Market Overview:

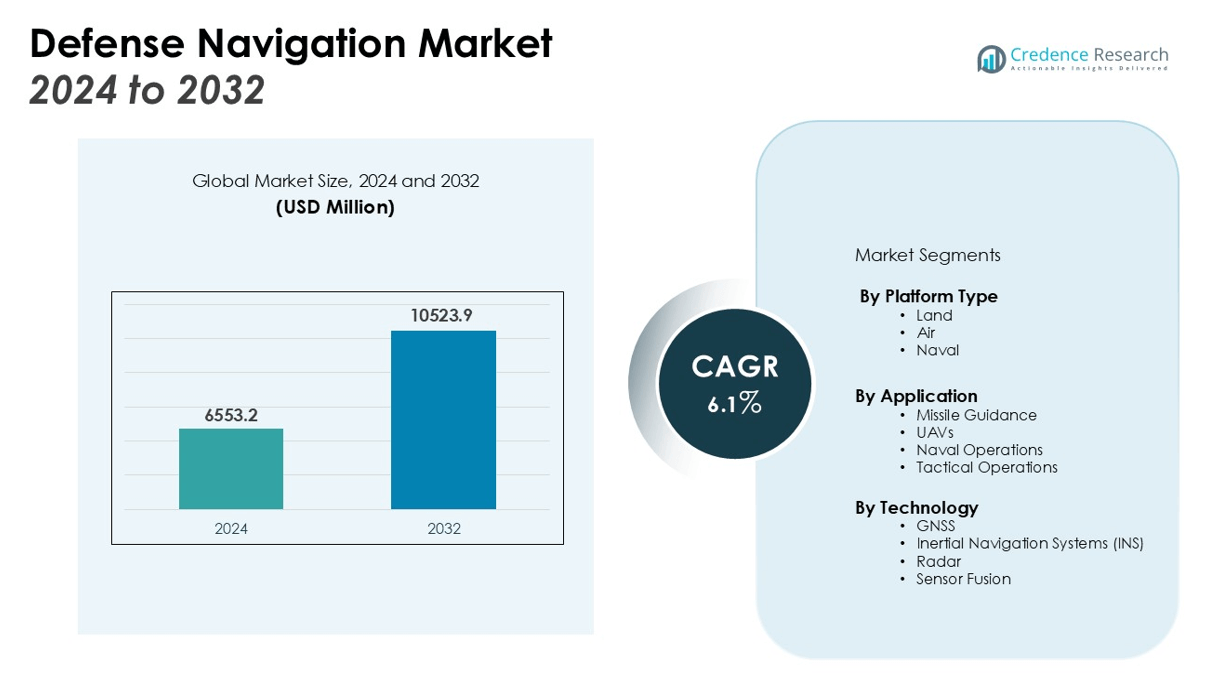

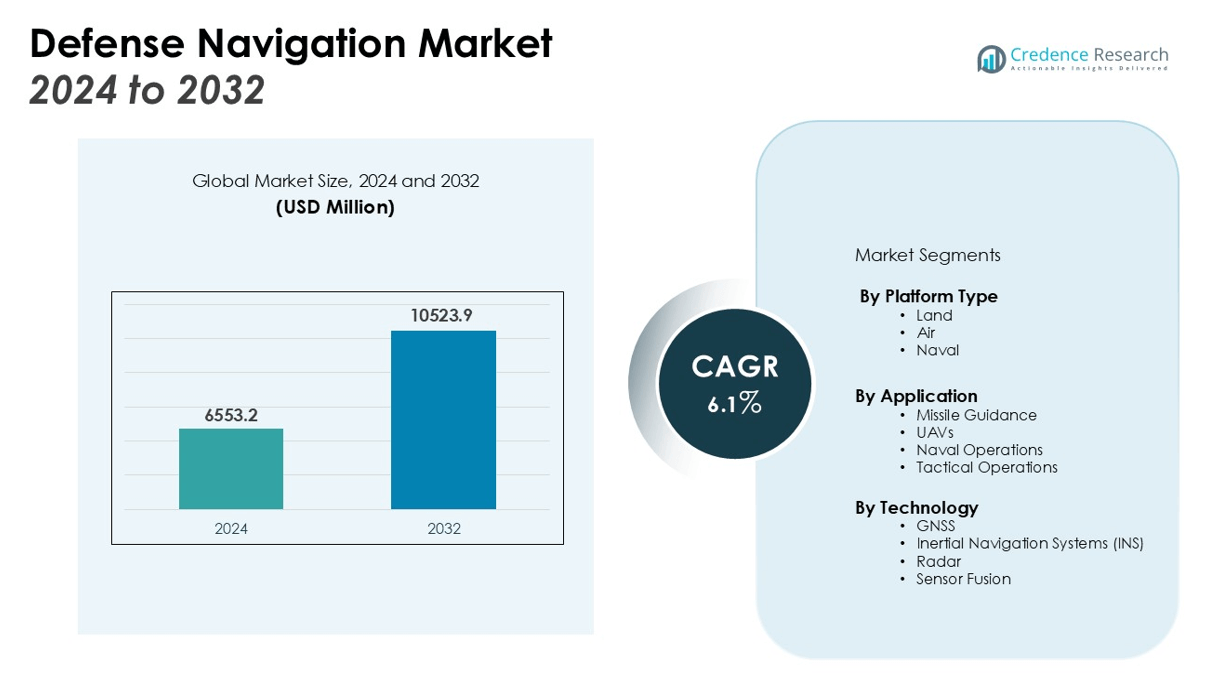

The Defense Navigation Market size was valued at USD 6553.2 million in 2024 and is anticipated to reach USD 10523.9 million by 2032, at a CAGR of 6.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Defense Navigation Systems Market Size 2024 |

USD 6553.2 million |

| Defense Navigation Systems Market, CAGR |

6.1% |

| Defense Navigation Systems Market Size 2032 |

USD 10523.9 million |

Key drivers of the market include the continuous need for improved GPS systems, the integration of advanced sensor technologies, and the increasing importance of autonomous systems in defense operations. Moreover, the development of highly accurate and secure navigation systems, coupled with the growing defense budgets across various regions, is propelling the demand for innovative navigation solutions in military applications. Technological advancements in navigation systems, such as GNSS-based solutions, are expected to further drive market expansion. The rise in geopolitical tensions and territorial disputes is also driving the demand for enhanced defense navigation capabilities.

Regionally, North America leads the defense navigation market, accounting for the largest market share, primarily driven by the U.S. military’s substantial investments in advanced navigation technologies. Europe and Asia-Pacific are also experiencing significant growth, with countries such as Russia, China, and India ramping up defense modernization efforts, increasing demand for sophisticated navigation systems. Additionally, the increasing focus on military collaborations and defense alliances in these regions further fuels the demand for advanced navigation technologies.

Market Insights:

- The Defense Navigation Market is valued at USD 6553.2 million and is projected to reach USD 10523.9 million by 2032, growing at a CAGR of 6.1% from 2024 to 2032.

- Increased demand for accurate and secure GPS systems is driving market growth, especially for military applications such as missile guidance, UAVs, and tactical operations that require high precision and resistance to jamming.

