Market Overview:

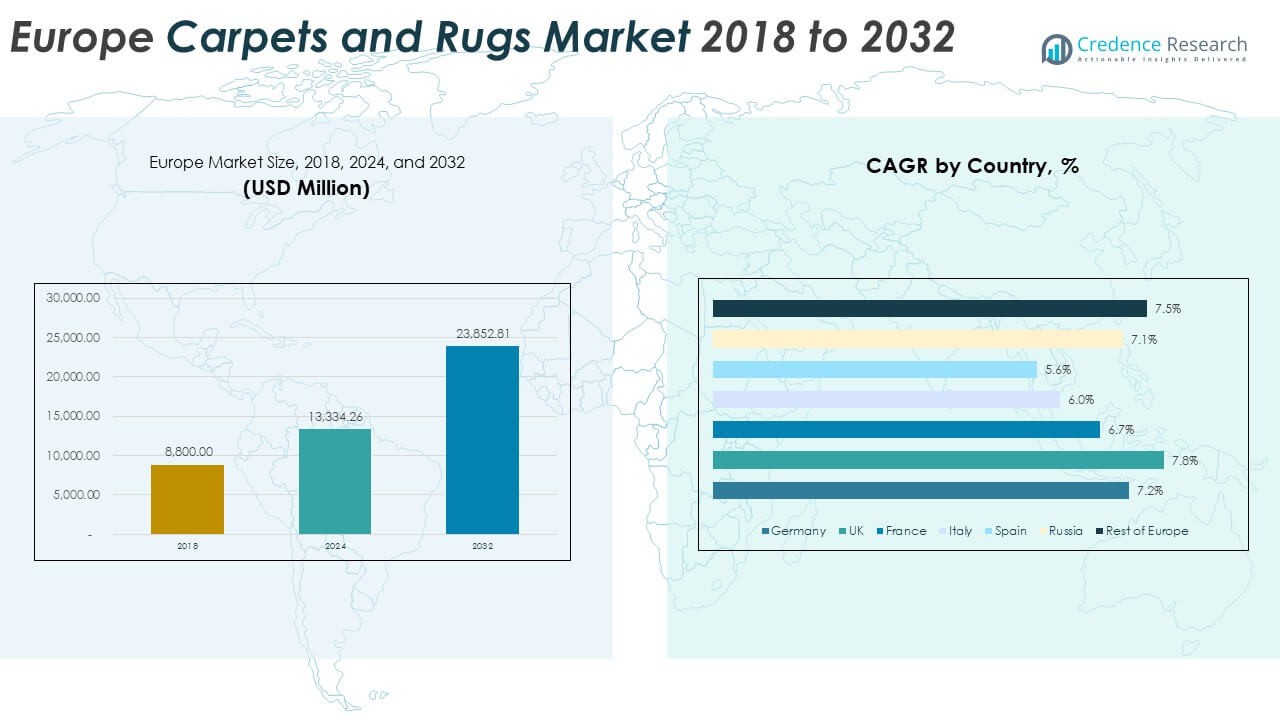

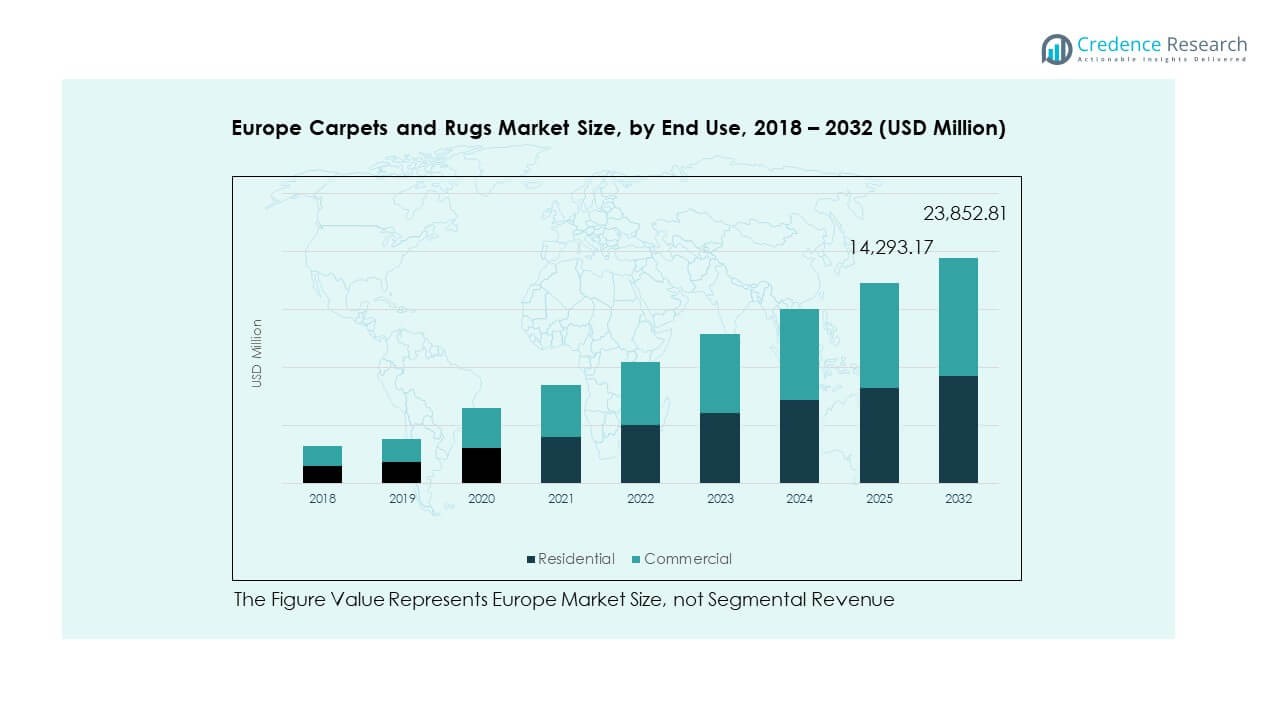

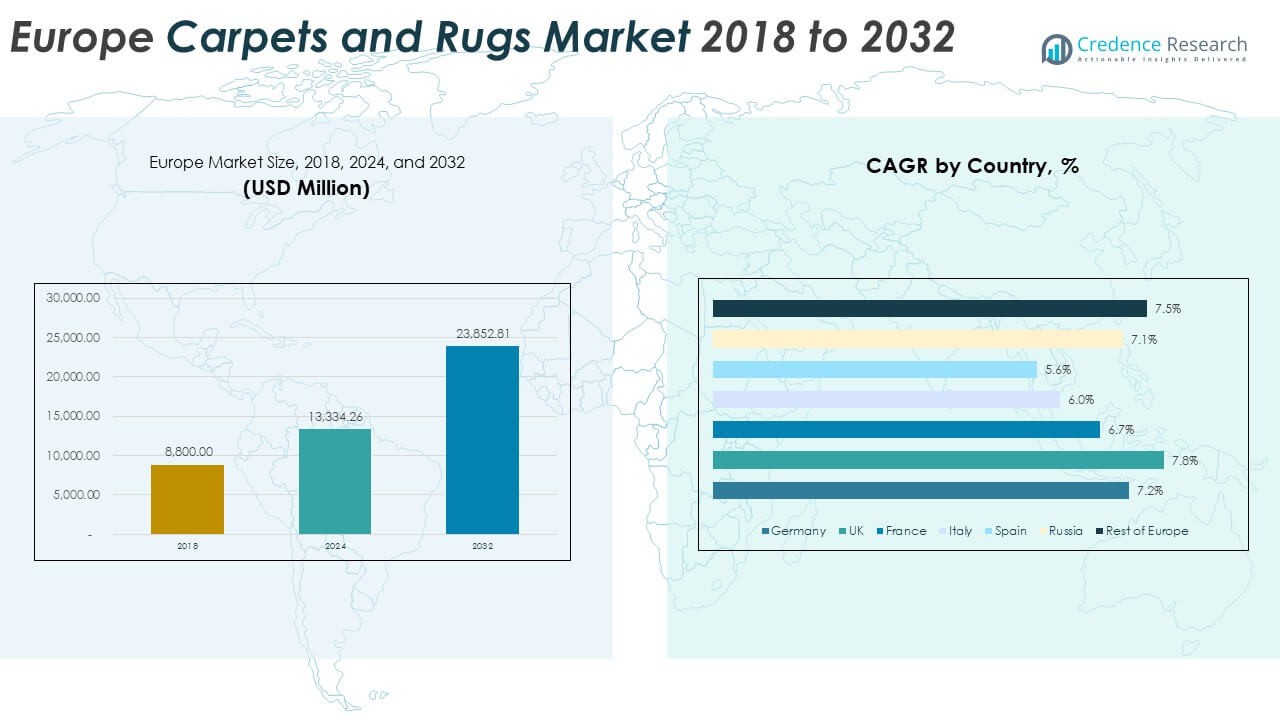

