Market Overview:

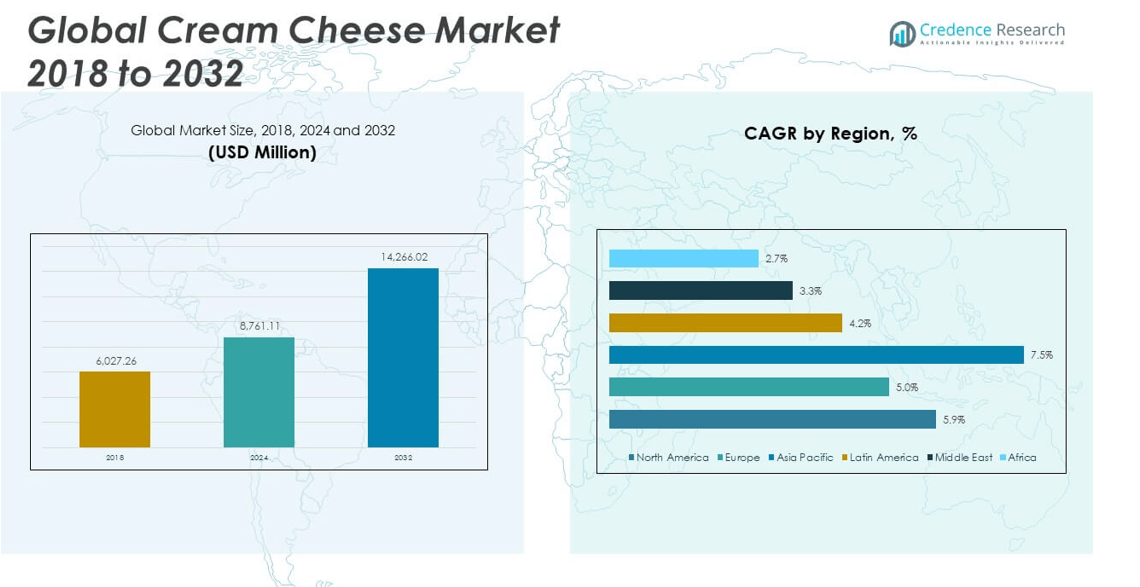

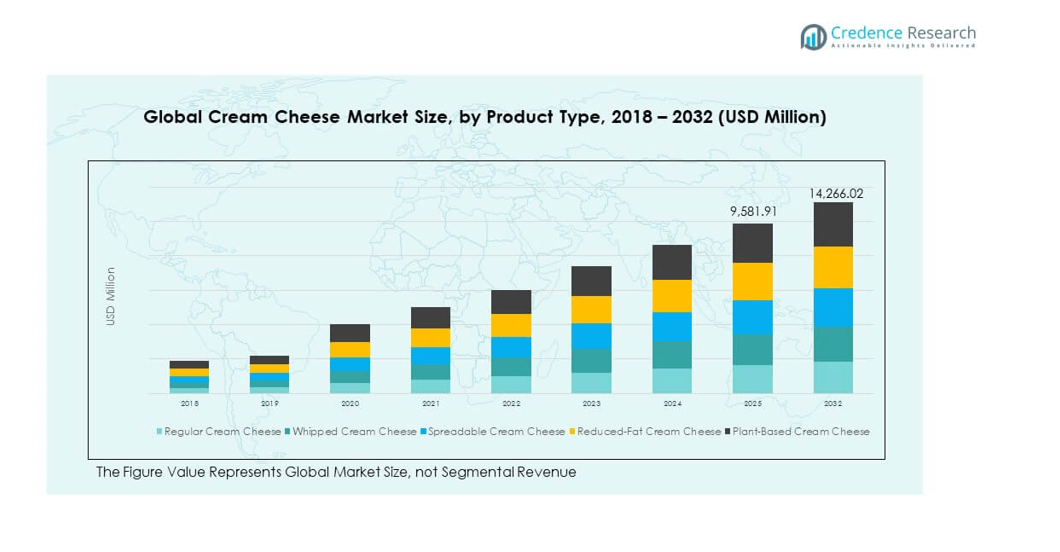

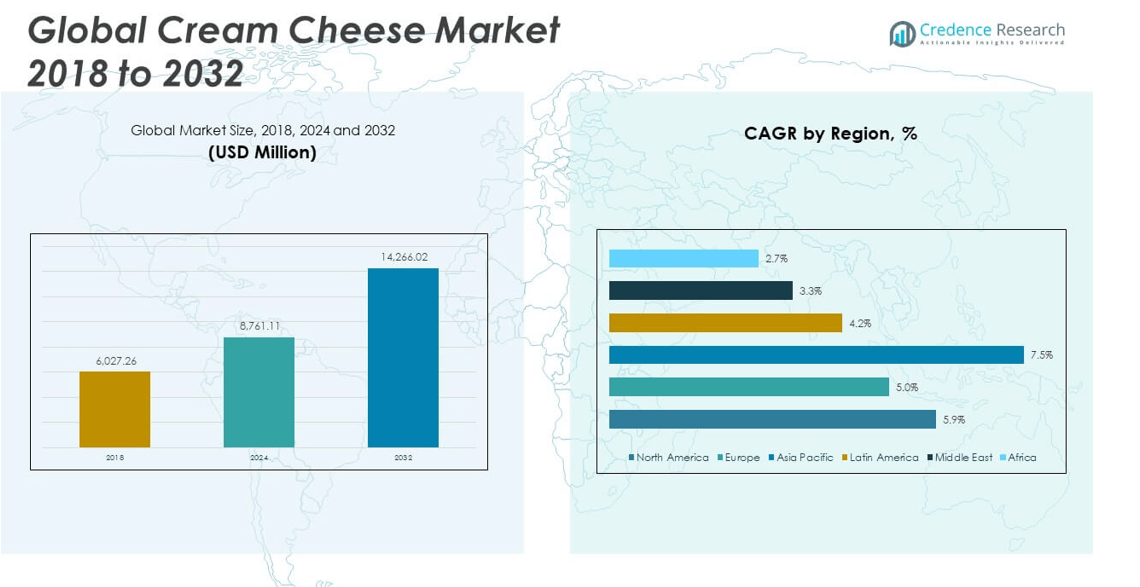

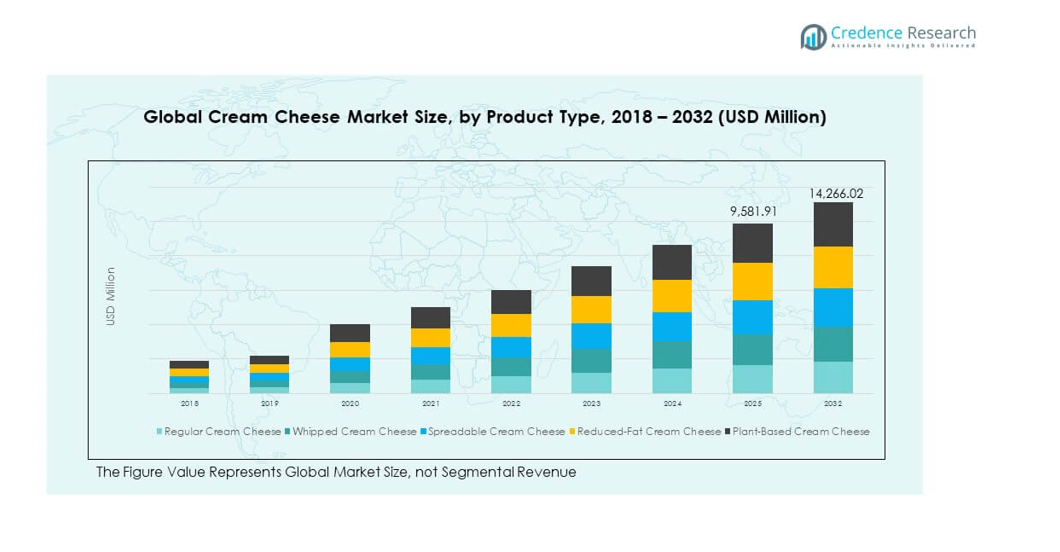

The Global Cream Cheese Market size was valued at USD 6,027.26 million in 2018 to USD 8,761.11 million in 2024 and is anticipated to reach USD 14,266.02 million by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cream Cheese Market Size 2024 |

USD 8,761.11 million |

| Cream Cheese Market, CAGR |

5.85% |

| Cream Cheese Market Size 2032 |

USD 14,266.02 million |

The market is being driven by the growing demand for convenience foods, rising popularity of bakery and confectionery products, and increasing consumer preference for versatile dairy-based spreads. It benefits from shifting dietary patterns, where consumers are seeking protein-rich and indulgent products. Rapid urbanization, coupled with the expansion of modern retail channels, has improved product accessibility, while innovation in flavors and low-fat variants caters to evolving tastes. Additionally, the rising influence of Western food culture in developing countries supports cream cheese adoption across diverse culinary applications.

