Market Overview

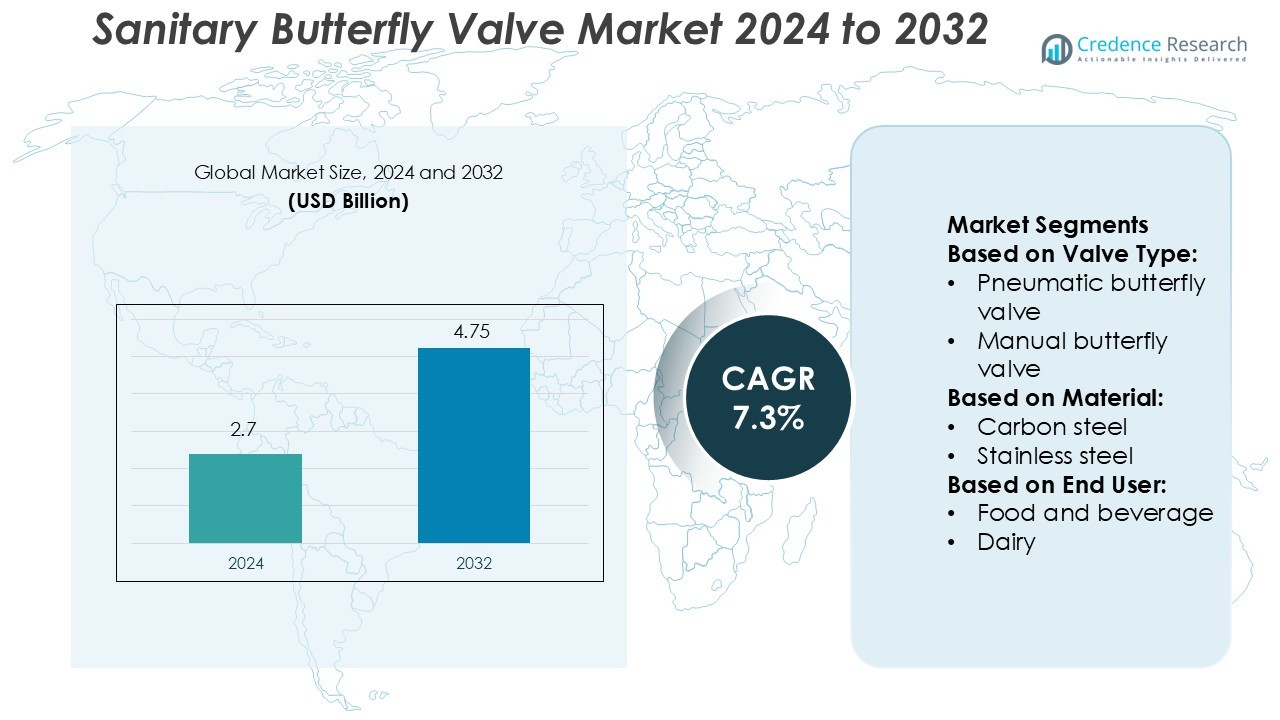

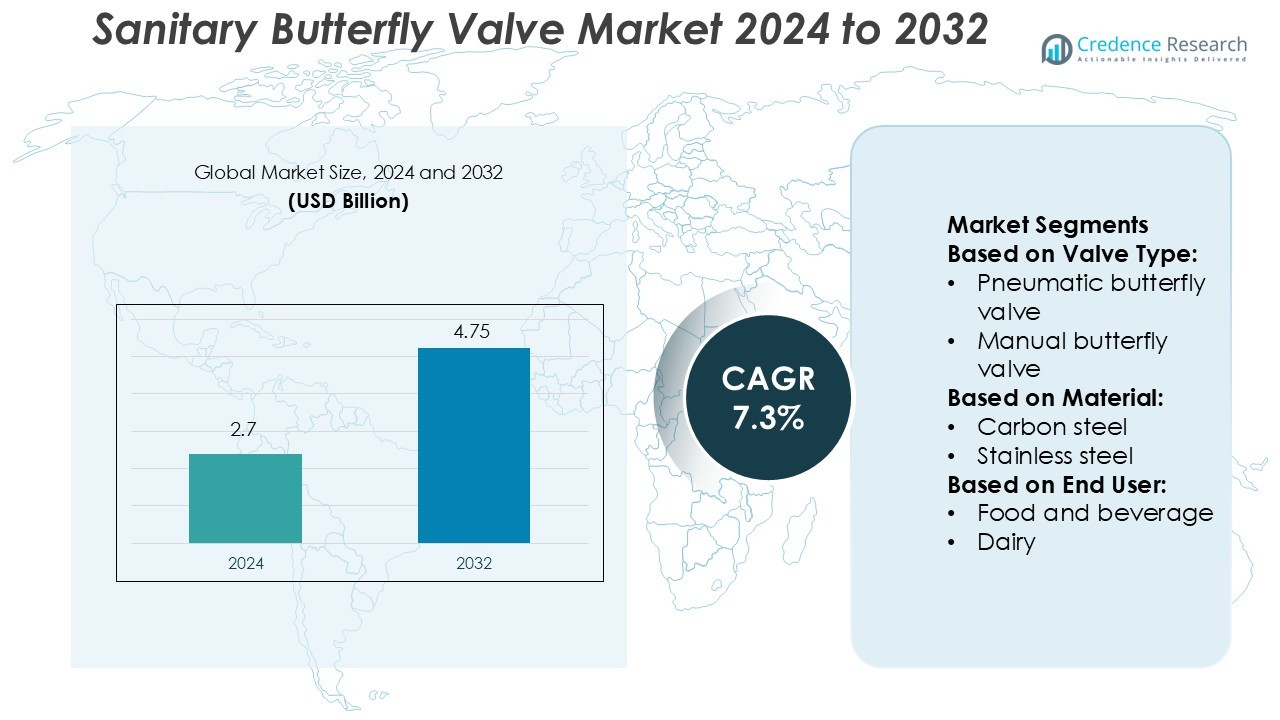

Sanitary Butterfly Valve Market size was valued USD 2.7 billion in 2024 and is anticipated to reach USD 4.75 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sanitary Butterfly Valve Market Size 2024 |

USD 2.7 Billion |

| Sanitary Butterfly Valve Market, CAGR |

7.3% |

| Sanitary Butterfly Valve Market Size 2032 |

USD 4.75 Billion |

The Sanitary Butterfly Valve Market is shaped by leading players such as GEA Group, Alfa Laval, Bray International, Crane, Dixon Valve & Coupling, Donjoy Technology, Adamant Valves, INOXCN Group, J&O Fluid Control, and Dairy Pharma Valve. These companies focus on advanced hygienic valve technologies, automation compatibility, and compliance with global sanitation standards. Continuous innovation in materials, sealing precision, and CIP/SIP functionality strengthens their market position across key industries. North America leads the global sanitary butterfly valve market with a 31% share in 2024, driven by strong demand from the food, beverage, and pharmaceutical sectors alongside advanced automation and process control adoption.

Market Insights

- The Sanitary Butterfly Valve Market was valued at USD 2.7 billion in 2024 and is projected to reach USD 4.75 billion by 2032, registering a CAGR of 7.3% during the forecast period.

- Market growth is driven by the increasing demand for hygienic and efficient fluid control systems in food, beverage, and pharmaceutical industries.

- Automation, smart valve technology, and sustainable material innovation are key trends enhancing performance and compliance across modern processing facilities.

- The market faces challenges related to high initial installation costs and strict regulatory certification requirements for sanitary equipment.

- North America leads with a 31% share due to strong automation adoption, while pneumatic butterfly valves and stainless-steel variants dominate segmentally for their precision, corrosion resistance, and suitability in cleanroom environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Valve Type

Pneumatic butterfly valves dominate the sanitary butterfly valve market with a 42% share in 2024. Their strong presence is driven by high automation capability, precision control, and suitability for hygienic processes. Industries prefer pneumatic systems due to their quick response and low contamination risk. Manual valves maintain steady demand in low-cost operations. Electric and hydraulic types gain traction in automated food and beverage plants, but pneumatic valves remain preferred for clean-in-place (CIP) and high-pressure environments due to efficiency and minimal maintenance needs.