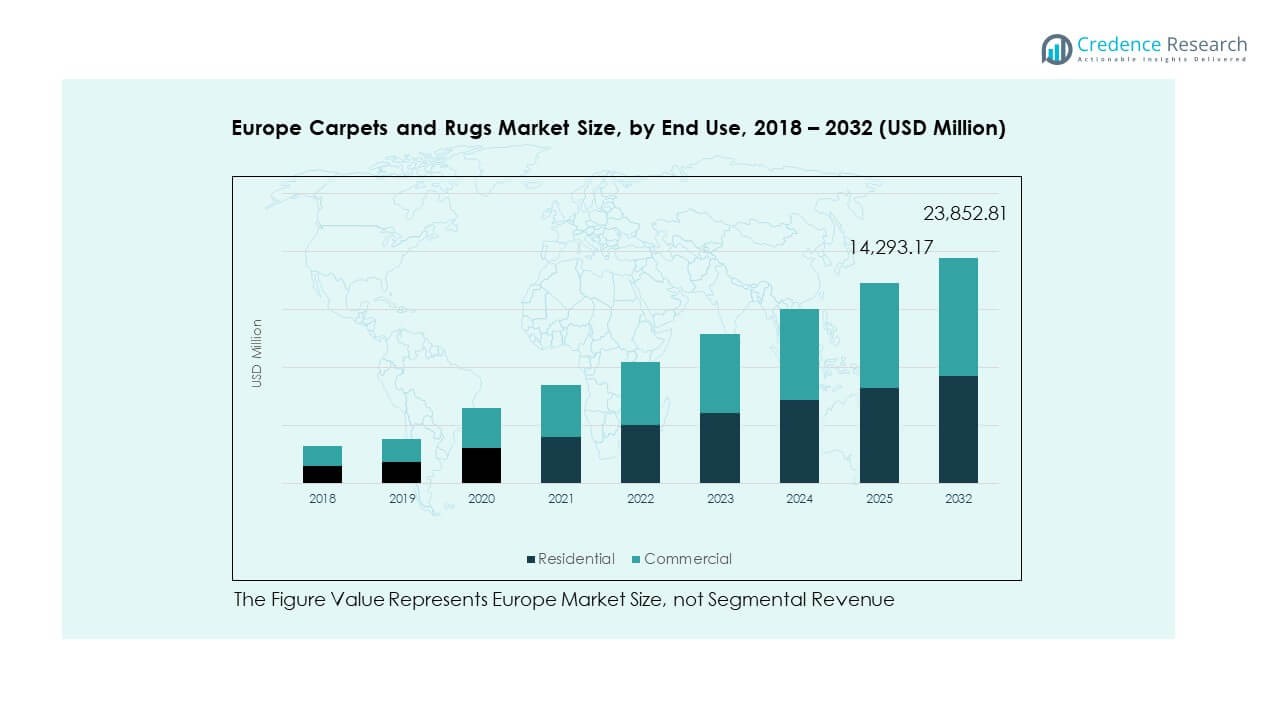

The Europe Carpets and Rugs Market size was valued at USD 8,800.00 million in 2018, reaching USD 13,334.26 million in 2024, and is anticipated to reach USD 23,852.81 million by 2032, at a CAGR of 7.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Carpets and Rugs Market Size 2024 |