Regionally, North America leads the cream cheese market due to strong bakery consumption, established dairy processing infrastructure, and high consumer demand for premium spreads. Europe follows with a robust tradition of cheese consumption and innovation in gourmet offerings. Meanwhile, Asia-Pacific is emerging as the fastest-growing market, driven by urban population growth, increasing disposable incomes, and expanding use of cream cheese in bakery chains and fast-food outlets. The Middle East also shows potential with rising Western food adoption, while Latin America’s market is gradually expanding due to increased demand for dairy-based snacks and fusion cuisines.

Market Insights:

- The Global Cream Cheese Market was valued at USD 6,027.26 million in 2018, reached USD 8,761.11 million in 2024, and is projected to touch USD 14,266.02 million by 2032, expanding at a CAGR of 5.85% during the forecast period.

- North America (43.2%), Europe (27.2%), and Asia Pacific (21.1%) dominated in 2024, supported by strong bakery industries, established dairy infrastructure, and growing urban consumption.

- Asia Pacific (21.1%) stands out as the fastest-growing region with a 5% CAGR, driven by urbanization, rising disposable incomes, and expanding bakery and quick-service restaurant adoption.

- Regular cream cheese accounted for the largest share of the Global Cream Cheese Market in 2024, contributing 42%, supported by household demand and bakery applications.

- Plant-based cream cheese represented 12% of the Global Cream Cheese Market in 2024, reflecting strong growth potential among vegan and lactose-intolerant consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising consumer preference for convenient and protein-rich dairy-based spreads

The Global Cream Cheese Market is witnessing strong growth due to increasing consumer demand for versatile and convenient dairy products. Consumers are shifting toward protein-rich diets, and cream cheese is viewed as both indulgent and nutritious. It supports a wide range of culinary applications, from bakery and confectionery to snacks and packaged foods. The convenience of ready-to-use spreads aligns with modern lifestyles where quick meal preparation is valued. Growth of premium spreads also influences consumer purchase behavior across developed and developing markets. Product innovation in flavors and healthier variants expands its appeal to younger demographics. Rising household consumption combined with foodservice integration continues to boost overall demand.

Expansion of bakery and confectionery industries supporting product demand

The Global Cream Cheese Market benefits significantly from the expansion of bakery and confectionery segments. Cream cheese is widely used in cakes, pastries, cheesecakes, and desserts, which are gaining traction in both retail and foodservice channels. It serves as a vital ingredient in premium baked goods, driving sustained demand from urban populations. Rising café culture and specialty bakery outlets enhance product visibility and usage frequency. Foodservice chains rely on consistent cream cheese supply to maintain product quality and customer satisfaction. The rise of artisanal bakery products has created new opportunities for specialized cream cheese offerings. Growing popularity of bakery formats in Asia-Pacific also contributes to expanding demand.

- For instance, Arla Pro, the company’s foodservice brand, offers professional cream cheese solutions tailored for bakery applications, designed to deliver smooth texture and reliable stability in baked goods such as cheesecakes, frostings, and pastries.

Influence of Western food culture and changing dietary patterns

The Global Cream Cheese Market benefits from the growing influence of Western cuisines in emerging economies. It is increasingly incorporated into fast-food items, ready-to-eat meals, and fusion cuisines. Young consumers adopt Western dining habits, creating a higher consumption base for dairy spreads. Restaurants and quick-service chains promote products that integrate cream cheese into sandwiches, pizzas, and snacks. Shifting dietary preferences encourage consumers to opt for products that offer both taste and nutritional value. The rise of convenience-driven eating habits enhances cream cheese’s role as a preferred choice for quick meals. Growth in disposable incomes also supports higher purchasing power for premium dairy categories.

- For instance, Mondelez International’s Philadelphia brand has expanded its portfolio in global markets, including China, by offering flavored cream cheese variants such as strawberry and smoked salmon to meet evolving consumer preferences in snacking and bakery applications.

