Market Overview

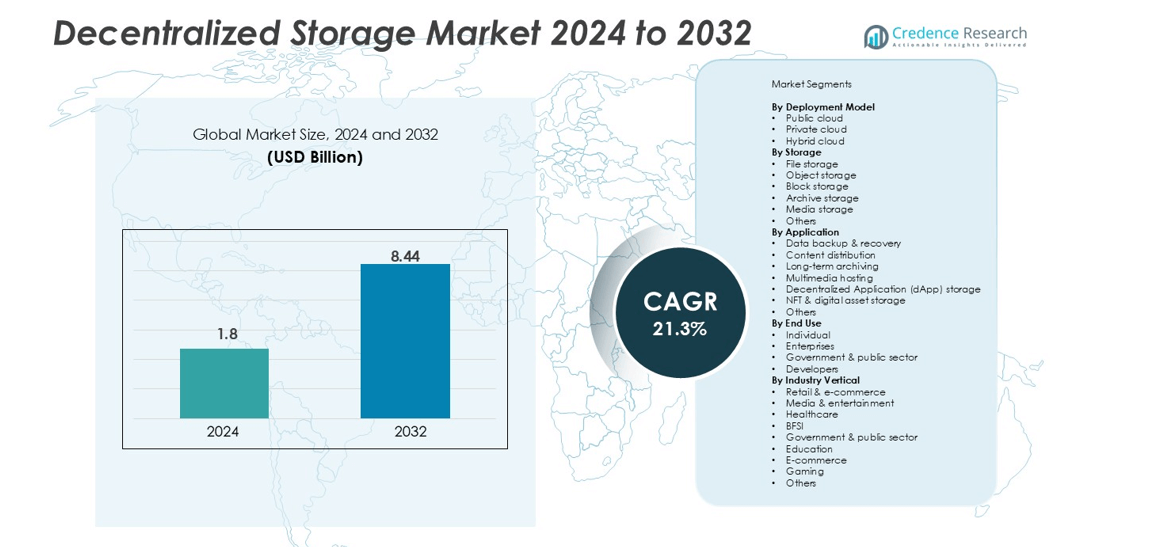

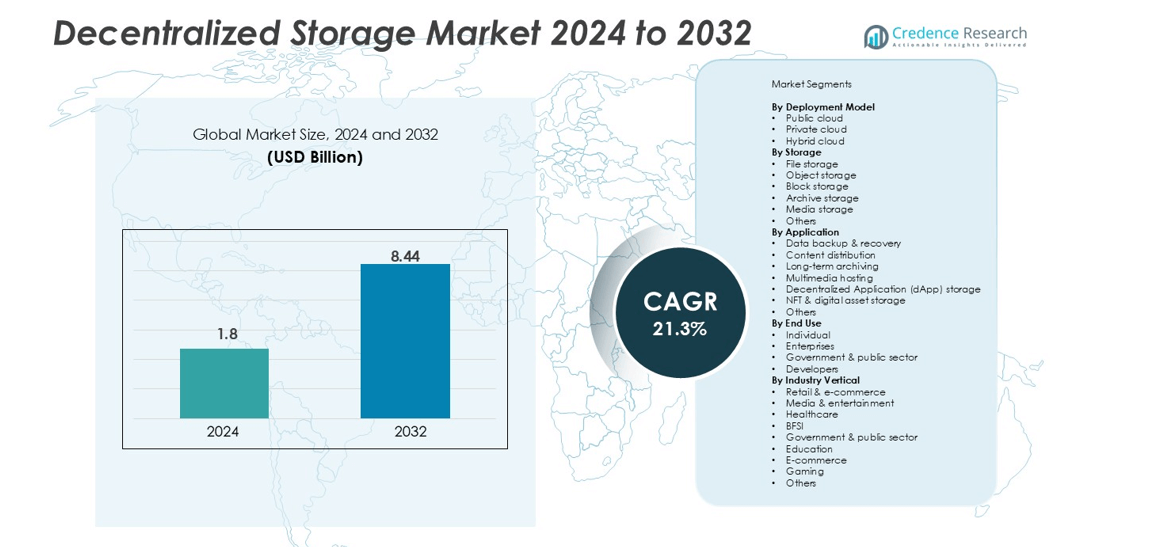

The Decentralized Storage Market size was valued at USD 1.8 billion in 2024 and is anticipated to reach USD 8.44 billion by 2032, at a CAGR of 21.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decentralized Storage Market Size 2024 |

