Market Overview

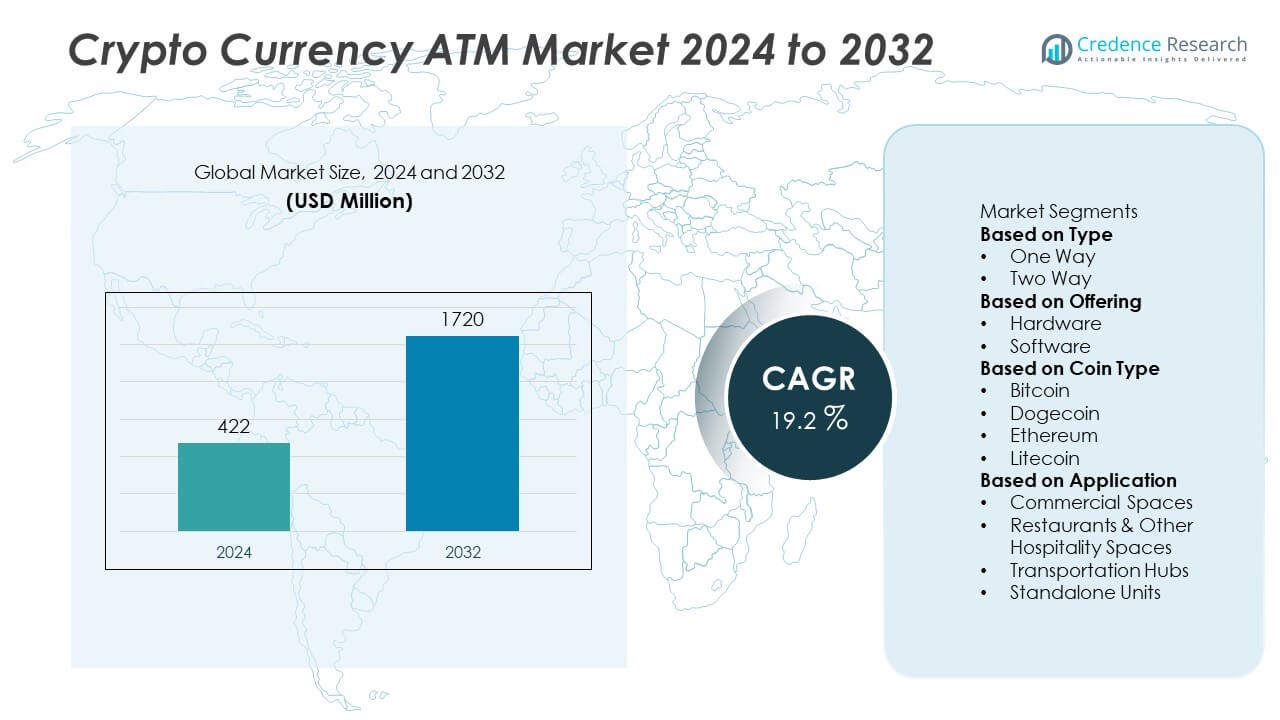

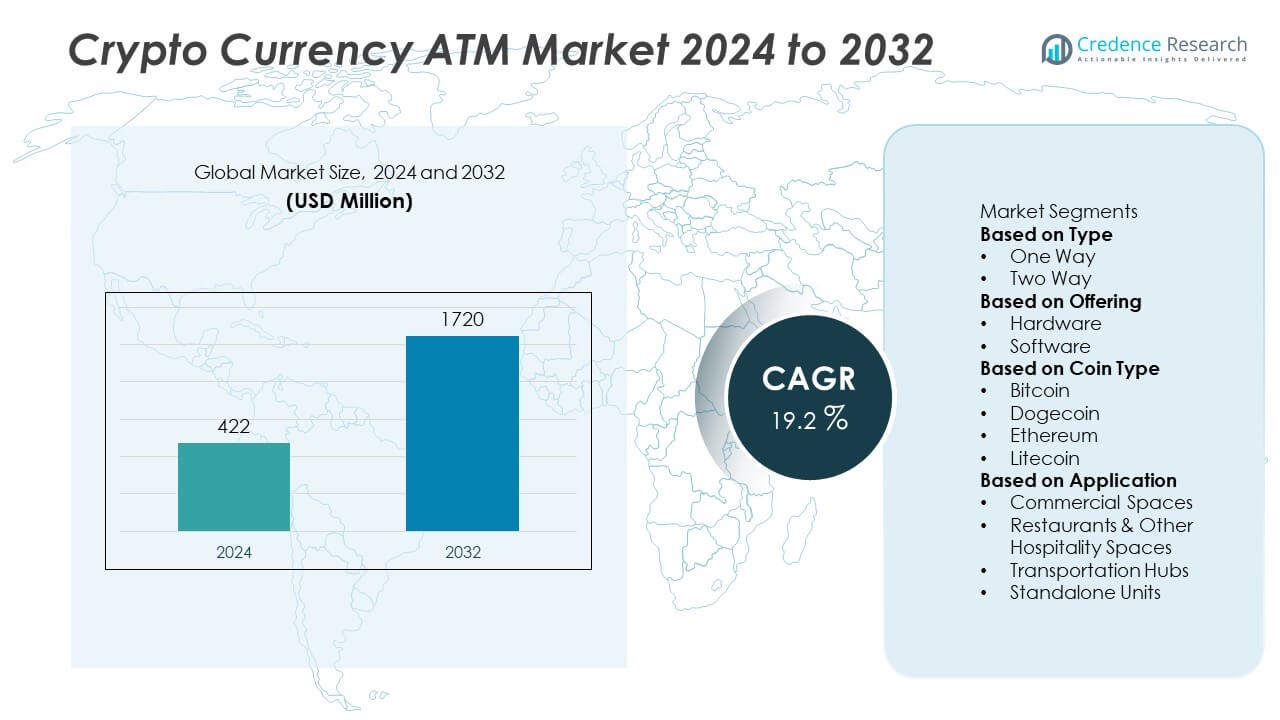

The Crypto Currency ATM Market size was valued at USD 422 million in 2024 and is projected to reach USD 1,720 million by 2032, growing at a CAGR of 19.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crypto Currency ATM Market Size 2024 |

USD 422 Million |

| Crypto Currency ATM Market, CAGR |

19.2% |

| Crypto Currency ATM Market Size 2032 |

USD 1,720 Million |

The Cryptocurrency ATM market is gaining momentum as rising adoption of digital currencies, increasing demand for faster and more convenient financial transactions, and growing awareness of blockchain technology drive installations worldwide. Regulatory support in select regions, coupled with enhanced security features and user-friendly interfaces, is fostering consumer trust and expanding usage.

The Cryptocurrency ATM market demonstrates strong geographical diversity, with North America leading adoption due to high cryptocurrency usage, robust infrastructure, and favorable regulatory frameworks in certain states. Europe is also witnessing rapid expansion, supported by growing digital payment ecosystems and supportive fintech initiatives. Meanwhile, Asia-Pacific is emerging as a high-potential region, driven by rising crypto awareness, urbanization, and increased remittance activities in countries like India, Singapore, and the Philippines. Latin America and the Middle East are gradually adopting crypto ATMs, fueled by demand for alternative financial systems and cross-border transaction needs. Key players driving innovation and global deployment include Genesis Coin, General Bytes, BitAccess, and Lamassu, who focus on enhancing transaction security, expanding