Market Overview:

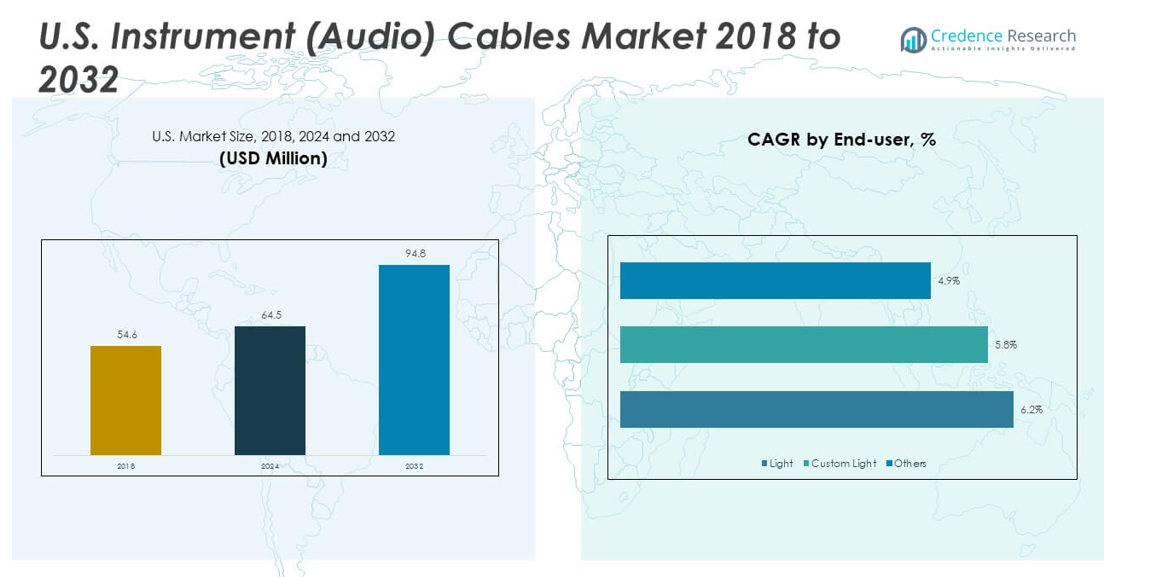

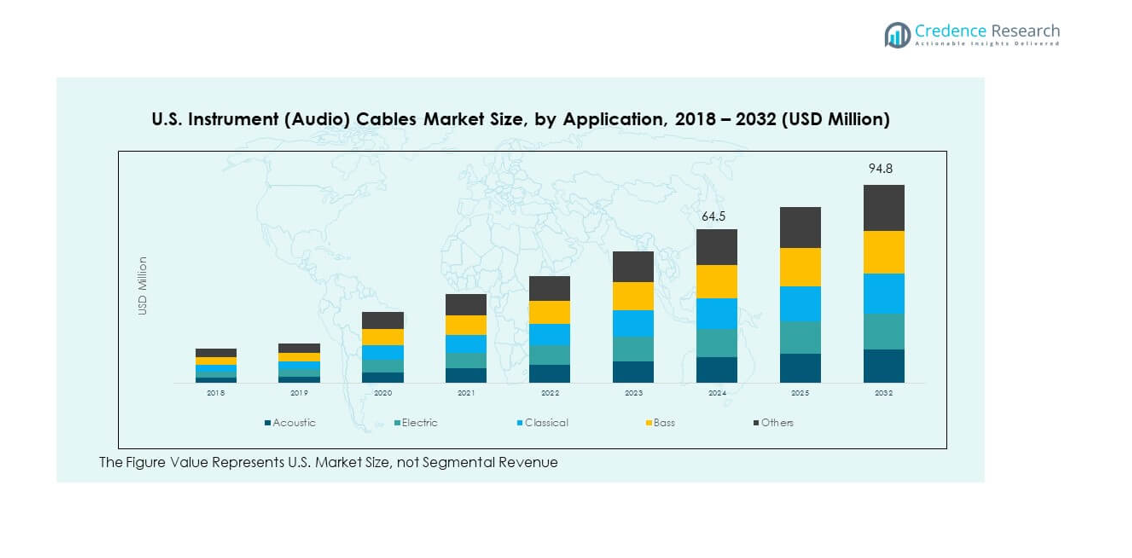

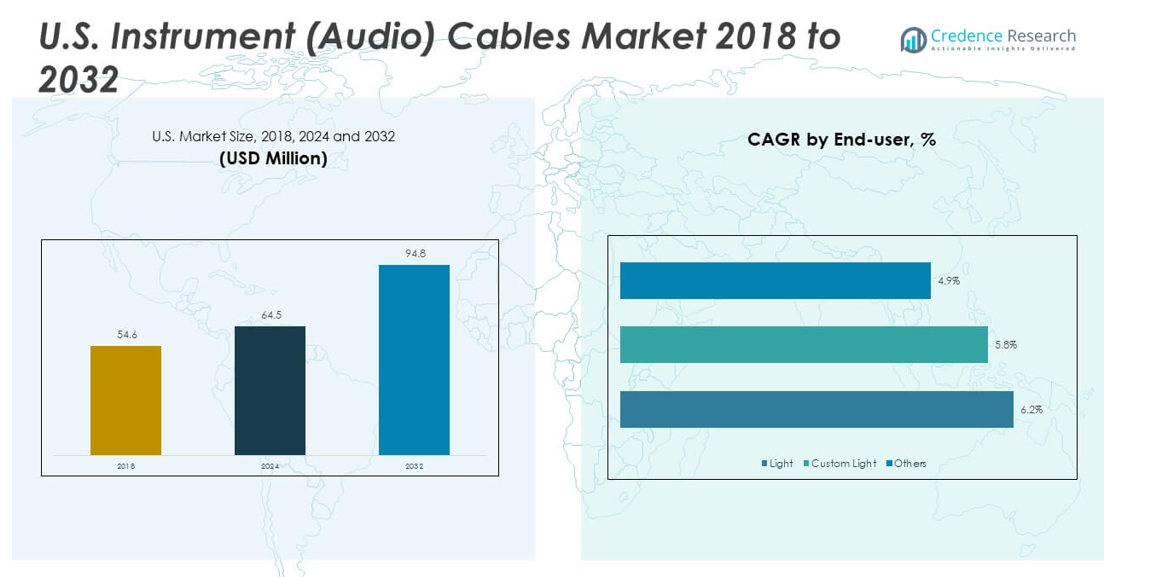

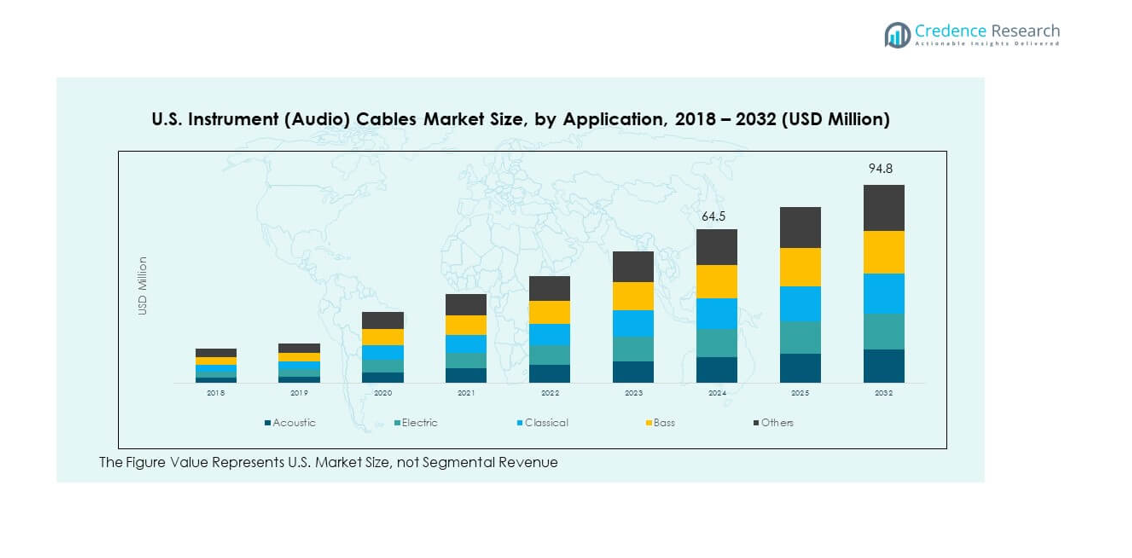

The U.S. Instrument (Audio) Cables Market size was valued at USD 54.6 million in 2018 to USD 64.5 million in 2024 and is anticipated to reach USD 94.8 million by 2032, at a CAGR of 4.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Instrument (Audio) Cables Market Size 2024 |