Growth in retail distribution networks and product accessibility

The Global Cream Cheese Market continues to expand with the development of modern retail infrastructure. It benefits from supermarket and hypermarket growth, where branded products enjoy better visibility and shelf presence. Online platforms contribute significantly to product distribution, offering convenience and direct-to-home delivery. Organized retail formats promote premium dairy brands through wider product assortments. It ensures better access for urban and semi-urban consumers across diverse regions. Growing consumer trust in packaged and branded dairy further supports expansion. Promotional campaigns and product sampling in retail stores strengthen brand loyalty. Expanding retail coverage remains a key factor sustaining market growth.

Market Trends

Rising demand for organic, natural, and clean-label cream cheese offerings

The Global Cream Cheese Market is experiencing a clear trend toward organic and clean-label formulations. Consumers prioritize transparency in food labels, preferring products free from artificial flavors and preservatives. It drives manufacturers to adopt natural ingredients and eco-friendly processing methods. Organic cream cheese appeals to health-conscious consumers seeking sustainable choices. Premium positioning of natural variants enhances their market value among affluent buyers. Growing awareness about additive-free food strengthens this demand across developed markets. The trend aligns with broader health and wellness movements reshaping global dairy consumption patterns.

- For instance, Philadelphia, a Kraft Heinz brand, expanded its portfolio with the launch of a plant-based cream cheese spread in the U.S. in 2023, developed without dairy ingredients and designed to cater to vegan and flexitarian consumers seeking alternative options.

Product diversification with flavor innovations and specialty variants

The Global Cream Cheese Market shows a trend of diversification through flavored and specialty offerings. Consumers increasingly seek unique taste experiences beyond traditional plain cream cheese. It motivates producers to introduce herb-infused, fruit-flavored, and spiced varieties. Specialty products targeted at gourmet and premium segments drive category expansion. Innovative packaging also supports differentiation and longer shelf life. Foodservice operators incorporate new flavors to create signature menu items. Regional flavor adaptations gain traction in local markets, reinforcing cultural acceptance. This diversification broadens the consumer base and sustains engagement with evolving tastes.

Technological integration in processing and packaging for quality assurance

The Global Cream Cheese Market is witnessing adoption of advanced technologies in processing and packaging. Manufacturers invest in automation and improved pasteurization systems to ensure product consistency. It enhances safety standards while reducing operational inefficiencies. Packaging innovations such as resealable containers and portion-controlled packs appeal to on-the-go consumers. Technology also improves shelf life and reduces food waste. Smart labeling supports consumer trust by offering detailed nutritional transparency. Supply chain monitoring through digital platforms ensures better quality control and distribution efficiency. These advancements strengthen consumer confidence and market competitiveness.

Growing popularity of low-fat and lactose-free cream cheese alternatives

The Global Cream Cheese Market is influenced by rising demand for healthier dairy alternatives. Low-fat and lactose-free variants appeal to consumers with dietary restrictions or wellness goals. It ensures inclusivity for lactose-intolerant individuals and health-conscious segments. Manufacturers actively launch products addressing calorie control and digestive health. Foodservice operators integrate such products into menus to serve diverse customer needs. Expansion of wellness-driven food categories provides additional growth channels. These alternatives maintain the creamy texture and taste profile of traditional products while offering added health benefits. The trend ensures sustained engagement across evolving dietary preferences.

- For instance, Miyoko’s Creamery offers its Plant Milk Cream Cheese made from organic cultured cashew milk, crafted to deliver a creamy texture and spreadability without the use of added oils or gums.

Market Challenges Analysis

High competition from substitutes and fluctuating raw material costs limiting profitability

The Global Cream Cheese Market faces significant challenges from strong competition with substitutes like butter, margarine, and plant-based spreads. It is under constant pressure from price-sensitive consumers who explore alternative spreads with lower costs. Volatility in milk prices and dairy supply chain disruptions create uncertainty in production expenses. Manufacturers experience margin pressure when raw material costs surge. Intense rivalry among established brands leads to frequent promotional pricing and discount-driven strategies. Fluctuating global dairy trade policies also add complexity to procurement and exports. Sustaining profitability requires strong supply management and product differentiation strategies.

