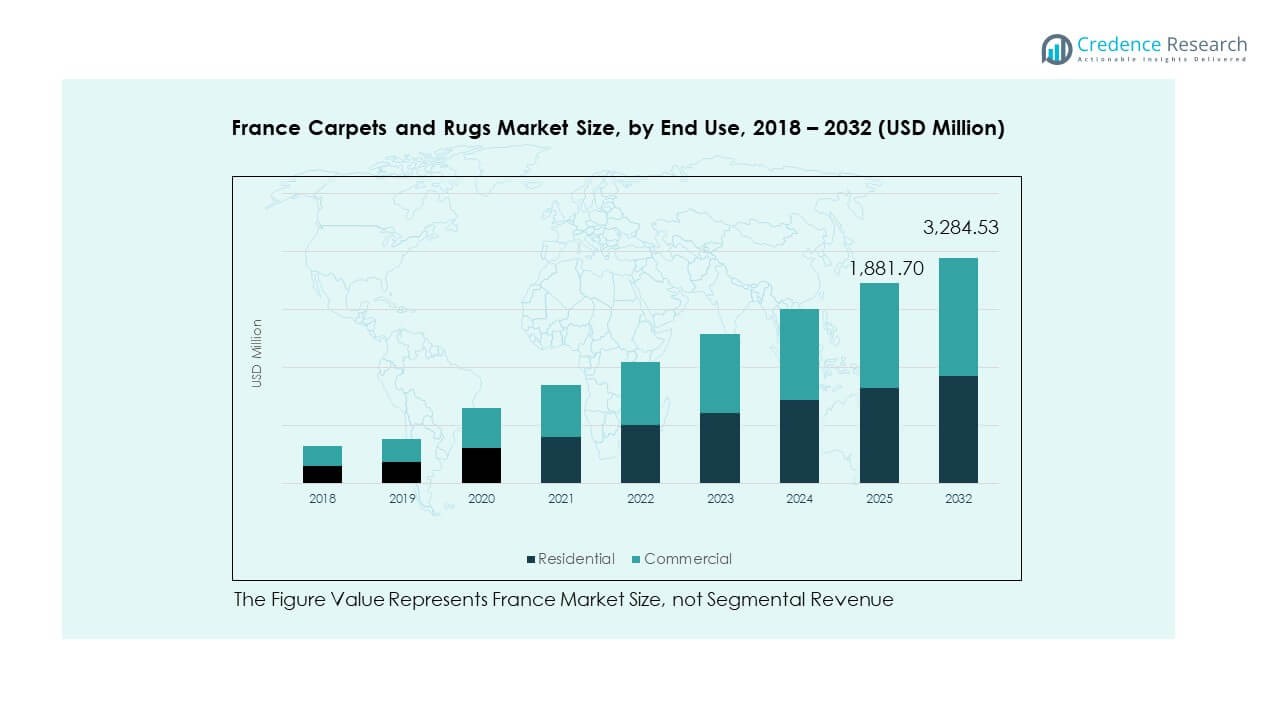

- The residential segment holds a dominant share, contributing significantly to the market’s growth, while the commercial sector continues to expand, particularly in office spaces and hotels.

- The residential segment’s share is set to grow from 2024 to 2032, reflecting the growing demand for home décor and sustainable flooring solutions in private homes.

Market Drivers:

Increasing Consumer Demand for Aesthetically Pleasing Flooring Solutions

The growing interest in home décor and interior design drives demand for high-quality carpets and rugs in France. Consumers are increasingly prioritizing aesthetics and design when selecting flooring options, contributing to the market’s growth. The desire to enhance living spaces with comfortable and visually appealing products is pushing up sales across residential and commercial sectors. The French population’s appreciation for stylish and luxurious floor coverings contributes to the market’s ongoing expansion.

- For instance, Tarkett reports that its French “Made in France” production site in Sedan has implemented tailored solutions and design‑driven flooring for residential homeowners and hospitality projects.

Preference for Sustainable and Eco-Friendly Products

Sustainability plays a significant role in shaping the France Carpets and Rugs Market. Consumers are more inclined to invest in eco-friendly materials like organic wool, bamboo, and recycled polyester. The increasing awareness of environmental concerns drives manufacturers to adopt green practices. It leads to the production of carpets and rugs that are biodegradable, recyclable, and free from harmful chemicals. As a result, eco-conscious products are gaining a strong foothold in the market.

