Market Overview

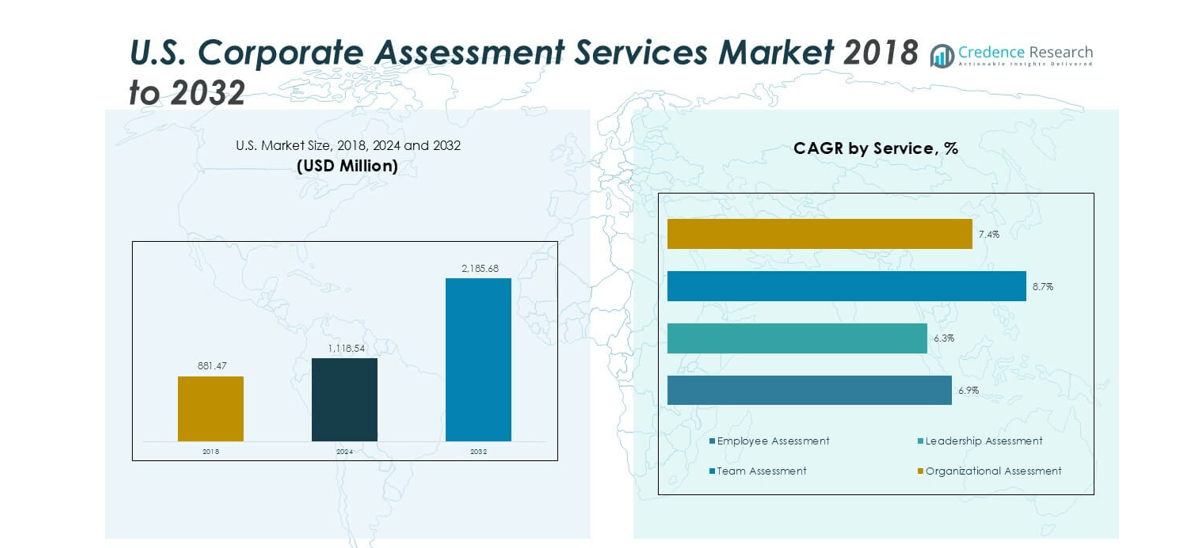

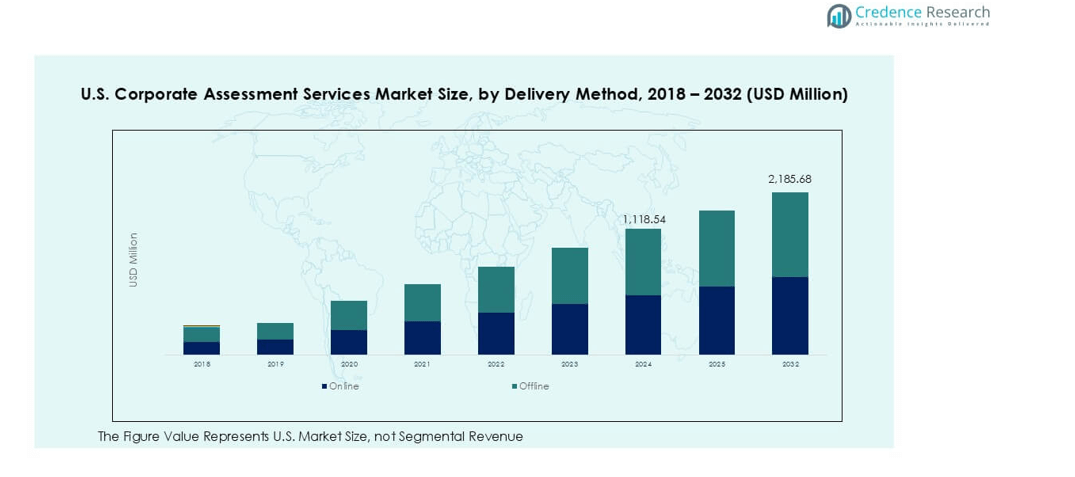

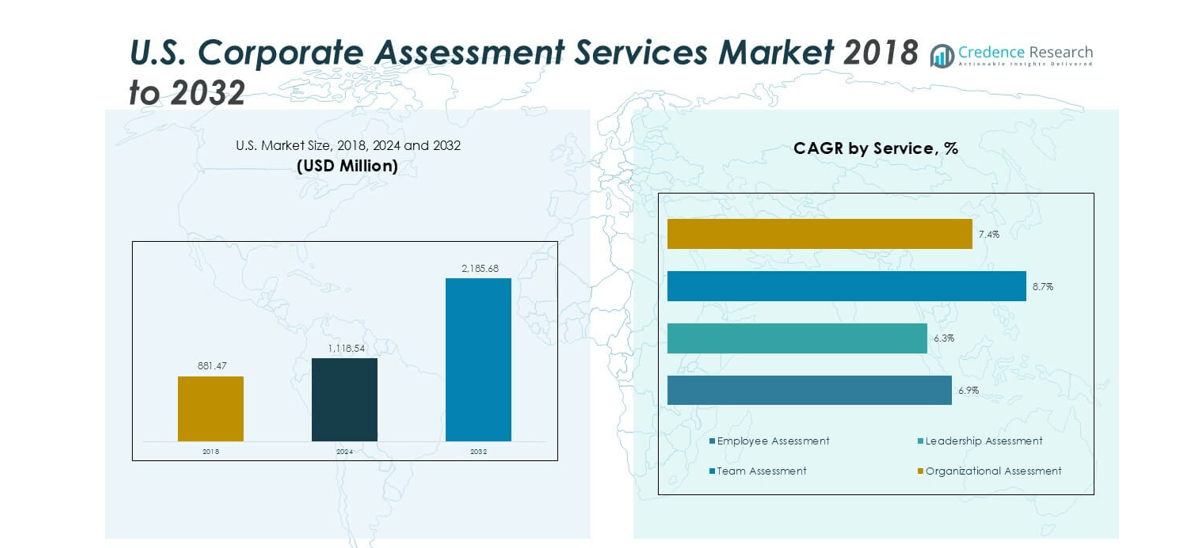

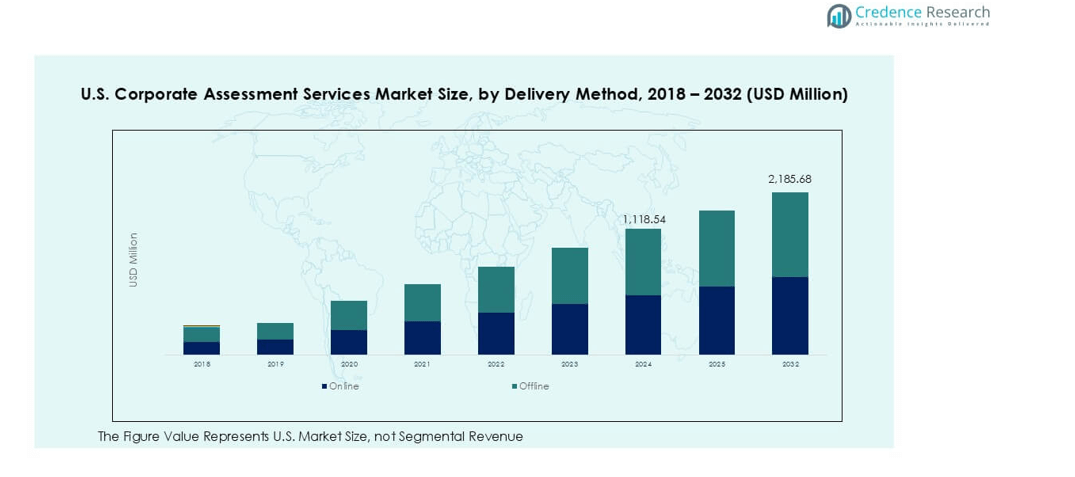

The U.S. Corporate Assessment Services market size was valued at 881.47 million in 2018, growing to 1,118.54 million in 2024, and is projected to reach 2,185.68 million by 2032, expanding at a CAGR of 8.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Corporate Assessment Services Market Size 2024 |

USD 1,118.54 million |

| U.S. Corporate Assessment Services Market, CAGR |

8.73% |

| U.S. Corporate Assessment Services Market Size 2032 |

USD 2,185.68 million b |

The U.S. corporate assessment services market is led by major players such as Aon plc, SHL Group Ltd., Korn Ferry, Mercer, Hogan Assessments, IBM Corporation, DDI (Development Dimensions International), HireVue, Criteria Corp, and The Predictive Index. These companies dominate through advanced psychometric tools, AI-enabled analytics, and leadership development solutions tailored to enterprise needs. The South region leads the market with a 31% share, driven by expanding corporate hubs in Texas, Florida, and Georgia. The Northeast follows with 29%, supported by strong demand from financial and consulting sectors. Technological innovation, digital integration, and growing emphasis on data-driven talent management continue to define competitive advantage across these regions.

