Market Overview:

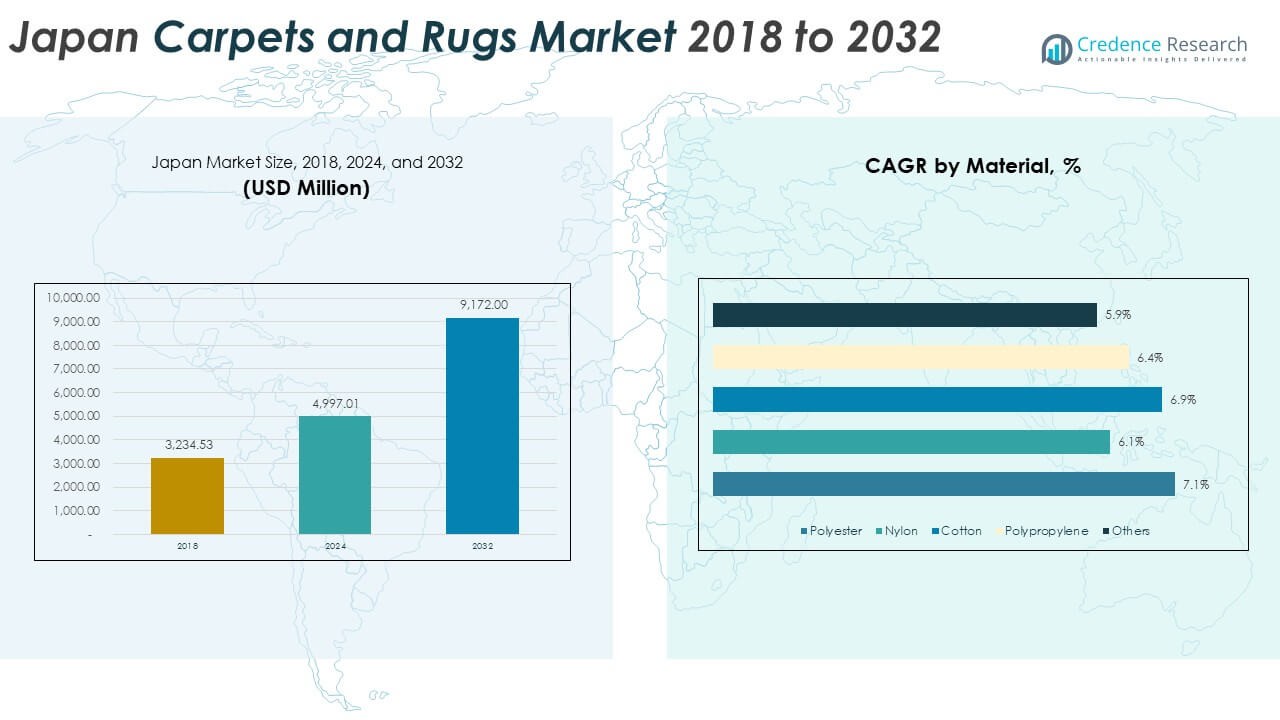

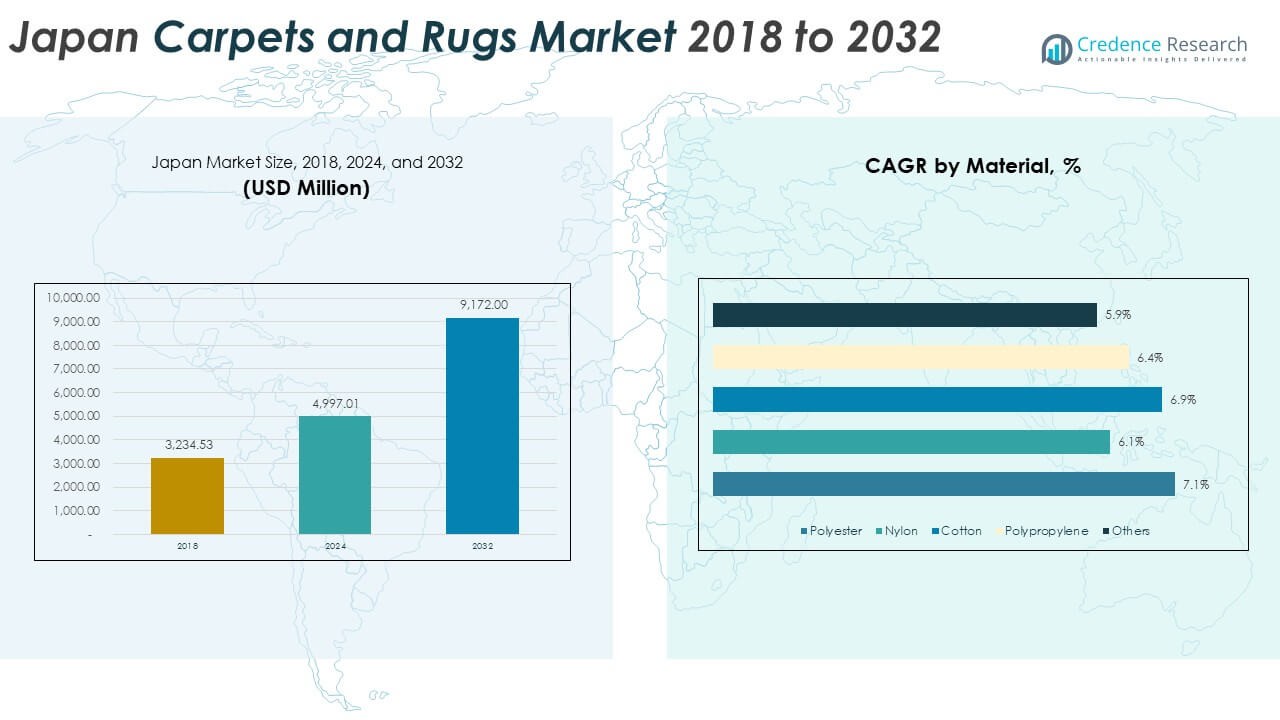

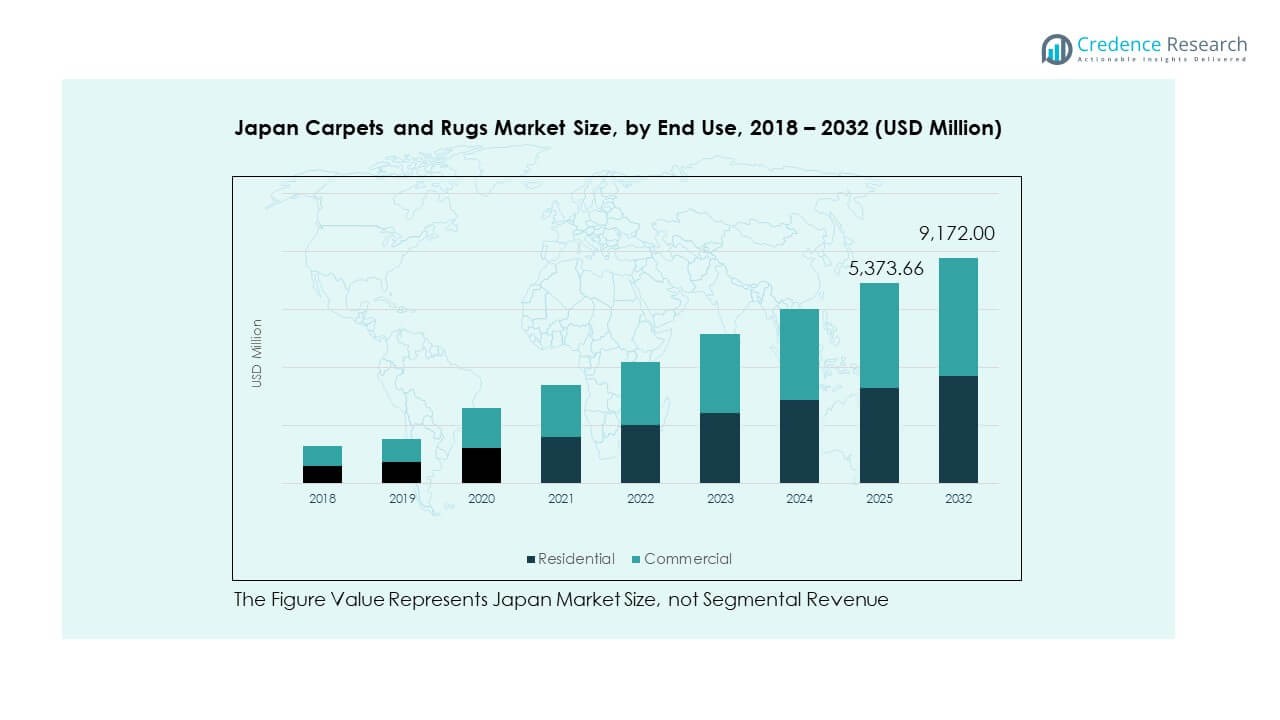

The Japan Carpets and Rugs Market size was valued at USD 3,234.53 million in 2018 to USD 4,997.01 million in 2024 and is anticipated to reach USD 9,172.00 million by 2032, at a CAGR of 7.72 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Carpets and Rugs Market Size 2024 |

USD 4,997.01Million |

| Japan Carpets and Rugs Market , CAGR |

7.72 % |

| Japan Carpets and Rugs Market Size 2032 |

USD 9,172.00 Million |

The market is being driven by rising consumer demand for premium and custom‑designed floor coverings in homes and commercial spaces. Homeowners and businesses in Japan increasingly invest in high‑quality carpets and rugs that offer durability, sustainability, and aesthetic appeal. Manufacturers respond by introducing eco‑friendly fibers, advanced stain‑resistant treatments and unique designs, thus spurring growth across the market.

Geographically, the Japanese domestic market leads due to strong renovation activity, steady housing turnover and commercial refurbishments in metropolitan areas. Emerging opportunities are noticeable in regional cities where builders and retailers expand carpet offerings to meet rising middle‑class demand. Meanwhile, the international trade of Japanese designs to other parts of Asia is gaining traction as overseas customers value Japan’s craftsmanship and modern aesthetics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Carpets and Rugs Market was valued at USD 3,234.53 million in 2018, is projected to reach USD 4,997.01 million in 2024, and is expected to grow to USD 9,172.00 million by 2032, with a CAGR of 7.72%.

- Japan dominates the market with approximately 70% share in 2024 due to high demand for premium products. Asia Pacific (excluding Japan) follows with about 20% share, driven by rising urbanization and disposable income. North America and Europe together account for roughly 10%, led by a preference for high-quality carpets in commercial and residential sectors.

- The fastest-growing region is Asia Pacific (excluding Japan), with a growing share driven by expanding real estate, infrastructure, and rising consumer spending in countries like China, India, and Southeast Asia.

