Market Overview

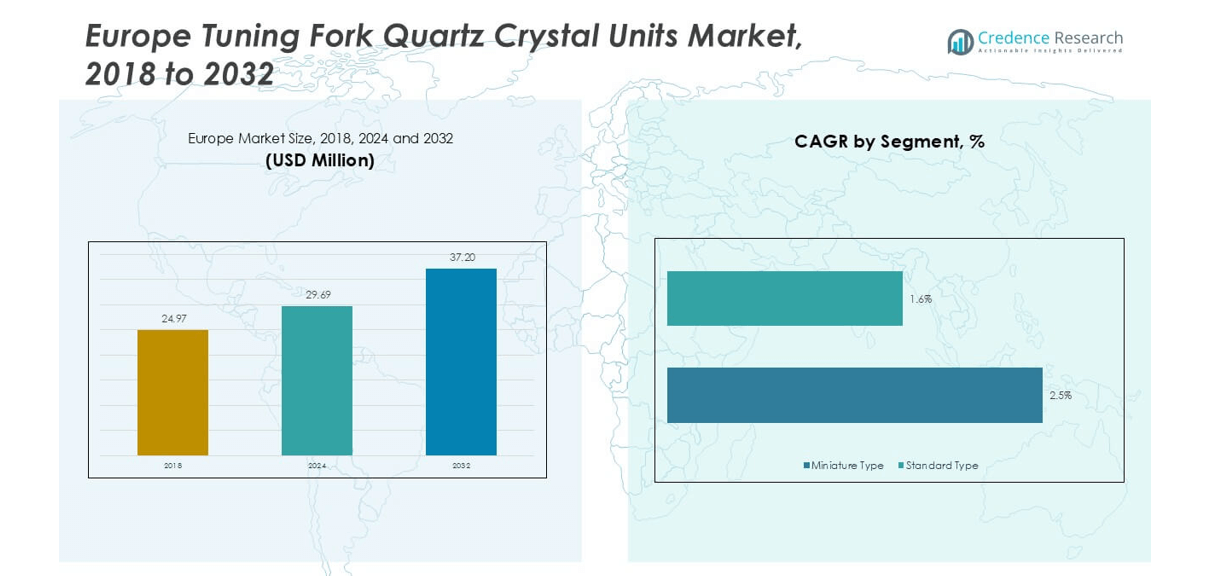

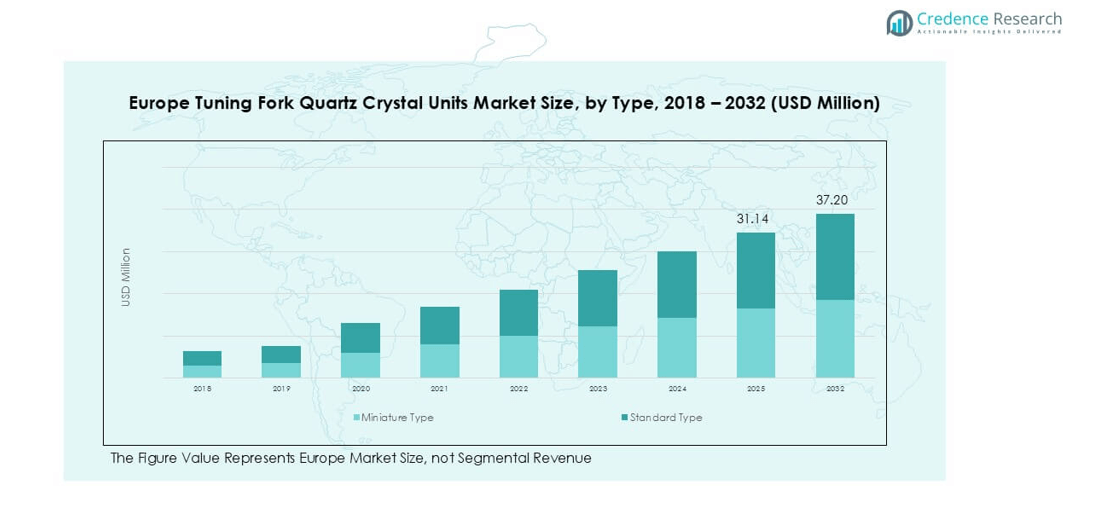

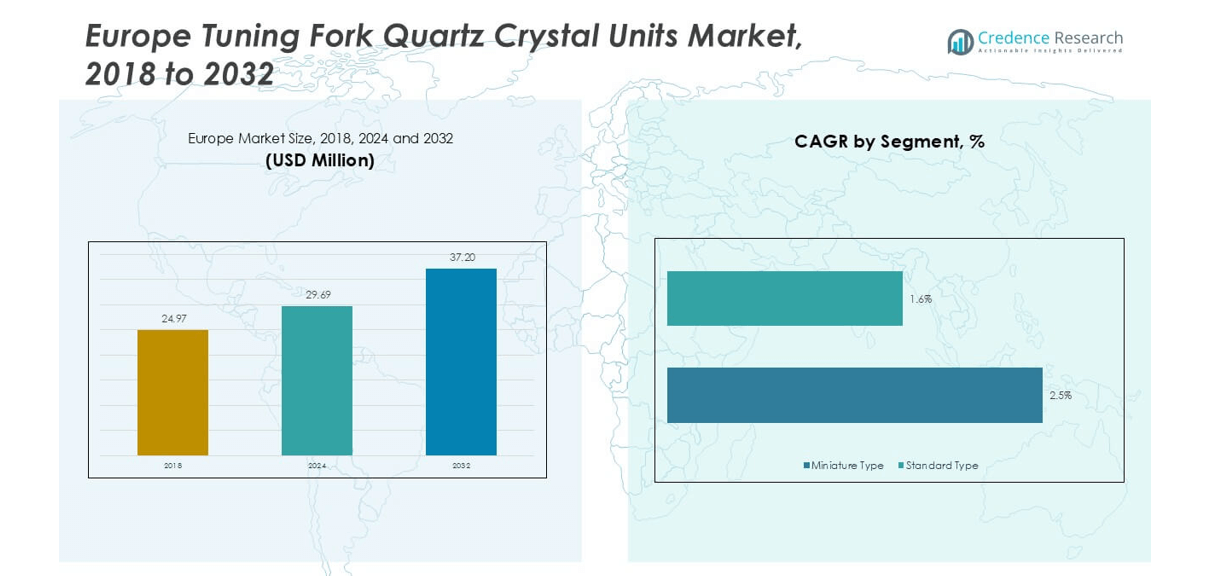

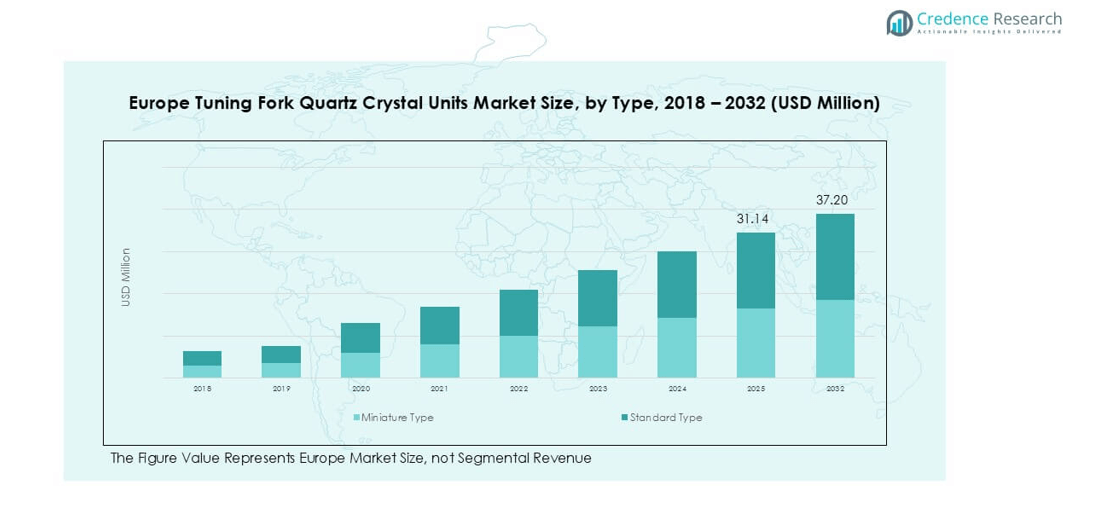

The Europe Tuning Fork Quartz Crystal Units Market was valued at USD 24.97 million in 2018 and increased to USD 29.69 million in 2024. It is projected to reach USD 37.20 million by 2032, growing at a CAGR of 2.6% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Tuning Fork Quartz Crystal Units Market Size 2024 |

USD 29.69 million |

| Europe Tuning Fork Quartz Crystal Units Market, CAGR |

2.6% |

| Europe Tuning Fork Quartz Crystal Units Market Size 2032 |

USD 37.20 million |

The Europe tuning fork quartz crystal units market is led by key players including Siward Crystal, Abracon, Jauch Quartz GmbH, Oscilloquartz SA, Connor-Winfield, Raltron Electronics Corporation, Bliley Technologies, NKG Quartz Crystal, SII Crystal Technology, and ECS Inc. These companies focus on precision frequency components, miniaturization, and high-stability designs catering to consumer electronics, automotive, and industrial automation sectors. Germany emerged as the leading region in 2024 with a 26% market share, supported by advanced automotive and electronic manufacturing ecosystems. The UK and France followed, collectively holding 32%, driven by strong IoT adoption and medical device integration.

Market Insights