- For instance, GEA’s hygienic butterfly valve range (male/weld connection type 721) supports a maximum product pressure of 10 bar and is available with nominal sizes from DN 25 up to DN 150 (Kvs values up to 1,800 m³/h for DN 150).

By Material

Stainless steel holds a leading 58% market share in 2024, driven by its corrosion resistance, smooth surface finish, and compliance with food safety regulations. The material ensures hygiene and durability in frequent washdown processes. Carbon steel and iron variants serve industrial-grade applications with lower sanitary requirements. Titanium and aluminum options find niche use in specialized environments needing lightweight or high-temperature resistance. The rising preference for 316L stainless steel valves in dairy and brewing sectors supports long-term reliability and reduced bacterial growth risks.

- For instance, J&O Fluid Control offers sanitary stainless-steel ball valves. The material for medium-contact parts is stainless steel, specifically AISI304 or AISI316L. The maximum pressure for these valves is up to 10 Bar. For valves with PTFE seals, the working temperature range is specified as -20 °C to +120 °C.

By End User

The food and beverage sector leads with a 47% market share in 2024, driven by strict sanitary standards and high process automation. Valves in this segment support CIP systems, preventing contamination during liquid handling and mixing. The dairy industry follows closely, using butterfly valves for milk transfer and pasteurization processes. Brewing and cosmetic manufacturing industries are adopting advanced valve designs for consistent flow control and hygiene. The growing trend of automated production lines continues to reinforce demand from large-scale food processing and packaging facilities.

Key Growth Drivers

Expanding Food and Beverage Processing Industry

The growing demand for hygienic and efficient fluid control in food and beverage production drives the sanitary butterfly valve market. These valves ensure contamination-free flow management, meeting stringent health and safety standards. Rising investments in automation and modern process control systems across breweries, dairies, and beverage plants further boost adoption. For instance, Alfa Laval’s hygienic butterfly valves are widely used for CIP and SIP applications, enhancing productivity and regulatory compliance in food-grade operations worldwide.

- For instance, Adamant Valves AV-1PW series pneumatic sanitary butt-weld butterfly valve. The valve supports sizes from 1/2″ up to 12″, which corresponds to DN15 up to DN300, confirming the size range mentioned.

Rising Focus on Pharmaceutical and Biotech Applications

Sanitary butterfly valves play a vital role in sterile and aseptic processes within pharmaceutical and biotechnology industries. Increasing production of vaccines, biologics, and injectable drugs demands valves with precise flow control and easy cleaning features. Manufacturers adopt stainless steel and electropolished valve surfaces to meet FDA and GMP standards. For example, Emerson’s ASCO series integrates high-performance seals ensuring zero dead space, making it ideal for pharmaceutical-grade fluid transfer and preventing cross-contamination risks.

- For instance, Donjoy’s regulation-type pneumatic butterfly valve supports sizes from 1″ (DN 25) up to 4″ (DN 100), is rated for pressure up to 10 bar, supports internal surface roughness of Ra < 0.4 µm when optioned, and operates at temperatures from -20 °C to +130 °C with EPDM seals.

Adoption of Automation and Smart Valve Technology

The integration of automation in process industries fuels the demand for electric and pneumatic sanitary butterfly valves. These valves provide remote operation, improved control accuracy, and real-time performance monitoring through smart actuators and sensors. Companies like GEA Group and Krones AG offer automated butterfly valve systems with digital feedback for predictive maintenance and process optimization. Such advancements enhance plant efficiency, reduce downtime, and support the growing shift toward Industry 4.0-enabled fluid management systems.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Valve Materials

Manufacturers increasingly focus on using recyclable and corrosion-resistant materials like stainless steel and titanium. The trend supports reduced maintenance costs and longer operational lifespans in food, dairy, and cosmetic applications. Companies are investing in lead-free alloys and low-emission production processes to comply with environmental standards. This move aligns with the global shift toward sustainability and opens opportunities for green-certified valve products across Europe and North America.