USD 64.5 million |

| U.S. Instrument (Audio) Cables Market, CAGR |

4.93% |

| U.S. Instrument (Audio) Cables Market Size 2032 |

USD 94.8 million |

The market is witnessing steady growth as demand for reliable and high-quality audio connections rises across professional studios, live performances, and home recording setups. Advancements in cable engineering, such as oxygen-free copper conductors, enhanced shielding, and durable jacketing, are driving adoption among musicians, audio engineers, and broadcasters. Growing preference for wireless systems has introduced competitive pressure, but the continued need for consistent sound quality and interference-free performance sustains strong demand for premium instrument cables in the U.S. market.

Regionally, the U.S. leads the market due to its strong base of music production hubs, live concert venues, and a thriving community of independent musicians. Cities such as Los Angeles, Nashville, and New York contribute significantly through their recording industries and live performance culture. Emerging growth is visible in smaller metropolitan areas where independent artists, local studios, and educational institutions are expanding investments in music infrastructure. These geographic dynamics ensure the U.S. remains the most influential player in shaping global instrument cable demand.

Market Insights:

- The U.S. Instrument (Audio) Cables Market was valued at USD 64.5 million in 2024 and is expected to reach USD 94.8 million by 2032, growing at a CAGR of 4.93%.

- The Global Instrument (Audio) Cables Market size was valued at USD 179.3 million in 2018 to USD 210.0 million in 2024 and is anticipated to reach USD 306.5 million by 2032, at a CAGR of 4.9% during the forecast period.

- Strong demand from live performances, recording studios, and broadcast facilities continues to drive steady market growth.

- Premium audio quality requirements among professionals and hobbyists encourage investments in advanced cable technologies.

- Competition from wireless alternatives and low-cost imports acts as a restraint, impacting pricing and margins.

- The West region leads with 34% share, driven by strong entertainment hubs and high investments in production infrastructure.

- The South region maintains significant demand supported by vibrant music culture and expanding live performance venues.

- The Midwest and Northeast collectively sustain balanced growth through strong adoption in education, orchestras, and community music programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing demand from live performance venues and professional studios driving cable adoption

The U.S. Instrument (Audio) Cables Market is driven by increasing demand from live performance venues, recording studios, and broadcast facilities that require consistent audio quality. The market benefits from strong activity in music festivals, concerts, and touring events where reliability of equipment determines performance outcomes. It supports musicians, sound engineers, and stage technicians who prioritize stable connections for instruments and amplifiers. It reflects the need for robust cable solutions that resist wear under frequent usage conditions. The rise of home-based studios also increases spending on quality cabling solutions. It shows how expanding creative production ecosystems are contributing to consistent demand. Strong brand loyalty among professionals sustains growth for premium cable categories. The alignment of cable durability with sound precision strengthens its market outlook.

- For example, Mogami Cable’s Gold Series instrument cable (model W2524) offers a capacitance of approximately 39.7 pF/ft (130 pF/m), which helps preserve signal clarity over longer runs.

Rising consumer interest in premium audio quality reinforcing product investments

Consumers in the U.S. show increasing preference for premium audio experiences, which drives the U.S. Instrument (Audio) Cables Market. It highlights the role of cables in ensuring clarity, tonal balance, and signal integrity across instruments. It emphasizes enhanced construction features such as oxygen-free copper wiring, multi-layer shielding, and reinforced connectors. The demand for cables that eliminate noise interference supports adoption among serious hobbyists and professionals. It reflects how rising disposable incomes allow consumers to prioritize quality over cost. Home entertainment and personal recording equipment further accelerate purchases of upgraded cables. It ensures a broader consumer base beyond professional use cases. It positions manufacturers to compete through innovation in sound enhancement technologies.

- For instance, Ernie Ball’s braided instrument cables utilize dual-conductors with multiple shielding layers and offer cable options up to 25ft (7.62m) in length, ensuring low noise and maximum flexibility for professional use.