- The Europe tuning fork quartz crystal units market was valued at USD 29.69 million in 2024 and is projected to reach USD 37.20 million by 2032, growing at a CAGR of 2.6%.

- Rising demand for compact and energy-efficient frequency control components in consumer electronics and automotive systems drives market expansion across major economies.

- Miniaturization trends, IoT adoption, and the integration of MEMS-based quartz technology are transforming product development and enabling precision in smart devices.

- The market is moderately competitive, led by Siward Crystal, Jauch Quartz GmbH, Abracon, and Oscilloquartz SA, focusing on innovation and OEM partnerships.

- Germany leads with 26% of the regional share, followed by the UK and France with a combined 32%, while the miniature type segment holds 63% of the overall market due to its widespread use in portable and connected electronic applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The miniature type segment dominated the Europe tuning fork quartz crystal units market in 2024 with a 63% share. Its compact size, low power consumption, and high frequency stability make it ideal for portable electronics and IoT devices. Growing demand for miniaturized components in wearables and smart sensors supports segment growth. Standard type units continue to serve legacy systems and industrial devices but are witnessing slower adoption. The shift toward energy-efficient and space-saving electronic designs remains the primary factor driving the dominance of miniature-type tuning fork crystals across European manufacturers.

- For instance, NDK offers a line of 7.0 mm × 5.0 mm crystal oscillators for industrial and other systems, which can be found in its product catalog. While NDK does produce tuning-fork crystals (often used for real-time clocks), these typically come in much smaller packages, such as 3.2 mm × 1.5 mm or even 1.6 mm × 1.0 mm, especially in its newer product lines.

By Application

Consumer electronics held the largest share of 45% in 2024, driven by rising production of smartphones, tablets, and smartwatches across Europe. These devices require precise timing control for processors and communication modules, boosting the need for tuning fork quartz crystals. The automotive segment is also expanding rapidly, supported by electronic stability systems and advanced driver-assistance technologies. Demand from medical equipment and IT applications continues to rise steadily. Growth in connected and multifunctional devices further strengthens the position of consumer electronics as the leading application segment.

- For instance, Murata is a leading supplier of automotive components, including timing devices like crystal resonators, and reported increased demand from the European mobility market in 2024.

