Market Overview

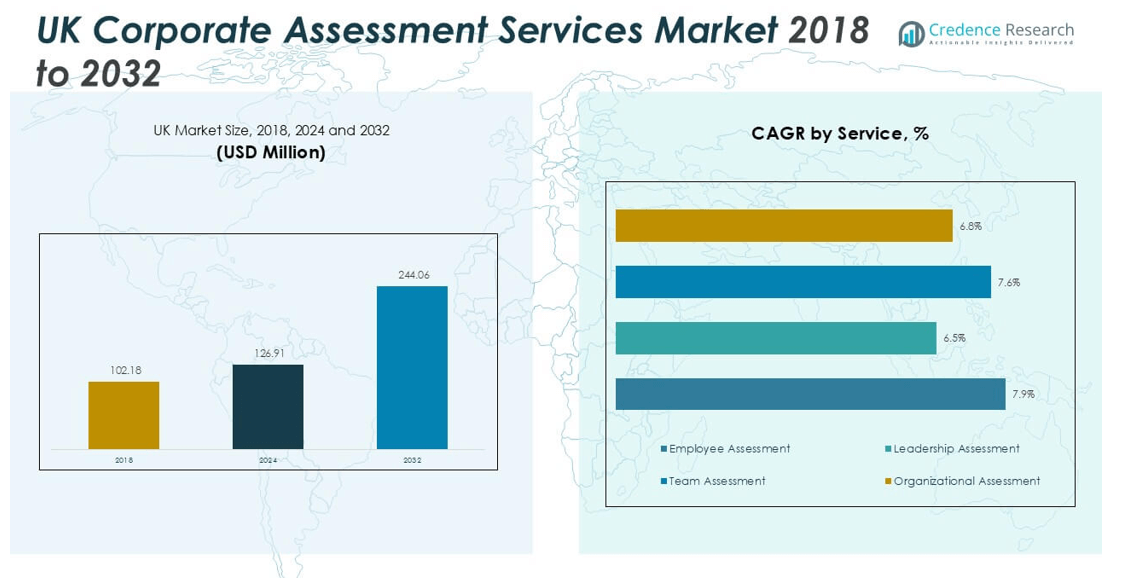

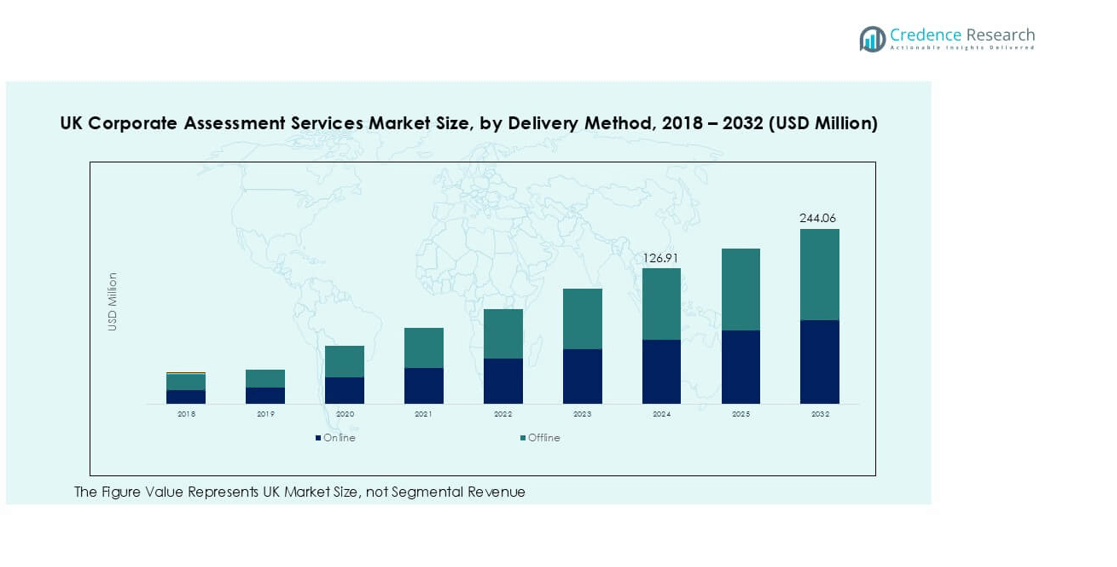

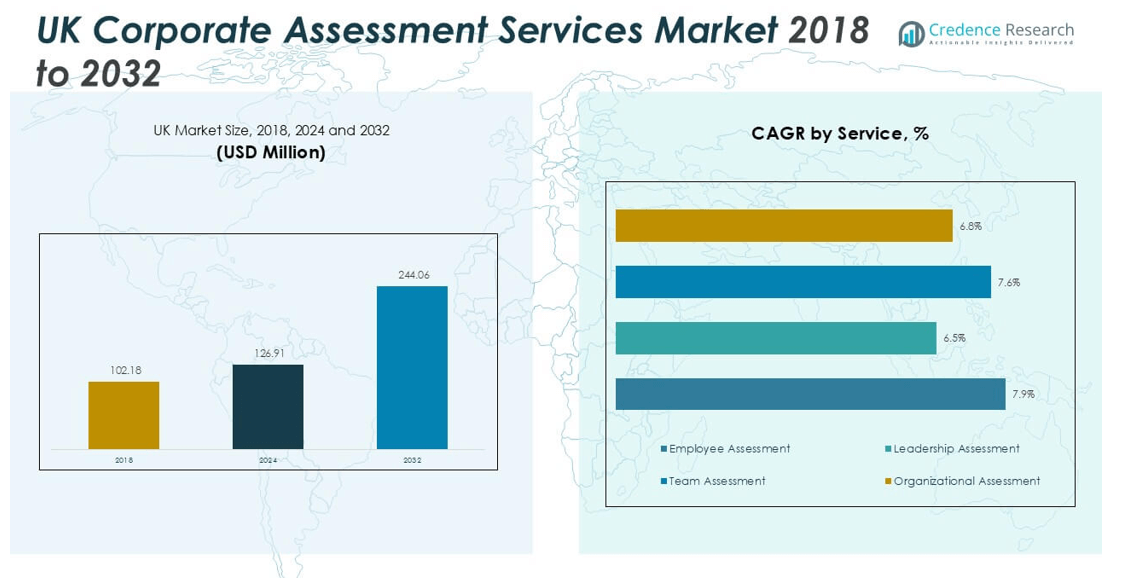

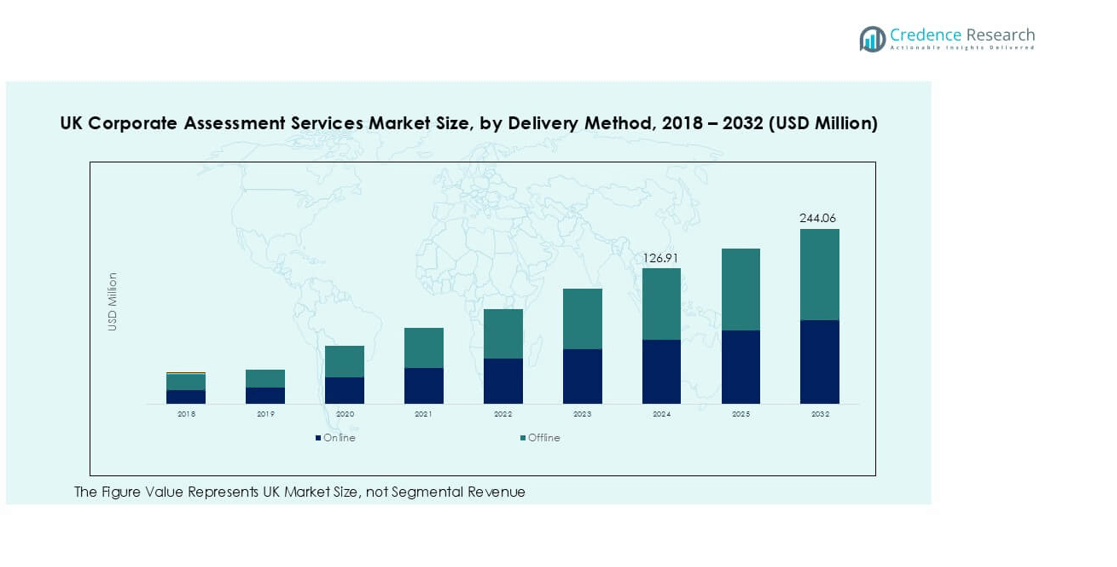

The UK Corporate Assessment Services market size was valued at USD 102.18 million in 2018, growing to USD 126.91 million in 2024, and is anticipated to reach USD 244.06 million by 2032, expanding at a CAGR of 8.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Corporate Assessment Services Market Size 2024 |