Expansion of educational institutions and training programs supporting wider usage

The growth of music schools, conservatories, and university programs in the U.S. directly impacts the U.S. Instrument (Audio) Cables Market. It aligns with greater institutional spending on reliable audio infrastructure for classrooms, rehearsal spaces, and performances. It supports the regular replacement cycle of cables due to wear and heavy usage in such environments. Strong collaboration between institutions and cable manufacturers boosts awareness of premium-grade solutions. It expands opportunities for brands to supply bulk orders and specialized configurations. It strengthens long-term relationships between vendors and the academic community. It enables manufacturers to capture steady demand beyond seasonal retail sales. It highlights the strategic role of education in sustaining market volume.

Influence of technology integration encouraging specialized product development

The U.S. Instrument (Audio) Cables Market is influenced by technology integration that supports durability and precision. It demonstrates how manufacturers are embedding features such as gold-plated connectors, braided shielding, and lightweight flexible jackets. It creates differentiation for brands competing in a saturated marketplace. It also supports product innovations aimed at minimizing signal degradation across long cable lengths. It shows how cable designs address stage performance requirements while maintaining portability. The introduction of hybrid cables with digital and analog compatibility also strengthens product positioning. It signals continuous evolution in design aligned with modern audio systems. It allows manufacturers to respond directly to musicians’ feedback and professional demands.

Market Trends

Transition toward eco-friendly materials shaping sustainable product development

The U.S. Instrument (Audio) Cables Market is witnessing a trend toward eco-friendly materials in product design. It reflects growing awareness among consumers and manufacturers about environmental sustainability. It encourages the use of recyclable insulation and bio-based polymers in cable jackets. It aligns with regulatory pressure on reducing plastic waste in consumer electronics. It also responds to customer demand for brands that commit to sustainability. It creates differentiation in the market by combining performance with environmental responsibility. It drives research and development efforts to innovate in materials technology. It ensures long-term alignment between industry practices and eco-conscious consumer behavior.

Integration of customization options offering tailored cable experiences

The U.S. Instrument (Audio) Cables Market is also shaped by customization, with manufacturers offering cables tailored to user preferences. It supports demand for varied cable lengths, connector types, and color-coded designs. It highlights how consumers value personalized products that match their instruments or stage setups. It improves user convenience in managing multiple cables during performances. It reflects an industry shift toward enhancing both utility and aesthetics. It strengthens brand loyalty by offering solutions adapted to professional workflows. It enables companies to cater to niche requirements of musicians and sound engineers. It reflects the wider adoption of premium pricing strategies for unique solutions.

- For instance, custom cable services allow musicians to build Mogami‑based cables with a choice of connectors, lengths, color boots, and optional labels, supporting unique stage or studio needs.

Growing role of e-commerce platforms supporting retail accessibility

E-commerce expansion is reshaping sales in the U.S. Instrument (Audio) Cables Market. It increases access to a broad range of products for both professionals and hobbyists. It enables smaller brands to compete alongside established names through direct-to-consumer channels. It enhances transparency by allowing consumers to compare specifications and reviews easily. It reflects how online platforms influence purchasing decisions based on peer recommendations. It increases market reach into smaller cities where traditional music stores are limited. It provides opportunities for bundled sales and promotional discounts that attract price-sensitive customers. It contributes to stronger competition and price variation across the market.

Influence of hybrid performance spaces shaping product preferences

Hybrid spaces for performances and recordings are influencing the U.S. Instrument (Audio) Cables Market. It demonstrates how musicians adapt to multipurpose venues that require flexible audio setups. It demands cables capable of supporting both live and studio environments with equal reliability. It reflects the need for portable yet durable solutions suited for dynamic conditions. It aligns with trends in content creation where artists balance stage shows with online streaming. It emphasizes versatility as a critical feature in product design. It encourages innovation in lightweight, compact, and high-strength cable formats. It strengthens the role of adaptability in sustaining product relevance across diverse contexts.

- For instance, Roland Corporation’s Black Series MIDI cables feature high-density shielding and commercial-grade connectors, ensuring reliable signal transfer and durability for professional synthesizer and studio setups.

Market Challenges Analysis

Competitive pricing pressure and rise of wireless alternatives reducing margins

The U.S. Instrument (Audio) Cables Market faces pricing pressure due to the availability of low-cost alternatives and generic imports. It restricts margins for established brands competing with inexpensive offerings. It reflects the struggle to differentiate in a market where cables are often seen as accessories. It challenges premium manufacturers to justify higher prices through superior quality. It highlights the rising influence of wireless solutions that reduce dependence on cables in some applications. It forces companies to diversify their portfolios or invest in hybrid technologies. It emphasizes the challenge of maintaining profitability in a competitive environment. It signals a critical need for innovation to retain market position.

