Market Overview

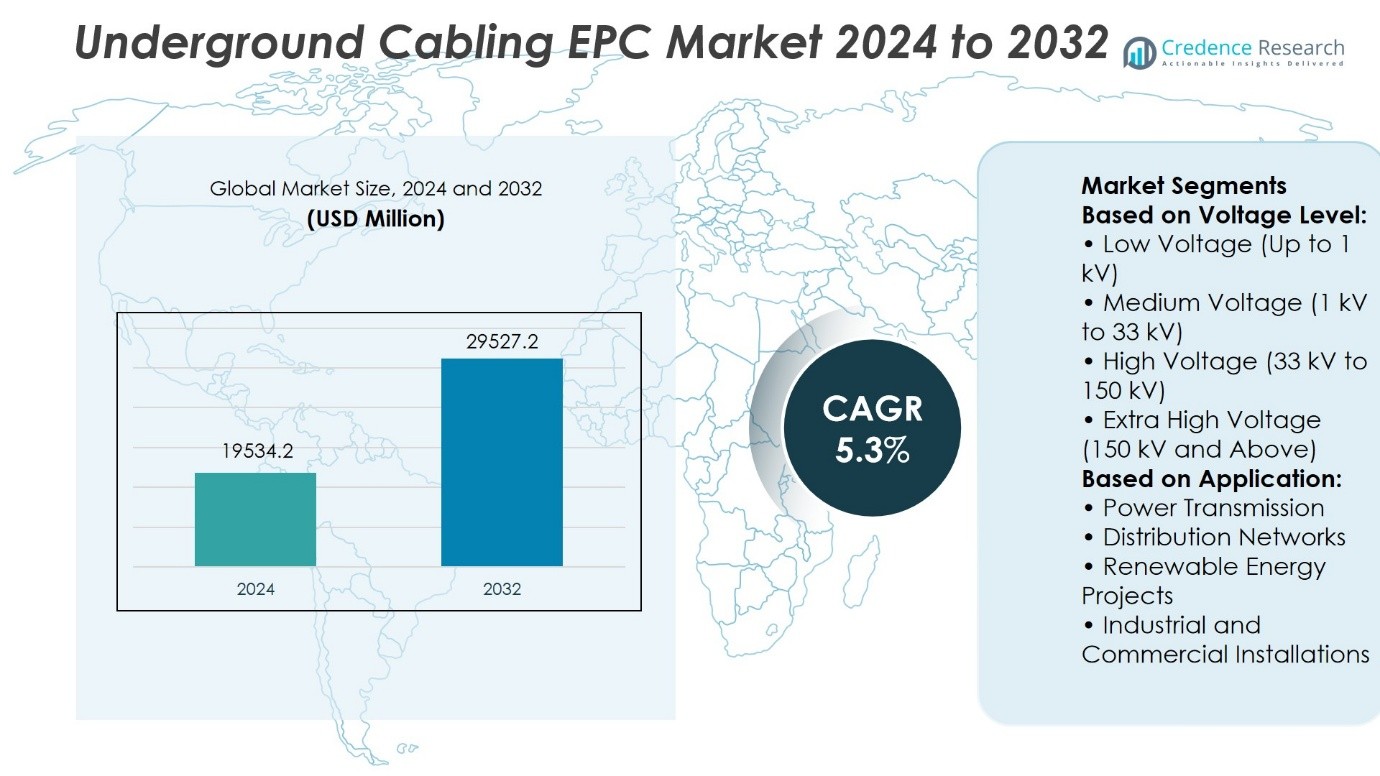

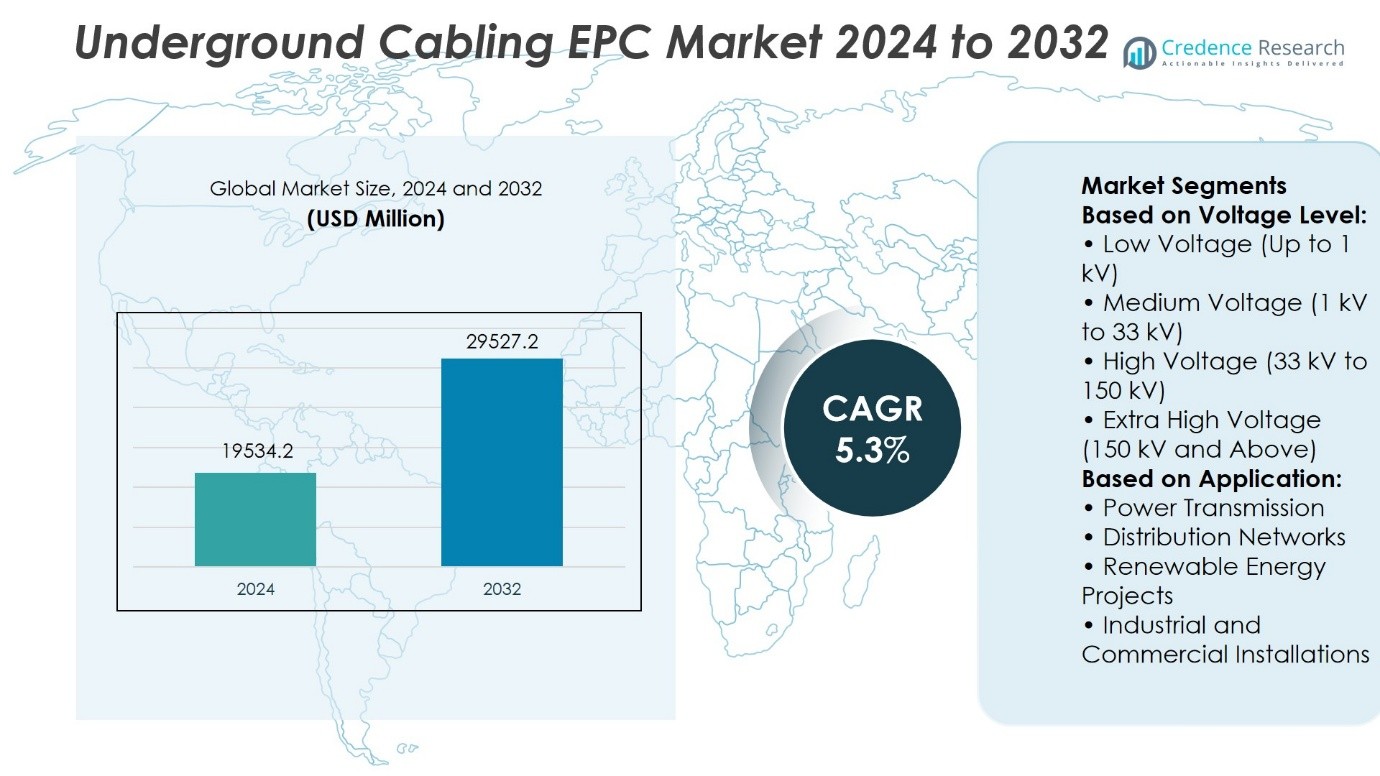

Underground Cabling EPC Market size was valued at USD 19534.2 million in 2024 and is anticipated to reach USD 29527.2 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Underground Cabling EPC Market Size 2024 |

USD 19534.2 Million |

| Underground Cabling EPC Market, CAGR |

5.3% |

| Underground Cabling EPC Market Size 2032 |

USD 29527.2 Million |

The Underground Cabling EPC Market advances through strong drivers and evolving trends that reshape global power infrastructure. Rising demand for grid modernization, urban expansion, and renewable energy integration fuels large-scale underground projects that ensure reliability and safety. Governments enforce stricter regulations and safety standards, pushing utilities toward underground systems in urban and high-risk regions. The market also benefits from technological innovation in insulation materials, trenchless installation methods, and digital monitoring tools that improve efficiency and reduce downtime. Growing focus on sustainability, aesthetics, and long-term reliability reinforces underground cabling as a strategic choice for future energy infrastructure.

The Underground Cabling EPC Market shows diverse geographical adoption, with North America and Europe leading through advanced grid modernization, while Asia Pacific expands rapidly with urbanization and renewable projects. Latin America and the Middle East & Africa display gradual but steady growth driven by infrastructure upgrades and city development. Key players such as Larsen & Toubro, Prysmian Group, Siemens, ABB, TechnipFMC, Saipem, Petrofac, Fluor Corporation, SNC-Lavalin, and Aker Solutions strengthen competitiveness through global expertise, engineering innovation, and strategic partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Underground Cabling EPC Market size was valued at USD 19534.2 million in 2024 and is projected to reach USD 29527.2 million by 2032, at a CAGR of 5.3%.