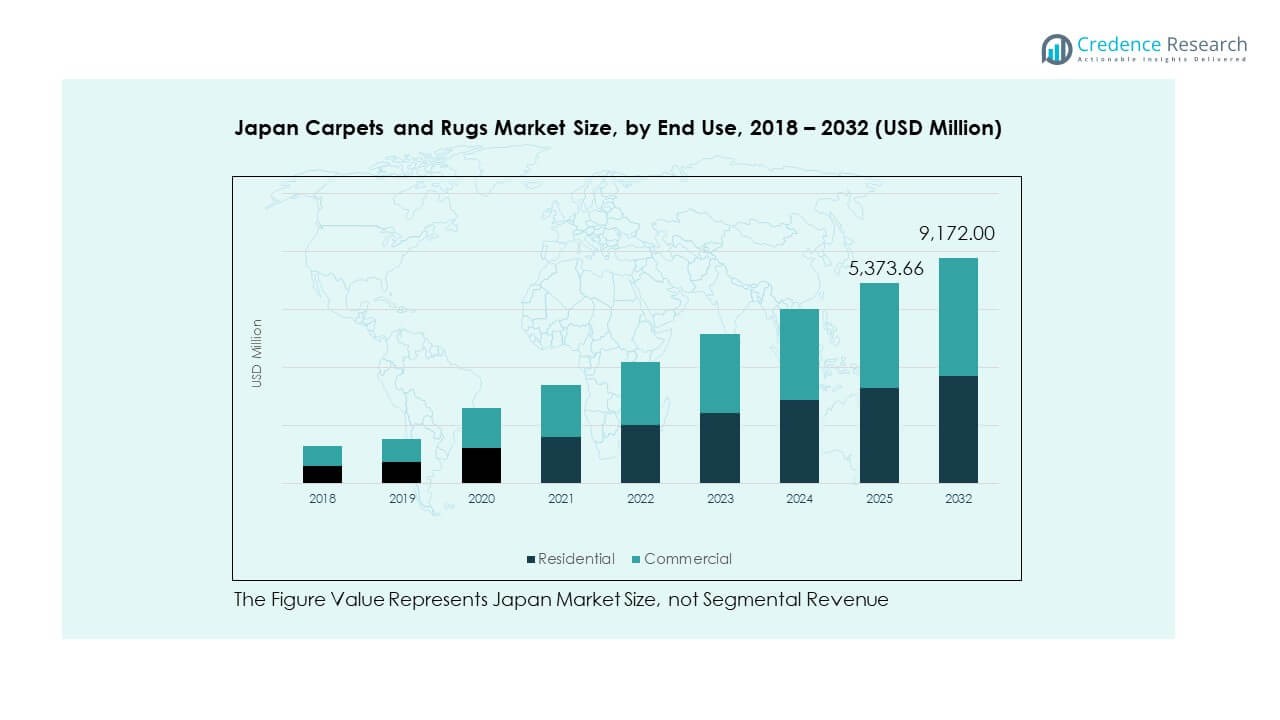

- The residential segment leads with a 60% share in 2024, reflecting a strong consumer preference for design and comfort, while the commercial segment holds 40%, driven by demand from office buildings, hotels, and retail establishments.

- Residential demand continues to dominate but is growing at a slower rate than the commercial segment, where increased investment in commercial spaces, particularly hotels and offices, is expected to drive faster growth in the coming years.

Market Drivers:

Rising Demand for Premium Products:

The Japan Carpets and Rugs Market is experiencing a surge in demand for premium products, driven by consumer preference for higher-quality materials. In residential and commercial spaces, consumers increasingly seek rugs and carpets with superior durability, comfort, and aesthetic appeal. This shift is influencing manufacturers to innovate, offering products that meet the needs for both functional and decorative purposes. As a result, companies are expanding their portfolios to include eco-friendly and luxury options, meeting the evolving preferences of Japanese consumers.

- For instance, SUMINOE Interior Products Co., Ltd. offers the ECOS® carpet tile series which uses up to 81% post‑consumer recycled content, demonstrating its commitment to premium sustainable floor coverings. In residential and commercial spaces, consumers increasingly seek rugs and carpets with superior durability, comfort, and aesthetic appeal.

Technological Innovations in Manufacturing:

Technological advancements play a key role in driving the Japan Carpets and Rugs Market. The introduction of automation and digital printing technologies has enabled manufacturers to produce more customized, intricate designs while improving efficiency. Innovations in fiber treatments, such as stain resistance and antimicrobial properties, have also made carpets and rugs more durable and easier to maintain. These developments contribute to a higher value perception of carpets and rugs, supporting overall market growth.

- For instance, Yamamoto Corporation became the first in Japan to introduce full‑colour digital jet printing equipment in its carpet manufacturing operations, enabling high‑resolution pattern output on demand.

Increasing Renovation Activities in Urban Areas:

Renovation and remodelling projects in Japan’s urban areas significantly contribute to the growth of the carpets and rugs market. As more residents and businesses opt for floor covering upgrades, the demand for stylish and high-quality carpets continues to rise. The expansion of the real estate market, coupled with increasing disposable incomes, boosts the demand for modern, stylish floor coverings in both new and renovated properties.

Preference for Sustainable and Eco-Friendly Options:

Environmental concerns are gaining importance among Japanese consumers, leading to a growing demand for eco-friendly carpets and rugs. Sustainable materials, such as recycled fibers and biodegradable options, are becoming more prevalent in the market. Manufacturers are aligning their product offerings to meet sustainability criteria, and this trend is expected to continue driving growth in the Japan Carpets and Rugs Market, as environmentally conscious choices gain traction.

Market Trends:

Rise in Customization and Personalization:

The Japan Carpets and Rugs Market is witnessing a trend towards more personalized and customizable options. Consumers are increasingly seeking carpets and rugs tailored to specific design preferences, such as size, color, pattern, and texture. This trend is being driven by both the residential and commercial sectors, where interior design plays a crucial role in creating unique, personalized spaces. Companies are investing in digital design tools and advanced production techniques to accommodate this shift toward custom products.

- For instance, companies in the modern textile industry, often leveraging advanced digital printing technologies, can provide clients with a broad range of color options and offer highly customized pattern runs designed for minimal batch sizes. Consumers are increasingly seeking home furnishings like carpets and rugs tailored to specific design preferences, such as size, color, pattern, and texture.