- For instance, Bray’s Series 22/23 resilient-seated butterfly valves accommodate discs in titanium (alongside stainless steel/PTFE) in sizes NPS 2 to 24 / DN 50 to 600.

Increasing Customization and Modular Valve Design

The market is witnessing a rise in demand for customized and modular sanitary butterfly valves suitable for diverse pressure and temperature conditions. Modular designs enable quick component replacement, minimizing downtime in continuous production environments. Leading manufacturers such as SPX FLOW and Burkert Fluid Control offer tailored configurations to meet specific plant layouts and automation needs. This customization trend enhances equipment compatibility, flexibility, and performance reliability in complex industrial setups.

- For instance, INOXCN Group manufactures these valves. The body material is confirmed to be SS 304 or SS 316L. The maximum working pressure is 10 bar. The specific temperature ranges listed for EPDM, Silicone, and FKM (Viton) seals align with INOXCN’s product specifications.

Growth in Emerging Economies and Infrastructure Expansion

Rapid industrialization in Asia-Pacific and Latin America presents strong growth opportunities for sanitary valve manufacturers. Expanding food processing units, dairy cooperatives, and beverage plants in countries like India, China, and Brazil are fueling product demand. Additionally, government initiatives supporting domestic manufacturing under food safety programs further encourage local valve production. Companies entering these markets with cost-effective and compliant solutions are likely to gain a competitive advantage in the coming years.

Key Challenges

High Initial Costs and Maintenance Complexity

The adoption of high-quality sanitary butterfly valves involves significant upfront investment, especially for automated systems. Small and medium enterprises face financial constraints in upgrading to stainless steel or hygienic-grade valves. Regular maintenance, cleaning, and validation procedures also add operational expenses. Furthermore, the need for specialized installation and periodic inspection increases long-term ownership costs, posing a challenge for cost-sensitive industries such as small-scale dairy and beverage producers.

Stringent Regulatory and Compliance Requirements

Manufacturers must adhere to multiple international standards like 3-A, EHEDG, FDA, and ISO for sanitary equipment design and performance. Meeting these requirements demands rigorous testing, documentation, and certification processes that increase product development timelines and expenses. Any deviation from compliance can result in product recalls or loss of certification. This stringent regulatory landscape makes market entry difficult for new players and compels existing ones to maintain high-quality benchmarks continuously.

Regional Analysis

North America

North America dominates the Sanitary Butterfly Valve Market with a 31% market share in 2024. The region’s leadership is driven by strong demand from the food, beverage, and pharmaceutical industries, which adhere to strict hygiene and safety regulations. The U.S. leads regional adoption due to advanced processing facilities and early automation integration. Key players such as Emerson Electric Co. and Alfa Laval invest heavily in digital valve technologies and clean-in-place (CIP) systems. Ongoing modernization in dairy and bioprocessing plants continues to support steady market expansion across the region.

Europe

Europe accounts for 28% of the global sanitary butterfly valve market, supported by its stringent regulatory standards and mature industrial base. The region’s emphasis on food safety, sustainable processing, and environmental compliance drives steady demand. Germany, Italy, and France serve as major hubs for manufacturing precision valves used in dairy, brewing, and pharmaceuticals. Companies such as GEA Group and Burkert Fluid Control Systems contribute to technological innovation through energy-efficient valve systems. Increased adoption of stainless steel and eco-friendly materials aligns with the EU’s Green Deal and sustainability goals.

Asia-Pacific

Asia-Pacific holds a 27% market share and represents the fastest-growing regional market for sanitary butterfly valves. Rapid industrialization, urbanization, and expanding food and beverage processing sectors in China, India, and Japan drive market growth. The region benefits from rising infrastructure investments and the establishment of new pharmaceutical and biotechnology plants. Local and international manufacturers, including Krones AG and Shanghai Liwei Valve, are expanding production to meet demand for automated sanitary valve solutions. Continuous government initiatives promoting food safety and manufacturing modernization further enhance regional market potential.