- Rising demand for grid modernization and renewable integration drives large-scale underground projects that ensure reliable and safe electricity supply.

- Technological trends include adoption of trenchless installation, advanced insulation materials, and digital monitoring systems that improve efficiency.

- Competitive landscape features global players focusing on engineering innovation, turnkey solutions, and strategic partnerships with utilities.

- High capital investment and complex project execution act as restraints, creating barriers for smaller contractors.

- North America and Europe lead with advanced modernization, Asia Pacific grows rapidly with urbanization and renewables, while Latin America and Middle East & Africa show gradual expansion.

- Key players such as Larsen & Toubro, Prysmian Group, Siemens, ABB, TechnipFMC, Saipem, Petrofac, Fluor Corporation, SNC-Lavalin, and Aker Solutions maintain strong global positioning.

Market Drivers

Rising Demand for Grid Modernization and Reliability

The Underground Cabling EPC Market advances through the increasing demand for modern power infrastructure that ensures consistent electricity delivery. Governments and utilities replace outdated overhead lines with underground systems that improve stability and minimize outages. The market benefits from the rising need to meet growing power consumption in urban and industrial centers. It supports integration of renewable sources by delivering high-capacity and low-loss connections across grids. Projects emphasize the reduction of technical losses, which strengthens grid resilience. Underground networks provide long-term reliability that aligns with the goals of sustainable power distribution.

- For instance, Siemens Energy completed a 26-kilometer underground high-voltage cable project in Germany in 2023, capable of transmitting 900 megawatts of renewable energy from offshore wind farms to the national grid, reducing transmission losses by nearly 38 gigawatt-hours annually.

Urban Expansion and Land Optimization Requirements

Rapid urbanization drives the Underground Cabling EPC Market as cities expand and space for overhead lines becomes limited. Underground systems allow effective use of available land in densely populated areas without compromising safety. It enables city planners to integrate reliable power lines with minimal disruption to public infrastructure. Municipalities adopt underground cabling to preserve aesthetics while protecting lines from external damage. This approach supports future city planning by aligning energy infrastructure with smart urban development. The trend strengthens adoption across metropolitan areas where land value and population density remain high.

- For instance, Larsen & Toubro executed the Mumbai Underground Power Transmission Project in 2022, deploying 110 kilometers of 220 kV underground cables, which freed up over 45,000 square meters of urban land previously restricted by overhead lines, directly supporting metro rail and roadway expansion.

Regulatory Mandates and Safety Standards Enforcement

Government policies and regulatory frameworks strengthen adoption of underground cabling by enforcing strict safety standards. The Underground Cabling EPC Market gains momentum from mandates to reduce hazards linked to overhead systems. It ensures compliance with fire safety codes, reliability benchmarks, and disaster resilience requirements. Regulatory authorities promote underground networks in regions prone to storms, flooding, or seismic activity. Compliance supports long-term operational efficiency and protects critical national infrastructure. Such policies accelerate investment in engineering, procurement, and construction services.

Technological Innovation and Cost Efficiency Gains

Innovation in cabling materials, trenchless installation methods, and digital monitoring systems drives the Underground Cabling EPC Market forward. It benefits from reduced project timelines and minimized environmental disruption. Advanced insulation materials extend operational life while cutting maintenance requirements. Digital sensors embedded in cables enable real-time fault detection and enhance operational transparency. These advancements improve return on investment by lowering operational risk and extending infrastructure durability. Technology integration ensures underground networks remain competitive against traditional systems while meeting modern energy demands.

Market Trends

Growing Shift Toward Smart and Resilient Energy Infrastructure

The Underground Cabling EPC Market reflects a strong movement toward smart grid integration and resilient infrastructure. Utilities invest in underground systems that support digital monitoring, predictive maintenance, and remote fault detection. It enables operators to optimize load management and improve power quality across urban centers. Demand rises for infrastructure that can withstand extreme weather conditions and natural disasters. Smart underground cabling ensures reduced downtime and higher service reliability. The trend strengthens the market position of EPC contractors that deliver advanced grid-ready solutions.

