Market Overview

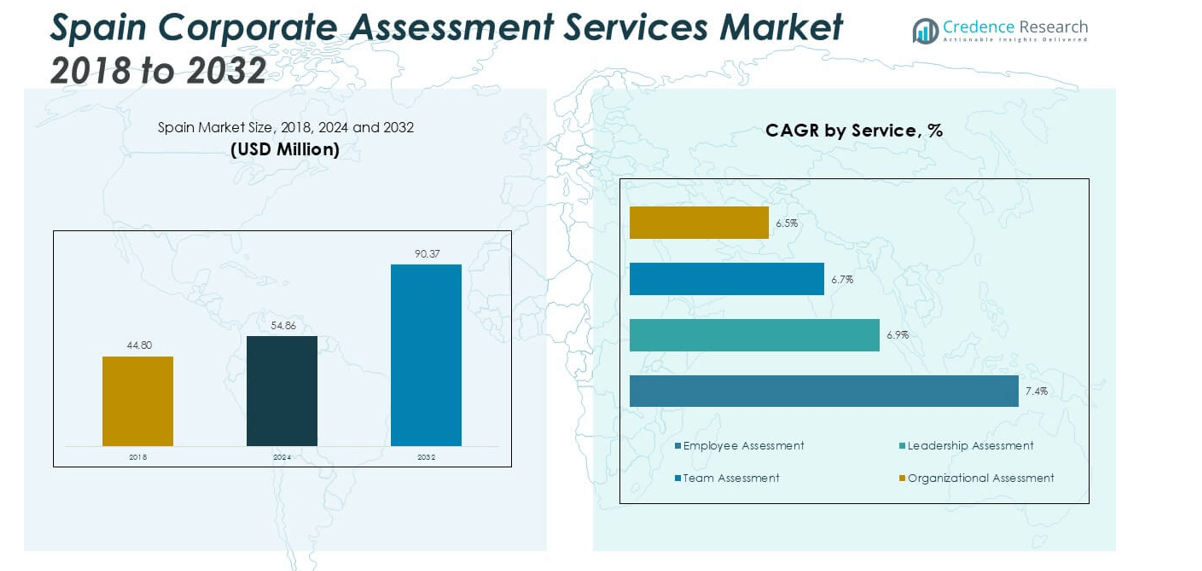

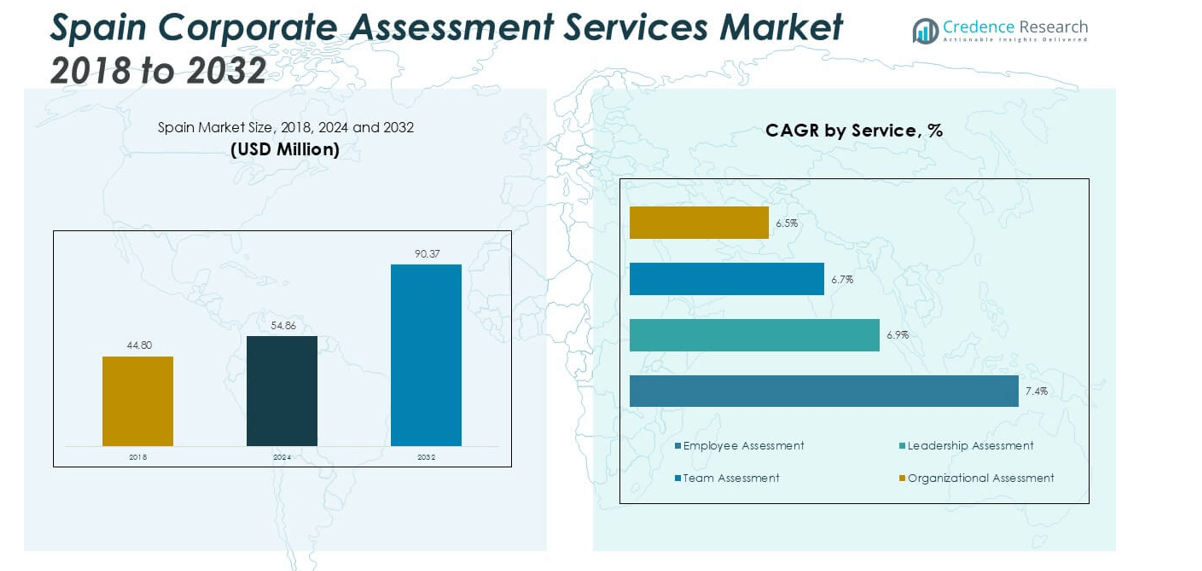

The Spain Corporate Assessment Services market size was valued at USD 44.80 million in 2018, growing to USD 54.86 million in 2024, and is projected to reach USD 90.37 million by 2032, expanding at a CAGR of 6.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Corporate Assessment Services Market Size 2024 |