Growth of Online and Direct Sales Channels:

Online shopping has become a significant sales channel for the Japan Carpets and Rugs Market. Consumers are increasingly turning to e-commerce platforms to browse, compare, and purchase floor coverings. The convenience of home delivery, coupled with the ability to easily access a wider variety of styles and prices, is driving this trend. In response, many traditional retailers are enhancing their online presence and offering virtual tools to help customers visualize how carpets will look in their homes.

- For instance, several major Japanese flooring manufacturers launched augmented reality “room visualizer” tools on their e‑commerce platforms, enabling customers to view how a carpet will look in their space before purchase. Consumers increasingly turn to e‑commerce platforms to browse, compare, and purchase floor coverings.

Integration of Smart Technology in Carpets:

Smart technology integration is becoming a notable trend within the Japan Carpets and Rugs Market. Companies are exploring ways to incorporate sensors and smart features into their products, such as carpets with embedded heating elements or carpets that can track foot traffic for wear patterns. These innovations cater to the growing demand for high-tech home and office furnishings, especially among tech-savvy consumers who value convenience and innovation in their living and workspaces.

Increasing Demand for Multifunctional Carpets:

The demand for multifunctional carpets is growing within the Japan Carpets and Rugs Market. Consumers are looking for floor coverings that offer more than just aesthetic appeal. Products that combine comfort with additional functionalities, such as enhanced acoustic properties or thermal insulation, are gaining popularity. This trend reflects a broader shift towards multifunctional home products that serve multiple purposes, especially in smaller living spaces where space optimization is important.

Market Challenges Analysis:

Rising Raw Material Costs:

One of the major challenges facing the Japan Carpets and Rugs Market is the rising cost of raw materials. The price increase in key materials such as wool, nylon, and polyester is impacting manufacturers’ ability to maintain competitive pricing. These cost pressures are passed on to consumers, which can limit the affordability of high-quality products. To address this, manufacturers are exploring alternative, cost-effective materials and finding innovative ways to improve production efficiency without compromising quality.

Competition from Alternative Flooring Solutions:

The Japan Carpets and Rugs Market faces competition from alternative flooring solutions, such as vinyl, tiles, and hardwood floors. These alternatives are often viewed as more durable and easier to maintain compared to traditional carpets and rugs. In addition, they are increasingly available in a wide range of designs and finishes that mimic the aesthetic appeal of carpets. As a result, the growing preference for these alternatives poses a challenge to traditional carpet manufacturers, urging them to enhance their value proposition.

Market Opportunities:

Expansion of Eco-Friendly Product Lines:

An important opportunity in the Japan Carpets and Rugs Market lies in expanding eco-friendly product lines. As environmental awareness continues to rise, consumers are seeking sustainable and recyclable flooring options. Manufacturers have the chance to capitalize on this trend by offering carpets and rugs made from biodegradable fibers or recycled materials. Positioning products as eco-conscious can attract a growing segment of environmentally aware consumers, enhancing market share in a competitive landscape.

Growth in Commercial and Hospitality Sectors:

The commercial and hospitality sectors present significant growth opportunities for the Japan Carpets and Rugs Market. With the increasing demand for luxury and high-quality interior designs in hotels, office spaces, and retail establishments, carpets and rugs that offer both functional and aesthetic value are in demand. This growth in commercial applications can drive long-term demand for carpets and rugs, especially those that provide unique design features or enhanced durability for high-traffic areas.