Expansion of Renewable Energy Integration and Transmission Corridors

The transition toward renewable energy accelerates demand for underground cabling to link generation sites with consumption hubs. The Underground Cabling EPC Market supports offshore wind farms, solar parks, and interconnection corridors that require high-capacity lines. It enables efficient evacuation of renewable power with minimal transmission losses. Large-scale underground systems help stabilize fluctuating renewable output and enhance grid balance. EPC providers design projects that address the technical challenges of renewable integration. This trend highlights the importance of underground infrastructure in clean energy transitions.

- For instance, Prysmian Group installed 135 kilometers of 320 kV HVDC underground cable in the DolWin3 offshore wind transmission project in Germany, enabling the transport of 900 megawatts of renewable power from offshore turbines to the onshore grid, directly strengthening Germany’s clean energy corridor.

Adoption of Advanced Installation Techniques and Materials

Innovation in trenchless technology, cross-linked polyethylene (XLPE) insulation, and high-voltage direct current (HVDC) cabling drives the Underground Cabling EPC Market. It reduces environmental impact and project execution time while improving long-term performance. Advanced techniques enable cable deployment in congested urban zones and challenging terrains. The adoption of robust insulation materials extends operational lifespans by decades. EPC firms utilize precision drilling and tunneling solutions that cut civil disruption. These advancements make underground cabling more cost-efficient and technically reliable.

- For instance, Nexans supplied and installed 90 kilometers of 400 kV XLPE-insulated underground cables for the ALEGrO HVDC interconnector between Belgium and Germany, completed in 2020, marking the first 1,000 megawatt HVDC link using XLPE technology to enhance transmission reliability across 90 kilometers of challenging cross-border terrain.

Rising Focus on Aesthetics, Safety, and Urban Planning Needs

Urban authorities increasingly view underground cabling as critical to modern city development. The Underground Cabling EPC Market aligns with the need to protect infrastructure while preserving city landscapes. It removes the visual clutter of overhead lines and mitigates risks from accidents or external damage. Underground systems support long-term urban planning strategies that integrate power lines with transportation and utilities. Public safety improves through reduced exposure to live wires during storms or disasters. The trend strengthens adoption in metropolitan regions that demand secure and future-ready power infrastructure.

Market Challenges Analysis

High Capital Investment and Complex Project Execution

The Underground Cabling EPC Market faces significant challenges from the high upfront investment required for design, materials, and installation. It demands specialized equipment, skilled labor, and extensive civil work that elevate project costs compared to overhead alternatives. EPC contractors manage risks linked to financing, procurement delays, and logistical constraints in urban or remote environments. Large projects often encounter hurdles in land acquisition and permissions, which extend timelines. Unforeseen ground conditions further increase costs and technical complications. These financial and operational barriers restrict adoption in regions with budget limitations.

Technical Limitations and Maintenance Constraints

Long-term maintenance of underground networks presents another challenge for the Underground Cabling EPC Market. It remains difficult to identify faults quickly due to buried infrastructure, which slows restoration after failures. Repairs require excavation, specialized tools, and skilled teams, driving operational expenses. Harsh environmental conditions such as soil moisture, flooding, and seismic activity reduce the durability of installations. It also requires careful thermal management to avoid overheating in densely packed cable corridors. Limited standardization in underground cabling practices complicates global project deployment. These issues hinder the scalability of underground systems in certain regions.

Market Opportunities

Expansion of Renewable Energy Projects and Smart Grid Development

The Underground Cabling EPC Market holds strong opportunities in the integration of renewable energy and the modernization of power grids. It supports offshore wind farms, solar parks, and cross-border interconnections that require reliable high-capacity transmission. Governments and utilities allocate investments toward smart grids that depend on secure underground cabling networks. EPC providers gain opportunities to deliver turnkey solutions that connect renewable generation with demand centers. Underground systems also reduce line losses, which aligns with the efficiency targets of clean energy projects. The trend strengthens the market position of contractors that combine engineering expertise with advanced technologies.