- The integration of advanced sensor technologies such as inertial navigation systems (INS), radar, and optical sensors is expanding the Defense Navigation Market, providing real-time, precise positioning data even in challenging environments.

- Autonomous defense systems, including UAVs and autonomous vehicles, are fueling demand for highly accurate, reliable, and secure navigation solutions to ensure their independent operation in real-time.

- Geopolitical tensions and territorial disputes are contributing to an increase in defense budgets, driving the demand for advanced defense navigation systems in regions like North America, Europe, and Asia-Pacific.

- Vulnerabilities to jamming and spoofing attacks remain a challenge in the Defense Navigation Market, requiring the development of more resilient navigation systems with enhanced countermeasures and signal encryption technologies.

- The high cost of advanced navigation systems, including multi-frequency GNSS and autonomous navigation solutions, presents a challenge for many defense agencies, particularly those with smaller budgets or emerging military forces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Accurate and Secure GPS Systems

The growing reliance on GPS systems in defense operations drives the demand for improved navigation technologies. Accurate and secure navigation systems are critical for military applications, including missile guidance, unmanned aerial vehicles (UAVs), and tactical operations. As military operations become more complex, the need for advanced GPS solutions with higher precision and resistance to jamming and spoofing intensifies. The Defense Navigation Market is witnessing a rise in demand for these robust, high-performance systems to ensure operational success and security.

- For instance, Raytheon Technologies stands as a leader in producing secure GPS systems, having designed and manufactured more than 10,000 GPS anti-jam units for military forces across the globe.

