Market Overview:

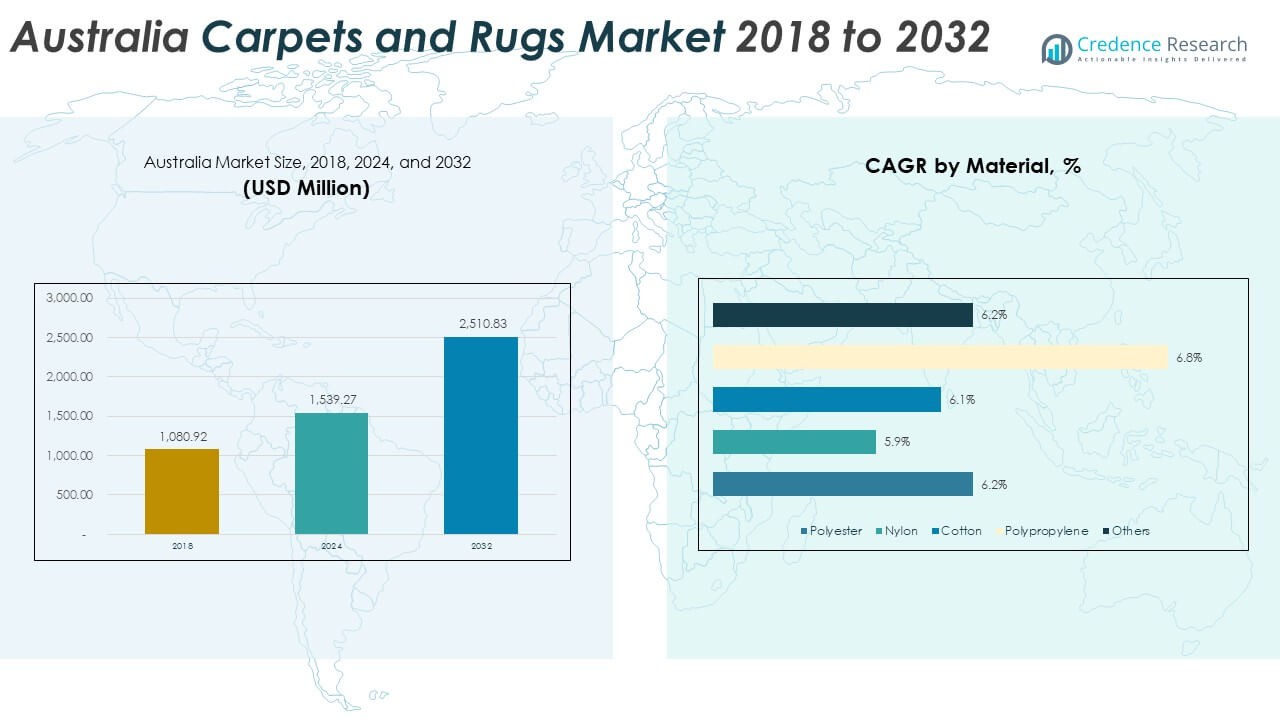

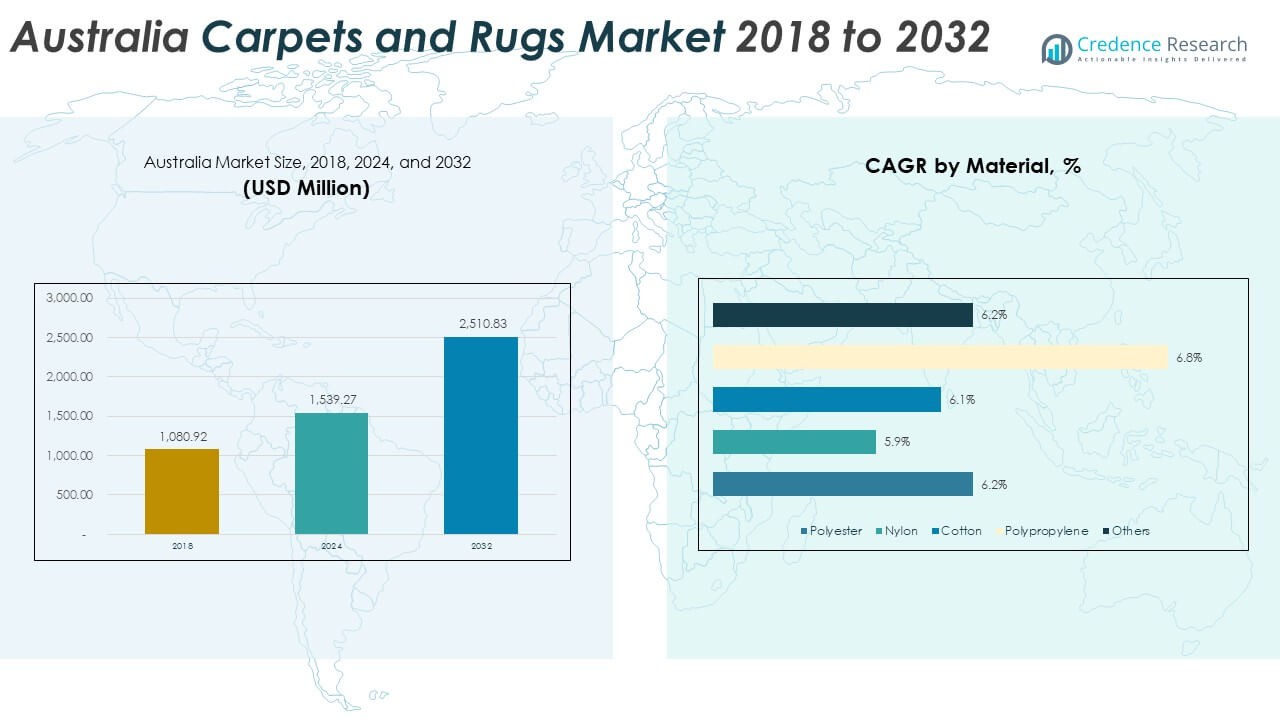

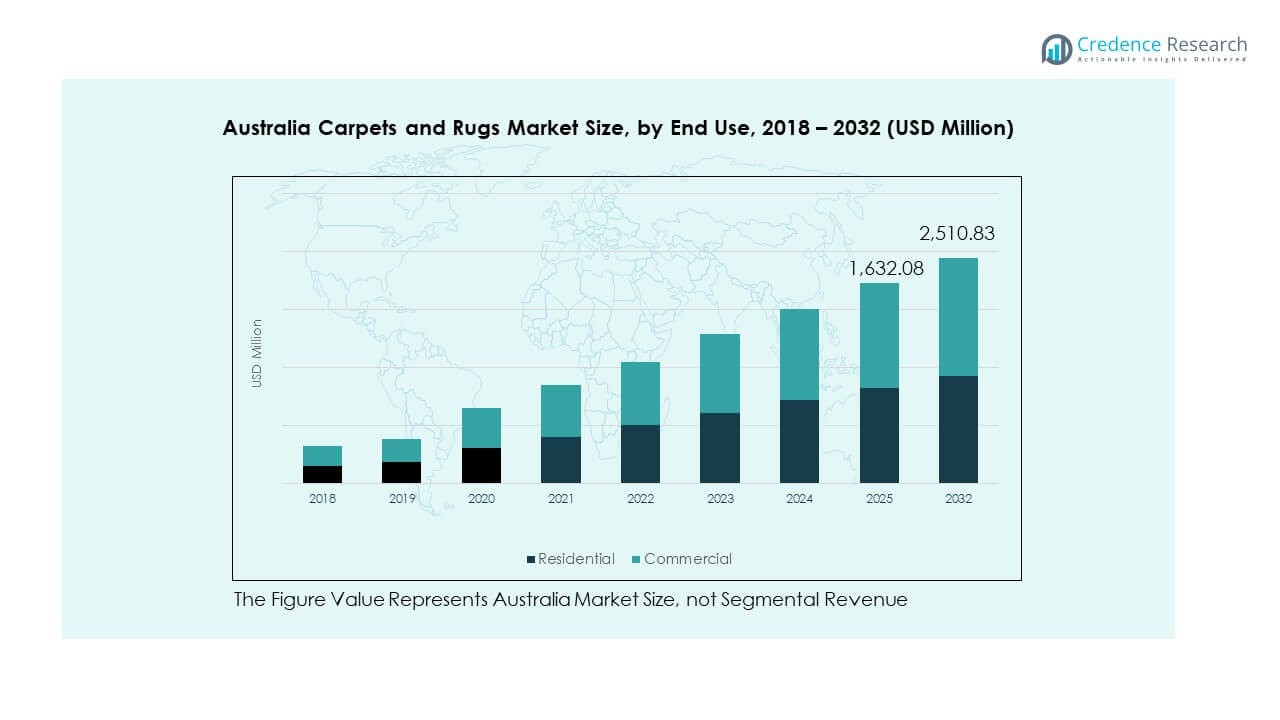

The Australia Carpets and Rugs Market size was valued at USD 1,080.92 million in 2018, reaching USD 1,539.27 million in 2024, and is anticipated to reach USD 2,510.83 million by 2032, at a CAGR of 6.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Carpets and Rugs Market Size 2024 |

