Market Overview

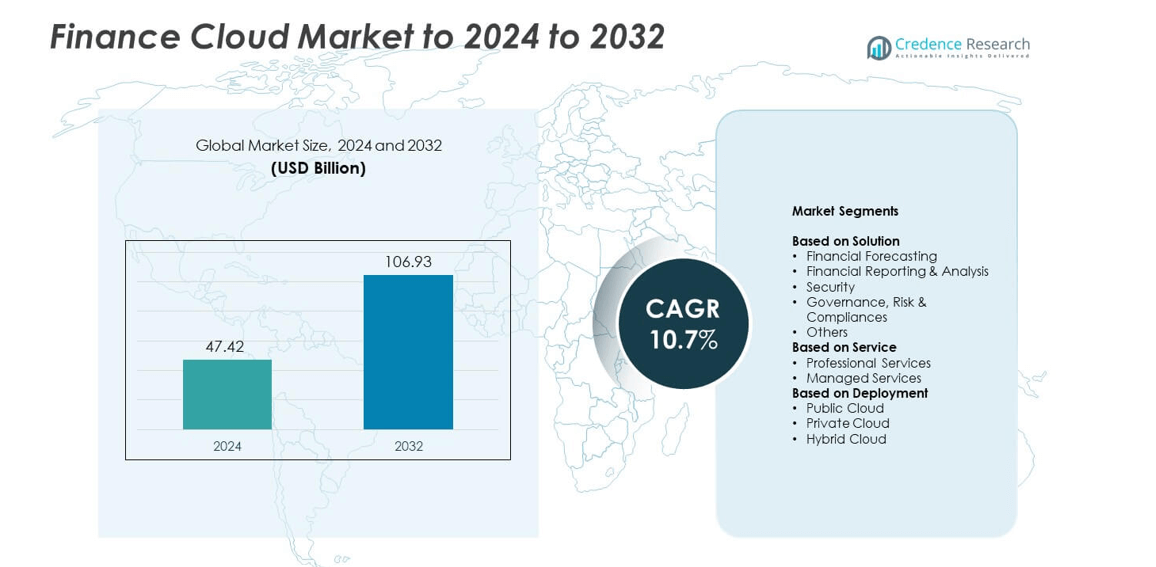

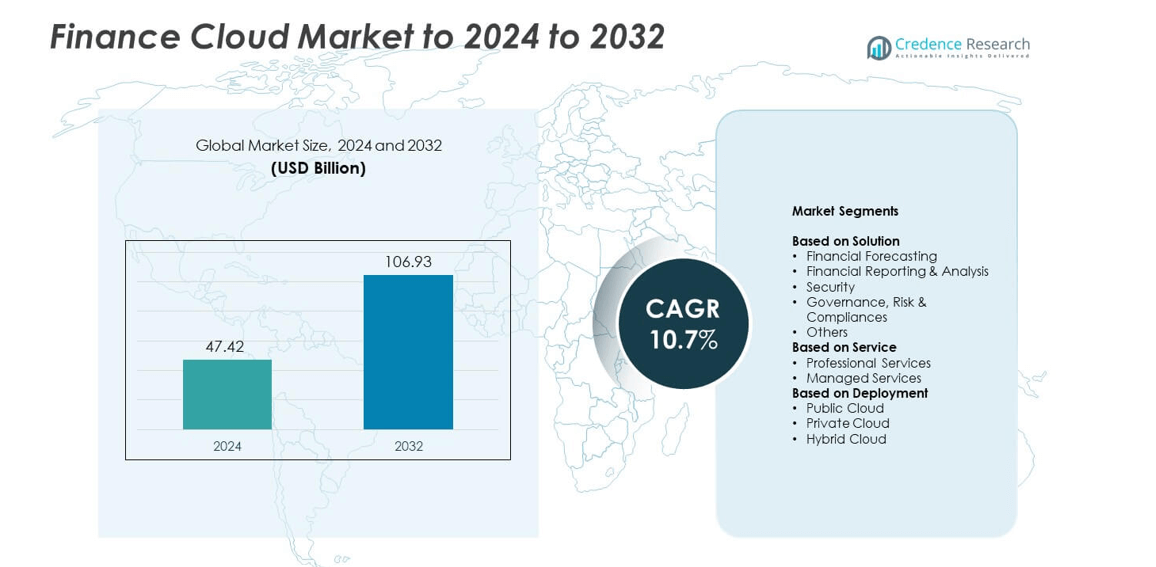

Finance Cloud Market size was valued at USD 47.42 billion in 2024 and is anticipated to reach USD 106.93 billion by 2032, at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Finance Cloud Market Size 2024 |