Integration of Advanced Sensor Technologies

The integration of advanced sensor technologies plays a crucial role in enhancing navigation capabilities. Systems such as inertial navigation systems (INS), radar, and optical sensors are increasingly being incorporated into defense navigation solutions. These technologies work together to provide real-time, precise positioning data, even in challenging environments. The Defense Navigation Market is expanding as defense agencies invest in these technologies to achieve seamless integration for more effective navigation in land, air, and maritime operations.

- For instance, Honeywell’s HGuide n580 inertial navigation system has enabled mobile mapping applications to achieve location accuracy of 10-20 centimeters even while navigating through cities with tall buildings.

Growth of Autonomous Systems in Defense Operations

The growing importance of autonomous systems, including autonomous vehicles and drones, is a significant driver of the Defense Navigation Market. These systems require highly accurate, reliable, and secure navigation solutions to operate independently in real-time, making advanced defense navigation technologies essential. The increase in defense budgets for autonomous military platforms drives the adoption of cutting-edge navigation systems, which are crucial for ensuring the success and safety of autonomous operations.

Geopolitical Tensions and Increased Defense Budgets

Geopolitical tensions and territorial disputes have led to an increase in defense spending, driving the demand for sophisticated defense navigation systems. Countries facing security threats are prioritizing military modernization, which includes the procurement of advanced navigation technologies. The Defense Navigation Market benefits from growing defense budgets, particularly in North America, Europe, and Asia-Pacific, as governments focus on enhancing military capabilities with state-of-the-art navigation solutions.

Market Trends:

Adoption of GNSS-based Navigation Systems in Defense Operations

The adoption of Global Navigation Satellite System (GNSS)-based navigation solutions continues to dominate the Defense Navigation Market. These systems provide military forces with high-precision positioning and timing capabilities, crucial for various defense operations, including combat, surveillance, and reconnaissance. The integration of GNSS with inertial navigation systems (INS) ensures accurate navigation even in GPS-denied environments, enhancing operational flexibility. Advances in GNSS technologies, including multi-frequency and multi-constellation capabilities, allow for more robust navigation in urban and challenging terrains. The increasing demand for seamless, real-time navigation systems drives further innovation within the market, as defense agencies seek more reliable and accurate solutions for mission-critical operations.

- For instance, in 2024, Boeing completed the world’s first recorded four-hour flight test of an aircraft using a six-axis quantum inertial measurement unit (IMU) to navigate entirely without GPS, with the system successfully producing real-time navigation data throughout takeoff, landing, and multiple maneuvers.

Rise of Autonomous Defense Platforms and Their Impact on Navigation Technologies

The rise of autonomous defense platforms, such as unmanned aerial vehicles (UAVs), autonomous naval vessels, and land-based vehicles, is reshaping the Defense Navigation Market. These platforms require advanced navigation technologies to operate independently with high levels of precision, safety, and reliability. As military forces invest in autonomous technologies, there is an increasing need for navigation systems capable of supporting these platforms’ autonomous decision-making and real-time operational requirements. The trend toward autonomous defense systems has pushed the market to develop more integrated, resilient, and adaptable navigation solutions that can handle dynamic environments and complex mission requirements. Enhanced sensor fusion techniques and artificial intelligence (AI) are playing key roles in improving the performance and accuracy of autonomous defense navigation systems.

- For instance, Northrop Grumman’s MQ-4C Triton autonomous maritime surveillance aircraft is capable of operating above 50,000 feet for over 24 hours continuously and provides four times the intelligent surveillance and reconnaissance (ISR) coverage of other autonomous platforms without sacrificing altitude, range, or endurance.

Market Challenges Analysis:

Vulnerability to Jamming and Spoofing Threats

One of the major challenges in the Defense Navigation Market is the vulnerability of GPS and GNSS-based systems to jamming and spoofing attacks. These threats pose significant risks to the accuracy and reliability of navigation systems used in defense operations. Adversaries can disrupt or manipulate signals, leading to navigation errors that can compromise mission success. Despite advancements in secure satellite technologies, the continuous evolution of jamming and spoofing techniques presents a persistent challenge. The Defense Navigation Market faces pressure to develop systems that are more resilient to these threats, requiring significant investments in countermeasures and signal encryption technologies.