By Sales Channel

Direct sales accounted for 51% of the market in 2024, emerging as the dominant distribution channel across Europe. Major OEMs prefer direct procurement from component manufacturers to ensure quality consistency and supply reliability. Distribution channels remain vital for smaller manufacturers and regional distributors serving diverse end-user industries. Online channels are gaining traction with the rise of e-commerce platforms offering technical components. The increasing focus on strategic supply partnerships and long-term contracts with electronic manufacturers continues to drive the strong share of direct sales in the European market.

Key Growth Drivers

Growing Demand for Consumer Electronics and IoT Devices

The rapid expansion of consumer electronics and IoT ecosystems across Europe serves as a key growth driver for the tuning fork quartz crystal units market. Miniaturized and energy-efficient crystals are essential for ensuring precise timing and synchronization in smartphones, wearables, and smart home devices. The region’s increasing adoption of connected appliances and industrial IoT systems is boosting demand for low-frequency and highly stable quartz units. European manufacturers are investing in R&D to develop ultra-miniature tuning fork crystals that deliver high accuracy and temperature stability. This surge in connected device production across Germany, France, and the UK continues to fuel consistent market growth.

- For example, Abracon’s ABM14 series is built in 1.0 mm × 0.8 mm form factor for space-constrained applications.

Expansion of Automotive Electronics and ADAS Systems

Automotive digitalization in Europe significantly drives demand for tuning fork quartz crystal units. These components are vital in electronic control units (ECUs), infotainment systems, and advanced driver-assistance systems (ADAS). Automakers in Germany, Italy, and France increasingly integrate frequency-control components for reliable data transmission and sensor timing. The rise of electric and hybrid vehicles further enhances demand for precision timing devices to support battery management systems and navigation units. As European regulations promote safer and more connected mobility solutions, crystal manufacturers are expanding automotive-grade product lines to meet stringent quality standards. The ongoing shift toward smart mobility strongly supports market expansion.

- For instance, Murata includes tuning-fork crystals in vehicle infotainment modules operating at 32.768 kHz or higher.

Growth in Medical and Industrial Automation Applications

The growing use of precise frequency control in medical and industrial automation systems drives steady adoption of tuning fork quartz crystals. Medical diagnostic devices, wearable monitors, and infusion pumps rely on accurate timing to maintain reliable performance. Similarly, industrial automation systems use these crystals for process control, data acquisition, and machine communication. European healthcare modernization and the rise of Industry 4.0 initiatives are increasing the installation of sensor-based systems. This trend supports higher consumption of reliable timing components, particularly in Germany and the Nordics, where manufacturing automation and digital healthcare solutions are expanding rapidly.

Key Trends & Opportunities

Miniaturization and Energy-Efficient Design Innovations

A major trend shaping the European market is the shift toward smaller and energy-efficient tuning fork quartz crystals. Device manufacturers seek compact frequency-control components to meet the needs of ultra-thin smartphones, smartwatches, and IoT modules. Advancements in MEMS-based crystal manufacturing are improving performance and reducing energy usage. This transition allows electronics producers to design lighter, faster, and longer-lasting products. The demand for customized crystal packages, particularly for high-frequency wearable devices, continues to grow across Europe’s technology hubs. As miniaturization aligns with sustainability goals, manufacturers are focusing on low-power, RoHS-compliant crystal units.

- For instance, Abracon’s ABS05 model offers a tuning fork crystal in a 1.6 mm × 1.0 mm package with load capacitance of 4.0 pF and ESR up to 90 kΩ, optimizing for lower power draw.

Rising Adoption of Smart Manufacturing and Digital Integration

The digital transformation of European industries presents strong opportunities for tuning fork quartz crystal suppliers. Smart factories increasingly depend on precise timing systems to support automation, robotics, and data-driven operations. The integration of IoT and AI technologies in production lines enhances the need for reliable, vibration-resistant crystals. Additionally, manufacturers are leveraging digital platforms for predictive maintenance and remote monitoring, further increasing demand for stable timing components. As governments across the EU promote smart manufacturing initiatives, suppliers that provide high-performance, temperature-stable crystals are likely to capture significant market share in industrial and telecom applications.