Durability concerns and replacement cycles creating operational barriers

Durability issues present another challenge for the U.S. Instrument (Audio) Cables Market. It emphasizes the wear-and-tear nature of cables subjected to frequent bending and transport. It forces musicians and institutions to engage in repeated replacement cycles that increase costs. It highlights the dissatisfaction among users who expect longevity despite demanding use conditions. It challenges manufacturers to balance affordability with durability in product design. It creates barriers for customer retention when lower-cost options offer similar lifespans. It influences perception of cables as disposable rather than premium assets. It highlights the need for improved material technologies to overcome reliability concerns.

Market Opportunities

Expansion of digital content creation offering new growth pathways

The U.S. Instrument (Audio) Cables Market presents opportunities in the expansion of digital content creation. It supports growth among independent musicians, podcasters, and live streamers who require reliable connectivity. It reflects how user-generated content expands beyond traditional music performances. It creates a growing demand for affordable, versatile, and portable cable solutions. It aligns with rising interest in building home studios with professional-grade setups. It ensures a steady customer base that seeks reliable solutions for content production. It provides long-term opportunities for manufacturers to market specialized products to this segment. It enables consistent growth aligned with digital transformation in entertainment.

Strong growth potential in niche and premium cable categories supporting market differentiation

Premium and niche categories provide opportunities for the U.S. Instrument (Audio) Cables Market. It supports expansion through gold-plated connectors, braided designs, and limited-edition offerings that appeal to professionals. It highlights opportunities to capture enthusiasts willing to pay for superior performance. It reflects how brand reputation influences purchases in the premium segment. It encourages companies to focus on differentiation through innovation and design. It positions specialty cables as symbols of quality within professional communities. It increases visibility for manufacturers investing in targeted marketing campaigns. It reinforces the role of innovation in driving long-term competitiveness.

Market Segmentation Analysis:

By application, the U.S. Instrument (Audio) Cables Market demonstrates strong performance across application segments, with acoustic cables maintaining a significant share due to their use among hobbyists, live performers, and traditional musicians who value reliable tone clarity. Electric instrument cables hold a dominant position driven by their essential role in professional studios, concert setups, and modern music production. Classical cables cater to a niche audience that prioritizes precision and interference-free sound for specialized instruments. Bass cables register steady demand, supported by the need for robust construction to handle lower frequency ranges. The “others” segment includes hybrid and specialty cables that meet emerging requirements from experimental musicians and evolving audio setups.

- For instance, Fender’s Deluxe Series Instrument Cables feature 95% oxygen-free braided shielding, 20 AWG wire, and gold-plated connectors, offering durability and consistent tone quality for both stage and studio use.

By end-user segmentation, light cables record consistent adoption as they suit general consumers, entry-level players, and casual performers seeking affordability. Custom light cables contribute a growing share, supported by professionals and advanced musicians who prefer tailored solutions that enhance performance and match instrument-specific needs. The “others” category captures specialized end-users such as recording engineers, broadcasters, and institutional buyers who require bulk orders and advanced configurations. The U.S. Instrument (Audio) Cables Market reflects how both consumer-level demand and professional-grade requirements sustain overall growth. It indicates the balance between mass-market accessibility and premium customization that continues to shape adoption trends across diverse segments.

- For instance, the Ernie Ball Classic Series Instrument Cable offers crisp highs, rich harmonics, and a rugged PVC jacket at an affordable price, making it a favorite among entry-level users and casual performers.

Segmentation:

By Application

- Acoustic

- Electric

- Classical

- Bass

- Others

By End-User

- Light

- Custom Light

- Others

Regional Analysis:

The U.S. Instrument (Audio) Cables Market shows strong regional variation, with the West region holding the largest share at 34%. It benefits from a concentration of music hubs such as Los Angeles and San Francisco, where recording studios, entertainment companies, and live concert venues drive consistent demand. It reflects the influence of California’s dominant media and entertainment industry, supported by high investments in sound production infrastructure. The presence of professional musicians and independent artists strengthens sales of premium-grade cables. Strong consumer preference for advanced audio quality encourages manufacturers to expand product lines in this region. It continues to act as a leading center for innovation and market penetration.

