Market Overview

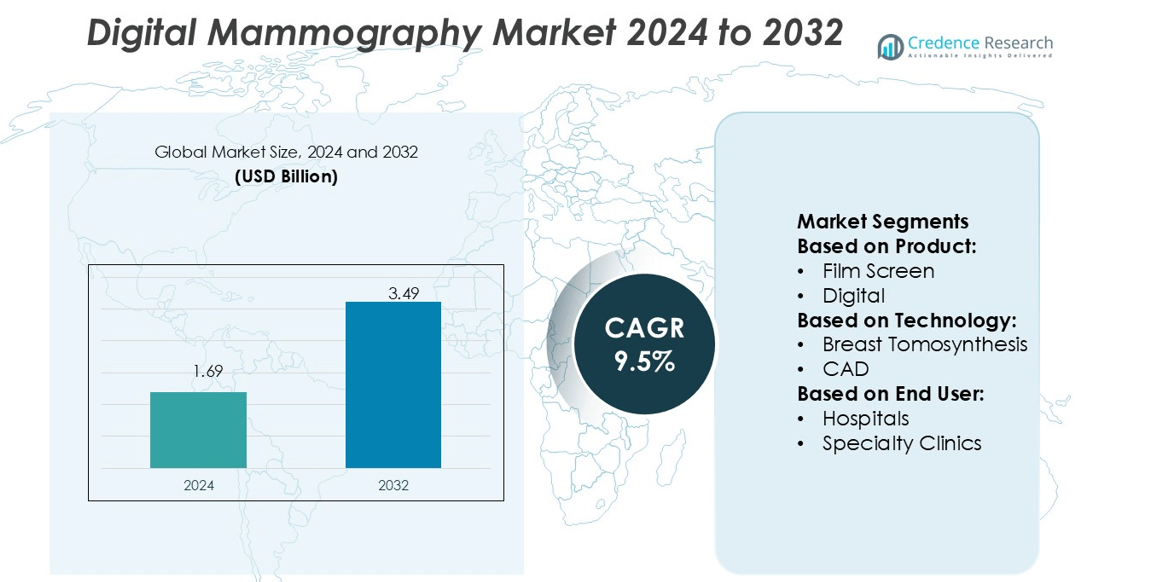

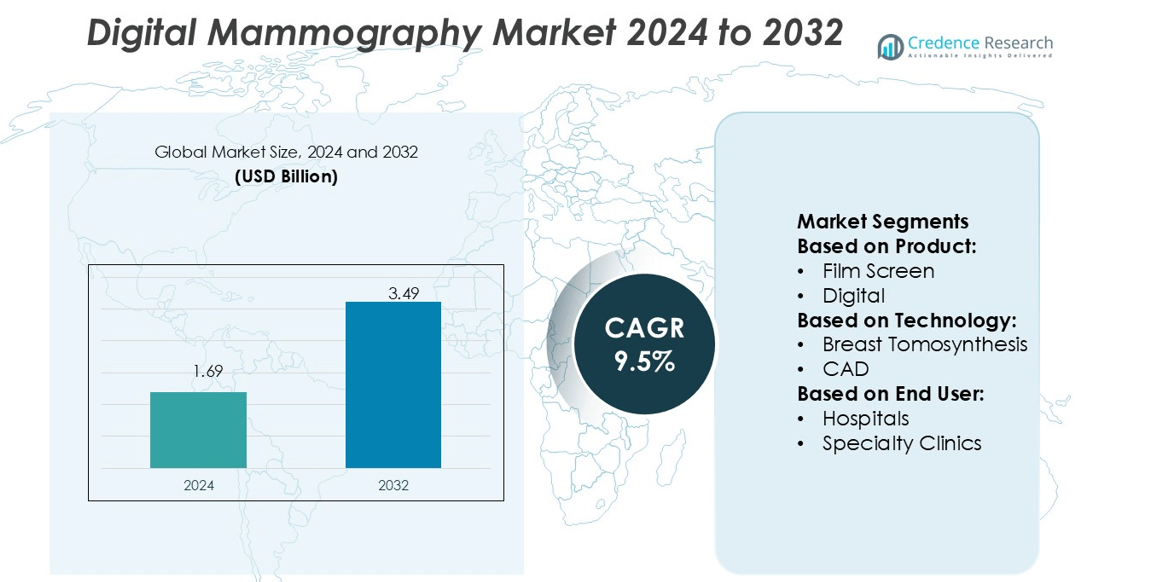

Digital Mammography Market size was valued USD 1.69 billion in 2024 and is anticipated to reach USD 3.49 billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Mammography Market Size 2024 |