USD 54.86 million |

| Spain Corporate Assessment Services Market, CAGR |

6.44% |

| Spain Corporate Assessment Services Market Size 2032 |

USD 90.37 million |

The Spain corporate assessment services market is led by major players such as Korn Ferry, SHL Group Ltd., Saville Assessment, PSI Services LLC (Cubiks), Hogan Assessments, AssessFirst, Harrison Assessments, and CEB (now Gartner). These companies dominate through advanced analytics, AI-driven evaluation tools, and customized leadership development programs. Central Spain leads the market with a 34% share, driven by strong corporate presence in Madrid and widespread adoption of digital HR tools. North Spain follows with 26%, supported by industrial growth and workforce modernization initiatives. Together, these regions represent the core of Spain’s demand for structured, technology-enabled assessment solutions.

Market Insights

- The Spain Corporate Assessment Services market was valued at USD 44.80 million in 2018, reaching USD 54.86 million in 2024, and is projected to hit USD 90.37 million by 2032, expanding at a CAGR of 6.44%.

- Market growth is driven by increasing demand for employee productivity assessment, leadership evaluation, and digital skill mapping across Spanish enterprises.

- AI-based assessment tools, gamification, and predictive analytics are emerging as key trends, enabling real-time talent insights and improved hiring accuracy.

- The market is moderately consolidated, with major players such as Korn Ferry, SHL Group Ltd., Saville Assessment, and PSI Services LLC competing through digital innovations and SaaS-based models.

- Regionally, Central Spain leads with a 34% share, followed by North Spain at 26%, driven by high corporate concentration and strong adoption of cloud-based assessment platforms across major industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