USD 13,334.26 Million |

| Europe Carpets and Rugs Market, CAGR |

7.38% |

| Europe Carpets and Rugs Market Size 2032 |

USD 23,852.81 Million |

The market is primarily driven by the growing demand for high-quality flooring solutions in both residential and commercial spaces. The increasing adoption of eco-friendly and sustainable carpets, driven by consumer preference for green products, has also contributed significantly to market growth. Technological advancements in carpet manufacturing, coupled with rising disposable incomes, have further bolstered demand across various regions. These trends reflect a clear shift toward premium and sustainable products, enhancing the overall market outlook.

In terms of regional analysis, Western Europe leads the market, with countries like Germany, France, and the UK having well-established demand for carpets and rugs in both residential and commercial applications. The emerging markets in Eastern Europe are experiencing growth due to increased urbanization and a rise in construction activities. However, the market remains competitive, with key players focusing on innovation, sustainability, and price competition to capture market share across various regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Carpets and Rugs Market was valued at USD 8,800.00 million in 2018, with an estimated value of USD 13,334.26 million in 2024, and is projected to reach USD 23,852.81 million by 2032, growing at a CAGR of 7.38% during the forecast period.

- Western Europe leads the market with a significant share, driven by established consumer demand, a robust manufacturing base, and a focus on sustainability, particularly in countries like Germany, the UK, and France, which have mature markets.

- The fastest-growing region is Southern Europe, particularly Spain and Italy, due to an increasing demand for residential and commercial carpeting linked to tourism and infrastructure expansion.

- Residential carpets hold a larger share in the market, accounting for a significant portion of revenue, while commercial carpets also contribute to growth with their use in offices, retail, and hospitality sectors.

- The Europe Carpets and Rugs Market shows a clear demand for premium, sustainable products in both residential and commercial sectors, highlighting the industry’s shift toward high-quality and eco-friendly flooring solutions.

Market Drivers:

Growing Demand for Sustainable and Eco-friendly Products

The Europe Carpets and Rugs Market benefits from a growing demand for eco-friendly products. Consumer preferences are shifting toward sustainable materials, such as recycled fibers and natural fibers like wool, cotton, and jute. These materials are gaining popularity due to their minimal environmental impact and improved recyclability. This trend is further reinforced by strict environmental regulations in several European countries, encouraging manufacturers to adopt greener practices. Many consumers now prefer carpets and rugs that are produced using renewable resources, contributing to the growth of the market.

- For instance, Mohawk Industries has introduced its SmartStrand product line, which includes sustainable carpets made with recycled materials and offers up to 37% recycled content. Furthermore, Shaw Industries has incorporated renewable resources like bio-based nylon into their carpet collections, supporting the growing consumer preference for environmentally conscious products.

Rising Disposable Income and Changing Lifestyles

As disposable incomes rise across Europe, consumers have more spending power, influencing their purchasing decisions in the carpets and rugs market. Home décor and interior design are becoming essential parts of people’s lifestyles. Consumers are investing in higher-quality carpets that offer both aesthetic appeal and long-lasting durability. The demand for premium products is driven by consumers seeking luxury and comfort in their homes and businesses. Additionally, urbanization in Europe has led to more investments in residential and commercial real estate, further boosting demand for carpets and rugs.

- For example, Tarkett S.A. is a major multinational corporation in the flooring market that offers a wide range of commercial flooring products, including vinyl, linoleum, carpet, and wood. The company focuses on combining quality and the latest designs with strong performance characteristics like durability and indoor air quality. Market trends align with a general consumer shift towards premium, durable, and design-oriented flooring solutions that offer specific benefits, such as eco-friendliness and performance.