Health concerns, regulatory constraints, and sustainability pressures influencing operations

The Global Cream Cheese Market is challenged by rising concerns about obesity, cholesterol, and dairy intolerance. It faces scrutiny from health regulators regarding fat and calorie content in cream cheese products. Governments encourage reformulation toward healthier options, increasing compliance costs. Growing pressure for sustainable dairy production creates additional hurdles for producers. Regulatory restrictions on labeling and nutritional claims add complexity for international trade. Health-driven shifts toward plant-based substitutes reduce market growth potential in certain regions. It compels manufacturers to innovate without compromising traditional taste profiles. Long-term competitiveness depends on balancing compliance, health concerns, and sustainability obligations.

Market Opportunities

Rising consumer shift toward premium, specialty, and health-oriented cream cheese products

The Global Cream Cheese Market presents opportunities through rising demand for premium and health-oriented products. Consumers increasingly prioritize low-fat, organic, and functional cream cheese options. It allows manufacturers to tap into health-conscious segments without compromising indulgence. Specialty flavors and gourmet offerings create strong differentiation in crowded markets. Expansion into fortified variants with added nutrients appeals to younger and aging populations alike. Premiumization strategies also enable higher margins across competitive regions. Growth of specialty retail and café chains strengthens the adoption of such innovative formats.

Expansion across emerging economies with rising disposable incomes and foodservice integration

The Global Cream Cheese Market shows strong potential in emerging economies driven by income growth and lifestyle changes. It benefits from the rapid expansion of bakery chains, quick-service restaurants, and modern retail. Western dining habits influence urban consumers to adopt cream cheese into daily diets. International players invest in localized production facilities to reduce costs and expand access. Regional foodservice operators integrate cream cheese into menus to meet diverse consumer demand. Expanding e-commerce penetration further boosts product accessibility in semi-urban markets. These dynamics create a strong platform for long-term growth opportunities.

Market Segmentation Analysis:

The Global Cream Cheese Market is segmented

By product type into regular, whipped, spreadable, reduced-fat, and plant-based cream cheese. Regular cream cheese holds a strong position due to its widespread use in households and bakeries. Whipped cream cheese appeals to consumers seeking lighter textures, while spreadable formats drive convenience-driven sales across retail channels. Reduced-fat variants attract health-conscious buyers who prioritize lower calorie intake without compromising taste. Plant-based cream cheese is gaining traction among vegan and lactose-intolerant consumers, supported by innovation in dairy alternatives and rising global demand for sustainable food products.

- For instance, Philadelphia introduced Whipped French Onion and Whipped Chipotle flavors in 2024, formulated with a light, airy texture for dips, and inspired by menu trend data highlighting a 77% growth in chipotle-flavored offerings.

By application, the Global Cream Cheese Market covers spreads, dips and sauces, cheesecakes and desserts, and fillings and frostings. Spreads dominate due to daily usage in sandwiches and wraps across both home and foodservice sectors. Dips and sauces are growing rapidly as cream cheese becomes a base ingredient in ready-to-eat snacks and restaurant menus. Cheesecakes and desserts continue to drive demand, supported by strong growth in bakery and confectionery industries worldwide. Fillings and frostings maintain steady demand through bakery chains and specialty stores. It reflects a balanced mix of traditional usage and emerging culinary innovation, ensuring strong opportunities across both established and developing markets.

- For instance, Daiya Foods introduced first-to-market dairy-free cream cheese packets in 2025, offered in convenient 1-oz single-serve formats, specifically designed for foodservice operators and grab-and-go consumers seeking plant-based alternatives.

Segmentation:

By Product Type

- Regular Cream Cheese

- Whipped Cream Cheese

- Spreadable Cream Cheese

- Reduced-Fat Cream Cheese

- Plant-Based Cream Cheese

By Application

- Spreads (sandwiches, wraps)

- Dips and Sauces

- Cheesecakes and Desserts

- Fillings and Frostings

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Cream Cheese Market size was valued at USD 2,629.30 million in 2018 to USD 3,782.16 million in 2024 and is anticipated to reach USD 6,175.74 million by 2032, at a CAGR of 5.9% during the forecast period. North America accounts for 43.2% market share in 2024, driven by strong demand in the U.S. where cream cheese remains integral to bakery, spreads, and packaged foods. The region benefits from an established dairy infrastructure and high consumer awareness about premium dairy offerings. It witnesses growing product diversification across low-fat and flavored formats, which appeal to health-conscious and younger demographics. Foodservice channels, including fast-food and bakery chains, reinforce demand through consistent menu integration. E-commerce expansion further improves product accessibility across urban and suburban households. Innovation in packaging and sustainable production practices strengthen consumer trust and brand positioning. It continues to lead the global market due to strong brand penetration and sustained bakery sector growth.