USD 1.69 billion |

| Digital Mammography Market, CAGR |

9.5% |

| Digital Mammography Market Size 2032 |

USD 3.49 billion |

The digital mammography market is shaped by major players such as Genoray, Planmed, Siemens Healthineers, IDETEC Medical Imaging, Fujifilm Holdings, Koninklijke Philips, Hologic, SINO MDT, IMS Giotto, and GE Healthcare. These companies focus on product innovation, AI integration, and advanced tomosynthesis to enhance imaging precision and screening efficiency. Strategic collaborations with healthcare providers and government programs strengthen their global presence. North America leads the market with a 38% share, supported by advanced healthcare infrastructure, high screening rates, and favorable reimbursement policies. Strong investments in technology and established screening programs position the region as the key hub for digital mammography adoption and innovation.

Market Insights

- The digital mammography market was valued at USD 1.69 billion in 2024 and is expected to reach USD 3.49 billion by 2032, growing at a CAGR of 9.5%.

- Rising breast cancer incidence and growing awareness of early detection are driving strong adoption across hospitals and diagnostic centers, with 3D mammography holding the largest product segment share.

- AI integration and tomosynthesis advancements are setting major trends, enabling higher accuracy, lower recall rates, and faster screening workflows.

- High equipment costs and limited access to skilled radiologists in developing regions remain key restraints, impacting broader technology penetration.

- North America leads the market with a 38% share, followed by Europe with 29% and Asia Pacific with 22%, while strong competition among Genoray, Planmed, Siemens Healthineers, IDETEC Medical Imaging, Fujifilm Holdings, Koninklijke Philips, Hologic, SINO MDT, IMS Giotto, and GE Healthcare drives innovation and regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The digital mammography market is segmented into film screen, digital, analog, and 3D mammography. The 3D mammography segment dominates the market with the largest share. This leadership is driven by its high image resolution and early cancer detection accuracy. The technology reduces false positives, improving patient outcomes and clinical confidence. Increasing adoption in breast cancer screening programs further strengthens this segment’s position. Major healthcare providers favor 3D systems due to their enhanced diagnostic capabilities and workflow efficiency, which align with evolving breast cancer screening guidelines and value-based care models.

- For instance, Genoray Papaya 3D (a Cone Beam Computed Tomography, or CBCT, system) Dental imaging for diagnostics, implantology, endodontics, and orthodontics. Varies depending on the field of view, with high-resolution settings of 75 microns for specific applications like endodontics.

By Technology

The technology segment includes breast tomosynthesis, CAD (computer-aided detection), and digital mammography. Breast tomosynthesis holds the dominant share, supported by growing demand for advanced imaging solutions. The technology provides 3D visualization of breast tissue, enabling better tumor localization and reducing recall rates. Hospitals and diagnostic centers increasingly prefer tomosynthesis for its superior clinical accuracy. Rising reimbursement approvals and technological upgrades by key manufacturers are also fueling growth. Integration with AI-based diagnostic tools further enhances detection precision, driving widespread adoption across both developed and emerging markets.

- For instance, Planmed Oy manufactures the Clarity™ 3D system. The digital breast tomosynthesis (DBT) system for breast imaging. The system acquires 15 low-dose projection images at +/- 15degree angles.

By End User

End users in the market include hospitals, specialty clinics, and diagnostic centers. Hospitals lead this segment with the highest market share due to their advanced infrastructure and high patient volumes. Many hospitals are integrating digital mammography with electronic health records for better clinical workflows. The growing number of breast cancer screening programs and government initiatives for early detection also support hospital adoption. Additionally, hospitals often benefit from favorable reimbursement policies and access to skilled radiologists, which strengthens their role as the primary setting for digital mammography services.

Key Growth Drivers

Rising Breast Cancer Incidence Globally

The increasing prevalence of breast cancer is driving strong demand for advanced screening solutions. Early detection significantly improves treatment outcomes, encouraging healthcare systems to adopt digital mammography. Governments and health organizations are investing in large-scale screening programs to address growing disease burdens. This rising need for accurate and efficient diagnostics has positioned digital mammography as a preferred choice over traditional methods. The technology’s ability to provide detailed imaging and reduce false positives supports its rapid integration across hospitals and diagnostic centers worldwide.

- For instance, Siemens Healthineers does manufacture the MAMMOMAT Revelation system. The system’s detector size is accurately stated as 24 cm x 30 cm.The system is used for digital mammography and breast tomosynthesis to enhance lesion visibility and aid in the detection of early breast cancer.