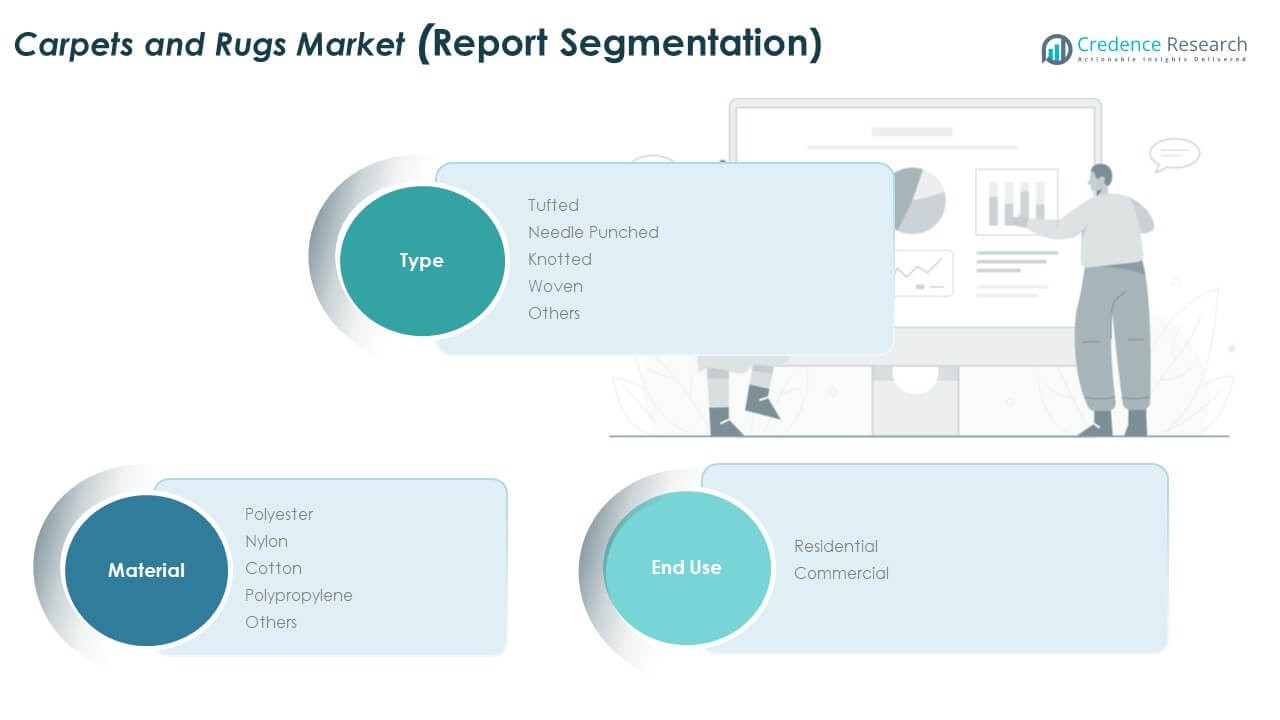

Market Segmentation Analysis:

By Type:

The Japan Carpets and Rugs Market is segmented by type into tufted, needle punched, knotted, woven, and other categories. Tufted carpets dominate the market due to their cost-effectiveness and versatility, making them suitable for both residential and commercial use. Needle punched carpets, known for their durability, are popular in industrial and high-traffic areas. Knotted carpets cater to the premium segment, offering craftsmanship and quality, while woven carpets are valued for their durability and aesthetic appeal, often found in luxury settings. Other types include customized and unique designs catering to niche markets.

- For instance, Yamamoto Corporation in Osaka operates Japan’s only integrated production line that combines tufting, weaving and high‑resolution digital printing machines capable of managing diverse carpet types. Tufted carpets dominate the market due to their cost‑effectiveness and versatility, making them suitable for both residential and commercial use. Needle‑punched carpets, known for their durability, are popular in industrial and high‑traffic areas.

By Material:

The material segment of the Japan Carpets and Rugs Market includes polyester, nylon, cotton, polypropylene, and others. Nylon holds the largest share in this segment due to its strength, resilience, and ability to withstand high foot traffic. Polyester, being more affordable, is often used in residential applications and has gained popularity for its eco-friendly attributes. Cotton provides a natural, soft option, while polypropylene is favored for its stain resistance and moisture-wicking properties. Other materials include eco-friendly options, such as recycled fibers, catering to sustainability-conscious consumers.

- For instance, SUMINOE Interior Products Co., Ltd.’s ECOS® carpet tile series uses up to 81% post‑consumer recycled content and achieves a 61% reduction in CO₂ emissions. Nylon holds the largest share in this segment due to its strength, resilience, and ability to withstand high foot traffic.

By End Use:

The Japan Carpets and Rugs Market is divided into residential and commercial end-use segments. Residential demand is driven by the need for aesthetic and comfortable home décor, with consumers favoring a blend of functionality and design. The commercial segment sees growth due to increasing demand for high-quality carpets in offices, hotels, and retail spaces, where durability and style are essential. Both segments are influenced by the ongoing trend of interior design customization.