Europe

The Europe Global Cream Cheese Market size was valued at USD 1,701.50 million in 2018 to USD 2,383.66 million in 2024 and is anticipated to reach USD 3,653.14 million by 2032, at a CAGR of 5.0% during the forecast period. Europe holds 27.2% market share in 2024, supported by a strong tradition of cheese consumption and diverse culinary applications. The market thrives on established bakery and patisserie industries where cream cheese plays a vital role in premium desserts. European consumers value authentic, artisanal, and organic dairy products, creating strong demand for high-quality cream cheese. Regional manufacturers focus on sustainable sourcing and clean-label innovations to meet regulatory standards and consumer expectations. Retail channels remain highly competitive with strong representation of both global and local brands. Foodservice expansion, particularly in cafés and specialty bakeries, sustains product relevance in urban markets. It remains resilient with stable demand for both traditional and reduced-fat variants across leading economies.

Asia Pacific

The Asia Pacific Global Cream Cheese Market size was valued at USD 1,176.73 million in 2018 to USD 1,851.83 million in 2024 and is anticipated to reach USD 3,409.71 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific accounts for 21.1% market share in 2024, emerging as the fastest-growing regional market. Rising urbanization and Western dining influence drive higher consumption in China, Japan, India, and Southeast Asia. Growth of bakery chains and quick-service restaurants fuels adoption across younger demographics. Expanding disposable incomes and lifestyle shifts enhance demand for premium dairy spreads. Local players invest in production facilities to reduce costs and improve product accessibility. Plant-based cream cheese alternatives also gain traction in urban centers with rising vegan populations. E-commerce platforms expand product reach beyond metropolitan areas. It demonstrates strong growth potential through rapid foodservice integration and evolving consumer dietary habits.

Latin America

The Latin America Global Cream Cheese Market size was valued at USD 278.66 million in 2018 to USD 399.92 million in 2024 and is anticipated to reach USD 574.73 million by 2032, at a CAGR of 4.2% during the forecast period. Latin America contributes 4.6% market share in 2024, supported by increasing demand for dairy-based spreads in Brazil, Argentina, and Mexico. Rising influence of Western bakery culture supports cream cheese adoption in urban centers. Growth of modern retail channels, particularly supermarkets, strengthens product distribution. Consumers favor affordable yet versatile dairy options, pushing demand for spreadable and regular cream cheese. Foodservice operators integrate cream cheese into local cuisines and quick-service offerings. The region also witnesses gradual growth in plant-based variants, reflecting health and sustainability trends. Challenges related to pricing and economic fluctuations exist but remain manageable with localization strategies. It presents steady opportunities for both multinational and regional producers.

Middle East

The Middle East Global Cream Cheese Market size was valued at USD 152.07 million in 2018 to USD 199.96 million in 2024 and is anticipated to reach USD 268.54 million by 2032, at a CAGR of 3.3% during the forecast period. The Middle East represents 2.3% market share in 2024, with growing demand driven by changing dietary habits and urban consumption patterns. Rising preference for Western-style bakery products boosts cream cheese adoption in premium dessert categories. GCC countries lead the regional demand due to high disposable incomes and exposure to global food trends. Expansion of modern food retail networks enhances product accessibility across urban centers. Local dairy producers focus on balancing affordability with premium quality to compete with international brands. Foodservice expansion, particularly in luxury hospitality, sustains demand for specialty cream cheese. Regulatory support for food diversification further boosts market penetration. It continues to display moderate growth tied to urbanization and lifestyle-driven consumption.

