Market Overview

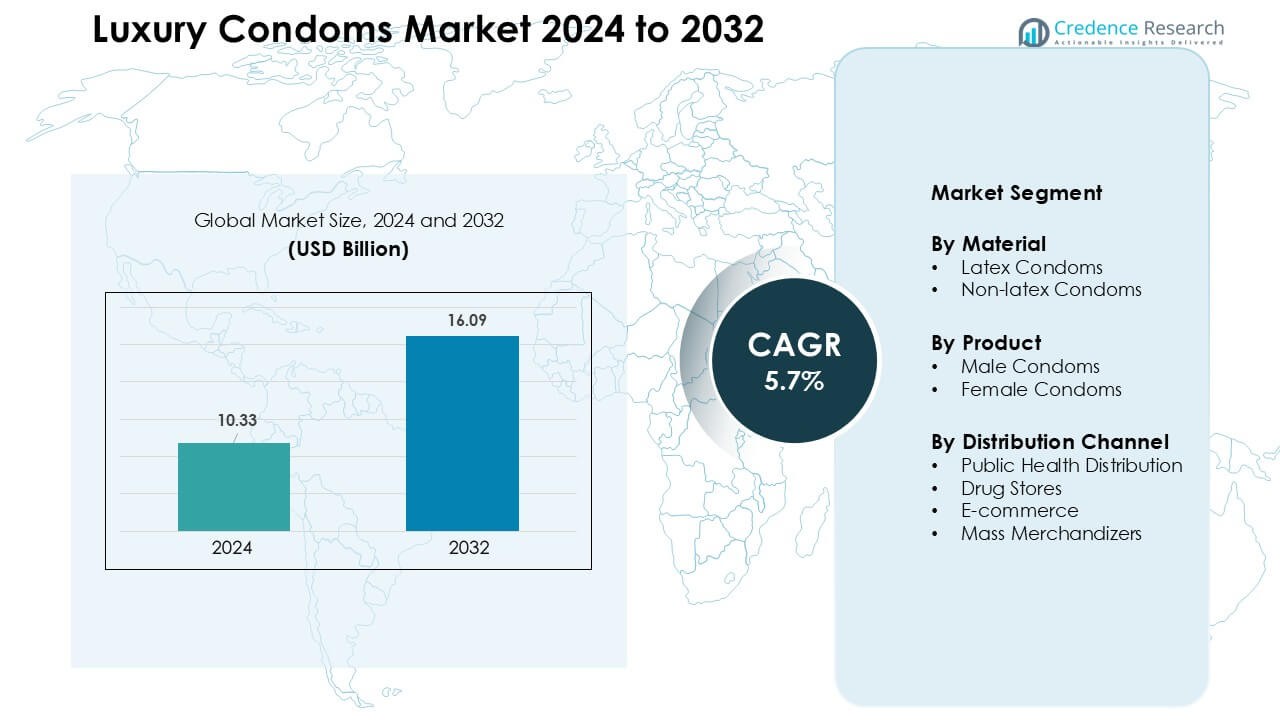

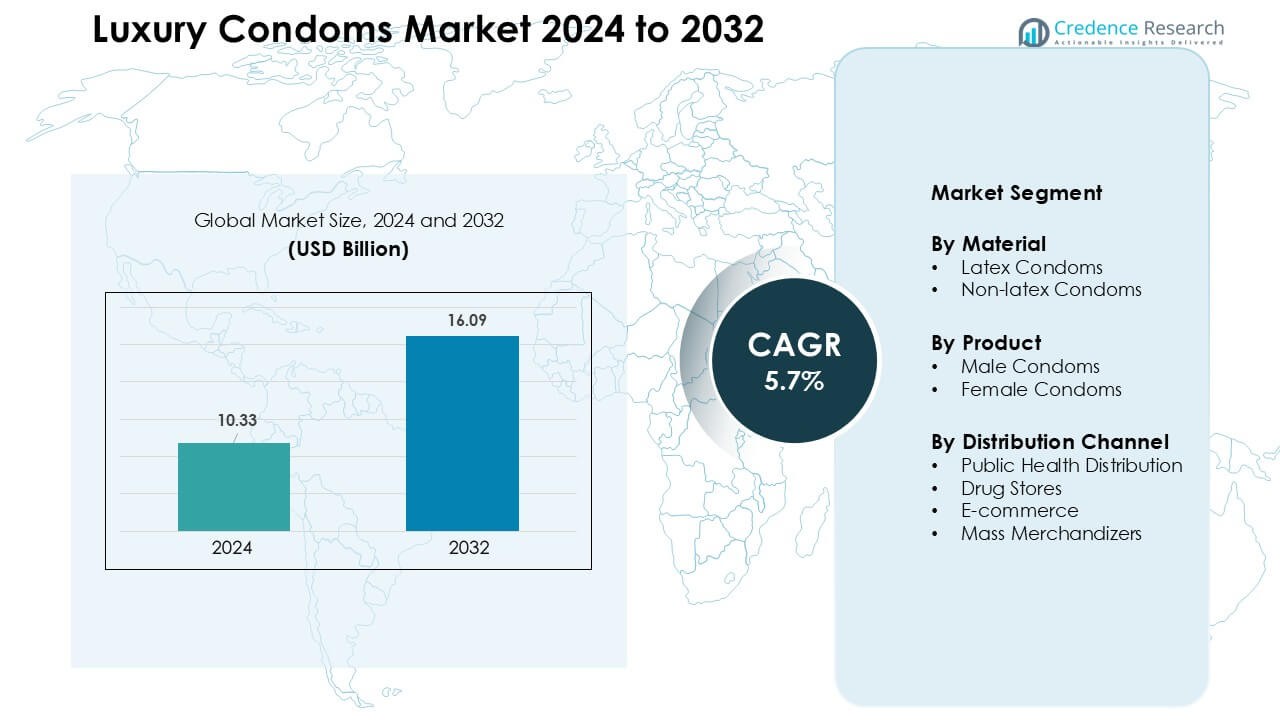

Luxury Condoms Market was valued at USD 10.33 billion in 2024 and is anticipated to reach USD 16.09 billion by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Condoms Market Size 2024 |

USD 10.33 Billion |

| Luxury Condoms Market, CAGR |

5.7% |

| Luxury Condoms Market Size 2032 |

USD 16.09 Billion |

The luxury condoms market is led by key players such as Reckitt Benckiser Group PLC, Church & Dwight Co., Inc., Cupid Limited, Okamoto Industries, Inc., Veru Inc., Karex Berhad, MAYER LABORATORIES, INC., Lifestyles, LELO iAB, and FUJILATEX CO., LTD. These companies compete through ultra-thin designs, premium materials, and advanced lubrication technologies that enhance comfort and intimacy. Strong branding, refined packaging, and wide e-commerce presence help these brands capture upscale consumers seeking higher performance. North America emerged as the leading region in 2024 with about 36% share, supported by strong sexual wellness awareness, broad product availability, and high adoption of premium non-latex and sensation-enhancing variants.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The luxury condoms market reached USD 33 billion in 2024 and is projected to hit USD 16.09 billion by 2032, growing at a CAGR of 5.7%.

- Demand rises as buyers prefer ultra-thin, hypoallergenic, and premium-feel condoms that improve comfort and intimacy, driving steady adoption across urban markets.

- Non-latex materials, designer packaging, and online subscription models shape key trends, while brands promote inclusive wellness and data-driven personalization.

- Leading players compete through fit innovation, advanced lubrication, and strong e-commerce visibility, with Reckitt Benckiser Group PLC and Okamoto Industries, Inc. holding strong positions.

- North America led the market with about 36% share in 2024, while latex held the dominant material share and male condoms accounted for the largest product segment.

Market Segmentation Analysis:

By Material

Latex condoms led the material segment in 2024 with an estimated share near 72%. Latex held a strong lead because this material offers high elasticity, strong protection, and wide global availability. Luxury brands used premium latex grades to add softness, odor-reduction, and ultra-thin designs. Non-latex options grew fast as buyers with latex allergies preferred polyisoprene and polyurethane. Demand also increased as non-latex types offered enhanced heat transfer and a more natural feel. Growth stayed steady across both materials due to rising awareness and premium positioning.