Key Challenges

Price Conmpetition and Cost Pressure Among Manufacturers

Intense price competition remains a critical challenge in the European tuning fork quartz crystal units market. Asian manufacturers, particularly from Japan, China, and Taiwan, dominate with cost-efficient mass production, exerting pricing pressure on European suppliers. Local producers face higher material, labor, and compliance costs, which affect profit margins. To remain competitive, companies must emphasize product differentiation through superior accuracy, extended lifespan, and custom packaging. However, balancing performance with affordability remains difficult, especially for smaller manufacturers. The growing demand for low-cost frequency-control components in consumer electronics continues to test the sustainability of premium European-made products.

Supply Chain Constraints and Material Availability

Fluctuations in raw material supply, especially quartz and electronic-grade metals, pose challenges for European manufacturers. Geopolitical tensions and transportation disruptions have increased lead times and procurement costs. Dependence on imports from Asia for specialized quartz substrates and electronic components adds vulnerability to supply chains. Additionally, compliance with EU environmental regulations, such as RoHS and REACH, requires suppliers to adopt cleaner but more expensive production methods. These constraints hinder scalability and timely delivery, affecting OEM relationships. To overcome these challenges, many European producers are investing in localized sourcing and sustainable material innovations.

Regional Analysis

UK

The UK accounted for 18% of the Europe tuning fork quartz crystal units market in 2024. Strong demand from consumer electronics, telecommunications, and automotive electronics drives market expansion. The country’s growing adoption of IoT devices, smart wearables, and advanced vehicle infotainment systems fuels consistent crystal consumption. Key players collaborate with local OEMs to deliver precision timing solutions compliant with UK manufacturing standards. Ongoing investments in 5G infrastructure and smart mobility solutions are expected to further support market growth through increased integration of frequency-control components across connected devices and communication systems.

France

France captured 14% of the regional market share in 2024, supported by strong electronics manufacturing and industrial automation sectors. The market benefits from increasing use of timing devices in automotive safety systems, healthcare monitoring equipment, and connected home appliances. French technology firms emphasize innovation in energy-efficient and miniaturized crystals for IoT and medical devices. Additionally, the government’s focus on digital transformation under the “France Relance” plan promotes domestic electronic component production. Growing adoption of smart technologies across consumer and industrial domains continues to drive steady demand for tuning fork quartz crystals in France.

Germany

Germany led the Europe tuning fork quartz crystal units market with a 26% share in 2024. The country’s dominance stems from its advanced automotive industry, precision engineering, and strong electronic manufacturing base. Demand for crystal units is particularly high in ADAS, electric vehicles, and industrial automation systems requiring high-frequency stability. Major global suppliers operate R&D and production facilities in Germany to meet strict quality and reliability standards. Expanding Industry 4.0 applications and smart factory initiatives continue to boost the integration of timing devices in intelligent control systems and connected industrial platforms.

Italy

Italy represented 10% of the European market in 2024, driven by increasing demand from consumer electronics and industrial automation sectors. The nation’s growing adoption of smart home technologies, along with its strong automotive components manufacturing, supports the use of tuning fork quartz crystals. Italian OEMs emphasize compact, energy-efficient designs suited for IoT applications and portable medical equipment. The government’s support for digitizing small and medium-sized enterprises further contributes to local adoption. As electronics manufacturing clusters expand, Italy’s market continues to show stable growth, particularly in applications requiring precise and durable timing control.

Spain

Spain accounted for 9% of the regional market share in 2024. Growth is driven by rising demand for connected devices, including smart appliances, wearables, and telecommunications equipment. The country’s expanding automotive electronics and renewable energy sectors also contribute to market development. Spanish manufacturers increasingly source tuning fork quartz crystals for embedded control and monitoring systems. Investments in technology parks and R&D initiatives across Madrid and Catalonia further enhance local production capabilities. Continued emphasis on digitalization and smart city initiatives strengthens Spain’s role in advancing frequency-control component adoption within the European landscape.