- For instance, Tarkett’s global programme “ReStart®” facilitates take‑back and recycling of any flooring, covering over 100 countries through its 12,000‑employee network and 35 industrial plants worldwide. Consumers are more inclined to invest in eco‑friendly materials like organic wool, bamboo, and recycled polyester.

Rising Demand in the Commercial Sector

The demand for carpets and rugs in the commercial sector continues to grow in France. Businesses in retail, hospitality, and office spaces are investing in premium floor coverings for aesthetic and functional purposes. High-quality carpets and rugs offer enhanced durability and ease of maintenance, making them ideal for high-traffic commercial environments. This trend significantly contributes to the growth of the France Carpets and Rugs Market, as companies seek flooring solutions that blend aesthetics with practicality.

Technological Advancements in Carpet Manufacturing

Innovative technologies in carpet production are further fueling market expansion. Advancements such as digital printing and advanced weaving techniques enable manufacturers to offer custom-designed carpets. These technologies not only improve production efficiency but also increase product diversity. The France Carpets and Rugs Market benefits from a range of design options that appeal to modern consumers. This ongoing innovation helps attract a wider customer base, boosting market demand.

Market Trends:

Growing Popularity of Smart Carpets and Rugs

Smart carpets and rugs are gaining traction in the France Carpets and Rugs Market. These innovative products integrate sensors and advanced technology to offer unique functionalities, such as temperature regulation and self-cleaning capabilities. Consumers are becoming increasingly attracted to such smart products due to their convenience and energy-saving potential. The growing trend towards incorporating technology into home interiors is expected to drive market growth.

- For instance, research titled “Smart Carpet: Developing a sensor system to detect falls”(published around 2010/2011) showed that embedded sensors successfully detected gait and falls across a trial involving 11 volunteers. These innovative products integrate sensors and advanced technology primarily to monitor movement and detect falls, offering functionalities like real-time location tracking and immediate alerts to caregivers.

Customization and Personalization in Carpet Designs

There is a rising trend toward personalized and custom-made carpets in France. Consumers now seek unique designs that reflect their personality and style. This trend is driven by a growing demand for one-of-a-kind floor coverings in both residential and commercial settings. Carpet manufacturers in France are increasingly offering bespoke solutions to meet these preferences, allowing customers to select patterns, colors, and textures tailored to their individual tastes.

- For instance, La Manufacture Cogolin in Provence‑Alpes‑Côte d’Azur offers hand‑woven rugs and custom panels on Jacquard looms, using materials such as wool, cotton, linen and silk to meet bespoke design demands. Consumers now seek unique designs that reflect their personality and style.

Rise of Online Retail for Carpet Purchases

E-commerce has become an important channel for the France Carpets and Rugs Market. More consumers are turning to online platforms to browse and purchase carpets due to the convenience and wide variety of options available. Online shopping provides easy access to detailed product descriptions, reviews, and comparisons, making it an attractive choice for customers. As a result, online sales of carpets and rugs are expected to continue growing, influencing market dynamics in France.

Sustainability Trends in Design and Manufacturing

Sustainability continues to be a driving force in the design and manufacturing of carpets and rugs. France’s consumers are increasingly interested in environmentally friendly products, leading manufacturers to develop carpets made from recycled and natural fibers. These sustainable options are gaining popularity in the market as consumers become more aware of their environmental impact. The increasing demand for sustainable materials and practices will play a crucial role in shaping the market’s future trends.

Market Challenges Analysis:

High Cost of Premium Materials

One of the significant challenges facing the France Carpets and Rugs Market is the high cost of premium materials used in manufacturing. While demand for luxury and eco-friendly products increases, the cost of sourcing and producing high-quality materials such as wool, silk, and organic fibers remains high. This results in higher retail prices, which may limit accessibility for certain consumer segments. As a result, manufacturers must find ways to balance product quality with affordability while maintaining profitability.

Intense Competition in the Market

The France Carpets and Rugs Market is highly competitive, with numerous established brands and new entrants offering a wide range of products. This level of competition puts pressure on companies to continuously innovate and differentiate themselves to capture market share. Price competition, along with consumer demand for unique and customized designs, adds to the challenges faced by companies. To remain competitive, manufacturers need to focus on brand loyalty, product differentiation, and efficient production processes.