- For instance, a renowned condom brand introduced a polyurethane-based line, such as Okamoto 0.02 or Trojan Supra BareSkin, that emphasized heat transfer and thinness, marketing it as one of the thinnest non-latex condoms among major brands.

By Product

Male condoms dominated the product segment in 2024 with close to 89% share. Their dominance came from broad acceptance, easy use, and a wider range of luxury variants. Premium brands pushed ultra-thin, ribbed, flavored, and extra-lubricated options that improved user comfort. Female condoms expanded at a moderate pace as governments promoted inclusive protection choices. However, adoption remained lower due to higher price, limited availability, and lower familiarity among new buyers. Market growth across both products rose as sexual wellness brands promoted safety and sensation together.

- For instance, historically procurement data from a global health agency shows that when distributing male and female condoms together, the ratio was often heavily skewed: for one female condom procured, 37 male condoms were procured in the same program (489 million male vs 13 million female).

By Distribution Channel

Drug stores led the distribution channel segment in 2024 with an estimated 44% share. Buyers trusted pharmacies for safe storage, authenticity, and access to premium brands. E-commerce grew at a rapid pace because online platforms offer privacy, bulk deals, and wide product choice. Public health distribution continued to serve cost-sensitive users but held a smaller share in luxury formats. Mass merchandizers showed steady demand as retail chains expanded wellness aisles. Growth across all channels increased as brands adopted discreet packaging and subscription-based online delivery.

Key Growth Drivers

Rising Demand for Premium Sexual Wellness Products

Growing interest in upscale sexual wellness products drives strong demand in the luxury condoms market. Young adults prefer high-quality materials, smoother finishes, and enhanced comfort to improve intimacy. Consumers also seek advanced sensations, ultra-thin designs, and innovative lubricants that add a premium feel. Many brands highlight texture refinement and natural-fit engineering to enhance user confidence. Rising awareness of sexual health encourages buyers to choose reliable protection with a more refined experience. Luxury positioning shapes strong brand loyalty because shoppers look for trusted names that balance pleasure and safety. This shift expands market penetration in urban areas where disposable income is rising, and digital marketing helps premium offerings reach wider audiences.

- For instance, ultra-thin and textured condoms, often positioned as premium products, have seen a surge in demand because they offer enhanced sensation and maintain the same high level of safety and protection as standard condoms due to advanced material science and rigorous testing.

Product Innovation and Material Advancements

Innovation in condom materials supports growth because buyers want better feel, durability, and comfort. Latex refinement reduces odor and increases softness, making premium variants more appealing. Polyisoprene and polyurethane options attract users with latex allergies while offering improved heat transfer. Manufacturers invest in thinner films that maintain strength while delivering a natural experience. Premium lubricants, including long-lasting and warming formulas, enhance product value. Technology-driven shaping improves fit, reducing slippage and boosting confidence during use. Brands also use sleek packaging and design-focused marketing to elevate product image. These enhancements help luxury condoms stand apart from mainstream variants, expanding demand among couples seeking superior performance.

- For instance, natural-rubber latex retains very high elasticity latex condoms can stretch up to 800% of their original size before breaking, which underpins their durability and snug fit even when made thinner for premium variants.

Expanding E-commerce Adoption and Privacy Preferences

Online purchasing fuels market growth because many users prefer discreet shopping. E-commerce platforms offer broad product ranges, subscription packs, and curated premium selections. Digital channels help brands showcase benefits through detailed descriptions and user reviews. Privacy remains a major driver, as buyers avoid social hesitation linked with in-store purchases. Fast delivery and secure packaging strengthen user trust. Online promotions encourage trial of higher-end variants, supporting upgrades from basic to premium choices. Digital campaigns on wellness platforms and social media broaden reach among educated urban consumers. As internet access rises globally, e-commerce continues to shape purchasing decisions for luxury condoms.