Market Insights

- The U.S. Corporate Assessment Services market was valued at 1,118.54 million in 2024 and is projected to reach 2,185.68 million by 2032, growing at a CAGR of 8.73%.

- Key growth drivers include rising demand for data-driven talent evaluation, leadership development, and AI-enabled psychometric tools across industries.

- Market trends show increased adoption of cloud-based assessment platforms, AI integration for predictive analytics, and growing focus on diversity and inclusion in workforce assessments.

- The market is competitive, with leading players such as Aon plc, SHL Group Ltd., Korn Ferry, Mercer, Hogan Assessments, and IBM Corporation, focusing on innovation and strategic expansion.

- Regionally, the South region leads with 31% share, followed by the Northeast at 29%, while by service type, employee assessment holds 42% share, reflecting strong enterprise adoption nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

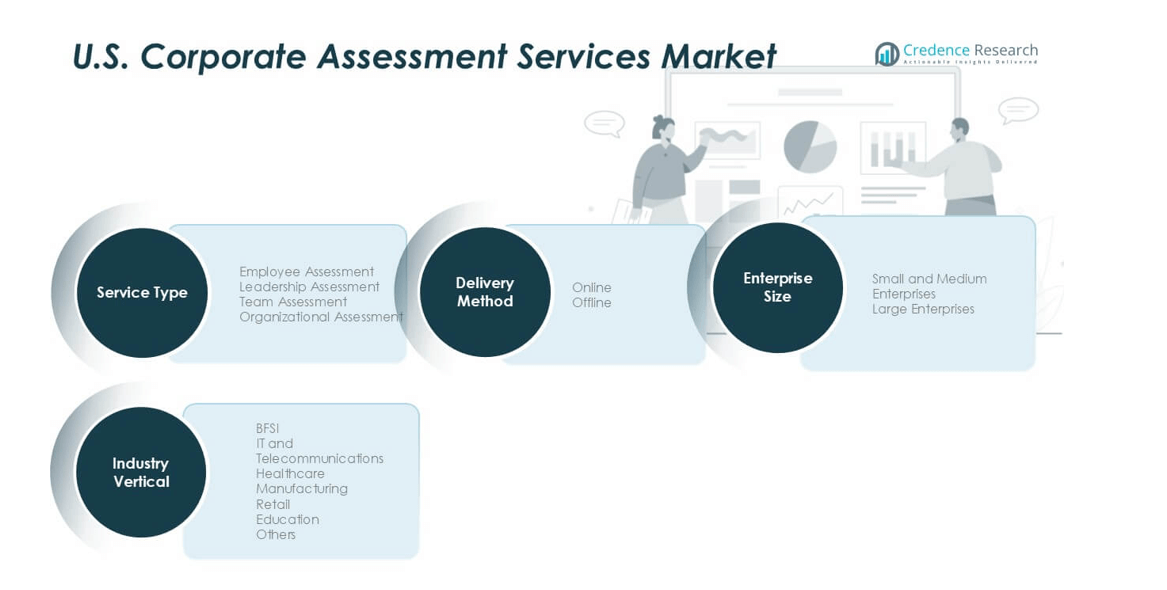

Market Segmentation Analysis:

By Service Type

The employee assessment segment dominated the U.S. corporate assessment services market in 2024 with a 42% share. Its dominance is driven by rising demand for data-driven hiring, talent benchmarking, and competency mapping across organizations. Companies are increasingly using psychometric and cognitive assessments to enhance recruitment efficiency and reduce turnover. The growing integration of AI and analytics in employee testing platforms is improving precision and scalability. Leadership and team assessments are also expanding steadily as businesses prioritize leadership pipeline development and collaboration optimization within hybrid work environments.

