Market Overview:

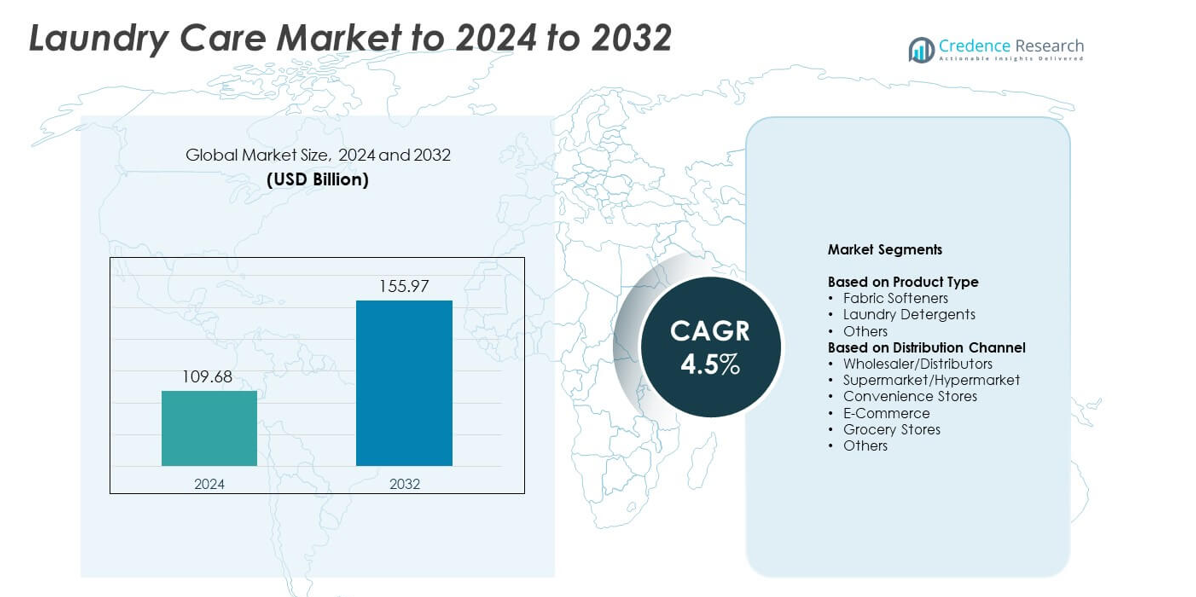

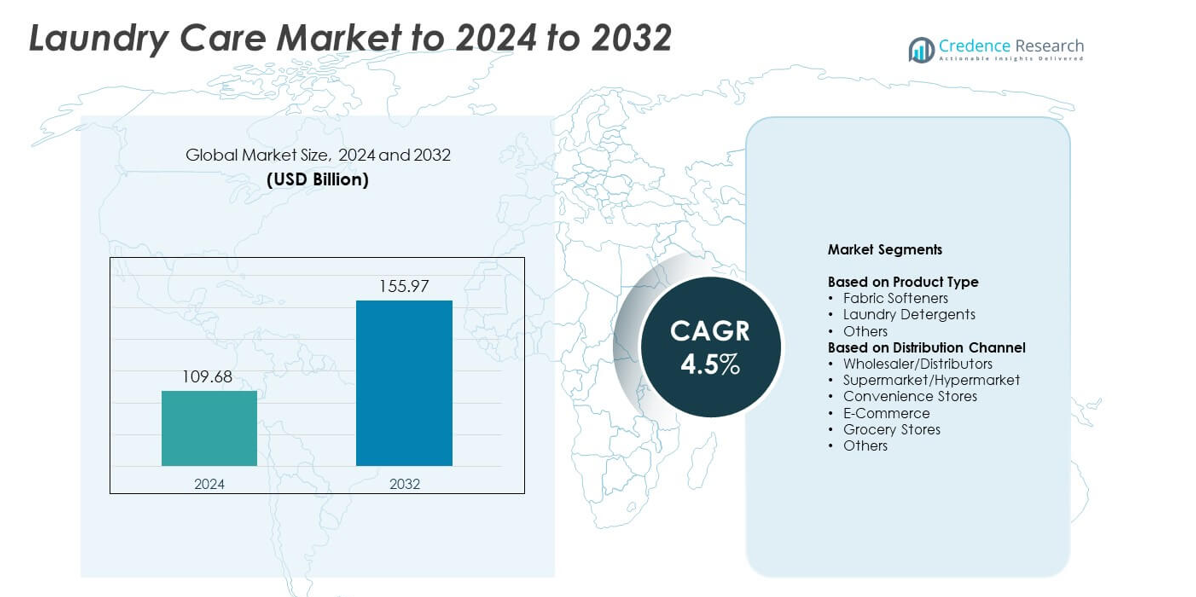

Laundry Care Market size was valued USD 109.68 Billion in 2024 and is anticipated to reach USD 155.97 Billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laundry Care Market Size 2024 |

USD 109.68 Billion |

| Laundry Care Market, CAGR |

4.5% |

| Laundry Care Market Size 2032 |

USD 155.97 Billion |

The Laundry Care Market is driven by major players such as Henkel AG & Co. KGaA, Colgate-Palmolive Company, LG Household & Health Care Ltd, Church & Dwight Co., Reckitt Benckiser Group PLC, Procter & Gamble Co., Lion Corporation, Golrang Industrial Group, Amway Corporation, Unilever PLC, S.C. Johnson & Son Inc., Kao Corporation, and Alicorp S.A.A. These companies compete through advanced formulations, strong brand positioning, and expanding sustainable product lines. Asia Pacific led the market in 2024 with about 36% share, supported by rising urbanization and growing detergent consumption. North America followed with roughly 32% due to strong premium product adoption, while Europe held around 28% driven by sustainability-focused purchasing trends.

Market Insights

- Laundry Care Market was valued at USD 109.68 Billion in 2024 and is expected to reach USD 155.97 Billion by 2032, growing at a CAGR of 4.5%.

- Rising hygiene awareness and growing use of liquid detergents and pods drive steady demand, while premium and eco-friendly formulations expand their share across urban households.

- Sustainability trends strengthen as consumers shift toward biodegradable detergents, recyclable packaging, and plant-based ingredients, with e-commerce boosting subscription-based purchases.

- Competitive activity intensifies as global brands upgrade fragrance capsules, stain-removal efficiency, and concentrated formulas, while private-label products pressure pricing in mature markets.

- Asia Pacific led the market with about 36% share, followed by North America at nearly 32% and Europe around 28%, while laundry detergents dominated the product segment with about 62% share due to strong household penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Laundry detergents dominated the product segment in 2024 with about 62% share, supported by strong household penetration and rising liquid and pod-based detergent