Key Trends & Opportunities

Shift Toward Non-latex and Hypoallergenic Options

A key trend involves rising interest in non-latex condoms, driven by comfort, allergy concerns, and enhanced sensation. Polyisoprene variants offer softness and elasticity similar to latex while eliminating irritation. Polyurethane types attract buyers seeking thinness and stronger heat transmission. Brands highlight hypoallergenic features to appeal to sensitive-skin users. This shift supports broader acceptance of alternative materials in premium categories. Growing awareness on safe-sex practices combined with comfort-focused choices encourages more users to adopt non-latex options.

- For instance, Latex condoms still dominate the market, accounting for around 80% to 90% of sales in North America in 2023.

Premiumization Through Design, Packaging, and Branding

Packaging and design trends push luxury condoms toward a lifestyle product image. Brands use minimalistic boxes, matte finishes, and stylish color schemes to target young adults. Premium packaging signals quality and helps products stand out in digital and retail channels. Some companies use fragrance-free latex, soft-touch texture, and tailored shapes to enhance experience. Effective branding promotes trust, leading buyers to treat condoms as a wellness accessory rather than a basic need.

- For instance, Durex Invisible condoms are generally sold in standard Durex packaging (which can be discreet, use premium accents, and minimal text depending on the region/campaign), and marketing campaigns often focus on themes of heightened intimacy and removing barriers, which appeals to younger, urban demographics like millennials.

Growth in Female-Focused Sexual Wellness Solutions

Female-centric wellness trends create new opportunities for luxury condom makers. Awareness campaigns highlight shared responsibility in safe sex, supporting interest in premium female condoms. Improved materials and better ergonomics encourage adoption. Brands that cater to women through inclusive marketing build stronger connections with modern buyers. This segment remains underpenetrated, offering room for innovation and long-term expansion.

Key Challenges

Limited Awareness and Preference for Low-cost Alternatives

A major challenge is low awareness of premium benefits in price-sensitive regions. Many buyers choose basic condoms because affordability remains the top priority. Luxury variants cost more due to advanced materials and high-end packaging, limiting mass adoption. In emerging markets, sexual wellness education remains uneven, slowing uptake of premium options. Retailers also prioritize high-volume, low-cost products, reducing visibility of luxury options. This price gap can restrict market expansion outside urban centers.

Cultural Stigma and Purchase Discomfort

Social stigma around condom purchases affects market growth in several regions. Many buyers avoid in-store purchases due to fear of judgment, limiting the reach of premium products that rely on visibility. Cultural discomfort around open discussions of intimacy slows adoption of newer designs and female condoms. Although e-commerce helps reduce hesitation, awareness gaps remain. Stigma also affects brand marketing, pushing companies to rely on discreet advertising rather than bold campaigns. This reduces market penetration in conservative areas.

Regional Analysis

North America

North America led the luxury condoms market in 2024 with an estimated 36% share. Strong demand came from high sexual wellness awareness, wide access to premium brands, and strong e-commerce penetration. Consumers preferred ultra-thin, hypoallergenic, and sensation-enhancing variants supported by strong brand marketing. Retail pharmacies and online platforms expanded premium assortments, improving visibility. Rising emphasis on safe intimacy among young adults further supported market growth. The region benefited from early adoption of non-latex materials, subscription models, and design-focused packaging that strengthened the shift toward luxury products.

Europe

Europe held about 28% share in 2024, driven by high sexual health awareness and strong acceptance of premium wellness products. Countries in Western Europe showed high adoption of non-latex and ultra-thin variants due to preference for comfort and refined design. Pharmacies and specialty wellness stores pushed premium assortments, while online channels gained traction through discreet delivery. Marketing efforts focused on sustainability and fragrance-free latex options, appealing to eco-aware buyers. Supportive regulations and open social attitudes allowed brands to promote premium intimacy solutions more effectively across major markets.