USD 1,539.27 Million |

| Australia Carpets and Rugs Market, CAGR |

6.45% |

| Australia Carpets and Rugs Market Size 2032 |

USD 2,510.83 Million |

The Australian market for carpets and rugs is growing due to factors like rising construction activities, particularly in the residential sector, and increased consumer preference for aesthetic, durable flooring solutions. Additionally, the growing trend toward home renovation and interior design boosts demand for high-quality carpets and rugs, contributing to market expansion.

The Australian Carpets and Rugs Market is primarily driven by urbanization and growing residential construction in major cities like Sydney and Melbourne. While the demand is high in established areas, emerging markets in suburban regions are also witnessing growth due to increasing disposable incomes and a preference for premium interior products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Carpets and Rugs Market was valued at USD 1,080.92 million in 2018 and is projected to reach USD 2,510.83 million by 2032, growing at a CAGR of 6.45% during the forecast period.

- The top three regional shares in the market are Australian Capital Territory & New South Wales (35%), Victoria & Tasmania (25%), and Queensland (20%), primarily driven by dense populations and active construction and renovation sectors.

- Queensland is the fastest-growing region, expected to expand further due to growing residential and commercial demand in cities like Brisbane, with a market share of approximately 20%.

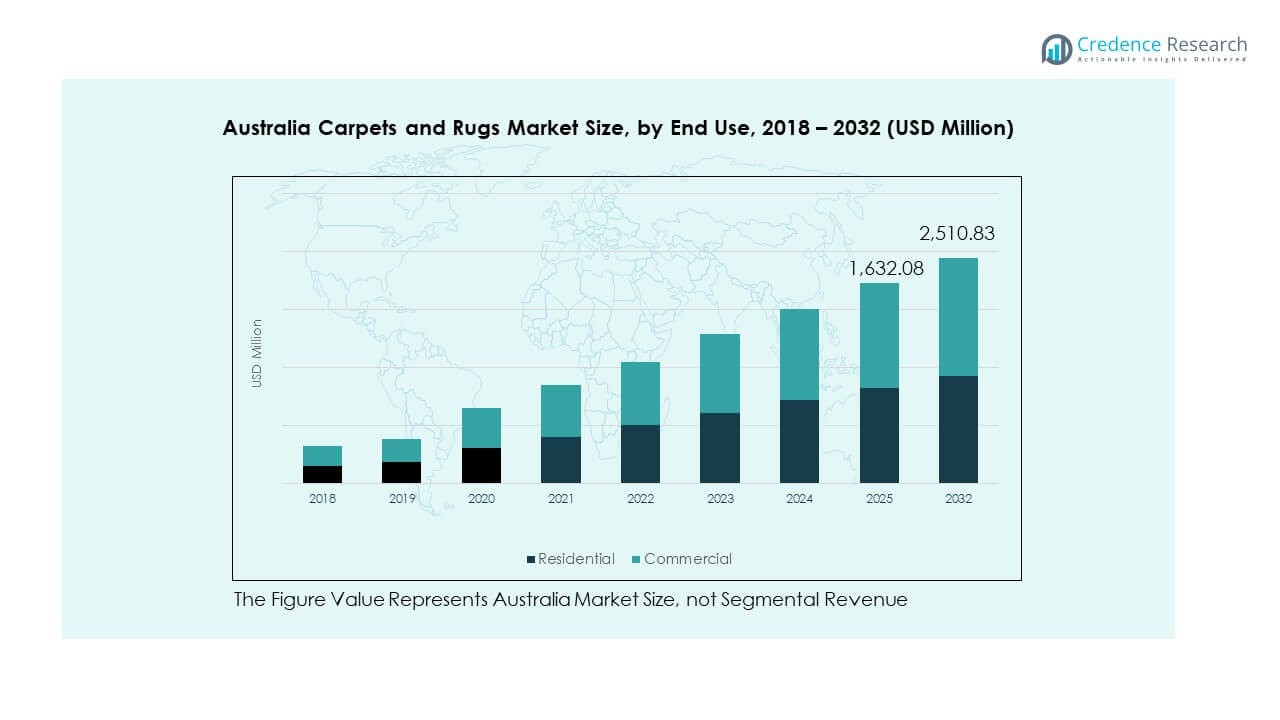

- The residential segment dominates the market with a 65% share, driven by ongoing home improvement trends, while the commercial segment holds 35%, driven by office and retail demand.