multi-currency support, and improving user experience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global Cryptocurrency ATM market was valued at USD 422 million in 2024 and is projected to reach USD 1,720 million by 2032, expanding at a CAGR of 19.2%.

- Increasing adoption of digital currencies and demand for quick, secure, and user-friendly financial transactions are major factors driving installations worldwide, supported by regulatory acceptance in select economies.

- Key market trends include integration with mobile applications, enhanced security protocols, and multi-currency transaction features that improve customer experience and attract both retail users and businesses.

- Competitive analysis highlights players such as Genesis Coin, General Bytes, BitAccess, and Lamassu, who are focusing on innovation in transaction security, network expansion, and customized machine interfaces to stay ahead in the market.

- Market restraints include regulatory uncertainties in several countries, high initial setup and maintenance costs, and the risks associated with fluctuating cryptocurrency values, which may slow adoption in certain regions.

- North America leads global adoption with strong infrastructure and favorable state-level regulations, Europe follows with fintech-driven growth, and Asia-Pacific shows high growth potential fueled by remittance needs and rapid digital adoption in markets like India, Singapore, and the Philippines.

- Latin America and the Middle East are gradually expanding their adoption of cryptocurrency ATMs, driven by the demand for alternative banking systems and cross-border financial transactions, reflecting opportunities for long-term market growth across emerging economies.