Market Opportunities:

Expansion of Sustainable Product Lines

There are significant opportunities in the France Carpets and Rugs Market for manufacturers to expand their sustainable product offerings. Consumers’ growing interest in eco-friendly and ethical products presents an opportunity for businesses to cater to this demand. Offering carpets and rugs made from natural, recyclable, or biodegradable materials can create a competitive advantage. Companies that embrace sustainability in both product design and manufacturing processes are well-positioned to capture market share.

Growth in Commercial Real Estate Development

The expansion of commercial real estate in France presents an opportunity for the carpets and rugs market. As more office buildings, hotels, and retail spaces are developed, there is a growing demand for durable and aesthetically pleasing flooring solutions. The trend of investing in high-quality flooring for commercial spaces provides a valuable growth avenue for manufacturers. This sector’s consistent growth will continue to create new opportunities in the market.

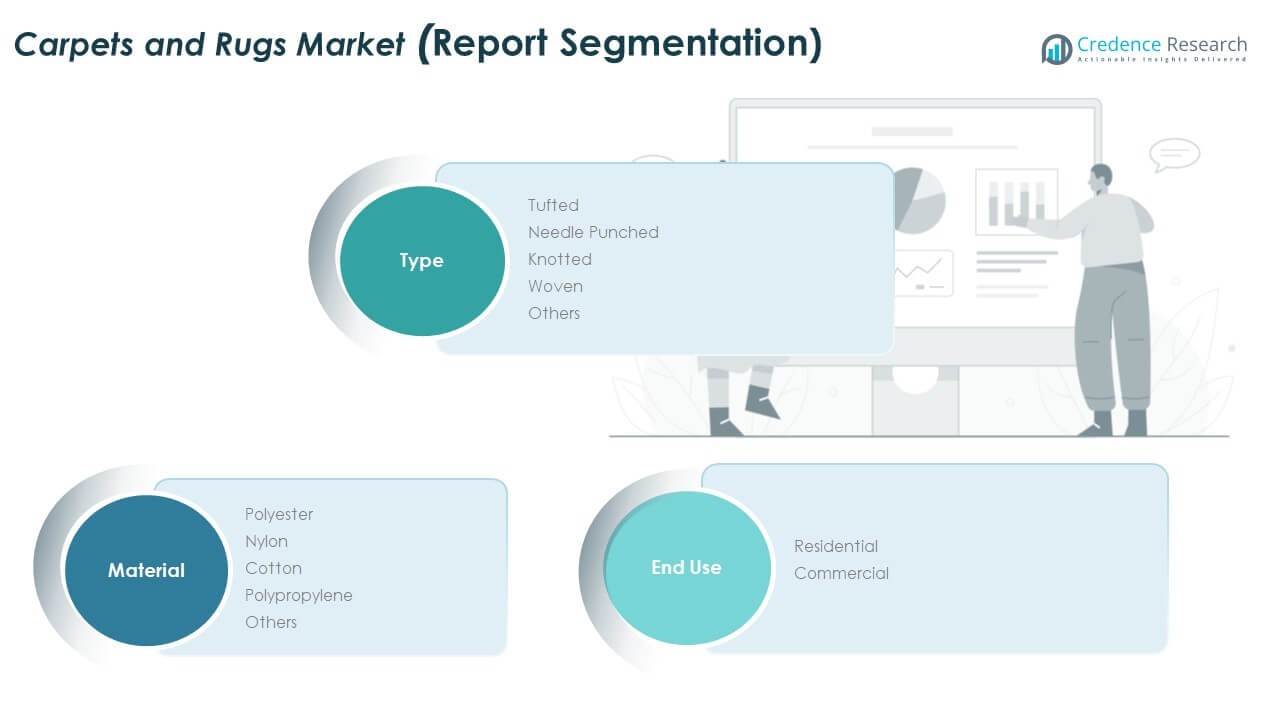

Market Segmentation Analysis:

