Market Overview:

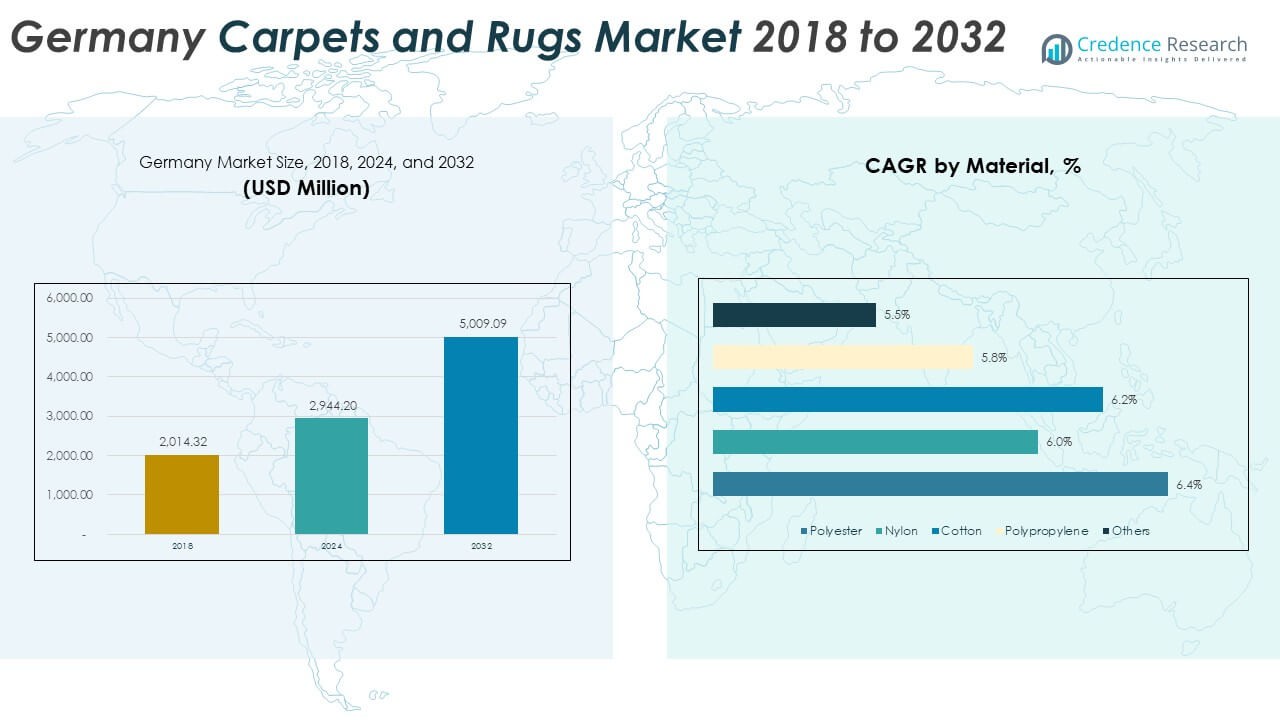

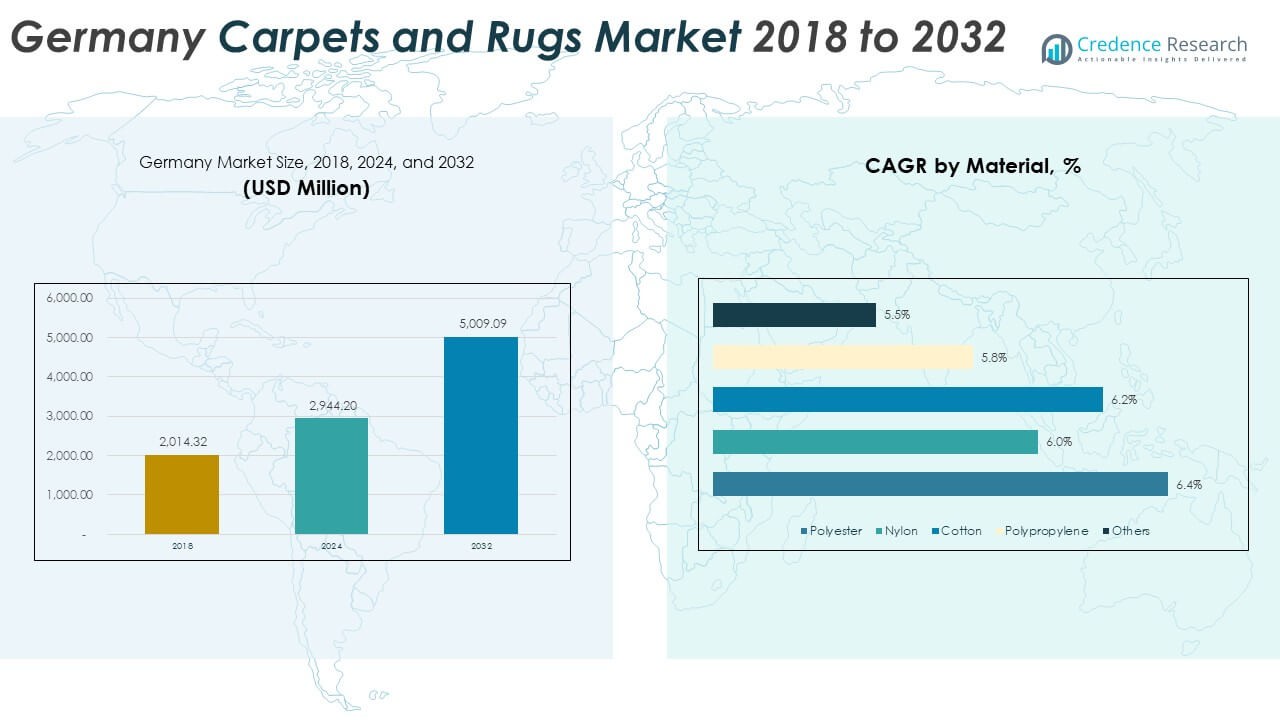

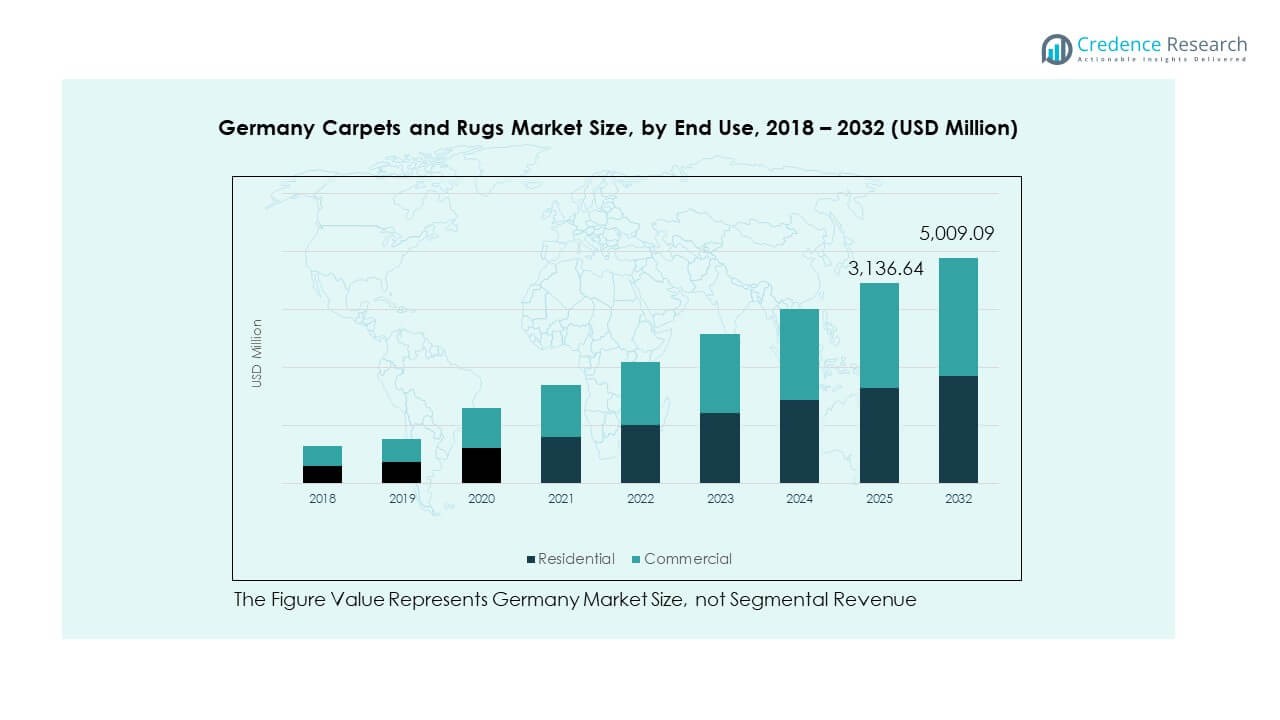

The Germany Carpets and Rugs Market size was valued at USD 2,014.32 million in 2018, reaching USD 2,944.20 million in 2024, and is anticipated to reach USD 5,009.09 million by 2032, at a CAGR of 7.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Carpets and Rugs Market Size 2024 |

USD 2,944.20 Million |

| Germany Carpets and Rugs Market, CAGR |

7.22% |

| Germany Carpets and Rugs Market Size 2032 |

USD 5,009.09 Million |

The market growth is driven by increasing demand for durable, design-oriented, and eco-friendly flooring solutions. The rise in renovation projects and growing consumer interest in interior aesthetics have boosted carpet sales across residential and commercial sectors. Sustainable production practices and innovations in stain-resistant and easy-to-clean materials are further strengthening product appeal. The hospitality and office refurbishment industries also contribute significantly to steady demand.

Germany’s carpet and rug production is mainly concentrated in regions such as North Rhine-Westphalia and Bavaria, where several key manufacturers operate. Northern and Western Germany dominate due to higher residential spending and established distribution channels. Meanwhile, Eastern regions are emerging as cost-efficient production hubs, supported by industrial investments and expanding export capacity to neighboring European markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Carpets and Rugs Market was valued at USD 2,944.20 million in 2024 and is projected to reach USD 5,009.09 million by 2032, growing at a CAGR of 7.22% during the forecast period.

- Germany commands the largest share of the European market, holding around 41.6% due to its advanced manufacturing base and strong domestic demand. France follows with 18.3%, driven by a high preference for premium and eco-friendly products.

- Italy and the UK represent emerging markets with a combined share of approximately 22.3%, benefiting from a focus on luxury and sustainable offerings.