Market Drivers

Rising Demand for Accessible Digital Asset Exchange

The Crypto Currency ATM Market grows on strong demand for convenient and accessible digital asset exchange points. Consumers prefer physical kiosks that allow direct cash-to-crypto and crypto-to-cash transactions without relying on complex online platforms. It provides a bridge between traditional banking and digital currencies, expanding financial access for underbanked populations. Increasing adoption of Bitcoin, Ethereum, and altcoins in retail and personal finance strengthens the relevance of ATM installations. Retail operators integrate ATMs in high-traffic locations, enhancing visibility and convenience. This demand anchors growth and pushes expansion in both urban and semi-urban settings.

- For instance, Coinsource deployed 800 Bitcoin ATMs across Kwik Trip gas stations in Wisconsin, Minnesota, Illinois, and Iowa by mid-2022, offering direct cash-to-crypto access at hundreds of convenient retail points

Expanding Global Acceptance of Cryptocurrencies in Payments

The widespread acceptance of cryptocurrencies in retail and e-commerce payments supports rapid expansion of the Crypto Currency ATM Market. Merchants and service providers across multiple sectors now allow digital currencies, creating the need for easy conversion tools. It helps consumers obtain crypto instantly to complete purchases and transfers, reinforcing transactional flexibility. Regulatory clarity in certain regions encourages legitimate use, while partnerships between ATM providers and payment processors improve operational scale. Rising cross-border remittances conducted through crypto further support installation in regions with large migrant populations. This trend highlights the role of ATMs as payment enablers in the evolving financial landscape.

- For instance, Coinme integrated over 10,000 cash-to-crypto points through its partnership with the Green Dot retail network in July 2025, enabling instant cryptocurrency access for remittance users across major U.S. convenience stores.

Technological Advancements and Security Integration

Continuous technological upgrades drive adoption in the Crypto Currency ATM Market by enhancing efficiency and security. Biometric authentication, QR-based wallets, and advanced encryption protocols provide safer transactions for users. It addresses concerns about fraud and privacy, reinforcing customer trust in public-facing ATM networks. Integration with real-time blockchain monitoring systems ensures regulatory compliance and transaction accuracy. Remote management platforms allow operators to update software and track usage analytics, improving uptime and profitability. These advancements create confidence among institutional investors and accelerate ATM deployment.

Strategic Investments and Expanding Network Deployments

Large-scale investments by ATM manufacturers and fintech firms accelerate the global expansion of the Crypto Currency ATM Market. Strategic collaborations with convenience stores, shopping centers, and fuel stations increase reach and adoption. It enables service providers to target both mature and emerging markets, building a wide geographic footprint. Venture capital funding strengthens product innovation and supports network scaling strategies. Governments in crypto-friendly nations encourage infrastructure development by reducing compliance hurdles for licensed operators. These factors combine to create a strong ecosystem that fuels long-term market growth.

Market Trends

Increasing Integration of Multi-Currency Support

The Crypto Currency ATM Market advances through wider integration of multi-currency capabilities across installed units. Machines that once supported only Bitcoin now offer Ethereum, Litecoin, stablecoins, and a growing portfolio of altcoins. It improves consumer choice and supports broader participation in digital finance ecosystems. Operators invest in software that enables dynamic updates to currency offerings, ensuring responsiveness to market demand. Growing retail adoption of diverse cryptocurrencies strengthens this requirement for multi-currency systems. This trend reflects a shift toward inclusivity and greater transaction flexibility for end users.

- For instance, GENERAL BYTES’ supported 40+ cryptocurrencies, BTC (Bitcoin), BCH (Bitcoin Cash), ETH (Ethereum), LTC (Litecoin), DASH, XMR (Monero), DOGE (Dogecoin), ANT (Aragon Network Token), BTXX, BURST, CLOAK, SMART (SmartCash), FTO, GRS, ICG, LEO, LINDA, LSK, MAX (MaxCoin.

Rising Adoption of Two-Way Transaction Capabilities

Operators expand service features by deploying two-way ATMs, a trend reshaping the Crypto Currency ATM Market. Unlike early models limited to cash-to-crypto, two-way units allow users to convert crypto back to fiat instantly. It strengthens the practical utility of ATMs and builds stronger consumer loyalty. Businesses hosting these ATMs attract more foot traffic, enhancing their revenue models. Transaction volumes rise steadily where two-way functionality is available, encouraging faster rollout in high-demand regions. This evolution positions ATMs as multifunctional gateways rather than simple vending systems.