Increasing Construction and Renovation Activities

The Europe Carpets and Rugs Market is experiencing growth due to the rising number of construction and renovation projects across the region. The demand for carpets is linked to the expansion of residential complexes, commercial properties, and public spaces like offices, hotels, and retail stores. This trend is particularly strong in emerging markets in Eastern Europe, where real estate development is on the rise. The ongoing renovation of older buildings is also contributing to the market’s expansion, as consumers seek to update their interiors with modern, stylish carpets.

Technological Advancements in Carpet Manufacturing

Advancements in carpet manufacturing technologies have played a key role in the growth of the Europe Carpets and Rugs Market. Innovations in carpet weaving, tufting, and dyeing processes have improved the quality, durability, and design of carpets. New technology enables the creation of carpets with intricate patterns and textures, catering to the growing demand for customization. Automation in manufacturing has also led to increased efficiency and cost reductions, benefiting both producers and consumers. These technological improvements have resulted in a wider variety of high-quality carpets that appeal to different market segments.

Market Trends:

Customization and Personalization Demand

The growing trend of personalization is significantly impacting the Europe Carpets and Rugs Market. Consumers are increasingly looking for custom-designed carpets that suit their specific needs and aesthetic preferences. Advances in digital printing technology have enabled manufacturers to produce carpets with intricate patterns, colors, and textures that reflect the unique tastes of customers. Personalized rugs are becoming particularly popular in high-end residential projects and boutique commercial spaces, where design flexibility and exclusivity are valued. As consumers seek to create distinctive living spaces, the demand for customized carpets is expected to grow.

- For instance, Kymo has introduced customized rugs, allowing customers to choose from an array of designs, colors, and textures. Their Unique Collection offers personalized carpets that cater to the growing demand for individuality and exclusive design options.

Shift Towards Luxury and High-Quality Products

There is a noticeable shift towards luxury and high-quality carpets in the Europe Carpets and Rugs Market. With growing consumer interest in premium home décor, carpets are no longer seen as mere functional items but as statement pieces that enhance the overall aesthetic of a space. Natural fibers, such as wool and silk, are becoming more desirable for their superior feel and durability. High-end carpets and rugs are being used in luxury hotels, upscale residential buildings, and executive offices. This trend highlights the increasing willingness of consumers to invest in high-quality products that provide long-lasting beauty and comfort.

- For instance, Brintons, known for its high-quality woven carpets, caters to the luxury segment by providing custom-designed carpets made from natural fibers like wool. The company’s carpets are widely used in luxury hotels, upscale residential buildings, and corporate offices.

Rise in Smart and Multifunctional Carpets

Smart technology is gradually making its way into the carpet industry, bringing about the trend of multifunctional carpets. These carpets are equipped with embedded sensors, lighting, or heating elements, offering added comfort and convenience. For instance, smart carpets can integrate with home automation systems to control lighting, temperature, or even monitor health metrics. This trend is gaining traction in high-tech homes and offices, where innovation and convenience are valued. The development of smart carpets is expected to open new avenues in the European market, particularly in technologically advanced regions.

Sustainability Initiatives in Production Processes

Sustainability is a key trend shaping the future of the Europe Carpets and Rugs Market. Manufacturers are increasingly focusing on sustainable production processes to meet the demand for environmentally friendly products. Many companies are shifting towards using recycled materials, such as PET (polyethylene terephthalate) fibers made from plastic bottles, to create carpets. This reduces the carbon footprint of carpet production and addresses consumer concerns about environmental impact. Furthermore, sustainable practices are also seen in packaging, transport, and product end-of-life management, which is appealing to eco-conscious consumers.

Market Challenges Analysis:

Raw Material Price Volatility and Supply Chain Issues

The Europe Carpets and Rugs Market faces significant challenges related to raw material price volatility and supply chain disruptions. Prices for key raw materials such as wool, cotton, and synthetic fibers fluctuate based on global supply and demand. These price variations can increase production costs for manufacturers, making it difficult to maintain competitive pricing. Additionally, supply chain disruptions, whether due to natural disasters, geopolitical tensions, or logistical issues, can delay production schedules and affect product availability. These challenges can impact the overall market stability and the ability of companies to meet consumer demand.