use. Growth rose as consumers preferred high-efficiency formulas that work in cold water and reduce energy use. Fabric softeners held a steady base due to demand for long-lasting fragrance and fabric conditioning needs. Other laundry products such as stain removers and bleach expanded as hygiene awareness grew across urban regions. The shift toward eco-friendly and hypoallergenic detergent options further supported segment expansion worldwide.

- For instance, Unilever states that about 3.4 billion people use its products every day in over 190 countries, giving its OMO and Surf laundry detergents one of the widest active user bases in the fabric and home care category worldwide.

By Distribution Channel

Supermarket and hypermarket outlets led the distribution channel segment in 2024 with nearly 38% share, driven by wide product visibility, bulk purchase options, and strong brand placement. Consumers preferred these stores because they offer multiple detergent formats and frequent promotional deals. E-commerce grew at a fast pace due to rising online shopping and subscription-based detergent delivery models. Grocery stores and convenience stores retained steady demand in rural and semi-urban regions. Wholesalers and distributors continued to support large-volume supply for commercial and institutional users.

- For instance, Walmart reports that each week approximately 270 million customers and members visit more than 10,750 stores and numerous e-commerce websites in 19 countries.

Key Growth Drivers

Rising Hygiene Awareness

Growing focus on health and sanitation boosted laundry product demand across households. Consumers adopted premium detergents with deeper cleaning abilities as concerns over bacteria and allergens increased. Brands expanded germ-protection and anti-odor ranges, which helped strengthen category growth. Urbanization and higher washing machine penetration created steady need for liquid detergents and pods. This shift toward advanced cleaning solutions made hygiene awareness a core growth driver.

- For instance, Reckitt highlights that its Dettol hygiene brand is now sold in over 124 countries (often cited as present in as many as 180 markets), reflecting how growing concern over germs and infection control has driven sustained demand for antibacterial cleaning and laundry products.