- By end use, residential carpets and rugs lead the market share, growing steadily due to increased disposable incomes and focus on home aesthetics.

Market Drivers:

Rising Construction Activities Boosting Demand

The Australia Carpets and Rugs Market benefits from the steady increase in construction projects, especially in residential and commercial sectors. Growth in urban areas has led to greater demand for aesthetically pleasing and durable flooring options. With more people investing in home renovations, the need for high-quality carpets and rugs continues to grow. The residential sector, in particular, is a significant contributor, driven by a demand for home improvement products. A surge in real estate activities also strengthens the demand for flooring solutions, ensuring steady market growth over the coming years.

- For instance, in Sydney, the residential construction boom has driven demand for durable and aesthetically pleasing flooring, with projects like the Barangaroo South development leading the way. With more people investing in home renovations, the need for high-quality carpets and rugs continues to grow. Companies like Godfrey Hirst have expanded their offerings in response to increased demand for both contemporary and sustainable designs.

Urbanization and Changing Lifestyles

Urbanization plays a major role in the growing demand for carpets and rugs in Australia. The expanding population in major cities like Sydney and Melbourne is increasing the need for interior design solutions. Changing lifestyles also drive preferences for modern home interiors, including flooring options like carpets. As people invest more in their homes, they seek high-end carpets and rugs to complement their living spaces. This shift toward luxury living and a preference for premium materials adds fuel to the market’s expansion.

- For instance, Melbourne has a large-scale, ongoing urban renewal project called Fishermans Bend, which is Australia’s largest urban renewal precinct, planned to house 80,000 residents and 80,000 jobs by 2050. This development includes plans for new roads, parks, schools, and community facilities, which naturally require a range of building materials and interior finishes as construction progresses.

Shift Toward Sustainable Products

Sustainability is becoming a key driver in the Australia Carpets and Rugs Market. Consumers and businesses are increasingly opting for eco-friendly and sustainable flooring options. Manufacturers are responding by introducing carpets and rugs made from natural fibers, such as wool and jute, which are biodegradable and renewable. The growing concern about environmental impact has also led to the introduction of recyclable carpet products. Sustainability initiatives, including eco-friendly production methods and materials, further support the market’s growth.

Innovations in Carpet Manufacturing Technology

Technological advancements in carpet production are driving market growth in Australia. Innovations in manufacturing processes are resulting in better quality products that offer superior durability and aesthetic appeal. The use of advanced techniques like 3D printing and improved dyeing methods allows for the creation of custom-designed carpets that meet diverse consumer demands. These innovations are not only enhancing the functionality of carpets but also improving their visual appeal, which directly influences purchasing decisions.

Market Trends:

Increase in Customization and Personalized Designs

The trend toward customization in the Australia Carpets and Rugs Market is gaining momentum. Consumers now prefer carpets and rugs that align with their individual tastes and home décor styles. As a result, manufacturers are offering products with personalized designs, colors, and textures. Customization is becoming a major selling point for premium and luxury carpets, allowing customers to create unique flooring solutions that reflect their preferences. This trend aligns with the growing demand for more individualized and exclusive home interiors.

- For instance, Shaw Industries Group has introduced personalized design options for its high-end carpet collections, allowing customers to select colors, textures, and patterns. This trend is becoming a major selling point for premium and luxury carpets, allowing customers to create unique flooring solutions that reflect their preferences. Brands like Godfrey Hirst also offer custom rug options, responding to the growing demand for individualized home interiors.

Growth of Online Retail in the Carpet Sector

The Australia Carpets and Rugs Market is experiencing a shift towards e-commerce as consumers increasingly prefer online shopping for convenience and variety. E-commerce platforms are offering a broad selection of carpets and rugs, allowing customers to browse a range of styles and price points. Online retail is providing a competitive advantage for manufacturers, as it opens up a larger customer base while reducing operational costs. This trend also supports direct-to-consumer sales, enhancing profit margins for businesses in the sector.