USD 47.42 billion |

| Finance Cloud Market, CAGR |

10.7% |

| Finance Cloud Market Size 2032 |

USD 106.93 billion |

The Finance Cloud Market features major players such as Microsoft, Amazon Web Services, IBM, Salesforce, Oracle, Google Cloud, Cisco Systems, Wipro, SAP, Sage Group, Acumatica, ARYAKA NETWORKS, and Unit4. These companies focus on expanding cloud-based financial platforms through AI integration, advanced analytics, and secure data management solutions. They invest heavily in hybrid and multi-cloud infrastructures to enhance operational flexibility and compliance. Strategic partnerships with fintech firms and regional service providers are strengthening their market presence. North America led the global market in 2024 with a 38% share, supported by rapid digital adoption, robust IT infrastructure, and strong demand for cloud-driven financial solutions.

Market Insights

- The Finance Cloud Market was valued at USD 47.42 billion in 2024 and is projected to reach USD 106.93 billion by 2032, growing at a CAGR of 10.7%.

- Growing demand for digital banking, AI-driven analytics, and secure financial data management is driving market expansion.

- Cloud integration with AI, big data, and automation is transforming financial operations, improving efficiency and compliance.

- The market is highly competitive, with leading companies focusing on hybrid cloud solutions and partnerships with fintech firms to expand global reach.

- North America led the market with a 38% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while the financial reporting and analysis segment dominated with a 34% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The financial reporting and analysis segment held the dominant share of 34% in 2024. The segment’s growth is driven by rising demand for real-time financial insights, advanced analytics, and automated reporting systems. Financial institutions are adopting AI-driven tools to improve accuracy, transparency, and speed in financial decision-making. Moreover, regulatory compliance and the need for timely financial disclosures further encourage adoption. Cloud-based financial reporting platforms enable seamless integration with ERP systems, allowing companies to streamline operations and gain predictive insights across global financial networks.

- For instance, Workday reports 2,000+ customers on Workday Financial Management.

By Service

The professional services segment led the market with a 59% share in 2024. The dominance is attributed to the increasing need for customized consulting, integration, and implementation services. Financial firms rely on expert service providers to ensure secure migration, data management, and regulatory compliance. As financial institutions transition to cloud-based architectures, the demand for training, auditing, and strategic advisory services continues to expand. These services enhance operational efficiency, reduce downtime, and optimize cloud resource utilization, helping financial organizations adapt quickly to evolving digital infrastructures.

- For instance, Accenture migrated 9 data centers into 3 cloud platforms for SAP SuccessFactors.

By Deployment

The public cloud segment accounted for the largest share of 46% in 2024. Its leadership is supported by cost efficiency, scalability, and easy accessibility offered by major cloud providers. Financial organizations increasingly prefer public cloud platforms for data analytics, risk modeling, and client service management due to lower capital costs and rapid deployment capabilities. Additionally, leading providers such as AWS, Microsoft Azure, and Google Cloud enhance data security and compliance frameworks, encouraging wider adoption. The ongoing shift toward open banking and digital transformation continues to boost public cloud deployment across financial institutions.

Key Growth Drivers

Rapid Digital Transformation in Financial Services

The increasing digitalization of banking, insurance, and asset management sectors is a major growth driver for the finance cloud market. Financial firms are adopting cloud platforms to modernize legacy systems and enhance customer engagement. The move toward digital-first services enables faster transactions, AI-driven analytics, and real-time reporting. Additionally, cloud-based solutions reduce infrastructure costs and improve scalability, supporting both large enterprises and fintech startups in their digital expansion strategies.

- For instance, Chase.com delivers an average of 15 releases weekly after its migration to AWS.