- For instance, SHL introduced its TalentCentral AI suite, which uses machine learning models to enhance predictive hiring accuracy, processing over 35 million assessments annually and operating in more than 150 countries.

By Industry Vertical

The BFSI sector held the leading share of 27% in 2024, owing to its focus on risk management, compliance, and performance-based evaluation frameworks. Financial institutions rely on advanced assessment tools to identify skill gaps, enhance productivity, and meet regulatory standards. The IT and telecommunications sector follows closely, supported by rising digital transformation and continuous learning initiatives. Healthcare and manufacturing industries are adopting customized behavioral and technical assessments to improve workforce adaptability. Education and retail sectors are witnessing increased use of online assessment platforms for training and performance evaluation.

- For instance, Cappfinity partnered with HSBC to deploy its online cognitive testing platform for over 60,000 applicants annually, improving hiring efficiency and compliance evaluation across its U.S. operations.

By Enterprise Size

Large enterprises accounted for the largest market share of 61% in 2024, driven by their structured talent development frameworks and higher investment in assessment technologies. These organizations use enterprise-grade platforms for leadership assessment, succession planning, and competency analytics. The growing shift toward predictive performance evaluation further supports adoption among large corporations. Small and medium enterprises are rapidly increasing usage as cloud-based and subscription-based models lower implementation costs. Rising awareness of employee productivity and engagement metrics among SMEs is expected to accelerate adoption through the forecast period.

Key Growth Drivers

Rising Demand for Data-Driven Talent Decisions

Organizations across the U.S. are increasingly adopting data-driven approaches to talent acquisition and management. Corporate assessment services enable HR teams to evaluate behavioral, cognitive, and technical competencies objectively. With the growing focus on reducing hiring bias and improving employee retention, companies are leveraging AI-based assessment tools to analyze candidate potential beyond resumes. Advanced analytics support predictive hiring decisions, linking assessment outcomes to performance metrics and long-term success. The integration of data analytics, machine learning, and psychometrics in recruitment and workforce planning is significantly driving market expansion among both large enterprises and SMEs.

- For instance, HireVue employs its AI-driven video interview platform, which has analyzed more than 70 million candidate interviews across 40 countries, using over 25,000 validated data points to assess communication skills, problem-solving, and role fit accuracy.

Growing Emphasis on Leadership and Skill Development

Leadership assessment programs are gaining traction as organizations aim to build resilient leadership pipelines. Companies are investing in customized leadership evaluation tools to identify high-potential employees and nurture managerial capabilities. As hybrid work environments evolve, assessing soft skills such as adaptability, collaboration, and decision-making has become crucial. Continuous learning and leadership readiness programs supported by digital platforms enhance succession planning and organizational growth. The rising focus on upskilling initiatives, executive coaching, and talent mobility further supports demand for comprehensive assessment frameworks across sectors like IT, BFSI, and healthcare.

- For instance, Korn Ferry has a long history and broad reach with its leadership assessment tools, which are used to evaluate millions of professionals across various organizations. Its Leadership Architect is a widely applied competency framework for identifying and developing leadership capabilities.

Technological Integration Enhancing Assessment Accuracy

echnology advancements are transforming the corporate assessment landscape by improving precision, scalability, and user experience. AI, natural language processing, and cloud-based systems enable personalized and remote assessments, offering deeper insights into employee performance and engagement. Gamified and virtual simulations are being increasingly used to enhance candidate experience and minimize test fatigue. Data analytics also helps organizations identify future skill requirements and track performance trends. This digital transformation across HR and talent management processes is fueling adoption, allowing firms to align workforce capabilities with evolving business strategies efficiently.

Key Trends & Opportunities

Adoption of AI-Powered and Remote Assessment Platforms

A major trend shaping the market is the widespread use of AI-enabled and remote assessment platforms. These technologies allow companies to conduct assessments seamlessly across geographies, reducing logistical costs and time-to-hire. Predictive analytics enhances accuracy in candidate evaluation, while AI algorithms detect behavioral traits and cognitive patterns. The adoption of chatbots, video interviews, and virtual simulations further personalizes the process. As remote work and hybrid models persist, digital assessment ecosystems are becoming essential for maintaining fairness, transparency, and consistency in employee evaluation.