USD 1.8 billion |

| Decentralized Storage Market, CAGR |

21.3% |

| Decentralized Storage Market Size 2032 |

USD 8.44 billion |

The decentralized storage market is led by major players such as Filecoin, Arweave, Storj Labs, Akash Network, BitTorrent (BTFS), Bluzelle, Cere Network, MaidSafe, InterPlanetary File System (IPFS), and The Graph. These companies dominate through scalable, blockchain-based storage solutions supporting Web3, DeFi, and enterprise data applications. Filecoin and Arweave lead in long-term archival storage, while Storj Labs and BTFS excel in distributed cloud frameworks. The Graph strengthens ecosystem interoperability by enabling decentralized data indexing. North America holds the largest market share at 34%, driven by strong developer adoption and Web3 investments. Asia Pacific follows with 29%, fueled by high blockchain adoption and growing digital infrastructure, while Europe accounts for 28%, supported by strict data protection regulations.

Market Insights

- The decentralized storage market was valued at USD 8 billion in 2024 and is projected to reach USD 8.44 billion by 2032, growing at a CAGR of 21.3% during 2024–2032.

- Growing demand for secure, transparent, and censorship-resistant data storage drives adoption across finance, healthcare, and government sectors. Enterprises are shifting from centralized cloud models to decentralized networks for enhanced control and privacy.

- Emerging trends include integration with AI-driven retrieval systems, tokenized storage incentives, and edge computing solutions that reduce latency and improve scalability.

- The market is highly competitive, with leading players such as Filecoin, Arweave, Storj Labs, Akash Network, and BitTorrent (BTFS) expanding through partnerships, blockchain upgrades, and decentralized node participation.

- North America holds 34%, Asia Pacific 29%, and Europe 28% of the global market, while the cloud-integrated segment leads with 41% share due to enterprise-grade scalability and interoperability advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Model

The hybrid cloud segment dominated the decentralized storage market in 2024, holding around 46% of the total share. Its leadership stems from growing enterprise adoption for balancing scalability, security, and cost-efficiency. Hybrid cloud deployment combines public and private infrastructure, enabling organizations to manage sensitive data securely while using decentralized public nodes for redundancy and performance. Businesses across finance, healthcare, and supply chain sectors prefer hybrid setups for regulatory compliance and enhanced interoperability. Rising integration of blockchain-based management layers and cross-cloud compatibility tools further strengthens hybrid cloud adoption in decentralized environments.

- For instance, IBM’s cloud offerings, such as Hybrid Cloud Satellite and Hyper Protect Crypto Services, can be integrated to provide clients with secure, highly controlled data management across hybrid cloud environments.

By Storage Type

Object storage led the market in 2024, capturing approximately 41% of total revenue. Its flexible architecture supports massive unstructured data storage required by decentralized networks. Object storage’s metadata tagging and scalability make it ideal for distributed ledgers, media archives, and NFT hosting. Companies leverage decentralized object storage to enhance reliability and minimize single-point failure risks. The segment’s growth is reinforced by increased demand for efficient replication, faster retrieval, and compatibility with decentralized file systems like IPFS and Filecoin, driving enterprise and Web3 adoption across large-scale data operations.

- For instance, according to a Q2 2024 Filecoin status report from Messari, the Filecoin network added 2.5 PiB (2,500 TB) of new sealed storage per day in mid-2024.

By Application

Data backup and recovery emerged as the dominant application segment, accounting for about 38% of the decentralized storage market in 2024. Organizations rely on blockchain-based distributed backups to ensure tamper-proof, encrypted, and redundant data storage. Decentralized backup solutions reduce downtime and eliminate reliance on centralized providers. This segment’s expansion is supported by enterprises’ growing cybersecurity needs, strict data sovereignty laws, and demand for cost-efficient disaster recovery solutions. Integration with smart contracts and distributed identity management tools also boosts trust, automation, and traceability in data restoration processes across industries.

Key Growth Drivers

Rising Demand for Data Privacy and Control

Organizations and individuals increasingly seek greater control over their data as concerns over breaches, surveillance, and centralized control grow. Decentralized storage solutions address these challenges by encrypting and distributing data across multiple nodes, ensuring privacy and resilience. Unlike traditional cloud storage, users maintain ownership and access rights without third-party oversight. Enterprises in finance, healthcare, and government are adopting decentralized systems to comply with strict data protection laws such as GDPR and HIPAA. This shift toward user-centric storage promotes transparency, accountability, and long-term trust in digital infrastructure.

- For instance, Storj Labs operates over 22,000 active storage nodes globally and enables users to store encrypted files across multiple independent operators, providing high data redundancy and compliance with international privacy standards.