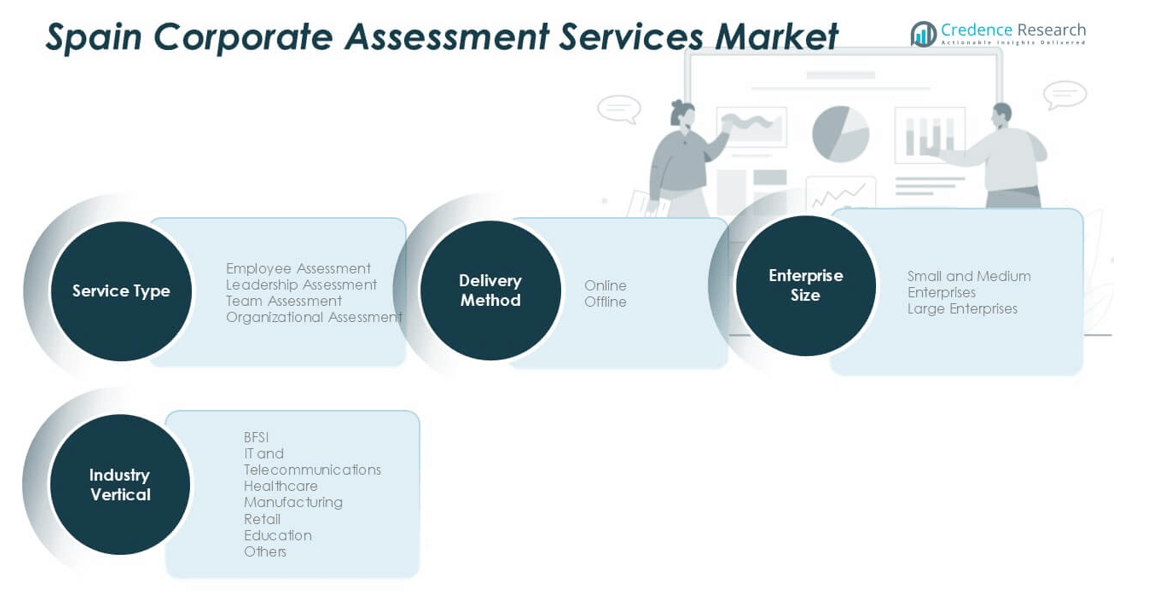

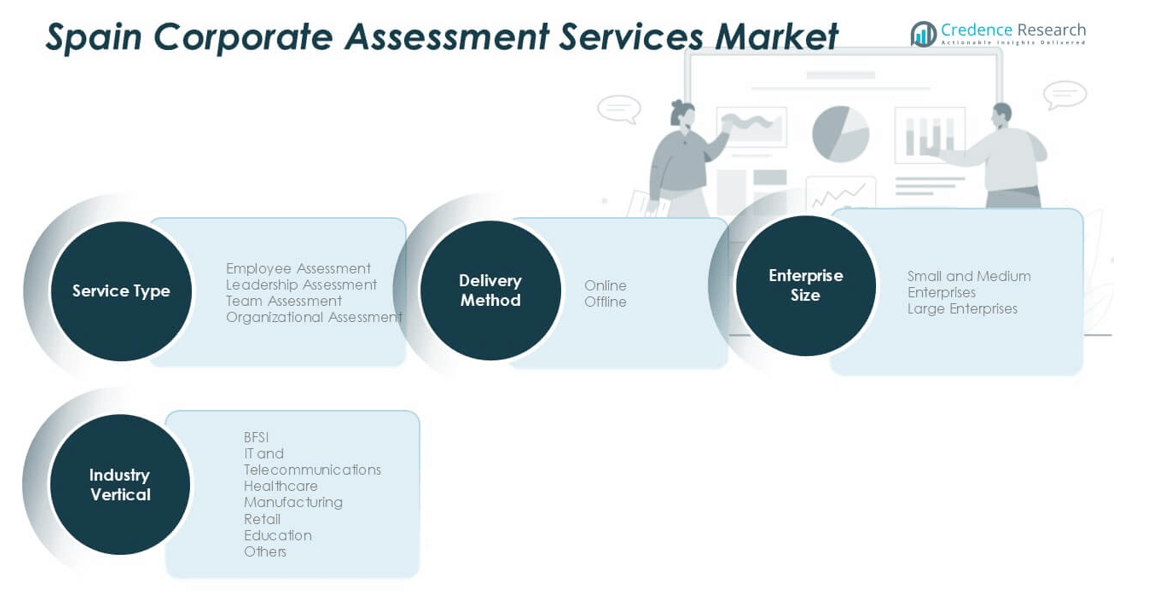

By Service Type

The employee assessment segment held the largest share of the Spain corporate assessment services market in 2024, accounting for nearly 41% of the total. Its dominance is driven by the growing focus on talent acquisition, skill mapping, and performance benchmarking across enterprises. Organizations increasingly adopt psychometric and cognitive assessments to enhance hiring accuracy and reduce turnover. The leadership assessment segment is expanding steadily as Spanish firms invest in succession planning and executive development to strengthen organizational agility and long-term performance.

- For instance, Mercer | Mettl specializes in using its platform to implement digital psychometric assessments for employers across the globe. The assessments are used to evaluate skills, personality, and behavioral traits to help screen candidates for various roles and can be tailored for over 200 job profiles.

By Industry Vertical

The BFSI sector dominated the market with about 27% share in 2024, driven by the sector’s emphasis on compliance, risk management, and leadership training. Financial institutions in Spain are adopting structured assessment tools to evaluate workforce integrity and decision-making capabilities. The IT and telecommunications sector follows closely, supported by strong demand for digital skill evaluation and behavioral analytics. Healthcare and education industries are also witnessing notable adoption due to the rising need for competency-based training and staff performance improvement programs.

- For instance, Banco Santander regularly invests in employee training and development to strengthen financial compliance and leadership skills across its workforce, using internal resources and various external partners.

By Enterprise Size

Large enterprises accounted for the majority share of around 64% in 2024. Their dominance stems from higher budgets for workforce analytics, leadership development, and employee performance tracking systems. These organizations prioritize structured assessment programs to improve productivity and cultural alignment across diverse teams. Small and medium enterprises are emerging as a fast-growing segment, supported by affordable cloud-based assessment solutions that enable efficient talent evaluation and organizational development without extensive infrastructure investments.

Key Growth Drivers

Increasing Focus on Workforce Productivity and Skill Alignment

Spanish companies are prioritizing workforce productivity through structured assessment tools that measure employee potential, skills, and behavioral traits. With industries shifting toward digital transformation, firms are using cognitive and psychometric testing to ensure employee capabilities align with evolving job requirements. Continuous performance evaluation and data-driven feedback help organizations identify training needs and optimize role fitment. The rising adoption of remote and hybrid work models further supports demand for digital assessment platforms that provide scalable, standardized evaluation methods. As employers seek to minimize turnover and strengthen workforce engagement, these tools are becoming a critical part of HR strategies, fueling sustained market growth.