Africa

The Africa Global Cream Cheese Market size was valued at USD 89.01 million in 2018 to USD 143.59 million in 2024 and is anticipated to reach USD 184.16 million by 2032, at a CAGR of 2.7% during the forecast period. Africa holds 1.6% market share in 2024, reflecting its emerging but underdeveloped market position. Growth is concentrated in South Africa and Egypt where bakery consumption and modern retail networks are expanding. Rising middle-class populations contribute to growing awareness of international dairy products. Distribution remains a challenge in rural areas due to infrastructure limitations. Imported brands dominate, though local players are gradually entering with affordable offerings. Health-conscious consumers in urban centers show interest in reduced-fat and plant-based cream cheese. Foodservice adoption remains limited but is improving with the spread of fast-food chains. It offers gradual growth prospects with opportunities tied to urbanization and retail development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Kraft Heinz Company (Philadelphia Cream Cheese)

- Arla Foods

- Fonterra Co-operative Group

- Lactalis Group

- Galbani

- Tatura

- Organic Valley

- Cream of Creams

- Daiya Foods

- Tofutti

Competitive Analysis:

The Global Cream Cheese Market features a competitive landscape dominated by multinational dairy corporations and regional players with strong distribution networks. Leading companies such as Kraft Heinz, Arla Foods, Fonterra, and Lactalis focus on product innovation, flavor diversification, and premium positioning to maintain brand loyalty. It is influenced by the rising popularity of plant-based and low-fat alternatives, prompting established players to expand their portfolios with healthier offerings. Regional producers emphasize affordability and local flavor preferences to capture price-sensitive consumers. Strategic collaborations with bakery chains and foodservice operators further strengthen market presence. Companies invest in advanced processing and packaging technologies to ensure product consistency and extended shelf life. Growing emphasis on sustainability and clean-label positioning enhances competitiveness among global leaders. The market continues to evolve through mergers, acquisitions, and targeted product launches across high-growth geographies.

Recent Developments:

- In June 2025, Arla Foods announced a new investment of US$69.63 million to expand its cream cheese production capacity at Holstebro Dairy in Denmark. This expansion is set to unlock an additional 16,000 tonnes of cream cheese production per year, directly addressing increasing global demand and positioning Arla Foods to grow further in the cream cheese category.

- In March 2025, Paras Dairy launched a new cheese brand named Galacia, which includes fresh cream cheese varieties targeted at expanding its premium dairy product portfolio and meeting rising consumer demand for specialty cheese products.

- In September 2024, The Kraft Heinz Company expanded its Philadelphia Cream Cheese brand by launching a refrigerated cream cheese frosting. This new product allows consumers to enjoy the creamy Philadelphia experience beyond traditional spreads, making it suitable for cakes and other baked goods, with 16oz tubs priced at $4.99 in the US.

- In August 2024, PopUp Bagels formed a strategic partnership with OLD BAY for the introduction of a new crab-flavored cream cheese, expanding innovation within the flavored cream cheese segment and highlighting the growing market for creative and premium dairy flavors in the global market.

Market Concentration & Characteristics:

The Global Cream Cheese Market reflects moderate concentration with a mix of global leaders and emerging regional brands. It is characterized by steady demand for traditional cream cheese alongside growing interest in plant-based and reduced-fat options. Global players dominate premium categories, while regional producers serve cost-sensitive segments with localized offerings. Innovation in flavors and packaging provides differentiation, while health-driven formulations influence product development strategies. Strong distribution through retail, e-commerce, and foodservice channels sustains competitiveness. It remains highly dynamic, shaped by consumer lifestyle changes, regulatory frameworks, and advancements in dairy technology.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Cream Cheese Market will experience steady growth supported by rising demand for convenient and versatile dairy-based spreads.

- Innovation in plant-based and reduced-fat formulations will expand the consumer base across health-conscious demographics.

- Expansion of bakery and confectionery industries will strengthen long-term usage of cream cheese as a key ingredient.

- Growing penetration of modern retail and e-commerce channels will improve accessibility in both developed and emerging markets.

- Regional diversification will increase, with Asia Pacific emerging as the fastest-growing market due to urbanization and changing dietary habits.

- Sustainability-driven production practices and clean-label trends will influence purchasing decisions and brand differentiation.

- Strategic partnerships between dairy producers and foodservice operators will enhance product visibility and adoption.

- Flavor innovation and specialty variants will capture premium segments and strengthen customer engagement.

- Advanced processing and packaging technologies will improve shelf life, safety, and convenience.

- Competitive intensity will rise, with global players focusing on acquisitions, regional expansions, and product launches to sustain market leadership.