Expansion of Web3 and Blockchain Ecosystems

The expansion of blockchain networks and Web3 applications is a major driver for decentralized storage adoption. Decentralized applications (dApps) rely on distributed systems for data hosting, smart contract execution, and tokenized asset storage. Platforms like Filecoin, Arweave, and Storj are increasingly integrated into NFT marketplaces, DeFi projects, and metaverse applications. These integrations reduce dependency on centralized servers, enhance uptime, and lower data retrieval costs. As developers and enterprises shift toward decentralized architectures, the demand for scalable, interoperable, and transparent storage networks continues to rise globally.

- For instance, the Filecoin network surpassed 1,500 active storage providers and achieved a total storage capacity exceeding 16 exbibytes, supporting large-scale blockchain data and NFT archiving applications across diverse ecosystems.

Growing Adoption of Edge and IoT Technologies

The rapid growth of IoT and edge computing ecosystems generates massive volumes of distributed data. Centralized storage struggles to manage the latency and bandwidth requirements for such real-time data streams. Decentralized storage networks enable localized data storage and faster access by distributing files closer to end users. This approach improves operational efficiency and reduces cloud dependence for connected devices in industries like manufacturing, logistics, and smart cities. The integration of decentralized systems with 5G and AI further supports real-time analytics and secure device-to-device communication.

Key Trends & Opportunities

Integration with Artificial Intelligence and Automation

AI-driven data indexing, retrieval optimization, and automated redundancy management are enhancing decentralized storage performance. Intelligent algorithms help maintain data integrity across distributed nodes, detect failures, and manage load balancing efficiently. These integrations allow systems to self-heal and adapt to varying storage demands, improving scalability and reliability. Startups are focusing on combining AI with decentralized frameworks to enable predictive maintenance and cost optimization. This trend is opening opportunities for AI-managed decentralized infrastructure that can serve as the backbone of the intelligent digital economy.

- For instance, Ocean Protocol integrates AI models with decentralized data marketplaces, enabling automated data curation and analysis across over 18,000 datasets, while projects like iExec use AI-driven task scheduling to optimize distributed compute resources for decentralized applications.

Emergence of Tokenized Incentive Models

Token-based incentives are becoming a defining feature of decentralized storage platforms. Storage providers earn tokens for contributing bandwidth and storage space, creating a self-sustaining economy. This decentralized reward system encourages participation and ensures scalability without centralized control. Projects like Filecoin and Sia have successfully implemented such models, driving higher adoption among both individuals and enterprises. The integration of token economics not only increases network resilience but also introduces new financial models for data management and infrastructure investment.

Key Challenges

Limited Standardization and Interoperability

The decentralized storage ecosystem lacks unified standards, making integration across platforms complex. Different protocols, encryption formats, and APIs hinder seamless data exchange and cross-platform functionality. Businesses often face challenges in migrating from traditional storage to decentralized networks due to compatibility issues. Without standardized frameworks, scalability and enterprise adoption remain restricted. Efforts toward interoperability, such as cross-chain bridges and open APIs, are underway but still face fragmentation across service providers.

High Latency and Network Dependence

Data retrieval speeds in decentralized systems can fluctuate due to variable node performance and network congestion. While decentralized storage ensures redundancy and fault tolerance, latency issues affect applications requiring instant access, such as streaming or real-time analytics. The dependence on network stability and node availability can impact service quality, especially in regions with weak connectivity. Improving caching mechanisms and developing hybrid storage models that combine decentralized and centralized elements are essential to overcome these performance constraints.

Regional Analysis

North America

North America holds the largest market share at 34%, leads with strong Web3 adoption and developer activity. Enterprises test decentralized backups for regulated data and audit trails. Financial services, media, and healthcare show rising pilot conversions. Data residency controls align with U.S. state privacy laws. Hyperscalers explore hybrid integrations with decentralized networks. Startups bundle storage with identity and key management. Edge builds use 5G networks and private clouds. Venture funding, security tooling, and reliable bandwidth support scale.

Europe

Europe accounts for 28%, benefits from strict privacy rules and digital sovereignty goals. GDPR and sector regulations favor user-controlled data storage. Governments back trusted data spaces and secure archives. Public clouds face localization demands from many industries. Decentralized Storage aids portability and vendor risk reduction. Financial, automotive, and manufacturing adopt for long-life data retention. IPFS gateways integrate with European content delivery partners. Energy-efficient nodes address sustainability targets and reporting.