Competition from Alternative Flooring Options

The Europe Carpets and Rugs Market also faces strong competition from alternative flooring options such as hardwood, vinyl, laminate, and tiles. These alternatives often offer lower maintenance costs and longer lifespans, which appeal to budget-conscious consumers. The growing preference for hard flooring surfaces in residential and commercial spaces is posing a threat to the traditional carpet industry. Furthermore, some consumers believe that hard flooring provides a more modern, clean look, reducing the demand for carpets and rugs. The market will need to address these challenges by highlighting the unique benefits of carpets and rugs to maintain their relevance in the flooring market.

Market Opportunities:

Growth in Eco-friendly and Sustainable Carpets

There is a significant opportunity in the European market for eco-friendly and sustainable carpets. With the growing focus on environmental responsibility, manufacturers are increasingly adopting sustainable materials and practices. This includes the use of natural fibers, organic dyes, and recyclable materials in carpet production. As environmental awareness among consumers increases, the demand for sustainable carpets is expected to grow. Manufacturers who can meet these sustainability demands have a clear opportunity to capture a larger share of the market.

Increasing Demand for Luxury and Custom Carpets

The demand for luxury and custom-designed carpets presents a substantial opportunity for growth in the Europe Carpets and Rugs Market. Consumers are willing to invest in high-end products that enhance the aesthetics and comfort of their homes and businesses. Custom carpets, which allow for personalized designs, colors, and sizes, are becoming increasingly popular. This trend is particularly evident in the high-end residential and commercial sectors, where interior design plays a key role. Companies that offer innovative, high-quality, and customizable carpet solutions stand to benefit from this growing demand.

Market Segmentation Analysis:

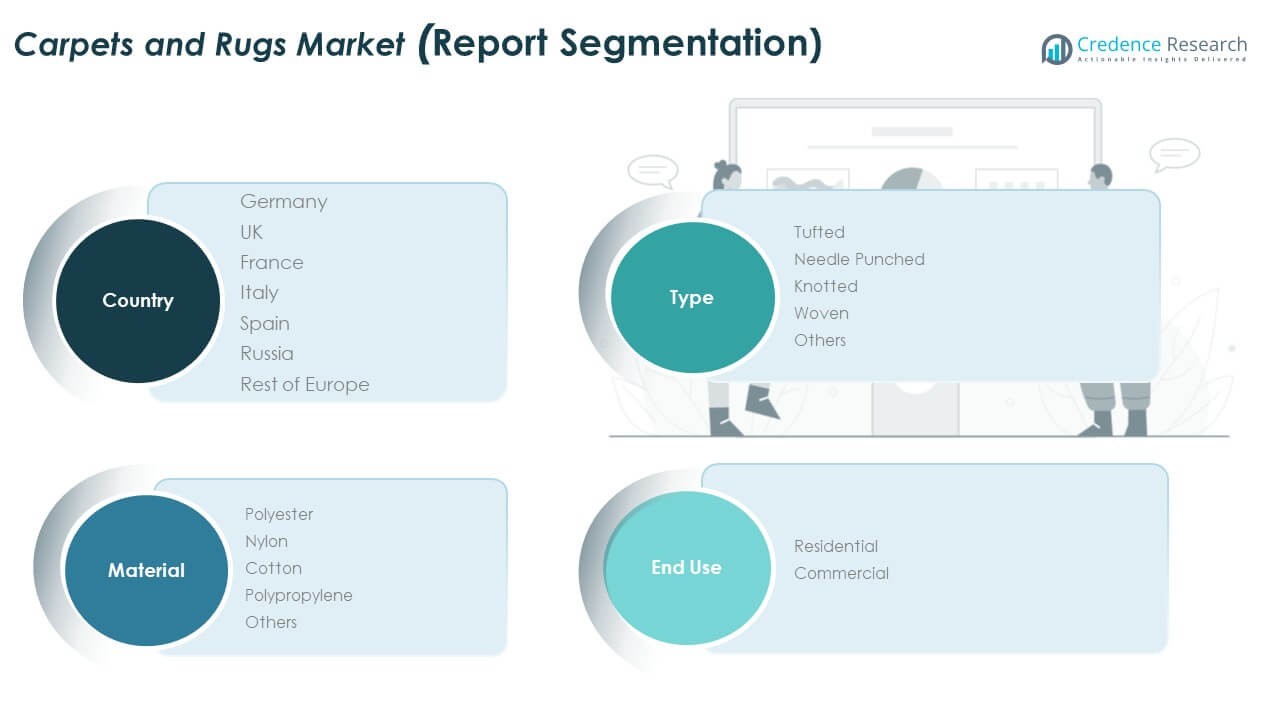

By Type

The Europe Carpets and Rugs Market is primarily segmented into tufted, needle-punched, knotted, woven, and other types. Tufted carpets dominate the market due to their affordability, durability, and versatility in both residential and commercial applications. Needle-punched carpets are recognized for their strength and are widely used in industrial and high-traffic areas. Knotted carpets cater to the premium segment with intricate designs and superior craftsmanship. Woven carpets are known for their long-lasting durability and aesthetic appeal, often used in luxury spaces. The “Others” category includes customized carpets that meet specific design needs, catering to niche markets.

- For example, Tarkett, a leading flooring manufacturer, produces needle-punched carpets designed for commercial spaces with high durability. Knotted carpets cater to the premium segment, offering intricate designs and superior craftsmanship.

By Material

Polyester, nylon, cotton, polypropylene, and other materials constitute the primary materials used in the European carpets and rugs industry. Polyester holds a significant share due to its cost-effectiveness and ease of maintenance. Nylon, known for its resilience and strength, remains the most popular material for high-traffic areas. Cotton is preferred for its natural feel and comfort, though it is less durable than synthetic alternatives. Polypropylene is commonly used for outdoor carpets due to its water resistance and durability. Other materials include sustainable and eco-friendly fibers gaining popularity among environmentally conscious consumers.

- For example, Shaw Industries, a key player, manufactures polyester-based carpets that are popular in both residential and commercial sectors due to their affordability. Nylon, known for its resilience and strength, remains the material of choice for high-traffic areas. Interface, a global leader in modular carpets, uses nylon in its carpet tiles for commercial spaces to ensure durability and long-lasting performance.

By End Use

The Europe Carpets and Rugs Market is divided into residential and commercial end uses. The residential segment leads the market, driven by increasing demand for home décor and comfort. Consumers are increasingly investing in high-quality carpets to enhance the aesthetic value of their homes. The commercial segment also experiences significant growth, with carpets being widely used in offices, hotels, retail outlets, and other public spaces. Commercial spaces prefer carpets that combine durability with style, catering to high foot traffic and specific design preferences.

Segmentation:

By Type:

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material:

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use:

By Region/Country:

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominance and Market Share (Leading Region)

Western Europe commands the largest portion of the Europe Carpets and Rugs Market, with one study noting that Germany alone held about 18.7% of the regional market share in 2024. It benefits from mature residential markets, high disposable incomes, and established manufacturing clusters for carpets and rugs. Large renovation cycles and commercial fit‑out projects in countries such as Germany, the UK, and France support steady demand. The region features advanced technological adoption, including digital printing and automation, which enhance productivity and design flexibility. Consumers increasingly prefer premium and sustainable flooring solutions, giving Western Europe a strategic advantage. Clusters of skilled labour, strong export capabilities, and well‑developed supply chains further fortify its leading position in the market.