- For instance, retailers like Carpet Court have expanded their online presence, offering a wide selection of carpets and rugs. E-commerce platforms enable customers to browse various styles, price points, and materials, making it easier to compare options.

Popularity of Natural Fiber Rugs and Carpets

Natural fiber carpets and rugs are becoming increasingly popular in Australia due to their sustainable nature. Consumers are moving toward options made from organic materials like wool, cotton, and jute, which are biodegradable and environmentally friendly. This trend is aligned with the growing emphasis on sustainability and eco-consciousness in the market. The demand for natural fiber products is particularly strong among consumers who prioritize ethical and eco-friendly choices for their homes.

Technological Advancements in Carpet Materials

Technological improvements in carpet materials are also a significant trend in the Australia Carpets and Rugs Market. New materials, such as stain-resistant and water-repellent fibers, are being incorporated into carpets and rugs to enhance their durability and functionality. These advancements not only provide practical benefits but also offer aesthetic options for customers, making them a popular choice. Such innovations continue to transform the market, offering a blend of style, comfort, and durability.

Market Challenges Analysis:

Fluctuating Raw Material Prices

The Australia Carpets and Rugs Market faces challenges related to the rising cost of raw materials, including wool, synthetic fibers, and natural fibers. Price fluctuations in these essential materials impact production costs, leading to price hikes for finished products. Manufacturers must navigate these market challenges by optimizing production processes and seeking alternative materials to control costs. These pricing pressures could potentially affect the profitability of businesses in the sector. Despite these obstacles, many companies are working toward securing long-term supplier relationships and exploring cost-effective manufacturing techniques.

Intense Competition from Alternative Flooring Options

The Australia Carpets and Rugs Market is also hindered by the growing competition from alternative flooring options like hardwood, tiles, and laminate flooring. These alternatives are gaining popularity due to their durability, low maintenance, and aesthetic appeal. While carpets and rugs remain a popular choice, consumers are increasingly considering these alternatives for modern, minimalist interiors. The challenge for the carpet market is to differentiate its products and prove their value in terms of comfort, warmth, and long-term functionality, despite the growing preference for hard surface flooring.

Market Opportunities:

Growing Demand for Eco-friendly Carpets and Rugs

There is a notable opportunity in the increasing consumer preference for eco-friendly carpets and rugs in Australia. As awareness about environmental sustainability grows, many consumers are seeking products made from organic and recyclable materials. Manufacturers have the chance to tap into this market by offering carpets made from natural fibers, such as wool, hemp, or organic cotton, and by utilizing sustainable production practices. This opportunity allows businesses to cater to the eco-conscious consumer while contributing to environmental protection.

Expansion in Suburban and Regional Markets

Another key opportunity in the Australia Carpets and Rugs Market lies in the expanding suburban and regional markets. With the growth of the real estate sector and increasing demand for home renovations in these areas, there is a rising need for quality flooring solutions. As more people move to suburban regions and invest in upgrading their homes, businesses in the carpet and rug industry have a chance to establish a strong presence in these emerging markets. Targeting these regions could significantly increase sales and market share for companies.