- For instance, Telefónica S.A. launched an AI-based talent assessment program to identify digital skill gaps and upskill workers for roles in cloud and cybersecurity. The company developed a reskilling application on the SAP Business Technology Platform, which integrates with its existing SAP SuccessFactors suite.

Expansion of Leadership and Succession Planning Programs

Leadership assessment services are gaining traction as Spanish organizations focus on building robust succession pipelines. Companies are emphasizing strategic leadership readiness to navigate market disruptions, technological innovation, and regulatory shifts. Assessments help identify high-potential employees, develop leadership competencies, and create tailored development roadmaps. Multinational firms and local enterprises are integrating 360-degree feedback, simulation exercises, and personality assessments into leadership programs. The trend toward internal talent promotion and reduced dependency on external hires also drives demand for these tools. As businesses in Spain pursue long-term organizational stability and cultural cohesion, leadership assessment solutions continue to represent a major growth catalyst for the market.

- For instance, Aegon España ran a “Total Leadership” initiative covering ~500 employees across Spain with 60 sessions of ~3 hours each, boosting employee engagement scores by ~50 points from baseline.

Rising Digital Transformation and Cloud-Based Assessment Platforms

Digital transformation across Spain’s corporate landscape has accelerated the adoption of cloud-based assessment services. Organizations are shifting from traditional paper-based tests to AI-enabled, automated evaluation systems that deliver real-time insights. Cloud platforms enable scalable, cost-effective, and remote assessment delivery, making them suitable for distributed teams. Advanced analytics and machine learning are now used to track skill gaps, behavioral patterns, and leadership potential with higher precision. The integration of gamified assessments enhances engagement and improves candidate experience. Furthermore, compliance with GDPR and enhanced data security measures are boosting enterprise confidence in digital assessment solutions. These innovations collectively drive the modernization of corporate assessment practices across sectors.

Key Trends and Opportunities

Growing Adoption of AI and Predictive Analytics in Assessments

AI-powered analytics are reshaping corporate assessment processes in Spain. Predictive models now evaluate behavioral patterns, emotional intelligence, and decision-making tendencies to support recruitment and succession planning. Enterprises use machine learning algorithms to interpret assessment data and correlate it with performance outcomes. This enhances talent identification and reduces hiring biases. The growing integration of natural language processing (NLP) tools also enables deeper evaluation during interviews and written responses. Vendors offering adaptive, AI-driven assessment tools are gaining traction as organizations seek precision and scalability. This trend creates strong opportunities for technology-driven firms specializing in HR analytics and digital evaluation systems.

- For instance, iSmartRecruit is an AI recruitment platform, founded in India with a global presence, that leverages AI tools like NLP for resume parsing and other recruitment tasks.

Rising Demand from SMEs for Affordable Digital Solutions

Small and medium enterprises in Spain are increasingly investing in digital assessment services due to affordable subscription models and reduced implementation costs. The availability of cloud-based, pay-as-you-go solutions allows SMEs to assess workforce competencies without large infrastructure investments. These platforms enable performance benchmarking, cultural fit analysis, and leadership identification, previously accessible only to large corporations. Vendors offering localized, language-specific assessments are well-positioned to serve this expanding segment. Additionally, government programs supporting digital upskilling and workforce development in Spain further strengthen SME adoption. This presents a major opportunity for market expansion across regional business clusters and startups.

Integration of Gamification and Virtual Assessment Centers

Gamification is emerging as a key innovation in Spain’s corporate assessment landscape. Companies are using interactive simulations, scenario-based tasks, and game-like interfaces to evaluate cognitive ability, problem-solving, and teamwork. These tools not only enhance participant engagement but also generate more authentic behavioral data. Virtual assessment centers replicate real-world decision environments, allowing employers to observe reactions under simulated pressure. As remote recruitment and hybrid workplaces become standard, these tools provide reliable and scalable alternatives to in-person evaluations. The trend is expected to redefine candidate experience while helping organizations attract and retain top talent effectively.

Key Challenges

Data Privacy and Compliance Concerns

Strict data protection regulations under the EU’s GDPR framework present significant challenges for corporate assessment providers in Spain. The collection, storage, and processing of sensitive employee data require full transparency and secure handling. Many firms struggle to align their assessment systems with compliance requirements, especially when using cloud-based or AI-integrated tools. Concerns around algorithmic bias and misuse of personal data further complicate adoption. Vendors must invest in strong encryption, anonymization protocols, and explainable AI frameworks to ensure legal and ethical integrity. Balancing innovation with privacy obligations remains a persistent barrier for sustained market expansion.