USD 126.91 million |

| UK Corporate Assessment Services Market, CAGR |

8.52% |

| UK Corporate Assessment Services Market Size 2032 |

USD 244.06 million |

The UK corporate assessment services market is led by key players such as SHL Group Ltd., Saville Assessment, Cubiks (now part of PSI Services LLC), Psytech International, Thomas International, Talent Q, Aon plc, Hogan Assessments, and Harrison Assessments. These companies dominate through strong technological capabilities, diverse testing tools, and strategic enterprise partnerships. England remains the leading regional market, accounting for 67% of the total share, driven by a high concentration of multinational corporations, financial institutions, and advanced digital infrastructure. The dominance of AI-based assessment tools and growing demand for leadership evaluations in England continues to reinforce its market leadership across the UK.

Market Insights

- The UK Corporate Assessment Services market was valued at USD 126.91 million in 2024 and is projected to reach USD 244.06 million by 2032, growing at a CAGR of 8.52% during the forecast period.

- Rising demand for data-driven hiring and AI-based talent analytics is driving market growth as organizations seek efficient recruitment and workforce optimization tools.

- Key trends include the integration of predictive analytics, gamified assessments, and remote testing platforms, enhancing accuracy and engagement across industries.

- The market is highly competitive, led by SHL Group Ltd., Saville Assessment, Cubiks, and Aon plc, with players focusing on digital transformation, leadership assessments, and adaptive testing models.

- England dominates with 67% market share, followed by Scotland (14%), Wales (11%), and Northern Ireland (8%), while the employee assessment segment leads by service type, accounting for 41% of the total market share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

The employee assessment segment dominated the UK corporate assessment services market in 2024, accounting for 41% of the total share. The segment’s leadership is driven by rising demand for data-based hiring and talent evaluation solutions across enterprises. Companies are increasingly adopting psychometric and cognitive testing tools to enhance workforce quality and reduce hiring errors. Integration of AI and analytics in assessment platforms helps evaluate behavioral traits and job fit with higher accuracy. The growing emphasis on workforce optimization and retention strategies further fuels the adoption of employee assessment services nationwide.

- For instance, SHL Group deployed its AI-driven TalentCentral platform to help organizations make more objective, data-driven hiring decisions. The company states that 35 million SHL assessments are taken every year around the world. This is used to draw from a database of over 45 billion data points on workforce skills and potential to assist in improving hiring precision and reducing bias.

By Industry Vertical

The BFSI segment held the largest share of 28% in the UK corporate assessment services market in 2024. Financial institutions rely heavily on structured assessment programs to identify high-potential employees, strengthen compliance, and reduce operational risks. The integration of leadership benchmarking and role-based psychometric tools supports workforce alignment in regulated environments. Additionally, increased digital transformation across banking and insurance sectors has accelerated the use of AI-driven online testing platforms. The need to enhance productivity, ensure ethical performance, and maintain trust in customer-facing roles drives continued investment in assessment services within the BFSI sector.

- For instance, HSBC, like many global financial institutions, uses advanced digital assessment platforms for leadership evaluation and succession planning. Such evaluations often involve behavioral simulations and data-driven performance analytics to strengthen internal talent pipelines.

By Enterprise Size

Large enterprises led the UK corporate assessment services market in 2024, representing 62% of the total market share. Their dominance stems from the widespread adoption of comprehensive talent evaluation systems to support leadership development and succession planning. These organizations invest in continuous assessment programs integrated with learning and development frameworks. The use of advanced analytics and automated scoring enhances objectivity and scalability across large workforces. Growing competition for skilled professionals and the need for consistent performance evaluation across global operations continue to drive demand from large enterprises.