- For instance, Genesis Coin, a bitcoin ATM software provider, has acquired 5,700 cryptocurrency ATMs from CoinCloud, expanding its powered network to over 12,600 ATMs, of which many are now live under its platforms

Growing Emphasis on Regulatory Compliance and KYC Features

Stricter financial compliance standards shape deployments within the Crypto Currency ATM Market. Regulators demand Know Your Customer and Anti-Money Laundering protocols integrated into ATM systems. It ensures legal adherence while fostering transparency and user trust. Operators deploy identity verification through biometric scans, government-issued IDs, and blockchain-based authentication. Compliance-driven features improve credibility with both governments and financial institutions. This trend redefines ATMs from experimental installations into legitimate, regulated financial infrastructure.

Expansion Across Emerging Markets and Retail Partnerships

Global ATM operators target untapped regions where traditional banking remains limited, shaping the Crypto Currency ATM Market. Emerging markets in Asia-Pacific, Latin America, and Africa attract new investments due to rising crypto adoption. It drives deployment in convenience stores, shopping malls, and fuel stations where cash usage is still dominant. Strategic partnerships with retail chains accelerate expansion and optimize placement in high-traffic locations. Lower installation costs and modular designs make rollouts feasible for small businesses. This expansion underscores the growing role of ATMs in bridging digital and cash-based economies.

Market Challenges Analysis

Regulatory Uncertainty and Compliance Pressures

The Crypto Currency ATM Market faces significant challenges from inconsistent regulatory frameworks across regions. Governments impose varying rules on cryptocurrency transactions, creating barriers for ATM operators in terms of licensing and compliance. It complicates international expansion and increases operational costs due to the need for jurisdiction-specific adjustments. Stricter Know Your Customer and Anti-Money Laundering obligations often require advanced technology integration, which smaller operators struggle to implement. Unclear tax policies further discourage investment and slow network growth in key markets. These factors collectively hinder predictable scaling strategies for industry participants.

High Operational Costs and Security Risks

Sustaining profitability in the Crypto Currency ATM Market remains difficult due to rising operational expenses and security concerns. Hardware procurement, cash handling, and constant software upgrades increase cost burdens for operators. It also faces risks from cyberattacks, skimming attempts, and physical vandalism targeting ATM units. Ensuring transaction security demands sophisticated encryption and biometric verification, raising investment requirements. Limited access to reliable banking partnerships in some regions restricts liquidity and weakens cash management efficiency. These operational and security challenges restrict widespread adoption and slow momentum in developing economies.

Market Opportunities

Expansion into Underbanked and Emerging Economies

The Crypto Currency ATM Market holds strong opportunities in regions with large unbanked populations and limited access to traditional financial services. ATMs serve as convenient gateways for people without bank accounts to participate in digital finance through cash-to-crypto conversions. It enables communities in Asia-Pacific, Africa, and Latin America to integrate into global financial ecosystems. Growing remittance flows across these regions further increase demand for quick, affordable, and decentralized transfer options. Partnerships with local retailers and convenience stores create accessible deployment points that support financial inclusion. This expansion potential highlights the role of ATMs in bridging the gap between conventional banking and cryptocurrency adoption.

Advancements in Technology and Value-Added Services

Rapid innovation creates growth opportunities by enhancing the functionality of the Crypto Currency ATM Market. Machines equipped with biometric authentication, contactless transactions, and multi-currency support deliver greater efficiency and user trust. It allows operators to expand services beyond simple cash-to-crypto exchanges, including bill payments, prepaid card recharges, and cross-border transfers. Integration with blockchain analytics tools also strengthens transparency and compliance while opening doors for institutional participation. Businesses hosting ATMs benefit from higher foot traffic and diversified revenue streams. These technology-driven improvements position ATMs as comprehensive financial service hubs with long-term market potential.

Market Segmentation Analysis:

By Type

The Crypto Currency ATM Market divides into one-way and two-way machines, each addressing different user needs. One-way ATMs dominate early installations by offering cash-to-crypto transactions, providing simplicity for new adopters. Two-way ATMs gain rapid traction with the ability to convert both fiat to crypto and crypto back to fiat, offering greater flexibility for frequent users. It creates higher transaction volumes and strengthens consumer trust by enabling instant liquidity. Two-way systems attract retail operators seeking to maximize foot traffic, while one-way units continue to hold appeal in regions with regulatory restrictions. The balance between both categories defines deployment strategies across global markets.