Latin America

Latin America captures 8% of the global market share, supported by increasing demand in Brazil, Mexico, and Argentina. The region’s food and beverage industry, particularly dairy and brewery sectors, drives significant valve adoption. Upgrades in hygienic processing equipment and government focus on food export quality compliance fuel growth. International manufacturers are forming partnerships with regional distributors to expand presence and improve after-sales service networks. Although cost constraints affect smaller facilities, rising investments in automated process control systems are improving market penetration across Latin America.

Middle East and Africa

The Middle East and Africa collectively account for 6% of the global market share. Growth in this region is driven by expanding dairy, beverage, and pharmaceutical industries, especially in the UAE, Saudi Arabia, and South Africa. Increasing investments in food processing and water treatment infrastructure enhance valve demand. Companies are introducing corrosion-resistant stainless-steel valves to cater to high-temperature and saline conditions. The gradual shift toward localized manufacturing and compliance with international sanitary standards creates opportunities for global suppliers entering emerging African markets.

Market Segmentations:

By Valve Type:

- Pneumatic butterfly valve

- Manual butterfly valve

By Material:

- Carbon steel

- Stainless steel

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sanitary Butterfly Valve Market features key players including GEA Group, Dixon Valve & Coupling, J&O Fluid Control, Adamant Valves, Donjoy Technology, Bray International, INOXCN Group, Dairy Pharma Valve, Alfa Laval, and Crane. The Sanitary Butterfly Valve Market is highly competitive, driven by continuous technological innovation and strict hygiene compliance standards. Manufacturers focus on enhancing valve efficiency, material durability, and ease of maintenance to meet the needs of food, dairy, and pharmaceutical sectors. Automation and digital monitoring technologies are transforming valve operations, supporting predictive maintenance and real-time process control. Companies are investing in R&D to develop lightweight, corrosion-resistant valves with improved sealing mechanisms and reduced energy consumption. Strategic partnerships, mergers, and expansions in emerging economies further strengthen global supply networks and ensure faster delivery of customized sanitary valve solutions.

Key Player Analysis

- GEA Group

- Dixon Valve & Coupling

- J&O Fluid Control

- Adamant Valves

- Donjoy Technology

- Bray International

- INOXCN Group

- Dairy Pharma Valve

- Alfa Laval

- Crane

Recent Developments

- In September 2024, Flomatic announced the expansion of its Sylax 3 Butterfly Valve series with the addition of a new 1 1/2 lug style model. Designed to deliver reliable and efficient flow control in compact systems, the newly introduced valve features a durable ductile iron body, a 316 stainless steel disc, and a stainless-steel stem. Engineered for bi-directional flow and dead-end service, it upholds the robust performance standards of the Sylax line.

- In January 2024, Baker Hughes Company, an energy technology corporation, released the Valve Lifecycle Management (VLM) Cloud application for end-user customers. The cloud application centers on three key areas: installed base management, monitoring & diagnostics, and aftermarket strategy & execution.

- In January 2024, Crane Company bought Vian Enterprises, a worldwide designer and producer of lubrication pumps & lubrication systems. The purchase helped Crane become stronger on gearboxes, auxiliary power units, and engines.

- In October 2023, Burhani Engineers Ltd. introduced a valves testing and rehabilitation hub in Nairobi, Kenya. This hub is expected to help lower the repair and maintenance costs for existing valves in oil and gas, power, mining, and other industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Valve Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for hygienic valves will increase with expanding food and beverage processing industries.

- Adoption of automated and smart valve systems will grow across manufacturing plants.

- Pharmaceutical and biotechnology sectors will drive continuous investment in sterile flow control solutions.

- Manufacturers will focus on energy-efficient and eco-friendly valve materials to meet sustainability goals.

- Integration of IoT and digital monitoring technologies will improve maintenance and operational efficiency.

- Emerging economies in Asia-Pacific and Latin America will experience strong market expansion.

- Customization and modular valve designs will gain popularity for flexible process applications.

- Regulatory compliance will remain a critical factor influencing product innovation and certification.

- Strategic mergers and collaborations will enhance global distribution and technology capabilities.

- Continuous R&D in corrosion resistance and clean-in-place systems will sustain long-term competitiveness.