Key Growth Drivers

Rising Demand for Data-Driven Hiring and Talent Analytics

The growing need for data-backed decision-making in recruitment is a major driver for the UK corporate assessment services market. Organizations are increasingly using AI-powered tools, psychometric tests, and cognitive analytics to measure candidates’ skills, behavior, and cultural fit with greater accuracy. These tools enable HR teams to minimize bias and improve employee retention by identifying top-performing talent early in the hiring cycle. The post-pandemic shift toward hybrid work has further increased reliance on digital platforms for remote assessments. As enterprises aim to improve workforce productivity and reduce turnover, the adoption of advanced assessment analytics continues to expand across industries.

- For instance, HireVue’s AI-powered video interviewing platform has been used to conduct tens of millions of interviews and other candidate engagements, including over 70 million video interviews by October 2025.

Growing Focus on Leadership Development and Succession Planning

UK companies are prioritizing structured leadership assessment programs to identify future leaders and manage succession effectively. With many senior professionals nearing retirement, organizations face growing pressure to nurture internal talent pipelines. Assessment services provide objective insights into leadership competencies, emotional intelligence, and decision-making abilities. Advanced platforms integrate behavioral and 360-degree feedback tools, enabling companies to track leadership readiness across levels. The rise of digital leadership simulations and scenario-based evaluations helps businesses align leadership potential with long-term strategic goals. This trend is particularly strong among large enterprises in finance, manufacturing, and technology sectors, where leadership continuity is critical.

- For instance, Deloitte implemented its Leadership Academy assessment framework for more than 55,000 UK employees, using AI-enabled feedback analytics and simulation-based modules to identify high-potential leaders across divisions.

Expansion of Digital Learning and Development Ecosystems

The integration of assessment services with learning management systems (LMS) is fueling market growth across the UK. Organizations are embedding evaluation tools within training frameworks to measure learning outcomes and performance improvements in real time. AI-enabled adaptive assessments personalize employee learning paths and provide actionable insights into skill gaps. This approach supports continuous professional development and ensures that training investments deliver measurable value. The shift toward digital-first learning environments, accelerated by remote and hybrid work models, has increased demand for scalable, cloud-based assessment platforms that support ongoing workforce development and certification programs.

Key Trends & Opportunities

Adoption of AI and Predictive Analytics in Talent Assessment

AI and predictive analytics are transforming how UK companies assess and manage human capital. Modern platforms analyze behavioral data, emotional tone, and response patterns to predict job performance and cultural alignment. Machine learning models refine test accuracy and fairness over time, reducing human bias. Employers benefit from automated scoring, candidate benchmarking, and predictive retention insights that improve workforce planning. The trend offers strong opportunities for vendors offering AI-driven tools compliant with ethical and transparency standards, aligning with the UK’s evolving data protection and employment laws.

- For instance, Pymetrics, now integrated into Harver’s portfolio following its 2022 acquisition, implemented its AI platform, based on neuroscience games, across some UK firms. Using a suite of 12 cognitive and emotional games, the platform helps companies identify candidate traits to improve hiring outcomes.

Increasing Use of Gamified and Immersive Assessments

Gamification and immersive technologies such as virtual reality (VR) are emerging as innovative assessment approaches in the UK market. These tools evaluate problem-solving, teamwork, and situational judgment in realistic environments. Gamified formats enhance candidate engagement, reduce test anxiety, and attract younger talent pools familiar with interactive interfaces. Companies in technology and finance sectors are early adopters, using game-based evaluations to identify creativity and adaptability. The growing availability of cost-efficient digital solutions presents new opportunities for assessment providers to expand their reach and differentiate their offerings in a competitive landscape.

Key Challenges

Data Privacy and Regulatory Compliance Concerns

Stringent data protection regulations, such as the UK GDPR, pose challenges for assessment service providers. Handling sensitive candidate information requires advanced encryption, secure storage, and transparent data usage policies. Non-compliance can result in financial penalties and reputational damage. Additionally, clients increasingly demand assurance on how assessment data is processed and retained. Balancing personalization with privacy has become complex as AI-driven platforms collect more behavioral and biometric data. To address this challenge, providers must invest in robust cybersecurity frameworks and maintain alignment with evolving national and EU-level data governance standards.