By Offering

Offerings in the Crypto Currency ATM Market include hardware, software, and services. Hardware forms the foundation, with advanced screens, biometric sensors, and QR scanners driving user experience improvements. Software solutions ensure secure wallet integration, real-time blockchain verification, and compliance with regulatory protocols. It supports efficient transaction processing and allows operators to manage networks remotely. Services such as installation, maintenance, and system upgrades create recurring revenue streams for providers. The growing need for full-service solutions positions this segment as a key driver of long-term adoption.

- For instance, GENERAL BYTES is the global leader in manufacturing and supporting Bitcoin ATMs, with over 18,000 crypto kiosks installed worldwide.

By Coin Type

The Crypto Currency ATM Market spans Bitcoin, Ethereum, Litecoin, and a growing range of altcoins. Bitcoin remains the leading currency supported due to its high recognition and widespread acceptance as a digital asset. Ethereum gains momentum as demand rises for transactions linked to decentralized applications and smart contracts. It encourages ATM providers to expand support for multiple cryptocurrencies, catering to diverse consumer preferences. Litecoin and stablecoins add value by enabling fast, low-cost transactions and hedging against volatility. Broadening coin support strengthens customer engagement and enhances the role of ATMs in mainstream financial ecosystems.

Segments:

Based on Type

Based on Offering

Based on Coin Type

- Bitcoin

- Dogecoin

- Ethereum

- Litecoin

Based on Application

- Commercial Spaces

- Restaurants & Other Hospitality Spaces

- Transportation Hubs

- Standalone Units

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for the largest share of the Crypto Currency ATM Market in 2024, contributing nearly 45% of the global revenue. The region benefits from early adoption of cryptocurrencies, well-established fintech infrastructure, and a favorable investment environment that supports ATM deployment. The United States dominates installations due to high consumer demand for convenient cash-to-crypto conversions and widespread acceptance of digital currencies in retail transactions. It also benefits from proactive ventures by companies such as CoinFlip and Bitcoin Depot, which continue to expand networks across convenience stores, gas stations, and malls. Regulatory clarity in select states strengthens consumer trust and attracts institutional support for large-scale deployment. Canada adds to growth with a rising number of cryptocurrency enthusiasts, government-backed blockchain initiatives, and a strong remittance industry. North America remains the hub for innovation in ATM technology, integrating two-way transaction models, biometric authentication, and compliance-driven features. This dominance underscores the maturity of the market and its ability to drive global trends in ATM infrastructure.

Europe

Europe holds the second-largest share of the Crypto Currency ATM Market, representing about 25% of the global value in 2024. The region’s adoption is supported by a strong digital payments culture, increasing consumer awareness, and growing retail acceptance of cryptocurrencies. Countries such as the United Kingdom, Germany, Spain, and Switzerland witness steady ATM installations, driven by rising demand for decentralized financial solutions. It benefits from supportive regulatory frameworks in crypto-friendly nations, while stricter guidelines in other regions limit rapid expansion. Major operators partner with retail chains, metro stations, and airports to improve accessibility for consumers. Europe also leads in integrating advanced security features and compliance systems, ensuring safe transactions aligned with EU financial standards. With cross-border transactions becoming more prominent, ATMs provide added convenience for tourists and international workers. The region’s focus on regulatory alignment and fintech innovation positions it as a strong contributor to market growth.

Asia-Pacific

Asia-Pacific captured around 18% of the global Crypto Currency ATM Market share in 2024, with rapid growth potential in the forecast period. Rising cryptocurrency adoption in countries like Japan, Singapore, Australia, and Hong Kong strengthens demand for physical exchange points. It benefits from increasing investments in blockchain infrastructure and growing participation from younger, tech-savvy populations. Japan and Singapore, with their progressive regulatory environments, lead the deployment of compliant ATM networks. Meanwhile, emerging economies such as India and Indonesia show rising consumer interest, though regulatory uncertainty slows large-scale installations. Operators expand through partnerships with local retailers, convenience stores, and transport hubs to capture mass-market potential. Asia-Pacific’s strong mobile payment culture and evolving financial ecosystems are expected to drive faster adoption of ATM networks in the coming years.

Latin America

Latin America accounts for roughly 7% of the global Crypto Currency ATM Market share, but shows significant opportunities due to high demand for remittance and alternative financial services. Countries like Mexico, Brazil, and Argentina drive adoption as populations seek decentralized solutions amid inflation and unstable banking structures. It provides a reliable bridge for cross-border remittances, especially from migrant workers in North America sending funds back home. Operators invest in low-cost deployment models to expand across high-traffic areas such as supermarkets and fuel stations. Despite regulatory challenges, consumer demand for affordable and instant access to cryptocurrencies continues to rise. Partnerships with fintech firms and retail businesses enhance regional expansion. Latin America’s position as a high-growth market makes it an attractive destination for global ATM providers seeking long-term opportunities.