High Costs of Advanced Navigation Systems

The high cost of advanced defense navigation systems remains a key challenge for many defense agencies. While technological advancements have led to improved performance and capabilities, they come at a significant price. The cost of integrating cutting-edge technologies such as multi-frequency GNSS, sensor fusion, and autonomous navigation solutions can limit the accessibility of these systems, particularly for smaller defense budgets or emerging military forces. As demand for more sophisticated and reliable navigation systems grows, defense agencies must balance technological improvements with budget constraints, creating a challenge for procurement and widespread adoption.

Market Opportunities:

Integration of Advanced Sensor Technologies for Enhanced Navigation

The Defense Navigation Market presents significant opportunities through the integration of advanced sensor technologies. The combination of GNSS with inertial navigation systems (INS), radar, and vision-based sensors is enhancing the precision and reliability of navigation in challenging environments. These integrated systems enable real-time updates and improve navigation performance, even in GPS-denied areas. The market is poised to benefit from innovations in sensor fusion and artificial intelligence, which improve data accuracy and adaptability. As defense agencies seek more reliable and resilient navigation solutions, the demand for such integrated systems is expected to grow, presenting ample opportunities for market expansion.

Expansion of Autonomous Defense Systems and Upgraded Navigation Solutions

The rapid expansion of autonomous defense systems offers substantial opportunities for the Defense Navigation Market. Unmanned aerial vehicles (UAVs), autonomous land vehicles, and naval platforms require sophisticated navigation systems to operate efficiently. The increasing adoption of autonomous platforms within military operations will drive demand for navigation solutions that are more accurate, resilient, and capable of handling complex, real-time scenarios. The Defense Navigation Market can capitalize on this trend by offering systems that enhance autonomous decision-making, sensor integration, and operational reliability, making it a crucial component of the evolving defense landscape.

Market Segmentation Analysis:

By Platform Type

The Defense Navigation Market is segmented into land, air, and naval platforms. The land platform segment holds the largest share, driven by the increasing demand for advanced navigation systems in military vehicles and ground operations. Airborne platforms, including UAVs and aircraft, are also expanding rapidly, with advanced navigation solutions essential for their autonomous operation and tactical precision. The naval platform segment is growing due to rising investments in autonomous naval vessels and the need for secure, high-precision navigation systems for strategic defense operations.

- For instance, in support of growing naval autonomy, Vard Electro is equipping 14 new marine robotic vessels with its SeaQ Remote technology to enable centralized remote operations.

By Application

The market is segmented by application into missile guidance, UAVs, naval operations, and tactical operations. The missile guidance segment is a major contributor, with navigation systems critical for ensuring missile accuracy and reliability. The growing use of UAVs for reconnaissance and surveillance further drives demand for navigation solutions capable of operating in GPS-denied environments. Tactical operations also account for a significant share, as military forces continue to upgrade their navigation systems for improved situational awareness and operational efficiency.

By Technology

The Defense Navigation Market utilizes technologies such as GNSS, inertial navigation systems (INS), radar, and sensor fusion. GNSS-based systems remain dominant due to their precision and widespread use across various platforms. INS technology is increasingly integrated with other systems to ensure reliable performance in GPS-denied environments. The growing adoption of radar and sensor fusion technologies enhances the market’s ability to provide real-time, accurate navigation data under challenging conditions, further advancing the capabilities of defense systems.

- For instance, a 77 GHz FMCW radar can achieve a range resolution of 10 cm, allowing for the differentiation of two closely-spaced targets.

Segmentations:

- By Platform Type

- By Application

- Missile Guidance

- UAVs

- Naval Operations

- Tactical Operations

- By Technology

- GNSS

- Inertial Navigation Systems (INS)

- Radar

- Sensor Fusion

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America’s Dominance in the Defense Navigation Market

North America holds the largest market share in the Defense Navigation Market, accounting for 40% of the global revenue. The United States’ substantial defense budget and investments in advanced navigation technologies contribute significantly to this dominance. The U.S. military’s focus on modernizing its defense infrastructure and enhancing operational capabilities has fueled demand for cutting-edge navigation systems. North American defense agencies continue to invest in GPS modernization, sensor integration, and autonomous systems, propelling the market forward. The region’s technological expertise, coupled with its robust defense strategies, ensures it remains a key player in the global defense navigation landscape.

Strong Growth and Increased Defense Spending in Europe

Europe holds a 25% market share in the Defense Navigation Market, driven by growing investments in defense technology and modernization. Countries like the United Kingdom, France, and Germany are prioritizing the integration of advanced navigation systems in both manned and unmanned platforms, boosting market demand. European defense agencies are increasing their focus on autonomous systems, secure navigation solutions, and cutting-edge sensor technologies. Regional collaborations, as well as the growing focus on strengthening NATO defense capabilities, further contribute to the expansion of the market in this region.