Limited Awareness Among Small and Medium Enterprises (SMEs)

While large enterprises actively adopt assessment technologies, many SMEs in the UK remain underpenetrated due to budget limitations and low awareness. Smaller firms often rely on traditional hiring methods without structured evaluation frameworks, leading to inefficiencies and high turnover. The perceived complexity of implementing assessment platforms also hinders adoption. Vendors face the challenge of creating affordable, simplified solutions that address SME needs without compromising quality. Expanding education and offering scalable, subscription-based pricing models can help providers tap into this untapped segment, driving broader market growth in the coming years.

Regional Analysis

England

England dominated the UK corporate assessment services market in 2024, accounting for 67% of the total share. The region’s leadership stems from a high concentration of corporate headquarters, financial institutions, and technology firms in cities such as London, Manchester, and Birmingham. Strong adoption of AI-driven assessment tools and leadership evaluation programs supports market expansion. The growing emphasis on diversity, inclusion, and employee well-being has further increased demand for structured assessment frameworks. England’s advanced digital infrastructure and large enterprise base continue to attract investments from global assessment service providers seeking long-term partnerships.

Scotland

Scotland held a 14% share of the UK corporate assessment services market in 2024. The region benefits from a strong education system, a skilled workforce, and a thriving financial services sector centered in Edinburgh. Organizations are increasingly implementing digital assessment platforms to enhance talent acquisition and leadership development processes. Public sector initiatives promoting digital transformation and workforce upskilling are driving adoption among government and educational institutions. The presence of regional universities collaborating with assessment providers to improve graduate employability further supports Scotland’s steady market growth in this sector.

Wales

Wales accounted for 11% of the UK corporate assessment services market in 2024, supported by rising investment in small and medium enterprises (SMEs) and expanding business services. Local companies are gradually integrating online and competency-based assessments to streamline recruitment and employee performance evaluations. The government’s support for digital innovation and workforce training programs has also encouraged adoption across industries such as manufacturing, education, and healthcare. Growing awareness of data-driven HR solutions, coupled with regional economic development efforts, continues to strengthen Wales’s position within the national corporate assessment landscape.

Northern Ireland

Northern Ireland captured 8% of the UK corporate assessment services market in 2024, driven by increased investment in technology, financial services, and education sectors. Belfast serves as a key hub for assessment service adoption, supported by a growing presence of multinational corporations and tech startups. Local enterprises are embracing online assessment tools to enhance employee engagement and leadership readiness. Government-backed digital skills programs are helping smaller businesses transition toward structured performance evaluation frameworks. Continued public-private collaboration and expanding regional innovation centers are expected to further enhance Northern Ireland’s market contribution in the coming years.

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK corporate assessment services market is highly competitive, with both global and domestic players offering advanced psychometric, cognitive, and behavioral evaluation tools. Leading companies such as SHL Group Ltd., Saville Assessment, Cubiks (now part of PSI Services LLC), Psytech International, Thomas International, Talent Q, Aon plc, Hogan Assessments, and Harrison Assessments dominate the market through broad assessment portfolios and technology-driven platforms. These firms focus on AI integration, predictive analytics, and cloud-based delivery to enhance user experience and result accuracy. Strategic partnerships with enterprises and universities are expanding their market reach and reinforcing credibility. Vendors increasingly differentiate through customizable solutions and localized content designed to meet sector-specific compliance and cultural requirements. Continuous innovation in gamified assessments, virtual leadership simulations, and mobile-first solutions further intensifies competition, pushing providers to focus on data accuracy, cost efficiency, and talent analytics to maintain market leadership in the UK.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady expansion driven by increasing digital transformation in recruitment and employee evaluation.

- Growing adoption of AI-based analytics and predictive assessment tools will shape future demand across industries.

- Integration of gamified and immersive assessment formats will enhance engagement and accuracy in candidate evaluations.

- Companies will focus more on leadership assessments and behavioral analytics to build strong internal talent pipelines.

- Cloud-based platforms and mobile-first testing models will gain traction among enterprises and SMEs.

- England will continue leading the market, maintaining over 65% regional share through 2032.

- Employee assessment will remain the largest segment, supported by strong adoption in BFSI and IT sectors.

- Rising compliance standards will encourage investment in secure, transparent, and bias-free testing systems.

- Partnerships between assessment providers and universities will expand graduate employability programs.

- Continuous innovation in digital psychometrics will strengthen market competitiveness and long-term growth prospects.