Limited Awareness and Resistance to Technological Change

Despite rapid digitalization, several Spanish organizations—particularly in traditional industries—remain hesitant to adopt advanced assessment solutions. Decision-makers often perceive digital tools as costly or overly complex compared to traditional evaluation methods. Resistance from HR departments accustomed to manual processes slows market penetration. Moreover, limited awareness of the measurable benefits of predictive analytics and behavioral assessments constrains adoption rates. Providers need to focus on education, cost optimization, and localized support to address these concerns. Without strong awareness campaigns and user-friendly solutions, the market’s full potential may remain underutilized across several industry verticals.

Regional Analysis

North Spain

North Spain accounted for around 26% of the Spain corporate assessment services market in 2024. The region benefits from a strong presence of industrial and financial enterprises in cities such as Bilbao and Santander. Companies in these areas emphasize workforce productivity, leadership training, and compliance-driven assessments. Increased investment in technology-based HR tools by large corporations and universities supports steady adoption. Moreover, the region’s growing focus on organizational transformation and employee engagement programs further drives demand for advanced digital assessment platforms across industries.

Central Spain

Central Spain dominated the market with a 34% share in 2024, led by Madrid’s role as the nation’s corporate and administrative hub. The concentration of multinational firms, financial institutions, and consulting agencies drives high demand for leadership and organizational assessment services. Businesses in this region prioritize talent analytics, succession planning, and cloud-based evaluation tools to streamline recruitment and performance measurement. The government’s digitalization initiatives and skilled workforce availability further strengthen Central Spain’s leadership in technology-integrated assessment practices across diverse industry verticals.

East Spain

East Spain held about 22% of the market share in 2024, supported by expanding business activities in Barcelona and Valencia. The region’s strong technology ecosystem and start-up culture promote adoption of AI-driven and gamified assessment tools. Companies emphasize innovative talent development strategies to maintain competitiveness in dynamic markets. The presence of a large service-based economy, including IT, telecom, and education sectors, accelerates demand for digital evaluation platforms. Continuous investment in human capital and localized training solutions also enhances the region’s contribution to Spain’s corporate assessment landscape.

South Spain

South Spain captured nearly 18% of the corporate assessment services market in 2024. The region’s growth is driven by the expanding tourism, retail, and manufacturing sectors that increasingly rely on workforce assessment for operational efficiency. Cities such as Seville and Málaga are witnessing growing adoption of online and hybrid assessment solutions among SMEs. Rising focus on employee retention, leadership development, and cultural fit analysis further supports demand. However, the region’s slower digital transformation pace compared to northern areas slightly restrains faster expansion, though awareness is gradually improving through regional HR initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- North Spain

- Central Spain

- East Spain

- South Spain

Competitive Landscape

The Spain corporate assessment services market is moderately consolidated, with global and regional players competing through innovation and service diversification. Key participants include Saville Assessment, PSI Services LLC (Cubiks), AssessFirst, Harrison Assessments, CEB (now Gartner), SHL Group Ltd., Korn Ferry, and Hogan Assessments. These companies focus on digital transformation, AI-driven analytics, and psychometric precision to enhance client value. SHL and Korn Ferry maintain strong brand recognition through enterprise-scale leadership programs, while Saville and Hogan emphasize personality and behavioral testing. Local HR consultancies are emerging with tailored, language-adapted tools to serve mid-sized businesses. Strategic partnerships, mergers, and SaaS-based delivery models are shaping competition, with emphasis on GDPR compliance, customization, and predictive analytics integration. As firms across Spain prioritize data-backed talent management and leadership development, competitive differentiation increasingly depends on technology innovation, scalability, and client-centric service delivery models aligned with evolving workforce strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of AI-driven and data-centric assessment platforms.

- Cloud-based tools will dominate due to scalability, flexibility, and cost-effectiveness.

- Leadership development programs will expand as firms focus on internal talent pipelines.

- Gamified and virtual assessments will gain popularity for improving engagement and accuracy.

- Small and medium enterprises will increasingly invest in affordable digital assessment solutions.

- Integration of behavioral analytics will enhance precision in hiring and workforce planning.

- Data privacy and ethical AI use will remain central to vendor competitiveness.

- Collaboration between HR tech providers and corporations will drive innovation in custom solutions.

- Demand for multilingual and culturally adaptive assessment tools will strengthen in regional markets.

- Continuous learning and performance tracking will evolve as key elements of long-term workforce strategy.