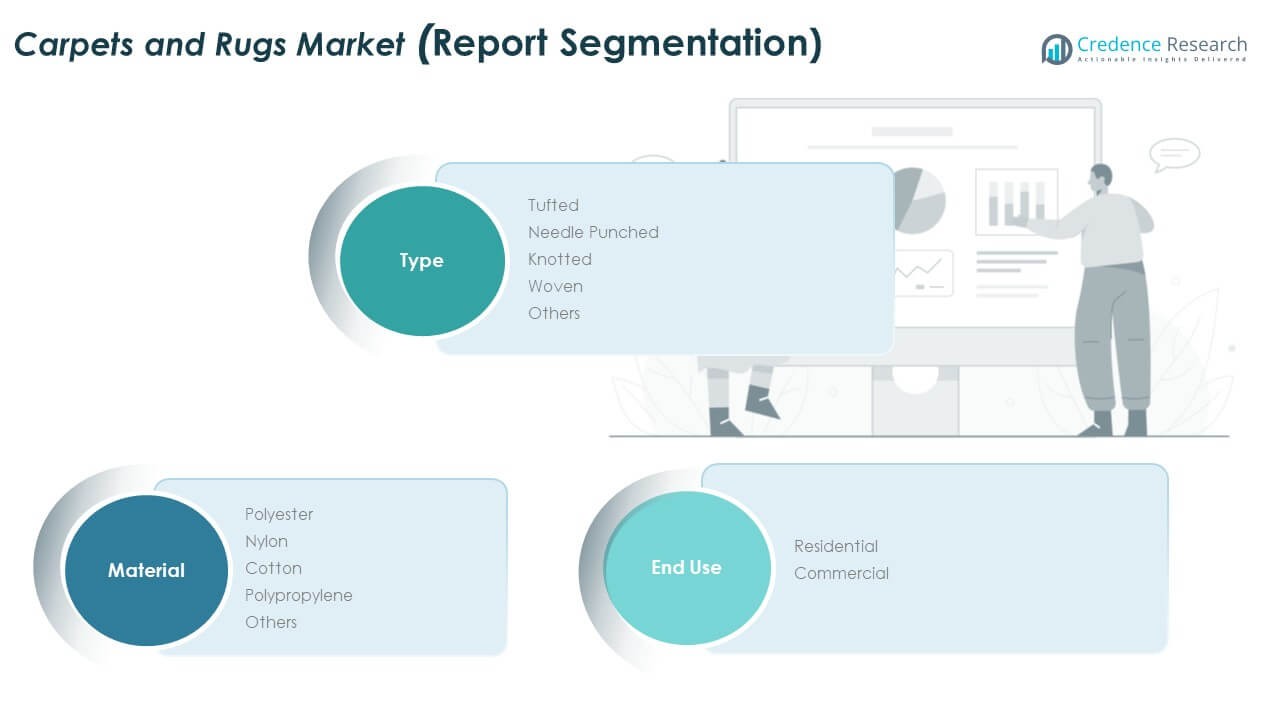

Market Segmentation Analysis:

By Type

The Australia Carpets and Rugs Market is segmented into tufted, woven, needle-punched, knotted, and other types. Tufted carpets dominate the market due to their affordability and versatility, catering to both residential and commercial needs. Woven carpets are recognized for their durability and premium quality, making them a popular choice for high-end applications. Needle-punched carpets, often used in industrial settings, offer durability and low maintenance. Knotted carpets are primarily found in premium segments due to their craftsmanship and higher cost. The “Others” category includes non-traditional types, contributing to niche demand.

- For instance, Godfrey Hirst’s tufted wool carpets are widely used in residential homes due to their durability and price competitiveness. Woven carpets are recognized for their premium quality and long-lasting durability, making them a popular choice for high-end applications like office spaces and luxury hotels. Companies like Bremworth have leveraged weaving techniques to create high-end, sustainable wool carpets, appealing to the eco-conscious market.

By Material

The market includes polyester, nylon, cotton, polypropylene, and other materials. Nylon remains the dominant material due to its strength, resilience, and ability to withstand heavy foot traffic. Polyester offers cost-effectiveness and is popular in residential spaces, while cotton, known for its softness, caters to high-end residential markets. Polypropylene is valued for its stain resistance and is commonly used in both residential and commercial settings. The “Others” segment includes natural fibers and sustainable materials that are gaining traction in the eco-conscious market.

- For example, Mohawk Industries’ nylon-based carpets are preferred for commercial use, providing long-term durability. Polyester offers cost-effectiveness and is popular in residential spaces due to its soft feel and affordability. Companies like Beaulieu Australia have capitalized on this trend, offering polyester-based options to meet demand for budget-friendly residential flooring. Cotton, known for its softness, caters to high-end residential markets, with manufacturers like Cormar Carpets producing premium cotton rugs that are highly sought after in luxury homes.

By End Use

The end-use segment divides into residential and commercial applications. Residential demand is driven by the growing home renovation trend, as consumers seek aesthetic and functional flooring solutions. Commercial use, driven by office buildings, hotels, and retail spaces, favors durable and cost-effective options. Both segments contribute significantly to market growth, with residential demand witnessing higher growth due to increased disposable income and a preference for personalized interiors.