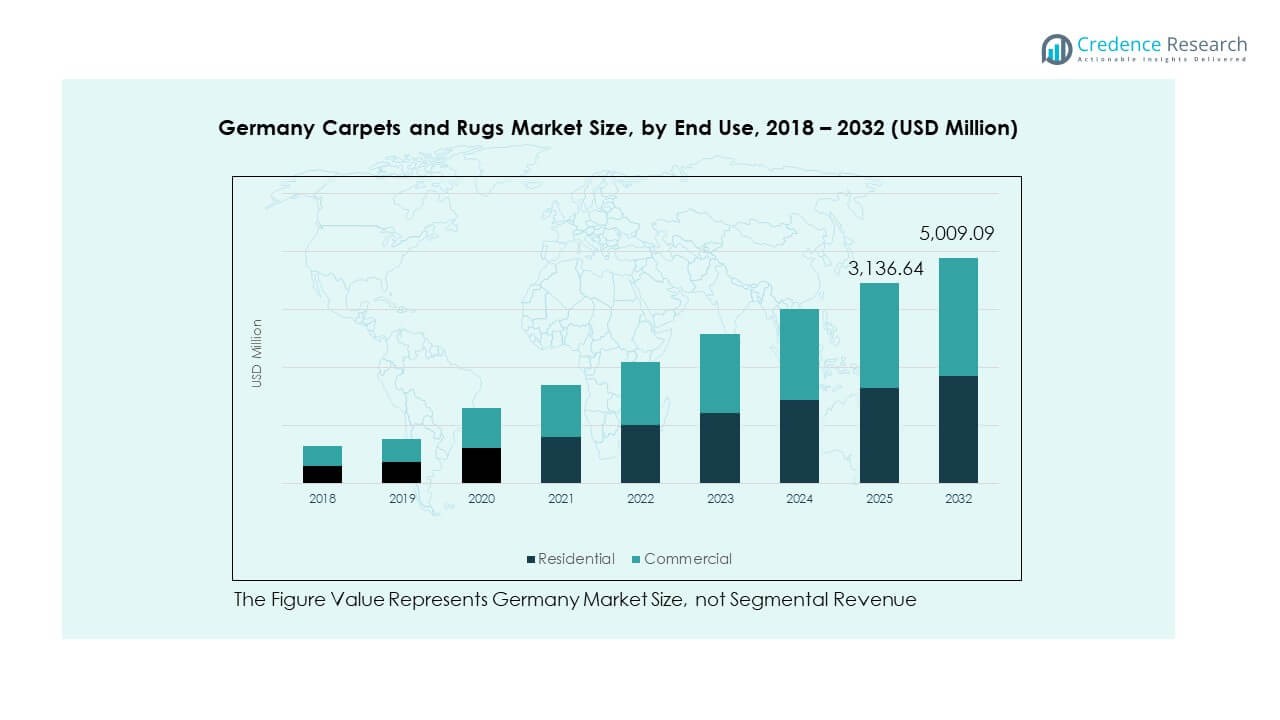

- The residential segment accounted for a larger share, contributing to over 60% of the market in 2024, while the commercial segment holds around 39%, driven by increasing office refurbishments and hospitality projects.

- The residential sector is expected to grow significantly by 2032, reaching USD 3,136.64 million, with increasing demand for home renovation and design aesthetics. The commercial sector also shows steady growth, with both segments contributing to market expansion.

Market Drivers:

Rising Demand for Eco-friendly Flooring Solutions

The growing preference for eco-friendly carpets and rugs significantly drives the Germany Carpets and Rugs Market. Consumers are increasingly seeking sustainable options made from natural fibers or recycled materials. As environmental awareness rises, manufacturers are adopting green practices, such as reducing water and energy consumption in production processes. This shift aligns with broader sustainability goals in the construction and interior design sectors. It also contributes to the growth of carpets with certifications like Global Recycled Standard (GRS). Demand for these products is not only driven by consumer choice but also by government regulations promoting eco-friendly products.

- For instance, Dura Tufting GmbH has introduced a range of carpets made from recycled PET bottles, reducing plastic waste and offering a sustainable solution for consumers. As environmental awareness rises, manufacturers like Shaw Industries are adopting green practices, such as reducing water and energy consumption in production processes, achieving a 30% reduction in water usage over the past five years.

Growing Home Renovation and Interior Design Spending

Rising disposable income and the increasing focus on home improvement in Germany are key drivers for the market. Consumers are investing more in interior design and upgrading their flooring solutions. The trend toward personalized and stylish home interiors boosts demand for a wide variety of carpets and rugs in various materials, colors, and designs. It reflects broader trends in the housing sector, where interior renovations and refurbishments are becoming a priority for homeowners. This expansion of residential construction and home improvement activities benefits carpet manufacturers and retailers alike.

- For example, Tarkett, a leading flooring manufacturer, has seen a significant rise in demand for their luxury vinyl and carpet tiles, especially among home renovators. Consumers are investing more in interior design and upgrading their flooring solutions.