Technological Advancements in Imaging

Continuous innovation in imaging technology is accelerating market growth. Digital mammography systems now offer high-resolution imaging, lower radiation exposure, and faster results. Features like breast tomosynthesis and AI-powered image analysis enhance diagnostic precision and workflow efficiency. These advancements allow radiologists to detect smaller lesions and improve screening accuracy. Leading manufacturers are also focusing on user-friendly and cost-effective solutions, expanding accessibility in both developed and emerging regions. This rapid technological evolution is strengthening clinical outcomes and increasing adoption across healthcare networks.

- For instance, Fujifilm continues to push mammography innovation with its AMULET and ASPIRE series. The AMULET Innovality system uses a direct-conversion amorphous selenium (a-Se) flat panel detector with a 50 µm hexagonal pixel pitch, supporting tomosynthesis acquisition over ±20° in HR mode.

Government and Private Screening Initiatives

Supportive government policies and private health programs are increasing access to breast cancer screening. National initiatives encourage early detection through subsidized or free mammography tests, especially for women over 40. Private healthcare providers are also launching awareness campaigns and mobile screening services to reach rural populations. These programs enhance patient participation rates and drive equipment demand. Strong funding for preventive healthcare and improved infrastructure is creating a favorable environment for digital mammography market expansion in both urban and underserved areas

Key Trends & Opportunities

Integration of AI and Machine Learning

The integration of AI and machine learning into digital mammography is transforming breast cancer screening. AI-assisted tools support radiologists in detecting subtle abnormalities with greater accuracy and speed. This reduces human error and improves early diagnosis rates. Several manufacturers are integrating AI algorithms into tomosynthesis systems, making advanced diagnostics more efficient. Hospitals adopting AI solutions benefit from faster reporting times and optimized patient workflows. This growing trend offers strong opportunities for product differentiation and new service models in the global market.

- For instance, Hologic does manufacture the 3Dimensions tomosynthesis system.The system uses a detector with a 70-µm pixel pitch. The system reconstructs tomosynthesis slices at 1 mm intervals.

Expansion in Emerging Markets

Emerging economies are witnessing rapid growth in digital mammography adoption due to increasing healthcare investments. Governments are expanding public screening programs and upgrading diagnostic infrastructure. Rising awareness among women and growing urbanization are also boosting screening rates. Manufacturers are launching cost-effective, portable mammography systems to serve rural and semi-urban areas. These developments are opening significant opportunities for market players to strengthen their presence in high-growth regions such as Asia Pacific, Latin America, and the Middle East.

- For instance, SINO MDT is a manufacturer of medical equipment, including digital mammography systems under the Navigator brand. The Navigator 3000A Series is a high-end digital mammography system that is marketed as a tomosynthesis (3D) model, although some versions may have been initially offered with an upgrade path from 2D functionality.

Shift Toward Personalized Screening

The shift from general to personalized breast cancer screening is gaining momentum. Digital mammography systems are increasingly being used in risk-based screening programs tailored to individual patient profiles. This approach improves detection efficiency and reduces unnecessary follow-ups. Advancements in imaging technology and AI-based risk assessment tools support this transition. Healthcare providers adopting personalized strategies can optimize resource utilization and enhance patient outcomes, creating new opportunities for manufacturers and service providers in the market.

Key Challenges

High Equipment and Maintenance Costs

The high cost of digital mammography systems remains a major barrier, especially for smaller healthcare facilities. Advanced imaging equipment requires significant investment in installation, maintenance, and staff training. This financial burden limits adoption in resource-constrained settings and rural areas. Many facilities rely on government subsidies or partnerships to manage these expenses. The lack of affordable options for low-income regions could slow market penetration, creating disparities in access to advanced breast cancer screening services.

Shortage of Skilled Radiologists

A shortage of trained radiologists and technologists poses a challenge to effective digital mammography implementation. Accurate interpretation of mammograms requires specialized expertise, which is often limited in rural and underserved areas. This skill gap can lead to diagnostic delays and affect patient outcomes. While AI-based tools are helping bridge some of this gap, they cannot fully replace human expertise. Expanding training programs and improving access to qualified personnel remain essential for sustaining market growth and ensuring quality screening services.

Regional Analysis

North America

North America dominates the digital mammography market with a 38% share. The strong position is driven by advanced healthcare infrastructure, widespread screening programs, and favorable reimbursement policies. The U.S. leads the region due to high awareness of breast cancer and rapid adoption of technologies such as tomosynthesis and AI-based diagnostics. Government-funded initiatives, including population-based screening programs, further support growth. Major players actively invest in innovation and product launches to strengthen their footprint. High spending on healthcare and continuous upgrades in imaging facilities maintain North America’s leadership in this market.