Rising Need for Data Security and Compliance

Growing cybersecurity risks and evolving financial regulations are driving cloud adoption with advanced security features. Finance cloud platforms now integrate multi-layer encryption, identity access management, and regulatory compliance tools. This ensures secure handling of sensitive financial data across public and private cloud environments. Governments and financial authorities are enforcing strict compliance standards, such as GDPR and PCI DSS, which further push organizations toward cloud systems designed for risk management and data governance.

- For instance, AWS lists 143 security standards and certifications in scope.

Integration of AI, ML, and Big Data Analytics

AI and machine learning technologies are transforming financial decision-making, risk analysis, and fraud detection. Cloud-based AI engines enable financial institutions to derive actionable insights from massive datasets. This integration enhances predictive forecasting, personalized financial services, and real-time anomaly detection. The scalability and processing power of the cloud make it ideal for implementing AI-driven financial applications that support better investment strategies, customer segmentation, and operational efficiency.

Key Trends and Opportunities

Growing Adoption of Hybrid and Multi-Cloud Models

Financial institutions are increasingly adopting hybrid and multi-cloud setups to balance performance, security, and flexibility. These models enable firms to use both private and public cloud benefits while avoiding vendor lock-in. Hybrid cloud deployment supports sensitive data storage on private infrastructure while leveraging public cloud for analytics and customer applications. This approach enhances compliance, improves uptime, and opens new opportunities for scalable, cross-platform financial services.

- For instance, Deutsche Bank moved around 260 applications to Google Cloud.

Expansion of Fintech Collaborations and Cloud Ecosystems

Partnerships between cloud service providers and fintech companies are creating new market opportunities. Cloud ecosystems allow fintechs to develop innovative digital banking, lending, and payment solutions faster. Financial institutions gain from these collaborations through accelerated innovation, cost reduction, and broader market reach. The integration of open APIs and Banking-as-a-Service platforms is also expanding access to cloud-native financial applications across global markets.

- For instance, Plaid connects to 12,000+ financial institutions and 8,000+ apps.

Key Challenges

Data Privacy Concerns and Regulatory Barriers

The finance cloud market faces challenges due to stringent data protection laws and cross-border data regulations. Different countries enforce varying compliance frameworks that restrict data transfer and storage practices. Financial institutions often struggle to align cloud operations with local regulatory requirements. These limitations slow cloud adoption in regions with strict financial supervision and increase operational costs for compliance management.

Integration Complexity and Legacy Infrastructure Dependence

Many financial firms still rely on outdated legacy systems that are difficult to integrate with cloud platforms. Transitioning to cloud-based systems often involves complex migration processes, data synchronization issues, and high initial investments. The lack of skilled IT professionals and the risk of operational disruption further delay digital transformation. Overcoming these technical challenges remains critical to achieving seamless, large-scale finance cloud adoption.

Regional Analysis

North America

North America dominated the finance cloud market with a 38% share in 2024. The region’s growth is driven by strong adoption of digital banking, cloud-native fintech platforms, and regulatory support for secure financial data storage. Major U.S. banks and insurance companies are leveraging cloud technologies for AI-driven analytics, fraud detection, and customer personalization. High investments from providers such as AWS, Microsoft Azure, and Google Cloud further enhance the regional market. The increasing shift toward hybrid cloud deployment and open banking frameworks continues to strengthen North America’s leadership in finance cloud adoption.

Europe

Europe accounted for a 27% share of the finance cloud market in 2024. The region’s expansion is supported by rising compliance demands under GDPR and PSD2 regulations, driving financial institutions toward secure cloud infrastructures. Banks across Germany, the U.K., and France are embracing digital transformation to improve efficiency and service transparency. Cloud solutions offering regulatory reporting and risk management features are witnessing strong demand. Additionally, the rapid integration of AI-based financial analytics and sustainable finance initiatives are promoting greater cloud adoption, particularly within the European fintech and asset management sectors.