Expanding Commercial Sector and Office Refurbishment

The growing demand for office refurbishment contributes to the expansion of the Germany Carpets and Rugs Market. With businesses prioritizing workplace aesthetics and employee well-being, more companies are opting for high-quality carpets and rugs. Carpets in commercial spaces, especially in offices, hotels, and restaurants, offer sound absorption and comfort while also contributing to the design and branding of the space. This trend is particularly significant in urban areas where the demand for modern office interiors is high. It reflects a growing demand from both small and large businesses investing in their office spaces to enhance employee productivity.

Technological Advancements in Carpet Manufacturing

Advances in carpet manufacturing technologies are driving the market forward by enabling the production of more durable, efficient, and cost-effective products. The use of automation and robotics in manufacturing processes helps reduce labor costs and improve production efficiency. Innovations such as stain-resistant and moisture-wicking carpets increase the appeal of rugs for residential and commercial applications. These technological advancements also support customizability, allowing consumers to choose unique designs and sizes tailored to their specific needs. With such innovations, the market continues to evolve, catering to a more tech-savvy and design-conscious consumer base.

Market Trends:

Increasing Popularity of Customization and Unique Designs

Customization is becoming a significant trend in the Germany Carpets and Rugs Market. Consumers now prefer carpets that reflect their personal style and needs, leading to a rise in demand for bespoke designs. Manufacturers are offering more personalized options, including custom sizes, colors, patterns, and textures. This trend is particularly popular in the high-end residential and commercial markets, where unique and visually appealing designs are essential. It enables consumers to create personalized spaces with carpets that complement their overall décor. The increased availability of online platforms for custom carpet orders further fuels this trend.

- For example, Object Carpet offers tailored carpet solutions where customers can choose from an array of materials, patterns, and colors, allowing them to create unique flooring designs. This trend is particularly popular in high-end markets, where companies like Victoria PLC focus on providing exclusive, handwoven rugs and custom-size carpets.

Growth of Online Sales Channels

The shift toward online shopping is another trend reshaping the Germany Carpets and Rugs Market. E-commerce platforms are increasingly becoming the preferred method for purchasing carpets due to convenience and a broader selection. Consumers are attracted to the ease of browsing products, reading reviews, and comparing prices from the comfort of their homes. Many manufacturers and retailers are investing in user-friendly websites and apps, offering direct-to-consumer services, and providing detailed product descriptions, samples, and virtual room design tools. This trend has made it easier for customers to access a wide range of carpets at competitive prices.

Focus on Health-conscious and Hygienic Flooring Options

Health-conscious consumers are increasingly opting for hypoallergenic, antibacterial, and easy-to-clean carpet options. The trend toward hygienic flooring solutions is growing, especially in households with children and pets. Carpets with anti-dust mite and antimicrobial properties are gaining popularity due to their ability to reduce allergens and maintain cleaner indoor air. This growing awareness of the health benefits of carpets promotes demand for products that offer both aesthetic appeal and functionality. The increased focus on indoor air quality is driving both residential and commercial consumers toward healthier carpet solutions.

Popularity of Multi-functional and Durable Carpets

The growing demand for multi-functional and durable carpets is another notable trend in the Germany Carpets and Rugs Market. Consumers are seeking carpets that offer both style and practicality, with improved durability and longer-lasting performance. Features such as stain resistance, waterproofing, and increased wear resistance are becoming standard. With busy lifestyles, consumers are looking for low-maintenance flooring options that can withstand high foot traffic and challenging environments. Manufacturers are responding by incorporating advanced technologies into the carpet design, ensuring that they meet modern consumer expectations for functionality and style.