Southern and Emerging European Markets (Growing Segments)

Southern Europe — notably Spain and Italy — is emerging as a high‑growth zone within the Europe Carpets and Rugs Market. One analysis reports Spain registering a 6.13% CAGR through 2030, driven by tourism‑linked hospitality refurbishments and resort construction. These countries benefit from increased infrastructure investment, renovation of legacy properties, and rising consumer interest in home décor upgrades. Although they currently command smaller market shares than Western counterparts, their growth momentum attracts attention from manufacturers and distributors. Cost‑sensitive segments in these markets still favour value offerings, while premium segments expand through designer collaborations and custom rugs. Manufacturers targeting Southern Europe often adapt products for climate conditions and local design tastes to capture share.

Eastern Europe and Rest of Europe (Emerging but Fragmented)

In Eastern Europe and the Rest of Europe segment, the market remains more fragmented with lower per‑capita carpet usage and disparate infrastructure development. According to one dataset, the UK led with 36.56% share in 2023 followed by Germany at 22.36% and France at 13.68%, leaving remaining countries with smaller shares. Local manufacturers face competitive pressures from low‑cost imports and logistic constraints. Nevertheless, urbanisation, increased real estate construction and entry of international brands gradually improve prospects. Manufacturers expanding production into Eastern Europe seek cost advantages and access to rising local demand. While market size remains modest, the region presents meaningful opportunities for incremental growth, especially for mid‑tier and value‑oriented products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Carpets and Rugs Market is highly competitive, with numerous players ranging from large multinational corporations to small regional manufacturers. Key companies such as Mohawk Industries, Shaw Industries, and Kymo lead the market, known for their diverse product portfolios, innovative designs, and sustainability efforts. Companies continuously invest in R&D, adopting new manufacturing technologies like digital printing and sustainable materials to meet consumer demands. Intense competition in the premium segment has led to increased differentiation in product offerings. Smaller players often focus on niche markets, such as custom designs or eco-friendly solutions, carving out competitive advantages in the fragmented regions.

Recent Developments:

- In October 2025, Mohawk Industries, Inc. announced its acquisition of Bremworth, a leading New Zealand carpet manufacturer specializing in broadloom wool carpet. Mohawk entered into a scheme implementation agreement with its New Zealand subsidiary, Floorscape, with the transaction expected to complete in the first half of 2026, subject to shareholder and regulatory approval. This acquisition strengthens Mohawk’s presence in the Australasian market alongside its existing ownership of Godfrey Hirst. The acquisition demonstrates Mohawk’s continued strategy of expanding its global footprint and product portfolio in the carpet industry.

- In October 2024, Shaw Industries Group signed a strategic agreement with PPG (PPG Industries) to offer the PPG FLOORING™ line of resinous flooring products. The partnership made these products available to Shaw’s customers in the commercial property market through its Patcraft® brand. This strategic agreement expanded the market reach for PPG’s products while adding to Shaw’s expansive portfolio of flooring and surface solutions. Shaw continues to operate successfully under the ownership of a Berkshire Hathaway-led investor group following its recent acquisition.

- In May 2024, Object Carpet intensified its strategic collaboration with Niaga, an innovation venture from Covestro, to advance circular carpet solutions. The partnership resulted in Object Carpet acquiring Niaga’s entire carpet patent portfolio, including patents specifically designed for circular carpet manufacturing. Object Carpet took over all patents for coating technology and processes for carpets and became Niaga’s main distribution partner for its carpet PES hotmelt adhesive.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable and eco-friendly products will drive market expansion.

- Innovation in carpet design, including smart and multifunctional features, will boost growth.

- Increasing disposable income in emerging regions will fuel residential demand for premium carpets.

- Commercial real estate development will spur demand for durable and cost-effective flooring solutions.

- Advances in manufacturing technologies, such as digital printing, will lead to more customization and faster production cycles.

- The trend towards customization and personalization will continue to influence consumer preferences.

- Emerging markets in Southern and Eastern Europe will offer new growth opportunities.

- Stringent environmental regulations will encourage further innovation in sustainable materials and production methods.

- E-commerce platforms will increase distribution channels and reach for both premium and budget segments.

- The focus on luxury and premium products will continue to rise, particularly in the high-end residential and commercial markets.