- For instance, SHL has deployed its Virtual Assessment & Development Center, which processes over 15 million online assessments annually across 150 countries, integrating AI-driven behavioral analytics to evaluate leadership potential and job readiness.

Increasing Focus on Diversity, Equity, and Inclusion (DEI)

Organizations are prioritizing DEI-focused assessment practices to build inclusive workplaces and reduce unconscious bias. Advanced assessment tools now incorporate anonymized testing, cultural intelligence metrics, and fairness audits to ensure equitable evaluations. Companies are investing in solutions that assess emotional intelligence and cross-cultural adaptability. This shift aligns with corporate governance goals and enhances brand reputation. As regulatory frameworks evolve, DEI compliance through structured assessment methodologies is expected to create significant opportunities for service providers offering inclusive, bias-free evaluation systems.

Key Challenges

Data Privacy and Compliance Concerns

The increasing use of digital and AI-based assessment tools raises major concerns about data privacy and compliance. Companies must ensure adherence to U.S. data protection laws such as CCPA and GDPR-like state regulations when handling sensitive employee data. Breaches or misuse of assessment data can lead to reputational damage and legal consequences. Service providers face pressure to maintain transparency in data collection, storage, and algorithmic decision-making. Ensuring cybersecurity, encryption, and ethical use of AI in assessments remains a critical challenge that could slow adoption in highly regulated sectors.

Resistance to Change and Integration Barriers

Many organizations still face internal resistance when adopting digital assessment tools due to legacy systems and traditional HR practices. Integration of new platforms with existing HRMS and learning management systems often requires significant time and investment. Smaller enterprises may lack skilled personnel to interpret analytics-driven results effectively. Additionally, employees may perceive assessments as intrusive or punitive if not implemented with transparency. Overcoming these cultural and operational barriers remains a key challenge for service providers seeking widespread adoption of modern corporate assessment solutions across industries.

Regional Analysis

Northeast U.S.

The Northeast region accounted for 29% of the U.S. corporate assessment services market in 2024, driven by the strong presence of financial, technology, and consulting firms. States such as New York, Massachusetts, and Pennsylvania lead demand due to high adoption of digital HR analytics and leadership assessment programs. Large enterprises in this region prioritize executive development and diversity-focused evaluation frameworks. The growing emphasis on workforce analytics in industries like BFSI and education further accelerates adoption, supported by advanced HR tech startups and widespread use of AI-based recruitment platforms.

Midwest U.S.

The Midwest held a 22% share of the market in 2024, supported by strong industrial and manufacturing bases across Illinois, Michigan, and Ohio. Companies in this region increasingly rely on employee and team assessment tools to improve productivity and operational efficiency. Manufacturing firms are integrating psychometric and behavioral assessments into workforce planning to address skill shortages. The region also benefits from growing demand in healthcare and retail sectors for talent benchmarking and training optimization. Expanding digital transformation initiatives in mid-sized firms are further fueling the adoption of scalable assessment solutions.

South U.S.

The South region captured 31% of the corporate assessment services market in 2024, making it the leading regional segment. States like Texas, Florida, and Georgia are experiencing rising adoption across diverse sectors, including IT, telecom, and financial services. Rapid corporate expansion, strong startup ecosystems, and investment in leadership training programs drive demand. Organizations increasingly prefer cloud-based platforms for employee evaluation and succession planning. The region’s growing pool of small and medium enterprises is also contributing to market growth through affordable digital assessment tools aimed at improving hiring accuracy and workforce development.

West U.S.

The West accounted for 18% of the U.S. corporate assessment services market in 2024, led by California, Washington, and Colorado. The region’s dominance in technology and innovation sectors supports demand for AI-driven and gamified assessment tools. Tech firms emphasize cognitive and behavioral evaluations to enhance recruitment and leadership potential. The expanding presence of major software and HR analytics providers further strengthens market penetration. Additionally, growing emphasis on remote work, employee engagement, and performance analytics among startups and large enterprises positions the West as a high-growth region for assessment service providers.