Shift Toward Convenience Formats

Busy lifestyles increased adoption of liquid detergents, pods, and concentrated formulas. These formats offered faster dissolving, easier measuring, and better compatibility with modern washing machines, creating strong appeal across young consumers. Brands pushed compact packaging to reduce waste and enhance portability. Convenience-focused innovations supported higher repeat purchases, making this shift an important growth driver in the Laundry Care Market.

- For instance, Procter & Gamble voluntarily recalled about 8,200,000 laundry pod bags in the U.S. and 56,741 in Canada in April 2024, covering Tide Pods, Gain Flings, Ace Pods, and Ariel Pods manufactured between September 2023 and February 2024.

Expansion of Premium and Sustainable Products

Demand grew for eco-friendly detergents, biodegradable softeners, and plant-based ingredients. Premium segments expanded as consumers valued fragrance retention, fabric protection, and low-chemical formulations. Companies invested in recyclable packaging and enzyme-rich formulas to meet sustainability expectations. This steady movement toward cleaner and premium solutions acted as a major growth driver and reshaped product positioning globally.

Key Trends & Opportunities

Growth of E-Commerce Laundry Care Sales

Online channels created strong opportunities through doorstep delivery, subscription packs, and bundled offers. Digital platforms enhanced product visibility and enabled niche brands to reach wider audiences at lower distribution cost. Rising mobile shopping increased demand for liquid detergents and value packs. Improved logistics and faster delivery made e-commerce a major trend driving long-term expansion.

- For instance, Amazon’s Delivery Service Partner network works with over 4,400 small businesses that employ more than 390,000 drivers to deliver over 20 million packages a day across 20 countries, supporting fast-growing online sales of household and laundry essentials.

Innovation in Fabric-Care and Fragrance Technologies

Brands introduced long-lasting fragrance capsules, color-protection technologies, and fabric-strengthening additives. These innovations helped companies attract customers seeking improved clothing durability and enhanced scent experience. Growth opportunities expanded as advanced formulas supported cold-water washing, reducing household energy use. Such product upgrades created strong differentiation in a competitive market.

- For instance, Henkel’s Persil Deep Clean Plus formula was engineered so its active substances penetrate deep into fibers and remove tough stains even at 20 degrees Celsius, demonstrating how enzyme technology now enables effective low-temperature washing with strong fragrance and care benefits.

Sustainable Packaging and Green Formulations

Companies adopted recyclable bottles, refill pouches, and low-plastic packaging to address environmental expectations. Demand for plant-based detergents increased as consumers preferred safer and greener cleaning solutions. Sustainability-focused innovation opened new growth opportunities in premium categories. This trend encouraged companies to redesign supply chains and reduce carbon footprints.

Key Challenges

Price Sensitivity in Mass Markets

Many consumers remain highly price-driven, limiting adoption of premium detergents and softeners. Discount competition across supermarket chains and online platforms pressures brand margins. Economic fluctuations reduce willingness to purchase specialized or high-cost laundry products. This price sensitivity acts as a major challenge for companies targeting mass-market households.

Environmental and Regulatory Pressures

Growing restrictions on chemical ingredients and wastewater emissions require continuous reformulation. Compliance increases production cost and slows market expansion for legacy products. Pressure to reduce plastic packaging adds further operational challenges. Companies must balance performance, safety, and environmental targets, making regulatory pressure a key challenge for the Laundry Care Market.

Regional Analysis

North America

North America held about 32% share in 2024, supported by high adoption of liquid detergents, pods, and premium fabric-care products. Growth increased as households shifted toward convenience formats compatible with high-efficiency washing machines. Strong presence of leading brands and rising interest in hypoallergenic and green formulations shaped consumer choices. Retail expansion across supermarket chains and rapid online delivery strengthened product accessibility. Demand rose further as dual-income homes favored compact and concentrated detergents, making North America a key regional market with steady purchasing power.

Europe

Europe captured nearly 28% share in 2024, driven by strong demand for sustainable detergents and biodegradable softeners. Consumers preferred eco-certified formulas as environmental awareness and regulatory standards increased across major countries. Cold-water washing trends pushed adoption of enzyme-rich detergents that offer strong cleaning with lower energy use. Private-label brands expanded shelf presence in hypermarkets, influencing price competition. E-commerce sales rose as consumers valued bulk packs and subscription models. Strong focus on sustainability and product safety kept Europe a mature yet innovation-driven market.