By Distribution Channel

The distribution channels for the Australia Carpets and Rugs Market include mass merchandisers, home centres, specialty stores, and others. Mass merchandisers and home centres offer a wide range of products at competitive prices, attracting budget-conscious consumers. Specialty stores cater to niche markets, offering premium and custom-designed products. The “Others” segment includes online retailers and direct-to-consumer sales models, which are becoming increasingly significant due to consumer convenience and access to a wide variety of options.

Segmentation:

By Type:

- Tufted

- Woven

- Needle-Punched

- Knotted

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use:

By Distribution Channel:

- Mass Merchandisers

- Home Centres

- Specialty Stores

- Others

By Region:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

Regional Analysis:

Australia Capital Territory & New South Wales Region

The region contributes roughly 35 % of the national value to the Australia Carpets and Rugs Market. It dominates due to dense urban population, strong residential construction in Sydney, and large commercial hubs in Canberra. Manufacturers and distributors focus here since the infrastructure and logistics favour easy market access. Many flagship showrooms and high‑end retail channels locate in this area, capitalising on consumer spending power. The high rate of renovation in established housing stock supports steady demand for rugs and carpets. The region’s share remains stable due to limited new housing land and ongoing refurbishment activity.

Victoria & Tasmania, Queensland, Northern Territory & South Australia

Victoria & Tasmania command about 25 % of the market, driven by Melbourne’s large population and design‑conscious consumers. Queensland contributes around 20 %, bolstered by tourism‑linked commercial flooring demand and growing residential markets in Brisbane and coastal areas. Northern Territory & South Australia together account for approximately 10 %, where smaller population centres still generate niche demand for premium and custom products. The unique climate and consumer preferences in these states create variation in material and type choice but the geographic magnitude keeps shares lower than major states.

Western Australia Region

Western Australia holds about 10 % of the Australia Carpets and Rugs Market, largely due to its mining‑linked commercial construction and the metropolitan Perth area. The region’s remote logistics increase costs, but its strong economy supports higher‑end product uptake. Demand in Western Australia often leans toward durable, low‑maintenance flooring suited for commercial applications in resource‑driven projects. Residential demand exists in Perth’s suburban growth zones, albeit at a slower pace compared to eastern states. The region offers important diversification opportunity for manufacturers seeking geographical balance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Carpets and Rugs Market is highly competitive, with both local and international players vying for market share. Companies like Godfrey Hirst Australia Pty Ltd and Bremworth Limited dominate the landscape, providing a wide range of products catering to residential and commercial demands. The market features intense competition in the mid‑range product segment, with numerous players offering cost‑effective solutions. Innovation in sustainable and custom designs is driving differentiation among competitors, allowing leading brands to expand their offerings. Companies that focus on sustainability, like those using eco‑friendly materials, hold a competitive edge in meeting consumer demand for environmentally conscious products. Despite the competition, the market remains fragmented with opportunities for niche players targeting specific customer preferences.

Recent Developments:

- In late October 2025, regulatory and industry announcements indicated that Godfrey Hirst and Bremworth were involved in a significant regulatory review process regarding Mohawk’s proposed acquisition of Bremworth, with the Commerce Commission in New Zealand publishing preliminary issues related to the acquisition and indicating close scrutiny of competition implications across Australia and New Zealand markets. This sequence followed Mohawk’s broader strategy to consolidate premium flooring brands under Floorscape’s umbrella.

- On October 1, 2025, Bremworth entered into a Scheme Implementation Agreement with Floorscape Limited, a wholly owned subsidiary of Mohawk Industries, to be acquired by Mohawk. The announcement notes that the transaction would position Bremworth’s premium wool carpets and rugs within Mohawk’s global distribution networks, expanding export reach and leveraging Mohawk’s capital and scale to compete more effectively in New Zealand and Australia.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Carpets and Rugs Market will continue to benefit from growth in residential construction and home renovation trends.

- Consumer demand for sustainable and eco-friendly carpets is expected to drive product innovation.

- The market will see an increase in the adoption of online retail channels, improving product accessibility.

- Major players are likely to focus on expanding their portfolios with high-quality, durable materials.

- Technological advancements in carpet production will introduce more durable and cost-efficient products.

- The commercial segment will remain a key driver of demand, particularly in hotels and office buildings.

- Demand for customizable and premium rugs will increase as consumers seek personalized home décor.

- Regional markets, especially in emerging suburban areas, will present new growth opportunities.

- Price sensitivity in certain segments will foster competition among low-cost providers.

- Strong market competition will continue to encourage strategic mergers, acquisitions, and partnerships.