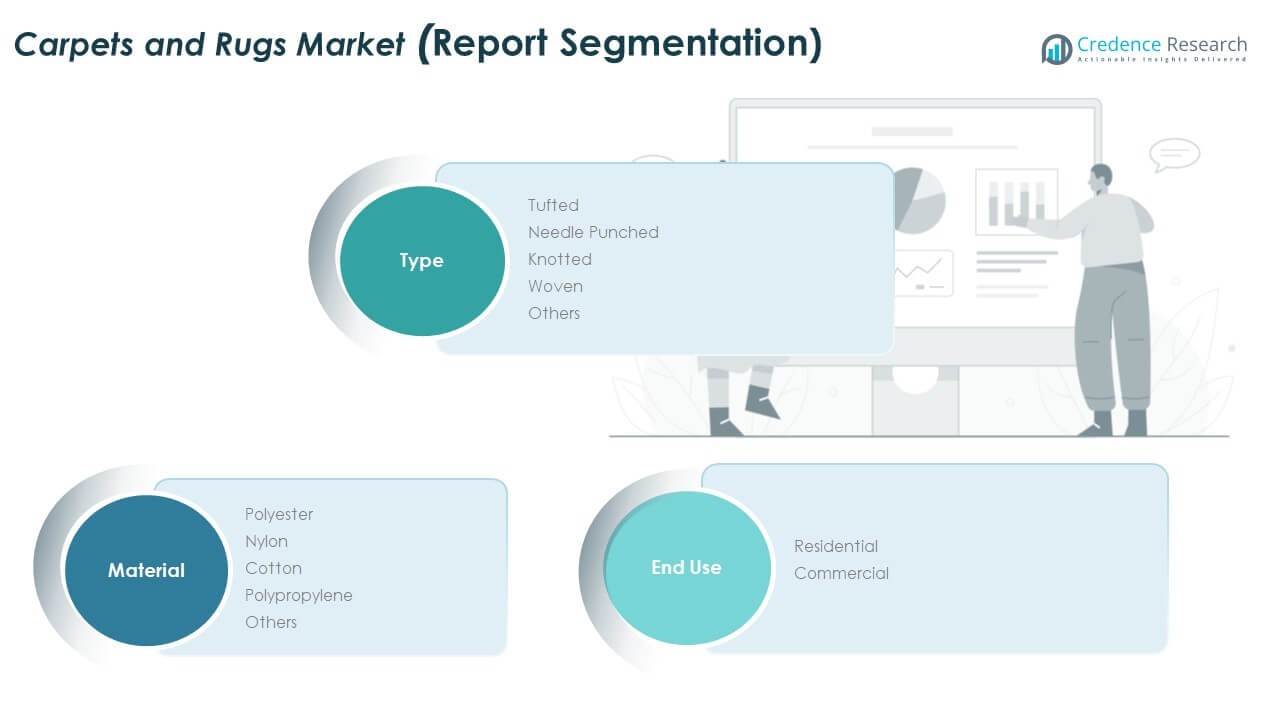

By Type:

The France Carpets and Rugs Market is categorized by type into tufted, needle-punched, knotted, woven, and others. Tufted carpets dominate the market due to their affordability and ease of production. Needle-punched carpets are favored in industrial and high-traffic areas for their durability. Knotted carpets cater to the premium segment, offering high-quality craftsmanship and intricate designs. Woven carpets are known for their longevity and aesthetic appeal, often found in luxury settings. Other types, including custom-designed rugs, meet niche market demands.

- For instance, Balsan produces around 45,000 m² weekly at its Arthon plant for contract applications. Knotted carpets cater to premium demand with hand craftsmanship.

By Material:

The material segment of the France Carpets and Rugs Market includes polyester, nylon, cotton, polypropylene, and others. Polyester holds a strong market share due to its affordability and ease of maintenance. Nylon remains the most popular material for its strength, resilience, and suitability for high-traffic areas. Cotton offers natural appeal and is preferred for its softness, while polypropylene is recognized for its resistance to stains and moisture. Other materials include wool and recycled fibers, which are gaining traction among environmentally conscious consumers.

- For instance, technical reviews note polypropylene carpet systems are prone to crushing or flattening in loop-pile installations, due to the material’s lower resilience compared to other fibers. Other materials include wool and recycled fibres, gaining appeal among eco-conscious consumers for their natural or sustainable properties.

By End Use:

The market is segmented by end use into residential and commercial applications. The residential segment holds a significant share, driven by consumer demand for home décor and flooring solutions. Commercial spaces, including offices, retail, and hospitality, also contribute to market growth due to the need for durable and stylish flooring in high-traffic environments.

By Distribution Channel:

The distribution channels in the France Carpets and Rugs Market include B2B (projects/contract) and B2C (retail). B2B sales are primarily driven by commercial and industrial applications, while B2C sales cater to the growing demand in residential sectors through retail and online platforms.