Market Challenges Analysis:

Intense Competition in a Saturated Market

The Germany Carpets and Rugs Market faces the challenge of intense competition, especially in the premium and mass-market segments. With many well-established brands and new entrants offering similar products, standing out in the crowded marketplace is difficult. Companies are increasingly competing on price, quality, and design differentiation. While price-sensitive consumers seek affordable options, those in the higher-end market demand exceptional quality and exclusive designs. The market’s saturation also affects profit margins, forcing companies to continually innovate and improve efficiency to stay competitive. This dynamic drives companies to focus on improving their product offerings and customer service.

Fluctuating Raw Material Prices and Supply Chain Issues

Another major challenge facing the Germany Carpets and Rugs Market is the volatility in raw material prices. The price of materials such as wool, polyester, and nylon can fluctuate due to global supply and demand dynamics, transportation costs, and environmental factors. These fluctuations affect the overall cost structure of carpets and rugs, impacting both manufacturers and consumers. Additionally, disruptions in the global supply chain, such as delays or shortages of key materials, can result in inventory issues and increased lead times. Companies must adapt to these challenges by securing reliable supply chains and managing costs effectively.

Market Opportunities:

Growing Demand for Sustainable Products

The growing preference for sustainable products presents significant opportunities for the Germany Carpets and Rugs Market. With consumers becoming more eco-conscious, there is a rising demand for carpets made from recycled or renewable materials. Manufacturers can capitalize on this trend by offering carpets with certifications such as GOTS (Global Organic Textile Standard) or other sustainability credentials. This demand for eco-friendly products is also driven by regulations promoting environmental responsibility in manufacturing processes. It provides an opportunity for companies to innovate and align their product offerings with consumer values around sustainability.

Expansion in Emerging Markets

There is significant growth potential for the Germany Carpets and Rugs Market in emerging markets. The increasing urbanization in countries such as India and China is driving demand for both residential and commercial carpets. As these markets grow, the demand for stylish and durable carpets is expanding, offering lucrative opportunities for German manufacturers to enter or strengthen their presence in these regions. The increasing standard of living and rising disposable incomes in these countries further support this growth. It presents a clear opportunity for expansion, both in terms of exports and local production.

Market Segmentation Analysis:

By Type

The Germany Carpets and Rugs Market is segmented into tufted, needle-punched, knotted, woven, and other types. Tufted carpets hold the largest share due to their affordability and versatility, making them suitable for both residential and commercial applications. Needle-punched carpets are known for their durability, making them ideal for industrial settings and high-traffic areas. Knotted carpets serve the premium segment, offering intricate craftsmanship and long-lasting appeal. Woven carpets, known for their strength and aesthetic value, are often preferred in luxury settings. The “Others” category caters to customized designs, meeting niche market demands for unique, tailored flooring solutions.

- For example, Shaw Industries has extensively invested in tufted carpet technology, with their Tufted modular tile lines, which are now one of the most preferred flooring solutions for office spaces, offering both durability and design flexibility. Needle-punched carpets are known for their durability, making them ideal for industrial settings and high-traffic areas.

By Material

Polyester, nylon, cotton, polypropylene, and other materials dominate the material segment of the Germany Carpets and Rugs Market. Polyester remains a popular choice due to its affordability, ease of maintenance, and variety of textures. Nylon carpets offer superior durability, making them ideal for high-traffic areas. Cotton, known for its natural and eco-friendly properties, is gaining traction in sustainable flooring solutions. Polypropylene, resistant to stains and moisture, is widely used in both residential and commercial settings. The “Others” category includes alternative fibers and blended materials that cater to specific consumer preferences.

- For example, Mohawk Industries has developed a line of polypropylene-based carpets, making them easy to clean and suitable for homes and high-traffic commercial areas. The “Others” category includes alternative fibers and blended materials that cater to specific consumer preferences.

By End Use

The end-use segment of the Germany Carpets and Rugs Market includes residential and commercial applications. The residential sector drives the demand for stylish, durable, and easy-to-maintain carpets for home interiors. The commercial sector, including offices, hotels, and retail spaces, requires high-quality, functional carpets that offer both aesthetic value and practicality. The growing demand for interior design and workplace aesthetics supports the expansion of both segments.