Urban Infrastructure Growth and Safety-Oriented Investments

Rapid urban development creates further opportunities for the Underground Cabling EPC Market by addressing the demand for safe and efficient power delivery in dense cities. It enables municipalities to optimize land use while removing overhead line hazards in crowded environments. Urban planners prioritize underground systems that improve aesthetics, reduce outage risks, and support integrated city infrastructure. EPC firms that deliver durable and low-maintenance cabling solutions capture long-term contracts with city authorities. Underground projects also align with regulatory frameworks focused on public safety and disaster resilience. The expansion of metropolitan infrastructure ensures a steady pipeline of opportunities for EPC companies worldwide.

Market Segmentation Analysis:

By Voltage Level

The Underground Cabling EPC Market divides by voltage level into low voltage, medium voltage, high voltage, and extra high voltage systems. Low voltage cabling up to 1 kV supports residential layouts, localized grids, and smaller commercial developments. It ensures safety and efficiency in short-distance power supply where compact networks are required. Medium voltage lines from 1 kV to 33 kV dominate utility-scale distribution across towns and industrial hubs. It enables reliable connections between substations and end-users, serving as the backbone of regional grids. High voltage networks from 33 kV to 150 kV address long-distance urban transmission requirements and deliver consistent power to large industrial clusters. Extra high voltage cabling above 150 kV supports cross-border power transfer, offshore wind integration, and mega infrastructure projects where uninterrupted supply is critical. EPC contractors focus on this segment to meet rising demand for bulk transmission capacity in both developed and emerging economies.

- For instance, KEI Industries supplied over 1,200 kilometers of low-voltage underground cables in 2022 for residential electrification projects under India’s Smart Cities Mission, ensuring reliable last-mile connectivity.

By Application

The Underground Cabling EPC Market segments by application into power transmission, distribution networks, renewable energy projects, and industrial and commercial installations. Power transmission projects require high and extra high voltage systems to ensure stable cross-regional electricity flow and national grid strengthening. It plays a vital role in supporting interconnection corridors and reducing losses across extended distances. Distribution networks represent a core segment, driven by urbanization and modernization of city infrastructure, where medium voltage cabling ensures efficiency and safety. Renewable energy projects highlight growing demand for underground cabling in offshore wind farms, solar parks, and hybrid power plants. It provides secure evacuation of renewable power into main grids while mitigating risks of environmental disruptions. Industrial and commercial installations utilize low and medium voltage lines to maintain operational reliability and support mission-critical processes. The rising adoption across diverse applications reflects the strategic importance of underground EPC solutions in modern power infrastructure.

- For instance, Sumitomo Electric installed 82 kilometers of 132 kV underground cable for the Tokyo Metropolitan Grid reinforcement project, enhancing supply reliability across multiple industrial districts.

Segments:

Based on Voltage Level:

- Low Voltage (Up to 1 kV)

- Medium Voltage (1 kV to 33 kV)

- High Voltage (33 kV to 150 kV)

- Extra High Voltage (150 kV and above)

Based on Application:

- Power Transmission

- Distribution Networks

- Renewable Energy Projects

- Industrial and Commercial Installations

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds about 36.2% of the Underground Cabling EPC Market. The region leads due to strong grid modernization programs in the U.S. and Canada. It focuses on replacing overhead lines with underground systems to improve reliability against storms and outages. Urban expansion and strict regulations encourage EPC firms to deliver advanced underground networks. Utilities invest in smart systems that support resilience and digital monitoring. High capital spending and complex approvals shape the market environment.

Europe

Europe accounts for around 27.8% of the global market. Countries such as Germany, France, and the UK adopt underground cabling to support urban density and preserve landscapes. Governments promote projects that improve safety and reduce the visual impact of overhead lines. EPC providers benefit from advanced technology use, including smart grid integration. The region emphasizes technical precision, energy efficiency, and environmental compliance. Strong collaboration between regulators and contractors keeps demand steady.

Asia Pacific

Asia Pacific contributes about 30% of the market, making it one of the fastest-growing regions. China and India drive large-scale adoption through city electrification and renewable energy integration. Underground cabling supports offshore wind and solar connections to main grids. Urbanization and industrial growth increase the need for safe and reliable systems. EPC companies face diverse terrain and regulatory challenges but gain major project volumes. Strong government investments keep the market expanding.

Latin America

Latin America holds nearly 8% of the market. Countries such as Brazil and Mexico introduce underground systems in urban centers. Projects focus on improving reliability and safety while reducing outages. Limited budgets slow down large-scale adoption, but public-private partnerships provide new opportunities. EPC contractors work on pilot projects to demonstrate long-term benefits. The market shows potential for steady growth in the coming years.