Russia

Russia held 8% of the Europe tuning fork quartz crystal units market in 2024. Market growth is primarily influenced by the defense, aerospace, and telecommunication industries requiring highly stable timing components. Local production remains limited, leading to significant imports from Japan and China. Rising demand for communication and navigation systems in defense modernization programs supports sustained market activity. However, geopolitical tensions and trade restrictions affect supply reliability and pricing. Despite these challenges, Russia continues to invest in domestic electronic manufacturing, aiming to enhance self-sufficiency and reduce dependence on imported frequency-control components.

Rest of Europe

The rest of Europe collectively represented 15% of the market in 2024, encompassing countries such as the Netherlands, Sweden, Poland, and Switzerland. These nations benefit from growing demand for timing components in industrial automation, smart wearables, and medical electronics. The Nordic region, in particular, emphasizes precision engineering and sustainable manufacturing processes. Eastern European countries are attracting investments in electronics assembly and automotive component manufacturing, supporting future growth. Collaborative research projects across EU nations are fostering innovation in crystal miniaturization and performance stability, strengthening the region’s contribution to Europe’s overall market development.

Market Segmentations:

By Type

- Miniature Type

- Standard Type

By Application

- Consumer Electronics

- Automotive

- Home Appliance

- IT & Telecommunication

- Medical Equipment

- Others

By Sales Channel

- Direct Sales

- Distribution Channels

- Online Channels

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe tuning fork quartz crystal units market is moderately consolidated, with competition driven by innovation, pricing, and precision performance. Leading players such as Siward Crystal, Jauch Quartz GmbH, Oscilloquartz SA, Abracon, and SII Crystal Technology dominate the regional landscape through extensive product portfolios and strong OEM partnerships. These companies focus on developing miniaturized and energy-efficient crystals to meet growing demand from IoT, consumer electronics, and automotive applications. European firms emphasize reliability and compliance with stringent industrial and environmental standards, while Asian suppliers strengthen their presence through cost-effective offerings. Strategic collaborations, local manufacturing expansion, and technology upgrades—particularly in MEMS-based quartz solutions—are shaping the competitive dynamics. Continuous investment in R&D, coupled with strong distribution networks, enables manufacturers to cater to diverse end-user requirements across industrial, medical, and telecom segments, ensuring sustainable growth and market differentiation across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siward Crystal

- Abracon

- Jauch Quartz GmbH

- Oscilloquartz SA

- Connor-Winfield

- Raltron Electronics Corporation

- Bliley Technologies

- NKG Quartz Crystal

- SII Crystal Technology

- ECS Inc

Recent Developments

- In 2023, Seiko Instruments unveiled a new series of tuning fork crystal units with ultra-high temperature stability.

- In 2023, NDK partners with a major automotive manufacturer to develop customized tuning fork crystals for advanced driver-assistance systems.

- In 2022, Diodes Incorporated acquired Peregrine Semiconductor Corporation, strengthening its position in the high-frequency crystal resonators segment.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth supported by strong demand from automotive and consumer electronics sectors.

- Miniaturization of components will remain a major focus area among manufacturers.

- Expansion of 5G networks and IoT infrastructure will increase demand for precise timing devices.

- Automotive digitalization and ADAS integration will continue to drive adoption of quartz crystal units.

- Advancements in MEMS-based crystal technology will enhance energy efficiency and durability.

- Local production in Germany, France, and the UK will strengthen Europe’s supply resilience.

- Competitive pricing pressure from Asian suppliers will encourage innovation and cost optimization.

- Environmental regulations will push manufacturers toward eco-friendly and RoHS-compliant production methods.

- Partnerships between OEMs and crystal suppliers will support customized application development.

- The market will maintain balanced growth as Europe focuses on smart manufacturing and digital transformation.