Europe

Europe holds a 29% share of the digital mammography market, supported by well-established screening frameworks and public health initiatives. Countries such as Germany, France, and the U.K. lead adoption due to government-funded breast cancer screening programs. High awareness, strong regulatory support, and advanced hospital infrastructure encourage rapid technology penetration. Integration of AI tools and 3D imaging into national screening programs is boosting demand. Additionally, collaborations between healthcare providers and manufacturers enhance access to innovative solutions. Europe remains a key region for product innovation and early adoption of advanced diagnostic imaging technologies.

Asia Pacific

Asia Pacific accounts for 22% of the market, representing one of the fastest-growing regions. Rising breast cancer incidence, expanding healthcare infrastructure, and increasing government investments are key drivers. Countries such as China, Japan, and India are rapidly adopting digital mammography solutions through national screening programs and public-private partnerships. Growing awareness among women and technological advancements, including portable and cost-effective systems, are boosting accessibility. Global manufacturers are expanding their presence to capture unmet demand. Rapid urbanization, rising disposable incomes, and healthcare modernization support sustained growth in this region.

Latin America

Latin America holds an 8% market share, driven by improving healthcare access and expanding cancer awareness programs. Brazil and Mexico are leading adopters due to public screening initiatives and hospital infrastructure upgrades. Regional governments are investing in diagnostic imaging to address rising breast cancer rates. However, limited funding and uneven resource distribution across rural areas present challenges. Manufacturers are targeting this region with affordable and mobile mammography units to expand screening reach. Ongoing health reforms and private sector participation are expected to enhance market penetration and strengthen growth opportunities.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share of the digital mammography market. Growth is supported by improving healthcare systems, increasing awareness campaigns, and gradual adoption of advanced diagnostic technologies. Countries such as the UAE and Saudi Arabia are investing heavily in healthcare modernization. International collaborations and government initiatives are enhancing breast cancer screening rates. However, limited infrastructure and high equipment costs restrain wider adoption across low-income countries. Mobile screening programs and partnerships with private healthcare providers are helping bridge accessibility gaps and expand early detection efforts.

Market Segmentations:

By Product:

By Technology:

By End User:

- Hospitals

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the digital mammography market features key players such as Genoray, Planmed, Siemens Healthineers, IDETEC Medical Imaging, Fujifilm Holdings, Koninklijke Philips, Hologic, SINO MDT, IMS Giotto, and GE Healthcare. The digital mammography market is defined by strong technological innovation and strategic expansion. Companies are focusing on advanced imaging solutions, integrating AI, and enhancing tomosynthesis capabilities to improve diagnostic accuracy and patient outcomes. Continuous investment in research and development supports the launch of systems with higher resolution, lower radiation exposure, and faster image processing. Strategic collaborations with hospitals, diagnostic centers, and public screening programs strengthen market presence. Manufacturers are also targeting emerging markets with cost-efficient and portable systems to expand access. Software advancements, cloud connectivity, and regulatory compliance further shape the competitive strategies across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genoray

- Planmed

- Siemens Healthineers

- IDETEC Medical Imaging

- Fujifilm Holdings

- Koninklijke Philips

- Hologic

- SINO MDT

- IMS Giotto

- GE Healthcare

Recent Developments

- In January 2025, Siemens Healthineers announced the first U.S. installation of its Mammomat B.brilliant mammography system. This system incorporates advanced 3D image acquisition and reconstruction technology, along with features for full-field digital mammography, breast biopsy, and titanium contrast-enhanced imaging.

- In November 2024, GE HealthCare introduced the Pristina Via mammography system, an enhancement of the Senographe Pristina platform. This system aims to improve screening experience for both technologists and patients. The launch underscores GE HealthCare’s leadership in women’s health imaging and bolsters its market presence through innovation and operational efficiency.

- In November 2024, Hologic, Inc. unveiled the Envision Mammography Platform at the Radiological Society of North America (RSNA). This platform provides patients a high-speed Hologic 3D mammogram featuring an industry-leading scan time of 2.5 seconds.

- In June 2024, FUJIFILM’s India Healthcare Division launched its first Skill Lab in partnership with NM Medical Mumbai to provide advanced training in full-field digital mammography technologies for radiographers and radiologists

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for early breast cancer detection will drive strong adoption of digital mammography.

- AI integration will enhance diagnostic accuracy and reduce reading time.

- Portable and mobile mammography units will expand access in rural areas.

- Cloud-based data sharing will improve collaboration among healthcare providers.

- Advancements in tomosynthesis will strengthen screening and diagnostic capabilities.

- Emerging markets will witness rapid adoption through government screening programs.

- Product innovation will focus on lower radiation dose and improved image clarity.

- Personalized breast screening programs will gain more attention and investment.

- Strategic partnerships will expand distribution networks and service coverage.

- Regulatory support and favorable screening guidelines will accelerate market growth.