Segmentation:

By Type

- Tufted

- Needle‑punched

- Knotted

- Woven

- Others

By Material

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use

Regional Analysis:

Regional Analysis of the Germany Carpets and Rugs Market

Germany drives the European carpets and rugs market, accounting for approximately 41.6% of the region’s total revenue share in 2024. It leads due to its advanced manufacturing base, high level of renovation activity and strong domestic consumption for both residential and commercial spaces. German companies invest heavily in sustainable production methods and design innovation, allowing them to maintain a competitive advantage. Domestic demand for premium flooring solutions supports steady growth, while exports strengthen the country’s regional dominance. The concentration of production and efficient supply chains reinforce Germany’s leading position.

France holds a significant position in the European market with a share near 18.3% in 2024. The country’s strong interior‑design culture and growing consumer interest in eco‑friendly and artisanal flooring solutions drive demand. French producers and retailers benefit from government incentives for sustainable materials and luxury housing upgrades, which accelerate adoption of high‑end carpets and rugs. The presence of a robust distribution and interior design services network supports market growth. France thus remains one of the key regional hubs for premium carpet offerings.

Italy and the UK represent emerging but less dominant geographies in the carpets and rugs space, contributing around 22.3% combined share (with Italy and UK individually lower) of Europe’s market in 2024. Italy’s heritage of handcrafted woven and knotted rugs attracts luxury buyers while its renovation market increases demand. The UK benefits from strong e‑commerce growth and modern workplace refurbishments pushing commercial carpet uptake. Both markets serve as fertile grounds for growth through differentiated product offerings and niche segmentation. Their expansion potential supports broader regional momentum for the carpets and rugs sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Carpets and Rugs Market is highly competitive, with several well-established domestic and international players. Companies in this market focus on product innovation, quality, and sustainability to differentiate themselves. German manufacturers emphasize eco-friendly production processes and premium product offerings to attract discerning consumers. The market includes a mix of large-scale manufacturers and smaller, niche players catering to specialized needs. The competitive landscape is shaped by technological advancements in carpet production and an increased focus on customization. As the demand for high-quality and sustainable flooring options grows, market players are investing in advanced manufacturing techniques to improve product durability and appeal.

Recent Developments:

- In June 2025, Tarkett innovated a circular recycling solution for Powerbond hybrid carpet through its ReStart program. In September 2025, Tarkett launched the Artisan Collection of broadloom carpets. The company acquired Classic Turf & Tracks in July 2024 and sold Diamond W distribution to Big D Floor Covering in July 2024.

- In April 2025, Lowe’s acquired the Artisan Design Group for $1.325 billion (completed by June 2025), expanding its flooring, cabinetry, and countertops offerings.

- Shaw announced early 2025 carpet launches featuring Pet Perfect+ with LifeGuard Spill-Proof Technology and new designs (ColorClarity, NaturalTwist). In November 2024, the company launched EcoWorx Resilient, a PVC-free flooring product. In September 2023, Shaw established a strategic partnership with Germany’s Classen Group for commercial flooring distribution.

- In November 2025, Beaulieu International announced the acquisition of Congoleum Flooring, a U.S. resilient flooring manufacturer. In May 2025, Beaulieu sold its Technical Textiles (BTT) division to RCP.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly and sustainable carpets will continue to drive market growth.

- Innovations in production technology will improve efficiency and product durability.

- The commercial sector will see an increase in demand for carpets due to office refurbishments.

- Rising consumer interest in customized carpets will lead to increased market segmentation.

- The growing trend of online sales will expand distribution channels for carpet manufacturers.

- Regulatory pressures on sustainability will influence product offerings and manufacturing processes.

- The market will witness increased competition as more international players enter the region.

- High-quality and luxurious carpets will remain in demand, particularly in the residential segment.

- The adoption of automation in manufacturing will lower production costs and improve quality.

- The rise of smart flooring solutions may present new opportunities for innovation in the carpet industry.