Middle East & Africa

The Middle East & Africa region contributed nearly 5% of the global Crypto Currency ATM Market in 2024, with expansion led by growing interest in digital currencies and improving fintech ecosystems. The United Arab Emirates and South Africa emerge as front-runners, driven by government-backed blockchain initiatives and strong crypto adoption among younger demographics. It supports financial inclusion by providing alternative services to unbanked and underbanked populations across the region. Limited regulatory clarity in some countries restricts rapid rollout, yet partnerships with retail operators and fintech startups encourage steady expansion. Increasing tourism in Gulf countries also drives demand for ATMs that offer multi-currency exchange services. With rising investment in digital infrastructure and growing acceptance of cryptocurrencies in cross-border trade, the region holds promising growth potential. The Middle East & Africa continues to transition from nascent adoption to structured development, paving the way for stronger contributions to the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Cryptocurrency ATM market is defined by a few dominant players who are driving innovation and shaping global adoption. Genesis Coin, General Bytes, BitAccess, and Lamassu are the key companies leading the market, each bringing unique strengths to the industry. Genesis Coin maintains a strong footprint in North America with a large installed base and consistent product upgrades. General Bytes emphasizes modular designs and multi-currency capabilities, appealing to both individual operators and enterprises seeking scalable solutions. BitAccess differentiates itself by integrating advanced compliance tools and cloud-based management systems that simplify operations and enhance regulatory alignment. Lamassu focuses on sleek design, user-friendly interfaces, and open-source software, attracting operators who value flexibility and transparency. These players are actively expanding their global networks through partnerships, reseller programs, and direct installations. Their strategies prioritize transaction security, anti-money laundering (AML) compliance, and seamless customer experience, which are critical to building trust in the cryptocurrency ecosystem. Innovation in areas such as mobile integration, biometric authentication, and expanded digital asset support is further intensifying competition. While barriers such as regulatory uncertainty and installation costs persist, the leading companies continue to strengthen their positions through technological advancements and regional expansion, ensuring sustainable growth and wider accessibility of crypto ATMs worldwide.

Recent Developments

- In July 2025, At the UNFI Holiday & Winter Show in Las Vegas, Bitstop debuted its latest innovations in retail: multi-coin crypto ATMs Gold ATMs that dispense Goldbacks, alongside advanced fraud protection and user education features.

- In July 2025, Coinme expanded its physical “cash-to-crypto” network to over 10,000 U.S. retail locations, adding more than 10,000 outlets via the Green Dot network.

- In June 2025, Coinme agreed to pay a $300,000 penalty to California regulators for violating the state’s crypto ATM transaction limits and failing to include required disclosures—marking the first enforcement action under California’s Digital Financial Assets Law. The settlement also includes $51,700 in restitution to a scam victim.

Market Concentration & Characteristics

The Crypto Currency ATM market shows a moderately concentrated structure with a few established players holding significant influence through extensive networks and consistent technological advancements. It reflects characteristics of rapid innovation, regulatory sensitivity, and strong demand from regions with high crypto adoption. Leading companies focus on enhancing transaction security, compliance features, and multi-currency capabilities to strengthen user trust and differentiate their services. It continues to attract new entrants, yet high installation costs, compliance requirements, and operational complexities create barriers that favor established providers. The market demonstrates dynamic growth patterns, driven by evolving consumer preferences, regional remittance needs, and integration with broader fintech ecosystems. It highlights both consolidation opportunities among larger operators and niche potential for smaller firms catering to specific geographies or user segments.

Report Coverage

The research report offers an in-depth analysis based on Type, Offering, Coin Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing consumer adoption of cryptocurrencies for everyday transactions.

- Regulatory clarity in major economies will drive wider acceptance and faster deployment of ATMs.

- Security features such as biometric verification and advanced fraud detection will become standard.

- Multi-currency support will increase, enabling users to access a broader range of digital assets.

- Integration with mobile apps and digital wallets will enhance accessibility and convenience.

- Partnerships with retail chains and financial service providers will boost installation rates.

- Emerging economies will see strong adoption driven by remittance needs and limited banking access.

- Network operators will focus on compliance solutions to align with evolving anti-money laundering rules.

- Competition will intensify as new entrants target niche markets and regional opportunities.

- Continuous innovation in user experience and cost efficiency will define long-term market growth.