Middle East & Africa

The Middle East and Africa represent about 7% of the market. Gulf nations invest in underground cabling for new cities, industrial hubs, and renewable projects. North Africa also moves toward upgrading transmission corridors. Harsh environmental conditions create demand for durable cabling solutions. EPC firms with expertise in high-temperature and sand-resistant designs gain advantage. Urban growth and diversification of energy sources strengthen opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Saipem

- Petrofac

- Aker Solutions

- Fluor Corporation

- Larsen Toubro

- Prysmian Group

- SNC Lavalin

- Siemens

- TechnipFMC

- ABB

Competitive Analysis

The Underground Cabling EPC Market features include Larsen & Toubro, Saipem, SNC-Lavalin, Siemens, Prysmian Group, Aker Solutions, TechnipFMC, ABB, Fluor Corporation, and Petrofac. The Underground Cabling EPC Market demonstrates intense competition driven by technological advancement, large-scale project execution, and demand for reliable infrastructure. Companies focus on delivering high-voltage and extra high-voltage solutions that support urban expansion, renewable energy integration, and cross-border transmission corridors. The market emphasizes innovation in trenchless installation methods, advanced insulation materials, and digital monitoring systems to improve efficiency and reduce operational risks. Firms strengthen competitiveness through global project expertise, engineering excellence, and strategic alliances with utilities and governments. Strong investment in research and development supports the creation of durable, climate-resilient solutions tailored to diverse regional conditions. The landscape highlights a shift toward sustainability, long-term reliability, and compliance with evolving safety regulations, reinforcing the role of underground cabling as a critical component of modern power infrastructure.

Recent Developments

- In July 2025, Sumitomo Electric Industries, Ltd. has installed of its 525kV XLPE HVDC underground cable system for Germany’s Corridor A-Nord project, signaling a major step forward in one of the nation’s key energy infrastructure initiatives.

- In December 2024, Hengtong Group commissioned a 380 kV underground cable EPC project for Enel Group at Fusina power plant in Italy. The project underscored the company’s commitment to meeting the project timeline in Italy, which in turn added to the deployment of HV cable across Europe region, adding to the industry growth.

- In August 2024, Italian cable manufacturer and installation services provider Prysmian has secured a contract valued at approximately USD 647 million to supply and install a new interconnector between Victoria and Tasmania, aimed at enabling the transfer of renewable energy between the two Australian states.

Market Concentration & Characteristics

The Underground Cabling EPC Market reflects moderate concentration, with a mix of global engineering leaders and specialized regional contractors competing across diverse project scales. It is characterized by high entry barriers due to capital-intensive requirements, advanced technical expertise, and strict regulatory compliance. Large multinational firms dominate high-voltage and extra high-voltage projects where technological innovation and project execution capacity are critical, while regional players focus on medium and low-voltage distribution networks. The market emphasizes long-term contracts, public-private partnerships, and strategic alliances with utilities to secure stable pipelines of projects. It relies on continuous innovation in insulation materials, trenchless installation techniques, and digital monitoring tools that enhance safety, reliability, and efficiency. Competitive dynamics highlight the importance of sustainability, resilience to environmental challenges, and compliance with safety standards. The structure ensures that only firms with strong engineering capabilities, financial strength, and global networks maintain leadership positions while smaller contractors remain significant in local markets.

Report Coverage

The research report offers an in-depth analysis based on Voltage Level, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Underground Cabling EPC Market will expand with rising demand for reliable and resilient power networks.

- Governments will prioritize underground cabling projects to strengthen grid stability.

- Renewable energy growth will create new opportunities for large-scale underground transmission corridors.

- Urbanization will increase adoption of underground systems to optimize land use and improve safety.

- Technological innovation in insulation materials and trenchless installation methods will improve project efficiency.

- Digital monitoring and fault detection systems will become standard features in underground networks.

- Regulatory frameworks will enforce stricter safety, reliability, and sustainability standards.

- EPC firms will strengthen partnerships with utilities to secure long-term contracts.

- Emerging economies will accelerate investments in underground distribution and transmission projects.

- Global competition will intensify as leading firms expand regional presence and enhance engineering expertise.