The South region accounts for 28% of the market, supported by its rich cultural heritage in music genres such as country, blues, and jazz. It demonstrates strong adoption in cities like Nashville and Austin, where live music culture sustains steady equipment demand. The growing presence of recording studios and performance venues supports consistent replacement cycles for cables. It attracts investments from established brands targeting professional and semi-professional users. The region’s thriving music tourism further enhances cable sales across live events and festivals. It positions the South as a critical contributor to long-term market growth.

The Midwest and Northeast together represent 38% of the U.S. Instrument (Audio) Cables Market, with the Midwest holding 20% and the Northeast 18%. It highlights steady adoption across educational institutions, orchestras, and community music programs. It reflects demand from universities and conservatories that maintain structured music education programs. The Northeast benefits from New York’s position as a global music and entertainment hub, driving consumption among professionals and hobbyists alike. It supports balanced demand across both premium and affordable product categories. It ensures regional stability, where both traditional and contemporary music practices sustain cable requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mogami

- Klotz

- Fender

- Ernie Ball

- Shure

- Boss

- Line 6

- Lava

- Monster

Competitive Analysis:

The U.S. Instrument (Audio) Cables Market remains highly competitive, with established brands such as Mogami, Klotz, Fender, Ernie Ball, Shure, Boss, Line 6, Lava, and Monster shaping industry dynamics. It reflects a mix of long-standing companies with global reach and niche manufacturers focused on specialized offerings. Premium brands differentiate themselves through high-quality materials, advanced shielding technologies, and durable construction that appeal to professional musicians and studios. Mid-tier players emphasize affordability and versatility to attract hobbyists and entry-level users. Competition extends into product innovation, where features such as gold-plated connectors, braided designs, and eco-friendly materials enhance positioning. It highlights the importance of strong distribution networks, with e-commerce playing a central role in reaching wider audiences. Companies also invest in partnerships with artists, music schools, and event organizers to strengthen brand recognition. It underscores how both innovation and marketing strategies define success in this market, where consumer loyalty and performance reliability remain decisive factors.

Recent Developments:

- In January 2025, Fender unveiled a wide range of new cables and gigging essentials at the NAMM show, expanding their accessory portfolio. These additions included upgraded cables designed to enhance sound quality and playability for musicians. Fender also highlighted fresh cable models among other accessory innovations tailored for diverse musical applications.

- In January 2025, Ernie Ball announced a new release of Braided Instrument Cables in a Pumpkin Pie colorway, as well as an updated Flex Cable Collection with straight-to-angle plugs. The company also launched the Silent Cable for noiseless performance and added Tim Henson Signature cables to its premium lineup.

- In January 2024, Klotz introduced a redesigned LaGrange Supreme Guitar Cable. The new edition celebrates its 45th anniversary, now with laser-engraved metal jack plugs and improved handling, while retaining its reputation for high-purity copper conductors, triple shielding, and classic performance.

Market Concentration & Characteristics:

The U.S. Instrument (Audio) Cables Market demonstrates moderate concentration, with a handful of established brands holding significant market shares while smaller firms compete in specialized niches. It balances between premium-focused companies that dominate professional segments and cost-driven players that cater to casual users. It reflects a mature market where technological improvements, brand reputation, and distribution strength define competitiveness. It maintains steady demand from both institutional buyers and individual consumers, creating opportunities across diverse product categories. It shows how competitive intensity drives continuous innovation, while brand trust and proven product reliability sustain long-term positioning.

Report Coverage:

The research report offers an in-depth analysis based on Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness consistent growth driven by increasing demand for high-quality sound reproduction in live performances and studio recordings.

- Rising popularity of home-based music production and personal studios will expand the consumer base for professional-grade cables.

- E-commerce platforms will strengthen accessibility, offering both premium and budget-friendly options to a wider customer audience.

- Continuous innovation in cable materials and shielding technologies will enhance durability and minimize interference.

- Customization options, including varied lengths, designs, and color-coded formats, will gain traction among professionals and hobbyists.

- The growing presence of music education institutions will sustain steady demand across bulk orders and long-term replacement cycles.

- Premium brands will maintain strong influence through endorsements, partnerships with artists, and expansion of signature product lines.

- Environmental considerations will encourage manufacturers to explore recyclable insulation materials and eco-conscious product designs.

- Hybrid performance spaces that support both live shows and digital streaming will drive demand for versatile cable solutions.

- Competitive intensity will remain high, with established brands leveraging innovation and smaller firms focusing on niche segments for differentiation.