By Price Tier:

The price tier segment is divided into economy, medium, and premium. The economy segment remains popular due to its affordability, while medium and premium segments cater to consumers seeking higher-quality, designer, and sustainable options.

Segmentation:

By Type:

- Tufted

- Needle‑Punched

- Knotted

- Woven

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use:

By Distribution Channel:

- B2B (Projects/Contract)

- B2C (Retail)

By Price Tier:

Regional Analysis:

Western France and Île‑de‑France Zone

The France Carpets and Rugs Market maintains a higher concentration of demand in Western France and the Île‑de‑France region. It captures nearly 30–35% of the national market share due to dense urban centres and high‑income residential developments. Most luxury and designer carpet sales occur in Paris suburbs and affluent coastal areas. Commercial refurbishments in offices and hotels further boost flooring investments in this region. Manufacturers and retailers locate showrooms here to stay close to key buyers. Because these areas host large contract projects, project‑based (B2B) sales climb steadily.

Southern France and Tourism‑Driven Coastal Areas

The southern French regions, including Provence‑Alpes‑Côte d’Azur and Occitanie, account for roughly 20% of the market, driven by hospitality flooring needs. High tourist volumes prompt frequent renovations in hotels and resorts, increasing demand for premium rugs and carpets. It favours woven, knotted, and designer types in upscale projects. Seasonal consumer turnover and second‑home purchases also support residential demand. Manufacturers often tailor product lines for coastal styles and sustainable fibres in this zone.

Rest of France and Emerging Interiors Segment

Regions outside metropolitan centres, such as the north‑east and inland departments, hold the remaining 45–50% of market share. Growth here stems from mid‑tier residential renovations and expanding retail channels. It includes economy and medium price‑tier segments, often using polyester and polypropylene materials. Commercial activity remains limited compared to the Paris region, but infrastructural upgrades in regional offices and schools provide consistent flooring demand. Retail penetration via online platforms also lifts growth in less‑served areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Carpets and Rugs Market is highly competitive, with several established players and new entrants vying for market share. Leading companies such as Tarkett, Shaw Industries Group, and Balsan dominate the market with a wide range of products targeting both residential and commercial segments. These players leverage innovative manufacturing technologies, such as digital printing and sustainable materials, to differentiate their offerings. They focus on enhancing product quality, expanding distribution networks, and catering to specific consumer preferences. Despite strong competition, companies continuously invest in R&D to develop eco-friendly products and offer customization options. Market players also strive to meet the growing demand for premium and eco-conscious flooring solutions to maintain a competitive edge.

Recent Developments:

- Mohawk Industries announced a transformative acquisition in October 2025 when it agreed to purchase Bremworth Limited, New Zealand’s leading premium wool carpet and rug manufacturer, through its wholly-owned subsidiary Floorscape Limited. The scheme implementation agreement was entered into on October 1, 2025, with shareholders expected to receive between NZ$1.05 to NZ$1.15 cents per share, with completion anticipated in the first half of 2026, subject to shareholder and regulatory approval. This acquisition represents Mohawk’s continued geographic expansion and strengthens its position in the premium wool carpet market, while also supporting New Zealand’s wool industry and regional economies.

- Tai Ping Carpets International demonstrated its commitment to innovation and design excellence through multiple strategic collaborations in 2025. In September 2025, the company unveiled the Ami Collection, created in collaboration with internationally acclaimed architecture and interior design studio AB Concept (founded by Ed Ng and Terence Ngan), which debuted at Tai Ping’s London showroom during London Design Festival (September 13-21, 2025), featuring handmade rugs that blend memory, material, and craftsmanship into contemporary creations.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Carpets and Rugs Market is expected to see steady growth driven by rising demand for sustainable flooring solutions.

- Innovation in manufacturing technologies, such as digital printing, will continue to reshape the market.

- The shift toward premium and eco-friendly products will open new growth avenues.

- Demand for customized carpets and rugs will rise, particularly in residential and commercial sectors.

- Online sales channels will gain importance as consumer shopping behavior shifts toward e-commerce.

- The commercial sector will witness increased demand, particularly in the hospitality and office spaces.

- Urbanization trends will fuel demand for high-quality carpets and rugs in residential and commercial properties.

- Increased adoption of eco-conscious materials, such as recycled fibers, will drive market expansion.

- Regional expansion, particularly in Southern France and coastal regions, will play a critical role in market growth.

- Manufacturers will focus on diversifying product offerings to cater to varying consumer preferences across price tiers.