Market Segmentations:

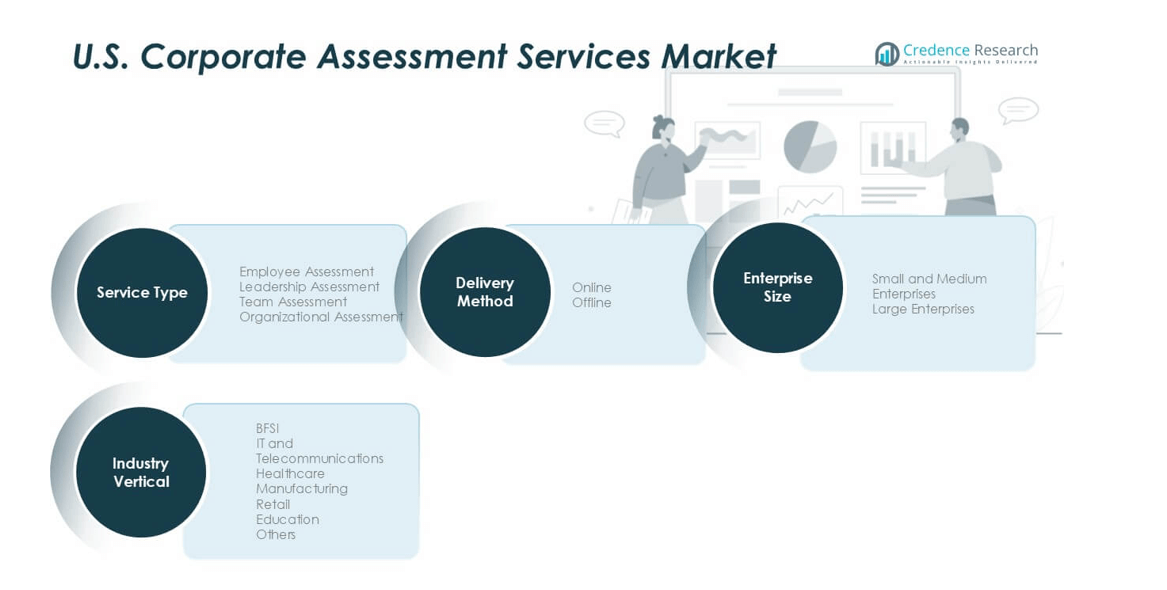

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- Northeast U.S.

- Midwest U.S.

- South U.S.

- West U.S.

Competitive Landscape

The U.S. corporate assessment services market is highly competitive, characterized by global consulting firms, specialized assessment providers, and technology-driven HR solution vendors. Leading players such as Aon plc, SHL Group Ltd., Korn Ferry, Hogan Assessments, and Mercer dominate through comprehensive talent analytics, leadership assessment, and psychometric testing platforms. These companies focus on innovation, AI integration, and data-driven insights to enhance workforce evaluation accuracy. Emerging providers like HireVue, Criteria Corp, and The Predictive Index are gaining traction by offering video-based, gamified, and behavioral assessments tailored for modern recruitment processes. Partnerships, product expansion, and strategic acquisitions remain key growth strategies, enabling providers to broaden their client base across industries such as BFSI, IT, healthcare, and manufacturing. Increasing emphasis on digital transformation, diversity inclusion, and remote workforce evaluation continues to intensify competition and drive continuous innovation within the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aon plc

- SHL Group Ltd.

- Hogan Assessments

- Korn Ferry

- Mercer

- IBM Corporation

- DDI – Development Dimensions International

- HireVue

- Criteria Corp

- The Predictive Index (PI Behavioral Assessment)

- CEB (now part of Gartner)

- Talent Plus Inc.

- Thomas International

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and analytics-driven assessment tools will continue to accelerate.

- Cloud-based platforms will dominate due to flexibility and scalability in workforce evaluation.

- Leadership and succession assessments will expand as companies prioritize internal talent pipelines.

- Demand for DEI-focused assessments will rise to promote fair and inclusive workplaces.

- Integration of gamified and immersive assessments will enhance candidate engagement.

- Small and medium enterprises will increase adoption through affordable digital solutions.

- Data privacy and ethical AI standards will become core priorities for service providers.

- Continuous learning and reskilling assessments will gain importance across industries.

- Collaboration between HR tech firms and consulting companies will strengthen service offerings.

- Regional growth will be strongest in the South and Northeast, driven by corporate expansion and digital transformation initiatives.