Asia Pacific

Asia Pacific led the Laundry Care Market with around 36% share in 2024, supported by large population size, urbanization, and rising middle-income households. Expanding washing machine penetration in China, India, and Southeast Asia boosted use of liquid detergents and fabric conditioners. Local brands gained traction through affordable pricing, while global players pushed premium and high-performance products. E-commerce adoption accelerated detergent and softener sales, particularly in urban hubs. Growing hygiene awareness and lifestyle upgrades continued to drive strong regional momentum.

Latin America

Latin America accounted for roughly 7% share in 2024, driven by increasing use of liquid detergents and fragrance-focused softeners. Economic recovery in key markets improved household spending on branded laundry products. Traditional trade channels such as neighborhood stores remained important, though supermarket expansion improved product variety. Price sensitivity shaped buying patterns, encouraging demand for concentrated and budget-friendly formulas. Promotional campaigns and value packs supported adoption across mass-market segments, keeping growth steady despite regional cost pressures.

Middle East & Africa

Middle East & Africa held close to 5% share in 2024, supported by rising urbanization and growing availability of global detergent brands. Adoption increased as modern retail formats expanded across Gulf countries and major African cities. Powder detergents remained widely used, while liquid detergents gained popularity among higher-income consumers. Climate conditions increased need for strong stain-removal and fragrance-enhancing products. Economic disparities kept demand mixed, but improving infrastructure and e-commerce access supported gradual market expansion across the region.

Market Segmentations:

By Product Type

- Fabric Softeners

- Laundry Detergents

- Others

By Distribution Channel

- Wholesaler/Distributors

- Supermarket/Hypermarket

- Convenience Stores

- E-Commerce

- Grocery Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Laundry Care Market is shaped by leading companies such as Henkel AG & Co. KGaA, Colgate-Palmolive Company, LG Household & Health Care Ltd, Church & Dwight Co., Reckitt Benckiser Group PLC, Procter & Gamble Co., Lion Corporation, Golrang Industrial Group, Amway Corporation, Unilever PLC, S.C. Johnson & Son Inc., Kao Corporation, and Alicorp S.A.A. The competitive landscape features strong product diversification, continuous formulation upgrades, and expanding premium ranges tailored to evolving consumer needs. Companies focus on liquid detergents, pods, and eco-friendly solutions to strengthen brand presence. Innovation in fragrance technology, fabric protection, and stain-removal performance remains central to gaining market advantage. Digital expansion through e-commerce, subscription models, and targeted online promotions enhances customer reach. Sustainability remains a major area of competition as global brands adopt recyclable packaging and plant-based formulations. Price competition remains intense across supermarket shelves, while private-label offerings continue to pressure established brands in mature markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henkel AG & Co. KGaA

- Colgate-Palmolive Company

- LG Household & Health Care Ltd

- Church & Dwight Co.

- Reckitt Benckiser Group PLC

- Procter & Gamble Co.

- Lion Corporation

- Golrang Industrial Group

- Amway Corporation

- Unilever PLC

- S.C. Johnson & Son Inc.

- Kao Corporation

- Alicorp S.A.A

Recent Developments

- In 2025, SC Johnson’s Ecover brand expanded closed-loop and refill solutions for its laundry liquids at scale in Europe.

- In 2024, Unilever launched Persil Wonder Wash, a liquid laundry detergent for short cycles as quick as 15 minutes.

- In 2024, Kao launched Attack ActivClean+ Laundry Stick in Singapore, an all-in-one powder stick detergent.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift further toward liquid detergents and pods due to convenience.

- Demand for eco-friendly and plant-based laundry products will rise across regions.

- E-commerce platforms will gain more share through subscription packs and faster delivery.

- Brands will invest in low-water and cold-wash technologies to support energy savings.

- Premium fragrances and long-lasting scent technologies will see strong adoption.

- Concentrated detergents will expand as consumers seek compact and low-waste options.

- Smart dosing and connected laundry devices will improve product efficiency.

- Private-label laundry products will grow due to competitive pricing.

- Refill packs and recyclable packaging will become standard across major markets.

- Growth in emerging economies will strengthen demand for both budget and mid-range products.