Asia Pacific

Asia Pacific accounted for roughly 24% share in 2024 and grew fastest due to rising disposable income and expanding urban populations. Young consumers drove demand for luxury condoms with enhanced lubrication, softer materials, and aesthetic packaging. E-commerce platforms improved product access, especially in India, China, and Southeast Asia. Increased sexual wellness awareness, wider retail penetration, and brand collaborations with influencers supported growth. Although penetration varied across countries, premium offerings gained traction as buyers shifted from low-cost basic condoms to performance-driven and sensation-focused variants.

Latin America

Latin America represented nearly 7% share in 2024, supported by improving awareness and rising interest in premium wellness products. Urban consumers selected ultra-thin and textured variants as global brands expanded distribution in major cities. Growth remained uneven because economic constraints limited affordability in several markets. E-commerce adoption improved access to luxury formats through discreet delivery. Marketing focused on shared responsibility in safe intimacy helped increase demand, especially among younger demographics. Despite challenges, premium condom adoption continued to rise with better product visibility and expanding retail networks.

Middle East & Africa

Middle East & Africa held close to 5% share in 2024, reflecting gradual adoption of premium condoms in select urban regions. Rising awareness programs and improved retail availability supported a slow but steady shift toward high-quality products. Cultural sensitivity restricted open promotion, but online platforms enabled discreet purchases. Premium non-latex and ultra-thin variants gained interest among educated urban consumers. Growth remained concentrated in Gulf markets, where higher income levels allowed broader acceptance of luxury wellness products. Continued digital expansion is expected to strengthen market reach across key urban centers.

Market Segmentations:

By Material

- Latex Condoms

- Non-latex Condoms

By Product

- Male Condoms

- Female Condoms

By Distribution Channel

- Public Health Distribution

- Drug Stores

- E-commerce

- Mass Merchandizers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The luxury condoms market features leading companies such as Reckitt Benckiser Group PLC, Church & Dwight Co., Inc., Cupid Limited, Okamoto Industries, Inc., Veru Inc., Karex Berhad, MAYER LABORATORIES, INC., Lifestyles, LELO iAB, and FUJILATEX CO., LTD. These companies compete through premium materials, ultra-thin designs, and advanced lubrication technologies that enhance comfort and sensation. Many brands focus on non-latex variants to meet growing demand for hypoallergenic options. Strong packaging design, discreet branding, and aesthetic appeal help premium products stand out across retail and online channels. Firms strengthen digital engagement through influencer promotions, wellness campaigns, and targeted ads. Competitive strategies include expanding e-commerce presence, launching subscription models, and improving distribution in urban markets. Leading players also invest in R&D to deliver better fit, refined textures, and enhanced safety, increasing brand loyalty. Regional expansion and partnerships with pharmacies, wellness platforms, and specialty stores further support market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Veru Inc. Announced the sale of its FC2 Female Condom® (internal/female condom) business to clients managed by Riva Ridge Capital Management. This transaction marked Veru’s exit from the female-condom commercial business as the company refocused on its pharmaceutical pipeline.

- In February 2024, Reckitt Benckiser Group PLC (Durex) Durex (Reckitt) has pushed new product innovations and marketing to move beyond basic condoms into premium/experience-led formats for example product launches targeting female moisturization/pleasure (Hyaluronic-acid–coated/ “anti-ageing” variants) and expansion of Durex’s presence via China livestreaming/e-commerce to reach premium buyers. These moves are positioned to lift Durex’s share of higher-priced/premium condom segments.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium materials such as refined latex and polyisoprene will gain wider adoption.

- Ultra-thin and natural-feel designs will become the core focus for new launches.

- E-commerce subscriptions will expand as buyers prefer discreet recurring purchases.

- Non-latex condoms will rise faster due to allergy awareness and comfort demand.

- Designer packaging and sustainability features will attract young urban consumers.

- Digital marketing and influencer promotions will shape brand visibility across regions.

- Female-focused condom innovations will increase as inclusive wellness gains momentum.

- AI-driven personalization will guide product recommendations and sizing support.

- Retail pharmacies will expand premium assortments to meet growing demand.

- Emerging markets will see higher adoption as awareness and income levels improve.