Segmentation:

By Type:

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use:

Regional Analysis:

Domestic Market Dominance in Japan

The Japan Carpets and Rugs Market remains overwhelmingly driven by its home market in Japan, which holds approximately 70% of the industry’s value share in 2024. It commands the largest regional revenue base thanks to stable refurbishment rates, strong domestic supply chains and consumer preference for floor coverings. Manufacturers prioritize Japanese consumers with tailored designs, high‑quality materials and compliance with local standards. Retail networks and distribution systems across Japan support efficient product roll‑out and peak penetration. Consequently, the domestic segment remains the core growth engine for the overall market.

Asia Pacific (Excluding Japan) Growth Momentum

The market outside of Japan but within Asia Pacific exhibited growth momentum and held roughly 20% share of the total in 2024. It benefited from rising disposable incomes in Southeast Asia, growing urban housing development, and increasing imports of premium flooring products. It diversified demand beyond Japan’s mature market and provided international manufacturers an expansion route. The region offers potential for Japanese exporters to leverage craftsmanship and design reputation. Regional logistics and trade agreements enhance market access and reduce entry costs.

Emerging Export and Global Import Channels

Emerging export markets and import activity contribute about 10% of the total share for Japan’s industry in 2024. It reflects Japanese exporters shipping carpets and rugs to markets in North America and Europe, which seek high‑end design and quality. Challenges in cost competitiveness impact this channel, yet niche premium segments sustain growth. Japanese firms also source materials globally, adding import dependency that shapes trade balance and supply chain strategy. International markets act as diversification outlets and help address domestic market saturation over time.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yamamoto Corporation

- Yamagata Dantsu

- Shaw Industries Group

- SUMINOE Interior Products Co., Ltd.

- TSAR Carpets

- Cormar Carpets

- Halbmond

- The Dixie Group

- Japan Carpet Co., Ltd.

- Other Key Players

Competitive Analysis:

The Japan Carpets and Rugs Market is highly competitive, with several established companies vying for market share. Major players focus on differentiation through high-quality products, innovative designs, and strong customer service. Companies such as Yamamoto Corporation and Shaw Industries Group leverage their reputation for quality and craftsmanship to appeal to both domestic and international consumers. The market sees strong competition in the tufted and woven carpet segments, where both local manufacturers and global brands battle for prominence. Japanese manufacturers are also investing in sustainable production methods to align with growing consumer demand for eco-friendly options. As the market continues to grow, the competition will intensify, particularly in the commercial and residential sectors, where innovation and design flexibility are key drivers of success.

Recent Developments:

- Cormar Carpets – Voted Best Carpet Manufacturer 2025 in August. Launched five new ranges including Zenith carpet with Ultralux polypropylene. Achieved full certification for recyclable polypropylene carpets with Innovate Recycle partnership, diverting 175+ tonnes from landfill.

- In February 2025, the Japan Recycle Carpet Association launched an innovative certification system for recycled carpet tiles. This certification system verifies carpet tile products that meet specific conditions, including specifying the Carbon Footprint of Products (CFP) and ensuring products meet rigorous recycling standards. The goal is to increase recycled carpet tiles’ market share from 20% to 50%, significantly reducing the environmental impact of the carpet industry in Japan.

- Shaw Industries Group – Signed strategic agreement with PPG for resinous flooring products in July 2024. Invested $24+ million to double capacity at Ringgold facility by 2026. Opened PEAK Performance Lab in March 2025. Named Official Flooring Provider of College Football Playoff in December 2024.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Japan Carpets and Rugs Market will continue to see increasing demand for sustainable and eco-friendly products.

- Innovations in design and materials will drive growth in the residential and commercial segments.

- The shift towards online retail will gain momentum, providing new opportunities for market penetration.

- Consumer demand for customization and personalization in carpet design will expand.

- The commercial sector will remain a key growth area, driven by increasing demand in offices, hotels, and retail spaces.

- Technological advancements in manufacturing processes will enhance efficiency and product quality.

- The market will experience growth due to rising urbanization and renovation activities in metropolitan areas.

- Regional trade agreements will enable Japanese manufacturers to tap into emerging markets.

- Increased awareness of floor hygiene and comfort will drive demand for premium products.

- Market players will invest in sustainable manufacturing practices to meet both consumer and regulatory demands.