Rapid Expansion of the Defense Navigation Market in Asia-Pacific

Asia-Pacific accounts for 20% of the global Defense Navigation Market share and is expected to experience rapid growth. Countries such as China, India, and Japan are significantly increasing their defense budgets to modernize their military forces and enhance their technological capabilities. The region is witnessing a surge in the adoption of autonomous defense systems, including UAVs and unmanned naval vessels, which require reliable and secure navigation technologies. Geopolitical tensions in the region further accelerate defense spending, creating significant opportunities for the Defense Navigation Market to thrive in Asia-Pacific.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- L3Harris Technologies Inc.

- General Dynamics Corporation

- Raytheon Technologies Corporation

- Safran S.A.

- Collins Aerospace

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- BAE Systems plc

- Leonardo S.p.A.

- Trimble Inc.

- Thales Group

- Honeywell International Inc.

- Elbit Systems Ltd.

Competitive Analysis:

The Defense Navigation Market is highly competitive, with key players focusing on developing advanced navigation systems to meet the increasing demand for precision and reliability in defense operations. Major companies in the market include Honeywell International Inc., Garmin Ltd., Rockwell Collins, and Lockheed Martin Corporation. These firms leverage their technological expertise to offer innovative solutions in GPS, inertial navigation systems (INS), and sensor fusion technologies. Companies are investing in research and development to improve the resilience of navigation systems against jamming and spoofing, which remain significant threats in modern defense scenarios. The market is also witnessing an increase in collaborations and partnerships, particularly in autonomous defense systems, to enhance product offerings. As defense budgets grow across regions, especially in North America, Europe, and Asia-Pacific, competition is intensifying, with companies striving to capture market share by providing cutting-edge, cost-effective navigation solutions tailored to military needs.

Recent Developments:

- In August 2025, RTX subsidiary Blue Canyon Technologies announced it was developing a new, larger spacecraft platform to address increasing demand.

- In June 2025, BAE Systems opened a new advanced assembly hall at its Govan shipbuilding facility in Glasgow, Scotland.

- In July 2025, Thales Group raised its 2025 sales growth forecast due to strong first-half demand in its defence and avionics businesses, and its order intake showed solid momentum.

Market Concentration & Characteristics:

The Defense Navigation Market is moderately concentrated, with a few large players holding significant market share. Key players like Honeywell International Inc., Garmin Ltd., and Lockheed Martin Corporation dominate the market by providing advanced navigation solutions. These companies focus on innovation and technological advancements, particularly in GNSS, inertial navigation systems (INS), and sensor fusion technologies, to maintain their competitive edge. The market is characterized by high entry barriers due to the complexity of developing reliable, secure navigation systems tailored to defense needs. Ongoing investment in R&D, along with strategic partnerships, is essential for companies to sustain growth. While the market is dominated by established players, the increasing demand for autonomous defense systems and robust navigation solutions is driving new entrants to explore niche segments, such as UAVs and autonomous vehicles. This trend further contributes to market diversification and increased competition.

Report Coverage:

The research report offers an in-depth analysis based on Platform Type, Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for advanced, secure navigation systems will continue to rise as defense operations become more complex and precise.

- Autonomous defense systems, including UAVs and unmanned naval vessels, will drive significant growth in the market.

- Military agencies will prioritize systems with greater resistance to GPS jamming and spoofing, fueling innovation in anti-jamming technologies.

- Integration of AI and machine learning into navigation systems will enhance real-time decision-making capabilities and operational efficiency.

- Increased defense budgets in North America, Europe, and Asia-Pacific will lead to greater investments in modernizing navigation systems across various platforms.

- Collaboration between defense contractors and governments will intensify, with a focus on developing state-of-the-art, customized navigation solutions for evolving defense needs.

- Sensor fusion technologies will play a crucial role in enhancing the accuracy and reliability of navigation systems, especially in GPS-denied environments.

- Geopolitical tensions will continue to be a driving factor, leading to more advanced defense systems and robust navigation technologies.

- The development of resilient and multifunctional navigation platforms will be essential to support the increasing use of autonomous defense systems.

- The market will see increased competition, with both established players and new entrants striving to offer cost-effective, high-performance solutions tailored to military applications.