Asia Pacific

Asia Pacific follows with 29%, expands through super-app ecosystems and developer communities. Web3 gaming, NFTs, and creator tools need durable content storage. Telecoms pilot decentralized edge storage near 5G sites. Enterprises pursue multi-cloud strategies to lower dependency risk. Governments push digital public infrastructure and data localization. Startups package storage with wallets and simple onboarding. Japan and South Korea drive high-reliability use cases. India and Southeast Asia accelerate low-cost node growth.

Latin America

Latin America grows from fintech, e-commerce, and media workloads. Startups adopt decentralized archives for compliance and cost control. Distributed nodes mitigate outages and cross-border content risks. Regional integrators offer managed retrieval and pinning services. Universities and labs host community nodes and datasets. Governments explore tamper-evident records for transparency. Payment rails support token incentives and microtransactions. Bandwidth improvements and developer grants lift adoption.

Middle East & Africa

Middle East and Africa adoption follows national digital transformation programs. Sovereign cloud goals encourage hybrid decentralized storage pilots. Energy, public sector, and telecoms test compliance-focused archives. Startups use decentralized content delivery for education and media. Regional hubs host nodes in free zones and datacenters. Token incentives attract community operators and students. Connectivity upgrades reduce retrieval latency and costs. Partnerships with system integrators enable enterprise onboarding.

Market Segmentations:

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Storage

- File storage

- Object storage

- Block storage

- Archive storage

- Media storage

- Others

By Application

- Data backup & recovery

- Content distribution

- Long-term archiving

- Multimedia hosting

- Decentralized Application (dApp) storage

- NFT & digital asset storage

- Others

By End Use

- Individual

- Enterprises

- Government & public sector

- Developers

By Industry Vertical

- Retail & e-commerce

- Media & entertainment

- Healthcare

- BFSI

- Government & public sector

- Education

- E-commerce

- Gaming

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The decentralized storage market features a competitive mix of blockchain-based infrastructure providers, distributed network developers, and emerging Web3 service enablers. Key players such as Filecoin, Arweave, Storj Labs, Akash Network, and BitTorrent (BTFS) lead the space with scalable, token-driven ecosystems supporting decentralized applications, NFTs, and cloud alternatives. These companies emphasize security, data redundancy, and economic incentives for node operators. InterPlanetary File System (IPFS) underpins several storage protocols, enabling interoperability and open data exchange. Startups like Bluzelle, Cere Network, and MaidSafe focus on edge performance and privacy-centric architectures, while The Graph enhances data retrieval and indexing efficiency across networks. Strategic partnerships with Web3 developers, enterprise cloud providers, and data centers strengthen adoption and infrastructure stability. Ongoing innovations in encryption, consensus algorithms, and retrieval latency reduction are intensifying competition, pushing vendors to balance scalability, energy efficiency, and network reliability while maintaining decentralized governance and transparent incentive models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Akash Network

- Arweave

- BitTorrent (BTFS)

- Bluzelle

- Cere Network

- Filecoin

- InterPlanetary File System

- MaidSafe

- Storj Labs

- The Graph

Recent Developments

- In November of 2024, Protocol Labs and the Filecoin Foundation together with other founding members launched the Decentralized Storage Alliance. This organization led by members seeks to promote decentralized technologies and services such as Filecoin, IPFS, and libp2p. It also facilitates transitions for Web2 companies to Web3 through education, advocacy, and best practices.

- In October 2024, Scope Technologies Corp. launched its subscription model. This new service offers individuals and small businesses full access to its encrypted and quantum-resilient decentralized cloud storage solutions. The QSE (Quantum Security Entropy) platform now allows individuals and small businesses to use the same advanced encryption and decentralized storage that mid-sized and enterprise clients use, ensuring their data is protected from current and future cyber threats. The platform is scalable, letting users expand their storage and security needs as they grow without losing performance or protection.

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Storage, Application, End Use, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of decentralized storage will accelerate as Web3 and blockchain ecosystems expand.

- Enterprises will increasingly integrate decentralized frameworks into hybrid cloud strategies.

- AI-driven optimization will enhance data retrieval speed, redundancy, and network efficiency.

- Token-based incentives will attract more storage providers and boost ecosystem sustainability.

- Governments will adopt decentralized models for secure digital records and transparency initiatives.

- Cross-chain interoperability will improve, enabling seamless data exchange between platforms.

- Edge and IoT applications will rely on decentralized storage for real-time data processing.

- Sustainability initiatives will drive demand for energy-efficient decentralized networks.

- Strategic collaborations between cloud providers and decentralized platforms will strengthen scalability.

- Regulatory clarity in data privacy and blockchain governance will accelerate enterprise adoption.