Asia Pacific

Asia Pacific held a 24% share of the finance cloud market in 2024, emerging as the fastest-growing region. Strong economic growth, high fintech penetration, and increasing mobile banking usage are key drivers. Countries such as China, India, Japan, and Singapore are witnessing rapid adoption of digital payment platforms and online banking services. Cloud vendors are investing heavily to localize data centers and enhance compliance with regional data protection laws. The rise of AI-powered financial tools, blockchain-based solutions, and open banking ecosystems is fueling ongoing expansion in the Asia Pacific market.

Latin America

Latin America captured an 8% share of the finance cloud market in 2024. The region’s financial institutions are rapidly adopting cloud technologies to modernize legacy systems and reduce operational costs. Governments are promoting fintech growth through open banking regulations and digital inclusion programs. Brazil and Mexico lead adoption, supported by growing online banking and payment services. Cloud-based financial analytics and cybersecurity solutions are gaining momentum as regional banks focus on improving customer engagement and transaction security. The region’s expanding fintech ecosystem continues to attract investments from global cloud service providers.

Middle East and Africa

The Middle East and Africa accounted for a 3% share of the finance cloud market in 2024. Growth is supported by government initiatives promoting digital banking and financial inclusion, particularly in the Gulf Cooperation Council countries. Financial institutions are adopting cloud solutions to strengthen risk management and compliance frameworks. The United Arab Emirates and Saudi Arabia are leading markets, driven by fintech partnerships and cloud-enabled payment platforms. Increasing investment in hybrid cloud infrastructures and the development of regional data centers are improving financial system resilience and accelerating market growth across MEA.

Market Segmentations:

By Solution

- Financial Forecasting

- Financial Reporting & Analysis

- Security

- Governance, Risk & Compliances

- Others

By Service

- Professional Services

- Managed Services

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Finance Cloud Market includes Microsoft, Amazon Web Services, Inc., IBM, Salesforce, Oracle, Google Cloud, Cisco Systems, Inc., Wipro, SAP, Sage Group plc, Acumatica, Inc., ARYAKA NETWORKS, INC., and Unit4. The market is characterized by intense competition as companies focus on cloud-native innovation, AI integration, and advanced data analytics. Vendors are investing heavily in secure and scalable cloud infrastructures to meet the rising demand from financial institutions. Strategic collaborations with fintech firms and regulatory technology providers are enhancing platform flexibility and compliance management. Product differentiation is driven by automation, hybrid cloud offerings, and real-time risk assessment tools. Additionally, major providers are expanding regional data centers to meet local data governance requirements and improve latency. Continuous R&D investments, customized service delivery, and advanced cybersecurity solutions are strengthening competitive positioning across global financial enterprises.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft

- Amazon Web Services, Inc.

- IBM

- Salesforce

- Oracle

- Google Cloud

- Cisco Systems, Inc.

- Wipro

- SAP

- Sage Group plc

- Acumatica, Inc.

- ARYAKA NETWORKS, INC.

- Unit4

Recent Developments

- In 2025, IBM Cloud introduced sovereign-cloud and high-performance AI infrastructure aimed at regulated industries, aligning with new DORA obligations.

- In 2024, Salesforce launched new AI-powered capabilities, built on the Einstein 1 Platform, to help banks handle transaction disputes more quickly and efficiently.

- In 2024, Google Cloud partnered with several banks and fintechs, including Citi, Bank Jago, and Klarna, to build cloud-native platforms focused on AI innovation, fraud detection, and modernizing infrastructure

Report Coverage

The research report offers an in-depth analysis based on Solution, Service, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The finance cloud market will continue expanding with strong demand for digital banking solutions.

- AI and machine learning integration will enhance financial forecasting, risk analytics, and fraud detection.

- Hybrid and multi-cloud deployments will become the preferred models among financial institutions.

- Regulatory compliance and data governance solutions will gain greater importance for cloud adoption.

- Fintech collaborations with cloud service providers will accelerate innovation in digital finance.

- Cybersecurity advancements will drive confidence in cloud-based financial platforms.

- Cloud-native applications will streamline payment processing and customer relationship management.

- Open banking and API-driven ecosystems will expand across developed and emerging markets.

- Edge computing and real-time analytics will improve speed and decision-making in financial operations.

- Sustainable and energy-efficient cloud infrastructures will become a key focus for financial organizations.